Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

With the lion's share of this week's stock gains happening in the overnight futures trading, it's the daily action that's stealing the spotlight. The market turned on a dime, and the bulls' performance has been strong. But can it last? Let's check whether stocks have indeed taken us on a one-way elevator ride.

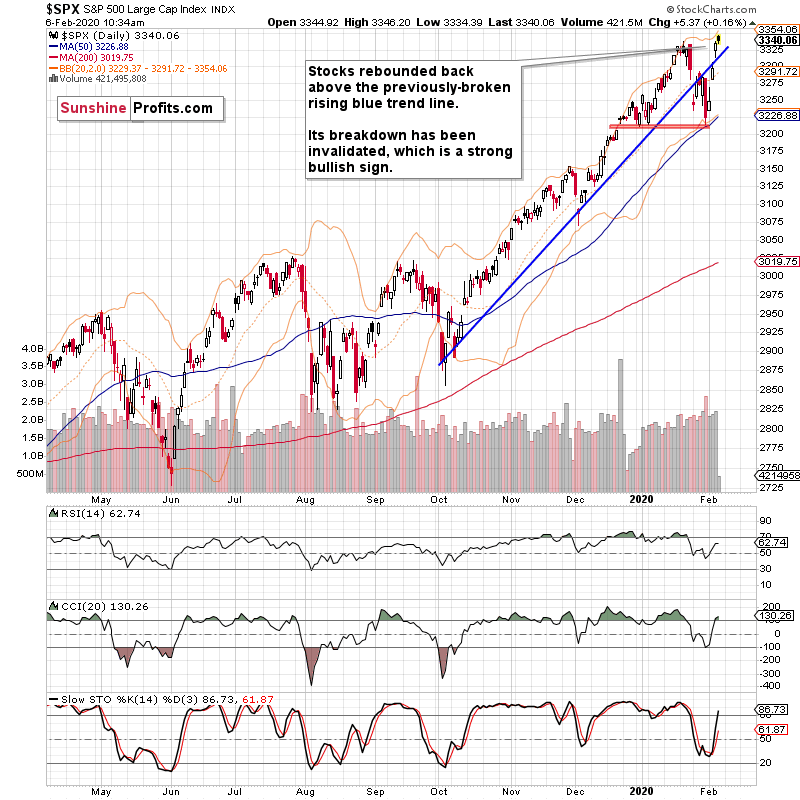

The daily chart will show us the significance of yesterday's price action (chart courtesy of http://stockcharts.com).

Three days in a row - three bullish gaps with further gains. That's the most concise summary to give when looking at last three days. Just going higher without much hesitation, as the lack of sizable knots shows. Technically, the most important development has been the invalidation of the breakdown below the rising blue trend line.

Let's get back to the story the knots tell. On Tuesday, the bulls gave up almost half of their gains since the opening bell. Yesterday, they had to face a wave of selling that erased almost half of the opening gap. They closed the session at new weekly highs though. That's a bullish print.

The daily indicators are painting a bullish picture - the CCI's sell signal is over while Stochastics remains on a buy signal. Yesterday's volume shows no evidence of an upside move's exhaustion, as it hasn't been profoundly above the preceding days' one.

And indeed, stock futures point to another bullish gap today. The index trades in a tight range and at around 3345 currently. Taking into account all the discussed improvement on the weekly chart and yesterday's session, would that be a suitable moment to buy from the risk-reward perspective? Not in our view.

Let's not forget the speculation of a coronavirus medical breakthrough nearby, as it has been the catalyst of yesterday's buying as well. And the US ADP figures revealed strong job market (at 291K jobs created, it almost double the analysts' expectations), lifting the bullish spirits further.

But is the coronavirus panic over, or just temporarily quelled? It's still likely we'll get another scare in the not-so-distant future. How will it reflect on the stock market path?

It's highly likely it will offer a more attractive entry point from the risk-reward perspective than we're facing now close to 3350. Yesterday's unfavorable entry point has become even more so today. Buying into the upswing practically at the pre-coronavirus top? Thanks, but no thanks. The most likely short-term scenario is a consolidation of recent gains as a minimum. The bears' return remains likely in the very near term.

Let's quote our yesterday's conclusion:

(...) As a reminder, we are in a stock bull market. The strong comeback highlights that we haven't seen reliable signs of a market top - thus, corrections are to be bought. And there is still a good likelihood of us getting one shortly, regardless of the improvement in the indicators. Therefore, staying on the sidelines remains the right course of action right now.

Summing up, the S&P 500 outlook got brighter yesterday, and the daily indicators are turning bullish. But it would be premature to declare this correction (in time and in price) as over. As a minimum, we can expect consolidation of this week's gains, and increasing bearish involvement near the 3350 highs. A favorable setup to get back in on the long side would naturally follow, as the rebound's veracity shows that stock bull market is climbing a wall of worry. In other words, it's alive and well.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care