-

People Worry Again. Will They Buy Gold?

July 9, 2020, 6:02 AMThe U.S. is still knee-deep in the first wave of Covid-19. So, gold should be still knee-deep in the bullish wave.

"Really not good." This is how Anthony Fauci, the U.S. leading infectious disease expert and the member of the White House Coronavirus Task Force, described the current state of the epidemic in America.

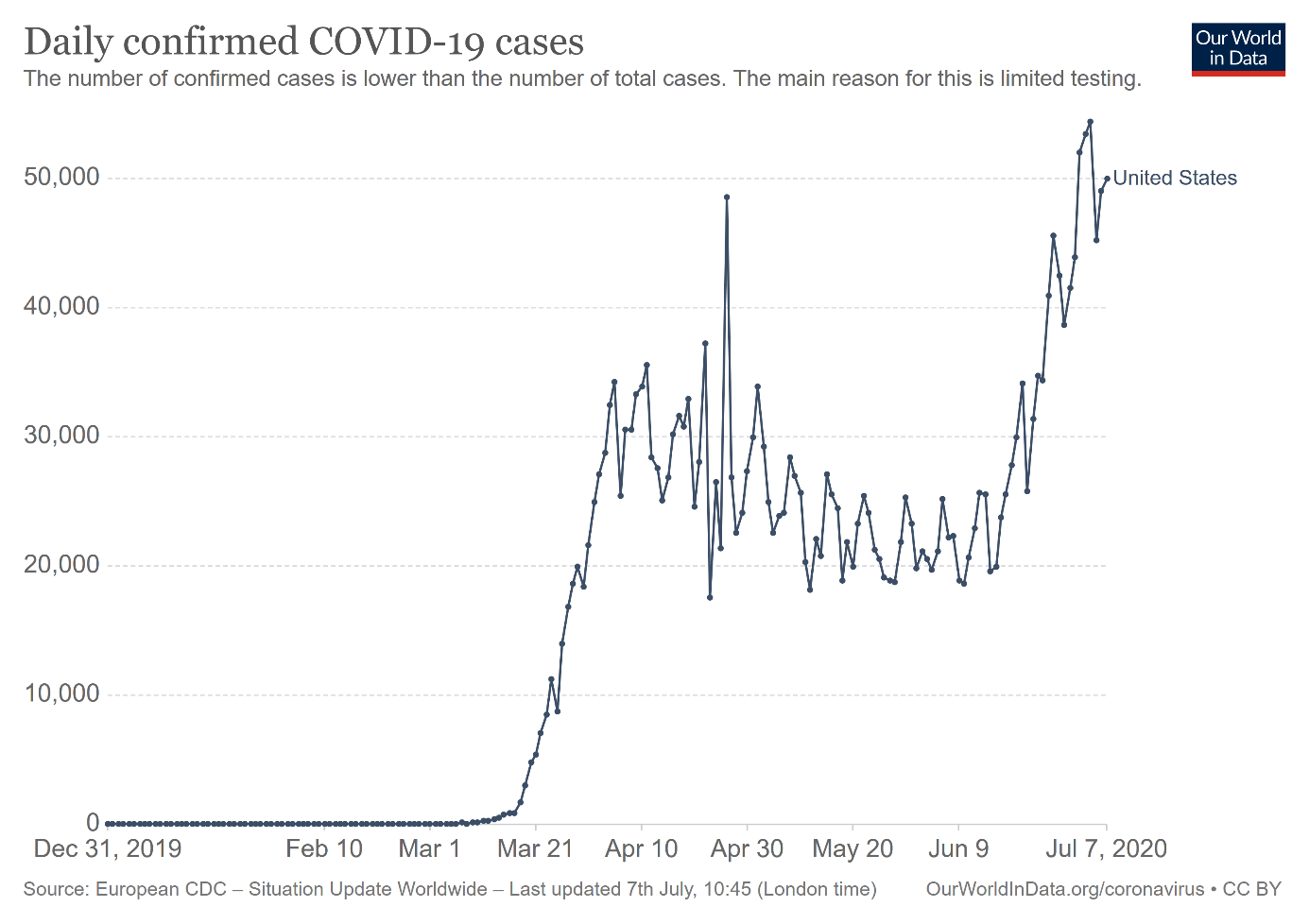

Fauci is right. Please take a look at the chart below. As one can see, the number of new daily confirmed cases of Covid-19 has surged recently, surpassing the April peak and jumping above 50,000. Since the beginning of the pandemic, almost 3 million Americans have become infected with the coronavirus and more than 130,000 people already died in the U.S. because of it.

The surge in U.S. coronavirus cases has made people worry again. Raphael Bostic, Atlanta Fed President, said on Tuesday:

We are hearing it more and more as we get more data. People are getting nervous again. Business leaders are getting worried. Consumers are getting worried. And there is a real sense this might go on longer than we have planned for.Indeed, more and more states and countries are rolling back the economic re-openings or even re-imposing lockdowns. For example, Melbourne, Australia's second biggest city, ordered its residents to stay in their homes for six weeks amid the resurgence of infections. In the U.S., New York expanded its travel quarantine for visitors from three more states, while Florida's greater Miami area rolled back its reopening.

However, the White House pushes the country to fully reopen, as President Trump said on Tuesday that the U.S. is "not closing, we'll never close". Given the resurgence in new cases, such calls are controversial. The full lockdown is, of course, absurd, and the incidence of deaths from Covid-19 are declining, but this is because the new infections occur mainly among young people. But if the coronavirus spreads wider, the daily number of deaths may rise again.

Implications for Gold

What does it all mean for the gold market? Well, data shows that current pandemic will remain active for longer than many people anticipated. As Fauci noted, America is "still knee-deep in the first wave and unlike Europe, U.S. communities never came down to baseline and now are surging back up." This is great news for gold prices. The longer the outbreak of Covid-19 lasts, the longer the safe-haven demand for gold will remain elevated. Moreover, until the health crisis is fully resolved, the economic activity will be subdued, while both the Fed and the Treasury will stick to the ultra-easy monetary and fiscal policies. After all, a resurgence in coronavirus cases makes Americans more cautious, hampering consumer spending and GDP growth. It will also make the disconnect between the real economy and financial markets even larger. Importantly, some of the government stimulus programs will expire at the end of July, so either the U.S. economic growth will slow down or we will see more fiscal and monetary measures. Given the upcoming presidential elections, the new round of support is likely, which should raise worries about the level of the U.S. fiscal deficit, federal debt and inflation, supporting the gold prices.

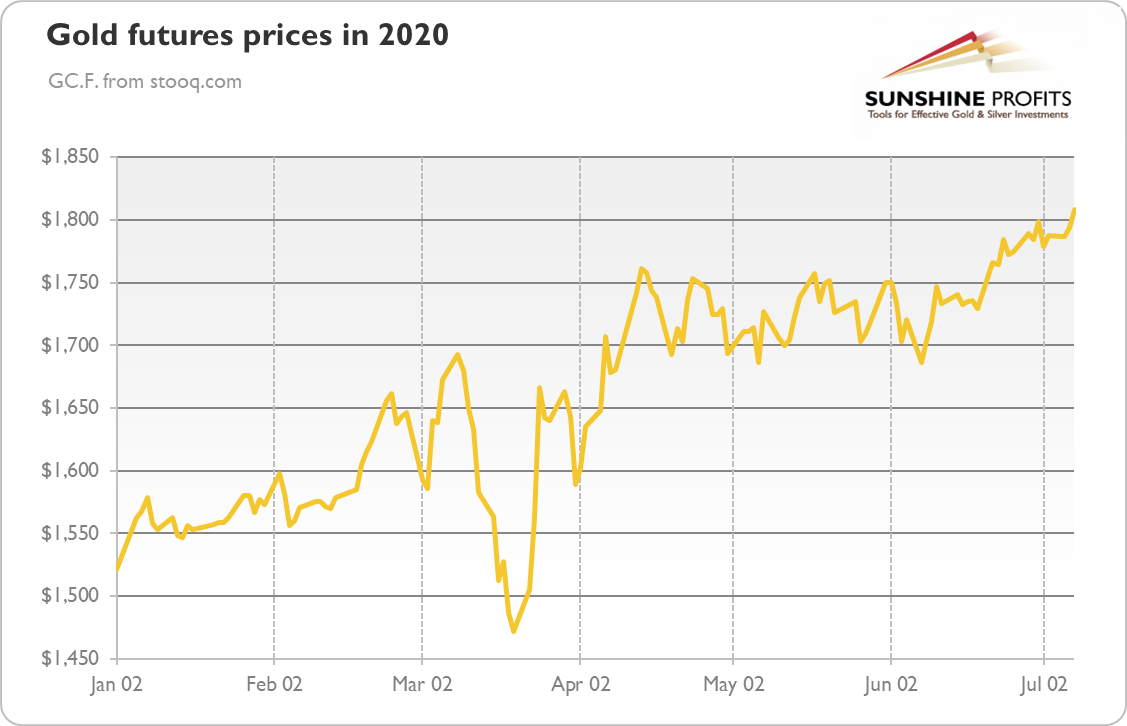

Not surprisingly, gold has been gaining recently. As the chart below shows, the price of the yellow metal has jumped above $1,800 yesterday (the chart paints future prices, but spot prices also surpassed this important psychological level).

Of course, it remains to be seen whether the price of gold will stay above $1,800 for long. But even if it retraces some gains in the near future, the further march upward is a matter of time in the current macroeconomic environment.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Gold March Forward on Fed's Forward Guidance?

July 7, 2020, 5:11 AMThe Fed could strengthen its forward guidance later this year. Given its dovish bias and the fresh viral outbreaks, it could be positive for gold prices.

Last week, the FOMC has published minutes of its meeting from June 9-10. They show a few interesting things. First of all, although the Fed officials could be satisfied with their monetary policy stance, they want to communicate better to the markets their intentions about the path of the federal funds rate and the Fed's balance sheet. In other words, the FOMC is likely to strengthen their forward guidance later this year:

Participants agreed that the current stance of monetary policy remained appropriate, but many noted that the Committee could, at upcoming meetings, further clarify its intentions with respect to its future monetary policy decisions as the economic outlook becomes clearer. In particular, most participants commented that the Committee should communicate a more explicit form of forward guidance for the path of the federal funds rate and provide more clarity regarding purchases of Treasury securities and agency MBS as more information about the trajectory of the economy becomes available.Now, the question is the type of the forward guidance which will be chosen. A few members of the Committee suggested the use of the calendar-based guidance, which sets a specific date beyond which accommodation will be reduced. But participants generally preferred outcome-based guidance. While a "couple" of them wanted to tie any rate hike to the decrease in the unemployment rate below a certain level, a "number' of central bankers preferred to make the normalization of the federal funds rate dependent on the inflation rate. Actually, they suggested that the Fed should not hike interest rates unless inflation would modestly overshoot the 2-percent target:

A number of participants spoke favorably of forward guidance tied to inflation outcomes that could possibly entail a modest temporary overshooting of the Committee's longer-run inflation goal but where inflation fluctuations would be centered on 2 percent over time. They saw this form of forward guidance as helping reinforce the credibility of the Committee's symmetric 2 percent inflation objective and potentially preventing a premature withdrawal of monetary policy accommodation.In plain English, it means that the Fed is likely to tolerate inflation above its target for some time and it will not hike interest rates unless inflation rate surpasses 2 percent. The Fed's dovish bias and reluctance to actively combat inflation are excellent news for gold which is considered to be a hedge against inflation. Higher inflation rate also mean lower real interest rates, which should be also supportive for the gold prices.

Second, the Fed expressed concerns about the next waves of the Covid-19 epidemic, which could additionally hit the US economy:

A number of participants judged that there was a substantial likelihood of additional waves of outbreaks, which, in some scenarios, could result in further economic disruptions and possibly a protracted period of reduced economic activity.The recent epidemiological data suggests that the Fed officials' worries were justified. As the chart below shows, on July 2, the number of daily new confirmed cases of the coronavirus in the U.S. was more than 52,000, surpassing the April peak and reaching a new record.

I don't know how for you, but for me the second uptick definitely looks like the additional wave of outbreaks! And the July 4 holiday weekend, which was - as always - celebrated with barbecues and fireworks displays, could only add fuel to fire. Of course, this time the reaction of authorities and citizens could be different and less aggressive, but it's hard for me to imagine that the resurgence of infections would not be negative for the GDP growth. Some states have already re-imposed restrictions or have slowed down reopening because of the resurgence of coronavirus cases. It means that the W-shaped recovery, rather than V-shaped rebound, is becoming more and more probable. Good news for gold! Of course, not necessarily in the very short term.

As we have repeated many times, the vivid recovery was never an option. Even without the second wave, the pace of economic growth would be slow after the initial rebound. As the FOMC admitted itself, "the recovery in consumer spending was not expected to be particularly rapid beyond this year, with voluntary social distancing, precautionary saving, and lower levels of employment and income restraining the pace of expansion over the medium term."

Moreover, high level of uncertainty, subdued consumer demand, a dearth in public infrastructure projects, and low oil prices would constrain business investments, capital expenditures and new hiring. Hence, "participants concluded that voluntary social distancing and structural shifts stemming from the pandemic would likely mean that some proportion of businesses would close permanently".

Implications for Gold

What does it all mean for the gold market? Well, the recent FOMC minutes show that the Fed will strengthen its forward guidance later this year. It may increase transparency of the American monetary policy and increase confidence in the Fed, which could be negative for the gold prices. However, given the U.S. central bank's dovish bias, the forward guidance would probably imply low interest rates for a very long period, which should be supportive for gold prices. The fresh viral outbreak only increases chances of further economic disruptions and very accommodative monetary policy.

Moreover, the Fed may use forward guidance based on inflation, announcing lack of any interest rate hikes unless inflation will reach a certain level, which could be above the 2-percent target (the Fed officials have long dreamed of raising the target or overshooting, so now they have the perfect opportunity to officially allow for higher inflation!). Such forward guidance would be particularly positive for the gold prices, as the yellow metal is seen as a hedge against inflation which shine the brightest in an environment of low real interest rates.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Steady Gold Amid Choppy Recovery

July 2, 2020, 5:39 AMInitial jobless claims are declining painfully slowly. The disconnect between the choppy recovery and financial markets creates upward risk for gold.

The initial jobless claims still paint grim picture. They amounted to 1.48 million in the week from June 13 to June 20, as the chart below shows. While the number of Americans who applied for unemployment benefit have been systematically declining since late March, the number of people who applied for receiving jobless benefits barely fell from 1.57 million recorded at the beginning of June.

The falling back toward a pre-pandemic normal level is disturbingly slow (analysts expected lower number) and it casts doubt on the strength of the recovery. After all, millions of Americans are still losing their jobs each week! The so-called continuing claims have been also falling painfully slowly after peaking in mid-May. To some extent, the elevated level of new claims results from too generous unemployment benefits (for many people, being unemployed is more financially attractive that going to work), but in part, it may be caused by weak demand for labor. After all, many companies are now restructuring to adapt to a radically different post-pandemic environment. No matter the reason, fewer people having job is always troublesome for the economy.

Importantly, the resurgence of new Covid-19 infections in many states could make the recovery even weaker, forcing the businesses to scale back and fire people again, if authorities tighten sanitary regulations or consumers start to distance socially again.

Disconnect Between Real Economy and Financial Markets

Given the choppy recovery, the disconnect between real economy and the financial markets has probably never been greater. And, as the International Monetary Fund's update on the global financial stability noted last week, the gap between the bullish mood among investors and the enormous uncertainties about the path of the economic is a serious risk to global financial stability:

Amid huge uncertainties, a disconnect between financial markets and the evolution of the real economy has emerged, a vulnerability that could pose a threat to the recovery should investor risk appetite fade (...) This decoupling raises questions about the possible sustainability of the current equity market rally if not for the boost of sentiment provided by central bank support.Indeed, market valuations appear stretched and "the difference between market prices and fundamental valuations is near historic highs across most major advanced economy equity and bond markets." Hence, many developments, including the tightening of monetary policy or the resurgence of coronavirus infections, could trigger a repricing of risky assets, which could destroy the economic recovery.

According to the IMF, another important risk for the financial system is high indebtedness, as debts may become unmanageable for some borrowers:

aggregate corporate debt has been rising over several years to stand at historically high levels relative to GDP. Household debt has also increased, particularly in countries that managed to escape the worst impact of the 2007-8 global financial crisis. This means that there are now many economies with high levels of debt that are expected to face an extremely sharp economic slowdown. This deterioration in economic fundamentals has already led to the highest pace of corporate bond defaults since the global financial crisis, and there is a risk of a broader impact on the solvency of companies and householdsImplications for Gold

What does it all mean for the gold market? Well, the weaker and more choppy the rebound, the better for gold, as the fragile recovery should assure elevated safe-haven demand for gold. Similarly, the larger gap between the real economy and financial markets, and the longer it lasts, the greater possibility of the financial crisis. In such environment, the yellow metal is an attractive portfolio diversifier, so we would not be surprised if gold crosses $1800 per ounce in the foreseeable future.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Coronavirus Strikes Back. But Force Is Strong With Gold

June 30, 2020, 4:59 AMWe all fear the second wave of infections. But the U.S. hasn't even controlled the first one! Bad news for Americans, but good news for gold.

Please take a look at the chart below. As you can see, the epidemiological situation in the United States does not look well. The number of new daily confirmed Covid-19 cases has been rising again since mid-June, which means that coronavirus is far from being contained. Actually, the number of new cases has almost reached a new record level!

Sadly, the number of daily deaths has also increased recently, as the chart below shows. The spike resulted from the change in methodology, but even without it, the downward trend has probably ended. Luckily, as now young people are mostly among the newly infected, the case fatality rate could be lower than in April.

Who could suppose that hasty reopening of economies without proper testing and contact tracing, and mass riots could cause the second wave of infections? Actually, this is what I was afraid of. At the beginning of June, I wrote:

the mass protests during the pandemic is, um, well, not something what epidemiologists dream of. You don't have to be a scientist to deduce that big demonstrations and large gatherings - and many protesters do not even wear masks - could accelerate the viral spread and increase the chances of the second wave of infections, or at least, hamper the deceleration of the epidemic.I mentioned today the second wage of infections. But actually America does not deal with the second wave. The U.S. could not even cope with the first wave! And, oh, just as a reminder, we are talking about the wealthiest country in the world!

The charts above present nationwide data. But situation in certain states is actually much worse. The number of new cases and hospitalizations are quickly accelerating in several states, which is going to be problematic for the economy and the markets. For example, Texas halted its reopening because of the resurgence of Covid-19 infections and hospitalizations.

Meanwhile, in New York, Governor Andrew Cuomo introduced quarantine for everyone coming from eight states suffering from the most intense resurgence of the coronavirus - Alabama, Arizona, Arkansas, Florida, North Carolina, South Carolina, Texas and Utah - and delayed the reopening of malls, gyms, and cinemas.

Moreover, some companies either has closed their stores (like Apple in Houston) or delayed the reopening of their premises (like Disney and its theme parks in California). Such actions hit, of course, the economy. For example, the U.S. economic recovery tracker developed by Oxford Economics showed a small deterioration in the week ending June 12 after 10 weeks of improvement. Hence, after a strong initial phase of recovery, we could enter a period of slower phase, or even a reversal, if the recent resurgence of Covid-19 infections accelerates and gets out of control.

Implications for Gold

What does it all mean for the gold market? Well, the longer and more severe the pandemic, the better for gold. The resurgence of infections implies the delayed rewind of the Great Lockdown. The more delayed the full economic unlock, the slower the recovery. Moreover, the accelerated spread of the coronavirus could trigger the reimplementation of lockdowns or other containment measures. In such a scenario, another stock market crash is likely. Gold could benefit then at the expense of risky assets. But the fire sale of equities could also pull gold down, at least initially. Another downward risk for the gold market is the strengthening U.S. dollar when turmoil hits. On Thursday, the greenback appreciated, while the price of the yellow metal declined. However, over the longer run, it seems that gold will remain an attractive safe haven for investors (and it can even gain more value) until the pandemic is over and the global economy recovers fully.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Likes the IMF Predicting a Deeper Recession

June 25, 2020, 9:05 AMIMF predicts deeper global recession and slower recovery, just as I expected. Good news for gold.

The June edition of the IMF's World Economic Outlook Report Update is out! The main message is that the IMF predicts now even a deeper recession than two months ago.

As a reminder, in April edition of the World Economic Outlook Report, the IMF projected that the global economy would contract sharply by 3 percent this year, while the U.S. economy would plunge 5.9 percent. When it comes to 2021, the IMF projected 5.8 percent growth for the global economy and 4.7 percent for the U.S.

Many analysts cheered the vigorous pace of recovery expected by the IMF. I did not. I remembered that the IMF's projections are always too optimistic, so I remained skeptical. That's I wrote:

If something seems too good to be true, it probably is. To be sure, there are many reasons for optimism. In some countries, the number of new cases has come down. And the unprecedented pace of work on treatments and vaccines also promises hope. However, the IMF's base scenario assumes basically the V-shaped recovery, which is not likely to happen. As long the society does not have herd immunity, the economy will not simply return to normal, pre-pandemic life. And if history of previous deep downturns is any guide, the reduced investment, employment and commercial bankruptcies will leave long-term scars on the economy.It turned out that the IMF was wrong and I was right. In the newest report, the Fund expects that the global economy will drop 4.9 percent this year (almost two percent below the April's forecast!) and that it will expand only 5.4 percent in 2021. When it comes to the U.S. economy, the IMF projects that it will plunge 8 percent (more than two percent below the April's forecast!) and that it will recover just 4.5 percent in 2021.

It means that the global and the U.S. economies are likely to experience their worst recessions since the Great Depression, far worse than the financial crisis of 2007-2009, and that they will turn out to be deeper than previously expected, while the pace of recovery will be more gradual than previously forecasted.

Indeed, as the chart below shows, the U.S. GDP will not return next year to the pre-pandemic level. It will happen in 2022 or maybe even in 2023. So, please forget about the V-shaped recovery, especially since that even these projections may be too optimistic.

Implications for Gold

What does it all mean for the gold market? Well, deeper recession and slower recovery are good news for gold, which shines the most during the period of economic crises and subdued economic growth, especially in the early stages of expansions.

Moreover, the grimmer IMF's report, combined with the rising number of daily new cases of Covid-19 in the U.S. (see the chart below), could decrease the risk appetite and increase the demand for safe-havens such as gold.

Indeed, the S&P 500 Index declined yesterday, while the price of gold surged to its highest in nearly eight years (as the chart below shows). The downward revision of economic projections and the resurgence of coronavirus in America clearly show that "we are definitely not out of the woods", as Gita Gopinath, the IMF's chief economist, put it.

And the coronavirus crisis will also generate medium-term challenges, as we repeated many times. In particular, the already high indebtedness will become even higher. According to the IMF, the public debt will reach this year the record high level, in both developed and developing countries. The global public debt is forecasted to jump above 101 percent, almost 20 percentage points above 2019 level. Such an abrupt rise increases the odds of a sovereign debt crisis and pressure for interest rates to remain at ultra-low levels. Such environment looks fundamentally positive for the gold prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM