-

Gold's Appeal Now That Two Key Uncertainties for Global Economy Are Gone

December 17, 2019, 7:08 AMChina and the U.S. have reached a preliminary agreement, which softens their trade war, while the landslide victory of Conservative Party in the UK parliamentary elections clears the path to Brexit. Given that downside risks for the global economy are now significantly lower, how much do investors still need gold?

UK Parliamentary Elections and Gold

On Thursday, the British people voted in another snap parliamentary election (the third such since 2015) called by Boris Johnson in October due to increasing parliamentary deadlock over Brexit. The Conservative Party won a landslide victory. The Tories got 43,6 percent of votes which translated into 365 seats. It means a net gain of 48 seats since 2017 elections. As a result, the Johnson's party won with a majority of 80 seats, the highest since 1987. The Scottish National Party also gained seats which can lead to the second referendum on Scotland's independence in the future. In contrast, the Labor Party performed disastrously, losing 60 seats, which was their worst result in more than 80 years. Jeremy Corbyn, the party's leader, has already said he will step down early next year.

What is, however, the most important, is that the results empower the prime minister which promised to 'get Brexit done' by the end of January. It means that the odds of Bremain diminished, while the chances of a quick exit increased. You might have different opinions on Brexit, but the prolonged uncertainty was certainly harmful for the economy. Now, that uncertainty is removed and companies can implement long-term plans once again. This is why the pound has soared after the results were published, as the chart below shows. The markets were simply fed up with the uncertainty which was finally removed. And the relief came, then. Thus, the results are bad for safe havens such as gold.

Chart 1: GBP/EUR exchange rate from December 10 to December 16, 2019

Phase One Trade Deal and Gold

On Friday, President Trump announced that the US and China had agreed to phase one trade deal. The 25-percent tariffs on Chinese imports would remain but the 15-percent tariffs levied on other goods would be cut in half. Moreover, the additional, penalty tariffs set for December 15th will not be implemented. In exchange, China agreed to purchases of U.S. agricultural and other goods. The two sides will also start immediately negotiations on more contentious issues such as intellectual property, technology transfer, etc. Trump tweeted:

We have agreed to a very large Phase One Deal with China. They have agreed to many structural changes and massive purchases of Agricultural Product, Energy, and Manufactured Goods, plus much more. The 25% Tariffs will remain as is, with 7 1/2% put on much of the remainder. The Penalty Tariffs set for December 15th will not be charged because of the fact that we made the deal. We will begin negotiations on the Phase Two Deal immediately, rather than waiting until after the 2020 Election. This is an amazing deal for all. Thank you!

Of course, the agreement is just a phase one of the thorough deal and still a lot may happen on the way. So, we are not sure whether the announced success is a real game changer for the global economy. However, the benefits are indisputable. No further tariffs were added, and some of the September tariffs were reduced, while China has agreed to buy $200 billion more in U.S. goods and services over two years. From the fundamental point of view, the deal removed a key source of uncertainty for the global economy that hampered business investments and purchases of risky assets. Hence, the deal could revive the risk appetite among investors and make safe-haven assets, including gold, to struggle.

Implications for Gold

What a big change has happened in the last few days! Not so long ago, the global economy was suffered from the uncertainty stemming from Sino-American trade war and Brexit. These risks were so grave that the Fed decided to deliver a few interest rate cuts, just as an insurance (but do not count on hikes when there risks dissipated!). Everyone was talking about recession and gold prices soared, peaking in early September.

Fast forward to today, and the path looks way clearer now. Boris is determined to deliver Brexit quickly, maybe even in January. Meanwhile, across the pond, Trump stroke a phase one of the trade deal. There is still a long way to go, but the specter of the full-blown trade war is over. The impact of geopolitical events on the gold prices is often exaggerated, but the easing of concerns about the two major sources of uncertainty for the global economy should revive the risk appetite, hitting gold and other safe-haven assets.

However, the yellow metal has shrugged off the last week's developments so far, which is good news, as one can see in the chart below. So, maybe, the price of gold will not adjust downward after the big news from Friday. Or it could even increase, given historically strong January gold performance.

Chart 2: Gold prices from December 13 to December 16, 2019

Having said this, the reduced risk aversion should fundamentally support the stock market at the expense of precious metals market. We will be watching carefully how the situation evolves, stay tuned!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Fed Says No Hikes In 2020. What About Gold?

December 12, 2019, 7:19 AMThe Fed kept the interest rates unchanged in December. The statement was rather hawkish, while the dot-plot rather dovish. What does such a mix imply for the yellow metal?

Fed Keeps Interest Rates Unchanged

Yesterday, the FOMC published the monetary policy statement from its latest meeting that took place on December 10-11th. In line with expectations, the U.S. central bank left the federal funds rate unchanged at 1.50 to 1.75 percent:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective.

The pause means that the FOMC has really completed a "mid-cycle" rate adjustments in October. The decision was unanimous, which confirms that there is no appetite for further cuts among the U.S. central bankers, at least not now.

Another important change was removing the part about the remaining uncertainty about the outlook. Instead, the Fed added the sentence that "the Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity (...)". It suggests that the U.S. central bank does not expect more easing of its monetary policy in the near future. That's a rather hawkish news, which is bad for the gold market.

No More Cuts, No More Hikes in 2020

But do not worry. The Fed published also the updated dot-plot. It shows no rate hikes in 2020 and just one in 2021, which is clearly a dovish change since September where the previous economic projections were published. Back then, the FOMC also expected no rate hikes next year and just one in 2021. But the Fed thought that the federal funds rate would be 1.9 percent at the end of 2019 and 2020, 2.1 percent in 2021, and 2.4 percent in 2022. While right now the U.S. central banks sees the interest rates at only 1.9 percent at the end of 2021, and 2.1 percent at the end of 2022. It means that the future path of interest rates will be flatter than expected.

Curiously enough, the Fed's stance will be easier without any particular economic justification: the whole path of expected growth in GDP and overall inflation is unchanged, core inflation is slightly down this year, while the unemployment rate got reduced over the whole path! But the lover level of the federal funds rate should be supportive for the gold prices, anyway!

Implications for Gold

Indeed, the immediate reaction of gold to the FOMC statement was positive, as the chart below shows. The price of the yellow metal rose from $1,470 to $1,478 during the first hour after the publication of the fresh announcement and economic projections (although the price has declined somewhat later).

Chart 1: Gold prices from December 10 to December 12, 2019.

But what to expect in the future? Well, the Fed will certainly talk a good deal about its neutral stance. However, we all know that the U.S. central bank is not truly neutral, for it has clear dovish bias. For years, the Fed projected higher interest rates that they actually turned out to be in reality. And the U.S. central bank is not eager to take interest rates back to the pre-crisis level. Not at all! As Powell said during his press conference, "I would want to see inflation that's persistent and significant" before raising rates again. That's huge declaration which means that Powell gave up on any try to normalize the interest rates.

So, the rule of thumb is that lack of clearly hawkish policy means dovish policy. Especially when the next economic downturn or a financial crisis arrives. From the fundamental point of view, such a rule is supportive for gold prices, so there are good chances fundamentally speaking that 2020 would deal the gold bulls a reason to celebrate.

There are also decent odds that the coming days will be hot for the gold market. Today, the ECB holds its first monetary policy meeting witch Christine Lagarde as the President of the bank. Also today, the parliamentary elections are held in the UK. Finally, the deadline for rolling out an additional $165 billion in U.S. tariffs for Chinese imports passes on Sunday. Stay tuned!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

The Last Hawk Flew to Heaven

December 10, 2019, 6:32 AMSad moment. Paul Volcker, the former Fed Chairman went to Bank of Heaven. We are not reporting this news due to the implications for gold prices, but as an opportunity to reflect on changes in the central banking since the time of Tall Paul and on their consequences for the gold market.

Tall Paul Has Gone

A great man passed away. Literally. Paul Volcker - who died on Monday, probably due to prostate cancer complications, at 92 - stood 6 feet and 7 inches high, or more than 2 meters. But Volcker's impressive height wasn't the only thing he could boast of. Our Readers are aware that we are not fans of central bankers, but we have to admit that Volcker not only literally but also figuratively cast a long shadow across the Fed, standing out by both past and current standards.

First of all, Volcker was probably the last Fed Chair that we could even remotely describe as the monetary hawk ready to fight inflation. As David Stockman wrote

Volcker accomplished this true anti-inflation objective with alacrity. By curtailing the Fed's balance sheet growth rate to less than 5 percent by 1982, Volcker convinced the markets that the Fed would not continue to passively validate inflation, as Burns and Miller had done, and that speculating on rising prices was no longer a one-way bet. Volcker thus cracked the inflation spiral through a display of central bank resolve, not through a single-variable focus on a rubbery monetary statistic called M1.

So, this is why you have heard about Greenspan's put or Bernanke's put, but not about the Volcker's put. The latter was not a hostage to the Wall Street (at least not in such an obvious and shameless way as his successors).

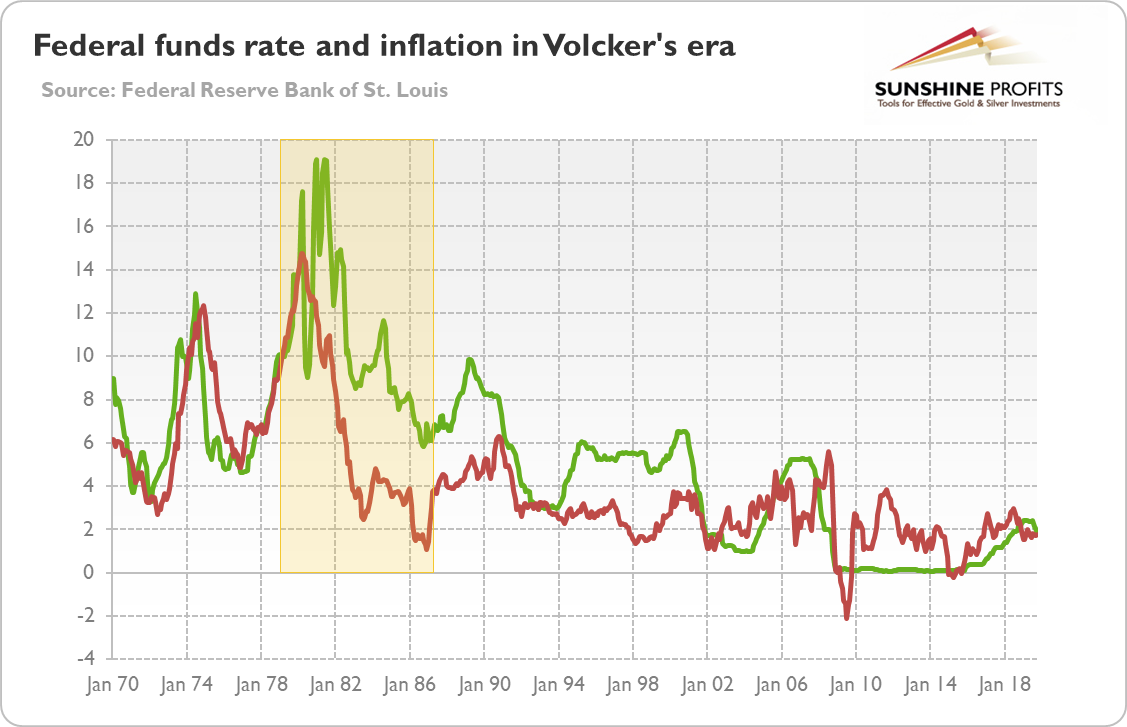

And Volcker also demonstrated political independence (yes, Reagan supported him, but many influential politicians wanted to take him down). As a reminder, he lifted the federal funds rate to 22 percent to tame double-digit inflation, as the chart below shows.

Chart 1: Effective federal funds rate (green line) and annual CPI inflation rate (red line) from January 1970 to October 2019.

Yes, you read it correctly: twenty two percent. So Volcker had the courage to do the right thing, even when it was immensely unpopular (there were even "Wanted" posters targeting Volcker for "killing" businesses) and led to a short-term recession. As William Poole, the St. Louis Fed President wrote in 2005,

Without his bold change in monetary policy and his determination to stick with it through several painful years, the U.S. economy would have continued its downward spiral. By reversing the misguided policies of his predecessors, Volcker set the table for the long economic expansions of the 1980s and 1990s.

Now, compare Volcker to Powell, who got scared of several Trump's tweets and modest corrections in the stock market and reversed the monetary tightening when the target for the federal funds rate was at mere 2.25-2.50 percent. Real hawks are gone.

Implications for Gold

This is, of course, positive for the gold prices from the fundamental perspective. The Fed shows more and more pronounced dovish bias. We know that inflation is much lower than in the Volcker era, but we bet dollars to doughnuts that even if inflation soared above 10 percent again, we would not see even approximately similarly strong Fed's response as Tall Paul delivered.

Another positive factor for gold prices are low real interest rates that declined due to Volcker having won the fight with inflation and restoring credibility in the U.S. monetary policy. However, this is also the gold's curse. Thanks to Volcker, the Fed still enjoys relatively high prestige and investors' trust. Hence, it seems that the dovish bias is not enough to spur a rally in gold. The yellow metal needs a grave Fed's error or an economic crisis that will shake investors' confidence and direct people toward safe havens.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. You can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

This Is What First Lagarde's Speech Means for Gold

December 5, 2019, 6:10 AMIn November, Lagarde delivered her first speech as the ECB President. Will she follow in Draghi's footsteps? But what should gold investors expect from her?

Key Takeaways from Lagarde's Speech

Recently, we have focused on the U.S. economy and the recession in its manufacturing sector. But let's not forget about Europe, whose economy is even weaker, and the monetary policy even more absurd. Two weeks ago, Christine Lagarde delivered her first policy speech as President of the European Central Bank.

First of all, Lagarde essentially confirmed the ECB's dovish stance. The financial markets expect the easy monetary stance to last for years and Lagarde did nothing to change these expectations. She said:

The ECB's accommodative policy stance has been a key driver of domestic demand during the recovery, and that stance remains in place. Monetary policy will continue to support the economy and respond to future risks in line with our price stability mandate.

Second, just as Draghi, Lagarde will keep the pressure on governments to ease their fiscal stance, supporting the constrained monetary policy. "It is clear that monetary policy could achieve its goal faster and with fewer side effects if other policies were supporting growth alongside it," she said. It's true that the EU definitely needs structural reforms. But Lagarde rather had in mind more budget spending and easier fiscal policy. And this will not be very helpful.

Third, following the Fed, the ECB will start a strategic review of its monetary policy framework in the near future. This is great, as it's always a good idea to review its strategy, but unfortunately the ECB is unlikely to change its unhealthy fascination with 2-percent inflation rate. Actually, investors can expect new monetary stimuli. The ECB will always find justification. Next to low inflation, there is always a... global warming.

And this is not a joke. Lagarde is really pushing for climate change to be part of the ECB's strategic review in an attempt to make the environment an essential part of monetary policymaking. Pssst, Christine, wanna a free advice? Climate change is an important and debatable issue, but not for central banks!

Implications for Gold

Recently, Lagarde has delivered her first speech as the ECB President. She has been tight-lipped on monetary aspects, so investors have to until the next ECB meeting to get some clues on her monetary policy views. But we already know that the ECB under Lagarde is unlikely to abandon its ultra dovish stance, at least unless inflation soars significantly. If anything, we can expect even more stimulus, as the ECB will have to react to not only "subdued inflation", "deflationary shock", but also to "climate crisis". No European mutation of Green New Deal will finance itself!

What does it all mean for gold? The permanently easy monetary policy stance could be seen as supportive for gold, which loves the environment of low and especially negative real interest rates. But eternally dovish ECB means also weak euro. And weak common currency implies stronger U.S. dollar, the greatest rival of gold.

Chart 1: EUR/USD exchange rate from January 2018 to November 2019

As the chart above shows, the EUR/USD exchange rate has been falling since January 2018. It confirms that the recent ultra dovish stance of the ECB has not been supportive to the euro. Hence, Lagarde may not give gold bulls reason for joy. We have doves in the U.S. and even more dovish doves in Europe, while the best combo for the yellow metal would be ultra doves at the Fed and ultra hawks at the ECB.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. You can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Manufacturing Goes Deeper Into Recession, Yet Gold Remains Muted. Why?

December 3, 2019, 8:00 AMThe ISM Manufacturing index fell 0.2 point to a reading of 48.1 in November. However, gold struggles to find momentum. What is going on exactly?

U.S. Manufacturing Sector Slumps Further

The Institute for Supply Management announced that its index of national factory activity dropped from 48.3 in October to 48.1 last month. The number was below expectations and it also remained below the 50 threshold, indicating contraction - shrinking for the fourth straight month. In other words, the manufacturing sector is still in recession.

We all know that. But what about the future and the broad economy? Well, situation looks better here, as the ISM index remains above the 42.9 level, which is associated with a recession in the broader economy. And the recent improvement in China's PMIs prompt some to say that the ISM is bouncing along the bottom. Moreover, the strike at General Motors is over, while Boeing hopes to resume deliveries of its 737 MAX.

However, the decline in new orders - the New Orders Index registered 47.2 percent in November, a decrease of 1.9 percentage points from the October reading of 49.1 percent - suggests downside risk, if anything. The fact that Trump restored tariffs on steel and aluminum imports from Brazil and Argentina will not help the domestic manufacturing sector which already is struggling with higher tariffs, trade uncertainty, slowing profit growth and weak overseas demand.

Following shaky economic reports - besides data on manufacturing, the index of pending home sales dropped 1.7 percent, while the personal incomes were flat in October - the Federal Reserve Bank of Atlanta slashed its fourth-quarter GDP estimate from 1.7 to 1.3 percent annualized rate, reviving worries of a slowing domestic economy.

Implications for Gold

What does it all mean for the gold market? From the fundamental point of view, weaker industrial production should support gold prices. This is because the manufacturing sector' problems could not only translate into slower economic growth, but also force the Fed to adopt again a more dovish stance and cut interest rates further in 2020.

But the manufacturing recession failed to spur rally in gold in the fourth quarter of 2019, as the chart below shows. The gold prices are clearly struggling to find momentum, even in the face of disturbing data on the U.S. manufacturing sector.

Chart 1: Gold prices (London P.M. Fix, in $) from October to December 2019.

However, other economic data ended up better than expected. Investors also became more optimistic about the trade deal between China and the U.S. So, given where the general stock markets are, gold is actually not doing bad - but the key test will be yellow metal's behavior in response to the recent greenback's weakening. Stay tuned!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. You can still subscribe to our Alerts at very promotional terms - it takes just $9 to read the details right away and then receive follow-ups for the next three weeks. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM