-

Markets Close Mixed Due to Mild Vaccine Concerns

December 4, 2020, 12:03 PMMildly concerning vaccine data and other headwinds weighed on the markets on Thursday as the indices closed mixed.

News Recap

- The Dow Jones closed up 86 points, or .29% after rising over 200 points at the session high. After closing at record highs for two straight sessions and hitting another intraday high, the S&P 500 pulled back .06%. The Nasdaq rose 0.23%, and small-caps once again led the way with the Russell 2000 gaining .60%.

- Reports that Pfizer was scaling back its vaccine rollout plan for 2020 due to supply chain issues weighed on markets. After finding raw materials in early production that did not meet its standards, Pfizer now expects to ship out only half the vaccines it planned to ship in 2020. However, Pfizer and BioNtech are still on track to roll out 1.3 billion vaccines in 2021. Pfizer’s stock fell 2% on the news.

- Jobless claims from last week came in at 712,000 and beat estimates of 780,000. This is the first time in 3 weeks that jobless claims fell, and was the lowest figure since the pandemic started.

- US job cuts also slowed in November. 64,797 job cuts were reported in November, a drop from the 80,666 cuts in October, and the second-lowest monthly total for 2020. However, it is 45.4% higher than the 44,569 cuts in the same month last year.

- The ISM Non-Manufacturing PMI, or indicator for the U.S. services industry, fell to 55.9 in November from 56.6 in the previous month, and was largely in line with estimates. However, this reading is the slowest increase in the services sector in six months.

- House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell spoke for the first time since the election and discussed the stimulus package. McConnell on Wednesday rejected a $908 billion bipartisan proposal but said that he sees “hopeful signs” toward reaching an agreement by the end of the year.

- Further stroking the flames of tensions with China, the House of Representatives unanimously passed a bill that will mandate Chinese companies to adhere to U.S. auditing standards if they want to be listed on American exchanges. President Trump is expected to sign the bill into law.

- COVID-19 continues to rage at alarming numbers. Over 100,000 patients are currently hospitalized. The initial wave in the spring never came close to this. 2,800 COVID-19 deaths were also reported- the highest single-day death toll on record.

In the short-term, there will be optimistic days where investors rotate into cyclicals and value stocks, and pessimistic days where there will be a broad sell-off or rotation into “stay-at-home” names. However, in the last two sessions, markets largely traded sideways.

In the mid-term and long-term, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would feel like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening such as small-caps should thrive.

Markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While more positive vaccine news continues to trickle in day by day, there is still discouraging COVID-19 news, economic news, and geopolitical news to consider. Amidst the current fears of a double dip recession with further COVID-19-related shutdowns and no stimulus, it is very possible that short-term downside persists. However, it’s encouraging that Pelosi and McConnell are talking again. If a stimulus passes before the end of the year, it will certainly boost sentiment.

Due to this tug of war between good news and bad, any subsequent move downwards will likely be modest in comparison to the gains since the bottom in March and since the start of November. It is truly hard to say with conviction that another crash or bear market will come. If anything, the constant wrestling match between sentiments will keep markets relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

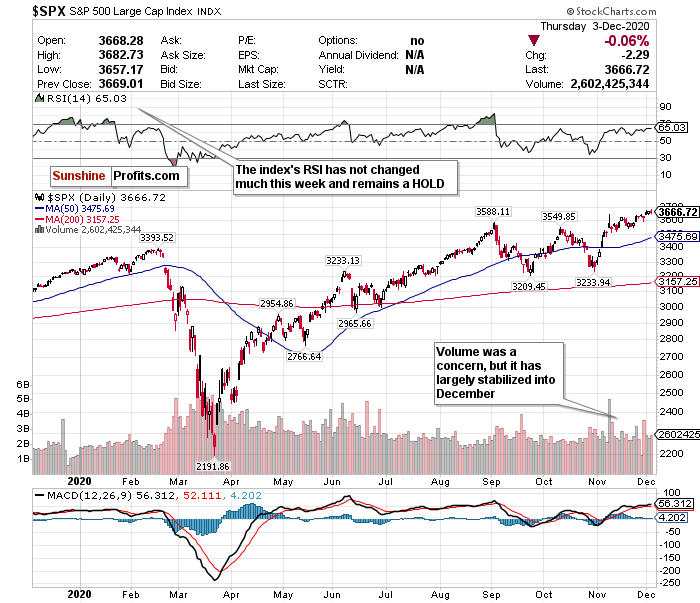

After two straight record closes, the S&P somewhat pulled back on Thursday. There are a few indicators that show that the S&P could face some near-term volatility, however, these indicators have largely stabilized this week. The S&P’s stabilization in volume for one is a big deal. After volume sharply declined from November 9th, there were doubts on the sustainability of the rally, but it has largely been stable over the last few weeks.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index, and an increase in stock price volatility. Therefore, a stable volume trend means that volatility may decrease. Again though, this is a market that trades largely on news and sentiment, so anything could change.

The RSI of 65.03 also keeps the S&P in a HOLD category. Although the RSI has not moved much this week, be very wary if it exceeds the overbought level of 70 - because it’s approaching – however, sideways trading should mute this.

With this data, further pullback from these levels would not be a shock… but another surge based on good news would not be a shock either. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

The premium analysis this morning will showcase a “Drivers and Divers” section that will break down some sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! Always happy to hear from you.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Stocks Close Mixed - S&P Notches Another Record Close

December 3, 2020, 8:51 AMAs investors weighed the latest vaccine news, stimulus progress, and economic data, the S&P 500 eked out another gain on Wednesday and closed at a record high for a second day in a row.

News Recap

- The Dow Jones climbed 59.87 points, or 0.2%, the S&P 500 gained .18%, and the Nasdaq fell 0.1%.

- Senate Majority Leader Mitch McConnell’s rejection of a bipartisan $908 billion stimulus proposal weighed on stocks and muted gains.

- Despite the positive vaccine data from today, with the UK becoming the first country to approve the usage of Pfizer and BioNTech’s vaccine, Federal Reserve Chairman Jerome Powell called the economic outlook “extraordinarily uncertain” yesterday.

- November’s private payroll data disappointed today and missed expectations. Economists expected 475,000 private jobs to be added in November. However, according to ADP, only 307,000 were added. This was also the lowest figure since July.

- The US reported 180,083 new Covid-19 cases- the most in four days and up from 157,901 the day before. 2597 people also died - the second-highest daily rate on record. Hospitalizations also continue to hit records with at least 98,691 beds occupied on Tuesday.

- Energy and financials were the best performing sectors on the S&P 500 today and rose 3.2% and 1.1%, respectively.

- Boeing led the Dow higher with a gain of 5.1%, while Salesforce lagged by nearly 9% after it confirmed its $27.7 billion acquisition of messaging platform Slack.

Because of the short-term tug of war between optimism and reality, it is fairly difficult to proclaim BUY or SELL calls for the near-term future. Rather, in the short-term, I feel more comfortable staying neutral and calling HOLD for broader markets. There will be optimistic days where investors rotate into cyclicals and value stocks, and more pessimistic days where investors run towards “stay-at-home” names and COVID winning tech stocks. Broader market selloffs could always happen as well.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, and optimism and relief will permeate the markets. The UK’s approval of Pfizer and BioNTech’s vaccine on Wednesday was a huge step forward on that front.

It is a simple fact - markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. Today’s muted and mixed moves should be more of the new normal than the March crash or November surge. Any short-term moves upwards or downwards should be relatively modest and tame. There is still too much pushing and pulling between bad news and good news to say with conviction that another crash or surge will come. If anything, this tug of war will keep markets relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

In the S&P chart above, there are a few indicators that show that the S&P could face some near-term volatility - especially after its run towards multiple record closes in the last week. However, again, it is hard to say with conviction there will be a major downturn. The RSI of 65.42 keeps the S&P in a HOLD category. While it is still close to an overbought figure, it has remained relatively stagnant this week.

The sharp decline in volume, especially relative to its record closes, is what is more concerning for me.

The consistent decline in volume for the S&P has been sharp and swift and continues to trend downwards. This is very concerning for volatility purposes.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index, and an increase in stock price volatility. Therefore, this drop in volume puts some serious doubt on the sustainability of the recent rallies and the S&P’s short-term outlook.

We’re in the early recovery phase of the cycle following the COVID-19 recession, but this rapid rebound is under pressure. Further pullback from these elevated levels would not be a shock… but another surge based on good news would not be a shock either. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Markets Recover Monday's Losses, Continue November Rally Into December

December 2, 2020, 9:12 AMU.S. stocks recovered Monday’s losses and kicked off December with more gains. The rallies we saw in November continued on to start the final month of 2020 - a year which has been quite trying and difficult.

News Recap

- The Dow Jones, which jumped as high as 400 points to hit a new intraday high, closed up 185.28 points, or 0.6%, to 29,823.92. The S&P 500 notched a record closing high and also rose 1.1%, while the Nasdaq gained 1.3% and also closed at a record high.

- Sentiment was boosted after lawmakers revealed on Tuesday a $908 billion stimulus plan that includes over $200 billion in Paycheck Protection Program small business loans.

- Additional vaccine news helped spur the markets as well, after Pfizer and BioNTech applied to the European Medicines Agency for conditional marketing authorization of their coronavirus vaccine. This could potentially put the vaccine to full use in Europe before the end of 2020.

- Electric-car maker Tesla (TSLA) gained 2.7% after S&P announced that the stock would be added to the S&P 500 index on Dec. 21 in a single step, despite the company’s large size. Apple (AAPL) also rose 3% along with Intel (INTC) to lead the Dow higher. Communications and financials led the S&P 500, rising at least 1.9% each.

- Zoom Video (ZM) was the laggard of the day and fell 15.3% despite reporting better-than-expected earnings for the third quarter.

- Markets picked up where they left off in November. The Dow rallied 11.8% in November, posting its best one-month performance since January 1987. The S&P 500 and Nasdaq also rose 10.8% and 11.8%, respectively, for their strongest monthly gains since April. After November’s gain and Tuesday’s rally, the S&P 500 is now up 13.8% for 2020.

- Value stocks and small-caps led last month’s rally since these are stocks largely reliant on an economic comeback. The vaccine news of the last several weeks buoyed the sentiment. The iShares Russell 1000 Value ETF (IWD) rallied 13.4% for the month, and outperformed its growth counterpart, the iShares Russell 1000 Growth ETF (IWF), by more than 3%. The small-cap Russell 2000 also had its best month ever and rose more than 18%.

- However, not all is well. Both Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin spoke before Congress on Tuesday, with Powell stating that the economic outlook for the U.S. was “extraordinarily uncertain,” and that the surge in COVID-19 cases “could prove challenging for the next few months.” Powell further said that a full economic recovery is unlikely until people feel safe and confident.

- Additionally, according to data compiled by Johns Hopkins University, more than 13 million COVID-19 cases have been confirmed in the U.S. along with over 266,000 deaths. Shutdown and emergency measures continue to be reimposed worldwide and in the U.S. Most recently, New York Gov. Andrew Cuomo’s announced that the state was reimplementing emergency hospital measures.

- ISM data also showed that U.S. factory growth slowed in November. Although figures pointed to expansion in the overall economy for the seventh month in a row, according to the ISM Manufacturing report, the PMI for the US fell to 57.5 in November from a two year high of 59.3 in October. Figures came in slightly lower than market forecasts of 58.

There will be optimistic days where investors rotate into cyclicals and value stocks, and pessimistic days where there will be a broad sell-off or rotation into “stay-at-home” names.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would be like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening, such as small-caps, should thrive.

It is a simple fact - markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While more positive vaccine news continues to trickle in day by day, there is still discouraging COVID-19 news, economic news, and geopolitical news to consider. Amidst the current fears of a double-dip recession with further COVID-19-related shutdowns and no stimulus, it is very possible that a short-term downside persists. However, Tuesday’s stimulus update offered some kind of hope. Due to this tug of war between good news and bad, any subsequent move downwards will likely be modest in comparison to the gains since the bottoms in March and since the start of November. It is truly hard to say with conviction that another crash or bear market will come. If anything, the constant wrestling match between sentiments will keep markets relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

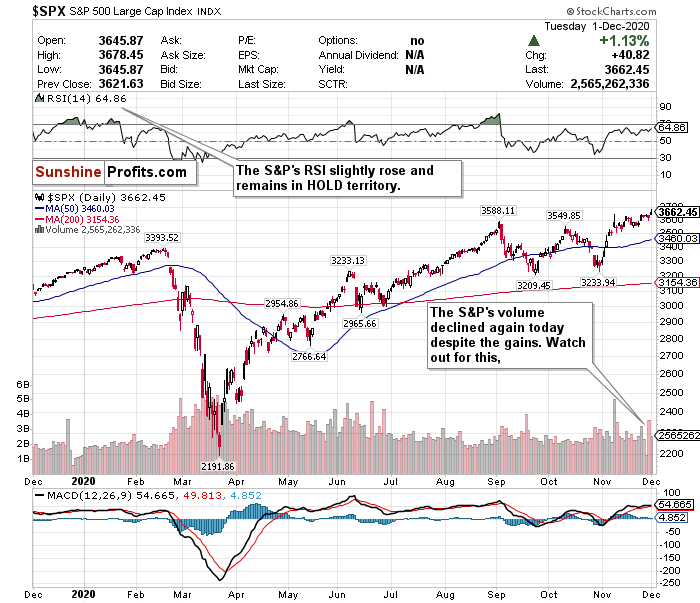

In Tuesday’s S&P chart, there are a few indicators that show that the S&P could face some near-term volatility. However, again, it is hard to say with conviction that it will be something major - especially compared to its gains since March. The RSI of 64.86 keeps the S&P in a HOLD category, and it has ticked up somewhat since Tuesday. Be very wary if the RSI exceeds the overbought level of 70 - because it’s approaching.

The S&P’s sharp decline in volume since November 9 is what is more alarming. Especially the fact that it declined on Tuesday - despite the index’s move to a record closing high.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index, and an increase in stock price volatility. Therefore, any drop in volume coinciding with a sharp rally puts some serious doubt on the sustainability of the up-trend and short-term outlook.

We’re in the early recovery phase of the cycle following the COVID-19 recession, but this rapid rebound is under pressure. Further pullback from these elevated levels would not be a shock… but another surge based on good news would not be a shock either. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Today’s premium analysis will showcase a “Drivers and Divers” section which will break down some sectors that are in and out of favor.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Stocks Finish November With Historic Gains, Despite Monday’s Losses

December 1, 2020, 8:40 AMStocks dropped sharply on Monday and ended November as traders took profits and monitored the progression of COVID-19. While much of Monday’s decline can be attributed to profit-taking, it was still a “sell the news” kind of day with the pandemic raging, and geopolitical tensions with China returning.

Regarding COVID-19, over 266,000 people have now died from the pandemic in the U.S., with more than 13 million confirmed cases in the country. Los Angeles County in California also imposed a new stay-at-home order before the weekend began.

Market sentiment took a further hit after Reuters reported that the Trump administration is considering blacklisting leading Chinese chipmaker SMIC and China’s national offshore oil and gas producer CNOOC.

The Dow Jones dropped 271.73 points, or .91% after dropping by as much as 400 points earlier in the day. The S&P 500 slid 0.46%, and the Nasdaq dropped 0.06%.

Travelers (TRV) and Chevron (CVX) were among the Dow laggards today, falling 3.6% and 4.5%, respectively. Cruise lines and airlines, despite performing strongly this month, also underperformed. Carnival (CCL) dipped 7.4%, and Norwegian (NCLH) slid 3.4%. American Airlines (AAL) dropped more than 5%, and Delta (DAL) fell 2%. Energy as a sector led the laggards on the S&P and dropped 5.4% - its worst day since June 24.

However, Moderna (MRNA) spiked 17%, after announcing that new trial data showed its COVID-19 vaccine candidate was more than 94% effective. The company further added that it will ask the FDA for emergency approval on Monday.

As we enter the final month of what has been a trying year, we can officially conclude that November 2020 was a month that the markets will never forget. Despite Monday’s losses, the indices posted some of their strongest monthly gains ever. The Dow rose 11.8% in November, its best monthly performance since January 1987. In November, the S&P 500 and the Nasdaq also climbed 10.8% and 11.8%, respectively, their biggest monthly gains since April. The small-cap Russell 2000 index however led the way, and had its best monthly performance ever, gaining over 18%.

Cyclical stocks led November’s rally due to the amount of positive vaccine news. Energy, which has been 2020′s biggest laggard, gained 26.6% in the month(!), while financials, industrials, and materials all gained at least 12.2% during the same time period.

Boeing (BA) and American Express (AXP) were November’s best performing Dow stocks, rising 45.9% and 30%, respectively, during the month. Chevron (CVX), JPMorgan Chase (JPM), Disney (DIS), and Honeywell (HON) also each rose more than 20% in November.

Because of the short-term tug of war between optimism and reality, it is fairly difficult to proclaim BUY or SELL calls for the near-term future. Rather, in the short-term, I feel more comfortable staying neutral and calling HOLD for broader markets. There will be optimistic days where investors rotate into cyclicals and value stocks.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, allowing optimism and relief to permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would be like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening should thrive.

After reaching a record close last week, the S&P 500 declined Monday in what appears to be a classic “sell the news” kind of day. It is a simple fact - markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While the latest Moderna announcement is another piece of positive vaccine news, there will be days, like today, when investors simply take profits and sell based on discouraging COVID-19 news, economic news, and geopolitical news (China). Amidst the current fears of a double-dip recession with further COVID-19-related shutdowns and no stimulus, it is very possible that a short-term downside persists. However, Monday’s move downwards was modest compared to the month’s gains. Furthermore, any other subsequent move downwards will likely be modest in comparison to the gains made after the March bottoms. It’s truly hard to say with conviction that another crash or bear market will come. If anything, the constant tug of war between good and bad news will keep it relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

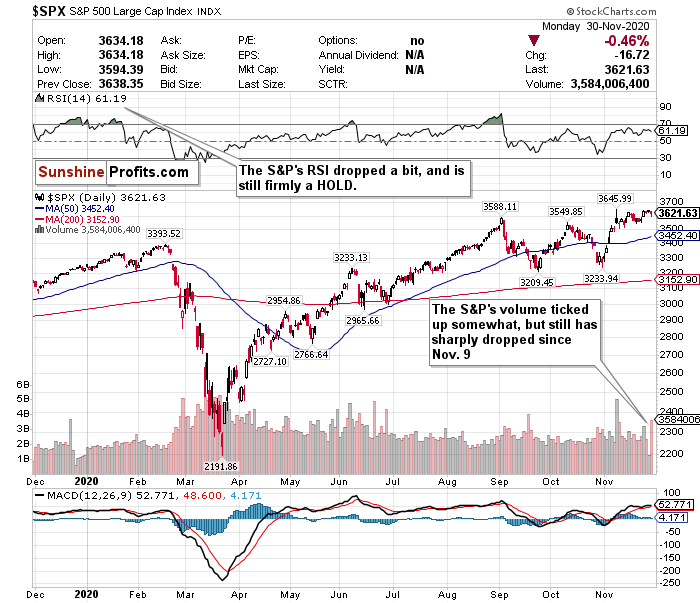

In the S&P chart above, there are a few indicators that show that the S&P could face some near-term volatility. However, again, it is hard to say with conviction that it will be something major - especially compared to its gains since March. The RSI of 61.19 keeps the S&P in a HOLD category and has somewhat dropped since its level Friday.

The sharp decline in volume since November 9. is what is more concerning.

Although volume generally is lighter than usual in the days before and after Thanksgiving, the consistent decline in volume for the S&P has been sharp and swift. Volume somewhat ticked back up today, but the broader decline is still somewhat concerning.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index and an increase in stock price volatility. Therefore, this drop in volume puts some serious doubt on the sustainability of the recent rallies and the S&P’s short-term outlook.

We’re in the early recovery phase of the cycle following the COVID-19 recession, but this rapid rebound is under pressure. Further pullback from these elevated levels would not be a shock, but neither would another surge based on good news. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Vaccine-induced Rally Keeps Moving Forward

November 30, 2020, 10:17 AMDear Readers,

My name is Matthew Levy and I’d like to welcome you to my new Stock Trading Alerts newsletter. A few words about me - after graduating with a Bachelor of Science in Economics from the University of Victoria in 2010, I developed a passion for helping clients meet their financial freedom through strong, risk-adjusted portfolios. Formerly, I was responsible for managing and co-managing over $600MM in cumulative assets for private households and institutions. I also undertook and completed my CFA® charter in 2015, a rigorous professional credential program promoting the highest standards of education, ethics, and professional excellence in the investment profession.

One of the many things I aim to accomplish with my newsletter is to help you personally navigate financial markets the way a professional would, by offering general market overviews over different time frames, leading and lagging sectors within the market, and (hopefully) captivating macroeconomic updates as necessary. If you want an excellent way to grab an edge over the market, sign up for our Stock Trading Alerts. You’ll stay up-to-date with my analyses and the ability to reach out with any specific questions or updates you would like to see in future newsletters. Sign-up is a few clicks away, and I look forward to helping you on your investment journey. Check out my full bio as well and send me a message if you have any questions!

You will find today’s free analysis (based on today’s premium Stock Trading Alert newsletter) below:

Markets last week rallied in a post-Thanksgiving shortened trading day.

The Dow Jones closed higher by 37.90 points, or 0.13% at 29,910.37. The S&P 500 notched another record closing high and gained 0.24%, while The Nasdaq also closed at a record high and advanced 0.92%. The small-cap Russell 2000 also rose another .56%.

Although the Dow did not end the week above 30,000 after piercing past that level for the first time ever on Tuesday, markets performed strongly this week and continued November’s surge. For the week, The Dow and S&P 500 rose 2.2% and 2.3%, respectively, while The Nasdaq gained nearly 3%. The small-cap Russell 2000 once again led the way and gained nearly 4%.

For the month, there has been euphoria and bullish mania consuming the markets due to political clarity after a bitter election, as well as positive vaccine data from three separate candidates. The Dow is up 12.9% in November to Friday's close, and on track for its biggest monthly gain since January 1987. The S&P 500 and Nasdaq are also up 11.3% and 11.9%, respectively. The small-cap Russell 2000, however, has led the way and is on track for its best month ever, up about 20%.

However, there are still very real concerns that could cap gains. Initial jobless claims this past week reached their highest level in 5 weeks, and increased to 778K in the week ended November 21st, compared to the revised level of 748K in the week before. This was also significantly worse than market expectations of 730K. US personal income also unexpectedly fell by 0.7% from a month earlier in October of 2020 compared to flat market expectations. Covid-19 also continues to ravage the country. More than 200,000 COVID-19 cases were reported in the U.S. on Friday - an all time high. When you consider that just three weeks ago we were reporting 100,000 cases a day, this is alarming and as bad as it’s ever been. After Thanksgiving, things could very well take an even harsher turn for the worse

Because of the short-term tug of war between optimism and reality, it is fairly difficult to proclaim BUY or SELL calls for the near-term future. Rather, in the short-term, I feel more comfortable staying neutral and calling HOLD for broader markets. There will be optimistic days where investors rotate into cyclicals and value stocks.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID would be like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening should thrive.

Short-Term

S&P 500

Although the S&P 500 reached another record close, markets continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While recent updates on several vaccine candidates have been positive, most recently with Astrazeneca and Oxford University’s, unprecedented surges in COVID cases combined with further economic damage is certainly concerning. Because of the rapid spread of COVID, lockdown measures have been reimposed around the world. Just this past week, many European countries extended lockdowns while LA reinstituted a 3-week “stay at home order,” for example. This could be very concerning for the S&P. Remember, there is still no stimulus or concrete plan for economic aid. If the jobless claims from this week show us anything, it’s that this economic recovery has a long way to go before returning to pre-pandemic levels. Fear of a double-dip recession is certainly very legitimate.

To sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction could certainly be on the horizon - especially without fiscal stimulus.

In this S&P chart, there are several indicators that show that the S&P could face some near-term pain and volatility. While the RSI of 63.72 keeps the S&P in a HOLD category, it has steadily risen throughout this month towards an overbought 70 level.

Pay close attention to the sharp decline in volume as well.

Although volume generally is lighter than usual in the days before and after Thanksgiving, the consistent decline in volume for the S&P has been sharp and swift. This is a red flag.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index and an increase in stock price volatility. Therefore, this drop in volume puts some serious doubt on the sustainability of the recent rallies and the S&P’s short-term outlook.

We’re in the early recovery phase of the cycle following the COVID-19 recession, but this rapid rebound is under pressure. A pullback would not be a shock… but another surge based on good news would not be a shock either. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM