tools spotlight

-

Gold Price in December 2019

December 3, 2019, 9:00 AMGold, silver and mining stocks moved higher during the last 24 hours, while the USD Index declined - just like they were all likely to. But in terms of the daily closing prices, silver moved lower, gold miners moved higher, and gold did barely anything. What does this tell us? What's in store for the gold price in December 2019?

These Days in PMs

It tells us that the short-term rally in the precious metals sector most likely still has some steam left in it. We've emphasized it many times before and we posted a big research paper on it - silver tends to outperform gold on a very short-term basis at the end of a given upswing, while mining stocks tend to be strong in the first half of the move.

Silver is definitely not outperforming on a short-term basis right now, but mining stocks have been magnifying gold price's gains in the last few weeks. This means that we haven't seen the final part of the short-term upswing just yet.

When it arrives - quite likely within the next several days - traders are once again likely to get excited by silver's "strength" and they will view as a good omen. Conversely, it will most likely be a perfect selling opportunity before the decline continues.

Why would the top form within the next several days? Our yesterday's comments on that matter remain up-to-date:

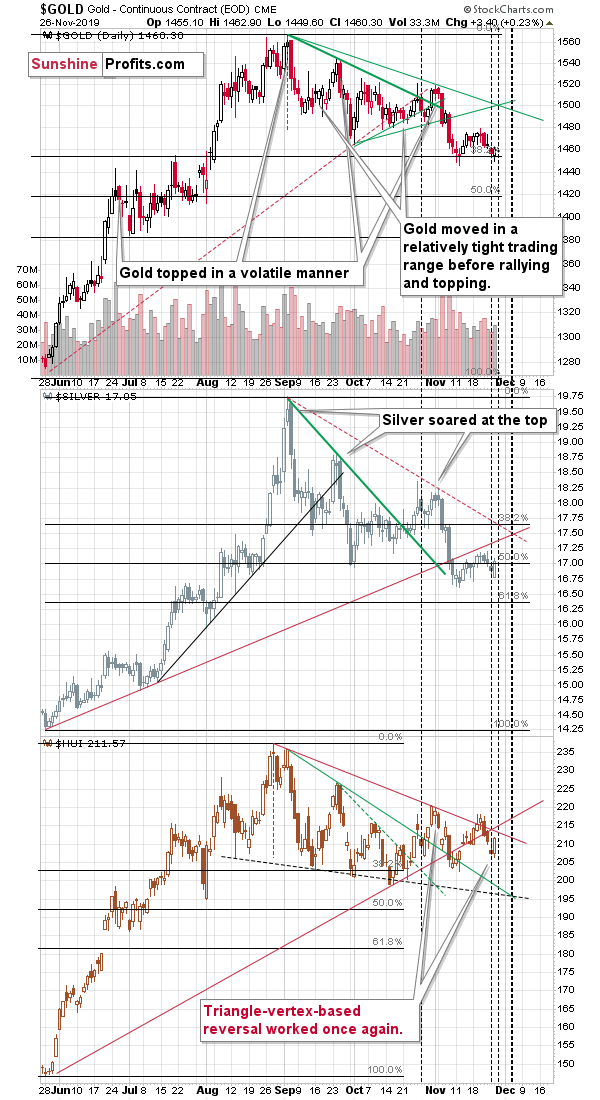

Because of the looming triangle-vertex based turning point. The recent turning points for gold, silver and mining stocks worked perfectly by pinpointing the early November top, and they also correctly estimated the most recent reversals - the local bottoms after which gold, silver and miners moved higher.

The early November top is clearest in case of silver (middle of the above chart), while the recent local bottoms are most clearly visible in case of gold miners (lower part of the chart).

The next triangle reversal is due this week, which makes it likely that we'll see some kind of turnaround shortly. The important detail about this turnaround is that it's confirmed by not one but two markets - silver and miners, which increases the odds that the reversal will indeed take place. The early-November top, for instance, was indicated by all three parts of the PM market at once.

Let's keep in mind that it's not the only factor pointing to this outcome. The True Seasonality for gold confirms the above.

On average, gold price has been spiking around late November and early December. Please note that while on average gold performs best in late November, the accuracy reading actually rises strongly in the next several days. This means that while the biggest price moves usually happened sooner, some of them arrive a bit late. When gold soared sooner, it didn't decline immediately. The take-away here is that even if the above is not 100% correct, and price spike doesn't happen right away, it means that it's still likely to arrive shortly.

Gold price is also likely to get some more help from the declining USD Index.

The Greenback's Support for Gold

The first part of December 2019 is likely to be characterized by not only a "surprising" turnaround in the gold price, but also by a reversal in the USD Index.

We previously wrote that the USD Index was likely to move lower once again before turning up and that this final part of the decline would likely trigger a rally in the yellow metal. Quoting our November 25 analysis:

The general rule for any market is that if it doesn't move in the way it "should" move given what's going on in the world, it means that - for whatever reason - it's not the direction in which the market is going to move next. This trading technique doesn't specify what is the reason for a given market's strength. The point is to detect and acknowledge this strength, and then to combine this information with other trading signals.

One of the biggest benefits of this approach is its widespread application. Knowing what is likely to move a given market and what kind of reaction would be normal, means that it can be applied - regardless of what the market is. It also applies to various terms, if one takes into consideration the likely time in which the effect of a given development "should" be in place. For instance, in case of long-term investment, one should pay attention to how the market reacts to the factors that matter in this time horizon, for instance demographics and shifts in supply & demand picture. In case of day trading, it's a matter of checking if a given individual piece of news (or price action from a key influencing market) causes a price move that seems natural. The bigger the divergence from what would be viewed as normal, the stronger the bullish or bearish signal becomes.

Moving back to the USD-gold picture, we previously wrote that the USD Index is quite likely to consolidate before rallying strongly and it seems that this consolidation is still taking place. The USDX didn't break to new November highs and Friday's rally is in tune with how the U.S. currency performed in case of previous consolidations that we marked in green.

Back and forth movement was common, and sometimes it took form of a day-to-day swings, and sometimes (such as in July and October), it meant two bottoms. There are no indications that would make Friday's upswing look any different than what we saw in October and July and thus it seems that we could easily see yet another downswing (perhaps to the recent lows) before the rally really picks up.

And what would gold be likely to do in such an environment? It would likely rally more visibly than it rallied recently - similarly to how it performed in the final parts of previous USDX consolidations. Despite today's few-dollar pre-market downswing, it seems that the top is not yet in and that gold will move higher shortly.

That's exactly what we saw yesterday and what we are witnessing today. We see yet another downswing (the USD Index is moving toward the recent lows), which suggests that gold is going to move higher in the short term. This confirms our earlier points.

All in all, it seems that as far as December 2019 is concerned, gold price is going to rally initially and then decline, probably much more than it had rallied. Gold might bounce back up before the end of the year, but not before declining first.

The Full View of Gold

Taking a broader point of view, the gold price decline has only begun. Gold failed to break above the late 2011 and mid-2012 lows on a sustainable basis. The small move above these levels was quickly invalidated as gold reversed on huge volume.

In fact, volume-wise, the situation is currently similar to what we saw in 2008 and 2018 before gold's declines. The increase in volume looks encouraging, but it really isn't. And by increase in volume, we mean the relative increase in volume that is above the average growth that can be explained by the increased popularity of the derivatives market.

There are several indicators visible on the above gold price chart - let's check what they are telling us.

First from the top is the RSI indicator - it's currently not flashing any signal, but it shows that the previous rally took gold to the red-hot emotionality levels, as the indicator moved well above its 70 line. Normally, reaching it means that a market is already overbought - gold was more overbought than that. The last time when it was similarly overbought was at the 2011 top.

The second indicator from the top is the Rate of Change indicator. It shows that gold's volatility is declining. That's certainly true - after a volatile rally, gold is taking a breather as investors are still figuring out what really happened. The lower the volatility before the move, the further gold can then move as the volatility again increases. Gold is not yet at its record volatility lows, but getting close to them and fast. It looks like the next big move is getting closer.

The second indicator from the bottom is the Stochastic indicator. It just flashed a buy signal, but the reliability of these signals is debatable, especially given that gold is still relatively close to its medium-term (August) top. Yes, the buy signals from Stochastic confirmed many bottoms. However, it's also true that there were cases when there were false buy signals before major declines.

The problem here is that these false buy signals took place in 2018 and 2008 - the two times that are so similar to the current situation volume-wise. Even though there were many times when the Stochastic indicator worked very well at detecting tops and bottoms, it seems that these two cases and their implications are more important.

Finally, we have the MACD indicator which is after a major sell signal. There were only several cases when we saw such clear sell signals from this indicator: the 2016 top, the 2011 top, the 2008 top, and the 2006 top. They were all followed by declines that were much bigger than what we've seen since August. That's one of the multiple reasons to think that despite the bullish outlook for the very short term, gold is going to - on average - decline in the following months.

Apart from summarizing the outlook of our long position opened right after the November 12 reversal, the full version of this analysis features a helpful overview of the key factors for gold at play - invaluable tools in planning when and where to profitably switch market sides, similarly to our preceding profitable short position. Please note that you can still subscribe to these Alerts at very promotional terms - it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

-

How Far Will Gold Reach Before the Upcoming Reversal?

December 2, 2019, 8:50 AMJust when most traders thought that the previous week is going to end in the red for gold, something exceptional happened. The USD Index reversed after rallying, and gold rallied sharply in response. In the end, gold ended the week in the green by forming a clear weekly reversal.

That was actually the second weekly reversal that we saw recently. Why is this important? Because of what happened shortly after we saw the opposite of it not so long ago.

The Anatomy of Gold Reversals

The August and early-September reversals were followed by sizable short-term declines and the combined reversals themselves have most likely created the 2019 top.

The opposite of what created the major top, should create a major bottom now, right? Not so fast. The double reversal is indeed bullish, but there's one more detail to pay attention to before calling a major bottom in gold. Gold's volume.

The volume that accompanied the August and September reversals was big, and the volume that we saw recently - especially last week - was small. Sure, it was the long Thanksgiving weekend, which means that fewer traders were making transactions, which explains why the volume was low. Still, knowing what's below the low volume's surface doesn't change the fact that low volume means that the candlestick formations (like the weekly reversal) should not be taken at face value. They give some hints, but they are not as reliable as if they took place on huge volume.

The recent situation is more similar to what we saw in early March. There was a clear weekly reversal, but it was accompanied by low volume. And what happened shortly thereafter? Gold rallied, but not significantly so. At least not within the next several weeks. This tells us that the recent reversals - while bullish - are not too bullish and not beyond the next week or a few of them. Perhaps not even beyond the next several days.

What would one use to forecast a top in gold prices within this week?

The Case for the Upcoming Gold Top

Because of the looming triangle-vertex based turning point. The recent turning points for gold, silver and mining stocks worked perfectly by pinpointing the early November top, and they also correctly estimated the most recent reversals - the local bottoms after which gold, silver and miners moved higher.

The early November top is clearest in case of silver (middle of the above chart), while the recent local bottoms are most clearly visible in case of gold miners (lower part of the chart).

The next triangle reversal is due this week, which makes it likely that we'll see some kind of turnaround shortly. The important details about this turnaround is that it's confirmed by not one but two markets - silver and miners, which increases the odds that the reversal will indeed take place. The early-November top, for instance, was indicated by all three parts of the PM market at once.

Let's keep in mind that it's not the only factor pointing to this outcome. The True Seasonality for gold confirms the above.

On average, gold price has been spiking around late November and early December. Please note that while on average gold performs best in late November, the accuracy reading actually rises strongly in the next several days. This means that while the biggest price moves usually happened sooner, some of them arrive a bit late. When gold soared sooner, it didn't decline immediately. The take-away here is that even if the above is not 100% correct, and price spike doesn't happen right away, it means that it's still likely to arrive shortly.

Based on the weekly candlestick reversals in gold, the looming triangle reversals, gold's True Seasonality, and other factors, it seems that gold is going to rally and top shortly.

Apart from outlining the take-profit targets of our long position opened right after the November 12 reversal, the full version of this analysis features a valuable sign from yesterday's action in mining stocks, and the analysis of gold's upcoming very short-term moves and targets. Bottom line, these are invaluable tools in planning when and where to profitably switch market sides - just as our preceding success with the earlier short position. Please note that you can still subscribe to these Alerts at very promotional terms - it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

-

Another Precious Metals' Reversal Coming Right Up!

November 27, 2019, 6:52 AMGold reversed yesterday, and so did the rest of the precious metal sector. Mining stocks and - what's important - silver showed strength relative to gold and rallied even more than gold. Silver's strength is important because it indicates that we are already in the second half of the short-term upswing in the precious metals market. If there only was a tool that would provide us with a more precise time prediction... Oh wait, there is one. And it just worked perfectly yesterday.

Precious Metals' Upcoming Reversal

The technique is called the triangle-vertex-based reversal, but let's just call it triangle reversals. When the rising support line crosses the declining resistance line, we have a vertex of a triangle. This vertex marks a moment when we are likely to see some kind of reversal. Sometimes it's relatively clear in advance what sort of reversal we are likely to see, and at times it becomes clear only right before the reversal.

It wasn't 100% clear recently, but after prices declined on Monday, we wrote that the turnaround is very likely. It was confirmed by the pre-market price action as well. However, what happened during the session made it even more obvious that we saw the start of yet another quick upswing. What's not to like about such a bullish set of circumstances?

What we saw yesterday was not the only triangle reversal on the horizon. In fact, there's one today and one early next week. Since this is the Thanksgiving weekend, the odds are that the particularly significant market action will be pushed off until the next week. But, once we're there, things could get very hot very soon.

The True Seasonality of gold confirms the above.

On average, gold price has been spiking around late November and early December. November 26 is marked right on the gold chart. That's the last pause before the final spike high in gold that is then followed by a decline to mid-December. This seasonality perfectly confirms what we can see based on the triangle reversals and what we can infer from silver's relative strength.

Please note that while on average gold performs best in late November, the accuracy reading actually rises strongly in the next several days. This means that while the biggest price moves usually happened sooner, some of them were a bit late. In case of the times when gold soared sooner, it didn't decline immediately. The take-away here is that even if the above forecast for gold is not 100% correct, and price spike doesn't happen right away, it means that it's still likely to arrive shortly.

Based on the triangle reversals, gold's True Seasonality, and other factors, the following week is likely to include an important top in gold, silver, and mining stocks.

Apart from outlining the take-profit targets of our long position opened right after the November 12 reversal, the full version of this analysis features a helpful hint from yesterday's action in mining stocks, and the analysis of both forthcoming precious metals' triangle turning points, and silver Q4 2019 seasonality. Bottom line, these are invaluable tools in planning when and where to profitably switch market sides - just as our preceding success with the earlier short position. Please note that you can still subscribe to these Alerts at very promotional terms - it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

-

Gold's Short-Term Upswing Is Alive and Well

November 26, 2019, 7:34 AMDoes gold seem to have declined recently? That's true - it seems to be this way. But that's not the truth. At the moment of writing these words, gold is trading higher than it closed yesterday, higher than it had closed on Friday, and even higher than it had closed on Thursday. The intraday highs and intraday lows were both lower on each of the above-mentioned days, but after the dust settled, it turns out that nothing major really happened. Or should we say, nothing particularly bearish happened from the short-term point of view. Let's take a closer look at what gold is doing right now.

Gold's Very Short-Term

Gold moved back up after touching its 61.8% Fibonacci retracement based on the mid-November upswing. This is a very short-term pullback within a short-term rally, nothing else.

The 61.8% retracement is the most classic of them all, as it's directly based on the Phi number. Long story short, this number is ubiquitous in many places in nature, and since people are part thereof and they are active in markets, perhaps it would be present in the market movement. It turns out that it is indeed present, and it quite often works remarkably well as a tool to detect support or resistance levels. At times, it can be used to make forecasts by multiplying one of the previous moves by 1.618. And, well, it tends to work quite often, despite there being theoretically no specific reason (other than mentioned above) why 1.618 should work, and not 1.792 or 1.123 or any other random number above 1.0.

This time, this level suggested a rebound and - voila - that's exactly what we saw in today's pre-market trading. Of course, the session is far from being over, and it could all change before the closing bell, but the odds are that it won't.

The below chart shows three more things.

Precious Metals Short-Term

One thing is that the shape of the recent price movement in gold doesn't resemble what we saw at the previous local tops. Conversely, it resembles the consolidations that took place before the final - and biggest - part of the short-term upswings.

Second thing is that the previous tops were accompanied by silver's strong outperformance and we definitely don't see this kind of strength right now.

Third thing is that yesterday was the first of the triangle-vertex-based reversals, which means that given yesterday's daily decline, the precious metals sector is now likely to move higher. And that's exactly what's taking place right now.

Based on the following three reversals, it seems that we'll see the next local top this or the next week.

But what about the short-term, what else can we say about our long position opened right after the November 12 reversal? Apart from outlining the take-profit targets, the full version of this analysis dives into the short-term indication from the gold miners. Similarly, the long-term interest rates are sending a valuable signal of its own to act upon. Bottom line, these are invaluable tools in planning when and where to profitably switch market sides - just as our preceding success with the earlier short position. Please note that you can still subscribe to these Alerts at very promotional terms - it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

-

The Prospects of Gold's Next Upswing

November 25, 2019, 8:04 AMThe USD Index rallied on Friday, and gold responded with an intraday decline - that's normal. What's not necessarily normal is the size of the daily change in gold compared to the size of USD's rally.

USD Index Bounces Higher

Namely, gold futures ended Friday's session exactly where they had closed on Thursday. There was no daily change in gold, even though it - theoretically - should have declined given USD's upswing. What does it mean? Gold's resilience means that gold has probably not finished its short-term upswing yet.

The general rule for any market is that if it doesn't move in the way it "should" move given what's going on in the world, it means that - for whatever reason - it's not the direction in which the market is going to move next. This trading technique doesn't specify what is the reason for a given market's strength. The point is to detect and acknowledge this strength, and then to combine this information with other trading signals.

One of the biggest benefits of this approach is its widespread application. Knowing what is likely to move a given market and what kind of reaction would be normal, means that it can be applied - regardless of what the market is. It also applies to various terms, if one takes into consideration the likely time in which the effect of a given development "should" be in place. For instance, in case of long-term investment, one should pay attention to how the market reacts to the factors that matter in this time horizon, for instance demographics and shifts in supply & demand picture. In case of day trading, it's a matter of checking if a given individual piece of news (or price action from a key influencing market) causes a price move that seems natural. The bigger the divergence from what would be viewed as normal, the stronger the bullish or bearish signal becomes.

Moving back to the USD-gold picture, we previously wrote that the USD Index is quite likely to consolidate before rallying strongly and it seems that this consolidation is still taking place. The USDX didn't break to new November highs and Friday's rally is in tune with how the U.S. currency performed in case of previous consolidations that we marked in green.

Back and forth movement was common, and sometimes it took form of a day-to-day swings, and sometimes (such as in July and October), it meant two bottoms. There are no indications that would make Friday's upswing look any different than what we saw in October and July and thus it seems that we could easily see yet another downswing (perhaps to the recent lows) before the rally really picks up.

And what would gold be likely to do in such an environment? It would likely rally more visibly than it rallied recently - similarly to how it performed in the final parts of previous USDX consolidations. Despite today's few-dollar pre-market downswing, it seems that the top is not yet in and that gold will move higher shortly.

But what about the short-term, what else can we say about our long position opened right after the November 12 reversal? Apart from outlining the take-profit targets, the full version of this analysis dives into the lessons from the short-term precious metals' moves. It's an invaluable tool in planning when and where to profitably switch market sides - similar to what we have successfully done with the preceding short position. Please note that you can still subscribe to these Alerts at very promotional terms - it takes just $9 to read the details right away, and then receive follow-ups for the next three weeks. Profit along with us.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM