tools spotlight

-

Two New Factors That Shine Light on Gold’s Situation

February 19, 2021, 10:54 AMAvailable to premium subscribers only.

-

Gold’s Downtrend: Is This Just the Beginning?

February 18, 2021, 10:14 AMWith the yellow metal just posting its lowest close since June and a bearish pattern forming, how vulnerable is gold to a further decline?

Gold and mining stocks just broke to new yearly lows – as I warned you in my previous analyses. And that’s only the beginning.

Let’s jump right into the charts, starting with gold.

Figure 1 - COMEX Gold Futures

In early February, gold broke below the rising red support line and it then verified it by rallying back to it and then declining once again. It topped almost exactly right at its triangle-vertex-based reversal, which was yet another time when this technique proved to be very useful.

Gold has just closed not only at new yearly lows, but also below the late-November lows (in terms of the closing prices, there was no breakdown in intraday terms). This means that yesterday’s (Feb. 17) closing price was the lowest daily close since late June 2020. At the moment of writing these words, gold is also trading below the April 2020 intraday high.

Gold was likely to slide based on myriads of technical and cyclical factors, while the fundamental factors remain very positive – especially considering that we are about to enter the Kondratiev winter, or we are already there. As a reminder, Kondratiev cycles are one of the longest cycles and the stages of the cycle take names after seasons. “Winter” tends to start with a stock market top that is caused by excessive credit. In this stage gold is likely to perform exceptionally well… But not right at its start. Even the aftermath of the 1929 top (“Winter” started then as well), gold stocks declined for about 3 months before soaring. In the first part of the cycle, cash is likely to be king. And it seems that the performance of the USD Index is already telling investors to buckle up.

And speaking of stocks, what about mining stocks? As you might already well know, just as with gold, the miners moved below the November lows in terms of both the intraday prices and daily closing prices. What does that mean? If you’d like to explore mining stocks in detail and are curious to know more about their prices and possible exit levels, then our full version of the analyses contains exactly what you need to know.

Getting back to gold…

Figure 2

If the fact that gold invalidated its breakout above its 2011 high, despite the ridiculously positive fundamental situation, doesn’t convince you that gold does not really “want” to move higher before declining profoundly first, then the above chart might.

As I wrote above, gold is currently more or less when it was trading at the April 2020 top. Where was the USD Index trading back then? It was moving back and forth around the 100 level.

100!

The USD Index closed a little below 91, and gold is at the same price level! That’s a massive 9 index-point decline in the USDX that gold shrugged off just like that.

There’s no way that gold could “ignore” this kind of movement and be “strong” at the same time. No. It’s been very weak in the previous months, which is a strong sign (not a fundamental one, but a critical one nonetheless) that gold is going to move much lower once the USD Index finally rallies back up.

Right now, waiting for gold to rally is like waiting for the light to turn green, arguing that eventually it has to turn green, while not realizing that the light is broken (gold just didn’t rally despite the huge decline in the USDX). Yes, someone will fix it and eventually it will turn green, but it doesn’t mean that it makes much sense to wait for that to happen, instead of looking around and crossing the street if it’s safe to do so.

Yes, gold is likely to rally to new highs in the coming years. And silver is likely to skyrocket. But in light of just two of the above-mentioned factors (gold’s extreme underperformance relative to the USD Index and the invalidation of a critical breakdown) doesn’t it make sense not to purchase gold right now (except for the insurance capital that is) in order to buy it after several weeks / few months when it’s likely to be trading at much lower levels?

We live in very specific times. Getting a “like” on a post or picture becomes a necessary daily activity and means of self-validation. Not “liking” something that others posted or that is massively “liked” may be frowned upon or even viewed as being disrespectful. Plus, it seems that no matter what you do, everyone gets offended very easily. When did honesty, independence and common-sense stop being virtues?

When it comes to gold investment analysis, it’s surprisingly similar. You either like gold and think that it’s going higher right away or you’re “one of them”. “Them” can be anyone who tries to manipulate gold or silver prices, “banksters”, or some kind of unknown enemy. “Analysts'” goal is often no longer to be as objective as possible and to provide as good and as unbiased an analysis as possible, but to simply be cheering for gold and provide as many bullish signals as possible regardless of what one really thinks about them. The above may seem pleasant to readers, but it’s not really in their best interest. In order to make the most of any upswing, it’s best to enter the market as low as possible and to exit relatively close to the top. What happens before a price is as low as possible? It declines. Why would something like that (along with those describing it) be hated by gold investors? It makes no sense, but yet, it’s often the case.

Top of Form

Bottom of Form

The discussion – above and below – can be viewed as something positive or negative for any investor, but while reading it, please keep in mind that our goal is the same as yours – we want to help investors make the most of their precious metals investments. Call us old-fashioned, but regardless of how unpleasant it may seem, we’ll continue to adhere to honesty, independence and common-sense in all our analyses

Ok, but why on Earth would the USD Index rally back up? The Fed is printing so much dollars – why would they be worth more?!

Because the currencies are valued with relation to each other and whether or not the USD Index moves higher or lower doesn’t depend only on what the Fed is doing.

Figure 3

What other monetary authorities do matters as well and right now the ECB is outprinting the Fed (that’s what the decline in the green line above means), which means that the euro is likely to fall more than the U.S. dollar. Therefore, the EUR/USD currency exchange rate would be likely to decline and since this exchange rate is the biggest (over 50%) component of the USD Index, it makes perfect sense – from the fundamental point of view – to expect the USD Index to move higher.

Can gold rally despite higher USD Index values? Absolutely. However, it would first have to start to behave “normally” relative to the USD Index, and before that happens it would have to stop being extremely weak relative to it. And the fact that gold is at the same price level despite a 9-index-point decline in the USDX is extreme weakness.

To make the technical discussion easier, I’m attaching the previous chart once again.

Figure 4

On Monday (Feb. 15), I wrote the following about the above chart:

The size and shape of the 2017-2018 analogue continues to mirror the current price action. However, today, it’s taken 118 less days for the USD Index to move from peak to trough.

Also, it took 82 days for the USDX to bottom in 2017-2018 (the number of days between the initial bottom and the final bottom) and the number amounts to 21.19% of the overall duration. If we apply a similar timeframe to today’s move, it implies that a final bottom may have formed on Feb. 12. As a result, the USDX’s long-term upswing could begin as soon as this week.

Also noteworthy, as the USDX approached its final bottom in 2017-2018, gold traded sideways. Today, however, gold is already in a downtrend. From a medium-term perspective, the yellow metal’s behavior is actually more bearish than it was in 2017-2018.

Also supporting the historical analogue, the USD Index’s current breakout above its 50-day moving average is exactly what added gasoline to the USDX’s 2018 fire. Case in point? After the 2018 breakout, the USDX surged back to its previous high. Today, that level is roughly 94.5.

Based on this week’s rally it seems that the final bottom formed on Tuesday (Feb. 16) – just 2 trading days away from the analogy-based target, and in perfect tune with what I wrote back then. The breakout above both: the declining blue line, and the 50-day moving average was verified, and the short-term outlook here is clearly bullish.

But isn’t the current situation similar to what happened in mid-2020? The correction that was followed by another decline?

In a way, it is. In both cases, the USD Index moved higher after a big decline, but that’s about it as far as important similarities are concerned.

What is different is the entire context. Even a single look at the above chart provides an instant answer. The mid-2020 correction was like the mid-2017 correction, and what we see right now is the post-bottom breakout, just as we saw in the first half of 2018.

There are multiple details on the above chart that confirm it, including the sizes of the medium-term declines, the position of the price relative to the declining support/resistance lines, as well as relative to the 50-day moving average, and even the green arrows in the RSI indicator show how similar the preceding action was in case of this indicator. The vertical dashed line shows “where we are right now” in case of the analogy.

Also, the fact that the general stock market has not yet declined in any substantial way only makes the short-term outlook worse (particularly for silver and miners). When stocks do slide, they would be likely to impact the prices of miners and silver particularly strongly.

And please remember, we’re looking for the bottom in the precious metals sector not because we’re the enemy of gold or the precious metals investor . On the contrary, we’re that true friend that tells you if something’s not right, even if it may be unpleasant to hear. We want to buy more and at better prices close to the bottom, and we’ll continue to strive to assist you with that as well.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Hidden Breakdown Almost Everyone Missed

February 17, 2021, 10:16 AMAs rising government bond yields crush the precious metals, with gold touching yearly lows today, there is one detail that has gone unnoticed.

I recently wrote that I would provide the details for the analogy to 2008 in the mining stocks, and that’s exactly what I’m going to do today. But first, let’s take a look at what happened yesterday (Feb. 16), because we’re seeing a major breakdown that I think almost nobody noticed.

This breakdown is not in gold.

Figure 1 - COMEX Gold Futures

At least not at the moment of writing these words.

Gold is testing its previous lows after reversing almost right at the triangle-vertex-based reversal. Please take a moment to appreciate this technique, as without it, one could have gotten prematurely excited by the early-Feb upswing, which actually turned out to be nothing more than a verification of the breakdown below the rising red support line. The outlook here remains strongly bearish for the following weeks.

The above-mentioned “hidden” breakdown is not visible in silver either.

Figure 2 - COMEX Silver Futures

The white metal is relatively strong compared to gold, which is perfectly normal given the current situation on the market:

- The precious metals market is just before a big price decline.

- The general stock market is still moving higher.

Given the proximity of the triangle-vertex-based reversal in silver, it could even be the case that silver moves higher one more (final) time before the slide starts. Then again, it could be the case that it declines sharply and bottoms shortly – just like it did in September 2020.

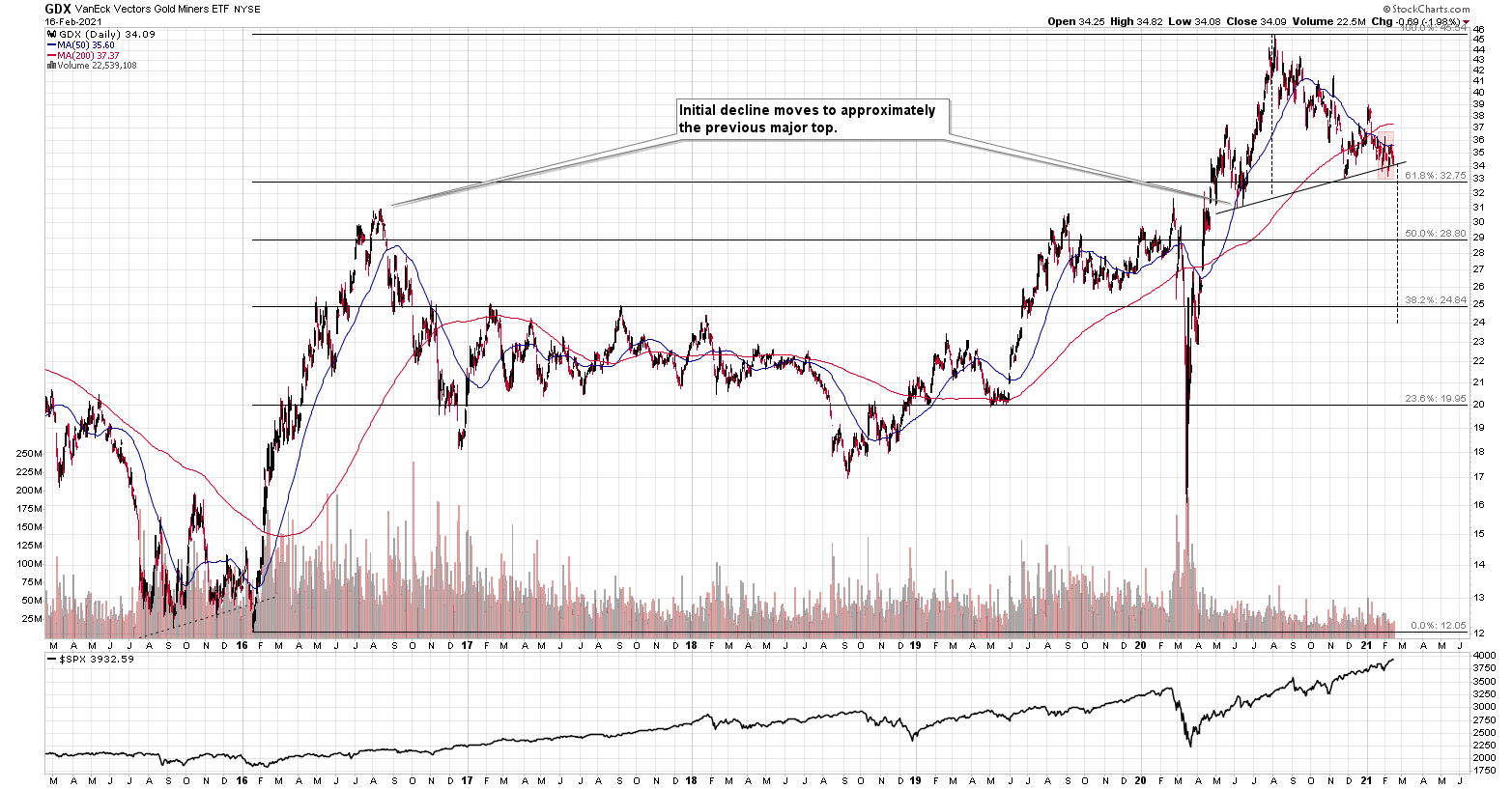

The above-mentioned “hidden” breakdown is not visible in the GDX ETF chart either, but we’re getting closer to the true answer.

Figure 3 - VanEck Vectors Gold Miners ETF (GDX)

The GDX declined by 2% yesterday, and just like gold it’s trading close to its 2021 and late-2020 lows. There was no major breakdown here… yet.

The 50-day moving average seems to have stopped the preceding upswing and miners are now ready to move lower.

The slide to about $31, then a comeback to $33 - $34 and then another – much bigger – slide continue to be the most likely outcome from here. The least certain part, in my opinion, is the existence or the size of the corrective upswing after the initial decline to about $31.

Ok, having said that, let’s see where the “hidden” breakdown happened.

It was in the HUI Index to S&P 500 ratio.

Figure 4 - $HUI, $SPX

This ratio shows how well gold stocks perform relative to other stocks. In other words, this ratio replies to the following question:

How would gold stocks perform if it wasn’t for the movement of the general stock market?

In a way, the above ratio is more “true” than the HUI Index itself, because it focuses much more on the “precious metals” aspect of the index.

What is important is that we are witnessing a breakdown below the rising support line that started in 2018, that was created based on also the 2019 bottom and that served as support at the 2020 bottom. The fact that this ratio managed to stop the decline is remarkable.

Let’s go through this again: gold stocks are doing something more bearish that they weren’t able to do even at the end of the 2020 slide.

The breakdown is not yet confirmed and it’s not yet significant, but it is a small crack in a very important dam. The implications are already bearish.

And this is especially the case given the analogy to 2008 that I will talk more about below.

Let’s start with a quote from my previous analyses:

I wrote on Feb. 5:

The three of the biggest declines in the mining stocks (I’m using the HUI Index as a proxy here), all started with broad, multi-month head-and-shoulders patterns. And now we’re seeing this pattern all over again.

Figure 5 - NYSE Arca Gold BUGS Index (HUI) and Slow Stochastic Oscillator Chart Comparison

The above picture should make it clear why I was putting “at least” in bold, when describing the targets based on the head-and-shoulders patterns.

In all three cases, the size of the decline exceeded the size of the head of the pattern. This means that the $24 target on the GDX ETF chart is likely conservative.

Can we see gold stocks as low as we saw them last year? Yes.

Can we see gold stocks even lower than at their 2020 lows? Again, yes.

Of course, it’s far from being a sure bet, but the above chart shows that it’s not irrational to expect these kind of price levels before the final bottom is reached.

The dashed lines starting at the 2020 top are copies of sizes of the declines that started from the right shoulder of the previous patterns. If things develop as they did in 2000 and 2012-2013, gold stocks are likely to bottom close to their 2020 high. However, if they develop like in 2008 (which might be the case, given the extremely high participation of the investment public in the stock market and other markets), gold stocks could re-test (or break slightly below) their 2016 low.

I know, I know, this seems too unreal to be true… But wasn’t the same said about silver moving below its 2015 bottom in 2020? And yet, it happened.

While describing gold’s very long-term chart (Figure 5 - above), I wrote that based on gold’s MACD indicator, the situation is also similar to what happened in 2008. The above chart shows some additional similarities. Let’s consider the sizes of moves between the 2004 bottom (one could argue that this is when the several-year-long rally started) and the 2008 top, between the initial 2006 top and the 2008 top, and between the very beginning of the final rally – at the end of the fake sharp downswing and the 2008 top.

I marked all of them with dashed lines and I copied them to the current situation. By “current” I mean what happened recently and in the previous years – to the situations that seemed analogous to the ones described above. For instance, the near-vertical 2020 downswing that was followed by a big rally that ended with a big head-and-shoulders top seems similar to what happened in mid-2007.

As one might expect, these dashed lines don’t point to the same price top. No wonder – the history doesn’t repeat itself to the letter, as the circumstances are not identical.

But…

What is remarkable is that on average, these dashed lines did a great job at approximately (!) pinpointing the end of the entire rally and the start of the next massive move lower. One of these three dashed lines is several months too early, one is several months too late, and one is almost exactly pointing to the 2020 top.

This makes the current situation even more similar to what happened in 2008, which has profoundly bearish implications for the entire precious metals sector. I will provide more details of this analogy in the following Gold & Silver Trading Alerts – stay tuned.

Keep in mind though: a move of this magnitude most likely requires equities to participate. In 2008 and 2020, the sharp drawdowns in the HUI Index coincided with significant drawdowns of the S&P 500. However, with the words ‘all-time high’ becoming commonplace across U.S. equities, the likelihood of a three-peat remains relatively high.

Let’s zoom in. Here’s how the situation looked like in 2008.

Figure 6

And here’s how it looks today (I’m using the GDX ETF, so that we get the direct implications for tradeable targets):

Figure 7

In both cases, the entire pattern started with a breakdown below the head-and-shoulders that triggered a decline that wasn’t as big as one might expect it to be.

The rally that followed has more or less doubled the size of the decline that preceded the above-mentioned bottom, but the rally itself had three distinct parts.

- The first part was the rally back to the previous highs (the mid-2005 highs and mid-2015 highs).

- Then, after a consolidation, we saw another rally and a correction below the 50-day moving average (marked with blue).

- And finally, we saw a top that took the form of a double top where the second top was slightly higher than the previous (mid-2006 and mid-2016) one.

Afterwards, we saw a sizable decline. After that decline, mining stocks entered a consolidation, which was either long (mid-2006 – mid-2007) or very long (late-2016 – early-2020). During the consolidation, mining stocks moved back and forth between the initial high and then the initial post-top low.

The consolidation ended when we saw a sharp decline that by itself triggered a powerful comeback – like a slingshot. The decline in 2020 is crystal-clear, and it is also visible in 2007. I remember how people reacted back to the near-vertical slide in mining stocks back in 2007 – the emotionality was sky-high even though miners didn’t decline as much as they did in 2020. If it wasn’t for the pandemic, it’s probable that the decline that we saw last year wouldn’t be as severe. Since the pandemic was a one-time (hopefully…), non-market-based event, it’s a piece of information that we should “discount” here. In other words, in my view, it’s justified to say that both sharp declines (2007 and 2020 ones) were similar.

What followed then was a sharp rally that had three major stages:

- The rally above the previous (2006 and 2016) high and formation of the initial top.

- The correction to approximately the previous (2006 and 2016) high.

- The rally to new highs and the final top there.

In both cases, the initial top from point 1 was the left shoulder of the broad head and shoulders pattern, while the final top (point 3) was its head.

In both cases, this head-and-shoulders formation had the right shoulder a bit higher than the left one (both, lows and highs), which caused the neckline to ascend in both cases.

In both cases, the middle of the right shoulder was indicated by the death cross (the 50-day moving average breaking below the 200-day moving average).

Then, at the very end of the head-and-shoulders pattern, we saw a quick (when viewed from the long-term point of view) back-and-forth movement around the neck level, when miners tried to get back above their 50-day moving average, but failed to do so.

I marked the above back-and-forth movement with red rectangles. This is where we’re currently at – most likely right before the massive plunge.

This might seem like an implication that’s too far-fetched, but if this analogy is to be upheld and the general stock market decline is needed to trigger the biggest part of the decline, then perhaps the above analogy is telling us that the general stock market’s rally is about to end. Bitcoin just reached an important psychological milestone ($50k), so it would be quite natural for it to decline now. This could be one of the triggers for the “big unwinding” of various bubbles that formed in the previous months (and years).

This could be exactly how the Kondratiev winter starts. And – as a reminder – based on how gold stocks performed under similar circumstances (in 1929 and 2008) they would be quite likely to keep declining for about three months after stocks top. The final bottom could therefore take place in May (or June, if stocks manage to delay their decline for longer). Naturally, the above might happen differently and – in particular – at different times, and these time predictions are not enough to enter risky option trades, but it does seem a quite possible scenario.

Now, what does the above analogy give us in terms of price targets? After spending a long time analyzing the above charts, I came to the conclusion that the 1-to-1 analogy won’t be reliable, but the indirect implications might. Just as the shape of the consolidation and size of the slide that triggered the rally were somewhat similar but not identical, the shape of the upcoming decline doesn’t have to be identical.

However, there are certain factors that would have been important anyway, and the link to 2008 only makes them stronger. Actually, there is no major surprise here. The key take-away is that the Fibonacci retracement levels as well as the previous lows and previous highs are likely targets for rebounds and their ends. This fits with what I’ve been featuring on the GDX ETF chart, so it only makes those points more valid.

There is one extra take-away, though. It’s not visible on the above chart, but the interesting observation was that the HUI Index corrected whenever it declined more than 29% of its nominal price, with the exception being the very first consolidation. In other words, when things get wild, and the miners decline more than 25%-30% of their nominal value, it means that they are almost ripe for a corrective upswing. This is a very important observation, because it tells us when we should be paying extra attention to nearby support levels and when we might consider temporarily exiting or even reversing our short positions.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM