-

Stronger Risk Appetite Sends Gold below $1,800

December 1, 2020, 12:26 PMGold plunged below $1,800. Will these declines finally end?

November doesn’t look like a good month for gold. The declines in the precious metals market continued last week. As the chart below shows, the price of the yellow metal dropped to $1,779 on Friday (November 27).

What is going on? Well, it seems that investors have switched into a risk-on state of mind, which sent the safe-haven assets such as gold substantially lower. You see, a lot of important things happened or are happening: a few vaccines are coming to the market, the formal transition of power from the current administration to President-elect Joe Biden has begun, and Biden picked Janet Yellen as his Treasury Secretary. All of this news reduced a substantial part of the uncertainty and has been welcomed by investors. They are convinced that the economy will find itself on the road to normality. The market participants have breathed a sigh of relief, reassured that the worst scenarios – of unconstrained pandemic, contested election, or an inexperienced, radical progressive responsible for U.S. financial matters – will not materialize.

Indeed, Wall Street can be happy. Yellen, the monetary dove, will work closely with the Fed (after all, Powell was on the Board of Governors under Yellen) to design whatever response necessary to sustain the asset price bubb… sorry, to stimulate the economy!

As a consequence of a stronger risk appetite and more optimistic economic outlook, investors started to price an interest rate hike in 2023. The more hawkish expectations have exerted downward pressure on gold prices.

Implications for Gold

But what about the more distant future of gold? Well, neither the vaccines, nor a Biden-Yellen duo will cure all of the U.S. economy’s problems over the long run. Actually, America will have to face a big health crisis in the very short term. The second wave of infections is already affecting the economy negatively. For example, personal income decreased 0.7 percent in October, followed by a 0.7 percent gain in September. And the number of initial claims have been rising again in November (albeit rather mildly so far).

The vaccines may take us into a new normality, but not to a unicorn fantasy land. Perhaps you don’t remember, but the pre-pandemic normality wasn’t wonderful, the pace of economic growth was not impressive, and indebtedness levels were already high. At present, economic growth is not going to accelerate substantially. The debt – both corporate and public debt – is considerably more substantial than before the pandemic. The real interest rates are lower, while the risk of inflation runs higher.

The return of normality could actually be positive for gold prices in the long run. Why? Because once the epidemic is over, a lot of people will want to travel, buy larger houses, and spend, spend, and spend some more! The pent-up demand, combined with some cracks in the supply chains, and increased broad money supply, could lead to the acceleration in inflation and thus, stronger demand for gold as an inflation hedge.

All these factors suggest that the price of gold should not return to a lower pre-epidemic level. After all, the world will come out of the pandemic with much higher debt levels and some lasting scars. Actually, the price of the yellow metal can continue its upward march in the medium or long run, however, it seems that gold requires a trigger to overcome its current weakness and move further north. That trigger can come in the form of the next U.S. stimulus package, some turmoil in the corporate debt markets, or the next dovish change in the Fed’s stance that could be announced in December. The reason might also be technical – gold could decline so much that the decline burns itself out as everyone who wants to sell will do so and the price – given the extremely bad sentiment - will be able to go in only one direction – up.

We will see – stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Biden and Yellen Pushed Gold to $1,800

November 26, 2020, 5:13 AMGold plunged to $1,800. What does this imply for the gold market?

Whoa! Tuesday, November 24 wasn’t too good for gold. The price of the yellow metal plunged then from $1,840 to $1,800. Actually, November was an awful month for gold prices, which dropped from a local peak of $1,941, or more than 7 percent.

So, what happened? Well, it seems that the positive news of the vaccines eliminated the negative tail-risk related to the pandemic. In consequence, the safe-haven demand for gold declined. On the other hand, the price of Bitcoin has jumped recently as investors increased their risk appetites. Moreover, the elections results also reduced the uncertainty in the marketplace. In other words, the economic outlook is improving as the uncertainty clouds begin to part.

Indeed, this week President-elect Joe Biden announced the beginning of a formal transition of power from Trump’s administration to his. Biden also started to announce nominations for top positions, which served to reduce the risk that a contested election had for uncertainty among investors.

In particular, there are rumors that Biden is likely to tap former Fed Chief Janet Yellen to become the next Treasury secretary. Investors know her and trust her, so they welcomed the possibility of her nomination for a key position in the new administration. Indeed, Yellen is well-known and well-respected, while having the knowledge and skills necessary for the position (although she has more experience in monetary policy than fiscal policy).

Moreover, Yellen, who is seen as a dovish person, is believed to be supportive of bigger government economic aid in order to stimulate the economy and recover quickly from the coronavirus crisis. Actually, she has for some time been calling for increased government spending to help combat the recession and has always been concerned about the labor markets, low participation rates and high unemployment. As well, as the former Fed Chief, Yellen will closely cooperate with the US central bank and will listen to the Fed’s calls for a fiscal package. She will, therefore, help sustain high government expenditure to assure that the labor market is recovering.

Implications for Gold

What does it all mean for the gold market? Well, the recent plunge in the gold market is disturbing. Some declines are perfectly understandable as the uncertainty related both to the pandemic and elections diminished. However, the divergence between equities and gold in their reaction to higher odds of more economic stimulus is bad news for the precious metals market. The return of normalcy in the marketplace and resulting strengthened risk appetite could make gold struggle for a while, especially if the real interest rates increase.

You see, the coronavirus crisis was very deep but short-lived and the return to normalcy has to arrive earlier than it did after the Great Recession. However, I don’t think that we will experience a replay of 2013 yet. The risk appetite increased, but the monetary and fiscal policies are still far from normalization. There is, of course, the risk of an increase in the interest rates, but the Fed will actively try to suppress the interest rates as long as it will not see inflation above two percent.

However, the long-term fundamentals haven’t significantly changed. The real interest rates actually remain deep below zero while the U.S. dollar remains weak. These factors should support gold prices and the expanding public debt should also help the yellow metal. Investors also shouldn’t forget about the possibility of a debt crisis or the risk of accelerating inflation when the epidemic ends and people increase their spending.

In other words, the ongoing fiscal and monetary stimulus should support or even push gold prices higher in the medium to long-run. It’s possible that, when confronted with the lack of a fiscal package, the Fed will introduce some changes at its upcoming meeting in December to keep the real interest rates at ultra low levels and to stimulate the economy.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Herd Immunity or Herd Insolvency: Which Will Affect Gold More?

November 24, 2020, 6:05 AMVaccines are coming. But so is the debt crisis. What does it imply for gold?

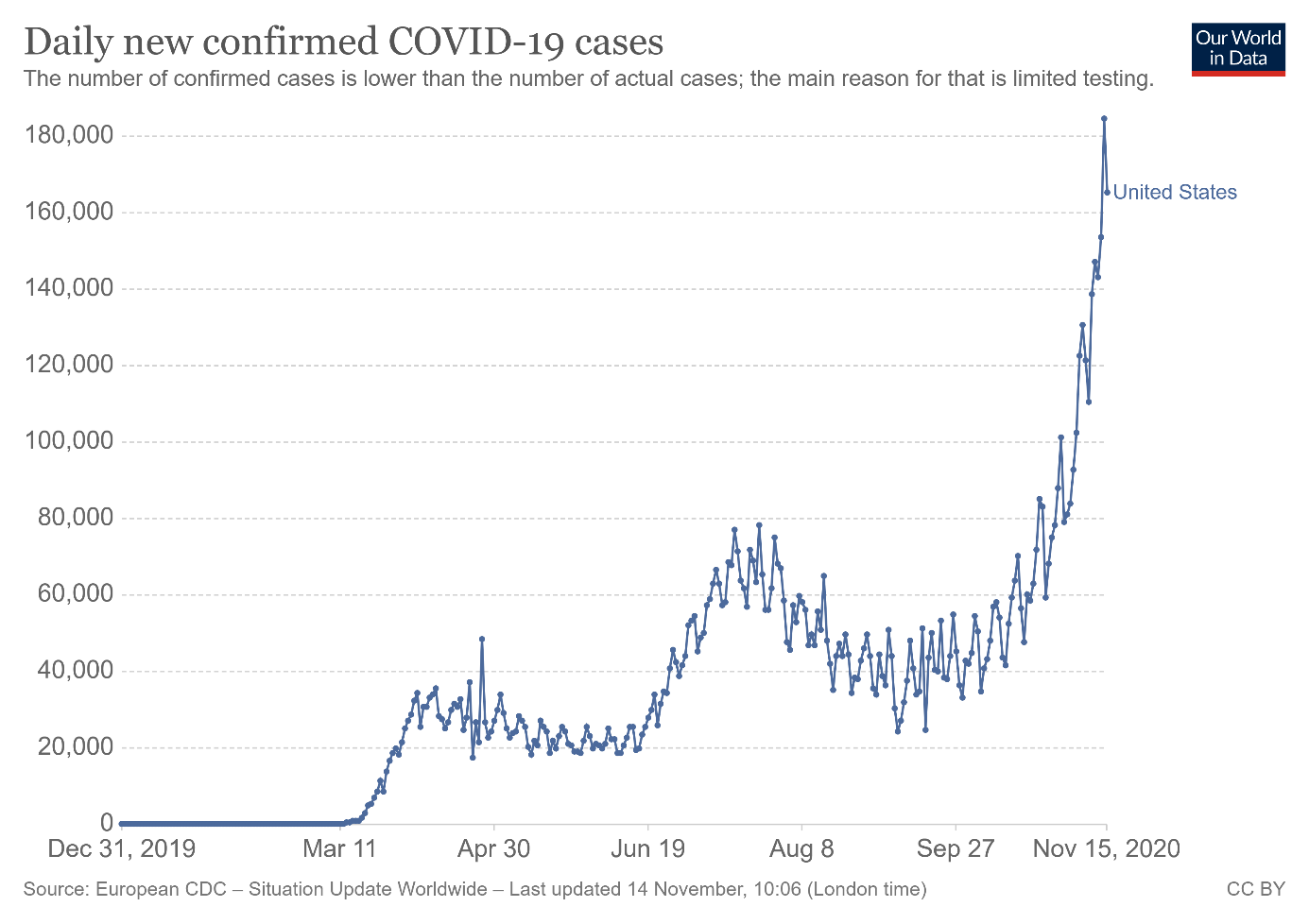

COVID-19 cases are still rising at an alarming rate in the United States. As the chart below shows, the rolling 7-day average of new daily infections stays above 160,000.

It means that the immediate economic outlook is rather dark. The short-term economic slowdown is good information for the gold market.

But there is also bad news for the yellow metal, and by that I mean the recent positive news on vaccine efficacy. It’s become clear that we will probably have the first doses of a vaccine – or even a few vaccines – by December 2020 or in early 2021, the tail-risk of no vaccines in the near future has been practically eliminated. This is why the stock market has increased despite rising Covid-19 cases. Simply put, some companies – like airlines – become investable again thanks to the breakthroughs in vaccine developments.

Does this mean that gold is doomed in the medium-term, or that the vaccines’ arrival will sink gold? Well, not necessarily. Although it’s true that the elimination of the tail risk weakens the safe-haven demand for gold, one mustn’t forget that gold was actually in a bullish trend before the pandemic started thanks to the accommodative Fed’s monetary policy.

So the question is: do you think that herd immunity will force the Fed to drop its dovish stance? Or will the eradication of the coronavirus make the whole new debt disappear? I don’t think so. In other words, the vaccines will solve the health crisis, but they will not solve all our economic woes. And the debt problem is poised to be one of the greatest global threats right now.

Indeed, just last week, the Institute of International Finance said that global debt is expected to surge from $257 trillion in 2019 to a record $277 trillion by the end of 2020. On a relative basis, the global debt is expected to soar from 320 percent to 365 percent of global GDP. This means that the global economy will struggle to get out from indebtedness without triggering an economic crisis.

And if you have any doubts that the wave of debt insolvencies is coming; in the previous week, Chinese state-owned company Yongcheng Coal & Electricity Holding Group defaulted. What is important is that it wasn’t an isolated event but a part of a series of defaults by top-rated state-owned enterprises. This bankruptcy highlights the risk of defaults in the corporate bond market. Importantly, the pile of corporate debt is massive not only in China, but also in the U.S., as the chart below shows. As well, the Fed will not help if the debt crisis occurs. The central banks can deal with the liquidity crisis, but not the solvency crisis. Oh boy, 2021 is setting itself up to be an interesting year!

Implications for Gold

What does it all mean for the gold market? With or without the coronavirus, the U.S. economy is becoming increasingly debt-dependent. The only problem being is that debt-driven economic growth is not sustainable in the long-run. Even a small increase in interest rates could lead not only to higher borrowing costs, but also to a wave of debt defaults. What does this imply? One possible outcome is that the interest rates will have to be kept at ultra low levels for years. It goes without saying that gold thrives in an environment of low real interest rates.

Moreover, some economists point out that the end of the pandemic could accelerate inflation, and that the Fed and the state governments would not oppose too much. Actually, the U.S. central bank has already announced its new monetary regime in which it wouldn’t react to an increase in inflation rates above its target. After all, higher inflation would help Uncle Sam to reduce the real value of debt and gold should benefit in such a macroeconomic environment.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

More Vaccines Are Coming. Will Gold’s Decline Be Their Side Effect?

November 19, 2020, 11:05 AMWith Moderna’s recent success, more vaccines are coming. Does this mean the end of the story for gold?

Who offers more? As you probably remember, last week Pfizer announced that – based on the interim analysis – its vaccine is more than 90 percent effective. Two days later, the Russians entered the game. The developers of the vaccine called Sputnik V announced that their vaccine demonstrated 92 percent efficacy in the first interim analysis of the third phase of clinical trials. However, the skeptics say that those results are based on only 20 confirmed Covid-19 cases. But hey, it’s better to not mess with Russians, so I won’t say a bad word about their vaccine!

On Monday (Nov 16th), Moderna announced that its own coronavirus vaccine trial was also nearing its end, with a 94.5 percent efficacy rate. Most importantly, Moderna’s vaccine requires lower storage temperatures compared to Pfizer’s, making it similar to the standard conditions in the pharmaceutical industry, thereby making it easier to distribute.

Two days later (Nov 18th) Pfizer released the results from its final efficacy analysis, which indicates that its vaccine is 95 percent effective. This means that only five percent of Covid-19 cases among the vaccine trial participants occurred in the group which got the vaccine, while 95 percent occured in the placebo group. The good news for humankind is that Pfizer’s vaccine efficacy held up across the age spectrum (and also across different characteristics such as gender and ethnicity). In people older than 65 (a high-risk group), the efficacy was reported to be 94 percent. Pfizer will therefore request the FDA’s emergency use authorization very soon, followed by Moderna. That’s great for the world. But what about the yellow metal?

Implications for Gold

The positive results from the two vaccines, better than previously expected, have raised hopes for the end of the pandemic. In other words, the positive results from the vaccine trials imply an increased chance of a faster than previously expected economic recovery in 2021. Since the epidemic clearly supported gold prices, its upcoming end means bad news for the price of gold.

However, after an initial huge drop in response to Pfizer’s initial announcement, the price of gold has somewhat stabilized. As one can see in the chart below, the price of gold plunged from around $1,940 to around $1,860-$1,870 after the first breaking news about the vaccine. But the impact of the subsequent announcements from both Pfizer and Moderna was much smaller.

Why? Well, although the recent news is great, the distribution of vaccines among the general population will take a few months. Consequently, there will be no herd immunity until at least mid-2021. If everything goes well of course, and the FDA approves both vaccines.

In the meantime, we’ll have to face the harsh autumn and winter seasons. And I’m not referring to the weather or white walkers – I mean the Covid-19 walkers whose population has recently increased. As the chart below shows, the daily infection rate in the U.S. still remains at about 170,000 cases. This means than more than one million new Covid-19 cases per week. So it’s possible that investors have to some extent shifted their attention from the vaccine to the more immediate threat.

The progressing spread of Covid-19 will hurt the economy, which is good news for gold. Indeed, although the upcoming vaccines reduce the pandemic-related uncertainty, the story for gold is not over yet. You see, there is still an elevated economic uncertainty. The public debt is ballooning, the monetary policy will remain very accommodative, and inflation is still a present risk (think about all this pent-up demand that could materialize next year). The vaccines will not fix all these problems and they will not undo the economic crisis that hit the U.S. this year and which will leave some long-lasting scars.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Vaccine vs. Virus. Key Battle for Gold

November 16, 2020, 7:56 AMThe vaccines will likely arrive – sometime in the future. However, Covid-19 cases are surging now. While there is light at the end of the tunnel, the fall and winter may be harsh. What does it mean for gold?

Fed Chair Jerome Powell spoiled the fun. It was so good: the election dust settled while Pfizer announced a vaccine breakthrough. And then Powell spoke on Thursday at the European Central Bank’s (ECB) forum, pointing out the risks ahead. In particular, he said that the economy as we know it might be over, and even though it’s recovering, “we’re not going back to the same economy”. In other words, Powell worries about the possibility of the pandemic and resulting economic crisis leaving long-term scars: “the risk is that there is some longer-run damage to the productive capacity of the economy and to people’s lives who have been disrupted by the pandemic”. Not good – the pace of economic growth was already quite sluggish before the pandemic, and now it may slow down further. Or maybe it is good news – for gold.

Moreover, Powell downplayed somewhat Pfizer’s announcement. He noted that although the vaccine news is great, there remain important challenges and uncertainties about the vaccine’s timing, production, distribution, and the efficacy for different groups. And “with the virus now spreading, the next few months could be challenging that year”.

Indeed, as the chart below shows, the US epidemiological curve has recently skyrocketed. The number of daily new Covid-19 cases has surpassed 180,000 last week, and although it has slowed down to around 165,000 on Sunday, the number is still extremely high. Even worse is that these are only officially confirmed cases. According to some epidemiologists, they are just the tip of the iceberg, with 70-90 percent of all cases being unreported.

And the number of hospitalizations is also rising, as one can see in the chart below. The problem is that at the current rate of infections and hospitalizations, the healthcare system will be quickly overwhelmed. In some places, hospitals are struggling to find beds for patients and are stretching their capacity to deliver care. Some epidemiologists even warn that America is entering “Covid hell”, in which a doctor will have to decide who to treat and who dies, not because of the coronavirus, but because of other health-related issues which couldn’t be addressed due to an overwhelmed healthcare system. May it not come true.

Implications for Gold

What does this all mean for the yellow metal? Well, Pfizer’s vaccine news is great for the economy and bad for gold, as it can reduce the pandemic-related uncertainty. However, the vaccine is the song of the future and in the meantime, the U.S. will have to face the darkest moments of the epidemic. The current strong wave of infections will hit both the healthcare system and the economy.

You see, the pace of economic recovery has already moderated. The current huge rise in Covid-19 cases will slow economic growth further in the fourth quarter. So, as investors will observe the progressing epidemic, the safe-haven demand for gold may revive. Moreover, the virus’s offensive means that further economic support is likely to be needed to help the economy. A fiscal stimulus is coming – and it will have to be bigger than previously thought. The additional government spending will add to the huge pile of public debt. Oh, by the way, the U.S. government started the 2021 fiscal year with an October fiscal deficit of $284 billion, an increase of 111 percent compared to October 2019. Therefore, although the upcoming positive news about the Covid-19 vaccine could exert some downward pressure on gold prices, the macroeconomic outlook remains supportive for the yellow metal.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM