-

Fed Goes All In - As In All In, and Stocks Like It

March 24, 2020, 9:42 AMOn the heels of the Fed's unlimited QE promise, the S&P 500 sprang to life finally. All the gains though were given up in less than three hours. As the futures keep climbing overnight, does it herald a turnaround?

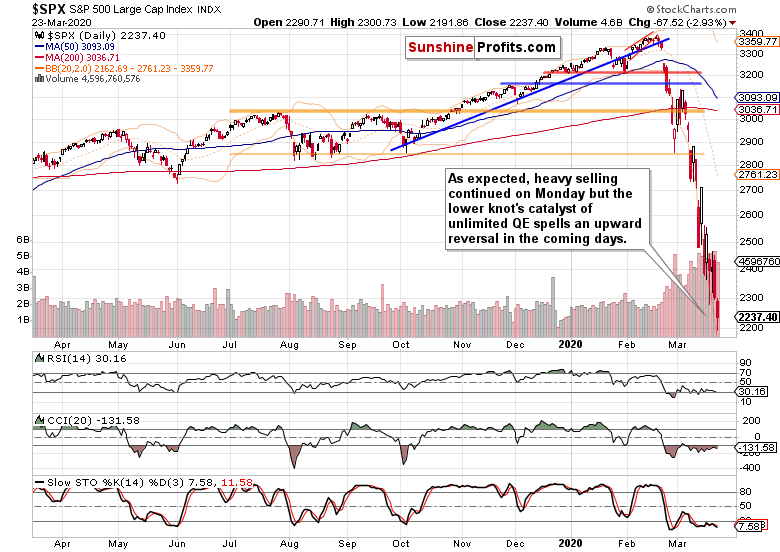

Let's start our analysis with the daily chart examination (chart courtesy of http://stockcharts.com).

Opening with a bearish gap, stocks continued with their slide as can be seen in both the S&P 500 index and the popular SPY ETF. Yet the Fed stepped in again, pledging unlimited QE. Stocks rallied as a result, but gave up all of their gains before too long.

In the overnight session, the futures made it to over 2333. Now, that's an example of some bullish action in the short-term.

Let's remember our yesterday's notes regarding the market breadth indicators:

(...) While they all confirm the bears as being in the driving seat, new highs minus new lows reveals that the sellers aren't as strong as they appear to be when one looks at price action only. The bullish percent index has also curled higher despite new 2020 lows being hit.

As a result, the market breadth indicators indicate a high likelihood of pause in the trend of continuously lower prices. Be it in the form of a sharp rally that runs out of steam relatively fast, or a somewhat more prolonged sideways trading with a bullish bias, it nonetheless justifies our decision earlier today to take the 168-point profit on our short positions off the table.

These observations turned out as expected. The Summary just below captures the short-term outlook accompanied by the trading plan.

Summing up, whilethe bears have the upper hand, the potential for a temporary upswing hasn't decreased despite Friday's slide. And this Fed move might surely stick for longer. The only practical question is whether the rate of new money creation will be faster than the rate of wealth destruction. As the markets like this move, it makes sense to give it the benefit of (short-term and conservative) doubt. The detailed trading plan for the hours or days ahead is reserved for our subscribers.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

Cashing in Huge Profits Just Before Today's Upswing

March 23, 2020, 8:27 AMThe S&P 500 upswing didn't materialize on Friday, and our decision to go short has paid off handsomely. Taking stocks to new 2020 lows on both intraday and closing basis, the bears clearly had a field day. As the S&P 500 closed the week near its lows, which way next for the badly battered stocks?

Let's start our analysis with the weekly chart examination (charts courtesy of http://stockcharts.com).

Prices broke down below the red support zone marked by the December 2018 lows. This is an important technical development that attests to the bears' strength just as much as the sizable weekly volume. As the weekly indicators continue to heavily favor the bears, it might seem that we're in for a one-way move lower in the coming days.

Not so fast. Consider the below weekly chart that takes a detailed look at the market breadth indicators.

While they all confirm the bears as being in the driving seat, new highs minus new lows reveals that the sellers aren't as strong as they appear to be when one looks at price action only. The bullish percent index has also curled higher despite new 2020 lows being hit.

As a result, the market breadth indicators indicate a high likelihood of pause in the trend of continuously lower prices. Be it in the form of a sharp rally that runs out of steam relatively fast, or a somewhat more prolonged sideways trading with a bullish bias, it nonetheless justifies our decision earlier today to take the 168-point profit on our short positions off the table.

As a reminder, we opened the wildly profitable short just as the upswing attempt was fizzling out on Friday when stocks were trading at 2385, and today's decision to cash in profits went out as the futures were trading at 2217. Since then, the upswing indeed materialized and reached almost 2240 before pulling back and spurting over 2270 as we speak.

Let's check the daily chart's closing prices for more insights.

While the volume of Friday's downswing hasn't been outrageously high, it has still been elevated. Coupled with the price action, it doesn't scream that a lasting reversal higher is imminent. On one hand, the CCI points to gradually decreasing selling pressure. On the other hand though, both RSI and Stochastics keep flashing their extended readings to the downside.Summing up, whilethe bears have the upper hand, the potential for a temporary upswing hasn't decreased despite Friday's slide. Quite to the contrary, and we plan to take advantage of it and position ourselves accordingly for the next big trade. We will keep our subscribers informed as it unfolds.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM