Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 and initial upside target at 3550 are justified from the risk-reward perspective.

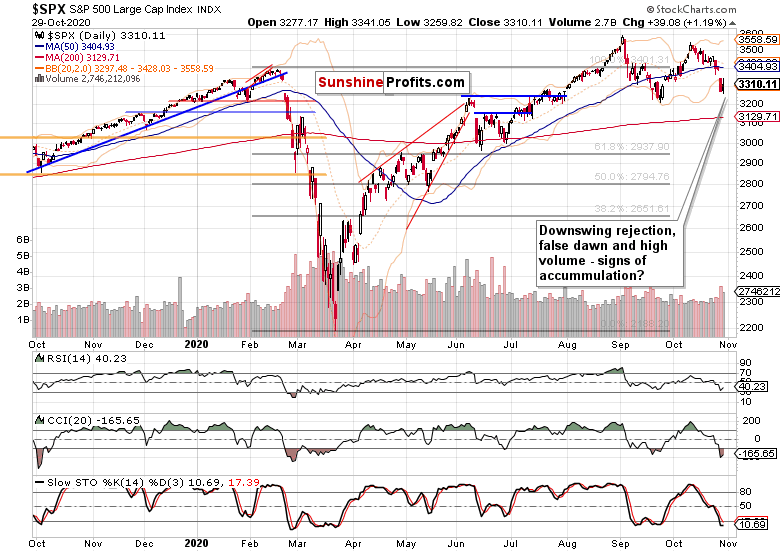

After a spooky Wednesday, the awaited daily candle rejecting both the downswing and upswing, came – and with a noticeably longer upper knot. A sign of the mid-October downswing approaching its selling climax, or a daily pause along Tuesday's lines?

I'm leaning towards the former as I think that regardless of Pennsylvania, Wisconsin or North Virginia mail-in ballots late counting deadlines, the Rasmussen poll's pro-Trump 31% share of African American vote, would indeed give him a landslide – or a result sufficient enough to spark fireworks in the asset classes sold as hard as stocks.

Even the clean energy ETFs such as e.g. ICLN, have stopped their parabolic rise as the Biden family issues (if that's an appropriate and fitting word) rose to the fore. The Wisconsin early vote interim results shows clearly the momentum in my view.

It's my opinion that we're carving out a volatile local bottom, and that the post-election fireworks would show that betting on a decline extension, would have been a wrong choice.

But let's move to the charts next – do they hint at my interpretation of the narratives and 2016 lessons as correct?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Stocks didn't really want to decline much more yesterday as both daily candle knots show. That's why I am not all that much worried about the premarket downswing to almost 3225 – it's the rebound back to 3275 in the futures as we speak, that gives me increasing confidence that the bottom in this volatile week, is at hand.

And similarly to the March 23 bottom (which was when I closed the open short position) that was also accompanied by daily ups and downs, I see the current price action as reversing higher similarly sharply across the board – and that means both stocks and precious metals (suppressed GDX:$GOLD is a strong hint of confirmation to me).

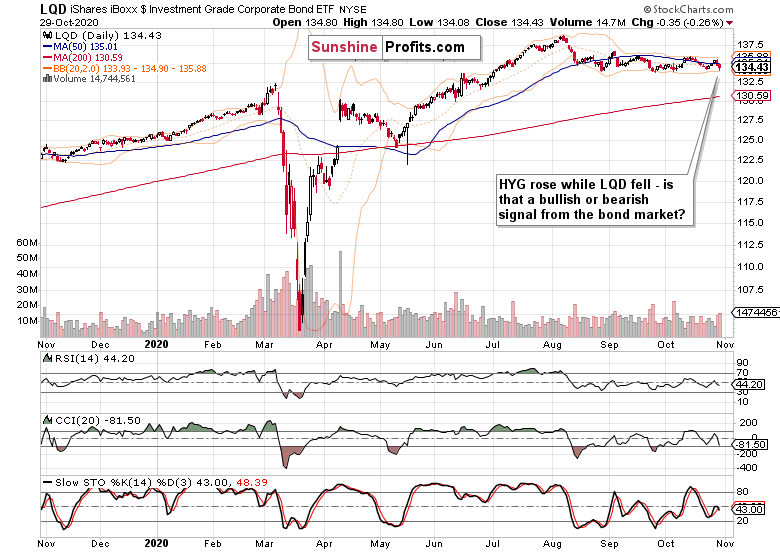

But what about the credit markets?

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) showed daily strength – more so than they did on Tuesday as compared to the preceding day. Also the relative volume comparison says that yesterday's move is to be trusted more.

Investment grade corporate bonds (LQD ETF) weren't though as resilient yesterday, which would hint at still prevailing risk-off wind blowing.

But such a mood isn't reflected in long-term Treasuries (TLT ETF) – they had a strong down day.

Let's feature the dollar untraditionally within the credit market sections already, as this is where the risk-off move is visible the most. It took the dollar quite some time to move higher, and the bulls seem to be getting starting there.

The stocks to all Treasuries ($SPX:$UST) ratio is far from making a lower low, which means that the uptrend (rotations into stocks from government bonds) is alive and well, regardless of this week's moves.

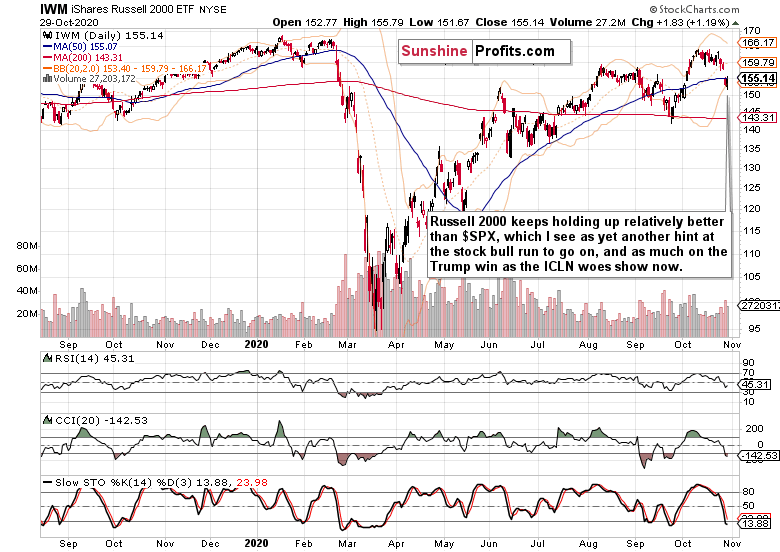

Market Breath, Volatility and Smallcaps

The advance-decline line has sharply recovered even though the price advance wasn't outrageous. That points to the upswing being led by sectors other than tech.

$VIX finally reversed, and the upside rejection is encouraging for the short run. It appears the stock downswing is getting long in the tooth.

The Russell 2000 (IWM ETF) is doing better than the 500-strong index, and just did so on a daily basis too. How long before the buying pressure can't be overwhelmed any longer?

Summary

Summing up, stock bulls have neither outshined, nor disappointed yesterday. The parallel to 2016 thus far remains intact, and I view the upper knot(s) as encouraging for the moment the election results come trickling in next week. Tech earnings didn't come in the strongest, but other S&P 500 sectors have stepped in.

Credit markets are still offering signs of an impending turnaround, and copper isn't willing to decline much more – I'm looking for similar turnarounds in other commodities too. The pre-election volatility could easily turn on a dime, leaving the impression of us going through a springboard in the making. The medium-term bullish trend simply hasn't changed one bit.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.