tools spotlight

-

Gold Price: REAL Implications of Yen’s Strength

December 20, 2022, 7:37 AMSomething major happened to the USD/JPY (yen), and it triggered a sizable overnight rally in gold and silver. What’s really going on?

The “Real” Move on the Horizon

Junior miners declined yesterday, and they moved to a new monthly low. However, I bet that you are now most interested in what happened in today’s pre-market trading, why it happened, and what it implies.

Gold moved higher, as did silver (chart courtesy of https://goldpriceforecast.com).

At the same time, the USD Index declined.

Looking at the above chart, we can see that these quick price movements are fairly normal, as most breakouts/breakdowns are followed by a correction - a confirmation of the breakout/breakdown. Consequently, the fact that we’re seeing it in the USD Index is currently quite normal. After all, it just broke above its declining resistance line a couple of days ago.

And since the precious metals sector is very strongly negatively correlated with the USD Index, the above means that today’s quick move higher in gold and silver is likely to end soon as well, and the “real” (= medium-term) move is likely to resume. In the case of the precious metals sector, this trend is down.

You know, one of the things that can tell us what’s real and what’s fake on the precious metals market is the performance of mining stocks. At the moment of writing these words, the markets are still closed in the U.S., so let’s take a look at what the GDXJ (a proxy for junior mining stocks) is doing in today’s London trading so far.

And there’s the thing.

It’s not doing anything (crude oil is more or less silent, too).

Ok, to be precise, the GDXJ did move a bit higher, but it’s a move higher by less than 1%, and it’s barely visible given the sizes of the recent price swings.

This further strengthens the above-mentioned scenario, in which the precious metals sector is simply verifying its breakdown yesterday.

But Why?

As always, it’s impossible to tell with 100% confidence what made a given market move, but today it seems clearer than on most days.

The Bank of Japan hinted at a hawkish twist in their approach, and the markets reacted, assuming that it was a major shift.

The currency moves that we have seen so far today appear to confirm that this is what the markets are focusing on right now (chart courtesy of https://silverpriceforecast.com).

The EUR/USD currency pair is moving sideways, while the USD/JPY pair truly plunged. What does it tell us? It tells us that whatever is happening on the currency market is not about the dollar per se – it’s about the yen.

This is more important than it seems at first glance. If the U.S. dollar’s weakness was the driving force behind the USD Index’s move lower, one could say that it’s really a bearish factor for gold. The USD, being viewed as a safe haven (whether we want to believe it or not, a large part of the world views the U.S. dollar as a safe/solid currency), would be losing appeal, and gold – being another safe haven – would be gaining it as an alternative.

However, it is not about the U.S. dollar’s weakness – it’s about the yen’s strength.

So, what is the real implication for gold?

It’s easier to understand the implication based on a counter-example. Remember when all the monetary authorities around the world were getting more and more dovish and they kept printing more and more money? That was bullish for gold, right?

Ok, so, now what we see is the opposite. The monetary authorities around the world are getting more and more hawkish, and the Bank of Japan appears to be finally joining the hawkish party, and that’s bearish for gold.

This remains true despite any short-term price movements caused by individual currency exchange rate changes. So, even if the yen continues to strengthen relative to the dollar for some time, gold might not be willing to react to it for much longer.

Why? Because in the short-term markets are particularly emotional. “OMG, USDX fell, let’s buy gold!” can dominate traders’ way of feeling/thinking (on a side note, “feenking” could be a new verb to describe the situation when one thinks that they are thinking about something, but actually they are just rationalizing their feelings).

Then, as the traders have some time to think about what’s really happening, they could sell gold as it becomes less and less appealing, given that fiat money can (at least for now…) provide more interest payments.

As you can see on the above chart, gold priced in the Japanese yen has been in a rather steady long-term uptrend for years. It’s close to the support line, though.

Based on the hawkish indications from the Bank of Japan, it seems that we might finally see a breakdown below this line, and when we do, the decline that could follow could be huge.

Please note that the price levels were rather steady throughout the year, even though gold fell substantially from a USD point of view. Consequently, it seems that the demand from the yen holders was quite strong, and if it now subsides… Things could get very unpleasant for gold permabulls. Also, for those who think that I’m always writing about lower gold prices, I would like to emphasize that so far this year, I have written about precisely 4 trades in junior mining stocks – two long and two short, and all of them were profitable. One position is still open (in my view, and it has the biggest potential).

Before summarizing, I have great news for you. If you’d like to get a LIVE follow-up on the above analysis (with the possibility to ask me questions) and see me talking about the top 3 gold trading techniques that I found to be working over and over again, then you’ll have a chance to get the above free of charge LIVE on Wednesday, Dec. 21 at 10 AM EST (4 PM CET) on our Youtube, Facebook, Twitter, and LinkedIn channels. If the above is not displayed as a link, just Google “Golden Meadow Radomski” and you’ll definitely find it. I hope to see you very soon :) And the easiest way to sign up is right here.

To summarize, despite today’s pre-market upswing in gold and silver, the outlook for the following weeks doesn’t look bullish at all. Conversely, as monetary authorities around the world get more hawkish, gold, silver, and mining stocks are likely to move lower.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold’s Most Important “Hammer”

December 19, 2022, 9:29 AMThe precious metals sector didn’t do much on Friday, but something very important happened in gold’s key driver – the USD Index.

Let’s get right to it.

There was very little change in terms of weekly prices as the USD Index declined by just 0.14.

However, the way the USD Index first declined and then moved back up makes all the difference!

The USDX at first declined, moving on one or more rumors regarding the Fed and what it’s going to do next (and probably on some other rumors as well), and then once it became clear that the pace of rate hikes has indeed decreased, Powell announced that there will be no U-turn in the near and medium-term future, and investors got a wake-up call.

Instead of pushing gold higher and the USD Index lower, they seem to have started to realize what’s really going on, and they reversed course.

The USD Index moved back up, while gold moved back down.

Ultimately, the U.S. currency ended the week practically unchanged, but it formed a bullish hammer candlestick. It’s a reversal candlestick, and let’s keep in mind that weekly candlesticks are much more powerful than the ones based on just daily price changes.

The above happened after a sizable short-term decline, so it’s very likely that it confirmed the change in the short-term trend – which, in all likelihood, is now up.

Since the correlation between the USD Index and the precious metals sector is very negative (below -0.9, while -1 is the most negative that the “linear correlation coefficient” can get), it means that as the USD Index moves back up, the precious metals sector is likely to move down. And these are not likely to be small moves, either.

In other words, i.e. based on the USD Index’s hammer reversal candlestick, one can expect gold to move much lower in the following weeks.

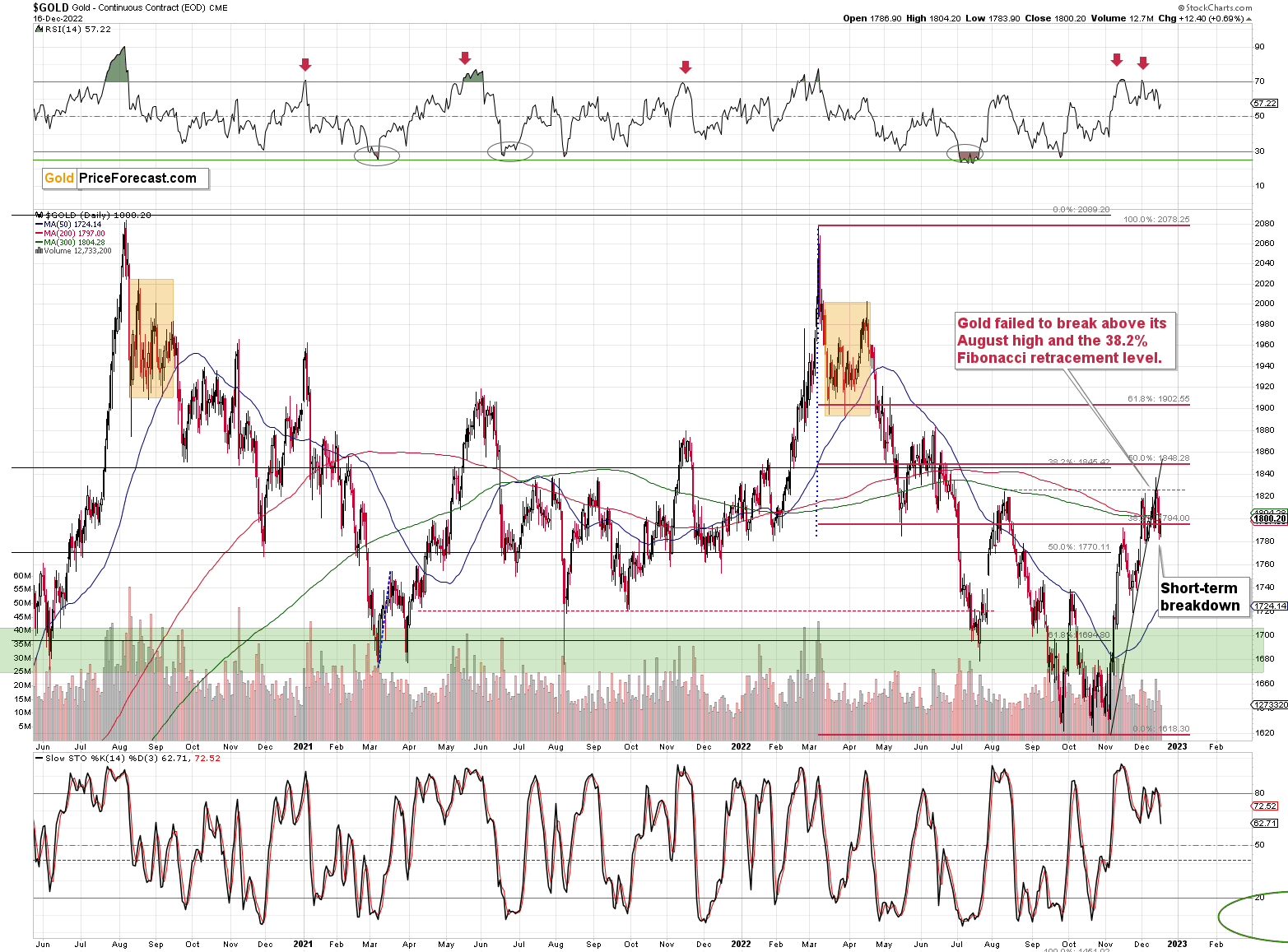

Gold ended Friday’s session higher, but it didn’t change the fact that it broke below its rising support line, and it all happened after the sell signal from the RSI.

Consequently, the intraday rally (and today’s pre-market move higher) is likely just a verification of the breakdown.

The thing that confirms the above theory is the low volume on which gold rallied on Friday. The buying power appears to have been limited or dried up. That’s bearish – very bearish – regardless of the few dollars that gold might rally within the next few hours.

So far today (chart courtesy of https://www.goldpriceforecast.com), gold tried to move back to the $1,800 level, but it hasn’t managed to do so.

The point is that even if gold does indeed move above $1,800 today, it won’t change much, as gold already confirmed its breakdown below its rising support line, and all other points from today’s analysis remain up-to-date as well.

The situation on the stock market is bearish, too.

The volume by which stocks declined on Friday was huge. It confirmed the strength of the bears – the selling force was enormous.

There were two similar situations in recent history. Stocks declined on huge volume at the end of May and in mid-September. In both cases, lower stock market values followed. And since history tends to rhyme, it’s likely that we’re going to see declining stock market prices this time as well.

Just like gold, stocks confirmed their breakdown below their rising support line. They also declined shortly after invalidating the attempt to break above the lowermost of the declining blue resistance lines.

Interestingly, stocks plunged after the above-mentioned rising support line crossed the declining blue resistance line. That’s no coincidence – prices tend to reverse at the vertices of triangles created by support/resistance lines. The term "responsibility" refers to the act of determining whether or not a person is responsible for his or her own actions.

As the stock market declines, commodities (i.e., silver), and mining stocks are likely to decline as well.

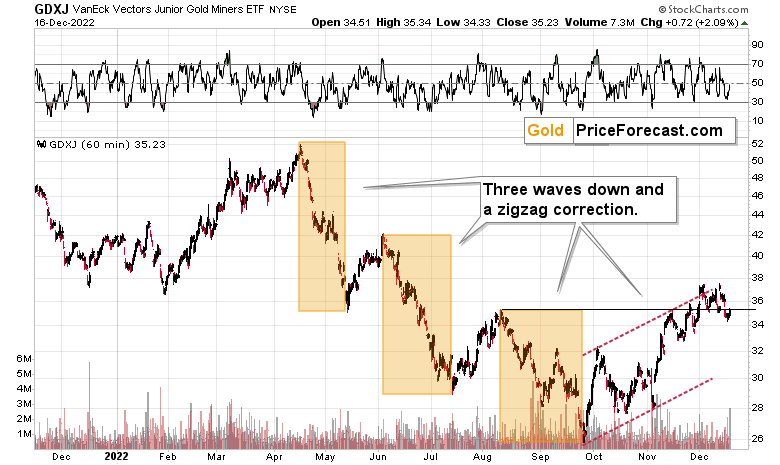

Speaking of the latter, let’s take a look at the proxy for junior mining stocks – the GDXJ ETF.

As you can see on the above chart, junior miners just broke back below their August and November highs, and they are now testing this move.

This test is likely to succeed, and miners are likely to decline much more.

Why? Because that’s what they “told us” beforehand. Well, they would have told us if mining stocks could speak – but since they can’t, they communicated in a different way. Miners "told us" that they are likely to fall by rising less than gold and falling more than gold.

Since at the same time silver moved profoundly higher relative to gold, we knew that the precious metals market really wants to move lower. After all, miners tend to lead gold, while silver lags behind, and plays catch-up. The above-mentioned relative performance of miners and silver relative to gold indicates that lower values of the precious metals sector are to be expected.

Since that move is not likely to be minor, it presents a great profit opportunity for those, who are positioned correctly.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

This Is How Silver Proves Its (Short-Term) Strength

December 16, 2022, 8:36 AMSilver's recent upward move was most likely just a corrective upswing. What usually happens after such adjustments are completed?

As I emphasized many times before, silver's outperformance is rarely a bullish sign, and the fact that it recently took a very visible form only indicates that the next slide will be of medium-term size, not just something short term.

Silver just invalidated its temporary breakout above the 61.8% Fibonacci retracement.

Yes, that’s a retracement that’s higher than the analogous ones in stocks, gold, and mining stocks, and… This is yet another confirmation of silver’s short-term strength.

Once again – it’s not something bullish, but very likely something bearish.

This means that the recent sizable rally is nothing more than a – sizable, but still – correction within a bigger downtrend.

Looking at silver from a long-term point of view helps to see the forest, not just individual trees.

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

What happens after corrections are over (as indicated by, i.e., silver’s outperformance)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Besides, the long-term turning point for silver is due in several months, and if silver repeats its previous 2022 decline, then it will bottom close to the turning point and also close to the $15 level– in the first half of 2023.

It’s likely to repeat its previous 2022, because that’s what tends to happen after flag patterns, and what you see on silver’s short-term chart between September and yesterday appears to be a flag pattern.

However, will silver only repeat its previous 2022 performance and not decline more than it already has?

Based on the analogies to 2008 and 2013, the latter is more likely. The 2013 slide was bigger than the initial decline that we saw in 2012. And the final 2008 slide was WAY bigger than what we saw before it.

Due to its industrial uses, silver is known to move more than gold, in particular when the stock market is moving in the same way as gold does. Since I think that gold and stocks are both likely to slide, silver is indeed likely to decline in a truly profound manner. Quite likely lower than just $15.

Consequently, my prediction for silver prices remains bearish, as does the outlook for the rest of the precious metals sector.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Story about Gold and the Fed’s U-turn

December 15, 2022, 8:09 AMWhat can happen while investors so stubbornly believe in the Federal Reserve's dovish pivot?

No U-turn.

“Nah, he’s bluffing” – investors were initially overwhelmed by the irresistible urge to ignore the obvious.

It’s been many weeks – months in some cases – since the Fed started not only talking about hawkish action, but actually taking it. Each time, investors assumed that it was all just smoke and mirrors. And who can blame them? Over the years, they learned to expect more money, more stimulus, and overall more dovish action, regardless of what happened temporarily.

“Yeah, right!” – investors scoffed.

“We can afford higher hikes, there’s too much debt, the interest payments will be too high, and nobody can afford a mass default.” – they argued in the first hours after Jay spoke.

No U-turn. – The thought echoed again, but nobody paid any attention.

Everyone saw that the Fed decreased the pace at which the rates were increased. It used to be 0.75% per hike previously, and now it’s just 0.5% - isn’t it a sign of the Fed getting dovish?

The markets even confirmed the above narrative. The USD Index declined, while the S&P 500 moved higher – at least initially.

As the closing bell rang, investors still felt confident in their dovish narrative, but deep underneath, they knew that something major had just changed.

The doubts began with “Could it actually be the case that he means, what we says?”, they progressed to “Wait a minute, if the rates are to be higher throughout 2023, there really can’t be no dovish U-turn anytime soon – there’s no room for it…” and concluded “Cutting the rates only after the inflation stabilizes at 2%? We’re nowhere close, it’s a long way up for the interest rates!”.

Investors went to sleep somewhat confused. Some – the most leveraged ones - actually had trouble falling asleep.

When they woke up, they woke up to a new reality.

The USD Index is up.

The S&P 500 futures are down.

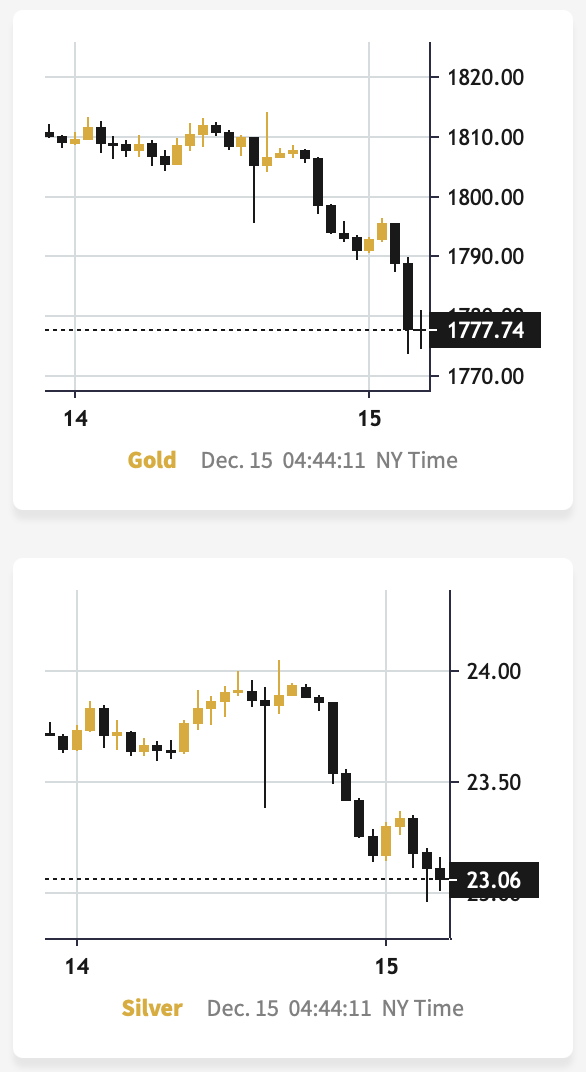

And gold… (chart courtesy by GoldPriceForecast.com).

Gold declined sharply below $1,800, while silver moved below $23 in less than 24 hours after trying to move above $24.

“OMG! It’s happening!” – investors felt as if they woke up not just after a night’s sleep, but after a yearly coma.

The U.S. markets were not open yet, but a quick glance at the GDXJ’s (proxy for junior mining stocks) prices in London trading revealed that the technical indications from the previous days didn’t lie. Juniors were down by more than 4%.

Then reality hit like Chuck Norris’ roundhouse kick.

“There will be no dovish U-turn anytime soon!”

“Wait a minute…” - neuronal connections speed up – “If the Fed is really hiking rates, and they are about to keep it up for the next year AND everyone was actually wrong to expect a U-turn, then…”

As the next thought emerged, some of the investors sharing it could feel the initial signs of characteristic cold sweat.

“Then the markets are really going to tumble big time.”

Suddenly, all previous reasoning for the U-turn started to look differently.

“Yeah, the pace of rate hikes might have decreased, but the Fed is still hiking! The business conditions are getting tighter, and there’s no end in sight. There’s nothing dovish or bullish about that!”

Does the extreme level of debt matter? “Well, why can’t the politicians just continue to raise the debt ceiling, just like they’ve done previously? They can, and they will, because that will be the easiest thing to do, and nobody wants to take the blame for triggering the crisis in the country.”

And the interest payments… If things get really bad, they can always tax the rich, tax the imports, or come up with money in all sorts of ways. Sure, many people won’t like it, but many more people don’t like inflation even more. That’s what remains the voters’ top concern, so that’s what will be fought – it’s as simple as that.

Besides, maybe the above would provide The Powers That Be with a great opportunity to move to a gov’t crypto currency? You know, when things in the current economic system get bad enough, people will probably meet major changes (like a move to gov’t crypto) with a feeling of relief instead of meeting the decision with torches and pitchforks.

Some investors’ thoughts raced through the above-mentioned points immediately, and some needed more time.

After each realization, sell orders followed for many assets, including commodities, stocks and gold. As more people woke up to the new reality, the flood of selling pressure intensified. And the pace at which they declined increased…

= = = = =

Some of the above have already happened. Some might have happened. And some might be waiting just around the corner.

How much of the above is fiction, and how much is reality? I’ll leave the decision up to you.

It will be very interesting to see how the story unfolds and probably extremely profitable for those, who are positioned accordingly before the price moves really pick up.

You have been warned.Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief -

Can the Gold Market’s Uptrend Begin Without the USDX’s Breakdown?

December 14, 2022, 8:38 AMThe recent connection between gold, silver, and mining stocks can help predict their next moves. So, given also the USDX’s performance, what is the outlook for the precious metals market?

Based on the comments below yesterday’s regular analysis and on yesterday’s intraday follow-up, you know that yesterday’s post-CPI rally in gold is unlikely to trigger a bigger rally, and it’s much more likely to be one of the final steps in the topping formation.

Here’s how it looks on the charts after the closing bell.

Junior miners tested their previous December high, and then they declined visibly once again. They even moved below the very recent intraday highs.

At the same time, gold moved to new December highs, and silver moved even higher. Precisely, it too moved to new December highs, but in the case of silver, the short-term uptrend is even clearer.

I’ve written quite a lot about what this kind of relative performance implies for the outlook, but I think it would be a good idea to re-state it once again. After all, it's the most difficult to remain calm and analytical at the tops and bottoms—when emotions are at their highest.

On Monday, I wrote the following:

The key thing that you can see above is that the way in which those three parts of the precious metals market behaved on Friday differed considerably.

While gold was more or less neutral, silver moved much higher, while gold miners moved… Visibly lower. In particular, it was the final few hours of Friday’s session (the last candlestick) that made the difference.

If used horizontally, green lines make it easier to compare the most recent performance to the early-December high. And:

- The GLD ended the previous week very close to that high.

- The SLV ended the week above that high.

- The GDXJ ended the week well below that high.

This means that silver was just particularly strong relative to gold, and miners were just particularly weak relative to gold.

Gold miners tend to be early in a given move, while silver prices tend to lag / catch-up in the final parts of the move. That’s what we’ve been able to see in the precious metals market for many years. Naturally, there were exceptions, but the above rule still holds for the majority of the time, especially when it’s both silver-gold and miners-gold links that point to the same thing.

Now, the miners-gold link suggests that a new downtrend is starting, because miners were weak relative to gold to a big extent.

The performance of the silver price, on the other hand, suggests that the rally is coming to an end, as it is clearly playing catch-up.

Yesterday’s price action is a continuation of the above-mentioned indications.

Meanwhile, the USD Index appears to be forming a double-bottom pattern close to its 2016/2017 and 2020 highs.

While it might not be obvious based on the above chart, yesterday’s close in the USDX was higher than the highest daily close in 2016, 2017, and 2020.

There was no important breakdown whatsoever.

And without an important breakdown in the USD Index, there’s little to no reason to think that the precious metals sector has broken higher and that a new uptrend is beginning.

No.

It’s quite the opposite, in my view. The corrective upswings in the markets appear to be ending.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM