tools spotlight

-

Here’s Why Gold Recently Moved Up

January 20, 2021, 8:08 AMGold moved higher as the USD Index moved lower in today’s pre-market trading. Before providing you with my thoughts on why that happened and what the implications are, let’s see exactly what transpired.

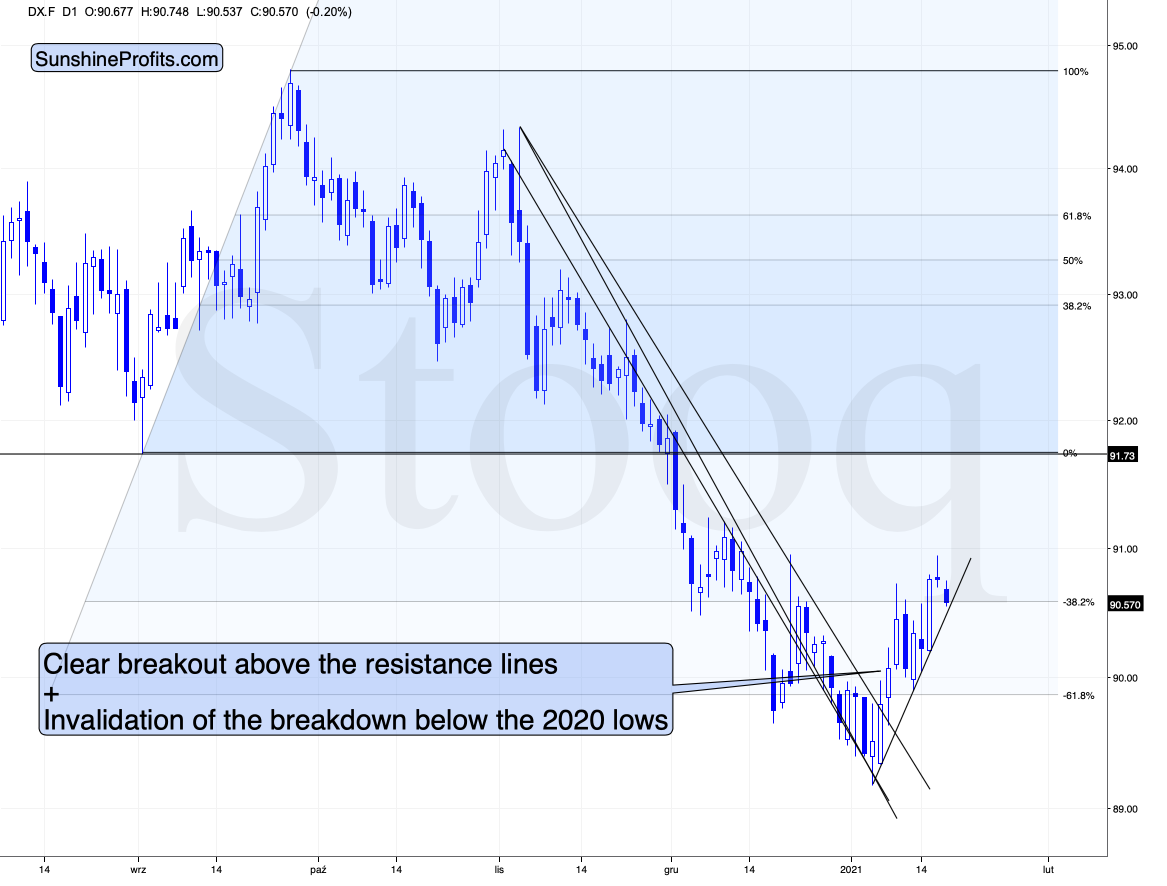

Figure 1 - USD Index

In yesterday’s (Jan. 19) analysis, I commented on the above USD Index chart in the following way:

The USD Index is after a major breakout above the declining resistance lines and this breakout was confirmed. Consequently, the USD Index is likely to rally, but is it likely to rally shortly? The answer to this question is being clarified at the moment of writing these words, because the USD Index moved back to its rising short-term support line that’s based on the 2021 bottoms.

If the USD Index breaks below it, traders will view the 2021 rally as a zigzag corrective pattern and will probably sell the U.S. currency, causing it to decline, perhaps to the mid-January low or even triggering a re-test of the 2021 low.

If the USD Index performs well at this time and rallies back up after touching the support line, and then moves to new yearly highs, it will be then that traders realize that it was definitely not just a zigzag correction, but actually the major bottom. In the previous scenario, they would also realize that, but later, after an additional short-term decline.

The weak performance of mining stocks that we saw last week, and relatively strong performance of silver (up by 1.24%) compared to gold (up by 0.34%) in today’s pre-market trading suggest that PMs are very ready to slide right now. This – as markets are interconnected – might make the strength in the USD Index more likely than not. In this case, the second above-mentioned scenario would be realized, and the price moves that I’ve been describing for some time now, would gain momentum quickly.

In either case, it seems that the outlook for the precious metals market remains bearish for the short and medium-term. It is only the immediate and very short term that have any notable differences. Therefore, it seems to make sense to keep the short positions in the mining stocks intact.

The USD Index moved lower, and at the moment of writing these words, its trading slightly below the rising support line. Is the more bearish (on a temporary basis) forecast for the USDX and more bullish forecast for gold being realized?

Let’s take a look at gold.

Figure 2 - COMEX Gold Futures

Gold is rallying today, but overall, it remains in a back-and-forth consolidation pattern, which continues to be similar to what we saw in November after a very similar (yet smaller) sharp decline.

Gold moved slightly above its September low in intraday terms, but not in terms of the closing prices.

Figure 3 - VanEck Vectors Gold Miners ETF (GDX)

Miners were barely affected yesterday. They moved slightly higher, but it seems to have been just a pause, similar to what we saw in mid-November – nothing more than that.

Ok, so that’s what happened. Before stating that the USD’s breakdown and gold’s strength today are game changers for the very short term, let’s think about the possible explanation for these price moves. Is anything special happening today that makes today’s session at least a bit different than other sessions? Something that could be affecting the USD Index and gold?

Of course, there is something like that! It’s the U.S. President’s inauguration day!

In any case, such a day could affect the temporary market movement, but this year it’s particularly the case, because of the recent Washington D.C. riot and popular conviction that “something might happen” that would prevent the inauguration and effectively allow Donald Trump to remain the U.S. President.

As I explained previously, I think that the probability for seeing the above is extremely low, but at this time, the markets and investors might be worried that this really is something that’s at least somewhat possible. If so, then the USD Index should be moving temporarily lower and gold – being a safe-haven asset – is likely to be moving higher. Of course, only temporarily, because it will soon become clear that the inauguration takes place without any major obstacles. There might be some local protests etc., but nothing that would change the situation in any meaningful manner. Consequently, this is most likely the day when the uncertainties and tension regarding the transfer of power in the U.S. start to decrease. At the same time, it’s likely that they will peak right before decreasing. Therefore, what we’re seeing in the USD Index and gold right now is perfectly understandable and natural. And likely temporary.

This means that the breakdown in the USD Index could be invalidated soon – perhaps even tomorrow (or later today) and the opposite would be likely in the case of gold and silver’s strength. They might fade away quite quickly. Either way, the outlook remains bearish in my view.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

What Happens to Gold When USDX Rallies?

January 19, 2021, 6:13 AMLet’s start with the two things that you might be wondering about. The first is gold’s reversal and the second is the USD’s small decline.

In short, yesterday’s reversal in gold is inconsequential, because it took place on a day when there was no trading in the U.S. Consequently, the data from this single session is not a reliable indication of anything. Besides, gold remains below its September 2020 lows and below its most recent short-term high. In fact, it’s even below the upper border of the small declining flag pattern.

And what about the USD’s small decline?

As you might have already guessed, it didn’t change anything either.

The USD Index is after a major breakout above the declining resistance lines and this breakout was confirmed. Consequently, the USD Index is likely to rally, but is it likely to rally shortly? The answer to this question is being clarified at the moment of writing these words, because the USD Index moved back to its rising short-term support line that’s based on the 2021 bottoms.

If the USD Index breaks below it, traders will view the 2021 rally as a zigzag corrective pattern and will probably sell the U.S. currency, causing it to decline, perhaps to the mid-January low or even triggering a re-test of the 2021 low.

If the USD Index performs well at this time and rallies back up after touching the support line, and then moves to new yearly highs, it will be then that traders realize that it was definitely not just a zigzag correction, but actually the major bottom. In the previous scenario, they would also realize that, but later, after an additional short-term decline.

The weak performance of mining stocks that we saw last week, and relatively strong performance of silver (up by 1.24%) compared to gold (up by 0.34%) in today’s pre-market trading suggest that PMs are very ready to slide right now. This – as markets are interconnected – might make the strength in the USD Index more likely than not. In this case, the second above-mentioned scenario would be realized, and the price moves that I’ve been describing for some time now, would gain momentum quickly.

In either case, it seems that the outlook for the precious metals market remains bearish for the short and medium-term. It is only the immediate and very short term that have any notable differences. Therefore, it seems to make sense to keep the short positions in the mining stocks intact.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

What’s Hurting Gold’s Short-Term Prospects?

January 18, 2021, 10:15 AMToday is Martin Luther King Jr. Day, and in honor of the important civil rights leader, the stock market is closed. However, we are publishing today’s analysis as an exception because we understand that readers are eagerly waiting to read our thoughts about last week’s closes and what may lie ahead.

After incoming U.S. President Joe Biden unveiled his $1.90 trillion stimulus package on Thursday evening (Jan. 14), crickets were heard across the gold market. The once boisterous crowd yawned with boredom, as rising U.S. yields and a resurgent U.S. dollar soaked up all of the attention (and the liquidity).

But preceding the despair, gold’s fate was sealed when it reached its triangle-vertex-based reversal point after a short-term rally (a topping indicator that I warned about previously). And now, with the miners’ underperformance prophesying a much steeper decline, fireworks could be on display in the coming weeks.

Please see below:

Figure 1 - Gold Continuous Contract Overview and Slow Stochastic Oscillator Chart Comparison

Gold is after a significant decline and also a pause that immediately followed. This means that it can slide once again any day (or hour) now. The tiny buy signal from the Stochastic indicator (lower part of the above chart) was already nullified by a sell signal. A similar occurence resulted in declines in late November.

Interestingly, please note that back in November, gold’s second decline (second half of the month) was a bit bigger than the initial (first half of the month) slide that was much sharper. The January performance is very similar so far, with the difference being that this month, the initial decline that we saw in the early part of the month was bigger.

This means that if the shape of the price moves continues to be similar, the next short-term move lower could be bigger than what we saw so far in January and bigger than the decline that we saw in the second half of November. This is yet another factor that points to the proximity of $1,700 as the next downside target.

In addition, fundamentals are also starting to take effect. The U.S. 10-Year yield has surged by more than 19% since the New Year, and despite Friday’s (Jan. 15) pullback, it still closed above Wednesday’s (Jan. 13) low.

Figure 2

And like a double-edged sword, the rising 10-year yield is accelerating the EUR/USD’s 2021 fall from grace (another development that’s hurting gold’s short-term prospects). And because the EUR/USD accounts for nearly 58% of the movement in the USD Index, a continuation of the trend could spell trouble for gold (As I mentioned on Jan. 15, gold’s 250-day correlation with the USDX is – 0.80.)

Figure 3

In summary, lower gold prices remain the path of least resistance. Until the miners start pulling their weight, gold is stuck in limbo. And because bearish technicals and fundamentals support another move lower for the GDX ETF, gold is unlikely to buck the trend. However, once the dynamic reverses, it will provide an attractive opportunity to profit from the eventual upswing.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

If a Bubble Pops, What Happens to Gold?

January 14, 2021, 8:20 AMAvailable to premium subscribers only.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM