-

ECB Changed Monetary Strategy. Will It Alter Gold’s Course?

July 13, 2021, 5:52 AMThe ECB adopts a new inflation target. Is the European Central Bank mimicking the Fed or doing its own thing? The revolution in central banking is spreading. Following the Fed, the European Central Bank has also modified its target. Last week, after an 18-months review of its monetary policy framework, the ECB published a statement on its monetary policy strategy, deciding to change its goal from “below but close to 2%” to a more symmetric aim of “2% inflation over the medium term”. The most important part of the statement is below:

The Governing Council considers that price stability is best maintained by aiming for two per cent inflation over the medium term. The Governing Council’s commitment to this target is symmetric.

The symmetry means that the ECB considers both overshooting and undershooting as equally bad. In the previous framework, the ECB clearly believed that downside deviations from inflation were less harmful than upside deviations.

The medium-term orientation means that the ECB accepts short-term deviations of inflation from the target, and acknowledges lags and uncertainty in the application of the monetary policy to the economy and to inflation. In particular, the ECB stated that there might be transitory periods in which inflation is moderately above target. However, similarly to Fed, neither “medium-term” nor “moderately” were defined more specifically.

Another interesting point in the statement is the recognition that “the inclusion of the costs related to owner-occupied housing in the HICP would better represent the inflation rate that is relevant for households”. So far, the ECB only covers costs of rents in the case of tenants. It doesn’t mean that the ECB will start including house prices in its measures of consumer inflation, but it’s a move toward more accurate measures that will better show true inflationary forces operating within the economy.

Last but definitely not least, the ECB emphasized the importance of climate change for price stability, monetary policy, and central banking:

Climate change has profound implications for price stability through its impact on the structure and cyclical dynamics of the economy and the financial system. Addressing climate change is a global challenge and a policy priority for the EU. Within its mandate, the Governing Council is committed to ensuring that the Eurosystem fully takes into account, in line with the EU’s climate goals and objectives, the implications of climate change and the carbon transition for monetary policy and central banking. Accordingly, the Governing Council has committed to an ambitious climate-related action plan. In addition to the comprehensive incorporation of climate factors in its monetary policy assessments, the Governing Council will adapt the design of its monetary policy operational framework in relation to disclosures, risk assessment, corporate sector asset purchases and the collateral framework.

The ECB’s ambitious climate-related action plan was announced during a separate press conference. The blueprint includes broader macroeconomic modelling, developing new indicators, conducting climate stress tests, etc. In particular, in the future, the ECB will be purchasing only adequately green assets:

The ECB will adjust the framework guiding the allocation of corporate bond purchases to incorporate climate change criteria, in line with its mandate. These will include the alignment of issuers with, at a minimum, EU legislation implementing the Paris agreement through climate change-related metrics or commitments of the issuers to such goals.

It doesn’t make any sense, of course. After all, as John Cohrane pointed out, “climate change poses no measurable risk to the financial system”. This is because the climate is not likely to cause a sudden, unexpected and enormous economic effect that could endanger the financial system. Climate is not weather – and even sudden natural disasters barely affect the financial system. Central banks should focus on price stability and not engage in achieving social or political goals. The deviations from their traditional narrow mission could only destroy their independence and, thus, their ability to hold inflation under control and prevent big financial crashes.

Implications for Gold

The ECB’s change is dovish, as it shows that the European central bankers are now more eager to tolerate an overshoot. It means that both the Fed and the ECB started to be more tolerant of overshoot exactly when inflation became higher. What a coincidence! The HCIP for the Eurozone is presented in the chart below.

So, the alteration could be seen as fundamentally positive for inflation hedges such as gold. However, the ECB could be less aggressive than the Fed. As Christine Lagarde said during the press conference, “Are we doing average inflation-targeting like the Fed? The answer is no, very squarely”.

On the other hand, a more dovish ECB should translate into a stronger dollar relative to both the euro and gold. But it’s also possible that the change in the monetary framework won’t significantly affect the precious metals, as the ECB is already ultra-dovish and has problems with even reaching the target, not to mention overshooting it.

It seems that gold is reacting now more to the decrease in the bond yields rather than to the changes in the US or EU monetary policies. As long as the interest rates are declining, gold is catching its breath. But this decrease may be temporary, so better watch out! Powell’s testimonies to Congress next week could provide us with more clues about gold’s outlook.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

FOMC Minutes: A Confirmation of Fed’s Hawkish Shift?

July 8, 2021, 9:23 AMThe latest FOMC minutes were… mixed. The discussion between hawks and doves continues giving gold no comfort. Who will gain the upper hand?

Yesterday, the FOMC published the minutes from its last meeting in June. Investors who counted on some clear clues are probably disappointed, as the minutes can please both hawks and doves. Indeed, the report showed that the Fed officials are divided on their inflation outlook and the appropriate course of action. The dovish side believes that the recent high inflation readings are transitory and they will ease in the not-so-distant future, while the hawkish camp worries that the upward pressure on prices could continue next year:

Looking ahead, participants generally expected inflation to ease as the effect of these transitory factors dissipated, but several participants remarked that they anticipated that supply chain limitations and input shortages would put upward pressure on prices into next year. Several participants noted that, during the early months of the reopening, uncertainty remained too high to accurately assess how long inflation pressures will be sustained.

Importantly, most FOMC members recognized that the risks to inflation forecasts leaned more to the upside. This means that the hawkish shift is indeed real, although the Fed will remain very accommodative:

Although they generally saw the risks to the outlook for economic activity as broadly balanced, a substantial majority of participants judged that the risks to their inflation projections were tilted to the upside [emphasis added] because of concerns that supply disruptions and labor shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed. Several participants expressed concern that longer-term inflation expectations might rise to inappropriate levels if elevated inflation readings persisted. Several other participants cautioned that downside risks to inflation remained because temporary price pressures might unwind faster than currently anticipated and because the forces that held down inflation and inflation expectations during the previous economic expansion had not gone away or might reinforce the effect of the unwinding of temporary price pressures.

As a consequence of fast economic growth and higher inflation than expected, some participants suggested that it would be appropriate to taper the quantitative easing and hike the federal funds rate sooner than previously thought. Or, to be at least prepared if higher inflation turns out to be more persistent than the consensus sees it:

In light of the incoming data and the implications for their economic outlooks, a few participants mentioned that they expected the economic conditions set out in the Committee's forward guidance for the federal funds rate to be met somewhat earlier than they had projected in March (…)

Various participants mentioned that they expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated at previous meetings in light of incoming data (…)

Participants generally judged that, as a matter of prudent planning, it was important to be well positioned to reduce the pace of asset purchases, if appropriate, in response to unexpected economic developments, including faster-than-anticipated progress toward the Committee's goals or the emergence of risks that could impede the attainment of the Committee's goals.

However, despite all these hawkish commentaries, the majority of FOMC members remains extremely cautious and believe that the economy has still a long way to achieve the Fed’s targets, especially full employment:

Many participants remarked, however, that the economy was still far from achieving the Committee's broad-based and inclusive maximum-employment goal, and some participants indicated that recent job gains, while strong, were weaker than they had expected.

So, given that the economy hasn’t yet fully recovered, inflation will likely be just transitory, and there is high uncertainty about the economic outlook, it would be premature to tighten the monetary policy and raise the interest rates:

Participants generally agreed that the economic recovery was incomplete and that risks to the economic outlook remained. Although inflation had risen more than anticipated, the increase was seen as largely reflecting temporary factors, and participants expected inflation to decline toward the Committee’s 2 percent longer-run objective (…)

Several participants emphasized, however, that uncertainty around the economic outlook was elevated and that it was too early to draw firm conclusions about the paths of the labor market and inflation. In their view, this heightened uncertainty regarding the evolution of the economy also implied significant uncertainty about the appropriate path of the federal funds rate (…)

Participants discussed the Federal Reserve’s asset purchases and progress toward the Committee’s goals since last December when the Committee adopted its guidance for asset purchases. The Committee’s standard of “substantial further progress” was generally seen as not having yet been met, though participants expected progress to continue (…) Some participants saw the incoming data as providing a less clear signal about the underlying economic momentum and judged that the Committee would have information in coming months to make a better assessment of the path of the labor market and inflation. As a result, several of these participants emphasized that the Committee should be patient in assessing progress toward its goals and in announcing changes to its plans for asset purchases.

Implications for Gold

What do the recent FOMC minutes imply for gold? Well, in some sense, not so much. The minutes don’t include any revolutionary insights we are not aware of. Moreover, they lacked any clear guidelines about the future US monetary policy, as we could find both hawkish and dovish remarks in them.

And indeed, the price of gold was little changed in the aftermath of the FOMC minutes, and it remained slightly above $1,800 it reached the day before (see the chart below).

However, the minutes haven’t offered any significant dovish counterweight to the recent hawkish statement and the dot-plot. The statement is often more aggressive than nuanced and soft. Hence, although the minutes do show the discussion among the Fed’s officials, the hawkish shift is real. Perhaps the most important part of the document is the paragraph about the transition into a post-pandemic world.

Members judged that the economic outlook had continued to improve and that the most negative effects of the pandemic on the economy most likely had occurred. As a result, they agreed to remove references in the FOMC statement that noted that the virus was "causing tremendous human and economic hardship" and that "the ongoing public health crisis continues to weigh on the economy." Instead, they agreed to say that progress on vaccinations had reduced the spread of COVID-19 and would likely continue to reduce the negative economic effects of the public health crisis.

So, although the recovery is not completed and the economy hasn’t reached the Fed’s goals yet, the normalization of the US monetary policy has begun. It’s a fundamentally negative development for the gold market. Of course, gold bulls may find some comfort in the fact that it will still take at least a few meetings to develop and announce a plan of tapering the asset purchases; the interest rates cycle will start only later. Another positive factor is, of course, that gold managed to stay above $1,800 despite the lack of any clear dovish signals in the minutes.

Nonetheless, the Fed’s hawkish U-turn – unless reversed because of another economic crisis, or unless accompanied by stagflation – should imply higher bond yields, a stronger greenback and, thus, weaker gold.

In other words, the minutes won’t change the current market narrative, which assumes that the economic recovery is on track while inflation is just transitory. As a reminder, the latest job gains were surprisingly strong, which moves the US economy closer to full employment. Such a narrative implies strong economic confidence and limited demand for safe-havens such as gold.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will Strong June Nonfarm Payrolls Add To Gold's Problems?

July 6, 2021, 11:03 AMThe US economy created 850,000 jobs in June. It could be another nail in gold’s coffin – what will the yellow metal do?

850,000. This is how many jobs the US economy added in June. It means that the recent nonfarm payrolls came above the forecasts (economist predicted 700,000 created jobs) and are much higher than the 583,000 in May or the deeply disappointing 269,000 in April (see the chart below). Big gains occurred in sectors heavily hit previously by the pandemic, i.e., in leisure and hospitality (343,000), public and private education (269,000), professional and business services, retail trade, and other services.

Furthermore, employment in April and May was revised upward by 15,000. The acceleration in the pace of job increases is a good sign for the US post-pandemic economy and a bad development for the gold market.

The only relief for gold could be the fact that the unemployment rate increased from 5.8% to 5.9%, as the chart above shows. This increase was a negative surprise, as economists forecasted a decline to 5.6%. This is also quite paradoxical –unemployment remains relatively high despite a record number of job openings.

Another potentially supportive factor for the gold market could be the 3.6% annual increase in wages, which means there will be higher wage inflation that could add to the consumer inflationary pressure. On the other hand, stronger wages could also support the Fed’s hawkish arguments for reducing quantitative easing and raising interest rates rather sooner than later.

Implications for Gold

The newest employment situation report is negative for the yellow metal mainly because it strengthens the position of hawks within the FOMC. With strong labor market, there are higher chances that the Fed will normalize its monetary policy earlier. As a reminder, some of the central banks believe that the Fed has already reached its inflation targets. So, the labor market target is what’s left. Strong job gains in June moved the US economy much closer to achieving this Fed’s goal and erasing worries that came in the aftermath of the extremely disappointing April reading.

In other words, the strong employment report may add to the current weakness in gold in the medium-term. What the yellow metal needs right now is the flux of unambiguously poor economic data that could trigger the dovish counterrevolution within the US central bank, not the positive reports that strengthen further the expectations of earlier hikes in the federal funds rate. So, the recent report could increase the bond yields and support the American dollar, creating downward pressure on gold.

However, the initial response of the yellow metal was positive. As the chart below shows, the price of gold increased on Friday. This is probably because the report wasn’t as good as it could be – i.e., although the nonfarm payrolls release beat expectations, the unemployment rate increased, suggesting that the Fed may, after all, not taper as soon as some investors believe.

Gold’s performance amid strong payrolls data is reassuring a bit. The yellow metal is still in the game; it may even return more decisively to the spotlight if investors cease to be relaxed about higher inflation. So far, the US central bank believes that inflation is transitory and markets are calm, but inflation may turn out to be more persistent than the Fed officials and the pundits claim. In such a scenario, the FOMC will have to catch up, which could trigger volatility or even recession; this is an environment in which investors could again switch to gold. But this is still a song of the future, and in the meantime, gold may struggle.

Anyhow, for now, investors are focused on the upcoming (tomorrow!) minutes from the latest FOMC meeting. They should provide us with more clues about the Fed’s monetary policy and the direction of gold prices in the future.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Suffered in June - Will It Rebound in 2021?

July 1, 2021, 9:04 AMJune was a terrible month for gold. Without a fresh crisis or a strong dovish signal from the Fed, gold may continue its disappointing performance.

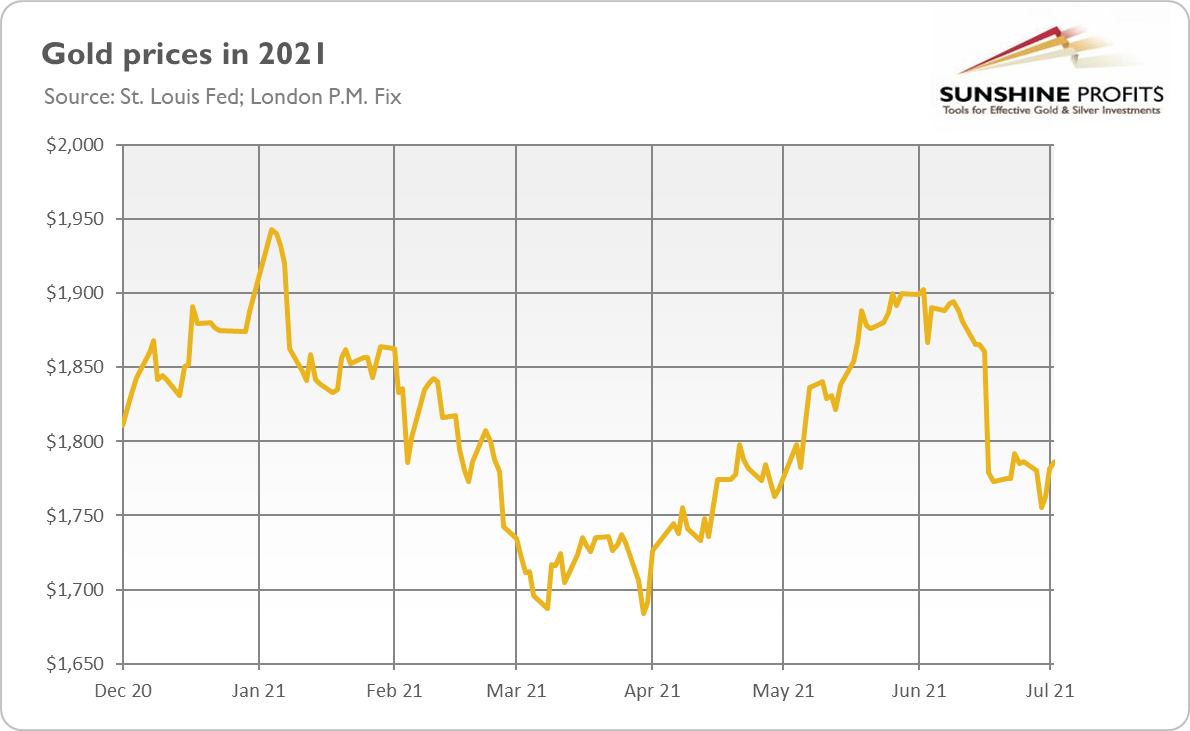

June wasn’t too kind to gold. As the chart below shows, the yellow metal plunged more 7.2% in the last month, the biggest monthly decline since November 2016. In consequence of the June rout, the whole first half of this year was awful for gold, which lost 6.6% in that period, the worst performance since H1 2013.

The dive was a result of the latest Fed’s dot-plot published in the aftermath of the June FOMC meeting which showed that the US central bankers could want to hike the federal funds rate earlier than previously thought. Although the dot-plot is not a reliable forecast of what the Fed will do, and a quarter-point hike in the interest rates in two years from now isn’t particularly hawkish, the change was sufficient to alter the crowd psychology. As a result, the market narrative has shifted from “the Fed will tolerate higher inflation, staying behind the curve” to “the Fed won’t allow inflation to run wild and will hike earlier because of the stronger inflationary pressure”.

The subsequent comments from the Fed officials helped to consolidate the new narrative. For example, only this week Thomas Barkin, Richmond Fed President, noted that the US central bank has made “substantial further progress” toward its inflation goal in order to begin tapering quantitative easing. Meanwhile, Fed Governor Christopher Waller stated that the Fed could begin tapering as soon as this year to have an option of hiking interest rates by late next year. Robert Kaplan, Dallas Fed President, went even further, saying that he “would prefer [a] sooner” start of reducing the pace of Fed’s asset purchases than the end of the year.

The hawkish U-turn among the Fed led to higher nominal bond yields, real interest rates, and a stronger US dollar, which also contributed to gold’s weakness. Meanwhile, inflation expectations reversed in June after a peak in May, which increased the real yields and also hit gold prices.

Implications for Gold

What do the changes in the Fed’s stance on the monetary policy and the market’s new narrative imply for gold? Well, the hawkish revolution is fundamentally negative for the yellow metal. Investors are now less worried about higher inflation, as they believe that the Fed will tighten its monetary policy sooner than previously thought. Such expectations boost the market interest rates, making the dollar more attractive compared to its major peers, while non-interest-bearing assets such as gold become less alluring.

However, this narrative, like all narratives, may quickly change. If we see more disappointing economic data coming, the Fed could return to its previous dovish stance. Also, if high inflation turns out to be more persistent or disruptive than expected, the demand for inflation hedges or safe-haven assets such as gold may increase again.

Furthermore, if inflation turns out to be merely transitory, as the Fed and the pundits believe, the US central bank will remain behind the curve, and gold may survive. Or, the Fed will have to lift the interest rates aggressively, increasing the risk of recession.

What is important here, the yield curve has already flattened. It is still high and far from the negative territory, but the peak is behind us. Thus, gold will suffer initially because of the hawkish Fed only to rebound later during the next economic crisis. But well, it seems that gold indeed needs a new catalyst to rally, and without any crises or dovish signals sent by the Fed, it will struggle.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Credit Spreads Declined Unprecedentedly. Will Gold Follow?

June 29, 2021, 9:54 AMWhen credit spreads narrow, it’s bad for gold. But this time there is a silver lining we can look for, although it’s quite adverse for the economy.

There are several important factors affecting gold prices. Many analysts focus mainly on the US dollar and real interest rates. However, what is sometimes even more important is economic confidence. Of course, the level of economic confidence is partially reflected in the strength of the greenback and the bond yields. However, I would like to focus today on credit spreads, an often overlooked indicator of economic confidence.

Why such a topic? It’s simple, just take a look at the chart below. As you can see, the ICE BofA US High Yield Index Option-Adjusted Spread, which is a proxy for a spread between the yield on below-investment-grade-rated corporate debt and Treasuries of the same duration, has recently declined to a very low level. To be more precise, the analyzed indicator slid from almost 11 in March 2020 to 3.1 at the end of June (the lowest reading since July 2007, the time just before the Great Recession started).

Implications for Gold

OK, great, but what does this mean for the gold market? Well, this is a negative development for gold prices, but with a silver lining. Let me explain. When credit spreads are narrow or in a narrowing trend, it means that economic confidence is high or in a rising trend. In such an environment, risk appetite is strong and demand for safe-haven assets such as gold is low. The fact that credit spreads have reached their multi-decade lows indicates that the economic expansion is doing well. If the boom continues, the Fed will eventually normalize its monetary policy a bit, and the interest rates will increase. Additionally, US banks have cleared the Fed’s recent stress tests, which means that they will no longer face restrictions on how much they can spend buying back stock and paying dividends. This change might strengthen the financial sector, additionally boosting economic confidence among investors. And this is all bad for the yellow metal.

However, we can look at very low credit spreads from the other side. After all, they have already decreased profoundly and further significant declines are not very likely. Furthermore, the last time they were so narrow was mid-2007, i.e., just a couple of months before the outbreak of the global financial crisis.

Hence, it might be the calm before the storm. The economic crisis, by definition, occurs when confidence is high and almost nobody expects any problems. A related issue here is whether the markets are properly assessing the risk. The low risk premium partially results from the low Treasury yields, which push investors who seek profits into riskier securities.

Some analysts point out the risks related to the surge in the public debt or inflation. For example, David Goldman notes that the rising gap between prices paid by the producers and prices received by customers ( June Philadelphia Manufacturing Business Outlook Survey) could depress output in the future, as companies wouldn’t be able to maintain profit margins in such an environment.

The bottom line is that the US economy has recovered and the economic expansion continues undisturbed. Given this trend and high economic confidence, despite the soaring prices and indebtedness, gold may struggle for some time.

However, credit spreads may widen abruptly when the next crisis hit, as they did in the aftermath of the collapse of the Lehman Brothers. In other words, although the economic confidence is strong, some important downside risks for the US economy are still present, and they could materialize later in the future. Perhaps investors know this – according to the WGC, we saw inflows to the gold ETFs last week, despite the plunge in gold prices. It shows that investors could have been taking advantage of lower prices to buy gold as a portfolio diversifier and protection against tail risks.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM