tools spotlight

-

Gold’s Bounce: Much Ado About Nothing

December 1, 2020, 10:38 AMThis surely isn’t one of William Shakespeare’s plays, but excitement over occasional corrections as if they herald something much bigger has elements of comedy. Let’s face it, emotion is ever present in the markets and when investors are swept up in waves of excitement, they sometimes make rash decisions and are pushed out to sea. Whether it’s precious metals or stocks, the lesson here is to keep one’s emotions at bay, especially with small upticks and counter-trend rallies.

Yes, gold is rebounding today – it rallied about $30 higher in today’s pre-market trading. Is the decline over, or is this nothing to call home about?

In short, it’s most likely the latter. If you recall the analogy to how gold performed almost a decade ago, then it’s clear that what we see here is quite normal. I described this analogy previously, but since this is particularly relevant today, it seems useful to go through the details once again.

The history rhymes, but this time, the similarity is quite shocking.

We copied the short-term chart and pasted it over the long-term chart above and next to the 2011 top.

They are very similar to say the least. Yes, these patterns happened over different periods, but this doesn’t matter. Markets are self-similar, which is why you can see similar short-term trends and long-term trends (with regard to their shapes). Consequently, comparing patterns of similar shape makes sense even if they form over different timeframes.

After a sharp rally, gold declined quickly. Then we saw a rebound, and a move back to the previous low. Some time later gold moved close to the most recent high and started its final decline. This decline was less volatile than the initial slide. That’s what happened when gold topped in 2011 (and in the following years), and that’s what also happened this year.

The patterns with this level of similarity are rare, and when they do finally take place, they tend to be remarkably precise with regard to the follow-up action.

What is likely to follow based on this pattern, is that we’re likely to see the end of the slower decline, which will be followed by a big and sharp decline – similarly to what we saw in 2013.

The above similarity also shows that gold’s decline might initially have counter-trend rallies – just as we saw in early 2013. Consequently, seeing such a rally could be viewed as a bearish confirmation of this self-similarity.

Well, that’s exactly what we see today – a counter-trend rally.

Does it change anything from the short-term point of view? Absolutely not. Gold didn’t even rally to its declining short-term resistance line.

Gold was declining almost each day recently, and no market can move up or down without periodic breathers – that’s exactly what seems to be taking place today. Not only is it not a game-changer; it’s actually in tune with how gold declined in 2013 – with periodic corrections.

Back in 2013 these corrections ended at some point and then the gold market truly plunged. This means that it seems best not to try to time each and every correction, but focus on the bigger move, instead.

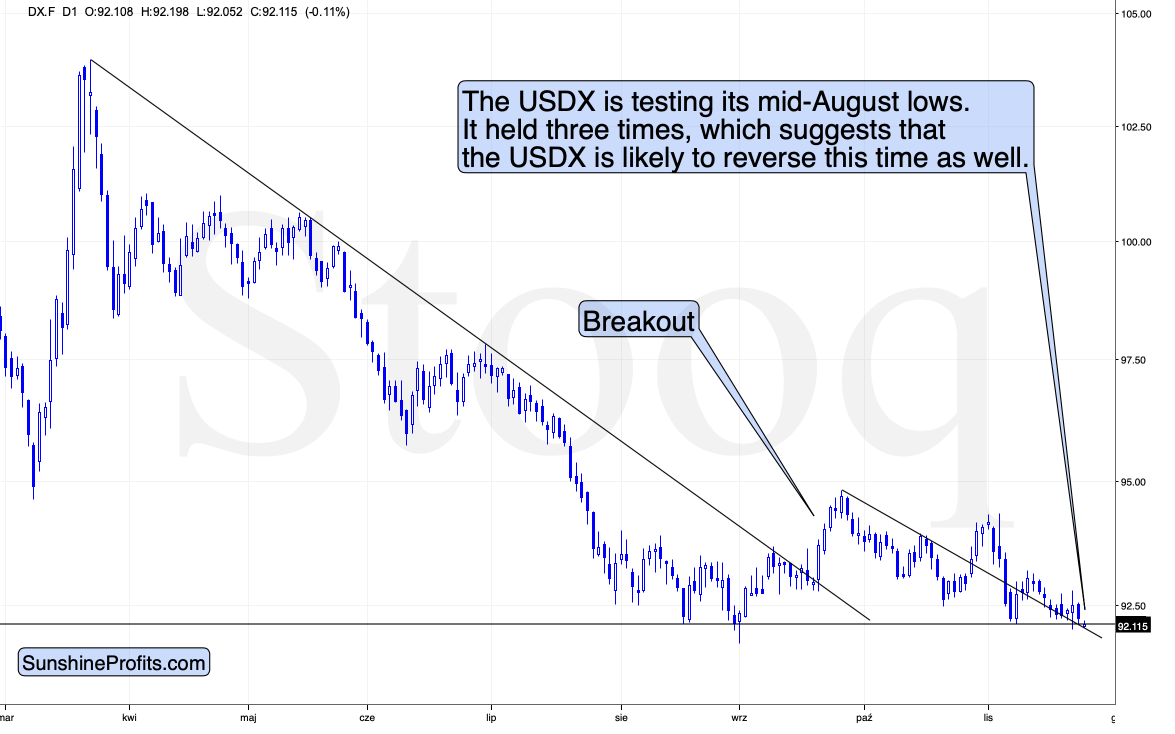

Especially that the USD Index has just invalidated its small breakout below the September low.

Yesterday, I commented on the above chart in the following way:

At the moment of writing these words, the U.S. currency is testing its previous lows. It’s slightly below the previous intraday low and this tiny breakdown is definitely not confirmed.

Given the Thanksgiving seasonality, it’s doubtful that there are any bearish implications at all.

Speaking of cyclicality, please note that the U.S. Dollar Index tends to reverse its course at the turn of the month. That happened early in the months of January, February, May, July, August, September, and November – thus occurring in over half of the year. Today is the last day of November and given the above regularities, it seems that the USD’s breakdown will be invalidated shortly.

Besides, that’s not even the most important detail from the precious metals investors’ point of view.

The most important detail is that all these bearish moves in the USDX failed to trigger any decent rallies in gold, which shows that the latter simply doesn’t want to rally from here.

That’s exactly what we saw – the USD Index’s breakdown was indeed invalidated.

What does it mean? It means that while gold, silver, and mining stocks might move higher this week, one shouldn’t expect this counter-trend rally to last long. As the USD Index rallies, precious metals and miners are likely to fall – perhaps much more dramatically than they fell in the past several days.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Probing Gold’s Bottom

November 30, 2020, 11:57 AMAs 2020 is wrapping up, investors are trying to narrow down the target for gold’s bottom in the coming weeks. And as the yellow metal is experiencing what appears to be its worst month in the past four years, the Gold Miners Bullish Percent Index ($BPGDM) once again provides us with some key insights into reading the bearish signals for the precious metals.

Last week, the BPGDM showed the highest possible overbought reading.

The excessive bullishness was present at the 2016 top as well and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing had caused the $BPGDM to move up once again for a few days. It then declined once again. We saw something similar also in the middle of this year. In this case, the move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline.

Based on the decline from above 350 to below 280, we know that a significant decline is definitely taking place. But has it already run its course?

Let’s consider two similar cases when gold miners declined significantly after the $BPGDM was very high: the 2016 decline and early-2020 decline.

In both cases, the HUI Index continued to decline until it moved slightly below its 61.8% Fibonacci retracement level. This means that if the history is to repeat itself, we shouldn’t expect any major turnaround until the gold miners decline to 220 - 230 or so. Depending on how things are developing in gold, the above might or might not be the final bottom, though.

Please note that the HUI already declined below its 2016 high. This breakdown is yet another bearish sign.

Please note that back in 2016 (after the top), and in March 2020, the buying opportunity didn’t present itself until the $BPGDM was below 10. Currently, it’s above 30, so it seems that miners are likely to move even lower.

Two weeks ago, when I was preparing the analysis of the above GDX ETF chart, I commented on the late-week rebound in the following way:

On Thursday (Nov 12th) and Friday (Nov 13th) of last week, miners moved and closed higher, but it’s important to note that their upswing was tiny and not accompanied by strong volume. In other words, it has all the characteristics of the breather that’s going to be followed by another move in the direction in which the market had been moving previously.

The previous move was down, so the implications are bearish.

Something similar took place during last week as well as the previous week, and thus today’s comments will be similar. It seems that we now have this specific weekly gold stocks seasonality where miners decline strongly early in the week and then show some limited strength before the weekend.

For now, it seems that we have just likely seen a regular breather that is likely to be followed by further declines.

As indicated earlier, the biggest part of the decline might start shortly after Thanksgiving.

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there is just more than one month left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Further Clues Reveal Gold’s Weakness

November 25, 2020, 8:24 AMIt might have been tempting to think that the recent move lower in the U.S. Dollar Index would serve to push gold higher, as it usually does according to the traditional pattern. But these are extraordinary times and there are too many external factors weighing negatively on the price of the yellow metal.

As if the previous vaccine announcements weren’t enough, the latest vaccine trials from AstraZeneca further propelled positive news. And as Trump reluctantly gave Joe Biden the green light towards a transition to the White House, what more can the precious metals do but capitulate? The risky assets train is leaving the station and investors are climbing on board. There simply is no clear catalyst for gold to rally and it can only go further down from here before bottoming.

With this glut of headlines, what news can I possibly give you today? Well, I can tell you about some of the clues that yesterday’s decline provided and about one from today’s pre-market USD and gold trading.

Let’s start with the latter.

In today’s pre-market trading, the USD Index moved slightly lower, and at the moment of writing these words, it finds itself a bit below the mid-August bottom.

The invalidation of the intraday breakdown below this level was what triggered the biggest part of gold’s decline on Monday (Nov 23). This might happen again very soon, but this is not the clue that I was writing about earlier. Today’s clue is that since the USD Index might be breaking lower here, gold should have reacted with a visible rally – if it was past a bottom.

Gold didn’t react with a visible rally. Conversely, gold reacted with a small decline. This subtle clue tells us that gold hasn’t formed a bottom yet. And since gold doesn’t want to rally from here, and it seems that it’s about to get a bearish push from the USD Index (I expect the tiny breakdown to be invalidated just like the previous 3 attempts), we have a quite bearish combination of factors for the yellow metal.

Please note that moves in both the USD Index and gold were relatively small (so they could be invalidated before you read this) but this lowers the bearish implications only a little – after all, for some time in today’s pre-market trading gold was definitely moving a bit lower while the USDX was a bit lower as well.

What about the clues from yesterday’s session? They are visible on the mining stock chart.

Miners moved lower and while they tried to bounce back, they failed to do so, creating a bearish reversal during the day. This kind of shape during the day’s session is bearish in nature. It’s especially the case when we see it after a rally (it’s a shooting star candlestick or a gravestone doji candlestick in this case), but even during a decline it indicates more weakness. Please note that we already saw that a few times recently: on November 12 and 13, and on October 26.

The shape of yesterday’s session is one clue, and the steady buildup in volume as prices decline is another. The August, September, and October bottoms were characterized by a relatively average volume during the declines preceding them, and then a huge spike in volume at the bottom. This time, the volume is also significant in absolute terms, but not in relative terms. The volume is simply increasing as the price moves lower as more and more people become convinced that gold is no longer in a bullish mode.

The RSI indicator is approaching the 30 level, which some might view as bullish, but let’s keep in mind that back in March, the bottom was not yet in until the RSI moved into its low 20s.

So, while it’s clear that there are counter-trend rallies within any move, it seems that the precious metals market is not yet ready to launch a counter-trend rally right now. And even if it does start this kind of move, it’s unlikely that it would be significant. The outlook for the precious metals market remains bearish for the next few weeks.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM