-

S&P 500 Plunged - What Has Changed and What Has Not

August 12, 2020, 9:03 AMFrom within spitting distance of the all-time highs, stocks forcefully retreated, validating my call of a bear raid being likely to arrive soon. Just as I wrote, the bulls better tread carefully entering this week's trading - after being soundly defeated on Monday, the bears came back stronger yesterday.

Still, I closed the Thursday-opened long position for a 52-point gain, and didn't give up a single point back with another quick long (opened and exited yesterday). In similarly dicey situations that count on a reversal to bring in more profits, I like to have a reasonably tight stop-loss - not to mention adjusting it throughout the day so as to improve the open trade's risk-reward ratio.

That's what my intraday Stock Trading Alerts are all about, because an oftentimes overlooked aspect of all the profits at the beautifully rising equity curve, is how much risk the trader actually undergoes so as to reach those gains. Needless to say, I like to play it as safe as possible.

With yesterday's steep move lower being a wake-up call for the bulls, let's update the outlook wherever relevant.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

So, the downswing materialized yesterday, and the bears finally put their money where their mouth was. The S&P 500 didn't make it to the Feb all-time highs, erasing previous two sessions' gains.

The fiercer battles I called for yesterday, are in. Does it mean we've seen a reversal?

Let's turn for a fitting answer to my Friday's Stock Trading Alert:

(...) it's imperative to assess the downswing's internals, whether it is or isn't turning into something more serious and not merely temporary.

Having said that, let's turn to the credit markets.

The Credit Markets' Point of View

What a slide, closing at the intraday lows. The rising volume shows that the bears have been serious. Put its absolute level into context though, and two things become apparent. First, that we haven't likely seen a true reversal, and then that a return to previous highs won't be a one-day event.

Thus, it confirms the view that we've seen a setback, and the key question is how long will it take to repair the short-term damage - this concerns both the HYG ETF and S&P 500.

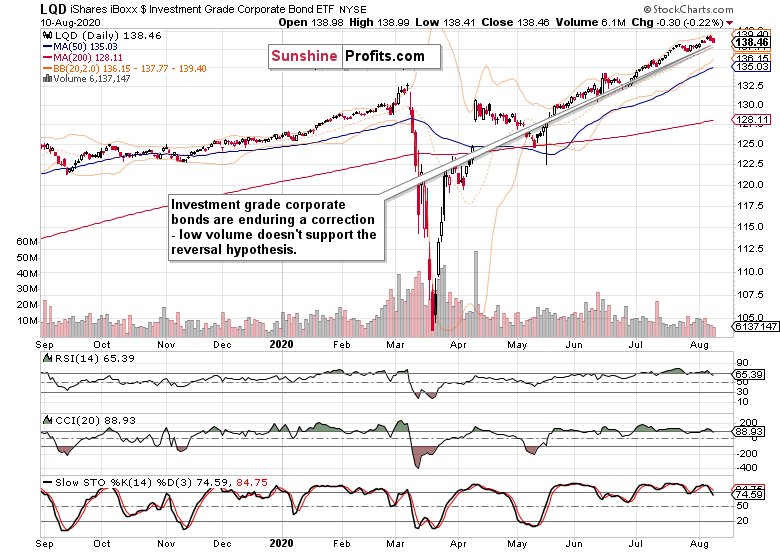

Investment grade corporate bonds (LQD ETF) seconded that decline, and on markedly rising volume. When quality bonds are losing breath, and faster than their riskier counterparts, it's naturally concerning. Well worth keeping a close eye on.

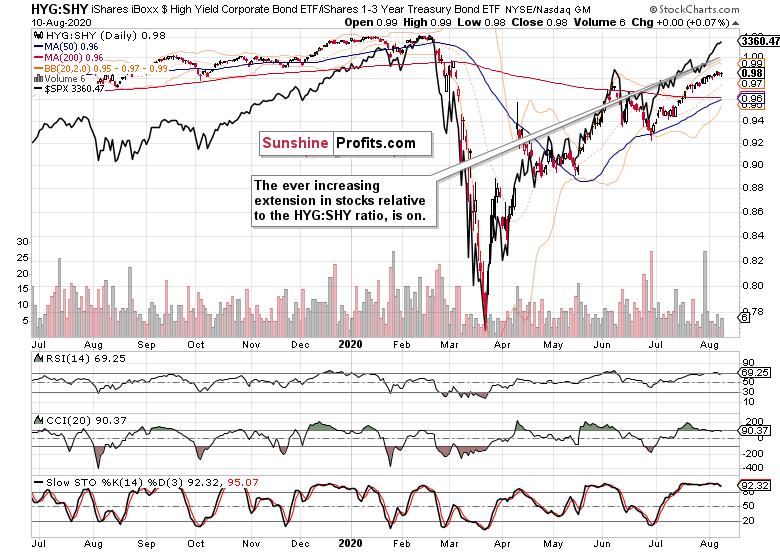

Both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - are currently pointing down, and the turnaround has been steep in both cases. This spells caution - how close is their bottom?

Encouragingly, longer-dated Treasuries caught a bid yesterday. They refused to extend losses during the U.S. session, which could indicate that the demand for quality bonds isn't all that far from returning.

Considering how much has the S&P 500 (black line) been extended before yesterday's decline, stocks have kept up really well relative to the HYG:SHY ratio. The jury is out on whether stocks would catch up with another downswing, or whether corporate bonds would rebound, and the best course of action is watch carefully for telling signs either way, and then to take appropriate action (from the risk-reward ratio point of view).

And what about those yesterday-mentioned three good reasons why the stock rally has a high likelihood to go on - are they still valid today?

Smallcaps, Emerging Markets and Other Clues

The Russell 2000 (IWM ETF) also reversed to the downside, but actually gave up less ground than the 500-strong index. That's a bullish sign.

Emerging markets (EEM ETF) actually moved higher yesterday, ignoring the dollar reversing intraday losses to close practically unchanged. These stocks are also sending a rather bullish signal.

The daily market breadth chart doesn't bring much new to the table - the decline has been relatively orderly, and the advance-decline line thus lacks fireproof implications.

The same can't be said about copper though. The red metal is enjoying a good week, having retraced a sizable part of Friday's heavy selling. While that's constructive, the bulls can't yet sound the all clear, and the coming sessions would put to test its dead cat bounce hypothesis.

Technology (XLK ETF) declined, but not that profoundly so as to say that it's now leading the S&P 500 lower. Yes, it's ahead of the index with its yesterday's downswing, but one swallow doesn't make a spring, which is why I am not ascribing a bearish signal to this sector just yet.

Summary

Summing up, yesterday's S&P 500 downswing took some cream off the bullish spirits, and the very short-term signals are inconclusive. The deterioration in credit markets stands against solid performance in smallcaps, emerging markets, copper and also the overnight recovery in gold. Yes, it's paying off to be watching gold as closely as I do, because that's another piece to the stock market puzzle. Should the yellow metal's rebound from the overnight $1880 mark extend beyond today's close, that would be an indication we aren't facing an immediate liquidity crunch today. And its absence would take some pressure off the stock prices. In the short-run though, stocks aren't out of the woods just yet totally, but I expect them to power higher and overcome the Feb highs before 2020 is over.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

S&P 500 Bulls Got Tested - All-Time Highs Next?

August 11, 2020, 9:26 AMStocks are getting so much closer to the all-time highs - day in and day out. The bear raid I anticipated, has been soundly defeated yesterday, stocks are extending gains and adding to my open profits Sure, greed is elevated, but not absolutely extreme. There aren't too many traders willing to make the contrarian bet and buy puts - the put/call ratio keeps hanging at the early June lows.

Yes, consider the stimulus conundrum kind of solved for now, and with the Fed support in the wings, the real economy realities can wait and be overshadowed by the China rebound stories and positive German sentiment readings. With the U.S. markets taking a cue and ready to bridge several quarters ahead, the path of least resistance in the S&P 500 is still higher as it's way too early for the elections uncertainty to hit like a sledgehammer.

The rising trend in Treasuries has been punctured by a two-day breather now, helping to fuel the bullish spirits in stocks - the conventional wisdom goes that when yields rise, the economic recovery has legs. With the dollar rally running into headwinds yet again, the risk-on trades gets another ally.

Last but not least, the correction in gold I called for on Friday to happen, takes away from the momentary inflation fears. And inflation rearing its ugly head, that would have the power to throw the stock bull out of whack. We aren't there yet.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Stock prices are steadily climbing higher, and yesterday's rising volume shows that the bears didn't attack in a really convincing way. Not too much firepower was needed to overcome them. Undeterred, stocks keep reaching higher.

But the Feb all-time highs are drawing nearer, and so does the upper border of the rising black trend channel on the weekly chart I featured yesterday. It's likely that these levels would result in fiercer battles fought.

As yesterday's downswing didn't turn into a correction, do the credit markets indicate smooth sailing ahead now? Not yet, not fully - that's my take.

The Credit Markets' Point of View

The sideways trend of recent days in high yield corporate bonds (HYG ETF) goes on, and doesn't really attract much selling pressure. And with ongoing fiscal and monetary support, how would it all of a sudden?

But investment grade corporate bonds (LQD ETF) are declining second day in a row. That makes it a correction, not a reversal though - let's not jump to conclusions, as a higher high is still likely to be made.

The overlaid S&P 500 closing prices (black line) keep trading at very extended levels relative to the HYG:SHY ratio. Again, the same question as yesterday pops - has the index reached a tipping point where the bears would step in?

That could still happen this week (especially if corporate bonds start to move down from their high plateaus), and the bulls better have gains locked in preparation for such a possibility however remote that might seem now.

Three good reasons why the stock rally has a high likelihood to go on, and not just today, follow.

Smallcaps, Emerging Markets and Market Breadth

The Russell 2000 (IWM ETF) finally overcame its early June highs visibly. Its momentum is quickening vs. the 500-strong index momentum. No signs of distribution in smallcaps favors the stock upswing to go on.

The Dow Jones Industrial Average ($INDU) had a strong day yesterday, and Nasdaq ($COMPQ) erased much of its intraday decline. Yes, tech (XLK ETF) is moving back to the pool position in the sectoral overview of S&P 500 advance drivers.

With stalling dollar, the emerging markets had it easier to find a floor. And their strong performance since early July didn't really suffer. The bulls still enjoy the benefit of the doubt.

The advance-decline line is the third reason in favor of higher stock prices - its yesterday's upswing put to rest the scenario of a very short-term bearish divergence in the making. The short-term view of S&P 500 market breadth remains more healthy than not overall.

Summary

Summing up, the S&P 500 upswing goes on, and yesterday's attempt to move lower proved very temporary. The sentiment is risk-on again even as stock market metrics relative to the credit ones keep being very extended. The Feb all-time highs keep acting as a magnet, but better be ready for the possibility of a move lower in stocks arriving with little fanfare.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM