-

Fed Stays Steady While BoJ Expands the Stimulus. What About Gold?

April 30, 2020, 10:47 AMThis week is hot for central banking: the Bank of Japan and the Federal Reserve have already held their monetary policy meetings. The former expanded its monetary policy easing, while the Fed remained steady. What do all these actions imply for the gold market?

Bank of Japan Expands Its Monetary Policy Easing...

This week is hot in the world of central banking: the Bank of Japan and the Federal Reserve have already held their monetary policy meetings, while the statement of the European Central Bank is scheduled for today.

Let's start from the BoJ. On Monday, the central bank of Japan expanded monetary stimulus, as the pandemic pain worsens. The BoJ sharply downgraded its economic forecast and now expects that the real GDP will decrease in fiscal year of 2020 between -5.0 to -3.0 percent, down from +0.8 to +1.1 percent forecasted in January. The central bank kept interest rates unchanged, but it loosened its monetary policy in two significant ways. First, it will nearly triple the maximum amount of additional purchases of corporate bonds and commercial paper. The expanded quantitative easing should theoretically be supportive for gold, but it boosted the Japanese stock market, and it could weaken the yen against the US dollar - the alternative for gold as a safe-haven asset.

Second, the BoJ removed the upper limit of an annual pace of 80 trillion yen and announced the unlimited purchases of government bonds: "The Bank will purchase a necessary amount of JGBs without setting an upper limit so that 10-year JGB yields will remain at around zero percent". It is in a way just a symbolic move, as the BoJ has only purchased less than 20 trillion yen per year, but it shows that the central bank is really determined to control the yield curve. Welcome financial repression, the true-and-tried gold's friend.

As the Bank of Japan is the vanguard of the unconventional monetary policy, investors should not be surprised when they see in the future that the ECB and the Fed also control the yield curve. Actually, this is what they already do, at least partially. So please be prepared that the ultra low bond yields could stay with us for long. This would be good news for the gold bulls, as the yellow metal shines the brightest in the environment of low real interest rates.

While Fed Stays Steady

Yesterday, the FOMC published its April policy statement. The US central bank held its monetary stance steady, i.e., it kept the federal funds rate at unchanged level close to zero and it did not alter its unconventional stimulus programs. The Fed reiterated that it was "committed to using its full range of tools to support the U.S. economy in this challenging time."

At his press conference, Powell acknowledged that the US entered a deep recession. He said:

It is clear that the effects on the economy are severe. Millions of workers are losing their jobs. Next week's jobs report is expected to show that the unemployment rate, which was at 50-year lows just two months ago, has surged into double-digits. Household spending has plummeted (...) Manufacturing output fell sharply in March and is likely to drop even more rapidly this month as many factories have temporarily closed. Overall, economic activity will likely drop at an unprecedented rate in the second quarter.

Let's stress here a few things from the press conference. First, Powell said that the Fed will use its lending powers "forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery". This is very strong, dovish rhetoric. It means that the ZIRP will not disappear anytime soon. Given the history of sluggish normalization of the monetary policy in the aftermath of the Great Recession, the very low interest rates and the enormous Fed's balance sheet will stay with us for years. As the chart below shows, the Fed's balance sheet has increased almost $3 trillion in 2020! This is good news for the yellow metal.

Chart 1: Fed's balance sheet from January 2008 to April 22, 2020.

Second, Powell admitted that it was practically impossible to predict when the economy starts to improve. Importantly, he acknowledged that even when social distancing rules are eased, people could still worry and, thus, we won't go back to pre-coronavirus levels for some time, especially that there is a risk of viral resurgence. All this means that investors believe that the US will recover faster than both the economists and the Fed think. We are afraid that such expectations are too optimistic. If investors adjust them, we could see stock prices to decline - then, gold prices could initially fall as well due to the liquidity-driven selloff, but they should rally later due to the safe-haven demand.

Third, it's important not only what Powell said but also what he did not say. Importantly, the Fed did not suggest more dramatic measures such as negative interest rates or buying stocks. The fact that the Fed does not think right now about new moves, is bad for gold. However, the realization that the US central bank is not going to buy equities, could halt the current rally in the stock market, which could also affect the gold market. Over at Stock Trading Alerts, we're keenly feeling for the winds of change - right now though, we're profiting on the stock upswing.

Implications for Gold

The latest FOMC meeting did not bring anything unexpected. Powell did not light up the fireworks. However, we still learned a few important things. The most important takeaway is that the Fed's unconventional monetary policy and zero interest rates will not disappear anytime soon. It remained steady in April, but the Fed maintains its dovish bias, which should support gold prices in the long run. After all, in the current economic environment of high indebtedness, elevated stock valuations, enormous uncertainty, low real interest rates and rising money supply, more and more investors are likely to add some gold into their portfolios.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Will Oil Going Negative Boost Gold Prices?

April 23, 2020, 4:52 AMMonday was a special day in the oil market, to say the least. First ever, if you will. But what does the turmoil imply for the gold market?

Oil Prices Plunge Below Zero

By now, we're all used to negative real interest rates and even negative nominal interest rates or bond yields. But on Monday, it turned out that even oil prices could go negative! Unfortunately, it does not mean that we now get paid on filling up the gas tank. Nor it implies that the economic laws ceased to operate while the world ends. As Nadia Simmons explained in the Oil Trading Alert, the negative oil prices only meant that the nearest futures contract for the WTI was trading below 0, as there is oversupply right now that resulted in the storage shortage for oil. So, investors tried to sell their futures before oil would be delivered to them with nowhere to store it.

I am not an oil expert - so I encourage you to read Oil Trading Alerts - but from the fundamental point of view, oil prices should rebound somewhat (not necessarily to the pre-pandemic level) in the long run. After all, the global demand for oil declined about 30 percent, while the OPEC and Russia agreed to cut production by about 10 percent. But the price of oil declined as much as two thirds! And, as the old economic adage says, the cure for low prices of a commodity (so it does not work for gold which behaves more like a currency) are low prices - producers will have to cut production at some point in the future (or they go bankrupt, also decreasing the supply), which should restore the equilibrium in the market.

Gold To Oil Ratio Surges

What is really interesting for us, is the relationship between the gold and oil prices. Unfortunately we have only data up to April 9, but you'll get the point anyway. As the chart below shows, we are observing right now a divergence between these two commodities. Although oil prices plunged by two third, the price of gold actually increased in the aftermath of the coronavirus pandemic.

Chart 1: Gold prices (yellow line, left axis, London PM Fix) and the crude oil prices (black line, right axis, WTI) from January 2 to April 9, 2020

Well, it should not be surprising - after all, gold is not merely a commodity, but also a monetary metal and the safe-haven currency. So, in times of economic crises, when global demand plunges while the risk aversion soars, gold outperforms industrial commodities. However, the scale of the divergence is striking.

Let's take a look at the chart below, which shows the gold to oil ratio. As one can see, the ratio between these two prices soared, increasing above 100 in March. You cannot notice this on the chart, but the ratio is now above 70, still much more than the historical average (we see similar trends in the ratio between gold and other precious metals). Gold may obviously go down in the short term, especially if we see a selloff in the stock market, but we think that oil prices would rather rise in the longer run. They can increase, of course, in tandem with gold prices, although at a different pace.

Chart 2: Gold to oil price ratio from January 1986 to April 2020

S&P 500 to Oil Ratio Also Soars

What is also interesting, is the current divergence between the oil market and the stock market. As the chart below shows, the ratio between black gold and the S&P 500 has soared recently.

Chart 3: S&P 500 to Oil Ratio from April 2015 to April 2020

This is really striking. Oil prices collapsed because global demand plunged. But why didn't the stock market fall as much? If the stock market is forward-looking, why the oil market is not looking through the valley as well? I know that both markets have their specific features (we deal with the key US stock index in Stock Trading Alerts) and that there are many companies in the S&P 500 not as sensitive to the same factors as the oil price is. But the observed divergence may suggest that not only the oil price should rebound in the long run (if we assume that the ratio is likely to reverse to the mean, which does not have to happen), but also that the stock market may eventually decline further.

After all, the stocks of oil producers should suffer after the carnage in the oil market. In particular, the US shale oil industry may be hit. It should strengthen gold as a safe-haven asset and as a hedge against equities, although the selloff in the stock market may pull gold down initially, as we observed it in March.

Implications for Gold

What does it all mean for the gold market? Well, the turmoil in the oil market could add the volatility in the stock market. It fell on Monday and Tuesday, but it remains to be seen whether we will see further declines on the way. Although there is sometimes correlation between oil prices and gold prices (due to their sensitivity to inflation), this time we see a clear divergence, as gold behaves like the safe-haven currency, not the commodity. There is also an intriguing divergence between the oil market and the stock market, which can be partially explained by the Powell's put, i.e., the Fed's ability to support the financial markets in times of turbulence. But, I have a good news for the gold bulls: the Fed can inflate financial assets, but it can't print gold, so eventually we should see higher gold prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Coronapocalypse Is Deeper than the Great Recession. Will Gold Shine Even More?

April 21, 2020, 5:45 AMThe recent economic reports show that the current coronavirus crisis will be bigger than the Great Recession. What does it imply for the gold market?

US Economic Data Paints a Gloomy Picture

This week was full of new reports about the US economy. And guess what, I don't have good news... First of all, let's start with the update about the weekly initial unemployment benefits. In normal times, the initial claims are not too keenly watched by investors. But in times of a pandemic, they are very informative. The spike in the initial claims may even become the symbol of this crisis. Anyway, the number of new claims for the unemployment benefits declined from 6.6 million in the previous week to 5.2 million in the week from April 4 to April 11, as the chart below shows.

Chart 1: Initial jobless claims from April 2019 to April 2020.

That's good that the number is not accelerating, but, hey, more than 5 million of Americans applied for unemployment benefit in just one week, about 25 times more than before the epidemic! And do you know what is even crazier? The monthly figure. In just the past four weeks, 22 million people went unemployed.

Now, I have two questions for you. First, how many Americans were in unemployment in February, before the outbreak of epidemic? I'll tell you: 5.8 million. So, in just one month we almost quadrupled this number. Second, do you know what is the implied unemployment rate? Well, when we add 22 to 5.8 million, and subtract the exact number from the pool of employed number, we will get 20.3 percent. Yup, more than 20 percent. So it is already higher than during the Great Recession and almost as high as during the Great Depression! Of course, our estimates may overestimate the unemployment rate as some people rather dropped out from the labor force, but still, the situation in the US labor market has become unbelievably grim in a unprecedentedly short a time.

Second, retail sales plunged a record 8.7 percent in March compared to the previous month, as one can see in the chart below. The decline was more than double the biggest one-month drop during the global financial crisis. Importantly, given that the lockdown began only in mid-March and initially sparked a panic buying of necessities, April will be much worse.

Chart 2: US retail sales (% monthly change) from February 1992 to March 2020.

Third, the industrial productionplunged 5.4 percent in March, as pandemic led many factories to suspend operations late in the month. As the chart below shows, it was a bigger decline than during the Great Recession. Actually, it was the biggest drop since early 1946. Moreover, capacity utilization for the industrial sector decreased 4.3 percentage points to 72.7 percent in March, the lowest level since the Great Recession. Again, the worse is yet to come in April.

Chart 3: Industrial production index (monthly % change) from November 2007 to March 2020.

Fourth, the recent readings of the regional manufacturing indices for April also reveal the deep economic crisis. For example, the New York Federal Reserve's Empire State business conditions index plunged from -21.5 to the -78.2 in April, the lowest number on record. Meanwhile, the Philadelphia Fed manufacturing index dropped from -12.5 in March to -56.6 in April, the lowest reading since July 1980.

Moreover, the National Association of Home Builders' monthly confidence index fell from 72 in March to 30 in April, the largest monthly change in the 30-year history of the index. So, it seems that the pandemic is also affecting construction and the real estate market.

Last but not least, the newest Beige Book indicates that economic activity contracted sharply and abruptly across all regions in the United States as a result of the COVID-19 pandemic. Importantly, most business contacts expect conditions to worsen in the next several months.

Implications for Gold

What does it all imply for gold from the fundamental point of view? Well, let's face it. This economic crisis is very deep, much deeper than Great Recession. So, if gold rallied to $1,900 in the aftermath of the Lehman Brothers' bankruptcy, why shouldn't it rally also now, when the economic calamity is much greater? After all, the real interest rates are lower, while the public debt is higher than a decade ago.

The only reason could be that this crisis, although deep, will turn out to be short-lived. It is, of course, possible, if some genius develops an accepted amazing treatment. I wish the pandemic ended quickly. I wish it could be just a one-and-done crash like in 1987. However, I'm afraid that we will not see a V-shaped recession, nor even a U-shaped depression, but rather a shift into the socially-distanced economy that operates at half capacity for some period of time. And the longer the crisis lasts, the higher chances that other "black swans" will land. Many things may happen: some banks or big companies may go bankrupt, or Italy can default on its bonds, etc. You see, the current financial system based on the fractional reserve banking, fiat money, moral hazard, high debt, low interest rates, is very fragile, so I bet that the risk aversion will remain high. Anyway, the interest rates should remain at ultra low levels. So, there are decent chances that we will see higher prices of safe-haven assets such as gold later this year.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Does Gold Really Care Whether Coronavirus Brings Us Deflation or Inflation?

April 16, 2020, 5:52 AMOne of the many bothering issues about the coronavirus crisis, is whether it will turn out to be inflationary or deflationary. What do both of these scenarios mean for gold ahead?

US Inflation Rate Declines in March

Many people are afraid that the coronavirus crisis will spur inflation. After all, the increased demand for food and hygiene products raised the prices of these goods. Moreover, the supply-side disruptions can reduce the availability of many goods, contributing to their increasing prices.

On the other hand, the current crisis results not only from a negative supply shock, but also from a negative demand shock. As a result of uncertainty, people cling to cash and forego unnecessary expenses. In addition, social distancing means reduced household spending on many goods and services, which exerts deflationary pressure. The most prominent example is crude oil, whose price has temporarily dropped to just $20 a barrel (although this was partly due to the lack of agreement between OPEC and Russia). Lower fuel prices will translate into lower CPI inflation rate. Entrepreneurs, especially those with large stocks of goods, will probably lower prices to encourage shopping. Moreover, the appreciation of the US dollar means lower prices of imported goods.

So, the disinflation pressure should prevail in the short term - and indeed, the first inflation readings in America (but also in other Western countries) show a decline in inflation. For example, the US CPI inflation rate declined 0.4 percent in March, following a 0.1 percent increase in February. It was the largest monthly decline since January 2015. The decrease was mainly driven by a sharp decline in the gasoline prices. However, the core CPI rate, which excludes energy and food prices, also decreased in March - by 0.1 percent (versus 0.2 percent rise in February), which was its first monthly decline since January 2010.

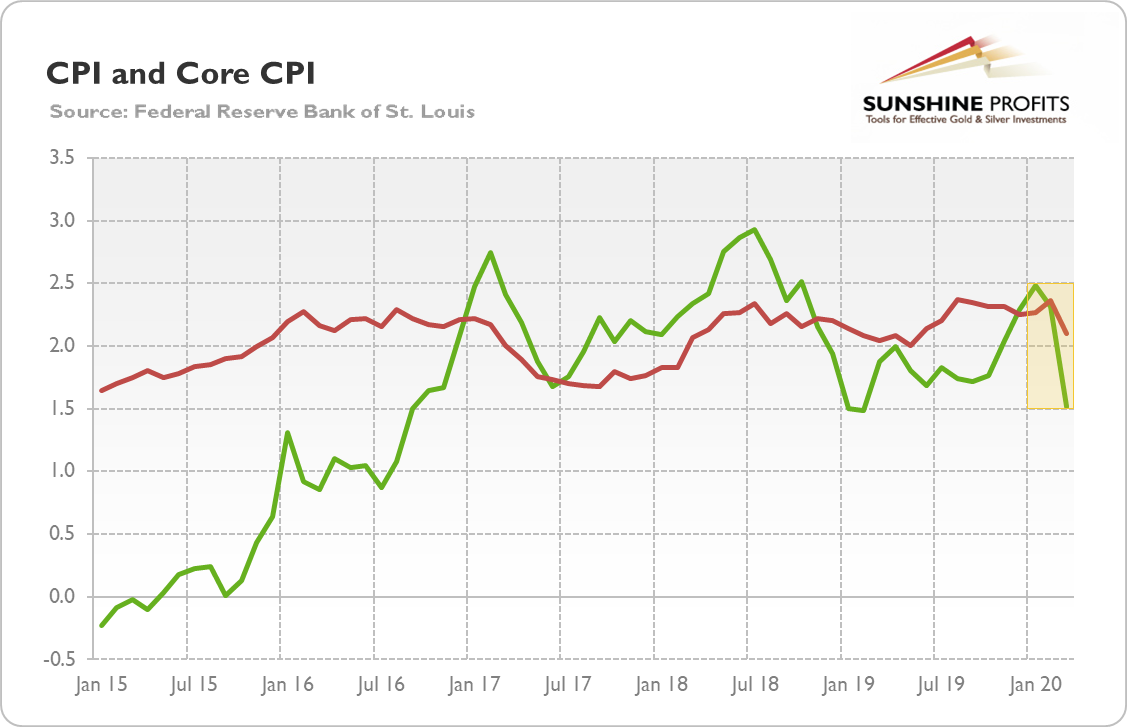

On an annual basis, the overall CPI increased 1.5 percent, which is a notably weaker increase than the 2.3 percent rise in February. The core CPI rose 2.1 percent over the last 12 months, compared to the 2.4 percent increase in the previous month. The chart below shows these disinflationary trends.

Chart 1: US CPI (green line) and core CPI inflation rate (red line) from January 2015 to March 2020.

So, Should We Expect Deflation?

No. I'm, of course, perfectly aware that the Great Recession was deflationary, as the CPI inflation rate plunged from 5.5 percent in July 2008 to -1.96 in July 2009. However, this crisis is different from the previous one. Neither during the global financial crisis nor during the Great Depression did we have a situation where such a large proportion of society does not go to work. So, the global quarantine with the associated limited international trade and broken supply chains imply that the productive capacity of the economy will suffer. And this may result in stagflation rather than deflation.

Moreover, the commercial banks are relatively healthy this time, which means that they are able to extend credit. Please note that this is the core of all emergency programs introduced by the Fed and other central banks all over the world. They encourage commercial banks to grant new loans to companies that have suffered as a result of the coronavirus crisis and social distancing. As the chart below shows, the credit supply in the US has accelerated in March.

Chart 2: US Bank credit (annual percentage change) from April 2015 to April 2020.

Given that in the contemporary monetary system new money supply is created when commercial banks extend credit, we should not exclude the risk of inflation later in the future, after the initial wave of disinflation.

Another inflationary risk factor in the longer term is the inevitable increase in federal debt, which may increase the temptation to monetize it or to strengthen the financial repression. It is widely known that the best times for governments to get out of debt is during negative real interest rates. And this can be achieved either by maintaining very negative nominal interest rates, or by increasing the inflation rate.

Therefore, while in the short term the disinflation scenario seems more likely, the risk of stagflation increases in the longer run, especially with too fast lending and excessive monetization of the debt.Implications for Gold

What does it all mean for the gold market? Well, those who buy gold mainly as an inflation hedge do not have to worry about their holdings - inflationary monster should disappear from our economy. Remember the stagflationary 1970s? Gold soared then.

However, even if the US economy plunges into deflation, I have good news. You see, gold is not just about inflation versus deflation. The yellow metal is a safe-haven asset which may shine during both inflationary and deflationary periods. After all, gold also rallied in the aftermath of the Lehman Brothers' bankruptcy, when the economy plunged into deflation for a while. Why? Well, gold's price is also sensitive to market sentiment and risk aversion. Then, gold is no one's liability. So, when deflation is accompanied by significant economic worries and a loss of confidence in the US dollar, gold may shine. Anyway, gold's future - in a world of negative real interest rates, elevated risk aversion and high public debt - looks bright.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Fed Was Caught Off Guard by the Economic Shock. And Gold?

April 14, 2020, 6:07 AMAnother week passed, and the number of jobless claims increased further. That was clearly not expected by the Fed, as the recent minutes shows. What does it all mean for the gold market?

Unemployment Claims Rose Further

Initial jobless claims have become one the most important data about the US economy these days. So, let's take a look at the chart below, which offers the updated graph revealing the number of new claims for unemployment benefits.

Chart 1: US Initial Jobless Claims from March 23, 2019 to April 4, 2020

As one can see, in the week of March 28 to April 4, 6.6 millions of Americans applied for the unemployment benefit. As the chart shows, this is a lower number than the 6.9 million in the previous week. Still, it means that in just three weeks, almost 16.8 million of US workers applied for unemployment benefits! Surely, part of that number is caused by the poor construction of the government rescue package, which encourages people to go for unemployment, simply because the average worker can get 16 percent more collecting unemployment than he would on the job.

However, the number remains unbelievable high. The official unemployment rate increased from 3.5 to 4.4 percent in March, but it did not capture the full monthly data. Given that 16.8 million of US workers have applied, the real unemployment rate is likely to be higher than 15 percent! It would mean that the US unemployment rate is already above the Great Recession levels - and that it could increase further toward the level last time seen during the Great Depression.

FOMC Minutes

The recently published minutes of the FOMC meeting from March 15 show that the Fed did not understand the gravity of the situation. Although all participants saw US economic activity as likely to decline in the coming quarter and viewed downside risks to the economic outlook as having increased significantly, they have been clearly caught off guard by how quickly the economy has actually deteriorated.

Indeed, the minutes show that "Participants observed that businesses would be more likely to lay off workers on a major scale if the downturn in economic activity came to be perceived as likely to be protracted."

Well, it turned out that almost 17 million of Americans applied for unemployment benefits in mere three weeks. The Fed clearly did not expect such a rapid and deep economic shock! Their poor judgement is striking. Please read this part of the minutes:

Several participants emphasized that the temporary nature of the shock to economic activity, the fact that the shock arose in the nonfinancial sector, and the healthy state of the U.S. banking system all implied that the current situation was not directly comparable with the previous decade's financial crisis and it need not be followed by negative effects on economic activity as long-lasting as those associated with that crisis.

First of all, this is not a temporary shock - unless you "define" temporary as "until the accepted treatment slash vaccine arrives". We will have social distancing - in one form or another - for months. In the last Fundamental Gold Report, I explained thoroughly why I don't buy the story of V-shaped recovery.

Second, the US economy is not healthy. To be clear, commercial banks have more capital and are indeed in better shape. But if they are so rock-solid, why the Fed intervened in the repo market even before the pandemic? As a reminder, the corporate debt of the US nonfinancial companies is at record highs. We could thus expect corporate defaults in the coming days and weekls. Moreover, the US households have little savings or cash buffer. More than 30 percent of renters did not pay their rent by April 5, according to data from 13 million units published by the National Multifamily Housing Council, compared to almost 20 percent who didn't pay by March 5. The segments of the economy are interconnected, so the problems of companies and renters can easily turn into issues for the financial institutions, including commercial banks.

Third, the current economic crisis could prove worse than the Great Recession. In terms of the unemployment rate and jobless claims, it is already much more worse!

Implications for Gold

All this means that the Fed's worst case scenario, which assumes no recovery until next year, is more likely to happen that the more optimistic one, in which economic activity starts to rebound in the second half of this year.

Indeed, the Fed is slowly learning that the situation is really serious. This is why on Thursday, the US central bank took additional steps to provide up to $2.3 trillion in loans to support the economy. In particular, the Fed started the Main Street Lending Program to ensure credit flows to small and mid-sized businesses.

However, as I explained it before, fiscal and monetary stimulus will not fully compensate for loss of output and income. The US economy is simply too big. And please remember that there is no free lunch. It means that all these rescue packages will increase the public debt and hamper productivity growth.

It is, of course, possible that the worst is behind us, the scientist will develop the new silver bullet, and the economy and the stock market will recover quickly. However, I think that we are just entering a recession. And no stock market bottom has never occurred outside of a recession. So, if history is any guide, the worst might actually be yet to come. It means that the price of gold is likely to go higher later this year, when the full scale of the economic calamity will be clear to all investors.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM