-

U.S. Kills General Soleimani. How Will Iran and Gold Respond?

January 6, 2020, 10:12 AMNot even the first week of 2020 has passed and we are inching closer to war! Tensions between the U.S. and Iran have significantly risen. What does it imply for the world and gold market?

Tensions between the U.S. and Iran Are Rising

On Thursday, I wrote that "black swans are flying just above the market surface". And, indeed, not even the first week of the new year passed, and the first swan has already arrived. It landed in Iraq on December 27, when Iranian-backed militia in Iraq attacked a U.S. military base, which killed an American contractor. The U.S. responded by launching airstrikes across Iraq and Syria, killing 25 Iran-backed militiamen. This has led to the attacks on the U.S. embassy in Baghdad.

In response, the U.S. killed on Friday in a rocket attack General Qasem Soleimani, commander of the Iranian Revolutionary Guards Corps-Quds Force, the branch of Iran's security forces responsible for operations abroad. According to the Pentagon's statement, the move was defensive:

General Soleimani was actively developing plans to attack American diplomats and service members in Iraq and throughout the region. General Soleimani and his Quds Force were responsible for the deaths of hundreds of American and coalition service members and the wounding of thousands more (...) This strike was aimed at deterring future Iranian attack plans.

The strike represents a substantial escalation in the low-level conflict between the U.S. and Iran - some experts even describe the attack on the general as little short of a "declaration of war" by the Americans against Iran. The elevated geopolitical risks may support gold prices, at least in the short-term.

Implications for Gold

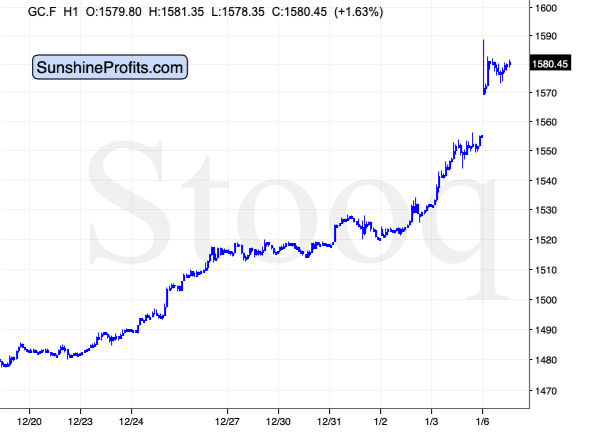

What does the escalation in tensions between the U.S. and Iran imply for the world and the yellow metal? Well, given that Soleimani was widely seen as the second most powerful figure in Iran, we should expect a response. Both Iranian president Rouhani and Supreme Leader Khamenei vowed revenge. Hence, tensions will be higher in the Gulf. The oil price has already increased about 4 percent in 2020. Similarly, the price of gold has jumped almost to $1,580 in the aftermath of Soleimani's death.

Chart 1: Gold prices from December 20, 2019, to January 6, 2020.

But what is likely to happen next in the gold market? I often repeat that impact of geopolitical events on the gold prices is short-lived, as people exaggerate the threats. The recent events in Iraq may thus entail only temporary effects on the gold prices. However, this time may be different, as people fear that the major escalation in tensions between the U.S. and Iran could transform into a full-blown war which has the potential to be one of the worst conflicts in recent times. For example, the Eurasia Group puts the chance of "a limited or major military confrontation" at 40 percent. What is important is that the U.S. would be directly involved in this conflict - and when America is threatened, gold prices move the most. A lot depends now on Iran's response. But investors should remember that gold has already been in bullish mood, so even when tensions soften, the awaited sharp downward move does not have to occur right away.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Setting Gold Market Expectations for 2020 Right

January 2, 2020, 10:18 AMHooray, the twenties are here! But what will the 2020 bring for the gold market? Shall we see the beginning of the Belle Époque for the yellow metal?

Gold at the End of 2019

The last year was a very good one for the gold bulls, as one can clearly see in the chart below. Despite the soaring equities, the price of the yellow metal rose from $1279 to around $1520, or more than 18 percent. Bravo!

Chart 1: Gold prices in 2019.

In particular, gold managed to jump again above $1,500 at the very end of December, which confirms that the turn of the year is usually positive for gold prices. In the last few years, gold rallied in the beginning of year. So, looking at gold's seasonality, January could be positive for the price of the yellow metal. But what about the rest of the year? Below I offer a few key insight. The more detailed fundamental outlook for gold in 2020, I provide in January edition of the Gold Market Overview.

Fundamental Outlook for Gold in 2020

From the fundamental point of view, 2020 may be worse for the yellow metal than in 2019. This is because the dovish central bank pivot that drove precious market in 2019 is largely behind us. The impact of existing accommodative U.S. fiscal policy is fading. The fears of recession are receding. The risks of the full blown U.S.-China trade war and a hard Brexit have diminished.

In other words, the monetary policy will be more hawkish than in 2019, while the fiscal policy will be similarly easy, supporting the U.S. dollar. The geopolitical headwinds have softened, which should help the risky assets and bond yields. So, we could see strong dollar, higher real interest rates and lower risk aversion - a very bad combination for the price of gold.

On the other hand, the next Fed move will be an interest rate cut, which can happen as early as this year. The expectation of a dovish move could support gold prices. Moreover, the U.S. GDP growth is expected to slow down, while inflation may finally rise. Meanwhile, growth may accelerate in other countries - if that happens, the greenback may weaken. Flatter U.S. growth with higher inflation and weakening dollar seems to be a positive combination for the gold prices.

However, the dovish expectations are already priced in to some extent, while inflation will not soar, but edge up, if at all. Given the dovish stance of the ECB and Bank of Japan, the U.S. dollar may remain relatively strong. This is why our base case is that fundamental outlook has deteriorated somewhat and after possibly pleasant beginning of the year, gold may struggle further down the road.

But black swans are flying just above the market surface. So, investors should be aware that they could be hit at some point with the harsh reality of economic slowdown in China and other countries, debt saturation, declining corporate profits, and uncertainty about the outcomes of the U.S. elections. In such an environment, gold will continue to be seen as an important safe-haven asset.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Gold in 2019: Lessons for the Year Ahead

December 31, 2019, 5:07 AMThe King is dead, long live the King - 2019 is over, long live the 2020! As tumultuous as they have been, what have we learned about the gold market in the past twelve months? And what can we glean from this knowledge for the times ahead?

Key Lessons For Gold Investors from 2019

Today is the last day of 2019. It was a good year for the gold bulls, as one can clearly see in the chart below. The price of the yellow metal increased from $1279 to $1474 (as of December 18 - yes, we wrote this article before the festive break). It means that gold rose more than 15 percent in 2019. The gold bulls cannot complain!

Chart 1: Gold prices (London P.M Fix, in $) from December 2018 to December 2019.

The main driver behind gold's success were fears of a U.S. recession and the related dovish U-turn within the Fed, which cut the federal funds rate three times after hiking it four times in 2018.

However, it was not surprising. After four hikes in 2018, it was more than certain that the Fed's stance would become more dovish and that the price of gold would then react favorably. What could be less expected was that the gold's appreciation would occur simultaneously with the strengthening U.S. dollar. As the chart below shows, we have not observed the traditional strong negative correlation between the greenback and the yellow metal. Actually, both assets moved in tandem strongly up during the summer!

Chart 2: Gold prices (yellow line, left axis, P.M. Fix, in $) and the broad trade weighted US dollar index (red line, right axis) from January to December 2019

Why? The recessionary fears boosted both the U.S.-denominated government bonds and gold. Although the yellow metal is the ultimate safe-haven, the U.S. Treasuries can also behave like a safe haven, at least when compared to other assets - due to the large liquidity flows they're able to absorb. So, as I always repeat, do not mechanically follow gold's correlations, but always look at the broader macroeconomic context!

The relationship between gold and the real interest rates seemed to be stronger in 2019. As one can see in the chart below, the peak in gold prices corresponded with the bottom in the bond yields. However, the correlation was far from being perfect. The real rates have been rising since January, while gold remained in a sideways trend until late May. It confirms that gold market is very complex and that gold investors should not count on simple automatic reactions.

Chart 3: Gold prices (yellow line, left axis, P.M. Fix, in $) and the yields on 10-year inflation-indexed Treasuries (green line, right axis, in %) from January to December 2019

Implications for Gold in 2020

Gold showed in 2019 that it can shine even when the U.S. dollar appreciates and the stock prices reach new record levels. So, 2020 does not have to turn out badly for the gold market. However, the Fed is going to be neutral or cut interest rates once at most. It means that the U.S. central bank will be less dovish than in 2019. While this needn't be a disaster for the yellow metal, investors should acknowledge that gold fundamentals are likely to deteriorate somewhat next year (unless the next crisis occurs). Fundamentals are, of course, not everything, but it seems to me that gold would welcome some ignition to beat or come on par with its performance in 2019.

Anyway, tomorrow will be already January which used to be a positive month for gold prices. So Happy January and the whole 2020! And let all the gold come to you in the New Year... and in the 2020s!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Trump Impeached in the House! Is It Time for Gold Now?

December 24, 2019, 3:45 AMLast week, the House voted to impeach Donald Trump. This is the third time in the U.S. history such an event has happened to the sitting President. What does it imply for the gold market?

Trump's Impeachment, Explained

On Wednesday, the House of Representatives impeached Donald Trump. He became only the third U.S. president in history to be impeached, following Andrew Johnson in 1868 and Bill Clinton in 1998.

According to the Constitution, the President "shall be removed from Office on Impeachment for, a Conviction of, Treason, Bribery, or other high Crimes and Misdemeanors". Democrats created two articles of impeachments which refer to these other high crimes and misdemeanors. The first one accuses Trump of abusing his power by pressuring Ukraine to investigate Joe Biden, the former U.S. Vice President, in order to interfere in the 2020 presidential election.

The House of Representatives also accused Trump of obstruction of Congress by directing administration officials and agencies not to comply with lawful House subpoenas for testimony and documents related to impeachment. The abuse of power article was passed on a 230-197 vote and the obstruction article was passed by 229-198.

Trump denies any wrongdoing, calling the impeachment inquiry a "witch hunt". Who is right? Well, we do not know. We are neither Trump's supporters, nor Democrats' fans - but let's face it: the whole process is very political. Democrats are still furious after Hillary Clinton's loss in 2016 and hate Trump. They hoped for several months that "Russiagate" would enable them to remove Trump from office, but it didn't work out. So they are taking their chances once more, although the White House's record of the call between Trump and Ukraine President is far from being a clear case for high crime, especially when you compare it to the Watergate scandal or Bill Clinton's lying under oath about his sexual relationship with Monica Lewinsky.

However, there may be more to the story than politics and hatred of political parties. We mean here the hostility of the so-called "deep state" or "intelligence community" directed at Trump who is an outsider. Interestingly, even mainstream media started to notice that there is a real enmity between Trump and agencies such as the CIA and the FBI (to be clear, we do not claim that Trump is without sins, but that there is a kind of bias against Trump among the so-called establishment).

Anyway, impeachment does not imply removal from office. No president has been ever removed from office by impeachment and Trump is not likely to become the first one. That would require a two-thirds majority in the Republican-controlled Senate. So, at least 20 Republicans would have to join Democrats in voting against Trump to convict him. This is unlikely to happen.

Implications for Gold

What does the impeachments theater mean for the gold market then? The risk of impeachment should theoretically support the safe-haven assets such as gold. However, given the low odds of Trump being removed from office, the markets are little moved. The yellow metal also has shrugged off the news from Washington, DC, as the chart below shows.

Chart 1: Gold prices from December 16 to December 19, 2019

The price of gold has increased the following day, but it can hardly be called a rally. Having said this, the end of year is positive for the gold market, given the unfavorable environment. I mean here the fact that the phase one trade deal between the U.S. and China was signed, while the Conservative Party's victory in the UK parliamentary elections cleared the path to Brexit in 2020. As two important headwinds for the global economy softened, one could reasonably expect that the price of gold would dive. After all, the risk appetite came back to the markets, bond yields increased, while equity markets reached record highs. And yet gold remained in a narrow trading range of $1,460 and $1,480. It seems that the yellow metal is preparing for a big move - now the question is in what direction (fundamentals suggest rather a decline, while the gold seasonal pattern favors an increase).

Chart 2: Gold True Seasonal Chart for Q4 2019

Depending whether you are a bull or a bear, we wish you to be content with the upcoming move!

We hope that you behaved well all the year and that Santa Claus will not impeach you... Merry Christmas!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

-

Gold and Lagarde - Friends or Foes?

December 19, 2019, 6:23 AMA week ago, Lagarde chaired the monetary policy meeting of the Governing Council of the ECB for the first time. An insightful press conference followed in the footsteps. What will her presidency imply for the ECB's policy and the gold market precisely?

Key Takeaways From First Lagarde Monetary Policy Meeting as ECB President

Last Thursday, the ECB held its December monetary policy meeting. The central bank maintained its stance steady, keeping the interest rates unchanged. However, the ECB has revised slightly down the outlook for real GDP growth for 2020, while the outlook for HICP inflation went slightly up.

But the main change occurred in the position of the President. Christine Lagarde has replaced Mario "whatever it takes" Draghi. Of course, it has happened some time ago, but only now she chaired her first monetary policy meeting and held a post-meeting press conference as the ECB President. What do her remarks and her presidency in general imply for the ECB's future and the gold market specifically?

First of all, we are now sure that the dovish stance on monetary policy will be prolonged. Lagarde confirmed the status quo on interest rates, quantitative easing, etc. She said that "All right, on the toolbox, I'm not going to revisit the past (...) Policy decisions that were made, stand, and were re-endorsed yet again".

Moreover, Lagarde communicates with the market pretty well. She reminded the audience in the very beginning that each president has his or her own style of communicating, so the analysts should not overinterpret her words. She also nicely escaped from being compared with Draghi, or being classifying as dove or hawk. Lagarde said that "I'm neither dove nor hawk and my ambition is to be this owl that is often associated with a little bit of wisdom". Nice rhetoric, Madame, but let's be honest, we all know that deep down you are a dove.

Indeed, Lagarde was rather candid on the negative interest rates. She did not criticize them and she did not announce any normalization. Instead, when asked about the existence of a "reversal rate", i.e. a policy rate whose adverse consequences outweigh the positive effects, she replied that it's not the case in the Eurozone. So, the madness of negative interest rates will continue. Is it really wisdom, Madame?

Last but not least, Lagarde announced that a top-down review of the ECB's strategy would get underway in January with a view to being completed by the end of 2020. And guess what, she did not say that, but I bet dollars to doughnuts that the review will call for a more symmetric inflation goal. As a reminder, the ECB aims to reach inflation rate at a level sufficiently close to, but below, 2 percent. I can imagine that the phrase "but below" must be a thorn in Lagarde's side. She already said during the press conference, that inflation at 1.7 percent is not close enough...

Implications for Gold

What does it all mean for the ECB's monetary policy and the gold market? Well, Lagarde is consensual. Lagarde speaks nicely. Lagarde smiles. But beware of the central banker! Don't be fooled by Madame Lagarde's charm. If it looks like a dove, flies like a dove, and coos like a dove, then it probably is a dove. And, indeed, Lagarde is a dove, or actually an ultra dove. So, we expect the status quo on the very easy ECB's monetary policy to continue, at least until the other members of the Governing Council express their objections.

Unfortunately, from the fundamental point of view, Lagarde's dovishness is not helpful for the gold prices. Fundamentally, I mean the fact that dovish ECB, or the ECB more dovish than the Fed, should work to weaken the euro against the U.S. dollar. And the dollar's strength should keep a downward pressure on gold prices.

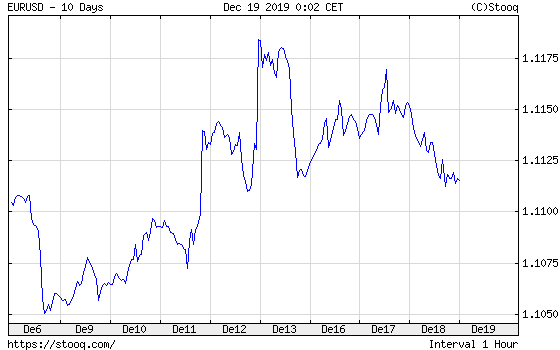

However, please note that the status quo of the ECB was already priced in. The EUR/USD exchange rate was barely influenced by Lagarde's press conference, as the chart below shows (the later sharp moves were caused by the outcomes of the UK parliamentary elections and Trump's tweets about trade policy).

Chart 1: EUR/USD exchange rate from December 6 to December 19, 2019

So, technical factors are also important in the gold market and right now, they might actually play first fiddle as we are approaching January, which is historically a positive month for the gold bulls.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM