-

Will Havoc in the Labor Market and (Dis)Inflation Make Gold Shine?

May 19, 2020, 5:05 AMThere is a true havoc in the US labor market, while inflation rate has declined. What does it mean for the gold market?

True Pandemonium Emerges in the US Labor Market

This week was full of economic data. Let's analyze them, starting, as usual, from the initial jobless claims, which became one of the most carefully studied indicator during the coronavirus crisis. As the chart below shows, in the week from May 2 to May 9, three millions of Americans applied for unemployment benefits.

Chart 1: US Initial Jobless Claims from April 6, 2019 to May 9, 2020

It implies two important things. First, the total number of people who applied for the unemployment benefit surpassed 36 million in the United States. It means that the implied naïve unemployment rate (which assumes no dropouts from the labor market) is almost 35 percent. Yes, you read it correctly: about one third of Americans belonging to the labor force is without job. The real unemployment rate is lower, of course, as some people dropped out from the job market, but, on the other hand, lots of states are still underreporting new unemployment claims as they cannot handle the crush of applications. Anyway, the number is probably higher than during the Great Depression!

Second, although the new initial claims are going to subside as states are reopening their economies, the recovery may be slower than commonly believed. Please look at the chart above once again. Although since the end of March, the number of new claims is on the decline, the US economy still loses several million jobs a week. The number of initial claims reached a peak in just two-three weeks, but six weeks have already passed since the peak and is the pre-pandemic level getting closer in sight?

The current havoc in the US labor market is unprecedented. And what is also unprecedented is the behavior of the stock market, given the ongoing pandemonium. One possible reason might be the hope that the crisis is temporary, which is partially justified. However, it might be also the case that the financial markets are a bit complacent, drugged by the Fed's monetary cocaine. Anyway, gold should get out of crisis strengthened due to the elevated uncertainty, lower real interest rates and higher public debt.

Inflation Rate Drops

And what about inflation? Will we see higher inflation rates? Or lower, as the recent data suggest? The US CPI inflation rate declined 0.8 percent in April, following a 0.4 percent move lower in March. It was the largest monthly decline since December 2008. The decrease was mainly driven by a sharp decline of 20.6 percent in the gasoline prices. However, the core CPI rate, which excludes energy and food prices, also decreased in March - by 0.4 percent (versus 0.1 percent decline in March), as practically all indexes declined, including huge declines in the prices of apparel and transportation services (airline fares posted record drop). The only important exemptions were flat shelter prices, and rising prices of medical care services and food. The drop in the core CPI was the largest monthly decline in the history of the series, which dates to 1957.

On an annual basis, the overall CPI increased 0.3 percent, significantly more than the 1.5 percent rise in March and the 2.3 percent rise in February. It was the smallest 12-month increase since October 2015. The core CPI rose 1.4 percent over the last 12 months, compared to the 2.1 percent increase in the previous month. It was the smallest increase since April 2011. The chart below shows these disinflationary trends.

Chart 2: US CPI (green line) and core CPI inflation rate (red line) from January 2015 to April 2020.

Importantly, gold prices did not show any weakness due to the lower inflation readings. For some people, it might be surprising - but not for our Readers, who know that gold is not just about inflation versus deflation. The yellow metal is a safe-haven asset which may shine during both inflationary and deflationary periods.

Implications for Gold

Does it negate our view that the current crisis could be more inflationary than the Great Recession? Not at all, we actually expected disinflation - we wrote in the Fundamental Gold Report published on April 16 that "in the short term, disinflationary pressure should prevail". So, we never ruled out the possibility of disinflation or even deflation - the disinflationary pressure was obvious for all economists. What we meant and we still mean is that during the current crisis, there are some forces that were absent during the Great Recession. This is perhaps why the disinflationary pressure has been so far weaker than during the global financial crisis and this is why it could consequently cause relatively higher inflation over the medium and long run.

We mean here the quickly rising the supply of credit and of broad money supply. Additionally, the reopening of economies should strengthen the inflationary pressure compared to the lockdown. It should translate into higher prices eventually, which should support the demand for gold as an inflation hedge. However, investors should remember that the increase in the broad money supply affects the prices with significant lag of several months, and it might be also be the case that the inflationary pressure will affect the asset prices more or earlier than the CPI Index.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Powell Sends a Message With Love for Gold

May 14, 2020, 6:03 AMPowell gave a much-awaited speech yesterday, in which he sent one bearish and two bullish messages for gold. What exactly did he say and what does it mean for the yellow metal?

Powell Sends One Bearish and Two Bullish Messages for Gold

Jerome Powell gave a speech yesterday at the Peterson Institute for International Economics. The Fed Chair acknowledged the unprecedented depth of the coronavirus crisis, and its disastrous impact for the US labor market, something we also noted many times:

The scope and speed of this downturn are without modern precedent, significantly worse than any recession since World War II. We are seeing a severe decline in economic activity and in employment, and already the job gains of the past decade have been erased. Since the pandemic arrived in force just two months ago, more than 20 million people have lost their jobs.

There are three key takeaways from Powell's speech. One is negative, while two are good for the gold market. Let's start from the bad news. The Fed Chair rejected the idea of negative interest rates. He noted that the evidence on the effectiveness of these monetary policy experiments conducted by the Bank of Japan and the European Central Bank "is very mixed". Powell was very clear on this issue:

I know that there are fans of the policy, but for now it's not something that we're considering. The committee's view on negative rates really has not changed. This is not something we're looking at.

This is bad news for the gold market, as the yellow metal shines when real interest rates are very low or even negative. The introduction of NIRP could push the yields even lower. Given that some traders started pricing in expectations that the Fed will push interest rates below zero next year, Powell's remarks could be interpreted as more hawkish than expected and, thus, as negative for the gold prices.

However, there were also dovish elements in the speech. First, Powell acknowledged something we have been repeating since the very beginning of this epidemic: the V-shaped rebound is unlikely and there are important downside risks on the way to recovery. He said:

What comes though is there is a growing sense I think that the recovery may come more slowly than we would like (...) The path ahead is both highly uncertain and subject to significant downside risks.

These grim words pushed the stock markets down on Wednesday. Importantly, Powell noted that the longer the recession takes, the more problematic it might become, as "the passage of time can turn liquidity problems into solvency problems." It means that although the easing of the economic lockdown should support the economy, we could see more problems and possibly more bankruptcies on the way (J.C. Penney is planning to file for bankruptcy as soon as tomorrow). The implication is that the safe-haven demand for gold should remain robust for a while, and gold is still a good portfolio's diversifier.

Second, although Powell rejected negative interest rates, he suggested that the Fed's policy toolkit could expand in the future. He said that while the Fed's response to the crisis "has been both timely and appropriately large, it may not be the final chapter". Moreover, Powell's remarks seemed to be designed to put pressure on Congress to do more to support the economy. He reiterated that the Fed has "lending powers, not spending powers," and he noted that "additional fiscal support could be costly but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery."

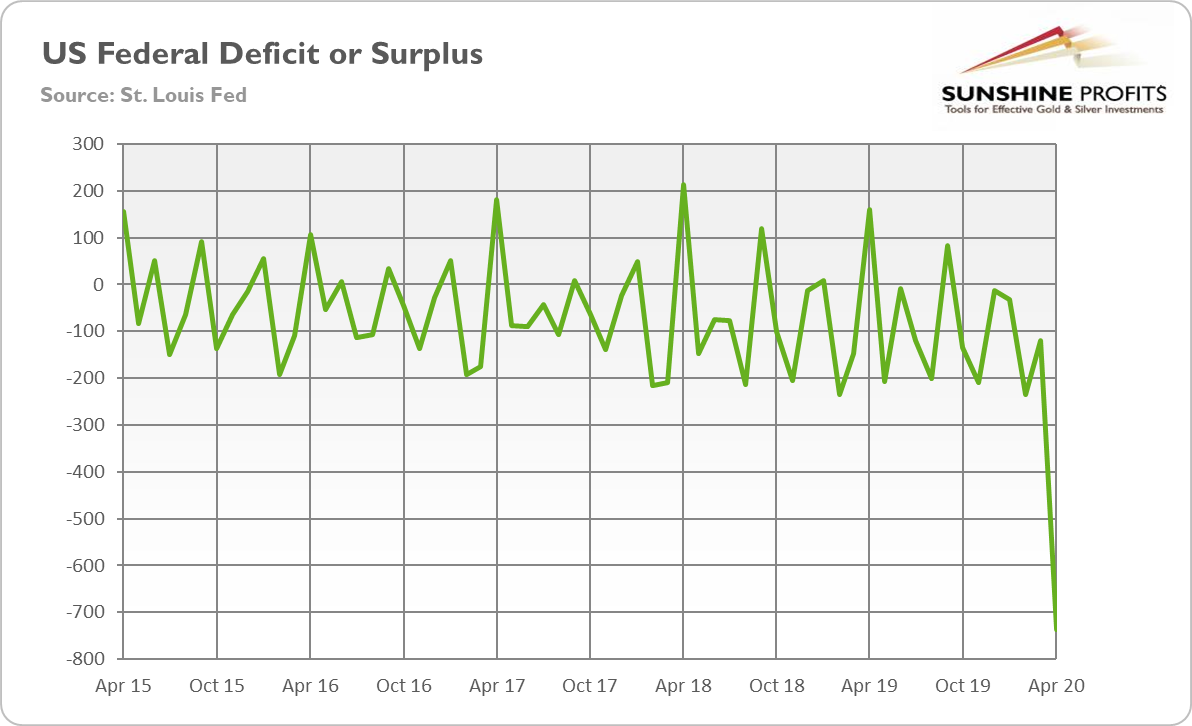

It means that we could see more fiscal deficits and even higher federal debt in the near future. As a reminder, Congress has already spent $2.9 trillion to fight the coronavirus pandemic and the House controlled by Democrats wants to add a new $3 trillion relief measure, despite the fact that the federal government ran a budget deficit of $737.9 billion in April, compared with the surplus of $160 billion in the same month last year, as the chart below shows.

Chart 1: US federal fiscal deficit/surplus (in billions of $) from April 2015 to April 2020.

Normally, higher public debt could drive up interest rates, but the Fed is ready to buy as many Treasuries as needed to keep bond yields at ultra low levels. However, we cannot exclude that at some point, the high federal debt could weaken the US dollar or lead to a sovereign-debt crisis, supporting gold prices.

Summing up, Powell gave a speech yesterday. He rejected negative interest rates, but he suggested that the recent Fed's measures are not the final chapter. As the recovery will be slower than many people still count on, while the uncertainty will be elevated, the Fed and the Treasury will remain dovish - all this means that the fundamentals of the gold market, which were bullish even before the pandemic, have become even more bullish now.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Will Job Market from Hell Support Gold?

May 12, 2020, 7:28 AMApril job report shows a terrible US labor market. Coronavirus destroyed 20.5 million jobs, pushing the unemployment rate to almost 15 percent. How far does the number reflect reality - and what does it actually mean for the gold market?

Apocalypse in the US Labor Market

14.7 percent. Remember this value well, as it will go down in history. This is the official US unemployment rate for April calculated by the Bureau of Labor Statistics. The unemployment rate soared from 3.5 percent in February and 4.4 percent in March. As the chart below shows, the spike is really historic, as such high level has not been seen in modern history.

Chart 1: US unemployment rate from January 1948 to April 2020

Indeed, the number is much higher than the peak noted during the Great Recession, which was considered to be a catastrophically high value. The current unemployment rate is the highest since the Great Depression.

This mammoth increase in the unemployment rate was driven by the giant losses in the nonfarm payrolls. The coronavirus destroyed 20.5 million American jobs in April, an unprecedented monthly change. Indeed, as the chart below shows, the number of destroyed jobs has been the largest since the 1939, when the data series begins.

Chart 2: US nonfarm payrolls from February 1939 to April 2020

The job losses were widespread, but - unsurprisingly - leisure and hospitality was the hardest hit, losing 7.6 million of jobs. Interestingly, during the health crisis and the greatest pandemic since the Spanish flu, even healthcare and social assistance lost 2.1 million of jobs.

Importantly, the real situation in the US labor market is even darker than the Employment Report suggests. Why? First, although the Great Lockdown is gradually unwinding, investors should remember that in the establishment survey, "workers who are paid by their employer for all or any part of the pay period including the 12th of the month are counted as employed, even if they were not actually at their jobs." It means that the current report does not count workers who lost their jobs after April 12 nor people on temporary layoff. As the BLS admits itself, if millions of Americans who have been furloughed and expect to return to their jobs are counted as unemployed, the unemployment rate would have been almost 5 percentage points higher.

Second, the initial claims paints much grimmer picture of the US labor market. As the chart below shows, in the week between April 25 and May 2, about 3.2 million Americans applied for unemployment benefits. It means that about 20 million of people became unemployment in March and about 33.5 million since the beginning of the COVID-19 epidemic. Meanwhile, the Employment Situation Report shows that there are "only" 23.1 million of unemployed people in the US...

Chart 3: US initial jobless claims from April 2019 to May 2020

The partial explanation - and this is the next reason why the US labor market is worse than the official data shows - is that some people who lost jobs, are not counted as unemployed, because they dropped out from the labor market. Indeed, the participation rate, i.e., the ratio of people in the labor force to the civilian population, decreased from 63.4 percent in February and 62.7 in March to only 60.2 in April, as one can see in the chart below. It means that more than 8 million of Americans gave up and removed themselves from the labor market. Please note that the participation rate plunged to the lowest level since January 1973 when only a part of women entered the labor market.

Chart 4: US civilian labor force participation rate from January 1948 to April 2020

And the employment-population ratio, which measures the number of people employed against the total working-age population, also plunged from 60 in March to 51.3 percent in April, the lowest rate and largest over-the-month decline in the history of the series, as the chart below shows. It means that only half of the Americans in the working age have employment.

Chart 5: US employment to population ratio from January 1948 to April 2020

For all these reasons, a better picture of the havoc might be painted by the broader unemployment rates. For example, the U6 unemployment rate, which also includes people marginally attached to the labor force and people employed part time for economic reasons, soared from 7 percent in February and 8.7 percent in March to 22.8 percent in April, as the chart below shows.

Chart 6: US broader unemployment rates (U4 - blue line; U5 - red line; U6 - red line) from January 1994 to April 2020

Implications for Gold

What does it all mean for the gold market? The April Employment Report is the jobs report from hell. There is true horror in the US labor market right now. It will, of course, recover, after the Great Lockdown ends. However, we don't think that the labor market will return to the pre-crisis level. The plunge in the labor participation rate shows that some people already withdrew from the labor market. Some of them will return, but not all of them. And some of the unemployed people will also drop out from the labor market. It means that with so many people unemployed or out of the labor market, the economy will growth rather slowly (after initial recovery that looks statistically great due to low base), which should support the gold prices.

However, the most important consequences for the gold market will be through the economic policy and higher inflation. Let's be honest, already with record low unemployment rate, the Fed started to consider the changed in its inflation target. Now, with the unemployment rate at 15 percent (and possibly higher), the doves will completely dominate the FOMC. In such a macroeconomic environment, all policymakers will focus on providing full employment. Nobody will care about a slightly higher inflation. Of course, the supposed slightly higher inflation could quickly get out of control. We do not say that this is going to happen for sure - what we mean here is that nobody will listen to monetary hawks, if any left, when the unemployment rate is so high, especially in the election year. Thus, the chances of higher inflation are higher, and they should support demand for inflation hedges such as gold.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

Will Gold Decline As Economies Gradually Reopen?

May 7, 2020, 4:43 AMHalf the US States and countries like Italy and Germany are gradually easing lockdowns. Taking measured steps, the moves are broadly cheered. Rightfully so? And what does the reopening mean for the gold market?

Epidemics: Bad, Good, and Ugly

By May 6, 2020, more than total 3.6 million of confirmed cases have been reported in the world and more than 250,000 have already died from the COVID-19. In the United States, about 1.2 million of cases have been identified so far, and more than 71,000 people have died. This is bad news.

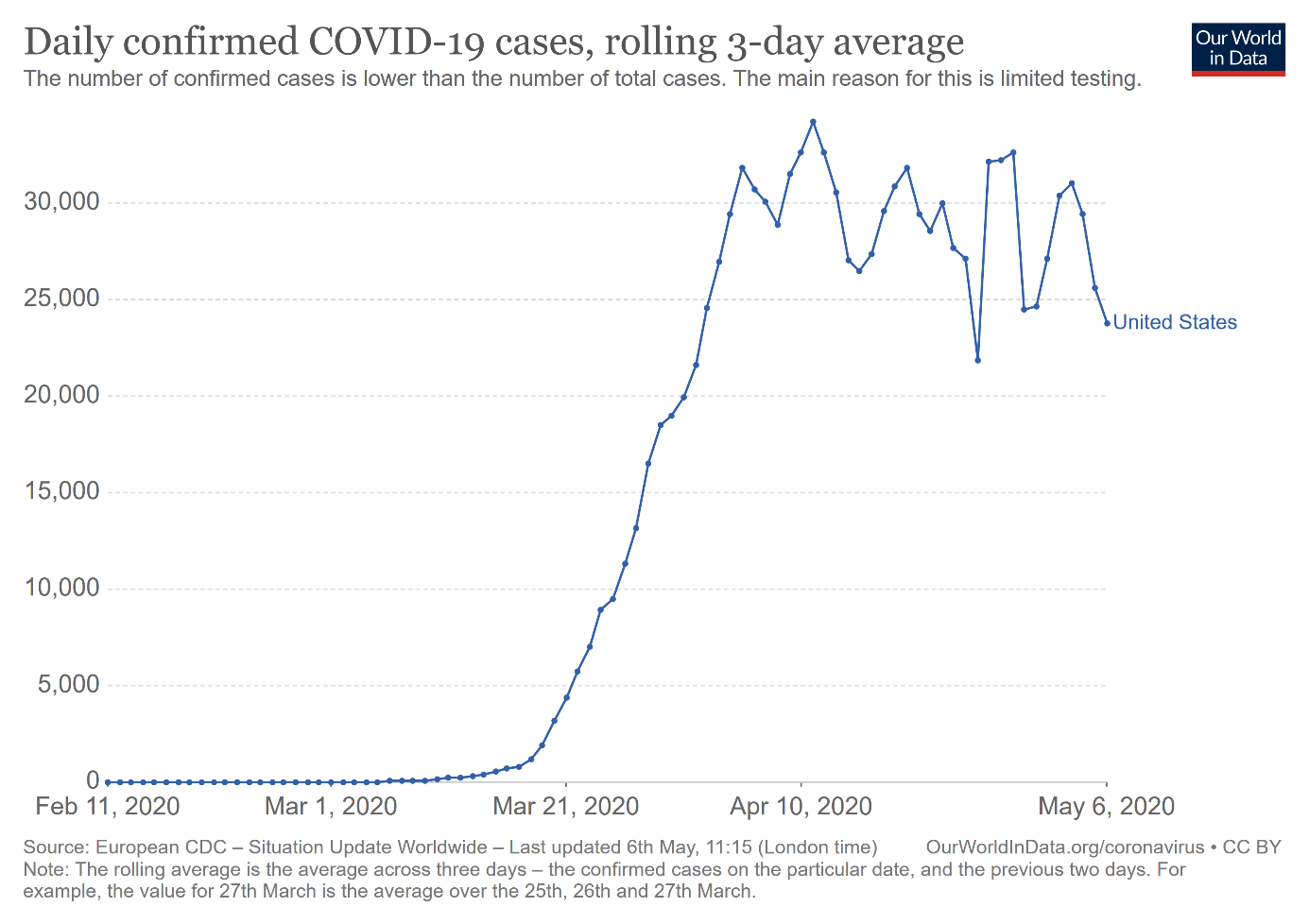

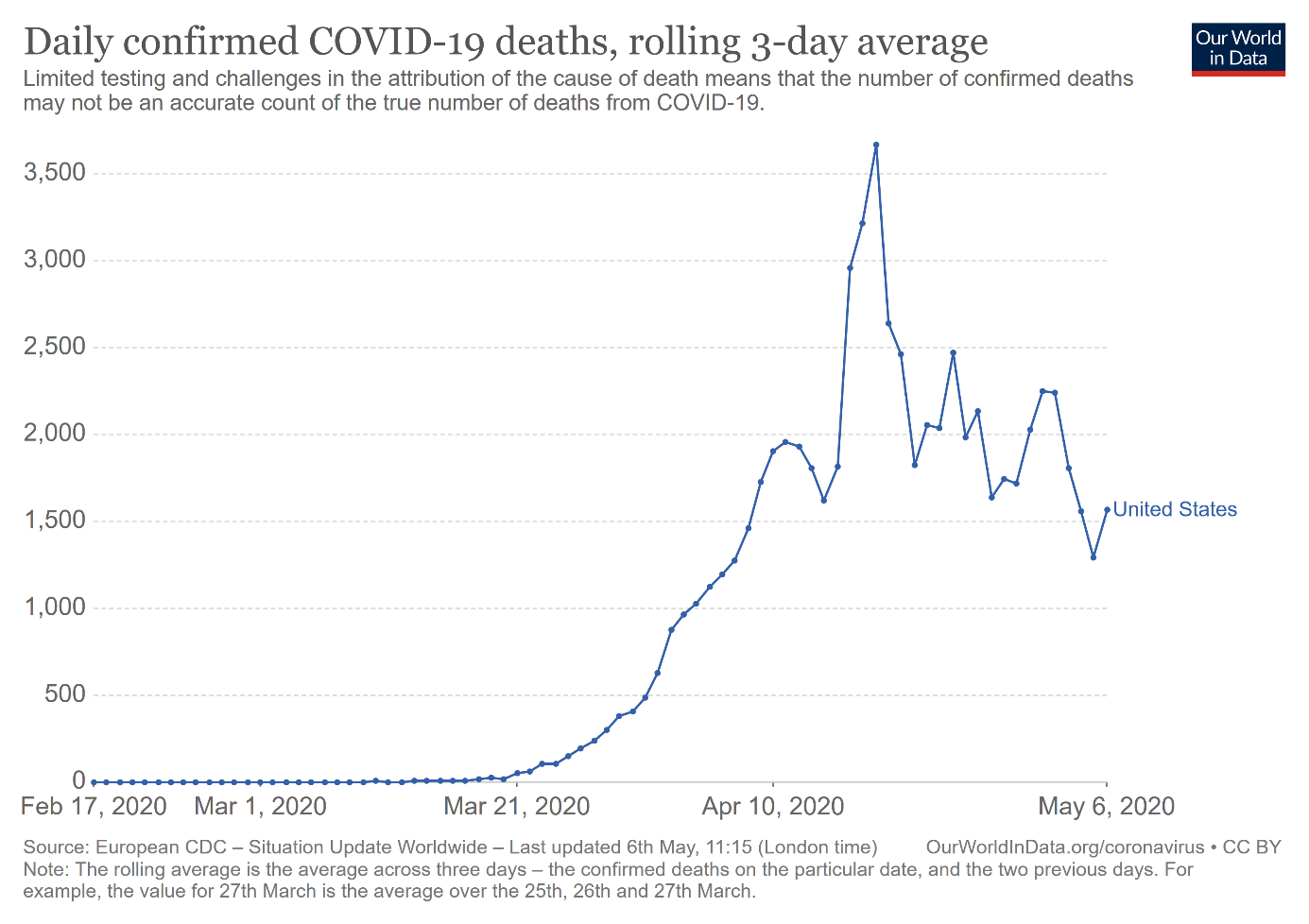

What is good is that the US epidemiological curve has flattened somewhat, which means that the growth pace of infections and deaths, has slowed down. As the charts below shows, the peaks in daily number of both confirmed cases and deaths are beyond us.

Chart 1: Daily confirmed COVID-19 cases (rolling 3-day average) in the US from February to May 6, 2020

Chart 2: Daily confirmed COVID-19 cases (rolling 3-day average) in the US from February to May 6, 2020

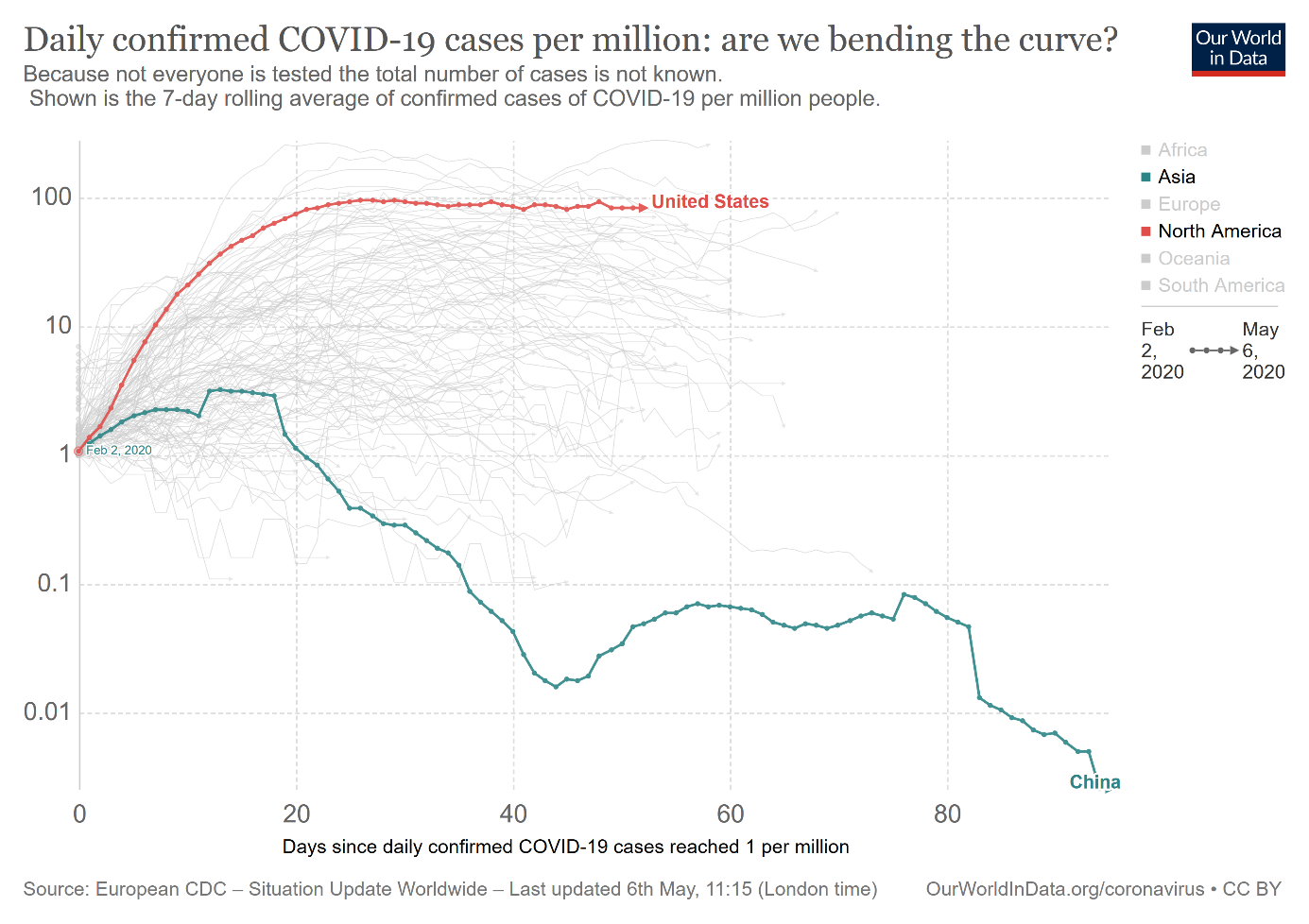

This is really great news, as it means that social distancing worked and we avoided the continuation of the exponential growth. However, the ugly truth is that the epidemic is far from over. As the chart below shows, the US epidemiological curve still remains steeper than for other countries. Indeed, its trajectory does not look still like the curve for China where the epidemic is practically over.

Chart 3: Daily confirmed cases per million people in the US compared to China and other countries.

And what is really disturbing is that the virus is mutating - the new study published by researchers at the Los Alamos National Laboratory found that the coronavirus that emerged in Wuhan, China, has mutated and the new, dominant and even more contagious strain is spreading across the U.S. So, it goes without saying that the virus can mutate further and arrive in autumn as an even more (or less, this is also possible) deadly slash contagious pathogen.

Countries and States Ease Lockdowns

But with flattened curved and the epidemic stabilizing, several European countries and more than a few US states are easing lockdowns. This is great news from the economic point of view. It was clear that economic shutdown could not last forever. However, this move is not without risks. The epidemiologists warn against the possibility of the second wave of infections in autumn, especially unless testing for the virus is expanded dramatically, which has not been done everywhere. Remember the Spanish flu? It attacked in three waves. And do you know why? Because many regions eased the restrictions too soon. We hope that the coronavirus will not return later this year, but, unfortunately, this is a possible scenario given the fact that we have not probably reached herd immunity yet.

Implications for Gold

What does the reopening of economies mean for the gold market? Given that the Great Lockdown took gold prices to about $1,700, does it imply that the Great Reopening will push gold down? Well, not necessarily.

Of course, given that a lot of bad news has been priced into gold prices, the easing of lockdown restrictions could spur optimism and diminish gold's safe-haven appeal. The recent breaking news that the German high court has challenged the European Central Bank's bond-buying authority has already weakened the euro against the US dollar, which can create downward pressure on the gold prices. And in our Gold Trading Alerts, we have warned Readers that, based on technical factors (e.g., the speculative interest in the gold market is very high), gold could go lower in the short-term, before it would go much higher.

However, investors should remember that the restrictions will be eased only gradually. And we could see second waves, at least in some places. And social distancing will not disappear during one night, so the economic recovery could be less vigorous than many people hope for. So, a lot of uncertainty will remain in the marketplace, supporting the gold prices (eroding U.S.-China trade relations can also help here). Moreover, when the lockdowns end, investors could shift their attention to the negative consequences of ultra easy monetary and fiscal policies, such as the very low real interest rates and high public debts.

To sum, although the price of gold could drop in the short-term, there is still room for further upward move later this year, as investors should continue to buy gold as an insurance against the huge increase in the money supply and the federal debt, as well as against the geopolitical risks (Trump's erratic stance on the epidemic changes the presidential race) and against the second wave of coronavirus.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

-

30 Million of Americans Applied for Unemployment Benefit. Should They Buy Gold?

May 5, 2020, 6:22 AMJust like the BoJ last week, the ECB also expanded its monetary policy easing. Meanwhile across the pond, more than 30 million of Americans applied for the unemployment benefit. What does it all means for the gold market?

European Central Banks Expands Its Monetary Policy Easing

Following the statements of the Bank of Japan and the Federal Reserve, the European Central Bank announced on Thursday its newest monetary policy decisions. Although the central bank of the Eurozone kept its main policy rates unchanged, it expanded its monetary policy stimulus in a few ways. First, the ECB eased conditions on the targeted longer-term refinancing operations (TLTRO III) during the period from June 2020 to June 2021 to 50 basis points below the average interest rate on the Eurosystem's main refinancing operations prevailing over the same period. It implies that the rate in TLTRO III can now be as low as minus one percent. In plain English, it means that the ECB loosened the refinancing conditions for commercial banks, paying banks to grant loans.

Second, the ECB introduced a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs). These operations will be conducted to support liquidity conditions in the euro area financial system. So, it seems that the TLTRO is not enough - in other words, the liquidity conditions in the euro area were rather poor as the central bank decided to introduce new refinancing operations. Well, we said many times that the euro area is very fragile and that the European banks are not healthy. This fragility is an important upside risk for gold, although the yellow metal prefers stronger, not weaker, euro versus the dollar.

Lagarde's Press Conference

Christine Lagarde, the ECB President, admitted during her press conference that the euro area is facing an economic contraction of a magnitude and speed that are unprecedented in peacetime. The real GDP for the euro area dropped 3.8 percent, quarter on quarter, in Q1 2020, although it was only partially affected by the spread of the coronavirus. So, you can imagine that Q2 will be much worse. The ECB's scenarios suggest that the GDP could fall by between 5 and 12 percent this year. What a wide range! It basically means that the economy is in the toilet, but nobody knows how much. But what is important, is that the ECB does not see a V-shaped recovery, even in the mild scenario. As you can see in the chart below, the central bank forecasts a U-shaped recession with the real GDP surpassing the pre-pandemic level in 2021 at the earliest.

Chart 1: Euro area real GDP under the mild, medium and severe scenarios

US Economy Is Not Much Better

The US economy performed better than the Eurozone, but the drop in the GDP in the first quarter of 2020 was still the largest since the Great Recession. According to the advance estimate, the real GDP decreased at an annualized rate of 4.8 percent in Q1 2020, or 1.2 percent quarter to quarter, as the chart below shows. Meanwhile, personal income fell 2 percent in March, while consumer spending slumped a record 7.5 percent last month. However, the pandemic came later to the US, so the second quarter is likely to be much worse.

Chart 2: US real GDP growth rate quarter-to-quarter from Q1 2007 to Q1 2020

Another important difference between the euro are and the US is that the labor protection is weaker in the New World. Although labor flexibility is generally good, the current scale of unemployment in the US is striking. As the chart below shows, 3.8 million of Americans applied for the unemployment benefit in the week between April 18 and April 25.

Chart 3: US Initial Jobless Claims from April 2019 to April 2020

It means that since the pandemic, more than 30 million of people went into unemployment, the highest number since the Great Depression. Actually, the unprecedented surge in layoffs means that the unemployment rate could already be higher than during the Great Depression, if we assume no dropouts from the labor market. In reality, of course, the unemployment rate will be lower, but this not really good news, as it means that some people just withdrew from the labor market and that they even do not seek a new job.

Implications for Gold

What does it all mean for the gold market? Well, the yellow metal gained almost 6 percent in April, marking the best month in four years, amid the coronavirus crisis intensifying and more monetary easing from central banks. We think that first, the weaker economic recover than many investors and analysts expect, and second, the resulting unprecedented monetary stimulus provided by the Bank of Japan, the ECB and the Fed is likely to increase future demand for gold. Tailwind for higher prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM