Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Stocks could have rebounded yesterday, but didn't – the daily action didn't bring too many telling news. And in today's premarket, stocks are under pressure again – well below the 3400 level. Indeed they are not out of the woods in the short run as I telegraphed yesterday – and in today's analysis, I'll lay out what I consider an inspirational scenario for the days ahead.

What about the narratives? Corona is back in the spotlight, especially in Europe where lockdowns are back on the table in France and Germany – not to mention protests in Rome or London – putting pressure on cyclicals. Big Tech is on the defensive over its role in Biden corruption news suppression. And stimulus talks are (predictably?) nowhere near their close.

Doom and gloom? On a daily basis, maybe.

S&P 500 in the Short-Run

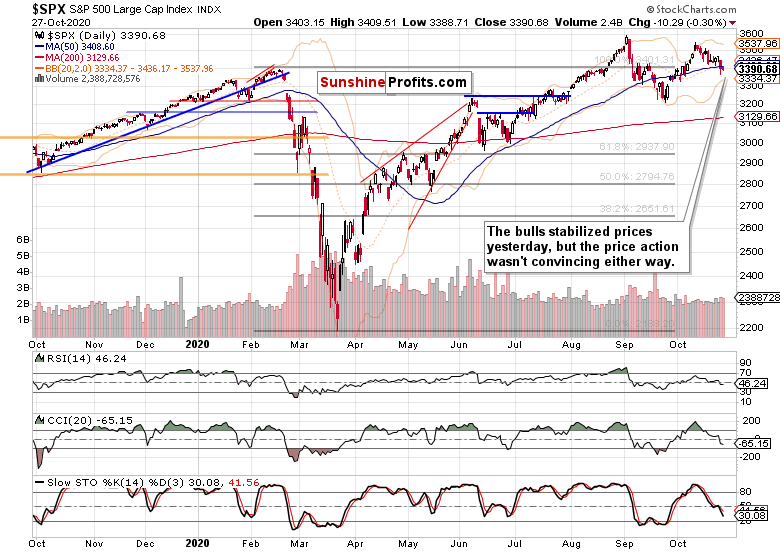

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The sellers didn't get far yesterday, but neither did the buyers. The daily volume remained elevated, and no clear conclusion as to the coming days trading, can be made based on this chart alone.

The Feb highs are being challenged – but what could the elections dynamics of the coming days bring next?

The pointer on the above chart marks the last few days before the 2016 elections. Notice the steady but slow deterioration before, the large red candle with a long lower knot, decreasing momentum with quite a few false intraday dawns, and finally an upswing that would have largely left you in the dust weren't you onboard already.

We're facing a similar situation – the message of Biden's likely win is being hammered on regardless of the mounting scandals. The country is polarized, with core supporters of both candidates expecting their camp's win. Until the votes are counted (and the accompanying matters such as mail-in ballots sorted out), it's still Trump vs. the Establishment.

And given the corona resurgence and still no stimulus, stocks are doing rather well in my view. Over the pond, they're suffering larger declines as the $SPX:$DAX ratio shows. Let's check whether some flight to the (perceived U.S.) safety is going on.

Credit Markets’ Point of View

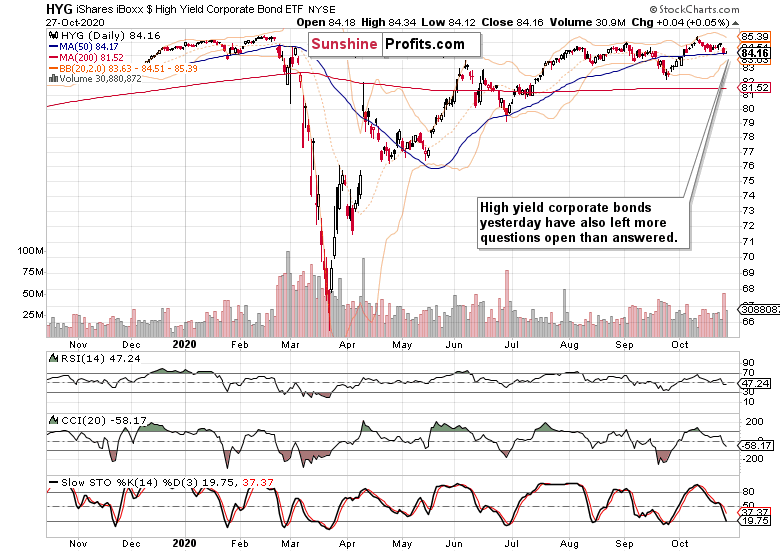

High yield corporate bonds (HYG ETF) didn't recover much lost ground really, and still remain in a perilous position. Relatively speaking though, they are trading much higher above their September lows that the S&P 500 does.

TIPS though have recovered just as smartly as investment grade corporate bonds (LQD ETF) did. The impression still remains one of an orderly risk-off episode, and not of a start of another major or minor crash.

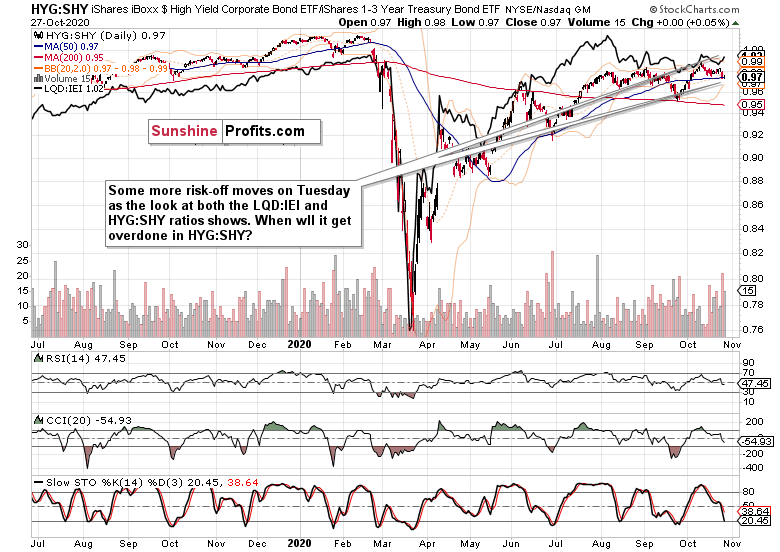

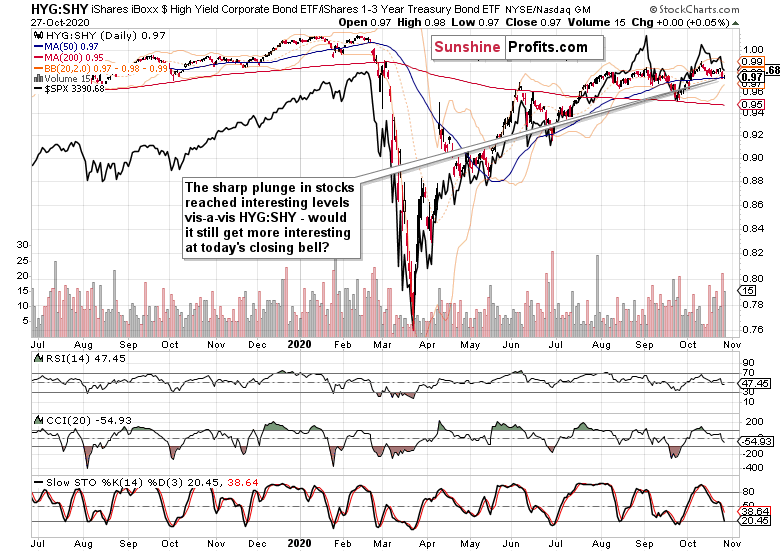

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved in line with the regular risk-off hypothesis.

Stocks have given up most of the high ground gained vs. the HYG:SHY ratio, and their relative valuation stemming from this chart, appears appealing enough already. The question remains whether we have seen the HYG bottom already, which doesn't appear to be the case yet.

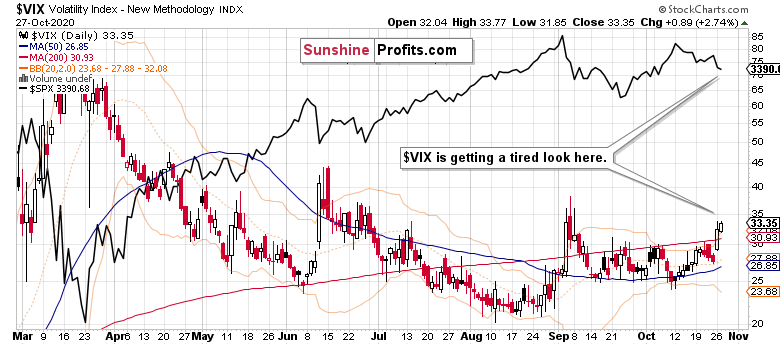

Volatility and the Force Index

How far is an intraday reversal in $VIX? Monday's upper knot hasn't been overcome yesterday, and I am not betting on a continuous resurgence in volatility here. Much depends upon how fast the elections dust settles.

The Force index is showing the dicey position the $SPX is in. It's already negative (not higher after yesterday's lackluster trading), while the Bollinger Bands still remain quite tight – that's quite a potential for some more downside in the short run. Will it all happen over this week?

Summary

Summing up, stocks missed to opportunity to recover some lost ground yesterday, and the key 3400 line is history now, but the Russell 2000 is holding up quite well. The selloff in oil, gold and silver illustrates the headwinds stocks are (and will be) facing today. Is the risk-off turning into an elections-enhanced panic? Both Treasuries and the dollar could have been rising some more if that were the case (wasn't the dollar sold a bit too indiscriminately before the elections?) – I look for the post-election period to be kinder to equities. Will they indeed look past the turmoil that some on the Left have been promising should Biden lose?

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.