-

Markets Surge Despite Storming of U.S. Capitol

January 7, 2021, 9:53 AMIn a news-filled day, the Dow Jones hit an all-time high on Wednesday (Jan. 6), despite unprecedented unrest taking place in Washington D.C.

News Recap

- The Dow climbed 438 points or 1.4% and briefly rose more than 600 points earlier in the day. The S&P 500 also gained 0.6% and hit an intraday record, while the Nasdaq fell 0.6%. The small-cap Russell 2000 surged by nearly 4%.

- The day began with investors focused on the Georgia U.S. Senate special election runoff. Democrat Raphael Warnock defeated incumbent Republican Kelly Loeffler, with other Democrat Jon Ossoff announced as the winner over incumbent Republican Sen. David Perdue later in the day.

- With a Democrat sweep in Georgia, the party now has control of the Senate. Although it is a 50-50 split (with two independents) in the Senate, both Democrats win, they have full control because Vice President-elect Kamala Harris will serve as the tiebreaker vote.

- Many believe that because President-elect Biden, a Democrat, has a House and Senate under Democrat control, he could more easily pass higher taxes and progressive policies that may hurt the market. On the other hand, others believe that this Democrat sweep could bring into effect a larger and quicker stimulus relief bill.

- The real news of the day was what happened at the U.S. Capitol building. After President Trump (and his family) led a “Stop the Steal” rally in Washington, D.C. to protest Congress’ certification of Joe Biden as the next president, angry MAGA supporters did the unthinkable and stormed the Capitol.

- Wednesday (Jan. 6) was the first time since 1814 that the Capitol building was physically breached by hostile actors.

- The invasion of the Capitol occurred after Vice President Mike Pence rejected President Trump’s calls to block Joe Biden’s election confirmation. Shortly after, the Capitol went into full lockdown.

- Later that night, the Capitol was secured and Congress reconvened to officially certify Biden as the president. The CBOE Volatility Index (VIX) moved higher due to the unrest at the Capitol.

- Caterpillar (CAT) surged 5.5%, while big banks such as JPMorgan Chase (JPM) and Bank of America (BAC) gained 4.7% and 6.3%, respectively. Other names and sectors that could be aided by Biden’s agenda rose as well such as the Invesco Solar ETF (TAN) which boomed 8.4%.

- Tech lagged on the day due to fears of higher taxes and higher stimulus potential. Facebook (FB) and Amazon (AMZN) each fell more than 2%, while Netflix (NFLX) dipped 3.9%.

- The 10-year Treasury note yield topped 1% for the first time since March.

What a newsworthy day Wednesday (Jan. 6) was. What started as a day focused on Senate runoff elections with the balance of Senate power at stake, ended with President-elect Biden being officially confirmed as the next president. But in between? A mob took over the capitol building! Did you ever think you would read that sentence in your lifetime?

Love him or hate him, President Trump is an eccentric character to put it lightly. Scorned, and still convinced that he won the election, Trump and his bruised ego whipped his supporters into a frenzy during a “Stop the Steal” rally and encouraged them to march towards the Capitol and make their voices heard. Somehow the protest turned into a storming of the Capitol after Vice President Mike Pence refused to overturn the election. Pence was later ushered out of the Senate and the Capitol went into lockdown.

What’s truly shocking here is that the markets still went up! In fact, the Dow hit yet ANOTHER all-time high! Whether you like it or not, this has to give you some sort of faith in the resiliency of capitalism,

The results of the Georgia election can be credited for the market surge.

Although some sectors plummeted due to fears of higher taxes and stricter regulations, with full Democrat control of the Presidency, Senate, and House, there is clarity for one, and expectations of further spending and government stimulus.

Goldman Sachs expects another big stimulus package of around $600 billion. While this could be bad for the national debt and have long-term consequences, in the short-term, it could send the economy heating. Small-cap stocks surged as a result.

I still believe that there will be a short-term tug of war between good news and bad news. Many of these moves upwards or downwards are based on emotion and sentiment, and I believe there could be some serious volatility in the near-term. Although markets on Wednesday (Jan. 6) may have been overly excited from the “Blue Wave” thanks to Georgia, consider this: the Capitol was invaded and the pandemic is still wreaking havoc! Even though the markets gained and the 10-year treasury ticked above 1% for the first time since March, the VIX still rose which means that fear is on the rise.

There was no pullback to end 2020 as I anticipated, but I still believe that markets have overheated in the short-term, and that between now and the end of Q1 2020 a correction could happen.

Carl Icahn seemingly agrees with me, and told CNBC on Monday (Jan. 4) that “in my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction.”

National Securities’ chief market strategist Art Hogan also believes that we could see a 5%-8% pullback as early as this month.

I believe though that corrections are healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March 2020. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

While there will certainly be short-term bumps in the road, I love the outlook in the mid-term and long-term once vaccines become more widely available. The pandemic is awful right now, and these new infectious strains out of the U.K. and South Africa are quite concerning. But despite this, I believe the positive manufacturing data released on Tuesday (Jan. 5) is a step in the right direction, especially considering all the restrictions that most countries are living through.

The consensus is that 2021 could be a strong year for stocks. According to a CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

Can Small-caps Own 2021?

Small-caps are the comeback darlings of the week. Although I believed that the Russell 2000’s record-setting run since the start of November was coming to an end, it has rallied over 5% in the last two trading days. Thanks to a Democrat sweep in Georgia and hopes of further economic stimulus, small-cap stocks have climbed back towards record highs.

I love small-cap stocks in the long-term, especially as the world reopens. A Democrat-dominated Congress could help these stocks too. But I believe that in the short-term, the index, by any measurement, has simply overheated. Before Jan. 4, the RSI for the IWM Russell 2000 ETF was at an astronomical 74.54. I called a pullback happening in the short-term due to this RSI, and it happened. Well now the RSI is back above 72, and I believe that a bigger correction in the near-term could be imminent.

Stocks simply just don’t always go up in a straight line, and that’s what the Russell 2000 has essentially been between November and December.

What this also comes down to is that small-caps are more sensitive to the news - good or bad. I believe that vaccine gains have possibly been baked in by now. There could be another near-term pop due to hopes of further stimulus, but I believe that it’s likely possible that small-caps in the near-term could trade sideways before an eventual larger pullback.

I truthfully hope small-caps decline a minimum of 10% before jumping back in for long-term buying opportunities.

SELL and take Wednesday’s (Jan. 6) profits if you can- but do not fully exit positions.

If there is a pullback, this is a STRONG BUY for the long-term recovery.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Markets Recover Some Losses, While Eyeing Georgia

January 6, 2021, 9:53 AMStocks gained on Tuesday (Jan. 5) after the major indices all sold off to start the year on Monday (Jan. 4).

News Recap

- The Dow Jones closed 167.71 points higher, or 0.6%, at 30,391.60. The S&P 500 advanced 0.7% and the Nasdaq climbed nearly 1%

- The Georgia Senate run-off elections on Tuesday (Jan. 5) were the main focus of investors. At the time of publication, Democrat candidate Raphael Warnock was declared the winner over the incumbent Republican Kelly Loeffler for the first Senate seat up for grabs. The other contested seat between Democrat Jon Ossoff and incumbent Republican David Perdue had yet to be called.

- The balance of power in the Senate depends on these results and markets could be volatile. Many believe that if the Democrats sweep the Georgia seats and win control, then higher taxes and progressive policies could hurt the market. On the other hand, others believe that a Democrat sweep could bring on larger and quicker stimulus relief.

- Better-than-expected ISM U.S. manufacturing data came in and helped stocks higher. According to the ISM, manufacturing rose to 60.7 in December from 57.5 in November. The consensus was that the index would slightly decline to 57.

- Energy stocks led the S&P higher and soared by 4.5% after Saudi Arabia agreed to voluntary production cuts in February and March. Oil giants such as Chevron (CVX) rose 2.7% as a result.

- Oil futures surged by 4.9% and briefly broke past $50 a barrel for the first time since February.

- Copper is a precious metal traditionally seen as a leading indicator for the global economy. On Tuesday (Jan. 5), it hit its highest level in nearly eight years and gained more than 2%.

- Gold also reached an 8-week high due to more declines from the dollar.

- Boeing (BA) was the best-performing Dow stock and gained 4.4%.

- U.K. Prime Minister Boris Johnson on Monday (Jan. 4) announced a national lockdown to slow the spread of a new, more contagious, coronavirus strain. Under these restrictions, people are only allowed to leave their homes for essentials, work (if they can’t from home) and exercise. Most schools, including universities, will also move to remote learning.

- According to data compiled by Johns Hopkins University, more than 85 million COVID-19 cases have been confirmed globally, including 20.8 million in the U.S. and 2.7 million in the U.K.

- Meanwhile, over 5 million people in the U.S. have now received a COVID-19 vaccination.

After stocks sharply dropped on Monday (Jan. 4) to kick off 2021, widespread gains on Tuesday (Jan. 5) offset some of these losses. While Monday (Jan. 4) was the first time since 2016 that the Dow Jones started a year off with declines, two major catalysts sent the major averages higher: the oil production agreement reached between OPEC and Russia, and better than expected manufacturing results from December.

This tug of war between good news and bad news can be expected in the early part of this new year. Although Monday (Jan. 4) witnessed a sharp pullback (and in my opinion, a predictable one), Tuesday (Jan. 5) witnessed a reversal. In general, though, I still believe that markets have overheated and that between now and the end of Q1 2020, a correction could likely happen.

Markets have overheated, and I believe that much of the good news ranging from economic stimulus to vaccines has been baked in. Eventually, the reality on the ground will outweigh the positive news in the short-term.

National Securities’ chief market strategist Art Hogan put it best in my opinion, saying that he believes we could see a 5%-8% pullback as early as this month. Hogan said that

“we have a tug of war between virus news and vaccine news the better part of six months, and that’s been balanced off by stimulus...That seems to be behind us, and right now I think the virus news takes over a little bit.”

Additionally, if the Georgia elections on Tuesday (Jan. 5) go as I think they’ll go (Democrat sweep), it could be a short-term catalyst leading to a potential correction. The balance of power in the U.S. Senate is at stake with these elections. Investors are likely to prefer a divided Senate. If the Democrats sweep and wrestle away Senate control from the Republicans, it could leave President Biden’s powers largely unchecked, and enable him to pass more ambitious, progressive, and less market-friendly policies.

At the time of this publication, Democrat candidate Raphael Warnock was declared the winner over the incumbent Republican Kelly Loeffler for the first Senate seat up for grabs. The other contested seat between Democrat Jon Ossoff and incumbent Republican David Perdue had yet to be called.

According to John Stoltzfus, chief investment strategist at Oppenheimer Asset Management , the S&P 500 could fall by 10% if the Democratic candidates sweep the Georgia runoffs.

“It is thought by not just a few folks on Main Street as well as on Wall Street that if tomorrow’s run-off results in a sweep for the Democrats — providing them with control of the Senate as well as the House — that it would bode ill for business with the likelihood that corporate tax rates could rise substantially,” Stoltzfus said.

On the other hand, a Democrat sweep could mean potentially larger stimulus packages - and soon.

There is optimistic potential, but the road towards normality will hit inevitable speed bumps and uncertainty. This Senate election and the potential market reactions reflect that.

If and when a correction does happen, I believe it will be healthy and a good thing. Corrections are normal market behaviors and happen more frequently than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). Since we have not had one since March 2020, I believe we are long overdue, and the catalysts are there. Most importantly though, a correction could be a great buying opportunity for what I believe will be a strong second half of the year.

While there will certainly be short-term bumps in the road, I love the outlook in the mid-term and long-term once vaccines become more widely available. The pandemic is awful right now, and these new infectious strains are quite concerning. But despite this, I believe the positive manufacturing data released on Tuesday (Jan. 5) is a step in the right direction, especially considering all the restrictions that most countries are living through.

The consensus is that 2021 could be a strong year for stocks. According to a CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

The premium analysis this morning will showcase a “Drivers and Divers” section that will break down some sectors that are in and out of favor. As a token of my appreciation for your patronage, I decided to give you a free sample of a “driver” and “diver” sector. Please do me a favor and let me know what you think of this segment! I’m always happy to hear from you.

Driving

Small-Caps (IWM)

Figure 1 - iShares Russell 2000 ETF (IWM)

After seeing a sharp pullback since Christmas week, the Russell 2000 briefly returned to its winning ways on Tuesday (Jan. 5). The IWM Russell 2000 ETF which tracks the small-cap index witnessed a 1.55% gain - its best day in a while.

Although I genuinely love small-cap stocks in the long-term as the world will eventually reopen, I believe that in the short-term the index has overheated. Until the start of this week, the RSI for the IWM Russell 2000 ETF was at an astronomical 74.54. Although the RSI is at a more manageable 62.84, I still believe that the party of seeing vertical gains is over for now.

Small-caps in the short-term will be more sensitive to bad news, and right now there is a lot. Vaccine gains have possibly been baked in by now and stocks just don’t go up vertically the way that the Russell 2000 did between November and late December. It is very possible that small-caps in the near-term could trade sideways before an eventual larger pullback. I truthfully hope small-caps decline a minimum of 10% before jumping back in for long-term buying opportunities.

For now, SELL and take short-term profits if you can - but do not fully exit positions.

If there is a pullback, this is a STRONG BUY for the long-term recovery.

Diving

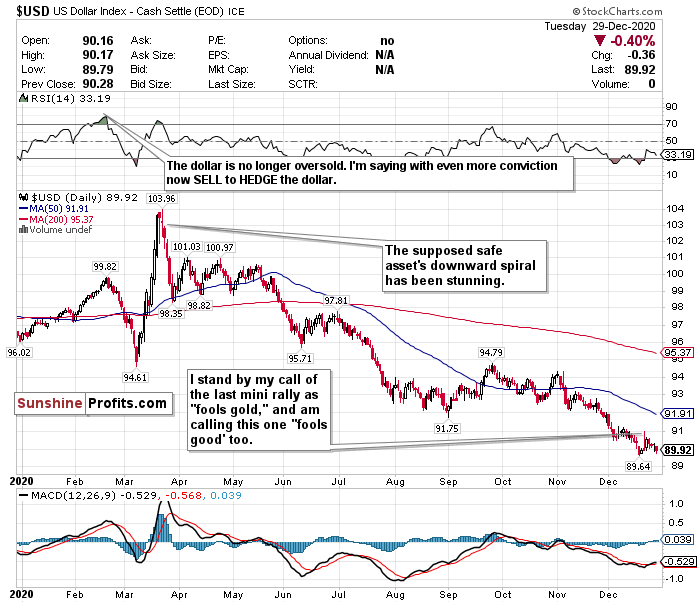

US Dollar ($USD)

Figure 2 - U.S. Dollar ($USD)

I have zero faith in the U.S. Dollar as a safe asset, even if we may see some short-term volatility and “risk-off” trades. I still am calling out the dollar’s weakness after several weeks despite its low levels. I expect the decline to continue as well thanks to a dovish Fed.

Any time the U.S. Dollar rallies, it is simply “fool’s gold.” Since I started doing these newsletters about a month ago, I have consistently said that any minor rally the dollar would experience would be a mirage. Since the dollar briefly pierced the 91-level on December 9th, it has fallen over 1.8%. Despite the dollar experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 1.25%. I believed the dollar would drop back below 90 before the new year, and here we are to start off 2021 with the dollar at 89.41. Since hitting a nearly 3-year high on March 20th, the dollar has plunged nearly 13.8% while emerging markets, foreign currencies, precious metals, and cryptocurrencies continue to strengthen. Gold for example reached an 8-week high on Tuesday (Jan. 5)

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. But in my view, you can do a whole lot better than the U.S. dollar for safety.

I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years. Meanwhile, the US has $27 trillion of debt, and it’s not going down anytime soon.

Another headwind to consider for the dollar is the Georgia Senate election. If Democrats sweep, there could be more aggressive stimulus in the near term. With Democrats controlling both the House and the Senate, more stimulus could be bearish for the dollar.

Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. With the dollar now at 89.41, we are coming dangerously close.

The dollar’s RSI is also nearly oversold once again and is trading significantly below both its 50-day and 200-day moving averages.

For now, where possible, HEDGE OR SELL USD exposure.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Major Averages Plummet to Start 2021

January 5, 2021, 10:37 AMQuick Update

In a quick update to kick off 2021, I wanted to summarize my correct calls, and what I profited on since beginning to publish these updates. While nobody can predict the future, the major calls I am most proud of since writing these letters are calling the short-term downturn in small-cap stocks, adding emerging market exposure, and hedging or selling the U.S. dollar.

I switched my call on small-caps, specifically the Russell 2000 from a HOLD to a short-term SELL on December 16th. The iShares Russell 2000 ETF (IWM) surged to unprecedented record gains since November 2020, however, I believed then and still believe that the index has overheated by many measurements. Since December 16th, the IWM ETF is largely flat. However, since peaking on December 23rd, the IWM has underperformed ETFs tracking the larger indices and has declined by nearly 3%. While I am still bullish on small-caps in the long run and maintain my STRONG BUY call on the Russell for the long-term, it is contingent on a pullback. I believe that pullback may have begun. I am hoping for a minimum 10% decline before jumping back in for the long-term.

Emerging markets have been some of the best performers in 2020, and I have made some bullish calls on specific regional markets for 2021 as well. I have been touting emerging markets since my first report, but when I switched my focus to specific regions, my calls became even more correct. I called Taiwan (EWT ETF) the best bet for emerging market exposure while avoiding the risks and baked in profits of China on December 3rd. Since then, the EWT ETF which tracks Taiwan has gained over 7% while the MCHI ETF which tracks China has barely gained over 1.4%. The Taiwan ETF has also outperformed the SPY S&P 500 ETF and the IEUR ETF which tracks Europe.

In conjunction with my bullish calls on emerging markets, my bearish calls on the U.S. dollar were also correct. Since I started doing these newsletters about a month ago, I consistently said that the dollar should be hedged or avoided because of the Fed’s policies, effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. Since the dollar briefly pierced the 91-level on December 9th, it has fallen nearly 1.4%. Despite it experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.77%. I believed it would drop back below 90 before the new year, and here we are to start off 2021, with the dollar at 89.85.

Markets kicked off the first trading day of 2021 with a dud, due to further concerns of COVID-19 cases and the Georgia Senate run-off elections.

News Recap

- Monday (Jan.4) marked the first negative start to a year for the Dow Jones since 2016. The Dow Jones closed 382.59 points lower, or 1.3%, at 30,223.89. The Dow at one point fell more than 700 points.

- The S&P 500 also fell 1.5% to 3,700.65, the Nasdaq fell 1.5%, and the small-cap Russell 2000 fell 1.47%.

- This was the biggest one-day sell-off since Oct. 28 for the Dow and S&P 500, and the Nasdaq’s worst sell-off since Dec. 9.

- While the sell-off to start the year could be due to natural consolidation, the growing number of COVID-19 cases around the world and its potential impact on the global economic recovery weighed on investors. To start the year off, U.K. Prime Minister Boris Johnson announced a national lockdown to slow the spread of a new, more contagious, coronavirus strain. With this lockdown, people are only allowed to leave their homes for essentials, work if they can’t from home, and exercise. Most schools, including universities, will also move to remote learning.

- According to data compiled by Johns Hopkins University, more than 85 million COVID-19 cases have been confirmed globally, including 20.7 million in the U.S. and 2.7 million in the U.K.

- Pay very close attention to the Georgia Senate run-offs on Tuesday (Jan. 5). The balance of power in the Senate is hanging on the vote and markets could be volatile due to the results. If the Democrats gain a majority, it could impact market performance and leave Biden’s powers largely unchecked. If the Republicans keep just one seat, it could likely check Biden’s more progressive ambitions.

- Coca-Cola (KO) and Boeing (BA) were the laggards on the Dow, falling 3.8% and 5.3%, respectively. Real estate stocks were the worst performing on the S&P and fell 3.2%. Utilities also declined 2.6%.

- About 4.6 million people in the U.S. have now gotten a COVID-19 vaccine.

Stocks dropped sharply on Monday (Jan. 4), to kick off 2021. It was the first time since 2016 that the Dow Jones started a year off with declines and was the biggest one-day sell-off since Oct. 28 for the Dow and S&P 500. It was also the Nasdaq’s worst one-day decline since Dec. 9.

Several catalysts can be blamed for the gloomy start to the year: natural consolidation, COVID-19, and the Georgia Senate runoff elections.

First and foremost, a decline like this was bound to happen, and I called this happening in the early part of the year. I still believe that there will be a short-term tug of war between good news and bad news, and that these moves are manic and based on sentiment. There was no pullback to end 2020 as I anticipated, but I still believe that markets have overheated in the short-term. Was Monday (Jan. 4) the start of a correction? Possibly. But either way, I think that between now and the end of Q1 2020, a correction could happen.

Carl Icahn seemingly agrees with me, and told CNBC on Monday (Jan. 4), “in my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction.”

I believe, though, that corrections are healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March 2020. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

Meanwhile, COVID-19 continues surging and there are very real fears of new strains discovered in the U.K. and South Africa that could be more contagious. U.K. Prime Minister Boris Johnson announced a national lockdown that could potentially last until mid-February. With this lockdown, people are only allowed to leave their homes for essentials, work if they can’t from home and exercise. Most schools, including universities, will also move to remote learning. This could be an ominous sign for stricter lockdowns to be implemented in other regions across the world.

Outside of COVID-19, political uncertainty has returned to the markets. The balance of power in the U.S. Senate is at stake, with Georgia run-off Senate elections set to occur on Tuesday (Jan. 5). Investors are likely to prefer a divided Senate. If the Democrats win both elections and wrestle away Senate control from the Republicans, it could leave President Biden’s powers largely unchecked, and enable him to pass more of his ambitious and progressive policies. Many investors do not anticipate these to be very market friendly. As results start to come in Tuesday evening, markets could react in a volatile manner.

According to John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, the S&P 500 could fall by 10% if the Democratic candidates win the Georgia runoffs.

“It is thought by not just a few folks on Main Street as well as on Wall Street that if tomorrow’s run-off results in a sweep for the Democrats — providing them with control of the Senate as well as the House — that it would bode ill for business with the likelihood that corporate tax rates could rise substantially,” Stoltzfus said.

This will also be a busy week for economic data with the manufacturing PMI report said to be released Tuesday (Jan. 5) and the non-farm payrolls report set to be announced Friday (Jan. 8).

Monday's sell-off (Jan. 4) serves as a very painful reminder that markets will still have to weigh the near-term risks against some of the more positive mid-term and long-term hopes on vaccines and re-opening.

The general consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

Does the Dow Approach 31,000 or 29,000 Before Mid-2021?

I have too many short-term questions for the Dow Jones. I believe it’s just as likely for the Dow to touch 29,000 again as it is to touch 31,000 before March.

After trading as low as around 29,650 at one point before the new year (Dec. 21), the Dow has remained firmly above 30,000. However, it has traded largely sideways over the last few weeks, despite opening Jan. 4 with a record high.

Despite some long-term optimism, for now, my short-term questions take precedence. I don’t like how COVID-19 is trending (who does?), I am disappointed in the vaccine roll-out, and I am concerned about the Georgia election. In the short-term, I am not convinced that the Dow will stay above 30,000 for more than a week at a time and I am also not convinced that it will hit more all-time highs before March.

In the short-term, I believe it is just as likely for the Dow to approach 29,000 as it is to approach 31,000 in the early months of 2021.

While I think a 35,000 call to close out 2021 is a bit aggressive, I do believe that the second half of 2021 could show robust gains for the index.

With so much uncertainty and the RSI still firmly in hold territory, the call on the Dow stays a HOLD.

This is a very challenging time to make a call on the Dow with conviction. But one thing I do believe is that if and when there is a drop in the index, it will not be strong and sharply relative to the gains since March 2020. I believe that it is more likely than not that we will be in a sideways holding pattern until vaccines are available to the general public by mid-2021.

For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Markets Fall as Senate Debates Higher Stimulus Checks

December 30, 2020, 12:02 PMQuick Update

As a quick update to kick off today’s newsletter, I would like to summarize my correct calls and what I profited on since beginning to publish these Driver & Diver updates. While nobody can predict the future, here are the major calls I am most proud of since producing these letters: 1) hedging or selling the U.S. Dollar; 2) selling energy; 3) switching my short-term call on small-caps from HOLD to SELL.

Ever since beginning these Driver & Diver updates on December 9th, I have made SELL calls for the U.S. Dollar and energy. My call on the U.S. dollar was based on the Fed’s policies, the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. Since the dollar briefly pierced the 91-level on December 9th, it has fallen over 1%. Despite the dollar experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.75%. I believed the dollar could drop back below 90 before the new year, and now here we are.

Since the first Driver & Diver, I also said that energy is unpredictable and volatile, and has consistently pulled back in 2020 after experiencing a hot streak. Since December 10th, the Energy Select Sector SPDR Fund (XLE) has declined over 9.5%.

I also switched my call on small-caps, specifically the Russell 2000, to a short-term SELL from a HOLD on December 16th. Although the iShares Russell 2000 ETF (IWM) is largely flat since I switched my call, by any measurement, the index has overheated. In this week alone, the IWM has underperformed ETFs tracking the larger indices and has declined by nearly 3%. While I am still bullish on small-caps in the long run and maintain my STRONG BUY call on the Russell for the long-term, it is contingent on a pullback. I believe that pullback may have begun.

Stocks fell on Tuesday (Dec. 29) after the major indices all hit record highs on Monday (Dec. 28). Investors monitored the Senate’s talks on higher stimulus checks.

News Recap

- The Dow Jones snapped a 3-day winning streak and declined 68.30 points lower, or 0.2%, to close at 30,335.67. At its session high, the Dow was up more than 100 points. The S&P 500 also snapped a 3-day winning streak and declined 0.2%, and the Nasdaq fell 0.4%. The small-cap Russell 2000 index continued its decline this week and fell 1.92%.

- The Democrat-led House voted late Monday to increase stimulus payments to $2,000 from $600. Although Senate Majority Leader Mitch McConnell blocked fast-tracking unanimous Senate approval on Tuesday (Dec. 29), many GOP Senators have expressed support for the stimulus increase. Time will tell what happens.

- Apple (AAPL) and Home Depot (HD) fell more than 1% each to lead the Dow lower.

- Intel (INTC) shares rose nearly 5% due to news of exploring “strategic alternatives.” Intel shares have lost nearly 18% this year, and the chipmaker has lost significant market share to many other semiconductor competitors.

- Amidst fears of a COVID-19 “surge on top of a surge” after the Christmas holiday, more than 2.1 million people in the U.S. have now been vaccinated. However, the U.S. is likely to fall far short of its goal to vaccinate 20 million people by the end of the year. Meanwhile, the U.S. has averaged at least 184,000 new infections per day.

- The U.K. became the first country to approve a COVID-19 vaccine by AstraZeneca and Oxford. This is the third emergency-use approval vaccine, but is not yet approved in the U.S.

Investors on Monday (Dec. 28) cheered President Trump’s signing of the stimulus bill. However, some of those gains were lost on Tuesday (Dec. 29) as eyes turned to the Senate’s decision on raising direct stimulus payments from $600 to $2,000.

While some of these declines can be attributed to the end of the year consolidation, profit-taking, and rebalancing, a lot of this can also be chalked up to an overheating market.

Some of these declines can also be due to a pandemic that is still not under control. The market has surged since March 23rd and has largely ignored the reality on the ground. But in the near term, a tug of war between good news and bad news is inevitable. Although vaccine distribution has officially begun, it has been a slower and choppier roll-out process than anticipated. The level of infection and death has also reached unprecedented levels.

“The viral resurgence has induced lockdown measures throughout the country, stunting economic reopening efforts. If the viral spread is not brought under control by year’s end, it will likely be a key initiative to do so in early 2021, before a vaccine has become widely distributed,” Jason Pride, CIO of private wealth at Glenmede said.

Despite the declines on Tuesday (Dec. 29), the general focus of both investors and analysts has appeared to be the long-term potential of 2021.

As Tom Essaye, founder of The Sevens Report said:

“The five pillars of the rally (Federal stimulus, FOMC stimulus, vaccine rollout, divided government and no double dip-recession) remain largely in place, and until that changes, the medium and longer-term outlook for stocks will be positive.”

While I still believe that this tug of war between good news and bad news will lead into the beginning of the new year, I am now convinced that these moves are manic and based on sentiment. There has not been a sharp pullback to end the year as I anticipated, however, I do believe that markets have overheated and that between now and the end of Q1 2020, a correction could happen.

There is optimistic potential, but the road towards normalcy will hit inevitable speed bumps.

I do believe, though, that a correction is healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

The mid-term and long-term optimism are very real, despite the near-term risks. The passage of the stimulus package only solidifies the robust vaccine-induced tailwinds entering 2021.

The consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a new CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000- a roughly 16% gain from last Thursday’s (Dec. 24) close of 30,199.87. Five percent also said that the index could climb to 40,000 by the end of 2021.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

The premium analysis this morning will showcase a “Drivers and Divers” section that will break down some sectors that are in and out of favor. As a token of my appreciation for your patronage, I decided to give you a free sample of a “driver” and “diver” sector. Please do me a favor and let me know what you think of this segment! I’m always happy to hear from you.

Driving

Small-Caps (IWM)

Figure 1 - iShares Russell 2000 ETF (IWM)

The Russell 2000 small-cap index has now officially underperformed the larger-cap indices for two consecutive days. I can’t remember the last time that I’ve typed that. The index has outperformed since the start of November and has been on a scorching hot record run. However, when it comes to stocks the law of gravity applies: “what goes up must come down.”

I love small-cap stocks in the long-term, especially as the world reopens. But ever since I switched my call on the iShares Russell 2000 ETF (IWM) from a short-term HOLD to a short-term SELL on December 16th, I saw this pullback coming.

Although the RSI for the IWM ETF is no longer overbought, I still believe that the index has overheated. I would like to see a bit more of a decline before jumping right back in.

I believed a short-term pullback for small-caps would eventually happen, and I feel that this could be the start. Truthfully, I hope the IWM declines another 7% or so because I am quite bullish on small-caps for 2021. The IWM has declined nearly 3% this week. If it drops another 7% or so as I said, then jump in for the long-term buying opportunities. I sure will.

SELL and take short-term profits if you can - but do not fully exit positions.

If this pullback extends further, this could be a STRONG BUY for the long-term recovery.

Diving

US Dollar ($USD)

Figure 2 - U.S. Dollar ($USD)

The U.S. Dollar on Tuesday (Dec. 29) dropped below the 90-level yet again and declined 0.40%. Despite the dollar experiencing a mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearishness of the dollar. I also stated that I believed the dollar could drop below 90 again before the new year. Well, here we are.

I am not a fan of the dollar and am not fooled by any mini-rallies. I called its rally past the 91-level three weeks ago “fool’s gold,” and I called any subsequent rally afterward “fool’s gold” as well. Since the open on December 23rd, the U.S. Dollar has declined another 0.75%.

I still am calling out the dollar’s weakness after several weeks, despite its low levels. I expect the decline to continue as well thanks to a dovish Fed.

Since hitting nearly a three-year high on March 20th, the dollar has plunged around 13% while emerging markets and other currencies have continued to strengthen.

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. Especially if there is a short-term correction coming in the markets. But in my view, you can do a whole lot better than the U.S. dollar for safety.

The dollar is still hovering around its lowest levels since April 2018. Despite this low level, I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on this as a value play or the dollar’s prospects over the next 1-3 years.

Meanwhile, the US has $27 trillion of debt, and it’s not going down anytime soon.

Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. I believe this is more likely to happen than the dollar piercing 91 again.

The dollar’s RSI is now back above 37 somehow as well despite significantly trading below both its 50-day and 200-day moving averages.

For now, where possible, HEDGE OR SELL USD exposure.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Major Averages Hit More Record Highs

December 29, 2020, 11:07 AMQuick Update

As a quick update to kick off today’s newsletter, I would like to summarize my correct calls and what I profited on since beginning to publish these updates. While nobody can predict the future, the major calls I am most proud of since producing these letters are 1) adding emerging market exposure and 2) hedging or selling the U.S. Dollar.

Emerging markets have been some of the best performers in 2020, and I have made some bullish calls on specific regional markets for 2021 as well. I have been touting emerging markets since my first report, but when I switched my focus to specific regions, my calls became even more correct. On December 3rd, I called Taiwan (EWT ETF) the best bet for emerging market exposure while avoiding the risks and baked in profits of China. Since then, the EWT ETF which tracks Taiwan has gained over 4.3% while the MCHI ETF which tracks China has fallen over 3.3%. The Taiwan ETF has also outperformed the SPY S&P 500 ETF and the IEUR ETF which tracks Europe.

My calls on the U.S. dollar were also correct. Since I started doing these newsletters about a month and a half ago, I consistently reiterated that the dollar should be hedged or avoided because of the Fed’s policies, effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. In the last month and a half, the dollar has fallen around 2.3%, and since it briefly pierced the 91-level on December 9th, it has fallen another 1%.

Markets kicked off the final week of 2020 with a surge towards record highs after President Trump finally signed off on the stimulus bill.

News Recap

- All major indices closed at record highs. The Dow Jones rose 204.10 points higher, or 0.7%, to close at 30,403.97. The S&P 500 climbed 0.9% to 3,735.36, and the Nasdaq rose 0.7% to 12,899.42. Meanwhile, the small-cap Russell 2000 underperformed and declined 0.38%.

- After President Trump called the $900 billion stimulus package an unsuitable “disgrace,” and alluded to possibly vetoing the bill, over the weekend the president signed the bill into law. By signing off, a government shutdown was averted while unemployment benefits were extended to millions of Americans.

- After President Trump demanded stimulus checks for Americans to be raised from $600 to $2,000 each, the Democrat-led House voted for this measure on Monday (Dec. 28). The ball is now in the GOP-led Senate’s court on the measure. They are not expected to approve the measure.

- Apple led the Dow higher, and gained 3.6%. Disney also climbed nearly 3%.

- Communication services, consumer discretionary and tech were the best performing sectors in the S&P 500, with each rising over 1%.

- Amidst fears of a COVID-19 “surge on top of a surge” after the Christmas holiday, over one million people in the U.S. have now been vaccinated. Meanwhile, the U.S. has averaged at least 184,000 new infections per day.

Markets cheered President Trump’s signing of the stimulus package and are further encouraged by the possibility of larger stimulus checks. After the market traded flat last week, it kicked off the final week of 2020 with a bang. Although it is still very possible that consolidation, profit taking, and rebalancing could happen in this shortened week, the general focus of both investors and analysts has appeared to be the long-term potential of 2021.

As Tom Essaye, founder of The Sevens Report said:

“The five pillars of the rally (Federal stimulus, FOMC stimulus, vaccine rollout, divided government and no double dip recession) remain largely in place, and until that changes, the medium and longer-term outlook for stocks will be positive.”

While I still do believe that there will be a short-term tug of war between good news and bad news, I am now convinced that these moves are manic and based on sentiment. There has not been a pullback to end the year as I anticipated. But I still do believe that markets have overheated, and that between now and the end of Q1 2020 a correction could happen.

There is optimistic potential, but the road towards normalcy will hit inevitable speed bumps.

I do believe though that a correction is healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

The mid-term and long-term optimism are very real, despite the near-term risks. The passage of the stimulus package only solidifies the robust vaccine-induced tailwinds entering 2021.

The general consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a new CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000 - a roughly 16% gain from Thursday’s close of 30,199.87. Five percent also said that the index could climb to 40,000 by the end of 2021.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

Will the Dow Approach 31,000 or 29,000 Before Mid-2021?

Figure 1 - Dow Jones Industrial Average ($INDU)

After trading as low as around 29,650 at one point last Monday (Dec. 21), the Dow has been firmly back above 30,000 for the last week. The blue-chip index also closed at yet another record high on Monday (Dec. 28).

I do think that the Dow has some more room to run in the next few days to close off the year. Trump’s signing of the stimulus bill was a belated Christmas gift for investors everywhere. If the Senate approves $2,000 stimulus checks, then another short-term pop can certainly happen.

My short-term questions though still remain as to whether or not the Dow can not only stay above 30,000 for more than a week at a time but also hit more all-time highs before March. The volume has also been very unstable as of late, but that is likely due to shortened trading weeks to close off the year.

In the short-term, I believe it is just as likely for the Dow to approach 29,000 as it is to approach 31,000 in the early months of 2021.

While I think a 35,000 call to close out 2021 is a bit aggressive, I do believe that the second half of 2021 could show robust gains for the index.

With so much uncertainty and the RSI still firmly in hold territory, the call on the Dow stays a HOLD.

This is a very challenging time to make calls with conviction. But one thing I do believe is that if and when there is a drop in the index, it will not be strong and sharp relative to the gains since March, let alone November. I believe that more likely than not we will be in a sideways holding pattern until vaccines are available to the general public by mid-2021.

For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM