tools spotlight

-

The Hesitant Moves in Gold - Can They Last Much Longer?

May 7, 2020, 8:10 AMPrecious metals haven't moved all that much on Wednesday, but is it time to get complacent? The wait continues... PMs declined yesterday, but the move was nothing to call home about. Still, it was more or less in tune with what we saw in March - provided that one takes into account the lower volatility in the short run.

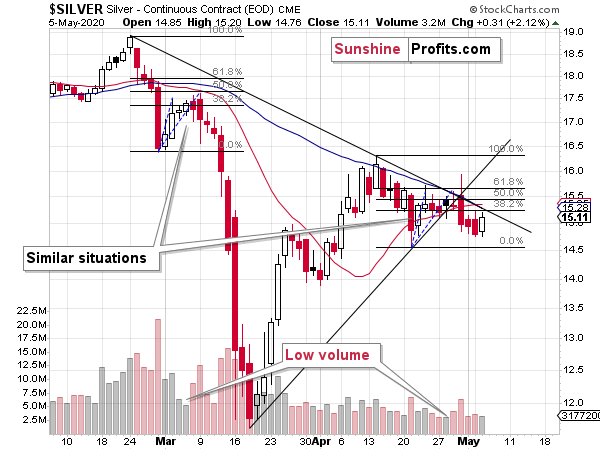

In the silver market, we saw that the small intraday breakout above the declining resistance line was invalidated, just as we had indicated in yesterday's analysis. Silver takes longer to start its move, but apart from that, the situation continues to be similar to what we saw in the first half of March. Our previous comments on the above chart, therefore, remain up-to-date.

On Thursday, the white metal reversed and declined profoundly on relatively big volume - just like it had done on March 9th. In the following two trading days, it had moved lower, but just slightly so. That's exactly what happened also this month - on May 1st and May 4th. And then...

In March, silver then plunged, and it took the white metals just three more days to slide below $12 from about $17.

As the starting point for silver for now is approximately $15, could it slide to about $10 in just 3 trading days?

Obviously, silver didn't slide profoundly yesterday (conversely, it moved higher), so the day-to-day similarity is no longer perfect. Does the lack of perfection invalidate the similarity altogether? No, at least not yet.

A useful question to ask is if this similarity - aside from the previous several days - was perfect from the beginning? It wasn't.

The mid-April bottom appears to be analogous to the late-February bottom, and the blue dashed lines (might not be clear at first sight, but once one knows where to look, they become visible) that connected these bottoms along with initial and final tops, were almost identical.

Almost.

Almost, means that they were not perfect, and the difference was in the length of the consolidation. The final short-term top took place a day later than the blue dashed line suggested. Initially, it even seemed that silver was breaking higher - above the declining resistance line.

Did this daily delay or the initial move in the other direction change the analogy? No. It delayed its consequences. Silver reversed and declined, anyway. And it did so in a profound manner, just like it did on March 9th. Throwing the analogy out of the window in late April would have been a mistake, a moderately costly one. Now, if the analogy does remain intact, then throwing it out of the window would now be very costly, as the follow-up move is likely to be much bigger.

In our opinion, the bearish implications remain intact, especially since it's just one of the markets that showed similarity to this period. Precious metals investors, look out.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and - in particular - the miners. It includes not only the final targets, but also the interim ones that could trigger a rebound as early as this week.

-

Silver Analogy, USDX Spike and the Upcoming Gold Move

May 6, 2020, 6:36 AMThe analogy to the first half of March in silver was practically perfect. They say that all good things come to an end, and so did this perfection. But does it mean that the entire similarity can be thrown out of the window? Conservatism bias should be avoided, but there's also a limit to which one should take new information into account without giving them a second thought. After all, it's prudent to wait for a confirmation of a breakout or a breakdown for a reason.

So, what happened in the silver market, and what didn't?

On Thursday, the white metal reversed and declined profoundly on relatively big volume - just like it had done on March 9th. In the following two trading days, it had moved lower, but just slightly so. That's exactly what happened also this month - on May 1st and May 4th. And then...

In March, silver then plunged, and it took the white metals just three more days to slide below $12 from about $17.

As the starting point for silver for now is approximately $15, could it slide to about $10 in just 3 trading days?

Obviously, silver didn't slide profoundly yesterday (conversely, it moved higher), so the day-to-day similarity is no longer perfect. Does the lack of perfection invalidate the similarity altogether? No, at least not yet.

A useful question to ask is if this similarity - aside from the previous several days - was perfect from the beginning? It wasn't.

The mid-April bottom appears to be analogous to the late-February bottom, and the blue dashed lines (might not be clear at first sight, but once one knows where to look, they become visible) that connected these bottoms along with initial and final tops, were almost identical.

Almost.

Almost, means that they were not perfect, and the difference was in the length of the consolidation. The final short-term top took place a day later than the blue dashed line suggested. Initially, it even seemed that silver was breaking higher - above the declining resistance line.

Did this daily delay or the initial move in the other direction change the analogy? No. It delayed its consequences. Silver reversed and declined, anyway. And it did so in a profound manner, just like it did on March 9th. Throwing the analogy out of the window in late April would have been a mistake, a moderately costly one. Now, if the analogy does remain intact, then throwing it out of the window would now be very costly, as the follow-up move is likely to be much bigger.

Silver is up in today's pre-market trading, and it's once again above its declining resistance line. It's the same line that it tried to break on April 30th, right before sliding during the day. Should we trust this move at this time, and view the bearish March - now analogy as invalidated? It seems too early for that, especially that viewing silver's short-term outperformance of gold as a bearish gold indicator is one of the most important gold trading tips. In our opinion, the bearish implications thereof remain intact, especially since it's just one of the markets that showed similarity to this period.

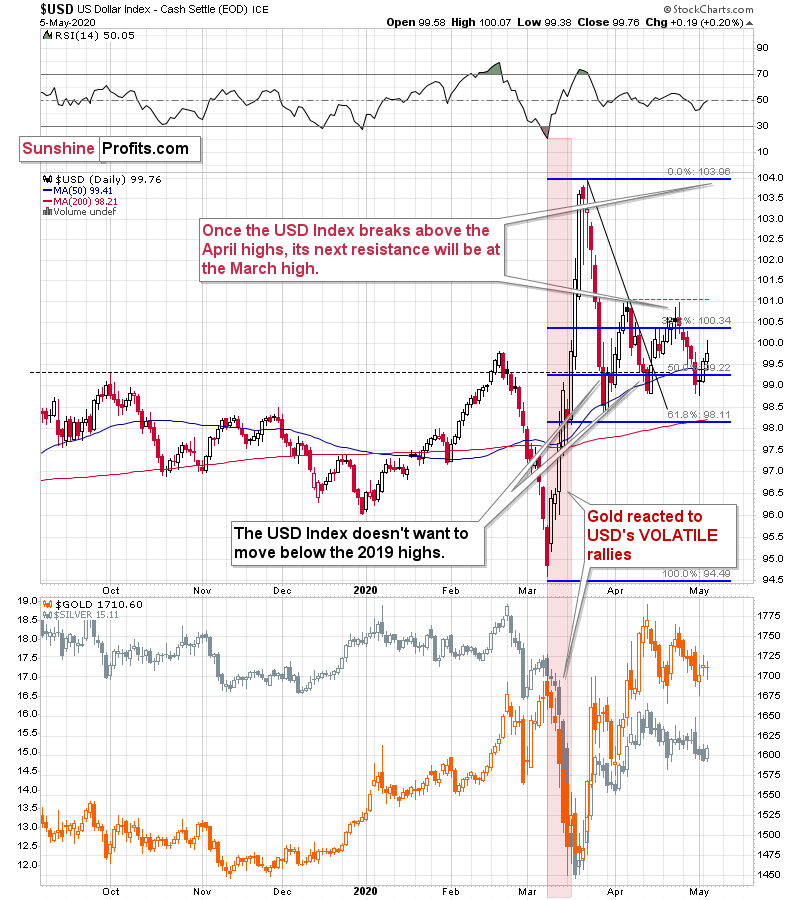

Gold and mining stocks moved higher yesterday, but the moves were not huge and they didn't invalidate our previous comments. Our comments on the link between gold and the USD Index remains up-to-date as well:

The USD Index moved higher (invalidating the breakdown below the 50-day moving average), but not particularly sharply so it's little wonder that gold didn't plunge. Gold futures moved slightly lower (while the GLD ETF closed slightly higher, which explains the daily gain in the miners - as we discussed in details in yesterday's Gold Trading Alert), but without any major repercussions.

Right now, the price moves appear to be taking place at a slower pace than their March pace of decline, but the price moves are similar, nonetheless. Back in March, gold declined with the USD Index for just one day, and this time they both declined for a several days. This time, gold corrected for two days (three if taking GLD into account), so by comparison, perhaps it corrected similarly significantly during the session? If so, then the analogy would remain present... And that was exactly what happened.

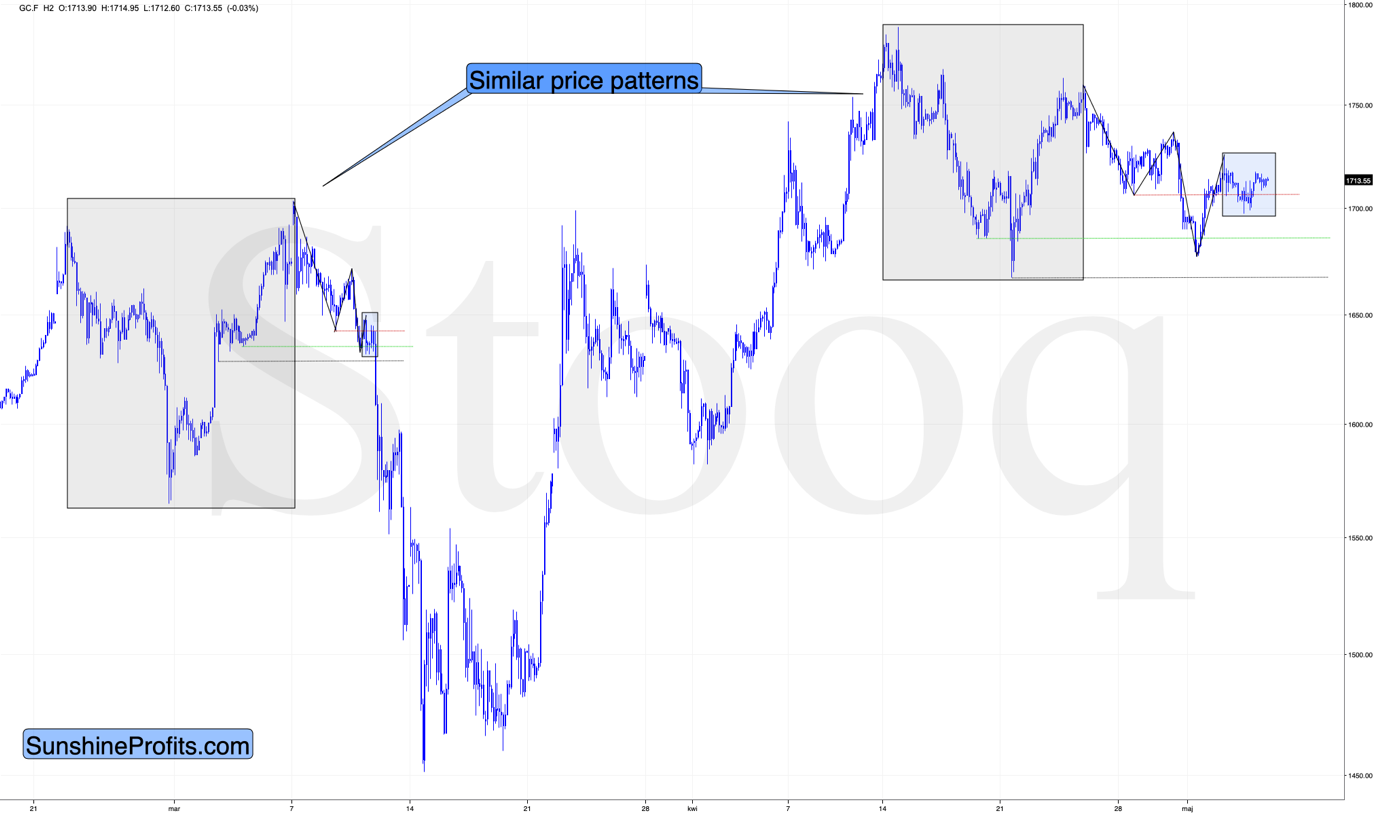

Looking at the above 2-hour gold chart, we see that gold's recent price movement resembles what the yellow metal did on March 11th and 12th. We connected the analogous highs and lows with black lines, and we used red, green, and black dotted lines to show you which levels were broken, and which ones were not.

The March 11th and 12th consolidation took place around the level of the most recent low - marked with red dotted line. It started when gold moved below one of the recent lows (the higher one - marked with green dotted line), but not below the final of the recent lows (the lowest one - marked with black dotted line).

Back in March, this was the final pause before the big drop, so the implications of the above similarity are bearish.

Please note that the price patterns that led to the above-mentioned self-similarity are similar as well - we marked them with grey rectangles.

From the Readers' Mailbag

Q: Hey PR: I honestly don't get it. I follow Stephanie Kammerman who tracks the Dark Pool prints of the big Wall Street firms. On March 20 there was a massive 3 million share print of UUP, the dollar index and then on April 7th there was the largest print of USDU that she had ever seen of 6 million shares of this dollar index. She was so moved that she wrote a blog about it saying it would have huge ramifications for gold. And what have these indexes done since then = NOTHING! I know that the Dark Pool sold the IAU shares of gold at the top and it appears they sold GDX at around $34 so it appeared you were onto something. But gold won't go down if the dollar goes down and folks are buying the QQQs like it is 1999 all over again! You keep saying to wait and wait and wait but what will make the dollar go up when the Fed & Treasury have debased the currency beyond any precedent?

A: These are critical times, so the amounts and volume levels can be truly epic, indeed. If this is indeed the case that there were huge trades in the dark pools (private exchanges that are generally not publicly available, and that are used by big institutions to conduct large transactions without impacting the market price). Ms. Kammerman writes in this blog post the following:

How can this information benefit you? Whenever we get massive prints on this index fund, we get massive moves on the dollar. If you trade forex, this could really give you an edge knowing that a big potential move on the dollar is about to happen. If you don't trade forex, here's another way you can use this valuable information.

If the dollar goes down, it must go down against something. Some years, the dollar has fallen fast against gold, and most likely gold would continue to rise if the dollar falls.

However, the exact opposite could happen if the dollar were to rise off this incoming Dark Pool volume.

In short, this is in tune with our preceding analysis. Now, let's speculate about how this could be taking place behind the scenes (all below is a mix of assumptions and estimations, not a fact, but it's easier to write in this way, without using "might have" every second word):

Really big players have already made huge bets for the moves in the US dollar index, which makes all the major bullish signals for it stronger. It's interesting that the bets were made about a month ago, on days when the USDX-based ETFs were declining after the rally. It's as if someone knew that something much bigger is just around the corner, and wanted to enter the market while it was still relatively easy to do so. Buying during daily declines is much easier than during rallies, as you don't have to chase the price higher, risking that the orders won't get filled. This might be particularly important, when the trades are so huge. Buying well ahead of the really big move (even a month) is also a good idea if you have a huge amount of capital, as you don't want to risk triggering the move before your entire order is already filled. Once the big guys have their positions, they can wait out whatever the smaller investors are going to do and ignore the temporary price moves while they wait for the move that they "knew" is coming.

As the big guys wait, we should see some signs of gold investment public's activity in the market. Remember that recently gold soared while it made headlines? Guess who's buying based on the headlines. Hint: it's not the pros. The mining stocks were one of the worst-performing parts of the stock market during the March decline. And they now soared. Investment public buys what is or just was very cheap, just because of that (note: this factor is not fully bearish, as it might actually be the real strength of the PM sector here - we view it as doubtful, but felt it needs to be said for greater clarity). Finally, did you notice that silver outperformed gold visibly during the previous top (April 30th), and it's doing so also today? That's yet another sign of investment public's activity. Among other reasons connecting silver's very short-term outperformance with investment public, silver is much smaller and more prone to being moved by individual investors.

What would trigger the moves? There doesn't have to be absolutely any meaningful trigger. When the market is ready to slide from the technical / emotional point of view, it will just react to some random event or news announcement. There are tens of them released each day and the market could attribute greater weight to any of them. If something profound happens or a profound news is released, it could speed things up, but regular news are likely to be enough anyway. Good candidates are ADP nonfarm employment change (released today), initial jobless claims (released tomorrow), non-farm payrolls (released on Friday), inflation, and GDP numbers. Plus, any official and unofficial (speeches) from monetary authorities (especially by the Fed). Or it could be something as small as Donald Trump's tweet. Or a new record in the Covid-19 death toll (it's about 71k in the US, and the UK just surpassed Italy in the death toll, moving to the second place globally, at least according to the official numbers).

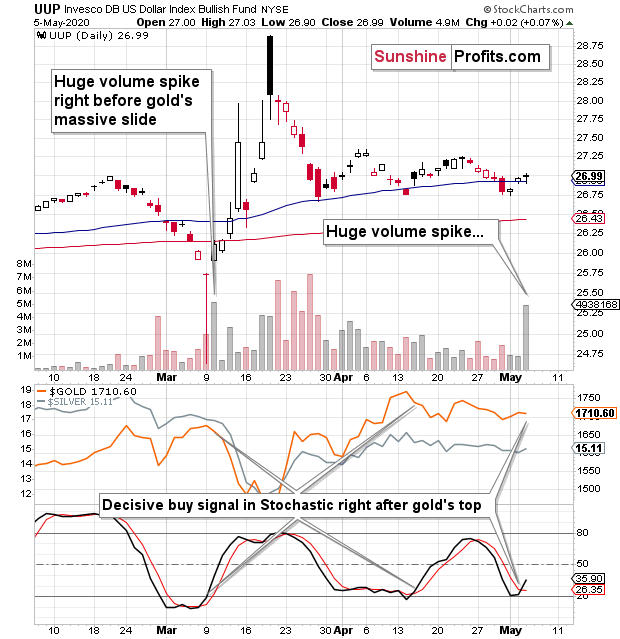

Finally, let's take a look at something interesting on the UUP ETF chart (proxy for the USD Index).

Please note yesterday's huge volume spike. There was only one similar volume spike in the past several weeks and it took place at an analogous time - right before the big rally in the USD Index, and right before the massive slide in gold, silver, and mining stocks. That's yet another confirmation of the March - May similarity.

We get another confirmation from the Stochastic indicator based on the UUP ETF. It just flashed a decisive buy signal. There were only two cases when it had done so in the recent past and they were both right after gold's top and before its short-term decline. The implications are bearish.

The above points about silver analogy and the USDX acting as a coiled spring on high volume, point overwhelmingly in the direction of the upcoming sizable precious metals move. Combined with other recently made points, they are very bearish in their implications.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and - in particular - the miners. It includes not only the final targets, but also the interim ones that could trigger a rebound as early as this week.

-

Silver Hints At the Upcoming Gold and Miners' Move

May 5, 2020, 6:25 AMIn yesterday's analysis, we wrote the following on silver:

Speaking of similarities to the first half of March, silver is providing us with an excellent confirmation.

On Thursday, the white metal reversed and declined profoundly on relatively big volume - just like it had done on March 9th. In the following two trading days, it had moved lower, but just slightly so. This time, there was - so far - just one trading day after the big daily decline, and during this day, silver declined rather insignificantly - just like it did in early March. If the analogy is near-perfect, we'll see some back and forth trading also today without a bigger change (a lower close is likely, though). And then...

In March, silver then plunged, and it took the white metals just three more days to slide below $12 from about $17.

As the starting point for silver for now is approximately $15, could it slide to about $10 in just 3 trading days? While we don't want to say that it's inevitable, we do want to stress that the outlook is very bearish, and that a major decline is likely just ahead, even if silver doesn't slide again as fast.

... It seems quite possible, though.

That's exactly what we saw yesterday - some back and forth trading without a bigger change, and with a lower close.

The analogy to early March might not be clear in other markets, but it is clear in case of silver. The white metal is behaving practically identically as it did back then. The implications continue to be very bearish.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and - in particular - the miners. It includes not only the final targets, but also the interim ones that could trigger a rebound as early as this week.

-

Friday's Supposed Gold Strength, Silver Cues and Sliding Stocks

May 4, 2020, 7:58 AMGold and the US dollar - the yellow metal doesn't really move regardless of the greenback. As the strength of their relationship (and even the direction gold takes in response) change over time, let's start today's analysis with a quick look at how they are doing currently. You're probably wondering why didn't gold slide, given that the USDX reversed on Friday.

The reply to this question has been visible on the below chart for days.

Namely, back in March, gold reacted strongly - and declined profoundly - when the USD index rallied sharply. Smaller upswings didn't trigger substantial reactions. Friday's upswing was tiny - just 0.07% - which means that one shouldn't expect gold to plunge. Therefore, the lack of gold's volatile decline is not particularly bullish or bearish - it's more or less normal.

Fundamentally speaking, one might be wondering what could trigger the demand for the US dollar to skyrocket. So far our answer was that plunging stock markets around the world, and investors' flight to safety would be what makes the US (& world reserve) currency to rally profoundly. And that remains up-to-date, but we would like to add one more important factor. This factor is that the Covid-19 cases are rising rapidly in countries that previously were barely on the radar screen in that regard.

Corona Updates from Around the World

The new daily cases in Russia just exceeded 10k.

They were just above 7k in Brazil, and they are now hovering at about 5k per day.

In India, the latest daily increase was just above 2.5k, but we see constant growth in this number.

The numbers from China are extremely low, but it seems doubtful if they can be viewed as realistic.

These countries together constitute the BRIC group, and their impact on gold was supposed to be positive in general, as their growth should have undermined the demand for the US dollar. Of course, that's just a general link and one of long-term nature. What is more interesting from the short-term point of view, is that the situation in these countries is - overall - getting worse at a greater speed than the situation is getting worse (in some states, it's actually getting better) in the US. This suggests that in the short run, we could expect the opposite to the general tendency to take place. People could be buying the USD not because it's perfect, or that the situation in the US is, but because it is better (or improving more smoothly) than what they see domestically.

Taking both factors into account, we have a strong case for a strong dollar. And initially gold - and the rest of the precious metals sector - is likely to respond to it with lower prices. The slide is unlikely to extend for more than a few weeks, but it's still very likely to happen.

Stocks, Ratios and PMs

The situation in the stock market is likely to impact the PMs negatively as well, at least in the short term. We previously commented on the S&P 500 performance in the following way:

During yesterday's session the S&P 500 closed very insignificantly above the 61.8% Fibonacci retracement level and below the upper border of the price gap. In other words, it moved and reversed practically right in the middle of our target area. We wrote that the outlook was bearish, but that "on a very short-term basis, anything could happen in the stock market" and it did - we saw another daily move higher.

The final of the individual strong resistance levels is based on the upper border of the price gap. This gap is at 2972 in case of the S&P 500 index, and at 2964 in case of the S&P 500 index futures. Whether this level is "taken out" or not will depend on the closing price that we see. So far, the S&P futures moved to 2964 today and then they declined - trading at 2948 at the moment of writing these words.

If stocks decline from here, they will confirm the strength of the above-mentioned resistance and at the same time, they would likely invalidate the tiny breakout above the 61.8% Fibonacci retracement, which could trigger technical selling. This would likely have a very negative impact on the mining stock sector.

That's exactly what happened. Stocks invalidated their breakout above the 61.8% Fibonacci retracement, and they have indeed triggered technical selling. The S&P 500 opened the day with a bearish price gap and then declined during the day, pretty much as it had declined on March 6th. On March 9th (which was the next trading day), the S&P 500 once again opened with a bearish price gap. We are writing this a few hours before the markets open in the US, but the S&P 500 futures are currently down by 0.8%, which increases the odds that we'll see a repeat of what we saw on March 9th - another daily move lower. That was more or less when the really volatile part of the decline in the precious metals market started.

Besides, we have a confirmation of this very bearish analogy also from other stock markets. For example, the German stock market is trading about 3% lower today.

The similarity to the first half of March is uncanny.

Speaking of similarities to the first half of March, silver is providing us with an excellent confirmation.

On Thursday, the white metal reversed and declined profoundly on relatively big volume - just like it had done on March 9th. In the following two trading days, it had moved lower, but just slightly so. This time, there was - so far - just one trading day after the big daily decline, and during this day, silver declined rather insignificantly - just like it did in early March. If the analogy is near-perfect, we'll see some back and forth trading also today without a bigger change (a lower close is likely, though). And then...

In March, silver then plunged, and it took the white metals just three more days to slide below $12 from about $17.

As the starting point for silver for now is approximately $15, could it slide to about $10 in just 3 trading days? While we don't want to say that it's inevitable, we do want to stress that the outlook is very bearish, and that a major decline is likely just ahead, even if silver doesn't slide again as fast.

... It seems quite possible, though.

On a side note, please keep in mind that (as we have been indicating, and as most of our colleagues didn't) despite the recent upswing in gold, and the general stock market, the gold to silver ratio didn't invalidate its breakout above the 100 level. Conversely, the breakout was confirmed, and it means that we should expect even higher values of the ratio. And yes, the values near 150 level are quite possible.

Silver investors and traders, look out below!

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and - in particular - the miners. It includes not only the final targets, but also the interim ones that could trigger a rebound as early as this week.

-

Confirmation of Our Previous Bearish Warning for PM Investors

May 1, 2020, 8:24 AMSilver at $15... perched high, or getting ready for a great dip? How far do the similarity lessons go in the white metal actually - can they be applied to today's situation?

As far as the SLV ETF is concerned, we also continue to see similarity between both periods: early March and late April.

In yesterday's analysis, we wrote that the SLV ETF closed Wednesday's session 2 cents above the upper border of its previous price gap, but that the breakout would likely be invalidated because of silver's triangle-vertex-based reversal.

That's exactly what happened. Silver reversed precisely on the day indicated by the triangle-vertex-based reversal, and it declined not only below the above-mentioned border of the price gap, but it even declined visibly below the rising support line.

All this happened on relatively strong volume. Interestingly, we saw exactly the same thing in early March. Shortly thereafter silver paused, but then it plunged with vengeance. It seems that we are just ahead of a similar move lower also this time.

The above chart shows just how well the reversal technique worked.

Also, let's keep in mind that silver is likely to decline below $9 based on its long-term analogy to 2008 that we've been featuring for months:

Silver plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we predicted silver below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Note: Silver at or slightly below $8 seems most probable at this time.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Now, some may say that back in 2008, silver rallied only to about $14 and since now it rallied to about $16, so the situation is now completely different and that the link between both years is broken. But that's simply not true.

The nominal price levels are just one of the ways that one should look at the analogy - far from being the perfect or most important one.

Please note that back in 2008, there were two smaller bottoms in silver, and this time we saw just one. The decline before the bottom was sharper, so is it really that surprising that the rebound was sharper as well? Silver ended the 2008 corrective upswing once it moved visibly above the declining orange line and that's exactly what happened recently. It also topped once it reached its 10-week moving average (red line). That's exactly what just happened.

This MA is at $15.12 and at the moment of writing these words, silver is back below it, trading at $14.88.

The situations are not perfectly identical in terms of nominal prices, but they remain remarkably similar given how different fundamental reasons are behind these price moves (in reality, what's behind both declines is fear that - itself - doesn't change).

The technique used for predicting silver price is clearer than the one that we applied for gold, so it seems useful to look not only at the USD Index for signs, but also at the white metal itself. Once silver moves to $8 or below it, it will likely serve as a strong buy sign for gold, regardless of the price at which gold will be trading at that time.

Also, please note that silver formed a big shooting star candlestick during the previous week, which is a topping sign. The volume was low, but it was not low just during the formation of this candlestick, but it's been low during this month's upswing as well. It's relatively unclear whether the volume is confirming or invalidating the shooting star. Consequently, we view it as a bearish confirmation, and we wouldn't open a position based just on it. However, since it's just one of the factors pointing to much lower silver prices in the next few weeks, we view the very bearish outlook as justified.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and the miners. It includes not only the final targets, but also the interim ones that could trigger a rebound as early as next week.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM