-

Will Biden Build Back Better… Gold?

May 4, 2021, 6:52 AMNew spending is coming! And because of that, Biden’s speech to Congress was fundamentally positive for gold.

Last week was full of big events. The FOMC released its newest statement on monetary policy meeting, while Powell held the press conference. On the same day, President Joe Biden made his first speech to Congress. Let’s take a look at his words.

First of all, Biden laid out his American Jobs Plan, which proposes more than $2 trillion to upgrade US infrastructure and create millions of jobs. No matter that infrastructure spending has no stimulus effect, according to economic research.

Second, if you think that $2 trillion is a lot of money, given America’s huge indebtedness, you are clearly wrong. Two trillion is practically nothing and definitely not enough, so Biden proposed another $1.8 trillion American Family Plan in investments and tax credits to provide lower-income and middle-class families with inexpensive childcare.

Third, Biden understands that all these expenditures cannot be funded solely by increasing already huge fiscal deficits (see the chart below) and issuing new bonds.

So, he proposed a hike in tax rates:

It’s time for corporate America and the wealthiest 1% of Americans to pay their fair share. Just pay their fair share (…) We take the top tax bracket for the wealthiest 1% of Americans –

those making $400,000 or more – back up to 39.6%.No matter that corporate taxes are implicit taxes on labor and that the current proposals for tax hikes are unlikely to fund the White House’s ambitious plans.

Biden also proposed several reforms of the labor market: a 12-week paternal leave for families and an increase of the minimum wage to $15 an hour.

So, in short, his speech called for several bold economic policies aiming to increase government spending and strengthen the American welfare state. Sounds good… for gold.

Implications for Gold

What does the Biden speech, and more generally his economic agenda, imply for the precious metals market? Well, it seems that the President cares not only about the workers, but also about the gold bulls. His plan is fundamentally positive for the yellow metal. After all, Biden wants to further increase government spending, which will weaken the long-term pace of economic growth and add to the mammoth pile of the public debt.

There are also hints that this massive government spending flowing directly to the citizens could ignite inflation. After all, the US economy has already recovered from the pandemic recession, at least in the GDP terms, as the chart below shows. So, Biden’s economic agenda risks that the economy will overheat igniting inflation.

He also adopted a more confrontational stance toward China, which could elevate the geopolitical worries and increase the demand for safe-haven assets such as gold.

Another potential benefit is the proposal to raise corporate taxes, which is clearly negative for the US stock market and the greenback. Hence, gold could gain at their expense, especially if we see a pullback in the equity market…

Last but not least, the increase in the minimum wage, and other labor market reforms, will not help in a quick employment recovery, so the Fed will maintain its dovish policy for longer. Indeed, we should look at Biden’s message together with the Fed’s signals. Biden proposed trillions of dollars in new spending, while Powell reiterated no hurry to raise interest rates. What a policy mix! We have both easy monetary policy and loose fiscal policy, a golden policy mix, indeed.

Gold didn’t react strongly to these events, which is a bit disturbing, but this can be explained by the gains on Wall Street, as investors felt reassured that a financial bonanza would last undisturbed. So, the economic confidence remains high, but if it wanes, especially if inflationary threats come to the surface, gold may perform better.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Powell Lull Gold Bulls to Sweet Sleep?

April 29, 2021, 9:53 AMThe Fed left its monetary policy unchanged. However, the lack of any action amid economic recovery is dovish – good news for gold.

On Wednesday (Apr. 28), the FOMC has published its newest statement on monetary policy. The statement wasn’t significantly altered. The main change is that the Fed has noticed the progress on vaccinations and strong policy support, and that, in consequence, the economic outlook has improved.

Previously, the US central bank said that indicators of economic activity and employment “have turned up recently, although the sectors most adversely affected by the pandemic remain weak”, while now these indicators “have strengthened”, while “the sectors most adversely affected by the pandemic remain weak but have shown improvement”. So, the Fed acknowledged the fact that the economy has significantly recovered.

Similarly, the US central bank is no longer considering the epidemic as posing “considerable” risks to the economic outlook. Instead, the pandemic “continues to weigh on the economy, and risks to the economic outlook remain”. It means that the Fed has become more optimistic and does not see risks as considerable any longer. This is bad for the price of gold although it’s not a very surprising modification, given the progress in vaccinations. However, no hawkish actions will follow, so any bearish impact for gold should be limited.

Another important alteration is that inflation no longer “continues to run below 2 percent”, but it “has risen, largely reflecting transitory factors”. This would be normally a hawkish change with bearish implications for gold. But the Fed doesn’t worry about inflation and is not going to hike the federal funds rate anytime soon, even when inflation remains above the target for some time. As Powell pointed out, “the economy is a long way from our goals, and it is likely to take some time for substantial further progress to be achieved.” Thus, gold bulls may sleep peacefully.

Implications for Gold

Indeed, they can relax with Mr. Powell on guard. The Fed Chair has reiterated during his press conference that the US central bank is not going to tighten its dovish stance and reduce the quantitative easing:

It’s not time to start talking about tapering. We'll let the public know well in advance. It will take some time before we see substantial further progress. We had one great jobs report. It is not enough to start talking about tapering. We'll need to see more data.

Uncle Jay and his bedtime stories… about inflation that is only “transitory”. Once upon a time,

the PCE inflation [is] expected to move above 2% in the near term. But these one-time increases in prices are likely to have only transitory effects on inflation.

Well, sure. Nonetheless, this is the favorite story of central bankers all over the world told to naive citizens. Just wait for the April inflation readings – they will be something! Of course, it is going to be too early to declare persistently higher inflation, but I’m afraid that the Fed may be too carefree about such a possibility.

So, in the aftermath of the generally dovish FOMC meeting, the dollar slid yesterday, while the price of gold went up. Gold continued its recovery from the March bottom, as depicted in the chart below. This makes sense: after all, the Fed reiterated that it would maintain its current ultra easy stance for the foreseeable future, despite the fact of acknowledged improved economic outlook.

In other words, the Fed’s inaction made the US central bank more dovish given the better economic outlook and higher inflation. The statement’s language about the coronavirus and the economy was more optimistic, but inflation was considered to be transitory and no hawkish actions were signaled. So, the recent FOMC meeting should be positive for the gold prices from the fundamental point of view, although gold may continue its recent, generally lackluster performance for a while. Of course, the expansion of Fed’s accommodative monetary policy would be much better for the yellow metal, but the lack of any hawkish signals could still clean the room for gold for further upward moves.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Euro and Gold Go Up With Pandemic Upturn in Euro Area?

April 27, 2021, 10:10 AMThe worst may already be behind the euro area’s economy. This bodes well – both the euro, as well as gold, can benefit from it.

The Governing Council of the European Central Bank met last week, keeping its monetary policy unchanged. The inaction was widely expected - no surprises here. The June meeting could be much more interesting as the ECB will have to decide whether or not to slow its bond buying under the Pandemic Emergency Purchase Programme that was accelerated in the second quarter of the year. Given the dovish stance of the European policymakers, and the bank’s pledge to provide the markets with favorable financing conditions during the pandemic, we shouldn’t expect any tapering soon.

Certainly, there are important dovish parts of the latest ECB’s statement on its monetary policy. It stems from the grim economic situation in the euro area. The real GDP declined by 0.7 per cent in the fourth quarter of 2020, and it is expected to decrease again in the first quarter of 2021. The nearest future doesn’t look promising:

The near-term economic outlook remains clouded by uncertainty about the resurgence of the pandemic and the roll-out of vaccination campaigns. Persistently high rates of coronavirus (COVID-19) infection and the associated extension and tightening of containment measures continue to constrain economic activity in the short term.

However, investors should always look beyond the near-team outlook. In the medium-term, the situation in the euro area looks much better. As the ECB notes, this is because the current virus wave seems to have peaked in Europe, while the pace of vaccination is accelerating:

Looking ahead, the progress with vaccination campaigns, which should allow for a gradual relaxation of containment measures, should pave the way for a firm rebound in economic activity in the course of 2021.

Furthermore, the European Union’s 750 billion euro recovery fund has cleared a key court challenge. Last week, the Germany’s constitutional court dismissed objections to the European aid package.

All these factors are positive for the euro and, thus, also for the price of gold. As you can see in the chart below, gold was highly correlated with the spread between the American and German long-term government bond yields - the widening divergence in the US and European interest rates that started in August 2020 pushed the yellow metal down.

Implications for Gold

The third wave of pandemic has already peaked in Europe; therefore, the old continent may somewhat catch up with the US. This could narrow the divergence in yields, creating downward pressure on the greenback while supporting the gold prices.

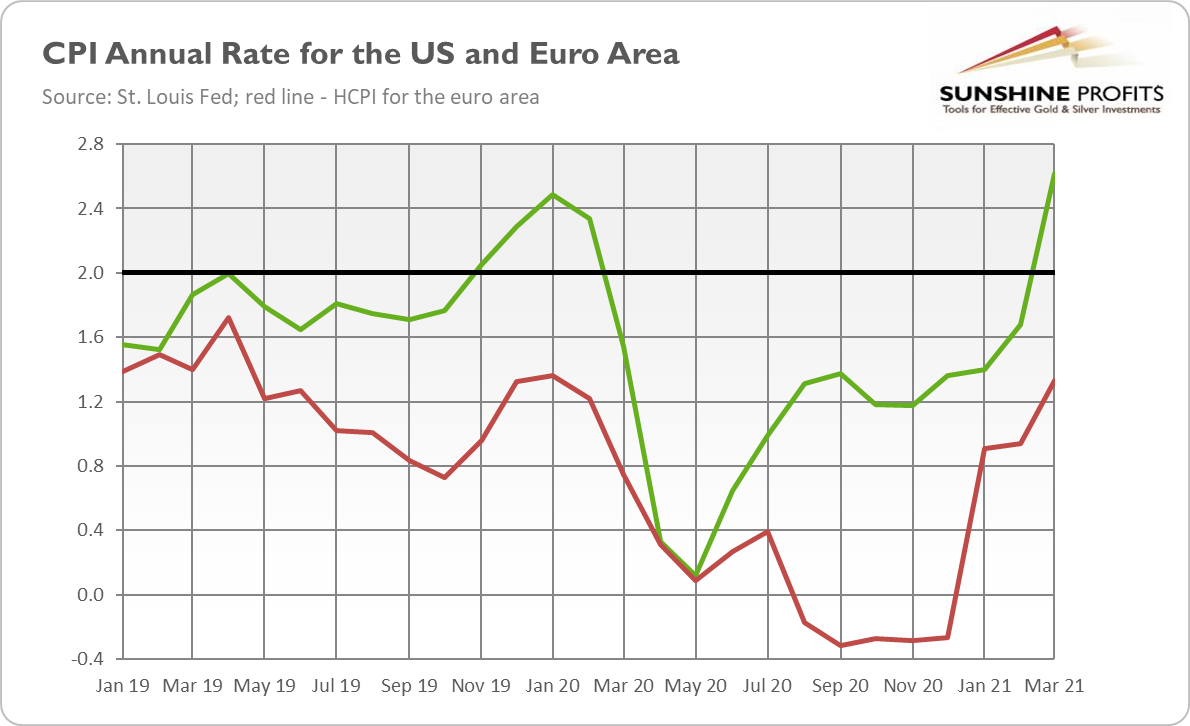

Another positive factor for the euro and the yellow metal is the fact that although inflation jumped in both the US and the euro area, it’s much higher in the former country as the chart below shows. So, the purchasing power parity could support the common currency, as well as gold, against the greenback.

What’s funny here is that Lagarde, just as Powell, argued that inflation “has picked up over recent months on account of some idiosyncratic and temporary factors and an increase in energy price inflation”. Sure, some idiosyncratic and temporary factors helped inflation to soar, but there are always some idiosyncratic and temporary factors. All the same, the central bankers point to them only when inflation rises, never when it declines. They always refer to these factors to justify their dovish bias and easy monetary policy.

Of course, it might be the case that inflation won’t materialize, just like it never did after the Great Recession. But this time may be really different due to the surge in the broad money supply and a huge increase in government spending in the form of direct cash transfers to citizens who are hungry for traveling, eating in restaurants, and generally a normal life with all its money-spending. So, inflation is the wild card, which makes it reasonable to have some gold in investment portfolios. Investors should remember that gold is an investor’s asset rather than a demand asset, which means that in periods of reflation, gold initially lags commodities, only to outperform them and shine brightly in later phases.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Continues to Rebound, Despite Hawkish Powell’s Letter

April 22, 2021, 9:23 AMThe price of gold rebounded further, despite hawkish Powell’s letter to Senator Rick Scott.

The second quarter of 2021 started much better than the first one for the gold bulls. As the chart below shows, the yellow metal rebounded from the late March bottom of $1,684 to $1,778 on Tuesday (April 20).

Is it a temporary recovery in a long, downward slide or a return to the bull market that started in 2019? Well, it’s probably too early to determine whether that’s the case. What is, however, crucial here is that the yellow metal has managed to go up, despite some bearish news. The most important fact is that Powell has replied to the letter from Senator Rick Scott on rising inflation and public debt. The Fed Chair’s reply was rather hawkish, as he said that any overshoot of inflation target would be limited:

We do not seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period (…) we are fully committed to both legs of our dual mandate – maximum employment and stable prices (…) We understand well the lessons of the high inflation experience in the 1960s and 1970s, and the burdens that experience created for all Americans. We do not anticipate inflation pressures of that type, but we have the tools to address such pressures if they do arise.

Although Powell didn’t say anything surprising, his tone and emphasis on the commitment to stable prices could be interpreted as generally hawkish and, thus, negative for the gold prices. However, the yellow metal continued its rebound, which is encouraging.

Implications for Gold

So why has gold been rising recently? Well, in a sense, the reason might be simple: the sentiment was so negative that the downward trend had to reverse. However, there are also some fundamental factors at play here. First of all, the rallies both in the bond yields and the US dollar have stalled. As the chart below shows, both the greenback and the real interest rates have receded from their March peaks..

The declines in the bond and forex markets enabled gold to catch its breath. Of further importance is that they started falling when it became clear that the Fed would be more dovish and tolerant of higher inflation than was originally believed by the markets.

Second, there has been a surge in global coronavirus cases which renewed a demand for the safe-haven assets, such as gold. Also, in the US, the number of confirmed cases and hospitalizations is increasing in some areas of the country, despite the vaccination progress. That is the effect of the new variants of the virus and the pandemic fatigue, i.e., many people tired of it have dropped their infection control measures.

Third, inflation is accelerating, which is becoming increasingly visible. For example, the latest IHS Markit U.S. Manufacturing PMI shows that costs and charges have historically elevated in March.

Supplier lead times lengthened to the greatest extent on record. At the same time, inflationary pressures intensified, with cost burdens rising at the quickest rate for a decade. Firms partially passed on higher input costs to clients through the sharpest increase in charges in the survey’s history.

Commenting on the numbers, Chris Williamson, Chief Business Economist at IHS Markit, said:

Raw material prices are increasing at the sharpest rate for a decade and factory gate selling prices have risen to a degree not seen since at least 2007. The fastest rates of increase for both new orders and prices was [sic] reported among producers of consumer goods, as the arrival of stimulus cheques in the post added fuel to a marked upswing in demand.

What matters here is that the inflationary pressure is likely to remain with us for a while, despite the pundits’ claims that it’s triggered merely by temporary factors. In the 1970s, they were talking the same – until stagflation emerged and gold shined.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Rebounds Amid Positive Economic Reports

April 20, 2021, 4:27 AMSeveral economic indicators have surprised us on the positive side. Nevertheless, the price of gold has rebounded.

Finally! The price of gold has been rising recently. As the chart below shows, the yellow metal rebounded from the late March bottom of $1,684 to above $1,770 on Friday (Mar. 16). This could be a promising start to the second quarter of 2021, which looks better than the first.

As you know, gold struggled at the beginning of the year, falling under strong downward pressure created by the improving risk appetite and rising bond yields. But the strength of these factors has begun to fade. You see, it seems that economic confidence has reached its maximum level, and it could be difficult for markets to become even more euphoric.

Please take a look at the chart below which shows the level of credit spreads – as you can see, they have fallen to very low levels, which implies that they won’t get much lower than they are right now. So, it appears that the next big move will rather be a rise in credit spreads or a decline in economic confidence.

Second, it seems that the rally in bond yields has run out of fuel, at least for a while. The U.S. long-term real interest rates reached their peak of minus 0.56% on March 18 of this year. Since then, they are in a sideways or even downward trend, declining to almost -0.70% last week, as you can see in the chart below.

As I explained earlier several times, the markets didn’t buy the Fed’s story of allowing inflation to rise substantially without hiking interest rates for several weeks or even months. However, it seems that Powell and his colleagues have finally managed to convince investors that they are really serious about the new framework, which puts full employment over inflation.

Of course, there are also positive geopolitical factors contributing to the rebound in the gold prices. The tensions between the U.S. and China, as well as the U.S. and Russia, have been rising recently. However, it seems that the decline in bond yields allowed gold to catch its breath, and that the macroeconomic outlook – including the credit spreads, interest rates, inflation, monetary policy and fiscal policy – will remain the key driver of gold prices throughout the year.

Implications for Gold

What does all this mean for the price of the yellow metal? Well, the recent jump in the price of gold is encouraging. What is important here is that this rebound occurred amid the flood of positive economic data. For instance, the initial jobless claims have decreased to 576,000, a lower level than expected and the lowest since the pandemic started, as the chart below shows.

Additionally, retail sales surged 9.8% in March, following a 2.7% decline in February, while the Fed’s Beige Book reported that “national economic activity accelerated to a moderate pace from late February to early April”. Additionally, both the Philadelphia Fed manufacturing index and the Empire State manufacturing index surprised us on the a positive side.

The fact that gold held its gains and continued the rebound even after the publication of several positive economic reports is bullish. Of course, it might be simply the case that the reduction in the real interest rates simply outweighed other indicators, but it’s also possible that gold’s bears got tired.

Indeed, the sentiment was so negative in the gold market that it couldn’t get much worse than it already was. Gold shined brightly during the Great Lockdown and economic crisis. But now, when the economy is recovering, gold has become persona non grata. However, this might imply that we are either close to or we have already reached the bottom. Only time will tell, of course, but the macroeconomic outlook seems to be rather friendly for the price of gold, especially if the real interest rates stop rising or even start declining again.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM