-

Why I See the Current Weakness in S&P 500 As Deceptive

July 16, 2020, 9:28 AMAfter Tuesday's bullish reversal, S&P 500 intraday consolidation came. How to read the doji just in? In today's analysis, I'll lay out the case for why I consider it to be healthy base-building - a springboard for stocks to take on the early June highs.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

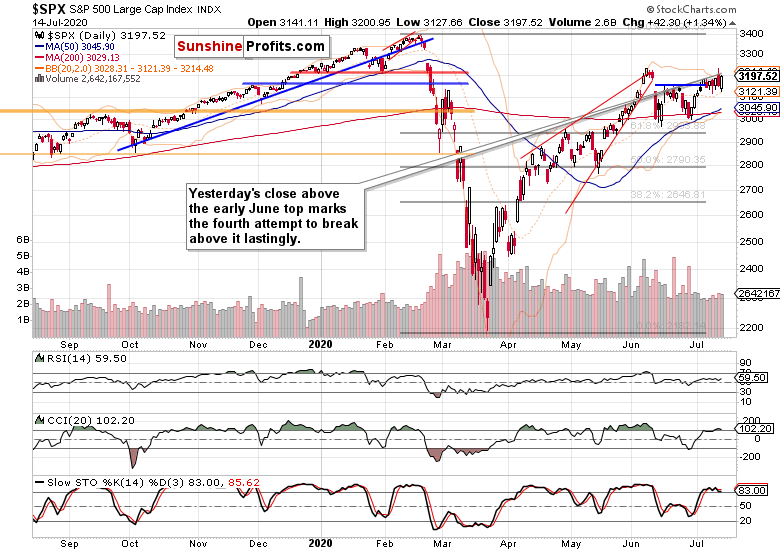

S&P 500 opened with a bullish gap, and defended it to the close. The volume has picked up again, and the pressure to go higher is building under the surface in my opinion. I says so because should the bears be willing to sell heavily in the 3220-3230 zone (potential double top area), they would have done so - the fact they haven't been willing to push prices materially lower, is telling by itself.

Yes, the volume behind the upswing off the late June lows hasn't been outstanding, but only prices falling sharply and preferably also on rising volume, would make it a double top. Prices merely approaching previous local top don't make it so, and could trick the bulls into taking profits off the table prematurely. The battle to overcome them might not turn out to be all that fierce in the end.

Yes, we have short-term indecision in the S&P 500, and the early June highs are keeping the gains in check so far. But which way are the scales really leaning?

The Credit Markets' Point of View

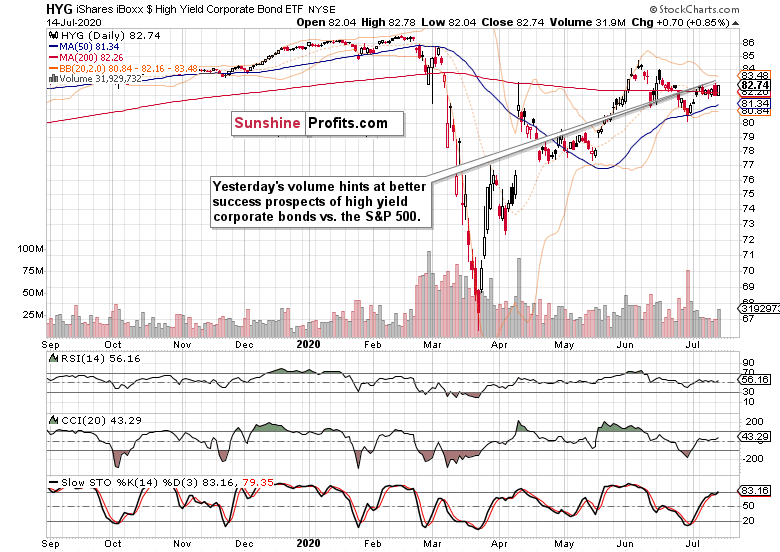

High yield corporate bonds (HYG ETF) also gapped higher yesterday. Sticking to their opening gains, they've left the trading range of recent sessions. While the volume hasn't been outstanding, it still hints that the path of least resistance is higher.

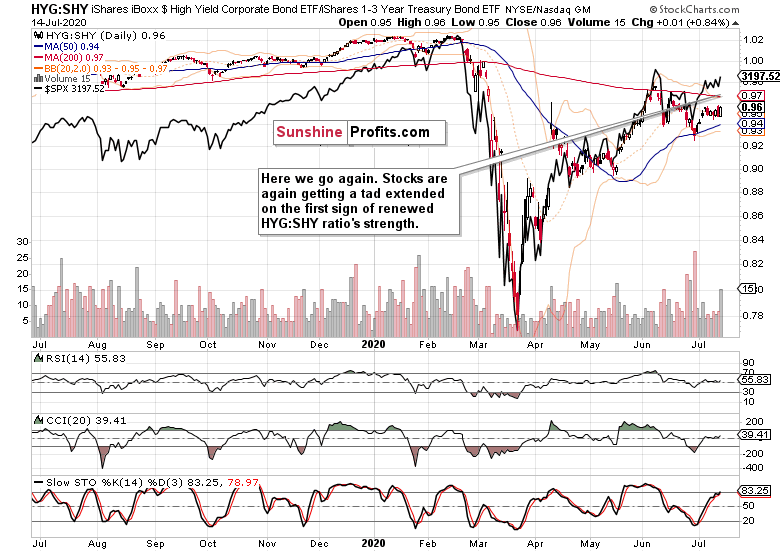

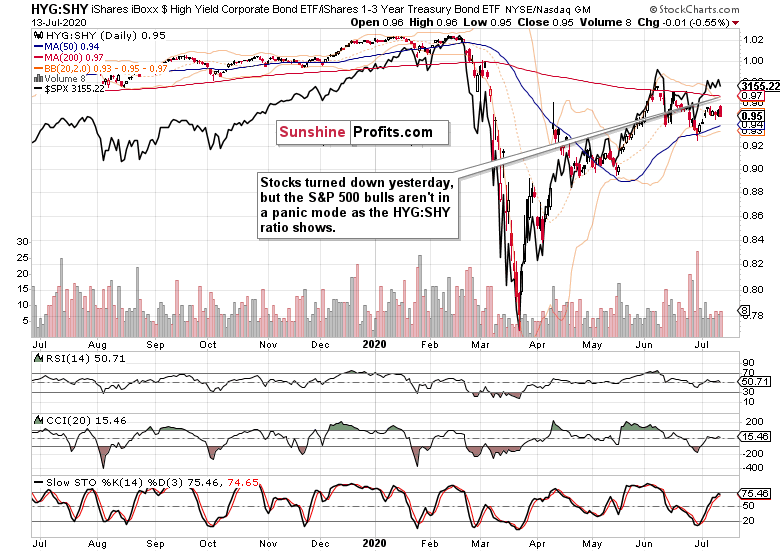

Both the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) are moving in unison. The dynamic is conducive for further stock market gains as the early-May example of LQD:IEI leading HYG:SHY higher shows.

Looking under the hood of the S&P 500 thus reveals that stocks aren't getting vulnerable and extended in any dramatic way. Their upswing continuation is amply supported by the credit markets.

Volatility, Smallcaps and Sectoral Analysis Weigh In

The $VIX has been confined to a relatively tight range throughout July, yet stocks kept their upside momentum. And I expect the upcoming volatility readings not to throw a spanner into the stocks' works.

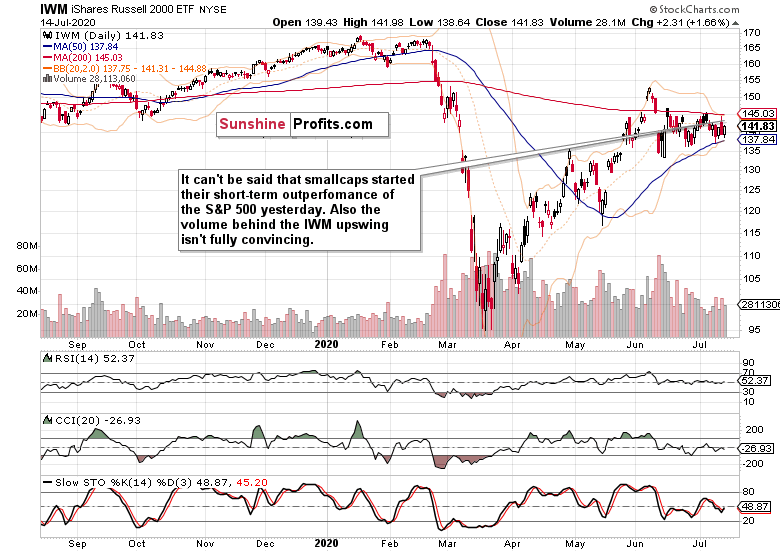

Yesterday's move in the Russell 2000 (IWM ETF) is a groundbreaking development. After weeks of lagging behind within the lower bounds of the smallcaps' relative performance, the IWM ETF finally sprang higher.

The IWM chart shows the strength behind yesterday's move precisely. Sizable opening gap, extension of gains throughout the session, and finishing near the intraday highs. Coupled with strongly rising volume, that's a bullish combination - especially that this is another attempt to overcome the 200-day moving average.

The tech (XLK ETF) bulls are ready to buy every dip, aren't they? While its heavyweight stocks are bidding their time, the semiconductors (XSD ETF) keep their relative strength, and have actually closed at new 2020 highs. Once the Amazons and Microsofts of this world decide that their consolidation is over and join in, the S&P 500 stock bulls would get a mighty ally.

So far, healthcare (XLV ETF) is doing the heavy lifting, joined by financials (XLF ETF). Yes, cyclicals are firing higher as the materials (XLB ETF) or consumer discretionaries (XLY ETF) show. Both energy (XLE ETF) and industrials (XLI ETF) ticked higher yesterday, too.

Summary

Summing up, given that tech keeps largely dragging its feet in the short run, the S&P 500 rendezvous with the early June highs just underscores the cyclicals taking the baton. Talking other short-term signs of life, the Russell 2000 has unequivocally spoken yesterday. Credit market signals, emerging markets outperformance and very long-term Treasuries pausing also raise the odds for the stock upswing to continue once tech is done with its consolidation. And chances are it would soon be, because semiconductors are quietly making new highs.

Forget U.S. - China tensions, the Fed's rare weeks of cautious tightening, or new lockdown fears. Banking Q2 earnings have been largely met with market applause, and there seems to be a never ending stream of positive vaccine news that boosts the bullish spirits. The yesterday-mentioned strong stomach to withstand sudden downturns in market perceptions of risk, might not be called upon all that often, after all.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Another Day, Another S&P 500 Reversal. Let's Cheer It!

July 15, 2020, 9:28 AMAfter the sharp downside reversal late Monday, stocks refused downswing continuation yesterday. Slowly initially, then ever more forcefully into the closing bell. That seems to be a perfect definition of a reversal, right?

In today's article, I'll answer how much we can applaud it, and assess the stock upswing's prospects along the way.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

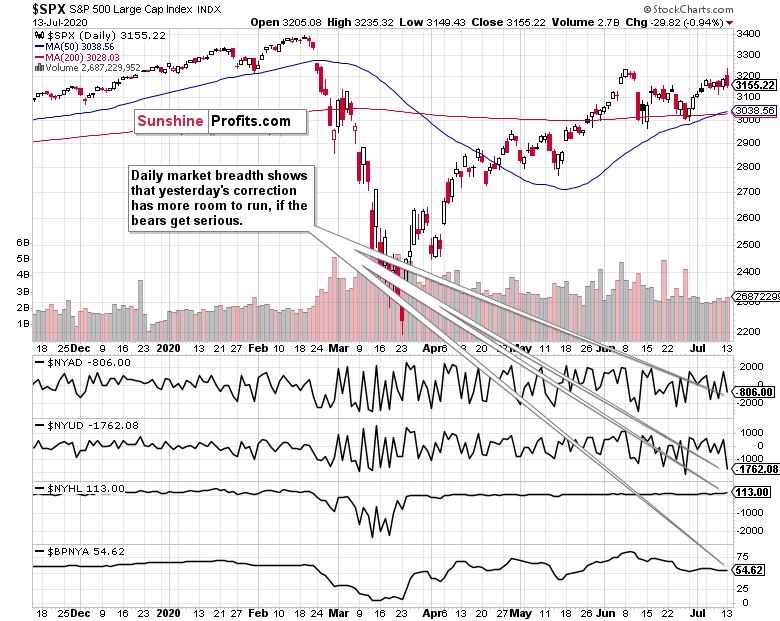

Stocks clearly reversed and closed again above their mid-June highs. The move happened on solid volume, which works to raise its prospects of success. It's certainly positive for the bulls to see volume on a rising path since the start of July.

Let's check next whether the credit markets support the turnaround.

The Credit Markets' Point of View

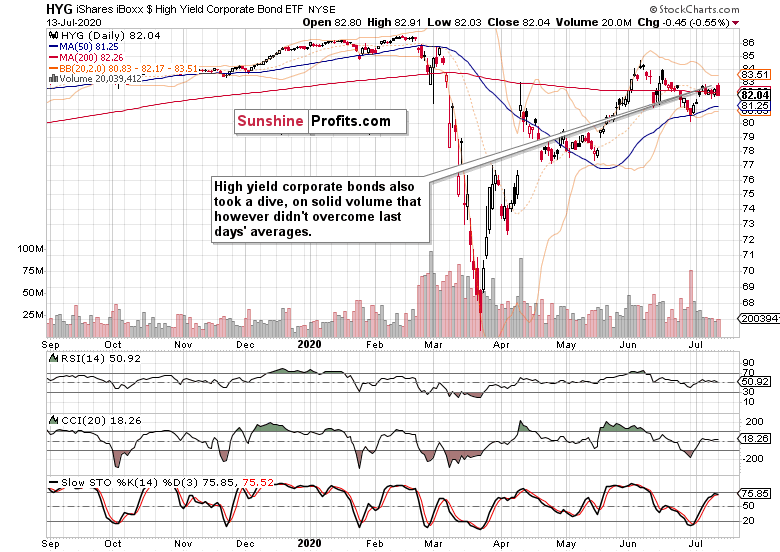

High yield corporate bonds (HYG ETF) also rose strongly, and on a high volume. That's encouraging, and raises the odds of the move's extension. Having that in mind, the recent consolidation might be getting close to over, and unless today's trading finishes in the red on even heavier volume, the weights remain tilted to the bullish side here.

S&P 500 closing prices (black line) overlaid on the high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) chart shows that stocks got a little extended relative to this metric. Not outrageously so, but still.

Considering this signal against the momentum of preceding day though, I would put more weight on the momentum. In other words, unless the ratio tanks, stocks aren't likely to suffer a material hiccup.

Yes, that means that they're ignoring Monday's California lockdown (affecting over 80% of the state's population, altogether 30 counties). This makes for an interesting dynamic though. Given that Gov. Newsom was the first to use this indiscriminate measure, and stocks together with bonds keep ignoring this development, the markets are in effect betting on this being "a red herring on par with early April Fauci raising the specter of not emerging from lockdowns until a vaccine arrives".

In other words, the markets are saying that Democrats won't have the guts to become the Party of Lockdowns, because that might very well backfire come November. I am not so sure markets are being completely right on this though. Yes, they may come to a certain degree regardless of Trump and his administration not being in the least appetite for them. Ultimately though, it's the governors and mayors who also have their say. Let's just hope their decisions would be based on rigorous data and not on the likes of 100% positive test rates achieved by the Florida Department of Health.

S&P 500 Market Breadth, Smallcaps and Emerging Markets

The advance-decline line flipped again to the bullish territory, but could have been arguably at a higher level given where the S&P 500 closed. No reason to declare its current position as a bearish divergence though just yet. After getting today's closing prices, we'll be smarter but I think that the advance-decline line would add to its gains later today.

The Russell 2000 (IWM ETF) is coming back to life, but things aren't all peachy here. The volume for an upside reversal could be easily bigger to make it more trustworthy, but smallcaps can move with a great momentum in a short period of time too.

Yes, pressure for a sizable move is building, but its yesterday's chart is rather neutral in the IWM ETF implications for the S&P 500 in the very short run.

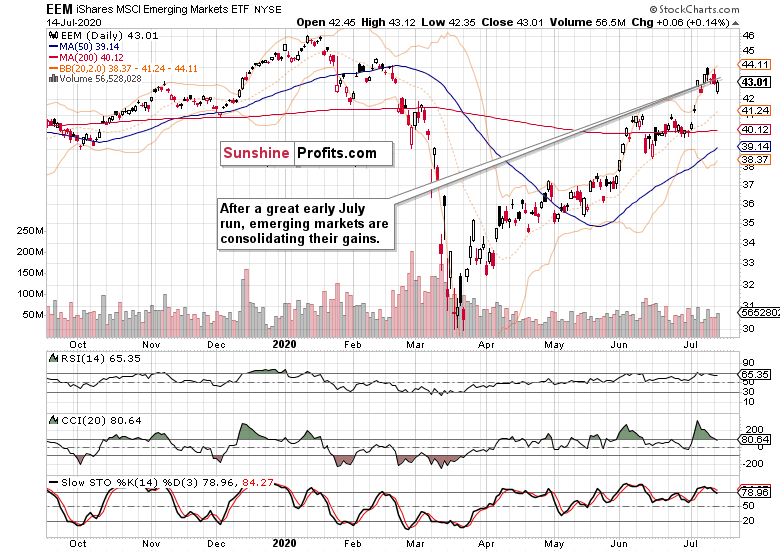

Emerging markets (EEM ETF), that's another story. They're starting to outperform the U.S. counterparts, which is encouraging for the stock bulls. Let's see the EEM performance in detail next.

The caption says it all. There's no reason to say that we're looking at an island top currently. It's in the making, thus incomplete, thus lacking implications. And given the story the volume tells, I think that it's not trustworthy. The bullish-to-sideways slant is the prevailing outlook here.

S&P 500 Sectors in Focus

Some froth has been taken off with the heavyweights' plunge. Some. Tech (XLK ETF) is still trading inside its steeply rising channel, but it must be noted that in June and July, the swings'magnitude has risen, and the momentum of increases has slowed down.

While that doesn't mean that tech is about to move away from its higher highs and higher lows trajectory, it might imply that some degree of consolidation is in its future.

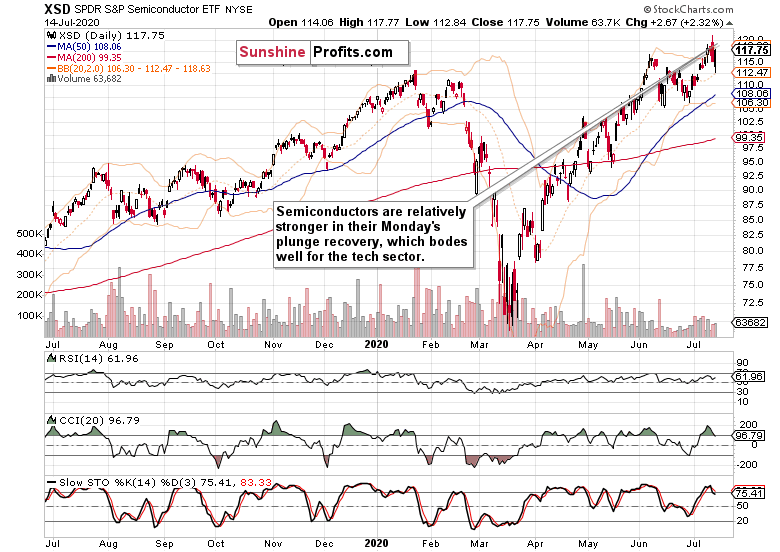

Yesterday, it has reversed higher on significant volume instead of keeping the index down for a day longer. Do semiconductors (XSD ETF) point to the likelihood of a more pronounced reversal in tech prices soon?

The segment has erased more of its losses than the full tech sector. This fact gently tips the scales in favor of both the XLK ETF and S&P 500 upswing to reassert themselves.

With financials (XLF ETF) coming back to life (they really have quite some catching up to do) and healthcare (XLV ETF) rising on finely dosed vaccine hype news, this bodes well for cyclicals in general, and naturally for the full index overall. Additionally, such news help to send the USDX into a tailspin, as the risk appetite increases.

Summary

Summing up, with Monday's lockdown fears on the back burner now, stocks have reversed much of this week's retreat. Credit markets also turned, and quite a few more factors than not appear to be aligned in the stock bulls' favor. Tech heavyweights' performance later today is arguably the key short-term watchout. Just as much as a quick reemergence of another lockdown news, or the ongoing Fed tightening (when would something break?). Barring these, the factors are leaning bullish, and an open position becomes a question of risk-reward ratio preferences and a strong stomach to withstand sudden downturns in market perceptions of risk.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

The Quick Souring of the S&P 500 Mood

July 14, 2020, 9:42 AMWe got that extension of Friday's rally on Monday, as I called for. Vaccine hype news. Good for bulls with tight exit orders - I managed to take a 55-points profit off the table. But big tech (think Microsoft, Amazon) suffered with talk of its bubble rising, U.S. - China tensions increased, and California sweepingly rolled back its reopening.

Spooky stuff for stocks, and they tanked. The brightening outlook I discussed after Friday's session, didn't last all that long. But is the selling over now, or we better brace for some more?

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

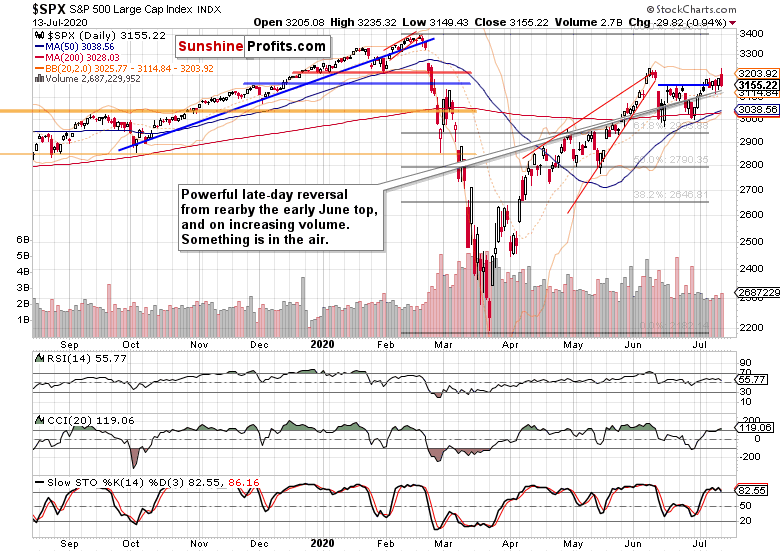

Stocks couldn't overcome their early June intraday highs just below 3230, and reversed lower on slightly increasing volume. Closing at the blue line connecting the mid-June tops, I see that the similarity to the S&P 500 taking on the late April and early May highs might be disappearning - unless the bulls pull out a rabbit out of their hats soon.

How likely is that? Vaccine news have lifted cyclicals - financials (XLF ETF) liked that. Then, Gov. Newsom rolled back California's reopening. Cold water that brought about a black daily candle in financials. It doesn't matter that they closed higher than they opened. It's the veracity of the reversal that should spook the bulls.

I would say that it's the fear of lockdowns and not surging corona cases per se, that it the culprit here. And it could make for a quick souring of market sentiment. Not that the bulls would be in a majority now, but there were some signs of greed creeping in already. Not excessive, but still.

Big banks are starting to report today, and the JP Morgan and Well Fargo Q2 results are in. Banks better have beefed up loan reserve provisions, because if California is a preview of things to come, and as reliable one as back in March when it was the first state to impose lockdowns... then things aren't going to look great for commercial real estate among many others.

How did yesterday's selloff reflect upon the credit markets?

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) also plunged, and ended in a similarly dicey position as the S&P 500. A ray of hope for stock bulls would be volume that didn't stand out. But in my opinion, it's premature to ascribe it a bullish interpretation, or to treat it as merely a consolidation just yet.

Overlaying the high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) with the S&P 500 closing prices (black line) shows that stocks bulls aren't panicking, as in really panicking. Based on recent days' perspective, yesterday's stock downswing appears as just a part of choppy trading ruling the markets lately.

While that's a possible interpretation, I wouldn't rule out some knee-jerk moves in the short run. I think the potential for more selling is definitely there, and not only because of the fundamental dynamics I described a while ago.

Enter S&P 500 market breadth.

Arguably, the advance-decline line could go still lower before its rebound happens. The bears have probably set their sights to the 200-day moving average support that's around 3030. That would make for quite a turn in sentiment - but if you look at the daily S&P 500 chart, not that much would be happening purely technically speaking unless we break below the mentioned 200-day moving average, or the 61.8% Fibonacci retracement at around 2940.

Remember that only one bull market overcoming its 61.8% Fibonacci retracement eventually plunged below its starting point - the post WWII one. I don't think this bull run will suffer the same fate.

For now, caution is the best course of action as the very short-term outlook is rather unclear - yet with a distinctly bearish flavor.

Summary

Summing up, yesterday's late-day reversal has the potential to stick with us for longer due to the lockdown fear dynamics. Then, the tech ran into a brick wall yesterday. The Russell 2000 reversed on a strong volume, hinting at distribution. Credit markets show that panic hasn't yet set in for stock bulls, which is one of the reasons why this selling wave might very well not be over yet.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM