tools spotlight

-

Upcoming Rally in Gold Price or Just a Pause?

May 26, 2023, 11:03 AMDear Premium Subscribers, you will find the latest premium analysis on our new platform: Golden Meadow.

Dear not-yet Subscribers, this premium article (with the above title) is available for our subscribers only. However, please note that we very often publish free analyses that are based on the premium versions, and you can find them (they might have the same or different titles) at GoldPriceForecast.com and SilverPriceForecast.com.

The premium analyses include multiple timely details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief -

Gold Price’s Parabolic Warning

May 25, 2023, 5:48 AMBriefly: <positions removed from the preview version of the analysis>

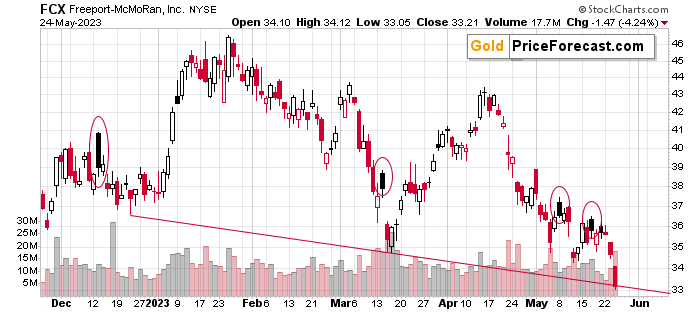

We are taking profits from the position in the FCX. (We might re-enter the short position here soon, though.)

What a slide in juniors and the FCX! And you know what? That’s not the end – that’s a start. And gold price’s parabolic performance confirms it.

Before I move to the analysis of the precious metals sector, here’s a quick info regarding our (now previous) position in the FCX. I’ve been featuring $27.13 as the downside target for this short position, but it seems that the risk-to-reward ratio at this time no longer favors keeping it open, which is why I think that taking profits off the table is now justified.

We entered this short position on April 5, when FCX was still trading close to $40. It just closed close to $33.

Congratulations to everyone who participated in this trade!

On one hand, the technical picture for the medium-term still favors severe (!) declines in the FCX, and the short-term technical situation in stocks doesn’t look good, but on the other hand, we might get some sort of “relief rally” when the debt ceiling scare is over (as a reminder, I see less than 0.1% chance of the U.S. defaulting on its debt).

Technically, the FCX just moved to a declining support line, which could be viewed as a neck level of a head-and-shoulders pattern, but we would need to see a breakdown (and its confirmation) first in order to say that this formation is indeed likely to lead to much lower FCX values.

And we’re likely to get it, but at this point, seen a corrective upswing is too likely for me to keeping a short position open. Just because I initially placed a lower downside target doesn’t mean that I won’t adjust the trade whenever the situation justifies it. Of course, the same goes for the precious metals sector, too, which might get oversold relatively soon… (more on that later today).

So, again, congratulations to those who are taking big profits from this less-than-2-month-long trade. This profitable trade extends our streak of profitable trades by one more. It’s now at least 7th profitable trade in a row (of course, taking unleveraged instruments into account; not options etc.) – I’m starting the counter in early 2022 here. And yes, I’m fully expecting that the current trade in junior miners will be very profitable as well.

I’ll keep my Gold Trading Alerts subscribers up-to-date regarding the upcoming trades.

Having said that, let’s start the main part of today’s analysis with a quote from the beginning of this week. On Monday, May 22, I wrote the following:

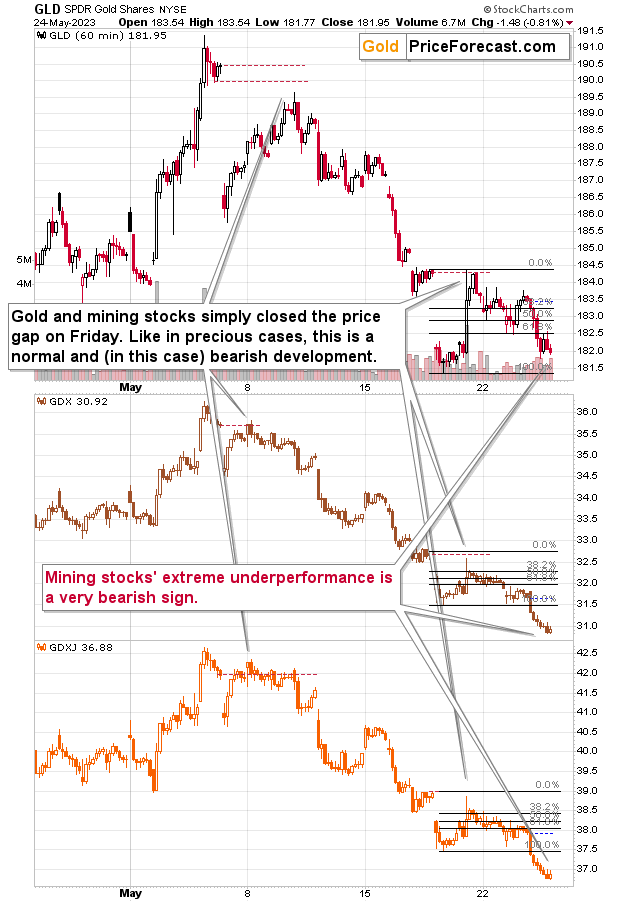

This time, the critical context is provided by the mining stocks. And more precisely, by the fact that miners were weak relative to gold.

While the GLD ETF (proxy for gold, which I’m using to have an apples-to-apples comparison with GDX and GDXJ) moved above its early-May lows, that didn’t happen in case of GDX or GDXJ – proxies for senior and junior mining stocks, respectively.

Miners tend to be weaker than gold during declines, and they tend to be stronger than gold during upswings, especially in upswings’ early parts.

This is the extra angle that one wouldn’t get while looking at gold price alone. Thanks to knowing how miners performed relative to gold (poorly), one can estimate, what’s the most likely outcome with greater accuracy than without this information.

Given what miners just did, the odds are that Friday’s upswing was just a correction and not the beginning of another bigger rally.

Moreover, please note that GLD, GDX, and GDXJ tend to either “close the gaps” or correct in the “gap’s territory”. And that’s what we saw once again on Friday.

A price gap is created, when a given market opens well below or above the closing price from the previous session. The space between the previous days’ close and the new open is a “gap”. It’s essentially a group of price levels at which there was no trading as the markets were closed.

Gold and gold miners tend to then – after such a price gap is formed – to move back to the previous closing price and then continue the trend.

We saw something like that earlier this month, and we saw it on Friday.

What does it mean? It means that since the gap was closed / almost closed, the precious metals sector can now decline once again – quite possibly in a profound manner.

You already know what happened next. Gold price declined, and mining stock prices truly plunged.

Interestingly, the way in which they all declined suggests that there’s more to come. After all, miners continue to be exceptionally weak relative to gold.

While the GLD remains above its recent lows, both: GDX and GDXJ are already after a breakdown to new short-term lows and a sizable extra decline.

And here’s the best part:

It looks like gold is about to plunge too, thus contributing to an even bigger (!) slide in the mining stocks.

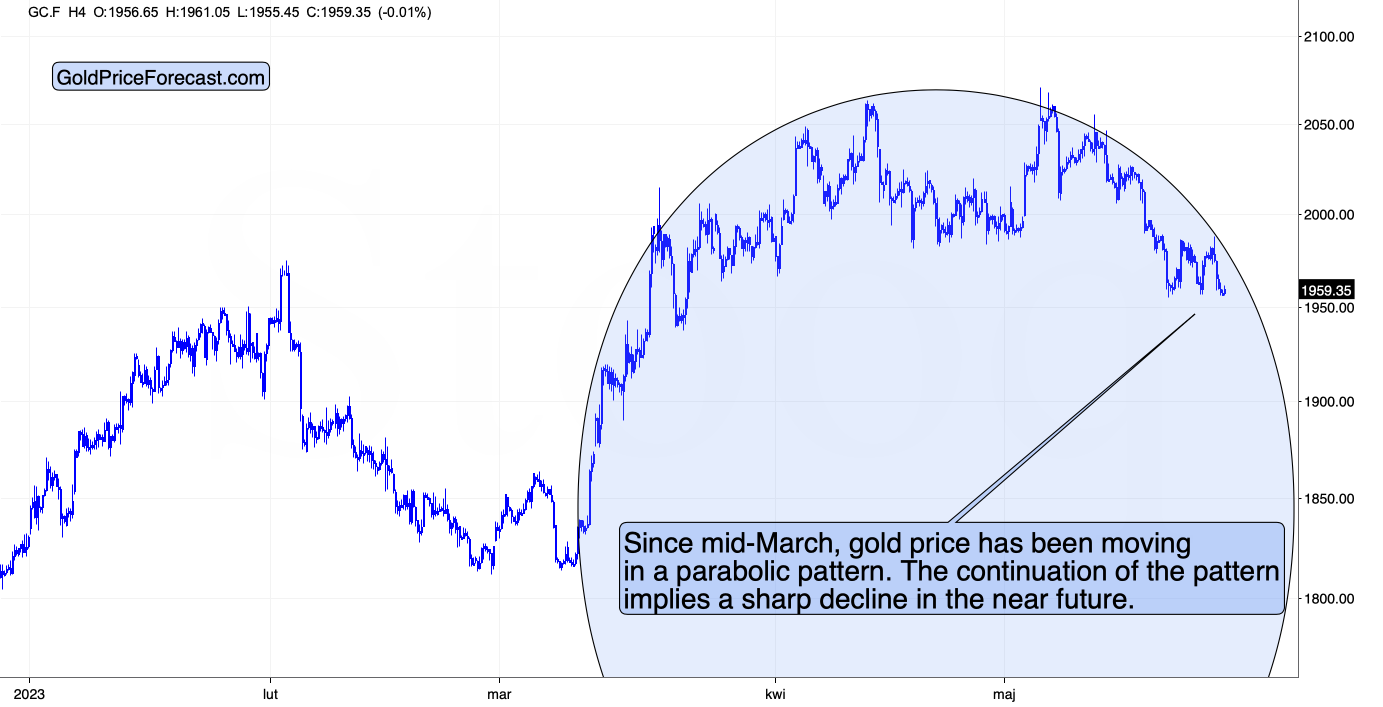

The thing is, if you look at the price performance of gold since mid-March, it’s clear that it’s been moving in a parabolic manner.

Parabolas have a sharp start, then the rally decelerates, we have a broad top, and then the decline starts to pick up. And then, it accelerates to the downside just as the rally initially accelerated to the upside.

After invalidating the breakout above its initial 2023 high, gold made two more attempts to rally above it, and both failed. This is not surprising, given the rallying USD Index, but what might have been surprising is that those attempts took place at all.

However, looking at gold’s performance from the point of view of this parabolic pattern, it’s obvious why this back-and-forth movement materialized.

It was too early for gold to plunge even lower when it first invalidated the breakout above the early 2023 highs. However, now, after the back-and-forth action, it seems that the time is up, or almost up.

And just like it took just a short while for gold to rally in March, it might take just a short while for it to slide. Besides, miners’ performance has this “big slide” written all over it.

This might be a bold statement, but this big move lower might even happen this month. No promises here, but please note the above chart and the below chart featuring the USD Index.

The USDX is in the full-rally mode, and we also know (based on even the most recent observations) that the USDX tends to reverse its course close to the end of the month. However, it’s still a week until the new month starts. This means that the USDX could rally some more this month, which could give gold the extra push to move to much lower levels.

If it weren’t for miners’ extremely weak performance, I’d say the above is just “possible” and not “likely”. But since miners DID underperform gold to a great extent… It does appear likely.

Also, in Friday’s flagship Gold Trading Alert, I wrote that I didn’t trust the S&P 500’s breakout above its previous highs and that I expected it to be invalidated soon.

Not only was it invalidated, but it was followed by a sizable (from the short-term point of view) decline almost immediately.

Right now, the S&P 500 futures are verifying the breakdown below the rising support line. If they succeed, another move lower is likely in the cards. That’s the likely scenario.

And yes – this decline is likely to cause further damage to mining stock prices, especially junior mining stock prices.

I know that it might be difficult to believe that we have such a powerful combination of multiple bearish factors in play for junior miners, but this is really the case. Can they really fall substantially from here? Not only can they fall substantially, I actually expect them to fall in a truly extreme, 2008-style manner.

Remember the carnage of 2008? Or 2020? (And the fact that I wrote about going long in the mining stocks on March 13, 2020, extremely close to their intraday bottom on the day when the yearly bottom was formed? see below for details)

Back in 2020, it took just 5 trading days for GDXJ’s price to be cut in half. This time it’s likely to take more time, but if something like that was possible just a few years ago, it’s definitely possible this time as well!

Think about it – the real rates are already high and moving higher, and it was probably only the “return to normalcy” emotional stage of the bear market in stocks that prevented people from really acting on it. And since they are now starting to wake up to what’s real-ly (pun intended) happening, the prices are starting to reflect it.

This is a tremendous opportunity, but it won’t be around forever. In fact, given gold’s parabolic pattern and the invalidation that we saw in stocks, it looks like this is one of the final days to prepare for this downswing in the miners (and for reaping enormous rewards from it).

<the summary with details of positions was removed from the preview version of this analysis. For the up-to-date analysis along with the current positions, please subscribe to Gold Trading Alerts>

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

-

This is Why Stocks’ Invalidation is Critical for Junior Miners

May 24, 2023, 7:38 AMDear Premium Subscribers, you will find the latest premium analysis on our new platform: Golden Meadow.

Dear not-yet Subscribers, this premium article (with the above title) is available for our subscribers only. However, please note that we very often publish free analyses that are based on the premium versions, and you can find them (they might have the same or different titles) at GoldPriceForecast.com and SilverPriceForecast.com.

The premium analyses include multiple timely details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief -

As Expected, The Gold Price Continues to Fall

May 23, 2023, 8:46 AMDear Premium Subscribers, you will find the latest premium analysis on our new platform: Golden Meadow.

Dear not-yet Subscribers, this premium article (with the above title) is available for our subscribers only. However, please note that we very often publish free analyses that are based on the premium versions, and you can find them (they might have the same or different titles) at GoldPriceForecast.com and SilverPriceForecast.com.

The premium analyses include multiple timely details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM