-

Has the Stock Bulls' Strength Returned?

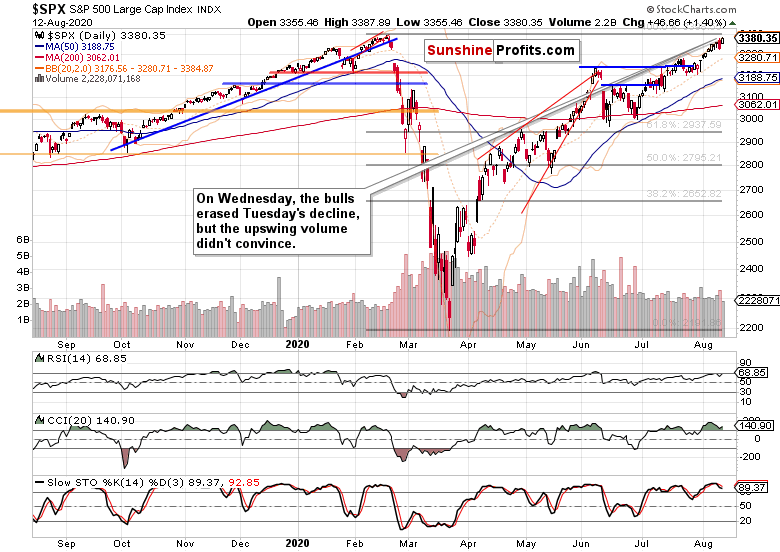

August 13, 2020, 9:10 AMStocks have yet again approached the all-time highs, but on volume that wasn't this low in months – that's a red flag. The stimulus talks haven't really progressed, but markets there is no jittery sentiment as the put/call ratio stubbornly clinging to its lows show.

But let's look under the hood of the stock advance as that fittingly illustrates all the above.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The bulls countered, but the volume leaves a lot to be desired. This is making the renewed advance to the Feb highs vulnerable in the short-term as the signs are far from aligned, to put it mildly.

Enter the credit markets.

The Credit Markets’ Point of View

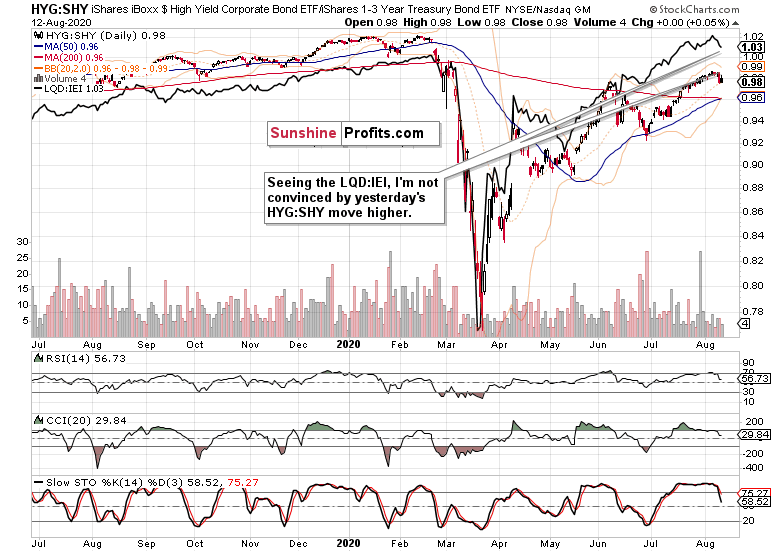

High yield corporate bonds (HYG ETF) haven't exactly recovered yesterday, which means they aren't pointing in the same short-term direction as stocks.

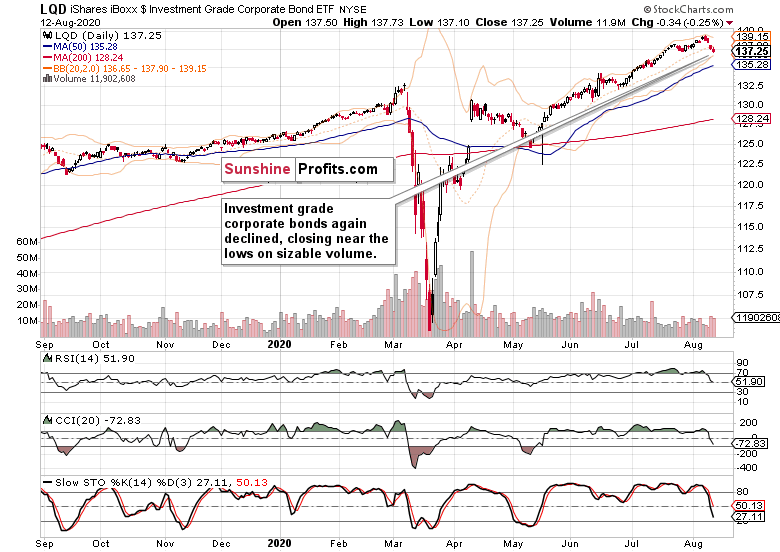

Neither are investment grade corporate bonds (LQD ETF) – they have been declining for four days in a row, and a bottom can't be called just yet.

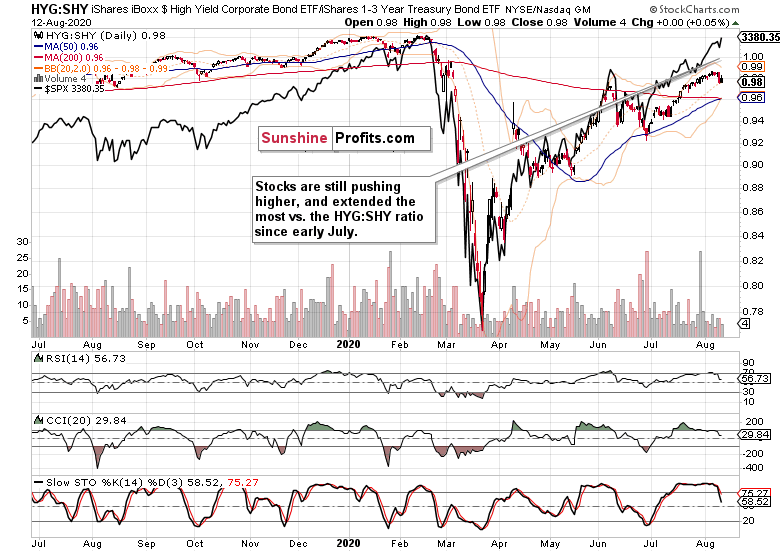

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – are currently pointing down, and one daily HYG:SHY turnaround doesn't change that.

It's concerning to see high quality debt instruments sell off, and that includes longer-dated Treasuries (TLT and TLH ETFs) too as they both moved below their Tuesday's intraday lows. It's still too early to call the bid for these instruments as returning.

The overextension of the S&P 500 (black line) relative to the HYG:SHY ratio is even more pronounced now. And also more concerning given that LQD:IEI is momentarily weaker than HYG:SHY. With its advance, the S&P 500 is cutting into an increasingly thinning air these days.

Summary

Summing up, yesterday's S&P 500 upswing bucked the warning signs of many a non-confirmation. While the magnetism of the all-time Feb highs is at play, the credit markets have been diverging for quite a few days already. Neither the smallcaps or emerging markets have bested their recent highs. Yesterday's increase in the S&P 500 advance-decline line didn't smash daily records either, which just adds to the long list of non-confirmations.

Thankfully for the bulls though, technology isn't leading to the downside, and neither are semiconductors. Still, the above makes for a long list of worries for the stock bull to climb – but that's what bull markets do.

As traders, carefully considering each trade's risk-reward perspective, is the best course of action given the presented circumstances. Some would even say – when in doubt, stay out.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM