-

The Fed Meets the S&P 500 Bull

June 11, 2020, 9:29 AMYesterday's Fed statement drove stock lower, but did the overnight slide tick all the boxes so far - that's the question to ask. And why exactly did the market get so disappointed with the FOMC moves? I'll answer these questions in today's analysis, and lay out the prospects for the stocks ahead.

S&P 500 in the Short-Run

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Well before going into the Fed policy statement, signs were there that the bulls aren't at their strongest, and I took profits from the open long position off the table. Since then, the S&P 500 went largely sideways until the Fed moment came. The following spike higher attracted the bears' interest, and stocks gave up all of their momentary gains. What exactly did the Fed say that it drove stocks that much lower in the overnight trading?

I expected them to not rock the boat - so, did they do it actually? Offering a sober assessment of the economy, they aren't looking to raise rates any time soon, and will keep the wheels greased. No surprise here.

But there are two things hanging in the air, one of which depends on the Fed, while the other doesn't.

I've written quite a few times lately about the rising Treasury yields. Rising yields translate into falling Treasury prices, and it raises the prospects of yield curve control arriving. Yield caps could indeed be coming. Quite logical if you consider that the Treasury needs to finance ever larger deficits.

When the economy expands or is expected to regain footing as is the case currently, and money flows from bonds into stocks, the S&P 500 is rising while the bond market (Treasuries) sees rising yields that translate into declining bond prices. That's what we have seen in the runup to yesterday's Fed.

Rising yields are a sign of belief in the recovery story, but when Powell reiterates fears of stubborn corona consequences and that he stands ready to expand the balance sheet to infinity should they rise too much, that certainly dampens the bullish spirits in stocks. And yesterday's action in both shorter- and longer-dated Treasuries (IEI ETF, TLT ETF respectively) have shown that the market isn't willing to bet against the Fed right now.

Against this background, paring some of the recent gains in stocks is understandable, especially when we consider the second factor that is outside of the Fed's control.

As the riots proceed, coronavirus made a comeback into the headlines. The fears of the second wave in the U.S. are here. This is likewise working to keep the risk appetite at bay.

Are the stock bulls panicking, with prices getting ahead of themselves in their downside move?

Before answering, one more thought about low yields and stocks. Once a recessionary shock is over (not getting worse) and inflationary pressures of the moment are still low (forget about the forward-looking inflationary expectation - they're not manifest in the real economy just yet), stock prices and bond prices tend to move hand in hand. The real economy is far from its potential output, and isn't overheating just yet.

Tick, that's what we're facing right now. That's why low yields are a good companion of a stock bull market. Remember, bonds top first, stocks next, and finally commodities. As we haven't seen a top in Treasuries just yet, the stock bull market peak is even farther off.

As promised, let's check now whether the stock bulls are panicking or not.

The Credit Markets' Point of View

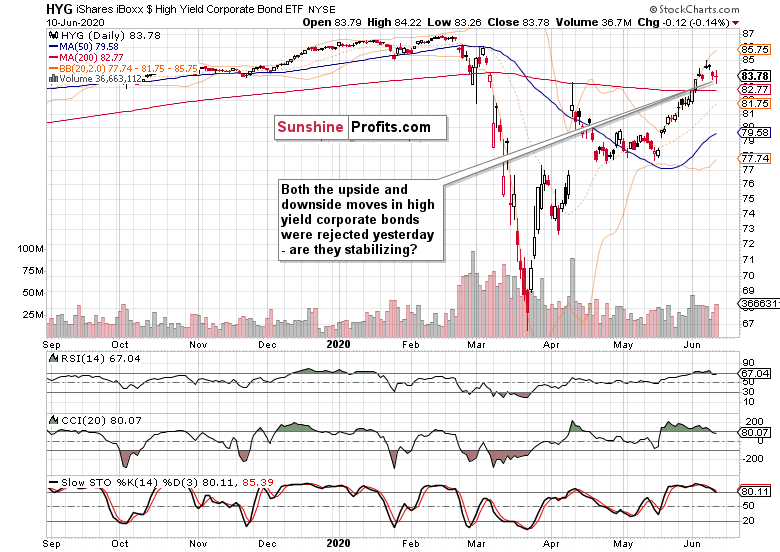

High yield corporate bonds (HYG ETF) refused to move any lower yesterday, but by the same token, they didn't rise either. The daily indicators are almost in unison on sell signals, so caution is warranted before calling the bonds stabilized. Needless to say, I continue to think we have still a bit more to go before seeing corporate bond prices above Friday's highs.

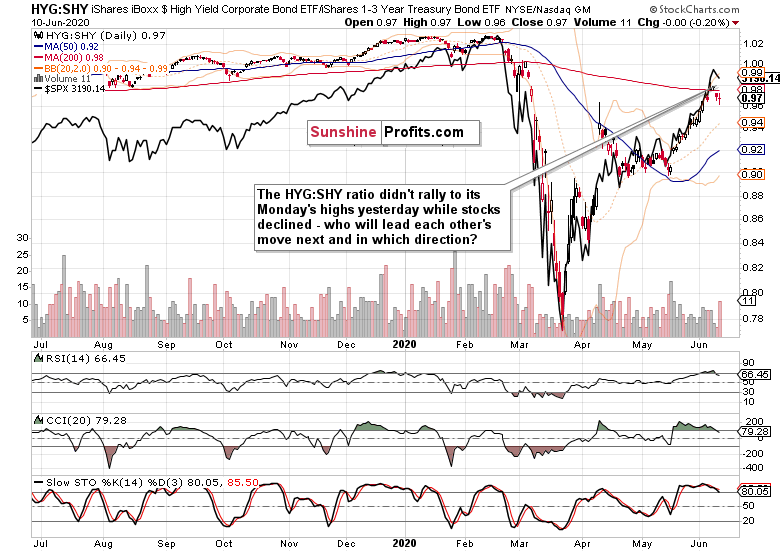

This is the shape of both the above-mentioned leading credit market ratios.

The more risk-on one (HYG:SHY) is still leading the downswing, and unless it edges higher, it's a red flag. As I wrote yesterday:

(...) The animal spirits are thus likely to get tested relatively soon, with perhaps today's Fed monetary policy statement and conference being the catalyst. Or Friday's inflation expectation figures could play that role.

Either way, unless credit markets recover, stocks are in the short-term danger zone.

Next, I showed you the following chart with overlaid S&P 500 prices.

The other yesterday's thoughts are valid also today, showing that stocks are still vulnerable in the short run.

(...) Stocks are kind of hanging out there in the short run, and the degree of relative extension makes me think that the stock upswing isn't likely to proceed with its previous momentum before taking a pause first.

What about the S&P 500 sectoral moves?

Key S&P 500 Sectors in Focus

Technology (XLK ETF) closed at new 2020 highs but gave up half of its intraday gains, while healthcare (XLV ETF) finished not too far from its Tuesday's closing values. Financials (XLF ETF) certainly led the downswing in the S&P 500 heavyweights.

Energy (XLE ETF), materials (XLB ETF) and industrials (XLI ETF) moved sharply lower yesterday, which is not a good short-term omen for the bull run.

As pointed out in yesterday's analysis:

(...) unless the credit markets get their act together, the short-term risks for stocks are getting skewed to the downside. That could be amplified by the USDX taking a breather after the recent sea of red.

The USD Index breather is underway as the greenback is finally making a move from its short-term lows. How vigorous that turns out to be, would put to test the stock market bull run. Remember, since the WWII ended, we've seen only one market rally above the 61.8% Fibonacci retracement that was followed by a plunge below the prior bear market low.

And I fully expect that the March 23 lows won't be challenged, let alone broken.

Summary

Summing up, the Fed provided the catalyst for stocks to move down, and neither the credit markets nor the sectoral analysis show signs that this correction is already over. Smallcaps at Russell 2000 (IWM ETF) are leading the downside move, which coupled with the earlier USDX move, raises short-term risks for stocks. Even accounting for today's premarket action, I still say short-term - the narrative of reopening optimism is only now being challenged by yet another down-to-earth Fed real economy assessment and returning coronavirus fears. The credit markets will show us how far the bulls are really willing to retreat.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

The Unfolding Soft Patch in S&P 500

June 10, 2020, 9:49 AMStocks indeed experienced a down day yesterday, and the credit markets say it might not be over just yet. With today's premarket upswing rejected at recent highs, will the bears smell an opportunity? While I continue to think it'll turn out to be a blip on the screen, I have my guard up.

S&P 500 in the Short-Run

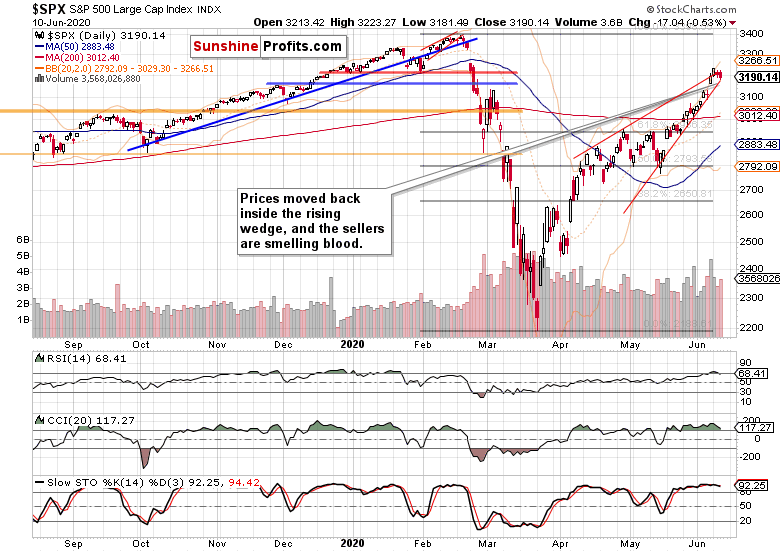

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The string of daily gains in one row was broken yesterday, and the first knock on the late-Feb bearish gap's lower border failed. The extended daily indicators are still a cause of short-term concern.

With stocks back at the bearish wedge, these were my yesterday's thoughts:

(...) Sure, the bears can force a test of the upper border of the rising red wedge - but will they be able to bring prices much back below that lastingly? Is such a reversal of fortunes on the cards right now?

Unless the Fed missteps tomorrow, that's not likely. And I don't really expect them to rock the boat in any meaningful way.

That's still the case, and I don't expect a truly hawkish surprise. If Powell calls again for more fiscal stimulus while saying that monetary policy alone can't save the day, that would facilitate a dip in stocks - regardless of reiterating that the Fed stands ready to act should the recovery run into headwinds. As he's unlikely to offer new programs or broaden existing ones, the bulls may become disappointed at no new additions to the punch bowl, and stock could have a bad day.

Today's intraday Stock Trading Alert captures why I've turned short-term cautious earlier today:

(...) But it's the two leading credit market ratios that are short-term concerning.

Both the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) declined yesterday, leaving stocks overextended in the short-term.

And the current very short-term price action in the S&P 500 (issues around the 3225 level) doesn't favor the bulls exactly.

Let's see the credit market action then.

The Credit Markets' Point of View

The sideways consolidation in high yield corporate bonds (HYG ETF) gave way to a daily downswing on higher volume than was the case on Monday. Does it mean that the correction is almost over, or that it has a bit further to run? While the jury is out, I think that given yesterday's session, we have still a bit more to go before seeing corporate bond prices above Friday's highs.

This is the shape of both the above-mentioned leading credit market ratios.

They weakened yesterday, and the more risk-on one (HYG:SHY) is leading the downswing, and that's a watchout. The animal spirits are thus likely to get tested relatively soon, with perhaps today's Fed monetary policy statement and conference being the catalyst. Or Friday's inflation expectation figures could play that role.

Either way, unless credit markets recover, stocks are in the short-term danger zone. This is how I mean it:

Stocks are kind of hanging out there in the short run, and the degree of relative extension makes me think that the stock upswing isn't likely to proceed with its previous momentum before taking a pause first.

Or will the ratio stage a sharp recovery and erase earlier losses fast? Given the action in short-term Treasuries (IEI ETF), I don't think such a move is immediately likely:

Buyers showed up in force yesterday, and the momentum will probably support these Treasuries as we approach the Fed statement later today.

Longer-dated Treasuries (TLT ETF) also gapped higher yesterday, but couldn't extend their gain. As they closed near their daily lows and on average volume, the conclusion is clear - the market place expects higher inflation down the road. And while today's CPI data haven't showed that playing out in the present just yet, Friday's inflation expectations likely will.

Would the Fed make noises about getting cautious with balance sheet expansion then? That would spoil the signals they've been sending up till now, which is why I don't expect any kind of their sharp U-turn this soon. Should we hear them hedging their positions (e.g. very closely watching the inflation data), we would need to turn cautious even more - after all, stocks generally don't take too well to any tightening (remember the 2013 Taper Tantrum?), and a mere slowdown in money printing can do the trick this time around as well. But it's still too early for a policy misstep of this proportion, I think.

What about the S&P 500 sectoral moves?

Key S&P 500 Sectors in Focus

Technology (XLK ETF) closed higher still, but healthcare (XLV ETF) gave up all of its Monday's gains. Financials (XLF ETF) closed where they opened - lower, that is.

With energy (XLE ETF) and materials (XLB ETF), it's been the same story as with financials. Industrials (XLI ETF) acted weaker than the other two stealth bull market sectors, which coupled with the heavyweights' performance means that some chop in stocks is probably ahead.

And unless the credit markets get their act together, the short-term risks for stocks are getting skewed to the downside. That could be amplified by the USDX taking a breather after the recent sea of red.

The caption says it all, and is one more reason for caution in the short run.

Summary

Summing up, stocks reversed lower yesterday, and signs are this correction isn't over just yet. That's because the move lower in both leading credit market ratios (and also in HYG and LQD ETFs themselves) is about to provide more of a headwind for the stock bull run in the short-term. The mixed sectoral performance highlights the risks ahead for the stock bulls, and so does the Russell 2000 (IWM ETF) trading close to Friday's open. This means that smallcaps are leading the downside move. While my medium-term bullish outlook remains unchanged, it's the short-term outlook that's problematic.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Soft Patch in S&P 500 Ahead - Or Almost Over Already?

June 9, 2020, 10:14 AMGoing from strength to strength, but isn't a soft patch in stocks drawing near - or better yet, aren't we entering it with today's premarket action? The bulls have shaken off anything coming their way recently, and I continue to think it'll turn out as a blip on the screen.

S&P 500 in the Short-Run

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Another day with higher stock prices still. While the lower volume than during Friday's spectacular upswing is no fly in the ointment, the extended daily indicators are one - but merely of short-term nature.

Why do I think that? Sure, the bears can force a test of the upper border of the rising red wedge - but will they be able to bring prices much back below that lastingly? Is such a reversal of fortunes on the cards right now?

Unless the Fed missteps tomorrow, that's not likely. And I don't really expect them to rock the boat in any meaningful way. The calls for more fiscal stimulus have been made, and the efforts towards accomplishing it are being made. The S&P 500 price action is telling us that the markets expect both parties to iron out the differences, with the end result being a stimulus bill to cheer.

That's how I interpret the price action thus far - regardless of the premarket decline driven by weak Geman export data. Do credit markets agree that the trend of generally higher S&P 500 prices is intact?

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) seem to be decelerating, but the breather so far took shape of a sideways move with lower bond values soundly rejected. Yesterday's hesitation also happened on lower volume, which is consistent with what we see in a pause within a trend. In other words, the trend is up and we haven't seen a true reversal yesterday.

Would the leading credit market ratios confirm this view?

Yesterday's HYG consolidation is mirrored in its ratio to shorter-dated Treasuries. It's just stocks that diverged with their upswing, sizable part of which came in the final 30 minutes before the closing bell.

While such price action is bullish (stocks want to go up, after all), it leaves them in an extended position relatively speaking. But given the HYG:SHY setback suffered so far, is that a cause for more than a very short-term concern?

Investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) are unyielding in their rise. Both leading credit market metrics point to a rather limited downside in stocks that I shouldn't really view as anything but a perfectly natural microrotation.

Both the 3-7 year Treasuries (IEI ETF) and 20+ year Treasuries (TLT ETF) recovered a bit of lost ground yesterday. Neither that, nor the USD Index pause is a game changer though. Look at gold, it's been unwilling to sell off much so far. Will it do so in the runup to the USDX upleg? What upleg when Treasuries' closing prices are largely giving the appearance of being ready for more downside before resuming their long-term uptrend? Will the Fed deliver a deflationary squeeze tomorrow that would take traders out of their risk-on and inflationary-hedges? I don't think so.

That's why the current environment of inflation picking up and money printing as far as eye can see, is fundamentally conducive to higher stock prices. Money is being created faster than it's being destroyed. Technically, I've laid out the position of the credit markets - will volatility analysis enrich our view?

The VIX has moved a little higher against the backdrop of rising stocks. Given the case for limited downside potential in stocks, the favorite volatility measure supports that assessment. It's because during bull market runs, the VIX doesn't make sharp spikes that would make one look for much more still - instead, it's bobbing around with a measured jump here and there amid generally falling or sideways values.

Now, VIX falling to around 6 as happened not all that long ago, that would be extreme complacency and mature stock bull market. We're nowhere near that currently.

Does the sectoral analysis support my thesis of the stock bull market having much further to run?

Key S&P 500 Sectors in Focus

Move on, the uptrend in technology (XLK ETF) is intact whatever intraday selling it meets. With the 2020 highs within spitting distance, the only question is how much of a resistance will they provide - both in time to overcome them, and in depth of price corrections to work out the extended daily indicators' readings before the bulls say enough is enough.

Healthcare (XLV ETF) is also getting ready to take on its February highs, and again it seems that overcoming them is merely a question of time.

Financials (XLF ETF) held onto their Monday's gains pretty well. Don't be deceived by the black candles - the sector still managed to keep most of its yesterday's bullish gap intact. The daily volume shows that the sellers haven't really stepped in with force, meaning the unfolding upswing has a solid chance of extending gains after the unfolding and in all probability shallow S&P 500 correction is over.

The stealth bull market trio has done well yesterday. Energy (XLE ETF), materials (XLB ETF) and industrials (XLI ETF) have extended opening gains, which is bullish for the stock market advance. Unless we see them making a top, this bull market has much further to run. And the bull is still very young, and the best is still ahead.

Summary

Summing up, stocks continue trading above the bearish wedge, and any downswing appears to be of temporary and rather shallow nature. The weekly and daily charts highlight the bullish outlook, and credit markets including Treasuries support the rotation into stocks with more buying power to come in from the sidelines. The sectoral performance remains conducive, and the strong showing of the early bull market trio (energy, materials and industrials) underscores that. So does the vigorous Russell 2000 (IWM ETF) performance or VIX being no cause for concern. As the dollar remains under pressure and unlikely to stage more than a reflexive short-term bounce, stocks won't probably face a new deflationary headwind any time soon. Tomorrow's Fed won't likely change that, and I expect Friday's inflation numbers to be a cherry on the cake. Coming full circle, the debt markets' performance is the key, and the rest broadly concurs with my bullish outlook.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM