-

When the Fed Says Everything Is Fine, Smart People Buy Gold

November 29, 2019, 4:48 AMThis month, the Fed has published the newest edition of its Financial Stability Report. Generally speaking, the level of vulnerabilities in the financial system has barely moved since the publication of the May edition of the report. Most of the U.S. central banks' observations are reassuring: investors' risk appetite generally appears to have returned to the middle level of its historical range, while the core of the financial sector appears resilient as leverage remains low and funding risks limited relative to the levels of recent decades.

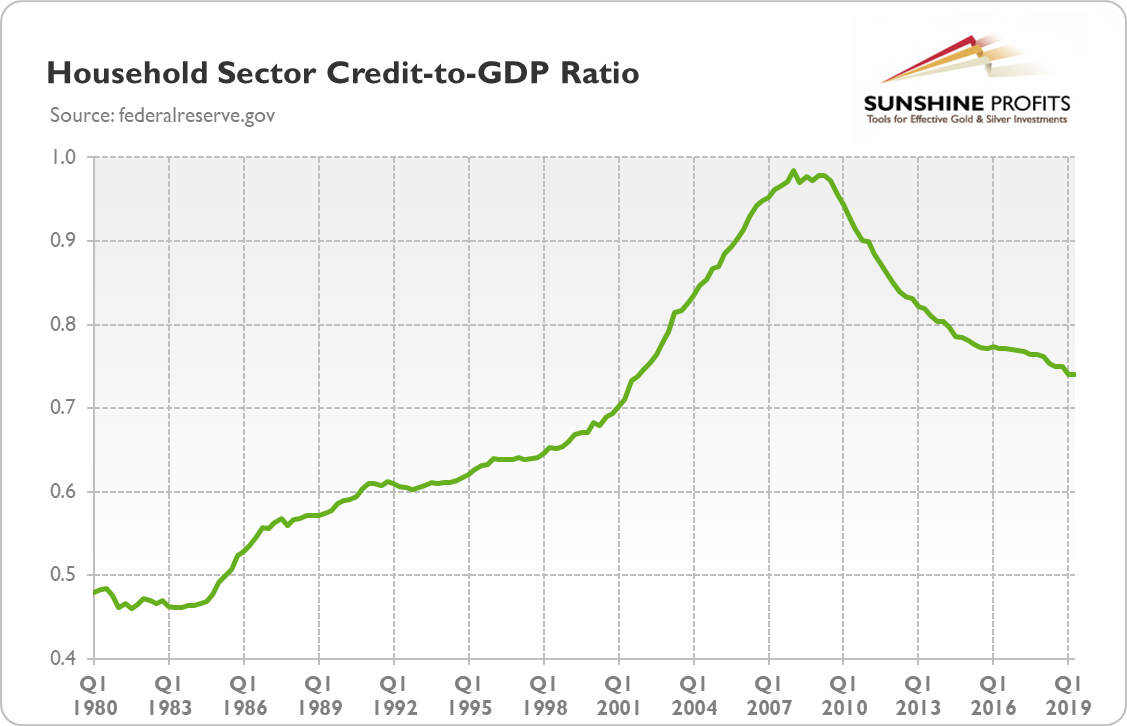

What is very important in light of the causes of the Great Recession, the largest U.S. banks remain strongly capitalized, while household borrowing remains at a modest level relative to income, as one can see in the chart below. Isn't that splendid news? Isn't this time different? Is it bad news then for the gold market?

No, and there are two reasons for it. Let's discuss the first one.

You see, the generals are fighting the previous wars, while the economists and officials are confronting the previous financial crisis. But history never repeats itself, it only rhymes. So the fact that the households are not heavily indebted this time, while big banks are finally well capitalized is praiseworthy, but it is irrelevant. I mean here that the lack of symptoms of the previous economic crisis does not exclude the next downturn, because the next crisis will be different.

Chart 1: US Household Sector Credit-to-GDP Ratio from Q1 1980 to Q2 2019

Where can the next global financial turmoil break out from? Many people worry about geopolitical conflicts, including the trade wars, that could spill over to the U.S. financial system and negatively affect the global economy. My research shows that geopolitical risks - and their impact on the gold market - are often exaggerated.

The next recession may also begin in China. Because of the size of the Chinese economy, significant distress in that country could spill over to the global markets through a rise in the risk premium, changes in the exchange rates, and declines in trade and commodity prices. Indeed, the pace of China's economic growth has already slowed down, and the global economy has weakened (while gold shined) in response.

Many market participants express concerns about something else, and this is the second factor that we mentioned previously. That's something that we will leave to our subscribers, though. If you would like to know what else could be the trigger of the next recession, I encourage you to read the full version of today's Fundamental Gold Report, which analyzes thoroughly the latest Fed's report on the financial stability its impact on the precious metals market. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

-

Central Banks' Gold Buying and Repatriation Spree

November 26, 2019, 8:33 AMCentral banks' purchases and repatriations of gold have caught our attention once again. In October, Serbia's central bank bought 9 tons of gold, following in the footsteps of many other central banks that have been adding to their gold reserves recently, including Russia, Hungary, and Poland.

Nine tons may seem to be a modest purchase, but the transaction was worth $438 million at $1,503 an ounce. And it has raised Serbia's gold reserves to 30.4 tons, constituting about 10 percent of the country's total reserves. Importantly, the National Bank of Serbia could carry on with its purchases, as it got clear message from the Serbian President, Aleksandar Vucic to continue boosting gold reserves in order to be better prepared for the economic crisis: "I think we'll continue doing that because of what we see in which direction the crisis in the world is moving," Vucic told the press.

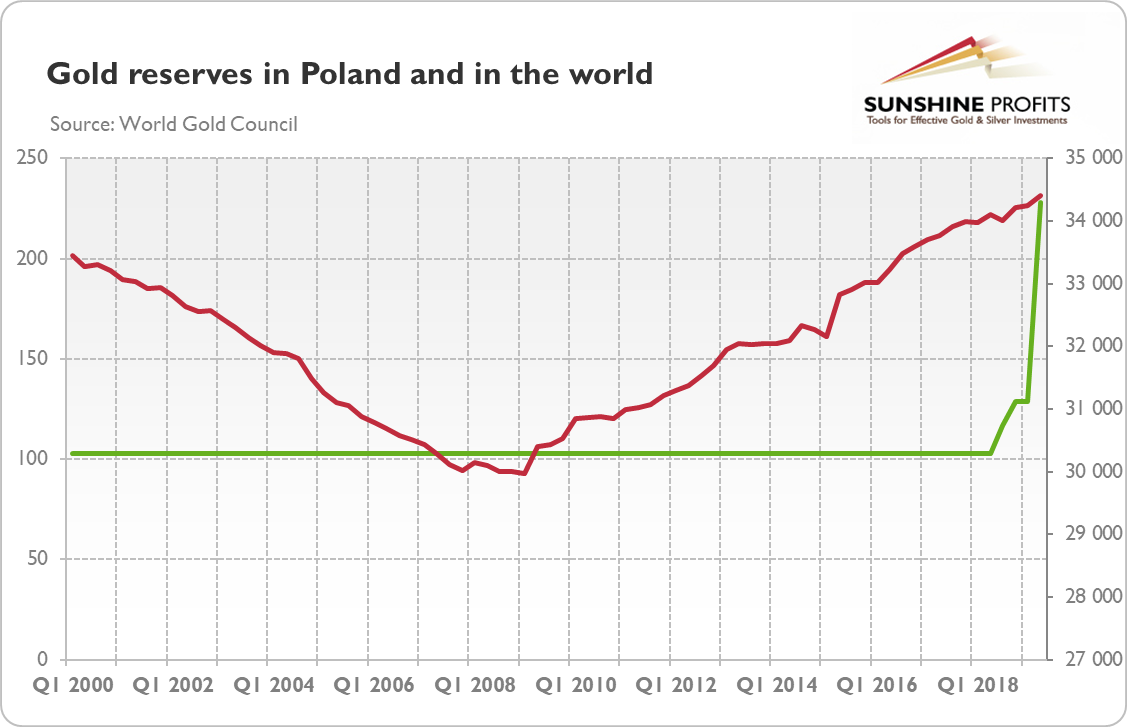

This purchase should be seen from broader perspective. Central banks added 156 tons of gold to their reserves in Q3, according to the World Gold Council.Although it was significantly lower than the record levels of Q3 2018, central bank buying remained healthy. Actually, central banks are on track to be net gold buyers for 10 consecutive years, as the chart below shows. And the trend is likely to continue in the coming years due to heightened global tensions, slowdown in economic growth, negative bond yields, and trade wars.

Chart 1: Gold reserves (in tons) in Poland (green line, left axis) and in the world (red line, right axis) from Q1 2000 to Q2 2019

Moreover, in September, Germany's central bank gold holdings have risen for the first time this century. Given that Bundesbank is still quite influential, its reversal may encourage other central banks to buy gold more decisively. September's outright purchase of the precious metal comes two years after Bundesbank repatriated 583 tons of gold worth about $31 billion.

When we discuss repatriation of gold, we have to mention Poland, which has rapidly boosted its bullion reserves over the past two years by 125 tons to 228.6 tons, as one can see in the chart above. And yesterday, the country has brought back around 100 tons of gold from the Bank of England's vaults in London. It means that around half of Poland's holdings in the UK were transferred back to the National Bank of Poland's vault in Warsaw. Adam Glapinski, the central banks' governor, commented the move as follows:

We have completed the procedure of bringing our gold to the country. In this connection, I can say that we brought Poles' gold home (...) We have as much gold in reserves as other industrialized and civilized countries (...) Our reserves are at an appropriate level, they are sufficiently high and safe, which does not mean that they cannot grow further. I think that in a few years the NBP may increase its reserves again. (...) The value of the imported metal is 18 billion zlotys, said the NBP president. If we sold gold recently bought now at current prices, we would have multi-billion profit (...) The gold symbolizes the strength of the country.

Don't you feel confused? Central banks abandoned the gold standard, and declared gold to be barbarous relic not suitable for modern times. We are told that fiat money is superior to precious metals. We are told that we should believe in the wisdom of the central bankers and their scientific management of the monetary policy. If so, why the heck the central banks buy the barbaric gold? To find out the answer, I encourage you to read the full version of today's Fundamental Gold Report, which in-depth analyzes the reasons behind the central banks' purchases of gold and its impact on the precious metals market. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

-

FOMC Minutes Reveal an Important Shift That's Key for Gold, Too

November 21, 2019, 7:43 AMYesterday, the Fed released minutes from its last meeting. They show an important shift among the meeting participants. In September, the FOMC turned more worried about the state of the U.S. economy, while just six weeks later in October, the Committee felt more optimistic again. Indeed, the central bankers noted that certain downside risks had softened:

Uncertainties associated with trade tensions as well as geopolitical risks had eased somewhat, though they remained elevated (...) Some risks were seen to have eased a bit, although they remained elevated. There were some tentative signs that trade tensions were easing, the probability of a no-deal Brexit was judged to have lessened, and some other geopolitical tensions had diminished.

The participants also worried less about the yield curve and the recessionary risk:

Several participants noted that statistical models designed to gauge the probability of recession, including those based on information from the yield curve, suggested that the likelihood of a recession occurring over the medium term had fallen somewhat over the intermeeting period.

Indeed, the yield curve has ceased to be inverted and has recently returned to positive territory. Consequently, the yield curve-derived recessionary odds have declined from 38 percent in August to 29 percent in October, as the chart below shows.

Chart 1: Spread between 10-year and 3-month Treasuries (blue line, right axis, in %) and the yield curve-derived recessionary odds (red line, left axis, in %, New York Fed's model) from January 2018 to October 2019.

However, the fact that the yield curve has become standard again does not mean that the risk of recession disappeared. Reinversions do not erase previous inversions. The damage has been done. The yield curve that has reverted to the normal may thus be the quiet before the storm. Indeed, some experts start to count down to recession when the yield curve becomes positive after the preceding inversion.

The FOMC members discussed not only the economic situation but also what tools to use in the next recession. In a rare case of unanimity, all Fed officials said they opposed the negative interest rates in case of a downturn, as both the ECB and BoJ have done:

All participants judged that negative interest rates currently did not appear to be an attractive monetary policy tool in the United States. Participants commented that there was limited scope to bring the policy rate into negative territory, that the evidence on the beneficial effects of negative interest rates abroad was mixed, and that it was unclear what effects negative rates might have on the willingness of financial intermediaries to lend and on the spending plans of households and businesses. Participants noted that negative interest rates would entail risks of introducing significant complexity or distortions to the financial system. In particular, some participants cautioned that the financial system in the United States is considerably different from those in countries that implemented negative interest rate policies, and that negative rates could have more significant adverse effects on market functioning and financial stability here than abroad.

However, there is hope for NIRP! After all, President Trump supports negative rates, so the Fed added sentence that it could rethink its stance in the future. Of course, who wouldn't be open to new solutions should the conditions change!

Notwithstanding these considerations, participants did not rule out the possibility that circumstances could arise in which it might be appropriate to reassess the potential role of negative interest rates as a policy tool.

Gold prices dropped in their initial reaction to the FOMC minutes, but the price action has been muted. But would you like to know what to expect from the Fed in the future and how it could affect the yellow metal? If so, I encourage you to read the full version of today's Fundamental Gold Report, which analyzes the Fed's stance and its impact on the precious metals market in more detail. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

-

Industry Slides Deeper into Recession. Will Gold Shine Now?

November 19, 2019, 8:31 AMSome analysts has argued that the manufacturing sector reached a through. But this not the case. The latest Fed's report on the industrial production and capacity utilization clearly shows that the pundits were wrong again. As they so often are. The industrial production fell 0.8 percent in October, much more than expected. It was the third drop in the industrial production in the past four months, following a 0.3-percent decrease in September, and the largest decline since May 2018.

Of course, the United Auto Workers strike at General Motors negatively affected the October report, pushing down automotive production by 7.1 percent. However, the weakness was not limited to the car industry. Excluding motor vehicles and parts, the index for total industrial production moved down 0.5 percent. The decline was broad-based: the index for manufacturing edged down 0.1 percent, mining production decreased 0.7 percent, while utilities output fell 2.6 percent. And the capacity utilization for the industrial sector decreased by 0.8 percentage point in October to 76.7 percent, the lowest level in 25 months.

The situation in the industrial sector does not look good on an annual basis either. As the chart below shows, the industrial production fell 1.1 percent over the twelve months ending in October, moving decisively into the contraction area.

Chart 1: US Industrial production from January 2008 to October 2019

So, now it should be clear that the industrial sector was significantly hit by weak global demand and trade wars, and entered recession. It should be worrying for the policymakers, but the Fed Chair downplayed the dangers. Powell said that the weakness in the manufacturing sector has not spilled over into the broader economy. He also pointed out the economy is driven by the consumers, not manufactures, so we should not worry: "the 70% of the economy that represents the consumer is healthy, with high confidence, low unemployment, wages moving up."

Arrrgh, I hear this argument very often. Although it's invalid! Would you like to know why Powell is wrong on the significance of the industrial sectors? If so, I encourage you to read the full version of today's Fundamental Gold Report, which analyzes the myth of economy driven by consumer spending. I will demolish this die-hard belief and draw conclusions for the current outlook of the U.S. economy and the gold market. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

-

How Big is Big Phil? And How Important CPI and Powell Are for Gold?

November 15, 2019, 10:24 AMThis week has been hot! Unfortunately, I could not cover the inflation report and Powell's testimonies earlier, as I attended the 8th International Conference "The Austrian School of Economics in the 21st Century," held in Vienna, to present my paper on zombie companies and the U.S. productivity slowdown, and to get inspired by the latest ideas and research topics. It was well-organized and probably the biggest Europe-based conference on the Austrian school and libertarianism this year. And it was very fruitful, just take a look what I got from one of the speakers!

Oh my God, 500 bolivars, isn't it a nice present? Nah, because of the hyperinflation in Venezuela, the banknote is rubbish, it's worth no more than few US cents.

Fortunately, another speaker handed out gold coins. Nah, I made it up. I wish it was true, but no one gives out gold for free, because unlike fiat money, gold is actually worth something. To be clear, I do not claim that all fiat currencies are as shitty as the bolivars right now are. I rather want to show what they can become, if institutional restrictions on the use of the printing press are removed. The great advantage of gold is that its supply is naturally limited, so the monetary stability does not rely on the wisdom and self-control of the FOMC members.

So, gold is naturally rare and it is indeed valuable. Actually, sometimes gold can be truly precious. Please take a look at the next photos. The conference was held in the Oesterreichische Nationalbank, i.e., the central bank of Austria (which is quite ironic, as the Austrian economists want to abandon the central banks, but the thing is that Barbara Kolm, Vice President of the General Council, supports the Austrian school of economics, and she is also the President of the Friedrich August von Hayek Institute and the Director of the Austrian Economics Center). And one could come across this impressive gold coin:

Isn't it pretty? But guess how much it weighs! No, more than 10 kilograms. And more than 20 kilograms... 31.103 kilograms, or 1,000 ounces. The coin was created for the 15th anniversary of the Vienna Philharmonic bullion coin in 2004. The so-called Big Phil has a nominal value €100,000, although it is made of pure gold and it is worth about €1.3 million. So if someone believed that coins can be used only for small payments, they have to change their minds now!

I shared with you the impressions from the great conference in Vienna, but would you like to know what I think about the recent inflation report and Powell's testimony in Congress? If so, I encourage you to read the full version of today's Fundamental Gold Report, which analyzes the fresh data on CPI and Fed Chair's remarks before the lawmakers. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM