-

Does the Shape of Yesterday's Session Spook You?

February 12, 2020, 12:55 PMAvailable to premium subscribers only.

-

Even At New 2020 Highs, This Is What's Still Missing

February 11, 2020, 11:15 AMAvailable to premium subscribers only.

-

No Returning of the Stock Market Bears?

February 10, 2020, 12:01 PMStocks rebounded strongly in the previous week, but have wavered on Friday. Their performance today isn't exactly shaping to be the strongest ever either. So, what is the status of the consolidation, and how will the market most likely proceed when digesting its recent gains?

Let's start with assessment of the weekly price action (charts courtesy of http://stockcharts.com).

Stocks reversed higher last week, and have closed the sizable bearish gap in the process. It doesn't support the bears anymore now. We can consider the November breakout above the upper border of the rising purple trend channel to be practically verified, as prices moved down almost testing it, yet bounced higher since.

The weekly indicators also complement the bullish picture. Both RSI and CCI have moved back into their overbought territories, putting their earlier sell signals to rest. Acting on Stochastics' sell signal flashed in its overbought area would indeed lead to a whipsaw. In short, the weekly indicators continue supporting the bulls.

But stocks retreated on Friday, and the week closed well below the challenged 2020 highs above 3355. Let's finetune the outlook on the daily chart.

Raise your hands if you think we've seen an abandoned baby candlestick formation. It's a bearish three-day pattern that starts with an upswing, then a doji forms above the previous day's close, and finally we get a declining session. That's as close a description of the last three days in stocks as it gets. The implications are bearish.

The evening doji star is another possible way to view the local top. Either of the two answers has a bearish meaning though.

While the daily indicators have curled down, they still keep painting a bullish picture - the CCI's sell signal is over while Stochastics remains on a buy signal. Also, yesterday's volume was lower than what you would expect to see in a strong reversal. These factors point in a direction of a temporary pause in the upswing, which is perfectly consistent with an evolving consolidation.

Today's action sees the index peeking over 3335 as we speak. That's actually encouraging given the renewed and growing coronavirus fears (some might call it reality recognition) - but don't get lulled to sleep by the relative calm. Despite the lower volume, the short-term has a raised bearish risk now. Unless the bearish formation gets invalidated, don't count on strong upswing continuation just yet.

Let's quote our Friday's key observation:

(...) it's our opinion that this is just the beginning of the consolidation. More precisely, shall we rather say correction?

Before summarizing, let's turn to the time-tested measure of volatility - the VIX.

It points in the direction of an upcoming sizable move. But in which direction is it more likely? Taking all the above into account, it's our opinion that it would rather point lower than higher.

This means that we are yet to see a suitable moment to enter long positions from the risk-reward perspective. A better entry point can be facilitated by more pronounced coronavirus fears flare-up. The consolidation of recent gains is underway and the bears' return remains likely in the very near term.

Let's quote our earlier conclusion:

(...) As a reminder, we are in a stock bull market. The strong comeback highlights that we haven't seen reliable signs of a market top - thus, corrections are to be bought. And there is still a good likelihood of us getting one shortly, regardless of the improvement in the indicators. Therefore, staying on the sidelines remains the right course of action right now.

Summing up, the S&P 500 short-term outlook worsened with Friday's downswing and the abandoned baby formation. Unless invalidated, it marks a high likelihood of stocks taking a breather in the upswing, regardless of it being favored by the weekly indicators. While it's true that Friday's reversal volume could have been higher, that doesn't take away much from the downside risks in the coming session(s), which is supported by the VIX examination too. It would still be premature to declare this correction (in time and in price) as over. As a minimum, we can expect continuing consolidation, and increasing bearish involvement not only in the proximity of earlier highs. A favorable setup to get back in on the long side would naturally follow, as the rebound's veracity shows that stock bull market is climbing a wall of worry. In other words, it's alive and well.

-

The Upcoming Test of the Stock Bulls' Resolve

February 7, 2020, 10:30 AMAnother day, another strong open for stocks yesterday. But this time, the bears pushed back. Has the consolidation started, and the market will digest recent gains now? Or as they say, one swallow doesn't make a summer?

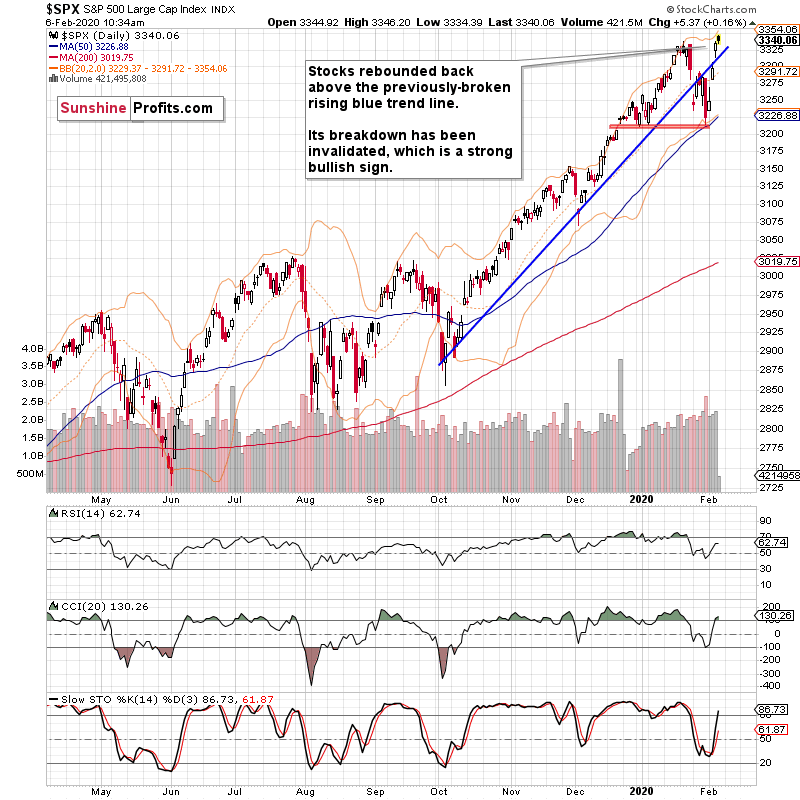

Let's take a look at the context of yesterday's price action on the daily chart (chart courtesy of http://stockcharts.com).

While stocks have opened yesterday with yet another bullish gap, the bears stepped in. The lower knot shows that they drove prices all the way down to the gap's border, but just couldn't close it. As a result, the gap remains open, and it continues to support the bulls.

And so does the invalidation of the breakdown below the rising blue trend line. Technically, that has been the most important chart development.

The bullish print of this week's candles also confirms that. The bears' attempts have been rebuffed, and the index marched higher.

The daily indicators keep painting a bullish picture - the CCI's sell signal is over while Stochastics remains on a buy signal. While yesterday's volume was lower than that of preceding days, it's perfectly consistent with what you would expect to see in a consolidation. And yesterday's session shows we have just entered one.

That's natural - every bull market needs to take a breather. We haven't seen one since the rebound from last Friday's selloff, and it's our opinion that this is just the beginning of the consolidation. More precisely, shall we rather say correction?

Of course - apart from the apparent coronavirus respite, the market has been pricing in China's announcement to cut tariffs on US imports in mid-Feb when a similar US measure comes into force. What a welcome action in front of the upcoming trade deal negotiation marathon!

Talking fundamentals, today's employment figures take every trader's spotlight. While the bar has been set quite low to overcome the analysts' estimate (and Wednesday's strong ADP figures would support that), it's the market's reaction to the numbers that matters. If you are a trader, keep that on your mind every time you think that in reaction to whatever announcement, the market should move this or that way - and don't let emotions take over.

And indeed, Non-Farm Employment change came in at 225K, beating the modest estimate of 163K. Stocks initially bounced, only to reverse again lower. This means the bulls are making no progress to erase the pre-market losses, as the index changes hands below 3335 currently.

Taking into account all the discussed improvement on the weekly chart and today's premarket action, we haven't yet seen a suitable moment to enter long positions from the risk-reward perspective.

A better entry point can be facilitated by another coronavirus fear flare-up in the not-so-distant future. While stocks are pointing lower today, we continue to think that we'll get a more favorable opportunity to buy down the road. The consolidation of recent gains is only getting started. The bears' return remains likely in the very near term.

Let's quote our earlier conclusion:

(...) As a reminder, we are in a stock bull market. The strong comeback highlights that we haven't seen reliable signs of a market top - thus, corrections are to be bought. And there is still a good likelihood of us getting one shortly, regardless of the improvement in the indicators. Therefore, staying on the sidelines remains the right course of action right now.

Summing up, the S&P 500 outlook keeps being bright regardless of the bulls taking a breather yesterday. While the daily indicators are sending a bullish message, stocks appear ready to move somewhat lower later today. It would still be premature to declare this correction (in time and in price) as over. As a minimum, we can expect continuing consolidation of this week's gains, and increasing bearish involvement not only in the proximity of earlier highs. A favorable setup to get back in on the long side would naturally follow, as the rebound's veracity shows that stock bull market is climbing a wall of worry. In other words, it's alive and well.

-

Why the Sky May Not Be the Limit For the Stock Market Just Yet

February 6, 2020, 11:16 AMWith the lion's share of this week's stock gains happening in the overnight futures trading, it's the daily action that's stealing the spotlight. The market turned on a dime, and the bulls' performance has been strong. But can it last? Let's check whether stocks have indeed taken us on a one-way elevator ride.

The daily chart will show us the significance of yesterday's price action (chart courtesy of http://stockcharts.com).

Three days in a row - three bullish gaps with further gains. That's the most concise summary to give when looking at last three days. Just going higher without much hesitation, as the lack of sizable knots shows. Technically, the most important development has been the invalidation of the breakdown below the rising blue trend line.

Let's get back to the story the knots tell. On Tuesday, the bulls gave up almost half of their gains since the opening bell. Yesterday, they had to face a wave of selling that erased almost half of the opening gap. They closed the session at new weekly highs though. That's a bullish print.

The daily indicators are painting a bullish picture - the CCI's sell signal is over while Stochastics remains on a buy signal. Yesterday's volume shows no evidence of an upside move's exhaustion, as it hasn't been profoundly above the preceding days' one.

And indeed, stock futures point to another bullish gap today. The index trades in a tight range and at around 3345 currently. Taking into account all the discussed improvement on the weekly chart and yesterday's session, would that be a suitable moment to buy from the risk-reward perspective? Not in our view.

Let's not forget the speculation of a coronavirus medical breakthrough nearby, as it has been the catalyst of yesterday's buying as well. And the US ADP figures revealed strong job market (at 291K jobs created, it almost double the analysts' expectations), lifting the bullish spirits further.

But is the coronavirus panic over, or just temporarily quelled? It's still likely we'll get another scare in the not-so-distant future. How will it reflect on the stock market path?

It's highly likely it will offer a more attractive entry point from the risk-reward perspective than we're facing now close to 3350. Yesterday's unfavorable entry point has become even more so today. Buying into the upswing practically at the pre-coronavirus top? Thanks, but no thanks. The most likely short-term scenario is a consolidation of recent gains as a minimum. The bears' return remains likely in the very near term.Let's quote our yesterday's conclusion:

(...) As a reminder, we are in a stock bull market. The strong comeback highlights that we haven't seen reliable signs of a market top - thus, corrections are to be bought. And there is still a good likelihood of us getting one shortly, regardless of the improvement in the indicators. Therefore, staying on the sidelines remains the right course of action right now.

Summing up, the S&P 500 outlook got brighter yesterday, and the daily indicators are turning bullish. But it would be premature to declare this correction (in time and in price) as over. As a minimum, we can expect consolidation of this week's gains, and increasing bearish involvement near the 3350 highs. A favorable setup to get back in on the long side would naturally follow, as the rebound's veracity shows that stock bull market is climbing a wall of worry. In other words, it's alive and well.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM