-

Grinding, Grinding, Stocks Keeps Rising

September 1, 2020, 9:18 AMEvery day, higher stock prices every day - sounds really nice? I bet it does for those not caught still on the short side of the market. While readings are getting a bit too exuberant, are they frothy enough to justify a long-awaited correction?

Let's check the charts and feel the pulse.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

It's quite hard to pick a soft spot in the stocks rally, isn't it? The rising volume though indicates that a consolidation wouldn't be all too surprising. While I am not calling for September storms, I think that we're in for a leaner month than August was.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) made a bearish move yesterday - rolling over on rising volume. But how bearish does it get? I see sideways consolidation not breaking below the mid-August lows as the most likely scenario. We're still in a predominantly risk-on environment, after all.

Investment grade corporate bonds (LQD ETF) recovered for second trading day in a row. The Fed-induced selloff was a bit too heavy, and I continue to look tor LQD to outperform long-dated Treasuries in the very short run.

And they indeed look set to do so, as more money out of the deepest bond market around, moves into the stock market.

Gold, Copper and Technology

Going sideways, and forming what could very well turn out to be a bullish flag in the end. No challenge of the summer lows just as I called for almost a month ago. The sell-the-news reaction to the new Fed approach towards inflation, is over - the yellow metal attempts to extend modest daily gains. That supports the no squeeze ahead hypothesis.

Copper confirms the bullish bias, and casts a vote in favor of the recovery. Best of all, neither the red metal nor commodities ($CRB) are overheating.

Technology (XLK ETF) keeps powering higher like there's no tomorrow, but the upper shadow on rising volume could pause it in the short run. Could and short run, these are the key words here. The chart is primed to go much higher, and who could responsibly call for a profound reversal? Not me, as in the current sad state of the real economy, tech stands ready to benefit the most.

From the Readers' Mailbag

Q: Hi Monica, first my compliment for your analysis.. one question, do you never follow the Cot Report to analyze the position of the small trader, large trader and commercial trader?? I follow a topic of an italian trader, who is always long from 2008 just following the Cot Report. he always say that is the only way to know what the big investor (commercial trader) are doing. Also he always say that until the small traders (all people like me...) and large traders are short, the market can go only up... commercial traders will protect the market. And looking what is happened in all these 12 years, I can say he is right until now. What do you think about that? About the Cot Report? is a reliable information to know what direction the market is taking?? thank you so much for any your comment/opinion.

A: Thank you very much, I am glad you're appreciating my writings. I like the sentiment readings and constituent parts of the fear and greed index much more. It's that the commitment of traders report has to a large extent lost its analytical edge over the recent decades, not just years.

We're living in many bubbles, and I won't mention any of the Fed-blown ones, or allude to the everything bubble - I'll say merely two words: passive investing. That's a bubble in its own right, or who in their right mind would buy into quite a few of the nosebleed P/E valuations? It makes one redefine what the smart money actually is, because that has changed.

Ignoring the macroeconomics would have been painful for that Italian trader - the flash crash of 2010 followed by 2011 when it looked we're headed for a recession. Or who could forget the summer of 2015 and early 2016?

I use a much broader mix of tools that I more or less regularly discuss in my daily public analyses (reading them over weeks and months brings out the most value into the open) - and the same goes for narratives that power the markets, or make them turn. The CoT one sounds coherent logically, but the practical application is troublesome.

Besides, the only ones who I heard to protect the market, have been the central banks really - once their hand gets twisted really badly. That's an example of what I catch with the momentum part of my style. You know, there is a time for everything, and everything in moderation. Powerful wisdom for life too.

Apart from my thoughts as to CoT in stocks, take a look at the below view of CoT and precious metals.

Or check Warren Buffet and his value investing theory. Very successful in its own realm, but he didn't really get gold - and only now has bought into the king of metals, whose bull market of the 2000s decade and September 2011 top, outperformed Berkshire Hathaway.

My point is that we're living in very different times, and need to use a more rich and precise set of tools in getting the market moves right.

-

The Daily Staircase Rally in Stocks Goes On

August 31, 2020, 8:56 AMHigher stock prices every day - or so it seems. And understandably so, given Fed's inflation tolerance, and regardless of consumer confidence taking an earlier hit. With the stimulus bill still stuck in Congress, the Fed is between a rock and a hard place. The economy appears slowing a bit in its recovery, and more support is needed. It's my opinion that it'll arrive before elections.

Talking elections, I see the aftermath of Kenosha "mostly peaceful" riots as a palpable turning point, bolstering Trump - the law and order candidate. And that takes away from the election uncertainty, from the fear of higher taxation among others. Let's face it - the economy is fragile, and needs stimulus beyond transfer payments to avoid the second dip.

It's usually at least the full month before that date, when stocks get especially vulnerable, so we still have a prospect of slower September ahead, but I look for the month to end in the black.

All right, let's see those narratives in the charts.

S&P 500 in the Medium- and Short-Run

I'll start today's flagship Stock Trading Alert with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

The picture painted is clearly bullish, and both the upper border of the rising black trend channel and the zone around the Feb highs, are done as resistances. Volume is slowly returning, and the extended weekly indicators don't worry me - both the momentum and fundamental reasoning why stocks, is there.

Yes, with the Fed move, I see debt instruments suffering, and a new source of money inflows to power stocks higher.

Such were my Wednesday's observations:

(...) The breakout is now confirmed as the bears haven't really appeared yesterday either. Even though the volume is relatively low, it doesn't detract from the rally's credibility in my eyes - it serves to merely make it less credible for some, while the stock upswing goes on. Until it doesn't, naturally.

But can I call for a top with a straight face, given the price action in stocks? No, the trend remains up - there is no sign of its reversal.

And absolutely, the bull run is alive and well. Day in and day out, stocks are rising, and the volume isn't pointing to any kind of trend reversal. A short-term pause? That will come one day, but won't flip stocks bearish in my opinion.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) still keep going nowhere, but are holding up much better than their investment grade counterparts (LQD ETF). In other words, it's risk-on according to the credit markets.

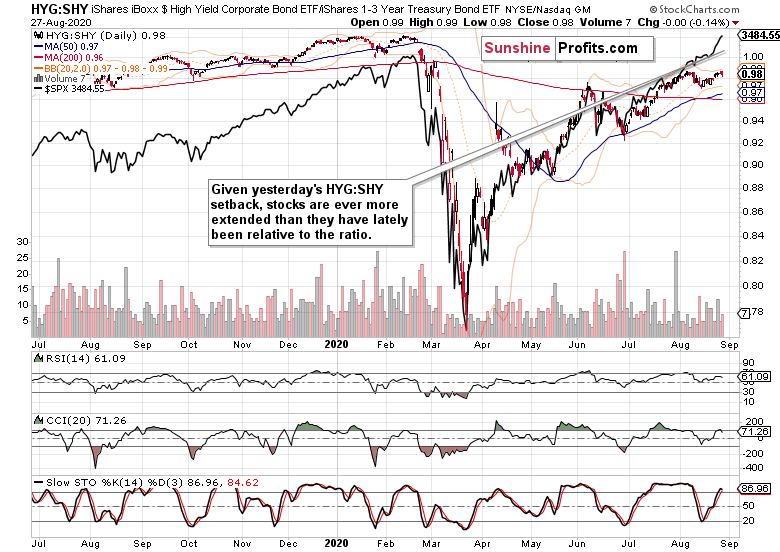

High yield corporate bonds to short-term Treasuries (HYG:SHY) are holding up much better than investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - and given the macroeconomic backdrop of the day, I am reading more into the HYG:SHY ratio. Little wonder given that now:

(...) the economy recovery story joins hands with bondholders demanding higher rates to make up for higher expected inflation.

At the same time, stocks getting ever more extended relative to the HYG:SHY ratio, are consistent with the TINA (there is no alternative) shift. While greed is at extreme readings, there are still plenty of bears that haven't capitulated yet.

S&P 500 Market Breadth and Sectoral View

The advance-decline line finally scored a noticeably higher reading, indicating that it's just a little bit less about the tech (or FAANG, have your pick) carrying the torch. Advance-decline volume has risen too, and the bullish percent index remains solidly in a bull market territory.

Technology (XLK ETF) keeps powering higher like there's no tomorrow, and the price action is of a healthy uptrend. Well, healthy - steady with hardly a correction. No sign of a top, definitely not in this leading sector.

Healthcare (XLV ETF) is on the rise too, as its prices are leaving the prolonged correction. The outlook is naturally bullish.

Financials (XLF ETF) typify cyclicals' performance - and that's still one of underperformance. With tech this prominently in the limelight, it's hard to see more than a few bursts of rotation into value plays as tech keeps firmly in the pool position.

Summary

Summing up, the S&P 500 keeps extending gains, and so does the tech sector. Volatility has made a move to the downside on Friday, pointing to little changes in the market character - it's still a bull market run, to put it precisely. The credit markets reflect the risk-on move, and both the top in stocks, and a meaningful correction, appear to be rather far off.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Bulls Are Heading for Another Weekly Gain

August 28, 2020, 9:24 AMJubilant bulls stampede over the Fed's predictably dovish messaging - not that the central bank had (m)any other real options to begin with. The rip your face off rally that I called for a few days ago, goes on to the dismay of the bears. I told you that calling the tops is a fool's errand in the current environment - and as safe as catching a falling knife during sharp downturns.

Talking downturn, when have we seen one lately in stocks actually? The news of a new California lockdown weeks ago - that was a memorable moment coinciding with a weaker patch in the S&P 500.

It was 8 days ago, when I put corona into proper perspective, making clear also on July 20 that life hasn't stopped even during the really deadly Spanish flu. The real economy is nothing that you can flip off and on with a switch - the consequences for the job market, small and medium businesses, and consumer confidence to name but a few, are far reaching.

Raise your hands if you remember the resignation and apology of top lockdown advocate, Neil Fergusson. Or what Fauci used to say. Such steps are the key risk for the stock bulls - so, I mention them, because they have the very real power to crash the economy, and the stock market rally with it.

Thus, I see Biden's readiness to go down the lockdown route again as having the potential to usher in the autumn storms in stocks - especially should he really wish to debate Trump, which not even Nancy Pelosi is inclined to see happening. That's a subtle indication to me that the stock rally has the power to go on without being thrown out of the kilter considerably.

The markets are moving on the Fed momentum, on the U.S. - China phase one trade deal progress, and on the slow but steady pace of real economy recovery.

Let's see those reflected in the charts.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Such were my yesterday's observations:

(...) The breakout is now confirmed as the bears haven't really appeared yesterday either. Even though the volume is relatively low, it doesn't detract from the rally's credibility in my eyes - it serves to merely make it less credible for some, while the stock upswing goes on. Until it doesn't, naturally.

But can I call for a top with a straight face, given the price action in stocks? No, the trend remains up - there is no sign of its reversal.

You won't hear any top calling from me today either, but the prominent upper knot and rising volume illustrate the battle that the bulls had to fight yesterday. I wouldn't be too surprised if the rally consolidated its recent sharp gains. As Mark Twain would say, any talk of an S&P 500 top though, would be premature.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) still paint a picture of short-term caution, but the bulls have repelled the below scenario I saw early yesterday as likely to materialize:

(...) the two daily upper knots are short-term concerning to me. I wouldn't be all too surprised if the bears stepped in on an intraday basis at least.

Investment grade corporate bonds (LQD ETF) declined on yesterday's Fed relaxing its approach towards inflation, and so did long-term Treasuries (TLT ETF). It's risk-on as evidenced by the steep rise in the high yield corporate bonds to all bonds (PHB:$DJCB) ratio, now that the economy recovery story joins hands with bondholders demanding higher rates to make up for higher expected inflation.

Stock bulls needn't worry though, because that kind of inflation with the power to break the bulls' backs, isn't here yet. For now, stocks can go on defying gravity, and becoming ever more extended relative to the HYG:SHY ratio. Greed is on, there are plenty of bears to throw in the towel, and the put/call ratio can still decline some more.

Copper, Gold and Oil

Copper is at it again - the metal with the PhD. in economics, keeps rising after almost verifying its breakout above the bullish flag. I understand that as another point for the economic recovery.

Gold gyrated on the day, and shows absolutely no signs of a systemic stress. I read yesterday's volume spike as rather a sign of accumulation than distribution, and look for the Fed news to translate into a well-bid king of metals. Such love slash inflation trade would reflect well on stocks too.

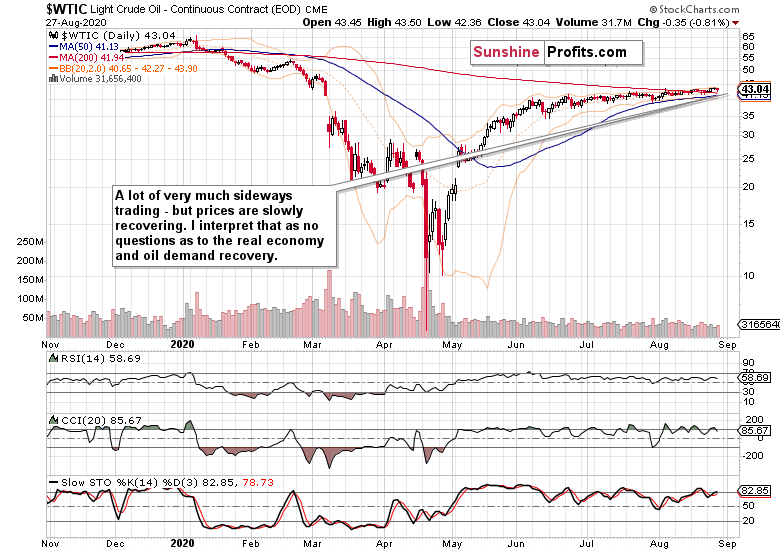

Oil ($WTIC) isn't breaking down right now, and its mostly sideways moves indicate to me that demand isn't disappearing. In other words, the markets see no immediate real-economy challenge just ahead, and there isn't enough inflation to bring about a spike in commodities ($CRB) just yet. That's good for the stock bulls, as we're still in the early stages of inflation when most benefit and precious few pay.

Summary

Summing up, the S&P 500 keeps extending gains, and so does the tech sector regardless of its daily indecision. Yesterday's volatility spike gave way to improving market breadth indicators, and most asset classes are reacting as expected during an economic recovery and a new Fed tailwind. It's risk-on, and stocks still stand to benefit broadly, and be rewarded for withstanding any short-term rickety ride that inevitably accompanies the bullish short- and medium-term outlook that I'll discuss on Monday.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM