Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks extended their short-term downtrend once again yesterday. Will the S&P 500 break below the early December low of around 4,500?

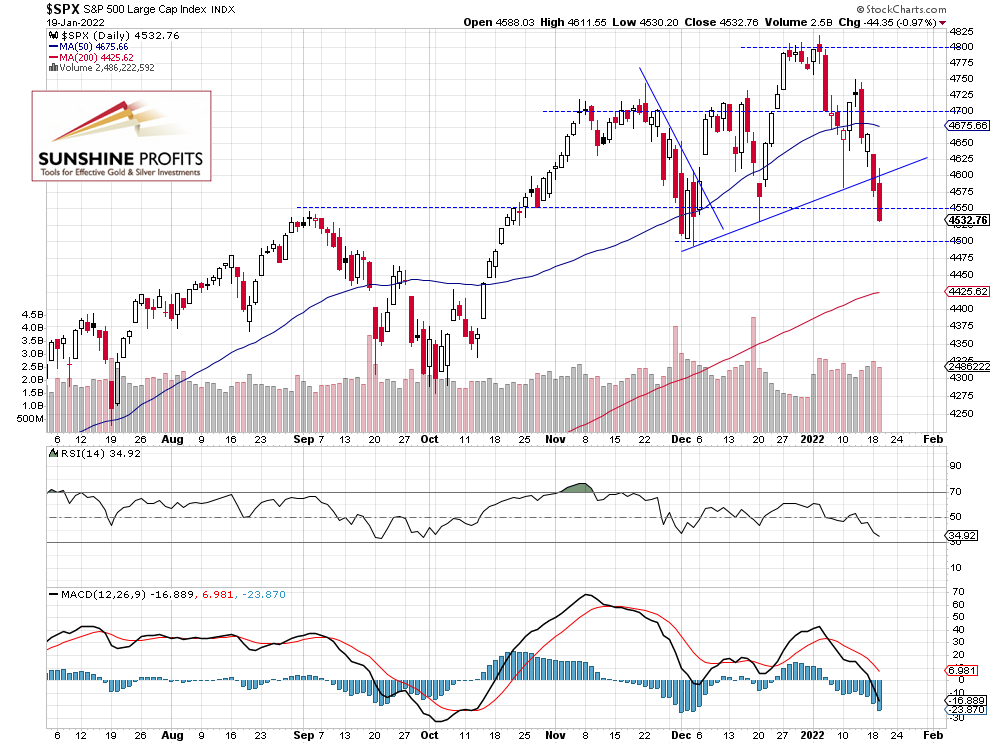

The S&P 500 index lost 0.97% on Wednesday following its Tuesday’s decline of 1.8%. It fell to the mid-December local low of around 4,530 and it was the lowest since Dec. 3. Investors reacted to worse-than-expected economic data releases, quarterly earnings and Russia-Ukraine tensions. Late December – early January consolidation along the 4,800 level was a topping pattern and the index fell to the previous trading range. This morning the market is expected to open 0.4% higher and we may see a rebound or an upward correction.

The nearest important resistance level is now at around 4,580-4,600, marked by the recent support level. On the other hand, the support level is at around 4,500, marked by the Dec. 3 low of 4,495.12. The S&P 500 broke below an over month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Is at the Previous Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market extended its downtrend yesterday, as it fell below the 4,550 level. It is trading along the previous local lows and we may see a short-term consolidation there. There have been no confirmed positive signals so far. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 0.4% higher this morning. We may see a rebound, however, there have been no confirmed positive signals so far. The quarterly earnings releases remain a bullish factor for stocks, but there is still a lot of uncertainty concerning Russia-Ukraine tensions.

Here’s the breakdown:

- The S&P 500 extended its downtrend once again and it is closer to breaking below the early December low.

- In our opinion no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care