tools spotlight

-

“It’s Too Hot in Here”: The Gold Market Expects a Cold Shower

April 22, 2022, 8:12 AMWhile I have been warning about the “expeditiously” hawkish monetary policy actions that should commence over the next several months, the man at the top put a stop to investors’ games on Apr. 21. To explain, Fed Chairman Jerome Powell said:

“It is appropriate in my view to be moving a little more quickly” to raise interest rates. He added: “I also think there is something to be said for front-end loading any accommodation one thinks is appropriate (…). I would say 50 basis points will be on the table for the May meeting.”

“It’s absolutely essential to restore price stability. Economies don’t work without price stability.”

Moreover, there is that word again:

As a result, while investors finally got the message, I warned on Apr. 21 that officials' guidance had been loud and clear for months. I wrote:

It’s funny how obvious Fed officials’ messaging has become. In a nutshell: Powell sets the tone, and his deputies recite his message in hopes that investors will react accordingly. However, with investors in denial and/or unable to see the forest through the trees, they’re not heeding the warnings.

Well, suddenly, the wake-up call elicited a shift in sentiment. With the S&P 500 under pressure and the GDXJ ETF suffering mightily on Apr. 21, reality finally re-emerged. However, with plenty of downside still left for both assets, the medium term should elicit plenty of hawkish fireworks. To explain, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

To that point, Powell said on Apr. 21 that the U.S. labor market is "too hot" and that the Fed needs to cool it down. "It is a very, very good labor market for workers," he said. "It is our job to get it into a better place where supply and demand are closer together."

Moreover, while I've warned on numerous occasions that Fed officials have sounded the alarm on the economic challenges that lie ahead, Powell said that it won't be "straightforward or easy" to administer a soft landing.

Please see below:

The Message Man

However, while investors’ light bulbs went off on Apr. 21, the reality is that these medium-term ramifications have been hiding in plain sight. Moreover, while Powell said that a 50 basis point rate hike in May is “on the table,” it’s likely a done deal. Here is why: I noted on Apr. 14 that the Bank of Canada (BoC) announced a jumbo rate hike at its last monetary policy meeting. I wrote:

The Bank of Canada (BoC) announced a 50 basis point rate hike on Apr. 13, and with the Fed likely to follow suit in May, the domestic fundamental environment confronting the PMs couldn’t be more bearish.

Please see below:

Moreover, BoC Governor Tiff Macklem (Canada's Jerome Powell) said that "We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed."

Furthermore, while he added that the BoC could "pause our tightening" if inflation subsides, he cautioned that "we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target."

However, with the latter much more likely than the former, the BoC's decision is likely a preview of what the Fed should deliver in the months ahead.

To that point, Canadian inflation data was released on Apr. 20. Surprise, surprise: the scorching results came in hotter than expected. For context, the figures in the middle column represent economists’ consensus estimates.

Please see below:

Furthermore, the most important point that investors miss is the political ramifications of inflation. For example, when low and middle-class citizens suffer financially, their hardship becomes front-page news. As a result, the unwanted attention is bearish for the financial markets because it forces politicians and, therefore, central banks to act.

Please see below:

Likewise, while America’s neighbor to the north is feeling the inflationary heat, the political story is the same in the U.S. To explain, I wrote on Apr. 20:

CNBC released its All-America Economic Survey on Apr. 13. The report revealed that “47% of the public say the economy is ‘poor,’ the highest number in that category since 2012. Only 17% rank the economy as excellent or good, the lowest since 2014.”

Please see below:

Likewise, I’ve also noted on numerous occasions that U.S. President Joe Biden’s approval rating is inversely correlated with inflation.

As a result, while investors assume that the Fed will bow down to the financial markets, the reality is that the game has changed. Previously, the Fed could support asset prices without the general public noticing. Now, inflation is front-page news and is hurting middle-class and poor Americans. Therefore, the Fed has to deal with the issue, and political pressure should force officials’ hands, whether they like it or not.

Thus, while the S&P 500 and the PMs have largely denied these hawkish realities, their price action on Apr. 21 is likely a sign of things to come. In addition, with the inflation story far from resolved, my comments on Apr. 6 still stand: [Fed] officials should keep hammering the financial markets until investors finally get the message.

A case in point: the Philadelphia Fed released its Manufacturing Business Outlook Survey on Apr. 21. The report revealed:

“The indicators for prices paid and prices received continued to suggest widespread price increases and inched higher this month. The prices paid index rose 4 points to 84.6, its highest reading since June 1979 (…). The current prices received index edged up from 54.4 to 55.0.”

Please see below:

On top of that, this month’s special questions revealed that inflation expectations have also increased. The report stated:

“The firms still expect higher costs across all categories of expenses in 2022: Responses indicate a median expected increase of 10 to 12.5 percent for raw materials and of 7.5 to 10 percent for energy and for intermediate goods, higher than when this question was asked back in January. The median expected change for total compensation (wages plus benefits) was unchanged at 5 to 7.5 percent.”

Please see below:

Also, please remember that the survey data was collected from Apr. 11 to Apr. 18. Therefore, inflation is still running away from the Fed. As further evidence, Tracker Supply released its first-quarter earnings on Apr. 21.

For context, the company operates a “retail chain of stores that sells products for home improvement, agriculture, lawn and garden maintenance, livestock, equine and pet care for recreational farmers and ranchers, pet owners, and landowners.”

CEO Hal Lawton said during the Q1 earnings call:

“What we’re seeing is very consistent with what we’re all reading in the headlines every day. I’ll start with persistent inflation. We had the CPI of 8.5% in the month of March, that we’ve seen 0.5 point increases a month for the last handful of months. It’s tough to say if we’re at peak inflation, the way I think about it is that we’re seeing persistent inflation. And I think we will see, strong inflation, not only through this year, but in the next year.”

As a result, the company is pricing its products ahead of the 8.5% CPI:

Source: Tractor Supply/Seeking Alpha

Source: Tractor Supply/Seeking AlphaFurthermore, I wrote on Apr. 21 that Procter & Gamble (P&G) had a similar message:

CFO Andre Schulten noted that ~5% price hikes in Q3 will look more like ~6% in Q4.

Please see below:

For your reference, favorable price elasticities mean that when P&G raises prices, the company is not seeing a drop-off in demand.

Likewise, with Lawton also highlighting consumers’ lack of resistance to the company’s price increases, his observations are bullish for Fed policy and bearish for the PMs.

Please see below:

Source: Tractor Supply/Seeking Alpha

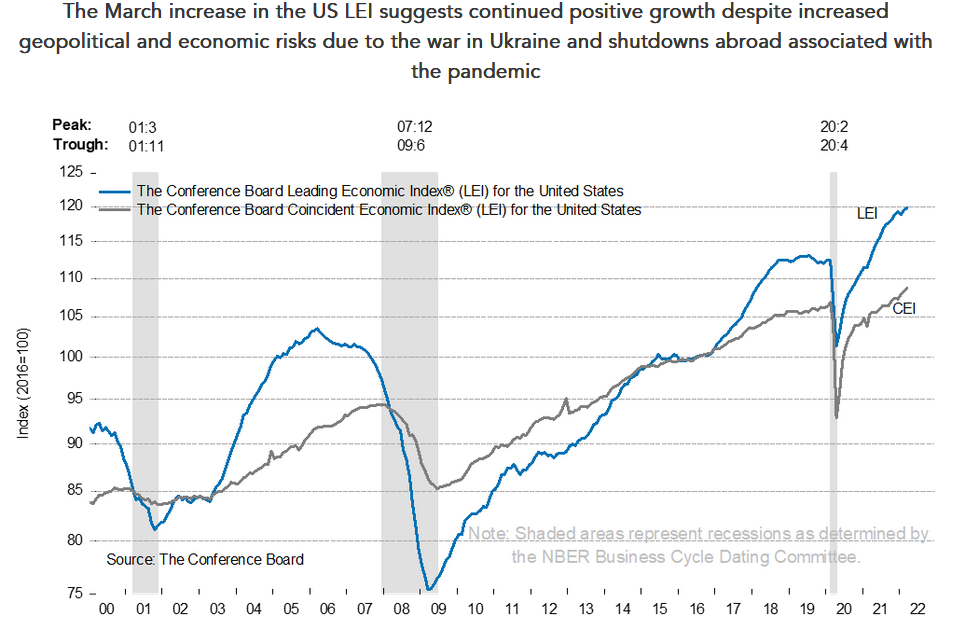

Source: Tractor Supply/Seeking AlphaFinally, The Conference Board released its Leading Economic Index (LEI) on Apr. 21. After increasing by 0.3% month-over-month (MoM) in March, the LEI has risen by 1.9% from September 2021 to March 2022. Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board, said:

“The US LEI rose again in March despite headwinds from the war in Ukraine. This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations. The Conference Board projects 3.0 percent year-over-year US GDP growth in 2022, which is slower than the 5.6 percent pace of 2021, but still well above pre-covid trend.”

Please see below:

The bottom line? The data continues to support hawkish Fed policy and has only intensified in recent months. Therefore, while I’ve noted that the PMs’ medium-term fundamentals are more bearish than at the end of 2021, the consequences of the Fed’s rate hike cycle should knock some sense into investors over the next few months.

Moreover, while Fed officials have been parroting the same message for weeks, Powell’s reality check on Apr. 21 is extremely bullish for the USD Index and U.S. real yields. Remember, the Fed needs to kill demand to tame inflation, which means pushing up real yields and reducing wages. As such, does this seem like a bullish six-to-12-month environment for risk assets?

In conclusion, the PMs declined on Apr. 21, and mining stocks were material underperformers. However, the daily damage still leaves gold, silver and mining stocks’ prices well above their fundamental values. As a result, there is likely plenty of room for further downside over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Is War the Only Factor Buffering Gold Right Now?

April 21, 2022, 7:55 AMDespite the fact that the financial markets were closed for the Easter holiday, there was still plenty of drama. For example, the U.S. 10-Year real yield hit 0% and briefly turned positive for the first time since 2020, the USD Index topped 101, and Fed officials warned of several rate hikes in the coming months.

However, while all of these developments are fundamentally bearish for the PMs, the most crowded trade on Wall Street has the commodities complex sitting pretty.

Please see below:

While Netflix's drubbing on Apr. 20 should be a cautionary tale of the consequences of deteriorating fundamentals, the PMs remain uplifted, but with the medium term likely to elicit a material shift in sentiment, don't be surprised if investors' wrath is eventually thrust upon them.

To explain, the devil is in the details, and when you watch for subtle clues, the puzzle pieces come together. For example, I warned on Apr. 13 that Fed officials' messaging couldn't be clearer. I wrote:

Fed Governor Lael Brainard said on Apr. 12: “Inflation is too high, and getting inflation down is going to be our most important task.”

More importantly, notice her use of that all-important buzzword.

And:

Moreover, where do you think she got it?

Likewise, St. Louis Fed President James Bullard said on Apr. 18 that inflation is “far too high” and that a rapid rise to neutral is the most likely outcome. For context, he wants to increase the U.S. federal funds rate to 3.5% by the end of 2022. Moreover, there is that word again:

Continuing the theme, San Francisco Fed President Mary Daly said on Apr. 20 that a 50 basis point rate hike in May is "complete" and "solid." As a result, it's like Fed officials have morphed into those toys that repeat the same message when you pull the string.

Please see below:

As further evidence, can you guess what Chicago Fed President Charles Evans said on Apr. 11?

Therefore, do you think it’s a coincidence that Fed officials are repeating the same message? Of course not. After the FOMC’s December monetary policy meeting, I warned that Chairman Jerome Powell uses his deputies to deliver remarks on his behalf. I wrote on Dec. 16:

As one of the most important quotes of the press conference, [Powell] admitted:

“My colleagues were out talking about a faster taper, and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

While Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

To that point, Evans added on Apr. 19: “On the way to December, you’d be looking for any confirmation of the storyline. It could be that short-term neutral is actually lower, and that by the time we get to 2.5%, it’s actually contractionary for a variety of reasons. It could go the other way too.”

However, given the state of inflation, he realistically said: “Probably we are going beyond neutral. That’s my expectation.” As a result, more than one 50 basis point rate hike is on the table.

Please see below:

Also noteworthy, Atlanta Fed President Raphael Bostic was the most dovish of the crew this week. He said:

“I really have us looking at one and three-quarters by the end of the year, but [inflation] could be slower depending on how the economy evolves and we do see greater weakening than I’m seeing in my baseline model. This is one reason why I’m reluctant to really declare that we want to go a long way beyond our neutral place, because that may be more hikes than are warranted given sort of the economic environment.”

However, stating that the neutral U.S. federal funds rate could range from 2% to 2.5% or be as low as 1.75%, he remains aligned with the FOMC's median projection of six more rate hikes (seven in total) in 2022. Also, there is that word again.

As a result, it’s funny how obvious Fed officials’ messaging has become. In a nutshell: Powell sets the tone, and his deputies recite his message in hopes that investors will react accordingly. However, with investors in denial and/or unable to see the forest through the trees, they’re not heeding the warnings.

Ironically, the U.S. technology sector has been decimated in recent months, while commodities remain uplifted. However, seven to 12 rate hikes over nine months will heavily impact demand and are materially bearish for commodities’ fundamentals. Therefore, one could argue that commodities have more to lose in the coming months than technology stocks.

In any event, investors seem to believe that either inflation will subside on its own or the Fed will back off. However, neither outcome is realistic. I’ve mentioned on numerous occasions that political ramifications should keep the pressure on the Fed. As a result, as long as inflation persists, the prospect of a dovish 180 is slim to none. To explain, I wrote on Apr. 20:

CNBC released its All-America Economic Survey on Apr. 13. The report revealed that “47% of the public say the economy is ‘poor,’ the highest number in that category since 2012. Only 17% rank the economy as excellent or good, the lowest since 2014.”

Please see below:

Likewise, I’ve also noted on numerous occasions that U.S. President Joe Biden’s approval rating is inversely correlated with inflation.

As a result, while investors assume that the Fed will bow down to the financial markets, the reality is that the game has changed. Previously, the Fed could support asset prices without the general public noticing. Now, inflation is front-page news and is hurting middle-class and poor Americans. Therefore, the Fed has to deal with the issue, and political pressure should force officials’ hands, whether they like it or not.

To that point, the inflation data continues to sizzle. For example, the Fed released its Beige Book on Apr. 20. The report revealed:

As for wage inflation:

“Employment increased at a moderate pace. Demand for workers continued to be strong across most Districts and industry sectors. But hiring was held back by the overall lack of available workers, though several Districts reported signs of modest improvement in worker availability. Many firms reported significant turnover as workers left for higher wages and more flexible job schedules.”

“Persistent labor demand continued to fuel strong wage growth, particularly for footloose workers willing to change jobs. Firms reported that inflationary pressures were also contributing to higher wages, and that higher wages were doing little to alleviate widespread job vacancies. But some contacts reported early signs that the strong pace of wage growth had begun to slow.”

As a result, with inflation and employment still holding firm, this is bullish for Fed policy and bearish for the PMs.

Furthermore, Procter & Gamble (P&G) released its third-quarter earnings on Apr. 20. For context, the company sells various consumer staples and household products. CFO Andre Schulten said during the Q3 earnings call:

“We said each quarter that we will undoubtedly experience more volatility as we move through the fiscal year. We've seen another step in cost pressures, and foreign exchange rates have moved further against us. Transportation and labor markets remain tight. Availability of materials remains stretched in some categories and markets. Inflationary cost pressures are broad-based and continue to increase with little sign of near-term relief and have resulted in consumer price increases across CPG categories and beyond.”

Thus, Schulten noted that ~5% price hikes in Q3 will look more like ~6% in Q4.

Please see below:

For your reference, favorable price elasticities mean that when P&G raises prices, the company is not seeing a drop-off in demand. Moreover, P&G is no small fry. In fact, the company ranked second on Consumer Goods Technology's (CGT) 2021 Top 100 Consumer Goods Companies list. Therefore, it's more fuel for the hawkish fire.

The bottom line? While the answers are hiding in plain sight, investors do what they usually do: they ignore the fundamentals until something breaks. Then, it’s a rush for the exits and the financial media does a post-mortem about why everyone should have seen it coming. However, it’s simply the nature of investor psychology.

Therefore, no matter how many times Fed officials say “expeditious-ly” or how much the inflation data supports even more hawkish policy, investors usually don’t get the message until it’s too late. However, when reality re-emerges, there will likely be a long way down before the PMs’ prices get to the oversold territory, from which another powerful rally could emerge.

In conclusion, the PMs were mixed on Apr. 20, as momentum still remains elevated. However, with real yields and the USD Index rising, the only things holding up the PMs are the Russia-Ukraine conflict and sentiment. Therefore, when the latter two wane and the former two remain, gold, silver, and mining stocks should suffer profound drawdowns.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important ones are as follows:

- Apr. 26: Confidence Board consumer confidence, Richmond and Dallas Fed’s manufacturing and services indexes, S&P/Case-Shiller home price index.

With consumer confidence providing insight into employment and inflation sentiment, the data highlights how “anchored,” or lack thereof, consumers’ medium-term expectations are with the Fed’s mandate. Likewise, the Richmond and Dallas Fed indexes are leading indicators of inflation and employment, while the S&P/Case-Shiller home price index offers a lagged look at housing inflation (which often leads to rent inflation).

- Apr. 28: Q1 GDP and Kansas City Fed manufacturing index.

GDP is lagged data, and investors are forward-looking. However, it's still important to monitor. Moreover, it will be interesting to see if the Kansas City Fed's data aligns with the Richmond and Dallas Fed's results.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

If Gold Read the Tea Leaves, It Would See the Shape of a Bear

April 20, 2022, 7:34 AMDespite increased war tensions, gold failed to break above $2,000. What’s worse, rising USDX and interest rates are already lurking on the horizon.

The precious metals just performed exactly as they were likely to. Despite the increase in war tensions, PMs and miners reversed instead of rallying, which indicated that the rally has probably run its course. Since the tensions can now (most likely) either decline or stabilize, gold and silver prices will presumably fall right away, or after a while, as the market starts paying attention to gold’s two key fundamental drivers:

- the USD Index

- the real interest rates.

Both are inversely correlated with the price of gold, and both are on the rise. It’s therefore most likely only a matter of time before gold declines, and the same goes for silver and mining stocks. In fact, silver and mining stocks are likely to fall harder than gold, as they’ve been very weak in recent years anyway. Let’s not forget that while gold moved above its 2011 highs, silver and miners are well below the 50% retracement from their respective 2011 highs.

Let’s check what gold did yesterday.

The gold price declined substantially, and it closed below its late-March 2022 high, thus invalidating the breakout above it. Instead of the breakout above $2,000, we saw the above. Instead of a bullish sign, we got a sell signal.

We also got another from the stochastic indicator that not only moved below its signal line, but also below the 80 level.

Moreover, let’s not forget that it all happened in tune with what we saw back in 2020, after gold’s major top.

Back then, gold retraced slightly more than 61.8% of the decline. Although this time it retraced slightly less, both cases are still very similar.

Consequently, this month’s recent upswing was not really bullish – it was a natural part of a bigger bearish pattern.

Just as gold reversed on Monday, so did silver. It also outperformed gold on a very short-term basis, which served as another bearish confirmation.

Silver’s outperformance of gold is often a sell signal, especially when it’s accompanied by mining stocks’ weakness, and we saw the latter too.

During yesterday’s trading, silver and junior miners were down rather similarly, but the latter had also been down on Monday, while silver had ended the session in the green.

Also, miners just invalidated their breakout above the March 2022 high in terms of the closing prices. No wonder here – the attempt to rally above the previous highs was accompanied by rather weak volume, suggesting that it would fail.

It did, and that’s a sell sign on its own.

Consequently, the current outlook for the precious metals market appears bullish in the long run but bearish in the medium- and short term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

How Many Months Are Left Until Gold’s Fundamental Landslide?

April 19, 2022, 8:53 AMWhile gold prices remain elevated and investors continue to ignore the implications of the Fed’s rate hike cycle, a reality check should emerge sooner rather than later. For example, Bank of America’s latest Global Fund Manager Survey shows that institutional investors don’t expect the Fed to turn dovish anytime soon.

Please see below:

To explain, the consensus expects six rate hikes in the coming months. However, while roughly 5% of respondents expected eight rate hikes in March, that figure increased to roughly 25% in April. As a result, institutional investors are slowly coming around to the hawkish realities that I warned about throughout 2021.

Furthermore, institutional investors’ assessment of monetary policy risk hit an all-time high in April.

Please see below:

Denial

However, old habits die hard, and while institutional investors realize what should materialize amid the Fed’s war on inflation, their positioning contrasts with the hawkish realities. As a result, the relative day-to-day calm contrasts with the crumbling house of cards.

Please see below:

To explain, the dark blue line above tracks the net percentage of respondents overweight equities, while the light blue line above tracks the net percentage of respondents expecting a stronger economy. If you analyze the right side of the chart, you can see that the light blue line is on par with the global financial crisis (GFC) lows. Despite that, though, institutional investors refuse to sell their stocks.

Thus, while fund managers believe that a material tightening of financial conditions will commence, the ‘buy the dip’ mentality is hard to break. However, with reality likely to force institutional investors to recalibrate their positions, the prospective negativity should have a profound impact on the PMs.

To that point, long oil/commodities are still the most crowded trades on Wall Street. Moreover, the idea that higher interest rates won’t impact commodity demand lacks credibility. In fact, slowing the U.S. economy should hurt commodities more than most sectors. As such, when the over-optimism reverses, the PMs should suffer substantial declines.

For more context, I wrote on Apr. 14

With Brainard and Waller telling you that their goal is to create a bullish environment for the USD Index and the U.S. 10-Year real yield, the PMs have fought this battle before and lost this battle before.

I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

To that point, Fed officials aren’t even pretending anymore. Waller said on Apr 13:

“All we can do is kind of push down demand for these products and take some pressure off the prices that people have to pay for these products. We can’t produce more wheat, we can’t produce more semiconductors, but we can affect the demand for these products in a way that puts downward pressure and takes some pressure off of inflation.”

Likewise, Waller was even more realistic when he spoke on Apr. 11: He said:

“With housing, can we cool off demand for housing without tanking the construction industry? Can we cool down labor demand without causing employment to fall? That’s the tricky road that we’re on.”

As a result, while Fed officials understand how difficult it will be to normalize inflation, investors remain in la-la land. However, when the “collateral damage” eventually unfolds, the shift in sentiment should result in the profound re-pricing of several financial assets.

Please see below:

Building on that theme, Fed officials continue to use the d-word when describing how they will tame inflation. Speaking on Apr. 14, Cleveland Fed President Loretta Mester said: “It’s not really a tradeoff right now, it’s really an imperative that we take the action, that we are committed at the FOMC to do that, to get inflation on a downward trajectory.”

As a result:

Likewise, Philadelphia Fed President Patrick Harker said on Apr. 14 that the central bank will deliver "a series of deliberate, methodical hikes" to curb "far too high" inflation.

Please see below:

As a result, while commodities remain the belle of the ball, the reality is that the Fed has to reduce demand. When the light bulb goes off that demand is dropping while prices remain sky high, commodities’ history of epic rallies and drawdowns will likely repeat.

To that point, as long as inflation remains problematic, the prospect of a dovish 180 by the Fed is slim to none, and with the data still coming in hot, investors remain unprepared for the medium-term readjustments.

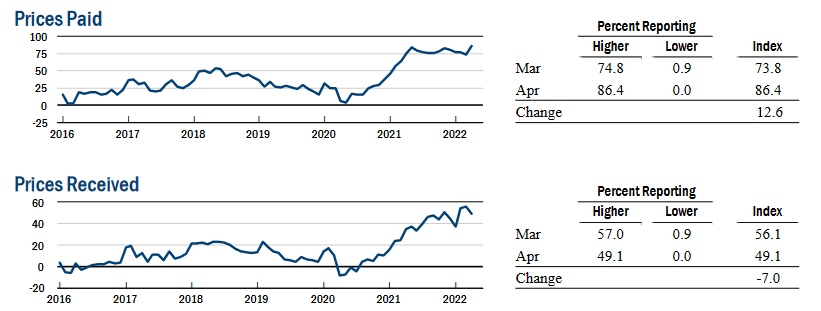

For example, the New York Fed released its Empire State Manufacturing Survey on Apr. 15. The report revealed:

“The prices paid index climbed thirteen points to 86.4, a record high, and the prices received index retreated seven points from last month’s record high, signaling ongoing substantial increases in both input prices and selling prices.”

Please see below:

In addition, the University of Michigan released its Consumer Sentiment Index on Apr. 14. Chief Economist Richard Curtin said:

“Consumer Sentiment jumped by a surprising 10.6% in early April, although it remained below January's reading and lower than in any prior month in the past decade. Nearly the entire gain was in the Expectations Index, which posted a monthly gain of 18.0%, including a leap of 29.4% in the year-ahead outlook for the economy and a 17.2% jump in personal financial expectations. A strong labor market bolstered wage expectations among consumers under age 45 to 5.3%, the largest expected gain in more than three decades, since April 1990.”

For context, wage growth of 5.3% is mutually exclusive with the Fed’s inflation goal. Moreover, when Powell and his crew begin their crusade to kill demand, consumers will likely suffer the same come-to-Jesus moment as investors.

Finally, the U.S. Census Bureau released its U.S. retail sales report on Apr. 14., and with the metric hitting a new all-time high of ~$666 billion in March, consumers’ spending spree remains alive and well. As such, the Fed still has plenty of work to do to curb demand and inflation.

The bottom line? While the PMs remain in momentum-driven upswings, their medium-term fundamentals continue to deteriorate. With real yields rising, the USD Index north of 100 and the Fed in inflation-fighting mode, the officials’ war against demand and inflation should upend the PMs in the coming months. As a result, while gold, silver, and mining stocks’ recent price action may seem bullish on the surface, there are plenty of material risks on the horizon.

In conclusion, the PMs were mixed on Apr. 18, as financial markets continued to assess macroeconomic developments. Moreover, while the Fed keeps hammering home its message, investors are still far from acknowledging reality. Thus, while the timing remains uncertain, medium-term enlightenment should result in a profound shift in sentiment.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Beating Inflation: Are The Fed’s Dreams Gold’s Worst Nightmare?

April 14, 2022, 9:58 AMWhile investors remain happy-go-lucky, fundamental data for gold and silver is now worse than in 2021. Is this the last chance to come back to earth?

As another week comes to a close, the winds of change are blowing across the financial markets. However, while many investors and analysts can see only sunny days ahead, fundamental storm clouds should rain on their parade over the medium term, and it’s quite possible that it’s going to happen shortly.

To explain, this week culminated with the USD Index soaring above 100, the U.S. 10-Year real yield hitting a new 2022 high, and Goldman Sachs’ Financial Conditions Index (FCI) hitting its highest level since the global financial crisis (GFC). However, the PMs paid no mind yet. In fact, investors across many asset classes continue to ignore the implications of these developments. So far.

With sentiment poised to shift when the economic scars begin to show, the “this time is different” crowd may regret not heeding the early warning signs. For example, the Bank of Canada (BoC) announced a 50 basis point rate hike on Apr. 13., and with the Fed likely to follow suit in May, the domestic fundamental environment confronting the PMs couldn’t be more bearish.

Please see below:

Moreover, BoC Governor Tiff Macklem (Canada's Jerome Powell) said: "We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed."

Furthermore, while he added that the BoC could "pause our tightening" if inflation subsides, he cautioned that "we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target."

However, with the latter much more likely than the former, the BoC's decision is likely a preview of what the Fed should deliver in the months ahead.

Please see below:

To that point, while investors continue to drown out officials’ hawkish cries, I warned on Apr. 13 that the Fed knows full well about the difficulty of the task ahead. I wrote:

Fed Governor Lael Brainard said on Apr. 12: “Inflation is too high, and getting inflation down is going to be our most important task.”

She added: “I think there’s quite a bit of capacity for labor demand to moderate among businesses by actually reducing job openings without necessitating high levels of layoffs.” As a result, she’s telling you that Fed officials will make it their mission to slow down the U.S. economy.

With phrases like “capacity for labor demand to moderate” and “reducing job openings” code for what has to happen to calm wage inflation, the prospect of a dovish 180 is slim to none. As such, this is bullish for real yields and bearish for the PMs.

More importantly, notice her use of that all-important buzzword?

And:

Moreover, where do you think she got it?

Echoing that sentiment, Chicago Fed President Charles Evans (a relative dove) said on Apr. 11 that more than one 50 basis point rate hike could be on the horizon. "Fifty is obviously worthy of consideration; perhaps it's highly likely even if you want to get to neutral by December."

As a result, with the USD Index and the U.S. 10-Year real yield already soaring, what do you think will happen if the Fed pushes the U.S. federal funds rate "to neutral by December?"

Please see below:

Even more hawkish, Fed Governor Christopher Waller said on Apr. 13: “I think we’re going to deal with inflation. We’ve laid out our plans. We’re in a position where the economy’s strong, so this is a good time to do aggressive actions because the economy can take it.”

He added: “I think we want to get above neutral certainly by the latter half of the year, and we need to get closer to neutral as soon as possible.”

As a result:

Now, if we presented these quotes to the permabulls, they would say: "So what? We already know that the Fed is going to raise interest rates."

However, while a higher U.S. federal funds rate is now the worst-kept secret, the impact on U.S. economic growth is far from priced in. With investors assuming the Fed will normalize inflation without hurting the U.S. economy, they are positioned for an unrealistic outcome. Stagflation, anyone?

Moreover, with the gold and silver prices ignoring everything the Fed throws at them, they're attempting to re-write the history books.

However, with Brainard and Waller telling you that their goal is to create a bullish environment for the USD Index and the U.S. 10-Year real yield, the PMs have fought this battle before and lost this battle before.

To explain, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

To that point, Fed officials aren’t even pretending anymore. Waller said on Apr 13:

“All we can do is kind of push down demand for these products and take some pressure off the prices that people have to pay for these products. We can’t produce more wheat, we can’t produce more semiconductors, but we can affect the demand for these products in a way that puts downward pressure and takes some pressure off of inflation.”

Likewise, Waller was even more realistic when he spoke on Apr. 11: He said:

“With housing, can we cool off demand for housing without tanking the construction industry? Can we cool down the labor demand without causing employment to fall? That’s the tricky road that we’re on.”

As a result, while Fed officials understand how difficult it will be to normalize inflation, investors remain in la-la land. However, when the “collateral damage” eventually unfolds, the shift in sentiment should result in the profound re-pricing of several financial assets.

Please see below:

Thus, investors’ uninformed state of denial will likely seem obvious in the months ahead. (Yes, I know, it’s difficult to remain rational while surrounded what’s irrational, and that’s the very thing that makes investing “simple, but not easy”). Moreover, while Macklem cautioned that the BoC could “pause our tightening” if inflation subsides, the same rule applies to the Fed. However, with inflation still raging, the Fed and the BoC are unlikely to change their hawkish tones anytime soon.

Case in point. The U.S. Bureau of Labor Statistics (BLS) released the Producer Price Index (PPI) on Apr. 13.,and with outperformance across the board, green lights were present for all of the wrong reasons. For context, the gray figures in the middle column were economists’ consensus estimates.

Please see below:

Likewise, the NFIB released its Small Business Optimism Index on Apr. 12. The report revealed:

“The NFIB Small Business Optimism Index decreased in March by 2.4 points to 93.2, the third consecutive month below the 48-year average of 98. Thirty-one percent of owners reported that inflation was the single most important problem in their business, up five points from February and the highest reading since the first quarter of 1981. Inflation has now replaced ‘labor quality’ as the number one problem.”

How about this divergence?

“Owners expecting better business conditions over the next six months decreased 14 points to a net negative 49%, the lowest level recorded in the 48-year-old survey.”

“The net percent of owners raising average selling prices increased four points to a net 72% (seasonally adjusted), the highest reading recorded in the series.”

Moreover, “a net 50 percent plan price hikes (up 4 points).”

Please see below:

On top of that, “a net 49 percent reported raising compensation, down 1 point from January’s 48-year record high reading. A net 28 percent plan to raise compensation in the next three months, up 2 points from February.”

Please see below:

Thus, while the Fed hopes to rein in inflation, U.S. small businesses plan more price hikes and wage increases than in February. Therefore, officials’ hawkish intentions are not nearly hawkish enough. As a result, the medium-term outlook for the U.S. federal funds rate, the USD Index and the U.S. 10-Year real yield couldn’t be more bullish. As mentioned, let’s not forget how optimism often turns to pessimism when the drama unfolds.

The bottom line? Investors lack the foresight to see how the Fed’s rate hike cycle will likely unfold. Moreover, with Fed officials warning of the “collateral damage” that occurs when they curb demand to reduce inflation, the permabulls have simply closed their eyes and covered their ears. However, when sentiment is built on a foundation of sand, it often collapses when reality re-emerges.

In conclusion, the PMs rallied on Apr 13 as momentum remains the name of the game. However, while sentiment remains robust, gold, silver, and mining stocks’ fundamentals are worse now than at any point in 2021. As a result, history shows that not only are the current prices unsustainable, but profound drawdowns are required for the PMs to reflect their intrusive values.

What to Watch for Next Week

With more U.S. economic data to be released next week, the most important ones are as follows:

- Apr. 21: Philadelphia Fed manufacturing index

With the regional data providing early insight into April’s inflation dynamics, continued price increases will put more pressure on the FOMC.

- Apr. 22: S&P Global’s U.S. manufacturing and services PMIs

Unlike the Philadelphia Fed’s index, S&P Global’s data covers the entire U.S. As a result, the performance of growth, employment, and inflation will be of immense importance.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. And if that occurs, the outcome is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM