-

Has Gold “Ever Given” to You?

March 30, 2021, 10:32 AMNeither the Suez Canal blockade nor the SLR exemption’s expiration should significantly affect gold, whose price is likely to be soon shaped by other factors.

Do you think you’ve had a bad day? If yes, then imagine the helmsman of the Ever Given who somehow managed to get his giant container ship stuck in the Suez Canal, disrupting global trade and causing economic damage worth millions of dollars each hour. Sure, the blockade won’t sink the global economy (pun intended), but it won’t help it either. After all, the Suez Canal is the gateway between Europe and Asia, through which around 12-13% of world trade flows, as does 30% of the world's daily shipping container freight. So, every day of obstruction disrupted the movement of goods worth about $9 billion, having a significant impact on global trade.

Of course, the world won’t end, and ships can always choose an alternative route around the Cape of Good Hope at the southern tip of Africa, but this route takes several days longer. So, the blockade has significantly delayed the consignments of goods and fuel, and exacerbated the already pandemic-disturbed supply channels. As a reminder, there are shortages of containers, semi-conductors, and other inputs and finished goods, that have significantly lengthened delivery times and pushed prices up. Although the blockade of the Suez Canal was temporary, it added additional disruption on top of existing supply problems. Meanwhile, the central banks and governments interpret everything as demand problems that need to be addressed through easy monetary policy and loose fiscal policy.

The accident of the Ever Given won’t significantly impact gold prices. And, as the chart below shows, we haven’t seen any substantial effects so far.

However, the blockade could remind investors (if they somehow managed to forget amid the pandemic) that black swans exist and fly low, and it’s reasonable to have a portion of one’s investment portfolio in safe havens such as gold (for instance, the insurance part of the portfolio). Additionally, the upward pressure on prices (although limited) could strengthen the appeal of gold as an inflation hedge, especially considering that officially reported inflation is likely to jump next month because of the low base effect and all the recent supply disruptions.

Fed Allows for Expiration of SLR

And now for something completely different. The Federal Reserve Board announced that the temporary change to its supplementary leverage ratio, or SLR, for bank holding companies will expire as scheduled on March 31. What does this mean for the U.S. economy and the gold market?

The SLR is a regulation that requires the largest U.S. banks to hold a minimum level of capital. The ratio says how much equity capital the banks have to hold relative to their total leverage exposure (3% in the case of large banks and 5% in the case of top-tier banks). To ease strains in the Treasury market during the Covid-19 epidemic, the Fed temporarily excluded the U.S. Treasuries and central bank reserves from the calculation. In other words, banks could increase their holdings of government bonds and central bank reserves without raising equity capital.

But now, with the exemption expired, their equity capital will be calculated again relative to the banks’ total leverage exposure, including Treasuries and central bank reserves. So, it might be the case that the banks will have to either increase the amount of equity (which is rather unlikely) or reduce the amount of government bonds. And if they sell Treasuries, it would add to the upward pressure on the bond yields. This would prove rather negative for gold, which is a non-interest-bearing asset.

However, it doesn’t have to be the case. I mean here that the U.S. eight large and systematically important banks wouldn’t fall below their 5% regulatory minimum. Actually, they are said to have a roughly 25% buffer above minimum thresholds, so the expiry of the SLR exemptions doesn’t have to significantly affect the functioning of the Treasury market, at least not immediately. Hence, the impact of the expiration of the SLR exemption could have limited effect on the gold market, if any.

It seems that the price of the yellow metal will be rather shaped by the real interest rates, the U.S. dollar, inflation, the level of confidence in the U.S. economy, etc. In the short-term, the focus on economic recovery could continue the downward pressure on gold prices, but in the long-term, the stagflation theme could resurface and push the price of the yellow metal up.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Powell and Yellen Sound Upbeat. Don’t They Like Gold?

March 25, 2021, 9:11 AMBoth Powell and Yellen testified before Congress. They sounded upbeat on the U.S. economy, but gold’s reaction was weak.

What a combo! Both Fed Chair Jerome Powell and the U.S. Treasury Secretary Janet Yellen testified before Congress this week. They spoke about the economic response to the economic crisis caused by the Covid-19 pandemic and the Great Lockdown.

In his prepared remarks, Powell sounded rather hawkish, as he noted that “the recovery has progressed more quickly than generally expected and looks to be strengthening.” As well, during the Q&A session, the Fed Chair seemed to be very confident about the economy and the central bank’s monetary policy. In particular, Powell told senators that 2021 was “going to be a very, very strong year in the most likely case.”

He also downplayed worries about higher inflation expressed by some lawmakers, arguing that the environment of low inflation we have observed for years before the epidemic won’t change anytime soon:

We think the inflation dynamics that we’ve seen around the world for a quarter-century are essentially intact — we’ve got a world that’s short of demand, with very low inflation. We think those dynamics haven’t gone away overnight, and won’t.

And Powell dismissed concerns about the supply disruptions as well, saying that “a bottleneck, by definition, is temporary”.

In a sense, Powell is right. A lot of supply disruptions are short-lived. But there are more inflationary factors operating right now, to name just a surge in the broad money supply. So, I’m afraid that he might be too conceited and understated the risk of higher inflation. You know, a lot of economic trends last – until they don’t. I’m referring here to the fact that the macroeconomic conditions change not gradually but rather abruptly. Inflation may remain low as long as inflation expectations are well-anchored, but if they become unanchored, inflation may rise quickly.

Importantly, Powell was also unmoved by the recent rally in the bond yields:

Rates have responded to news about vaccination, and ultimately, about growth (…) In effect there’s been an underlying sense of an improved economic outlook (…) That has been an orderly process. I would be concerned if it were not an orderly process, or if conditions were to tighten to a point where they might threaten our recovery.

Yellen also sounded rather hawkish in her prepared remarks, as she wrote that “we may see a return to full employment next year.” Yellen also admitted that asset valuations are high, but that she wasn’t worried about financial stability, nevertheless: “I’d say that while asset valuations are elevated by historical metrics, there’s also belief that with vaccinations proceeding at a rapid pace, that the economy will be able to get back on track”. However, she argued that economy needed more help to recover fully.

Importantly, Yellen admitted that higher taxes would be likely needed to raise revenues for increased government spending: “But longer run, we do have to raise revenue to support permanent spending”. Tax hikes could be negative for Wall Street and the economy, and thus, supportive for the price of gold.

Implications for Gold

What do Powell and Yellen’s testimonies imply for the gold prices? Well, the two most important economic figures in the U.S. didn’t surprise the markets, so the yellow metal reacted little to their statements, as the chart below shows.

However, as both Powell and Yellen sounded rather optimistic about economic growth this year, their remarks might prove negative for the yellow metal. What can be particularly bad for gold is Powell’s calm stance regarding the rising bond yields. Of course, he could just put a good face on higher interest rates, but gold would prefer a more dovish stance. However, gold’s lack of a larger bearish reaction to rather upbeat testimonies from Powell and Yellen can actually be taken as an optimistic symptom. Anyway, a more accommodative stance of the Fed would be very helpful for the yellow metal.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Powell Sounds Dovish, but Is He Dovish Enough for Gold?

March 23, 2021, 10:44 AMAlthough dovish, Powell downplayed the bond yield rally. The Fed’s more tolerant stance on inflation is good for gold, but the metal may continue its bearish trend in the short-term.

In the last edition of the Fundamental Gold Report, I analyzed the latest FOMC statement on monetary policy and economic projections. Today, I would like to focus more on Powell’s press conference. My reading is that the Fed Chair sounded like a dove. First of all, he emphasized several times that the jump in inflation this year will be only transient, resulting from the base effects and rebound in spending as the economy continues to reopen. And Powell explicitly stated that the US central bank will not react to this rise in consumer prices (emphasis added):

Over the next few months, 12-month measures of inflation will move up as the very low readings from March and April of last year fall out of the calculation. Beyond these base effects, we could also see upward pressure on prices if spending rebounds quickly as the economy continues to reopen, particularly if supply bottlenecks limit how quickly production can respond in the near term. However, these one-time increases in prices are likely to have only transient effects on inflation (…) I would note that a transitory rise in inflation above 2 percent, as seems likely to occur this year, would not meet this standard [i.e., the Fed’s goals of maximum employment and stable prices].

Second, Powell also pointed out that we are still far, far away from reaching the Fed’s employment and inflation goals. So, investors shouldn’t expect any hikes in the interest rates or any taper tantrum anytime soon. He was very clear on that, saying that it’s not yet time to start talking about tapering, and that the Fed will announce well in advance any decision to taper its quantitative easing program. Indeed, in a response to the question “is it time to start talking about talking about tapering yet”, he said:

Not yet. So, as you pointed out, we’ve said that we would continue asset purchases at this pace, until we see substantial further progress. And that's actual progress, not forecast progress. (…) We also understand that we will want to provide as much advance notice of any potential taper as possible. So, when we see that we’re on track, when we see actual data coming in that suggests that we're on track to perhaps achieve substantial further progress, then we'll say so. And we'll say so well in advance of any decision to actually taper.

Third, the Fed Chair reiterated a few times that the Fed’s changed its approach and it will not react to the forecast progress, but only to the actual progress, stating that:

the fundamental change in in our framework is that we’re not going to act preemptively based on forecasts for the most part. And we’re going to wait to see actual data (…) And we’re committed to maintaining that patiently accommodative stance until the job is well and truly done.

It makes some sense, of course, but it also increases the risk that the Fed’s response to rising inflation will be delayed. The same stance was adopted in the 1970s, when the central bankers believed that they would have plenty of time to react to any dangerous increases in consumer prices. But such an approach resulted in inflation getting out of control, leading to great stagflation. Gold shined then.

Implications for Gold

What does this all mean for the gold prices? Well, latest Powell’s remarks were dovish, which should support the yellow metal. But, as the chart below shows, we don’t see such a support reflected in the gold prices (London P.M. Fix).

Part of the problem is that the bond yields continued to rise, after a short pullback amid the FOMC statement, exerting further downward pressure on the gold prices. A related issue here is that although Powell sounded generally dovish, he expressed a relaxed view on the current rally in the interest rates. Indeed, when replying to a question on the bond selloff, Powell just said that “we think the stance of our monetary policy remains appropriate”. So, his comments imply that the bond yields have room to move further up in the near-term, thus hurting the price of gold.

However, there is certainly a level of interest rates that would be uncomfortable for the Fed (and Treasury), forcing it to intervene more decisively in the financial markets, and we’re not necessarily far from this level. Furthermore, given the rising inflation and inflation expectations, the real interest rates should rise at a slower pace than the nominal yields, and if they do actually fall, they would support the price of gold.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Fed Sees Higher Inflation. Will It See Higher Gold Prices Too?

March 19, 2021, 11:00 AMThe Fed now sees faster GDP growth, higher inflation, and no interest rate hikes until 2023. This new outlook is fundamentally positive for the gold market.

On Wednesday (Mar. 17), the FOMC published its newest statement on monetary policy. A statement that was little changed. The main modification being that the U.S. central bank has noticed that indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. The Fed also pointed out that inflation continues to run below two percent. So, the statement itself is mixed, as the emphasis on the improvement in economic indicators is rather hawkish, while explicitly mentioning the fact that inflation remains below the Fed’s target is rather dovish.

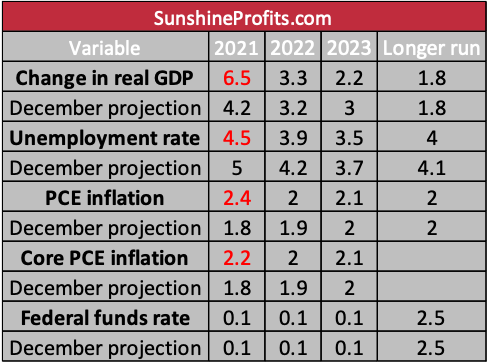

Importantly, the FOMC also issued yesterday its fresh economic projections. They can have quite the impact on the precious metals market, as the Fed forecasts a lower unemployment rate, higher GDP growth and higher inflation, as the table below shows.

The biggest updates in economic projections pertain to this year. In particular, the FOMC expects that the GDP will soar 6.5 percent in 2021, compared to a 4.2 percent rise expected in December. That’s a huge change! Meanwhile, the unemployment rate is forecasted to decrease to 4.5 percent instead of the 5 percent expected in the previous projections. So, it seems that the FOMC has incorporated the latest U.S. fiscal stimulus into its dot plot, assuming that Biden’s fiscal program will significantly boost the GDP growth, while reducing the unemployment rate. I remain skeptical whether we will see such a reduction in the unemployment rate, given the generous government support, which could potentially decrease the motivation to work, but time will tell.

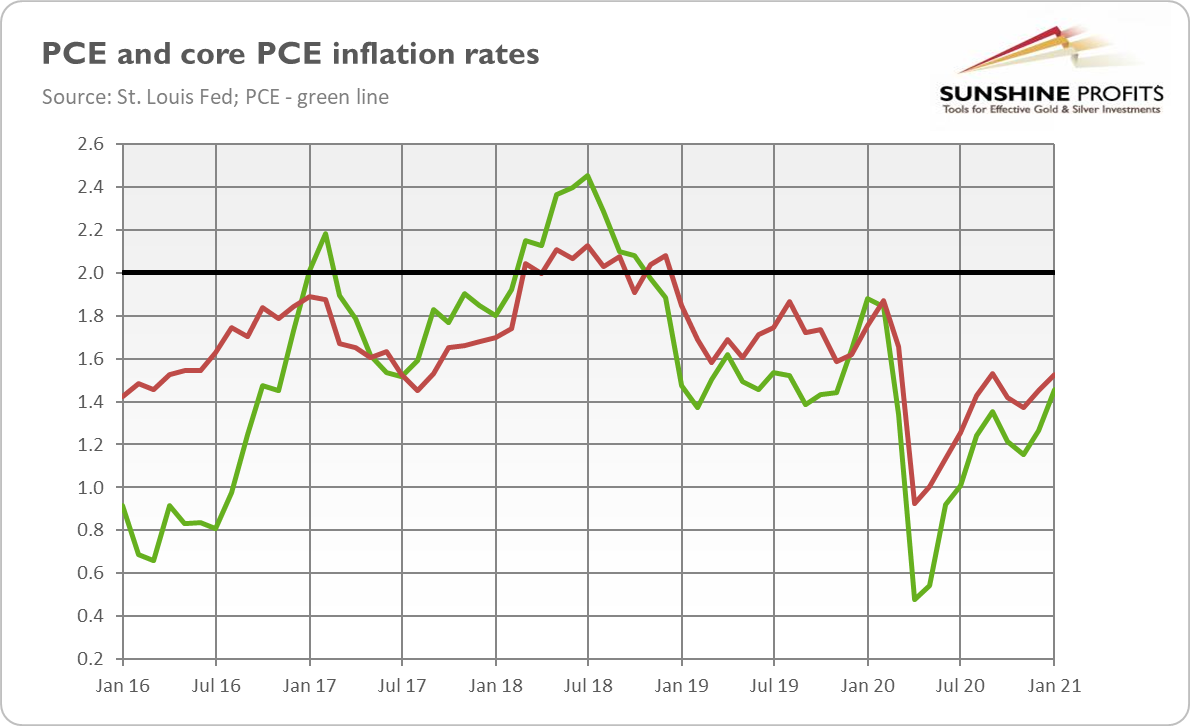

What is really interesting of note is that the Fed has also updated its inflation outlook. The FOMC members now believe that the PCE inflation will jump to 2.4 percent this year, compared to just 1.8 percent seen in December. Importantly, U.S. central bankers expect that the core PCE inflation will also rise faster, although slower than the overall index, reaching 2.2 percent in 2021, versus the 1.8 percent projected previously.

Implications for Gold

What does this all mean for gold prices? Well, the updated economic projections are good news for the yellow metal, at least from the fundamental point of view. This is because the Fed officials have officially acknowledged that inflation will jump this year. And not just “jump” – it will soar above the Fed’s two-percent target! Whoa, if this happened, it would be the first time since late 2018, as the chart below shows!

The U.S. central bank has also admitted that Biden’s plan – which clearly has the biggest impact on the updates in economic projections – will not only stimulate some growth, but it will also entail some inflation. This implies that the Fed expects households and companies will not save all the additional money they will get, but will rather start to spend, lifting both the GDP and consumer prices.

And what is of particular importance is that despite all these upward revisions in the expected pace of economic growth and inflation, the FOMC members haven’t changed the projected path of the federal funds rate. It means that the Fed is not going to react to the jump in inflation and tighten its monetary policy. So, the U.S. central bank will stay behind the curve, allowing for further reductions in the real interest rates. It goes without saying that higher inflation and lower real interest rates would be positive factors for gold prices.

However, although the price of gold soared on Wednesday (Mar. 17) above $1,750, it erased much of these gains yesterday (Mar. 18) and continues to suffer today. Why? Well, what is crucial is not merely the Fed’s signals, but whether investors trust them. And it seems that the markets doubt whether the U.S. central banks will not hike interest rates until 2023, especially considering that the rise in inflation is expected by many to be only temporary and that the number of hawkish FOMC members who see the hikes next year as appropriate has increased from one to four.

So, these fears of sooner-than-expected rate hikes, or the next taper tantrum, together with the still present risk of further rises in the bond yields, may still exert some downward pressure on the gold prices. But from the fundamental point of view, the recent FOMC projections, and Powell’s press conference (which I will cover next week), have been generally more dovish than expected and, thus, positive for the gold. Time will tell whether this event will be sufficient to alter the current bearish trend.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

ECB Accelerates Its Asset Purchases. Gold Needs Fed to Follow Suit.

March 16, 2021, 10:38 AMThe ECB accelerated its asset purchases, but unless the Fed follows suit, gold may continue its bearish trend.

On Thursday (Mar. 11), the European Central Bank decided to accelerate its asset buying under the Pandemic Emergency Purchase Program:

Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

The decision came after a rise in the European bond yields that has mirrored a similar move in the U.S. Treasuries (see the chart below). Christine Lagarde, the ECB President, was afraid that increasing borrowing costs could hamper the economic recovery, so she decided to talk down the bond yields.

Indeed, the growth forecasts for the EU have deteriorated recently amid the persistence of the pandemic and painfully slow rollout of the vaccines. According to the ECB, the real GDP of the bloc is likely to contract again in the first quarter of the year. So, the increase in the market interest rates could additionally drag down the already fragile economic recovery:

Market interest rates have increased since the start of the year, which poses a risk to wider financing conditions. Banks use risk-free interest rates and sovereign bond yields as key references for determining credit conditions. If sizeable and persistent, increases in these market interest rates, when left unchecked, could translate into a premature tightening of financing conditions for all sectors of the economy. This is undesirable at a time when preserving favourable financing conditions still remains necessary to reduce uncertainty and bolster confidence, thereby underpinning economic activity and safeguarding medium-term price stability.

Implications for Gold

What does this all mean for gold prices? Well, the ECB’s move should prove rather negative for the price of gold, at least initially. This is because the loosening of the European monetary policy could weaken both the euro and gold against the U.S. dollar. Indeed, as the chart below shows, although the price of gold increased on Thursday, it declined one day later.

Moreover, the acceleration in the ECB’s quantitative easing could further widen the divergence in the interest rates (that started rising in the third quarter of 2020, as one can see in the chart below) between the U.S. and the EU, which should also support the greenback at the expense of the yellow metal.

On the other hand, the fact that the ECB has intervened in the markets – announcing acceleration in the pace of its asset buying program, after a certain rebound in the bond yields – could turn out to be positive for gold prices, at least in the long-run. This is because it shows how fragile the modern economies are and how dependent they have become on cheap borrowing guaranteed by the central banks.

As I noticed earlier in the past, we are in the debt trap – and the central banks will not allow for the true normalization of the interest rates. The latest ECB’s action is the best confirmation that suppression of the real interest rates will continue, thus supporting gold prices. After all, the ECB has effectively put a cap on bond yields, introducing an informal yield curve control.

So far, only the ECB has intervened in the markets, but other central banks could follow suit. This week, the Fed will announce its decision on the monetary policy. And we cannot exclude that the American central bank will also signal a more dovish stance to calm the turmoil in the bond markets and prevent further increases in the interest rates. One thing is certain: gold needs some fresh dovish hints from the Fed to go up. Unless the Fed further eases its stance, I’m afraid that gold will continue its bearish trend.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM