-

FOMC Minutes Disappoint Gold Bulls

February 22, 2021, 11:01 AMThe recent FOMC minutes are hawkish and negative for the price of gold, but the Fed will remain generally dovish for some time.

Last week, the Federal Open Market Committee (FOMC) published minutes from its last meeting in January. They reveal that Fed officials became more optimistic about the economy than they were in December. The main reasons behind the more upbeat economic projection were the progress in vaccinations, the government’s stimulus provided by the Consolidated Appropriations Act 2021, and the expectations of an additional sizable tranche of fiscal support in the pipeline:

Most participants expected that the stimulus provided by the passage of the CAA in December, the likelihood of additional fiscal support, and anticipated continued progress in vaccinations would lead to a sizable boost in economic activity.

The Committee members were so convinced that the longer-run prospects for the economy had improved, that they decided to skip reference to the risks to the outlook in their official communications:

in light of the expected progress on vaccinations and the change in the outlook for fiscal policy, the medium-term prospects for the economy had improved enough that members decided that the reference in previous post-meeting statements to risks to the economic outlook over the medium term was no longer warranted.

Hence, the recent minutes are generally hawkish and bad for gold. They show that the FOMC participants turned out to be more optimistic about the U.S. economy over the medium-term, as they started to expect “strong growth in employment, driven by continued progress on vaccinations and an associated rebound of economic activity and of consumer and business confidence, as well as accommodative fiscal and monetary policy.”

And, although they acknowledged that inflation may rise somewhat in 2021, the Fed officials generally were not concerned about strong upward pressure, with “most” participants still believing that inflation risks were weighted to the downside rather to the upside. In other words, they expect more growth than inflation.

Implications for Gold

The Fed officials that have become more optimistic about the economy are proving negative for gold prices. Gold shines most when the Fed is pessimistic about GDP growth and the labor market, as these two factors are more prone to loosen the Fed’s monetary policy. In other words, gold prices need more inflation than economic growth in order to grow. Alternatively, gold needs the Fed to do something and expand its monetary accommodation.

Indeed, the last week hasn’t been good for the price of the yellow metal. As the chart below shows, it declined below $1,800 to $1,773 on Thursday (Feb. 18), the lowest level since November 2020.

Of course, the decline in the gold prices was more related to the significant selloff in the U.S. bond market than to the FOMC minutes. The bond yields increased sharply. For instance, the 10-year TIPS yields rose from -1.06 on February 10 to -0.87 on February 18, 2021, as one can see in the chart below.

However, both events clearly show elevated expectations about the medium-term economic growth. Both investors and central bankers have become more optimistic about the future amid progress in vaccinations and greater prospects for additional fiscal stimulus. The strengthened risk appetite has supported equity prices, making some investors head for the exits in the gold market.

Having said that, although gold prices still have some room to go lower – especially if real interest rates rally further – the fundamentals are still positive. I’m referring here to the fact that the U.S. economy has fallen into the debt trap. Both private and public debt is enormous. In such an environment, the interest rates cannot significantly increase, as they would pose a great risk to an overvalued equity market and Treasury. So, the Fed wouldn’t allow for really high interest rates and would intervene, either through expanding its quantitative easing program or through capping the yield curve.

Another issue is that the Fed is not going to change its dovish monetary policy anytime soon. Even in the recent, relatively upbeat minutes, Fed officials acknowledged that economic conditions were far from the central banks’ targets:

Participants observed that the economy was far from achieving the Committee’s broad-based and inclusive goal of maximum employment and that even with a brisk pace of improvement in the labor market, achieving this goal would take some time (…) Participants noted that economic conditions were currently far from the Committee’s longer-run goals and that the stance for policy would need to remain accommodative until those goals were achieved.

Moreover, the Fed’s staff assessed the financial vulnerabilities of the U.S. financial system as being notable. The asset valuation pressures are elevated, and vulnerabilities associated with business and household debt increased over the course of 2020, from levels that were already elevated before the outbreak of the pandemic. So, given all these fragilities, it is unlikely that we will see a really hawkish Fed or significantly higher interest rates. There is also a possibility of the next financial crisis, given the high debt levels. All these factors should support gold prices in the long-term, although more declines in the short-term are possible of course, due to the more positive sentiment among investors and rising bond yields.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Silver Will Outperform Gold, Says LBMA Survey

February 16, 2021, 10:00 AMGains are in the forecast for all the precious metals this year, and silver is believed to be the star of the show.

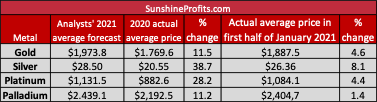

The London Bullion Market Association (LBMA) has just published its annual precious metals forecast survey. In general, the report is bullish, as the analysts expect significant gains in all the precious metals against 2020 average prices. However, the experts see only modest increases from mid-January levels.

In particular, the analysts’ 2021 average forecast for the price of gold is $1,973.8. It implies a 11.5-percent jump relative to the 2020 average (broadly in line with last year), but just a 4.6-percent increase compared to the price in the first half of January 2021.

Silver is expected to be the best performing precious metal this year. Its average price is expected to be $28.5 in 2021, or 38.7 percent higher than last year, and 8.1 percent up from the mid-January. The forecast for all metals is presented in the table below.

Among the important drivers of the performance of the precious metals prices this year are geopolitical factors, the impact of the COVID-19 pandemic, and the pace of economic recovery. However, in line with my own understanding of the gold market, the top three drivers for the gold price pointed out by the analysts are more related to the macroeconomic factors: negative or falling interest rates, a weaker U.S. dollar, and U.S. fiscal and monetary policies.

Of course, the above numbers are the averages of more than 30 forecasts from different analysts. The most bearish expert sees the average price of gold as low as $1.650, while the most bullish participant at $2,300. Also interesting is the wide high/low range of $1,192 ($2.680 as the highest high and $1,488 as the lowest low) compared to $780 last year. So, it could shape itself to be a volatile year!

Given my fundamental outlook, I include myself in the camp of cautious bulls. Why cautious? Well, the current bearish/sideways trend is disturbing – especially when compared to Bitcoin – and there are important downside risks. In particular, with the ongoing economic recovery, the risk appetite could strengthen, and the real interest rates could increase, given their already ultra-low levels. The bond yields could rise especially if investors start to expect the Fed’s tapering of quantitative easing. So, we could indeed see heightened volatility and I wouldn’t be surprised if the gains in 2021 turn out to be smaller than last year.

However, there are also significant bullish arguments that investors shouldn’t neglect. As William Adams points out in the LBMA survey, “There are numerous factors supporting the view that we have entered another commodity super-cycle and, if that is the case, gold is likely to run higher too”. Furthermore, and what I have emphasized for a long time, in the aftermath of this recession, the central banks and governments pumped liquidity “not just into the financial markets but at the household/retail level too, which might be more likely to be inflationary”. Indeed, this time not only the monetary base has increased, but the broad money supply too.

In addition, the public debt has increased massively and it’s going to balloon even further this year. Thus, investors may get worried about the high indebtedness and the increased likelihood of the debt crisis and buy more gold as a safe haven. Given the lavish fiscal policy, the Fed will remain very dovish, while the real interest rates will stay well in the negative territory, supporting gold prices. Indeed, the yields on almost 30 percent of the world’s investment-grade debt are now below zero, which should strengthen gold’s appeal as a portfolio diversifier. Actually, if inflation expectations pick up (partially due to rising oil prices), the real yields could decline again, supporting gold prices.

Implications for Gold

What does the LBMA annual forecast survey predict for the yellow metal? The report is bullish, as participants expect double-digit price gains this year compared to 2020. However, they see only modest increases from the first half of January 2021. They also provide many reasonable arguments why gold could have trouble duplicating the bullish performance of the last year (especially if higher inflation doesn’t materialize), which is actually in line with my own cautious view. Hence, I agree with Ross Norman, the winner of LBMA’s 2020 Precious Metals Forecast Survey, who says that “we expect gold to perform well in 2021, although at a slightly more subdued rate compared to 2020”.

Interestingly, while most analysts are cautiously optimistic about gold, they are much more upbeat on silver, believing that it will outperform the yellow metal in 2021. Although it seems that the short squeeze in the silver market attempted by Reddit investors has failed, there is no doubt that the poor man’s gold started 2021 better than the yellow metal. Will this trend continue? Only time will tell!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Tesla Charge Gold With Energy?

February 11, 2021, 10:47 AMTesla has supported the price of Bitcoin, but it can affect gold as well.

The bull market in cryptocurrencies continues. As you can see in the chart below, the price of Bitcoin has recently increased to almost $47,000 (as of February 10). The parabolic rise seems to be disturbing, as such quick rallies often end abruptly.

However, it’s worth noting that the price of Bitcoin has partially jumped because of the increased acceptance of cryptocurrencies as a legitimate form of currency by the established big companies. In particular, Elon Musk, the CEO of Tesla, has recently published a series of tweets that significantly affected the price of Bitcoin, Dogecoin, and other cryptocurrencies.

Furthermore, Tesla updated its investment policy to include alternative assets as possible investments. In the last 10-k filing to the Securities and Exchange Commission in January 2021, Tesla stated:

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity.

Importantly, these assets also include gold:

As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds, and other assets as specified in the future.

This means that Tesla wants to diminish its position in the U.S. dollar and to diversify its cash holdings. In other words, the company lost some of its confidence in the greenback and started to look for alternatives. So, it seems that Musk and other investors are afraid of expansion in public debt, higher inflation, and the dollar’s debasement.

And rightly so! The continued fiscal stimulus will expand the fiscal deficit even further, ballooning the federal debt. With the budget resolution passed last week, only a simple majority will be needed in the Senate to get Biden’s $1.9 trillion package approved, a majority that Democrats have.

Remember also that the U.S. economy added only 49,000 jobs in January, while 227,000 jobs were lost in December (revised down by 87,000!). The poor non-farm payrolls will strengthen the odds of a larger fiscal stimulus and easier fiscal and monetary policies.

Hence, combined with the ultra-dovish monetary policy and a Fed more tolerant to inflation, the upcoming fiscal support could ultimately be a headwind for the dollar. Initially, the prospect of fiscal support caused positive reactions on the financial markets, but as the euphoria passes, investors start to examine the long-term consequences of easy money and the large expansion of government spending. Importantly, the larger the debt, the deeper the debt trap, and the longer the zero interest rates policy will stay with us, as the Fed won’t try to upset the Treasury.

Implications for Gold

What does Tesla’s move imply for the precious metals market? Well, we are not observing the kind of rally in gold that we are currently witnessing in the cryptocurrencies sphere (see the chart below). And – given the size of the gold market – it’s unlikely that Musk & Co. could ignite a mania similar to the one seen in Dogecoin. The gold market is simply too big. Even the silver market could be too large for similar speculative plays – as the failure of the recent attempt of a short squeeze has shown.

However, the update of Tesla’s investment policy is a confirmation of gold as a safe-haven asset and portfolio diversifier. If other big companies follow suit, and we see an actual reallocation of funds from the U.S. dollar towards gold, the price of the yellow metal will get an invigorating electric impulse.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

2021 Should See Improved Gold Demand

February 2, 2021, 9:42 AMThe World Gold Council recently published two interesting reports. Gold demand plunged in 2020, but 2021 should be positive for the yellow metal.

On Thursday (January 28), the WGC published its newest report about gold demand trends: Gold Demand Trends Full Year and Q4 2020. The key message of this publication is that the gold demand of 783.4 tons (excluding over-the-counter activity) in the fourth quarter of 2020 was 28 percent lower year-over-year. As a result, it was the weakest quarter since the midst of the Great Recession in Q2 2008. The weak quarter made the whole year quite disappointing, as the annual gold demand in 2020 dropped by 14 percent to only 3,675.6 tons, making it the lowest level of demand since 2009.

The main driver of this decline was the COVID-19 pandemic, that triggered the Great Lockdown and the subsequent surge in gold prices. In consequence, jewelry demand plunged 34 percent to 1,411.6 tons, the lowest annual level on record. It shows that – contrary to popular opinion – consumers are price takers, not price setters, in the precious metals market.

So, what is really interesting for me is that the investment demand, the true driver of gold prices, grew 40 percent to a record annual high of 1,773.2 tons. Although there was a slight increase in bar and coin investment, the surge in investment demand was caused mainly by the great inflow into global gold-backed ETFs, whose holdings grew by 877.1 tons last year, a record level.

These inflows were, of course, fueled by the spread of the coronavirus and the fiscal and monetary policies that followed in response. Gold was actually one of the best performing major assets in 2020 amid high uncertainty and low real interest rates. Importantly, there were net outflows from the gold ETFs in the Q4, but they were concentrated in November, so the worst may be behind us.

When it comes to other categories, the central banks added a net 273 tons in 2020, the lowest level since 2010, as some central banks sold gold amid recession to obtain liquidity. It confirms gold’s role as a safe-haven asset and portfolio-diversifier. Indeed, gold had one of the lowest drawdowns during 2020, reducing investors’ losses. The technology demand fell seven percent in the last year to 301.9 tons due to the economic disruptions of the pandemic. Total supply fell four percent to 4,633 tons, the first annual decline since 2017, as the pandemic disrupted mine production.

The WGC’s demand report is, as always, interesting, but it should be taken with a pinch of salt. The reason is that the WGC wrongly defines the demand and supply for gold, narrowing it to the annual supply and its use, and omitting the great bulk of transactions in the gold market. In consequence, the report contradicts simple economic logic. According to the WGC, gold supply fell four percent, while gold demand declined 14 percent – but the average yearly price of gold gained 27 percent (see the chart below)! Whoa, when I learnt economics, the drop in demand (higher than the decrease in supply) was pushing the prices down!

Implications for Gold

But let’s leave the past and now focus on the future! In January 2021, the WGC also published its gold outlook for the new year. Not surprisingly, the industry organization is generally bullish, but it notices the headwinds as well. According to the WGC, the hope of economic recovery and easy money will increase the risk appetite, creating downward pressure on gold prices.

However, the WGC believes that the low interest rates and potential portfolio risks will support the investment demand for the yellow metal. In particular, ballooning fiscal deficits, the growing money supply and the possibility of higher inflation and the risk of the stock market correction (who knows, maybe the GameStop saga will trigger some broader bearish implications?!) should support gold prices.

The WGC’s conclusion turns out to be similar to my own 2021 outlook for gold: that it could be a positive year for the yellow metal, but less so than 2020 – at least under the condition that the global economy will experience a steady recovery without too much inflationary pressure. But inflation may arrive, ending the era of the Goldilocks economy – and possibly starting the year of gold. Only time will tell!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Powell: Inflation Can Rise In 2021 – So What Happens to Gold?

January 28, 2021, 10:28 AMThe first FOMC meeting in 2021 has concluded without any changes in monetary policy, while Powell sent a few dovish signals during his press conference.

The FOMC released on Wednesday (January 27) its newest statement on monetary policy. Generally speaking, the statement was little changed. The main alteration is that the U.S. central bank has acknowledged that “the pace of the recovery in economic activity and employment has moderated in recent months”. Wow, how did they notice that? They really must hire professionals! All jokes aside, this modification in the FOMC statement is dovish. Consequently, when analyzed separately, it’s positive for the price of gold.

Another change is that the FOMC now believes that “the ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook”. In December, the Fed thought that the pandemic would impact inflation only in the “near term”, with risks to the outlook “over the medium term”.

However, when considered holistically, the January statement is rather bad for the yellow metal, as the Committee neither changed the federal funds rate nor expanded its quantitative easing program. So we have another month without any additional easing of the U.S. monetary policy. Luckily, the ECB also didn’t loosen its stance, but still, the lack of any fresh dovish moves by the Fed is not helpful for gold.

Luckily, Powell comes to the rescue! Although he generally sounded rather neutral during his press conference, the Fed Chair has sent a few important dovish signals. First, he clearly excluded the possibility of premature tapering and the replay of 2013’s taper tantrum, saying that “the whole focus on exit is premature if I may say. We’re focused on finishing the job we’re doing, which is supporting the economy, giving the economy the support it needs.” The continuation of the quantitative easing, which will take years, is positive for gold.

Second, Powell acknowledged that inflation will increase in 2021, admitting that the Fed will not react to this rise, as it would be only transitory: “We’re going to be patient. Expect us to wait and see and not react if we see small, and what we would view as very likely to be transient, effects on inflation”. This is great news for gold, which is considered by many investors as an inflation hedge. Higher inflation, with the central bank behind the curve, also implies lower real interest rates, which will support gold prices.

Implications for Gold

What does the recent FOMC meeting imply for the gold market? Well, so far, it has reacted little to the Fed’s statement on monetary policy. The reason is simple: the lack of any moves was widely expected, so the markets got no surprises and reacted weakly.

However, the easing of the monetary policy could provide a fresh bullish signal that gold seems to need right now. Without such a spark, gold may continue its bearish trend for a while (see the chart below). And, although the markets did not expect any significant announcements from the Fed, some analysts speculated that the U.S. central bank could provide some guidance about the yield curve control. But it didn’t – so further declines wouldn’t be surprising in the short-term.

Some analysts even say that the gold’s price pattern of 2020-2021 resembles the period of 2011-2012. If true, it would be a terrible news for the gold bulls. However, history never repeats itself, but only rhymes. The current fundamental outlook is different. Why? Well, this time, in addition to quantitative easing and ZIRP, we also have a very easy fiscal policy with ballooning federal debt and new large fiscal deficits in the pipeline.

Another difference is the Fed’s stance. Right now the U.S. central bank openly admits that there is a possibility of upward pressure on inflation, but ask the markets to “expect us to wait and see and not react” (emphasis added). Well, the rise in inflation may be indeed only transitory – but, hey, didn’t they say the same before the 1970s stagflation?

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM