-

When People Riot, Should We Call Military or Gold?

June 4, 2020, 5:10 AMCould 2020 end, please? The pandemic is not over and the US suffers now from mass riots across the country. They could aggravate the coronavirus crisis and increase the demand for gold.

On May 26, a black man, George Floyd, was killed by the police in Minneapolis, Minnesota. During his arrest - he allegedly used earlier a $20 counterfeit bill in a nearby store - the police officer put a knee on Floyd's neck on the ground, although the arrestee was not aggressive and repeated several times that he could not breathe.

All the police officers involved in the arrest were fired the next day, but arrested only on Friday. The arresting police officer who strangled Floyd was charged with murder and manslaughter. But it was not enough for many people. Outraged by the police's brutality resulting in Floyd's death and lack of quicker arrest of the police officers, hundreds of protesters poured into the streets across the country, including New York, Washington DC and Los Angeles.

Initially, protests were peaceful but later they have escalated as police have clashed with demonstrators and many shops have been looted. More than 5,000 people were arrested since the beginning of the protests on June 2.

Indeed, the situation has become serious. On Friday night, the riots triggered the highest alert on the White House complex since the September 11 attacks, and Secret Service agents rushed President Trump to the White House bunker as protesters gathered outside, some of them throwing rocks. Twenty-three states have called in the National Guard to quell unrest, and Trump threatened on Monday to mobilize the military across the US.

Implications for Gold

What do the riots across the US imply for the country and the gold market? Well, the civil unrest should be positive for the yellow metal. There are three reasons for this. The first and most obvious is that geopolitical risks concerning the US directly could spur the safe-haven demand for gold. We are, of course, fully aware that geopolitical factors rather do not drive the long-term trend in the gold prices, but they help in the short-term. As the chart below shows, the yellow metal has been consolidating recently around $1,700.

Second, the mass protests during the pandemic is, um, well, not something what epidemiologists dream of. You don't have to be a scientist to deduce that big demonstrations and large gatherings - and many protesters do not even wear masks - could accelerate the viral spread and increase the chances of the second wave of infections, or at least, hamper the deceleration of the epidemic. The longer and more severe the epidemic, the better for gold.

Importantly, although the direct reason behind the protest was police brutality against black community, the long period of social distancing and economic lockdown, spurring high unemployment, aggravated the civil unrest. We warned in late April, that we could see the premature reopening of the economies or even the riots. Now, we have both. Bad combination from the health and economic point of views, but quite supportive for the gold market.

Third, the civil unrest could also slow the economic recovery from the COVID-19 pandemic. The violent protests and looting destroyed some stores, buildings and cars, subtracting from the GDP. Many people already reduced their economic activity due to the COVID-19 outbreak - the new civil protests can add a new layer of uncertainty and subdued consumer spending and business investment. Hence, although not a game-changer, at least not yet, the riots could support the gold prices, especially if they contribute to the current depreciation of the US dollar.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Are the Pandemic and Gold Bull Market Over?

June 2, 2020, 8:37 AMSome people think that the pandemic is dying out and that its end will stop the bull market in gold. But these claims are not entirely true: the epidemic is not over globally, and gold fundamentals will remain positive even after the containment of the coronavirus.

It seems that people are getting less worried about the COVID-19 epidemic. People go to pubs to drink beer with their friends, while the stock market is rallying. Meanwhile, the pandemic is far from over. Actually, the global number of new confirmed cases is constantly rising. On May 31, the WHO reported almost 128,000 cases, the most in a single day since the outbreak began, as the chart below shows.

It does not look like the end of the epidemic, does it? So why many people are relaxed, chilling on the beaches, while investors are so bullish? Are they blind to the drama happening right now?

Well, not necessarily. You see, there is a significant geographical divergence. While many richer countries are emerging from lockdowns, the number of new coronavirus cases is rising in poorer countries. As the chart below shows, the share of daily cases in Europe and North America is declining versus South America, Africa and Asia.

In particular, the chart below shows that situation in the US is normalizing. Not that the epidemic is over, but the peak is behind Americans and the trend is downward.

We know that it sounds brutal, but these are the facts. The stock market investors focus on what is happening in Western countries (and China, which is the factory hub for the West, and one of the biggest economies in the world, if not the biggest), shrugging off the problems of poorer countries. And the fact is that the coronavirus is gradually becoming the problem of developing economies. This is because the pandemic initially moved from China to Europe and then to North America - and only later to less developed countries. Another issue is that the Western countries were better prepared to cope with a pandemic than many poorer countries, so they are slowly containing the pandemic (its first wave at least).

The declining number of confirmed daily cases plus easing restrictions plus hopes for additional economic stimulus triggered expectations for swift recovery from a coronavirus crisis. The rebound is certain, but we would call for more caution. You see, the epidemic is not over, but even if it is, the economy is not likely to quickly return to the pre-pandemic level.

At the very beginning, many people were too complacent about the threat. Then, they overreacted and became too pessimistic. And, now, they can be too optimistic. After all, it's very difficult to live under lockdown and chronic stress for several weeks, so perhaps now some people must be relieved. We understand them, as we are also fed up with social distancing. But just because you close your eyes, it does not make you are invisible. The virus is still among us.

However, and luckily, the new coronavirus will not wipe out humanity and destroy the economy. But the pandemic and lockdown are not events that could be erased. They will leave scars and many businesses will not reopen.

Implications for Gold

What does it all mean for the global economy and the gold market? The pandemic is not over. Actually, it is getting worse as the rising number of infections in poorer countries shows. However, the epidemic is gradually being extinguished in the West. So, investors became more optimistic and started anticipating smooth sailing, although we still do not have a sufficient number of tests, or effective treatment, not to say a vaccine. Nor we have seen any signs of a V-shaped recovery.

When investors become more optimistic, they shift from safe-haven assets such as gold and turn into risky ones. This is a downside risk factor for the gold market. But such a transition could also soften the US dollar, supporting gold. Another supportive drivers are dovish monetary policy and loose fiscal policy, high public debts and negative real interest rates - importantly, these factors are not likely to go away anytime soon. So, gold fundamentals remain positive and they should support the gold price.

-

Is the Worst Behind Us and Gold Has to Plunge Now?

May 28, 2020, 5:41 AMA lot happened over the last few days. Let's start with the analysis of fresh economic data. First, the initial jobless claims came in at 2.4 million in the week from May 9 to May 16, as the chart below shows. While the number of Americans who applied for the unemployment benefit have declined for seven straight weeks following the peak of 6.9 million in late March, it is still a mammoth figure, much higher than before the pandemic (when about 200,000 people used to apply for the unemployment benefit each week).

It means that the devastation in the US labor market has been unprecedented. As the chart below shows, almost 39 million of people claimed benefits since the beginning of the epidemic, which implies that the unemployment rate is comparable now to the rate seen during the Great Depression, or even higher! Importantly, the trend of total claims since March 21, 2020, is still rising strongly, which means that the recovery is so far weak, despite the partial reopening of the economy.

Second, the Chicago Fed's national activity index, which measures whether the economy expands above or below the average growth, declined from a negative 4.97 in March to a negative 16.74 in April. The number is the worst in the data series history which begins in 1967, easily surpassing the disaster of the Great Recession, as the chart below shows.

However, situation has improved somewhat in May, at least according to regional manufacturing surveys. For example, the Philadelphia Fed Manufacturing Index rose from -56.6 in April to -43.1 this month. The reading is still terrible, but less so than one month ago. Similarly, the New York Empire State Index rebounded from -78.2 in April to -48.5 in May.

The latest PMI data from the IHS Markit also show some improvement. The flash manufacturing purchasing managers index rose from 36.1 in April to 39.8 in May, while the flash services purchasing managers index increased from 26.7 to 36.9. It means that the worst is probably behind us.

Implications for Gold

What does the recent bunch of data imply for the US economy and the gold market? Well, it seems that the rate of economic collapse has peaked in April. This is probably why the stock market rallied this week, with S&P 500 reaching the psychologically important level of 3,000. People become more optimistic with the number of infections of the coronavirus under control and relaxed containment measures. And a further planned easing will help the economy further, but demand could remain weak with some restrictions and social distancing remaining in place. In other words, the US economy should rebound later this year, but is not out of the woods yet - so the pace of recovery may be slower than the most optimistic investors hope for.

In other words, the stock market may be priced for an economic recovery that the data so far does not support. The initial crash was an overreaction, so now investors look for sparkles of hope everywhere. For sure, there are many reasons for being optimistic, but the war with coronavirus is not over. So, there might be some correction in price as investors could go into risky assets, but gold still seem to be a rational addition to the portfolio. Given that second-order effects (think about the consequences of high debt, geopolitical repercussions, or the possibility of corporate bankruptcies, etc.) have not been probably fully priced in yet, and that it's very difficult to predict them, the significant portion of the safe-haven demand for gold should remain in place.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Fed's Cap On Interest Rates Trigger Gold's Rally?

May 27, 2020, 5:39 AMLast week, the FOMC released the minutes from its last meeting. What implications do they carry for the gold market?

FOMC Finally Acknowledges the Situation As Serious

Last week, the FOMC has published minutes of its meeting from April 28-29. They show that the Fed reassessed the coronavirus economic implications since the previous meeting at which the central banks did not yet grasp the full gravity of the situation. This time, they acknowledged that "the second quarter would likely see overall economic activity decline at an unprecedented rate." Indeed, as we reported many times, the GDP will collapse, while the unemployment rate will soar to the levels not seen since the Great Depression.

And what's next? The Fed's baseline scenario is that economic growth will rise appreciably and the unemployment rate will decline considerably in the second half of the year, although a complete recovery was not expected by year-end. So, forget about the V-shaped recovery, even in the baseline scenario!

But the US central bank prepared also a more pessimistic projection which is "no less plausible than the baseline forecast." In this scenario, there would be further economic disruptions, which could lead to a protracted period of severely reduced economic activity:

a second wave of the coronavirus outbreak, with another round of strict restrictions on social interactions and business operations, was assumed to begin around year-end, inducing a decrease in real GDP, a jump in the unemployment rate, and renewed downward pressure on inflation next year. Compared with the baseline, the disruption to economic activity was more severe and protracted in this scenario, with real GDP and inflation lower and the unemployment rate higher by the end of the medium-term projection.The FOMC members noted several downside risks. The first is, of course, a negative evolution of the coronavirus outbreak and related uncertainty. Actually, the mere possibility of secondary outbreaks of the epidemic may cause "businesses for some time to be reluctant to engage in new projects, rehire workers, or make new capital expenditures." This is very important as investments are the real engine of economic growth. Unfortunately, the real business fixed investment slumped in the first quarter and they are expected to drop even further in the second quarter amid social distancing restrictions, declines in crude oil prices and elevated level of uncertainty. Thus, the future pace of economic growth might be sluggish.

The second major risk is, what we also warned about, that "even after government-imposed social-distancing restrictions come to an end, consumer spending in these categories would likely not return quickly to more normal levels." Some people even say that the behavioral changes could persist until the wide distribution of the vaccine. It doesn't require much imagination to predict that many companies will go bankrupt. For example, even before the pandemic, many restaurants had tiny profit margins. With only half of tables occupied, such enterprises will not survive. Not to mention airlines or travel companies. So, even the central banks figured out that "even after social-distancing requirements were eased, some business models may no longer be economically viable, which could occur, for example, if consumers voluntarily continued to avoid participating in particular forms of economic activity."

Third, some workers who lost job will not get it back quickly, as they may experience a loss of skills or even become discouraged and exit the labor force. As we wrote earlier, it is very easy to lose job or become broke, but it takes more time and effort to get a new job - especially if generous unemployment benefits do not encourage to take quick actions - or to set up a new business, especially when one is confronted with the sea of uncertainty.

Fourth, "higher levels of government indebtedness, which would be exacerbated by fiscal expenditures that were necessary to combat the economic effects of the pandemic, could put downward pressure on growth in aggregate potential output." Bravo, Fed, you finally realized that debt only borrows the economic growth from the future!

Fifth, there are significant risks to financial stability. A number of the FOMC members were concerned that banks and corporations could come under greater stress, if adverse scenarios for the spread of the pandemic and economic activity were realized. The high level of corporate debt and low energy prices exacerbates these risks.

Implications for Gold

The FOMC minutes reaffirms recent Powell's interviews, speeches and testimonies that prepare investors for an unprecedented disaster in the second quarter and subdued economic activity later this year with significant downside risks. As Powell's remarks were generally positive for the gold prices, the minutes should continue to be supportive for the yellow metal too, although the main message has been already known by investors.

However, the minutes show also two new things. First, they indicate that the FOMC members want to be more transparent regarding the future trajectory of interest rates. So, at the upcoming meeting, we could see important changes in the Fed's forward guidance: "While participants agreed that the current stance of monetary policy remained appropriate, they noted that the Committee could, at upcoming meetings, further clarify its intentions with respect to its future monetary policy decisions." Given the epidemiological - we are all epidemiologist now! - and economic situation, we expect dovish moves, which should be positive for gold prices.

Second, the minutes show the increasing support for the yield-curve control:

Several participants remarked that a program of ongoing Treasury securities purchases could be used in the future to keep longer-term yields low. A few participants also noted that the balance sheet could be used to reinforce the Committee's forward guidance regarding the path of the federal funds rate through Federal Reserve purchases of Treasury securities on a scale necessary to keep Treasury yields at short- to medium-term maturities capped at specified levels for a period of time.As the chart below shows, the real interest rates are already below zero. If the Fed decides to cap the bond yields, they will remain at ultra-low levels.

Chart 1: Real interest rates (red line, left axis, US 10-year inflation-indexed Treasury yields) and the price of gold (yellow line, right axis, London P.M. Fix)

The elimination of the upward pressure on the interest rates would be positive for the gold prices. Gold is a non-interest bearing assets, so it benefits from low real interest rates, in particular from negative interest rates.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Powell Decouple Gold from the Stock Market?

May 21, 2020, 5:57 AMThis week, Powell gave a long television interview and a testimony to the Senate. What groundbreaking did he say, and what do his remarks imply for the gold market?

Powell Gives Interview and Testifies

Powell dominated media news this week. On Sunday, the Fed Chair gave an interview to CBS news magazine "60 Minutes," while on Tuesday, he testified before Congress. What did he say? In an interview, Powell tried to persuade viewers that the Fed has not exhausted its powers to help the economy: "we're not out of ammunition by a long shot (...) So there's a lot more we can do to support the economy, and we're committed to doing everything we can as long as we need to". But are you really so powerful, if you need convince others that you are powerful?

He also reiterated his bearish views from the recent speech to the Peterson Institute for International Economics on the US economic growth in 2020, in which he said that in the second quarter, the GDP could drop by 20-30 percent on an annualized basis, while the unemployment rate could soar to 20-25 percent. Although the GDP will start to recover in the third quarter, it will take some time to pick up steam and the economy won't get back to where it was before the outbreak of pandemic by the end of this year.

Powell also said that the Congress should spend more money to prevent mass bankruptcies and that it is not the time to worry about the long-term consequences of the rising Fed's balance sheet and federal debt. So, investors could be prepared for even more interventions from the Fed and Treasury. New lending and spending programs should support gold prices, as the precious metals investors - contrary to bureaucrats and policymakers - really do think about long-term effects. After all, all crises leave scars and the coronavirus crisis will be no exception.

In his testimony before the Senate Banking Committee, Powell basically reiterated what he said earlier. First of all, he assured that the Fed could do much more. He said: "We are committed to using our full range of tools to support the economy in this challenging time even as we recognize that these actions are only a part of a broader public-sector response".

Implications for Gold

So, Powell does not expect - and we neither - the V-shaped recovery. Actually, Powell said that some sectors of the economy will recover only after the emergence of the vaccine! This is also what we said several times: only vaccine will fully restore the confidence among households, entrepreneurs and investors and without such confidence the recovery of the US economy will not be vivid. The lack of vigorous rebound creates a downside risk for the global stock markets, but it's rather positive for the gold market.

So far, we claimed that U-shaped recovery (or even L-shaped in some sectors) is more likely. However, there might be also a W-shaped path, a stop-go economy, where the economy swings between contraction and growth, between lockdowns and re-openings, depending on the number of new infections. Such manic-depressive economy should be positive for the gold prices, perhaps even more than the U-shaped recovery, as there is much more uncertainty in the former scenario.

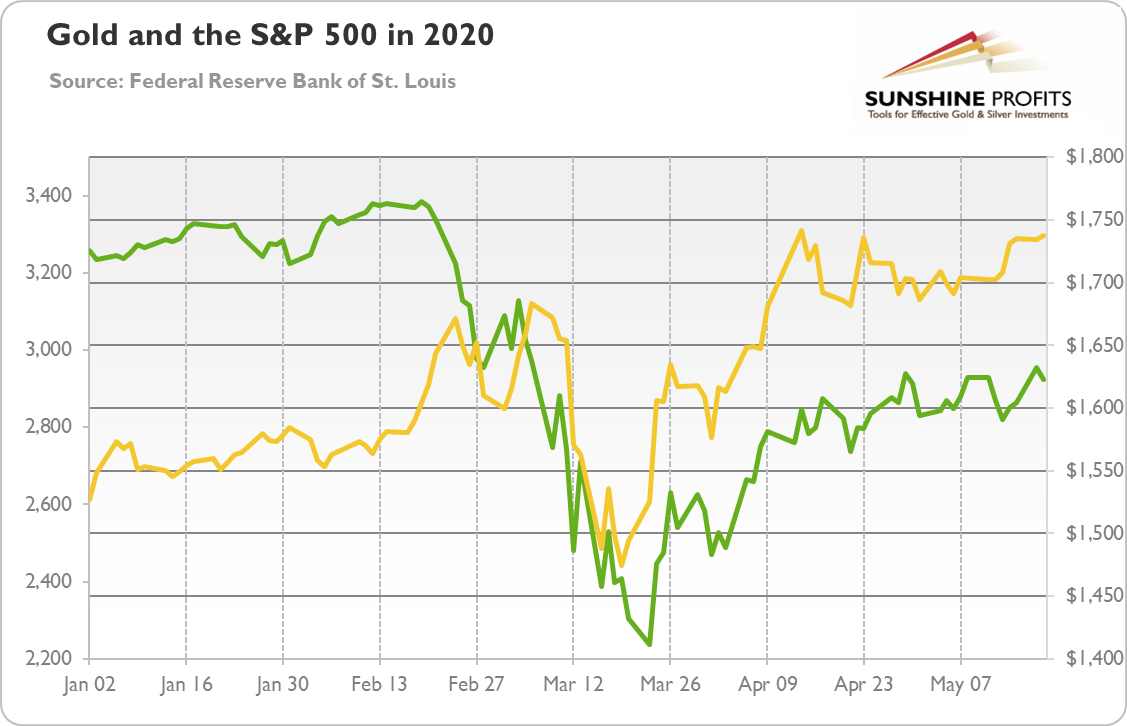

Importantly, Powell's cautious remarks and worries about the U-shaped or W-shaped recovery could cool stock markets bulls. Over the last few days, we have seen a possible decoupling of the tandem upside moves in gold and equities, as the chart below shows.

Chart 1: Gold prices (yellow line, right axis, London P.M. Fix) and the S&P 500 Index (green line, left axis) from January 2 to May 19, 2020

The price of gold went further up, while the S&P 500 Index came under pressure and seemingly started trading sideways. It is, of course, yet to be seen, whether the real decoupling will actually occur, but there are no doubts that in case it does, it could be a big (positive) change for the gold market.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits - Effective Investments Through Diligence and Care

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM