-

Trump Recovered. What about Gold?

October 8, 2020, 11:52 AMDonald Trump caught a coronavirus, but miraculously, he has already left the hospital in good shape. Unfortunately, gold didn’t show too much empathy about it.

Oh boy, what a week has been so far! On Friday, when it turned out that the United States President was tested positive for the Covid-19 and taken to the hospital, the whole world held its breath. Luckily, he was hospitalized for only three nights, and on Monday, he returned to the White House, after receiving state-of-the-art medical treatment for the coronavirus.

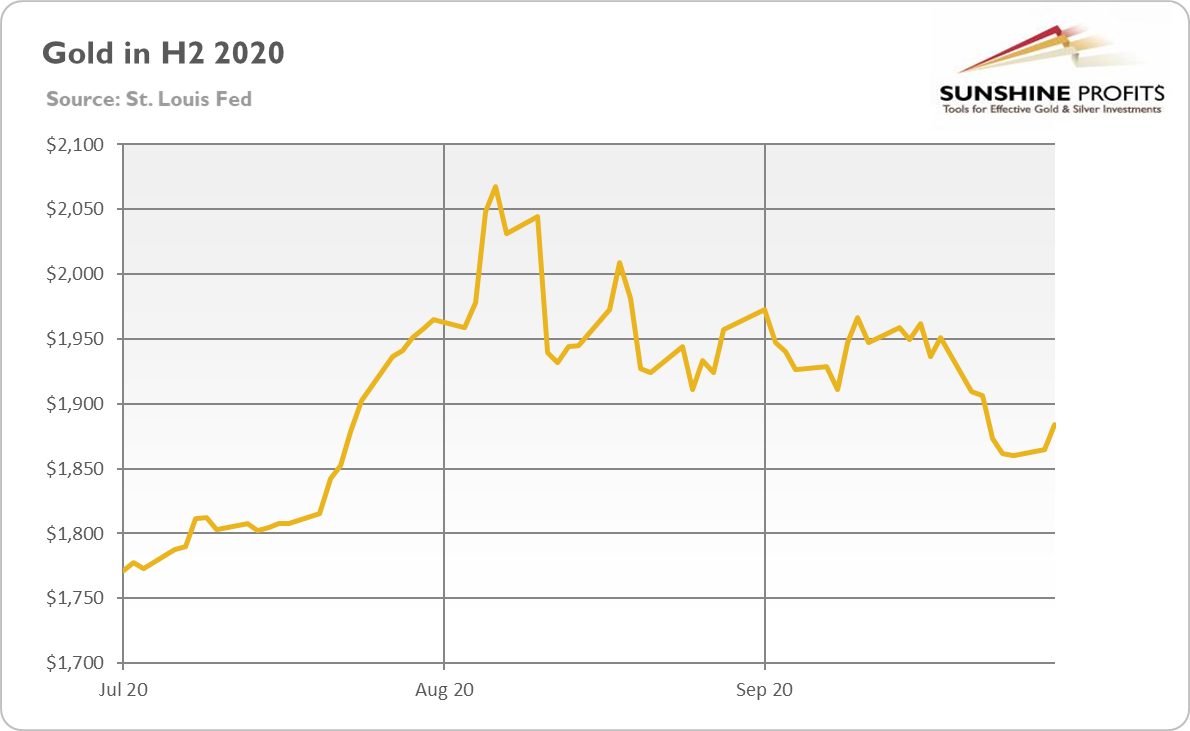

Surprisingly for some observers, as one can see in the chart below, gold moved truly little following the news about Trump’s infection. Indeed, the yellow metal has managed to jump above $1,900 again, and it had retreated after a few days above that line – just when Trump got out of the hospital.

Isn’t this muted reaction a bit strange? Just think about it, Donald Trump, which is the most powerful man in the world, could’ve died from Covid-19, which could put the US into political chaos, while the price of gold just increased for merely several dollars?

But, you see, gold’s reaction to the geopolitical events is often limited, as we’ve repeated many times in the past. And the news about Trump’s health were rather optimistic, which has not sparked a panic rush into safe-haven assets such as gold.

Moreover, Trump continued with his erratic behavior and halted all the stimulus talks until after the election. On Tuesday, he wrote:

“I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business.”

However, one day later, Trump softened his stance, saying that he was ready to sign a bill providing a fresh round of $1,200 stimulus checks. The political gridlock and the lack of a deal on fiscal aid have put downward pressure on both the stock market and gold.

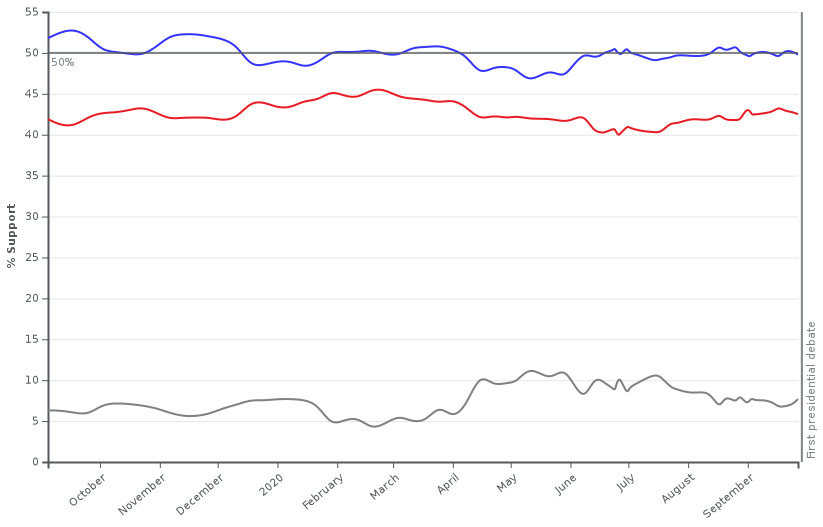

Another issue related to Donald Trump is that his aggressive performance in the first presidential debate did not help him boost his presidential race changes. As the chart below shows, Biden's advantage over Trump in national polls has increased to 10.1 percentage points.

The potential Biden’s victory and taking full control of Congress by Democrats is an important upward risk for gold, especially if the election results are contested.

Implications for Gold

What does all of the above mean for the gold market? Well, the fact that even the POTUS caught the coronavirus (and that the White House is in disarray with more than 20 people in the Trump’s administration infected recently) could renew the fears of the Covid-19. The President’s infection emphasizes the realities of risk right in front of all Americans and people worldwide.

Indeed, the pandemic is far from being over, as the chart below shows. The number of daily new confirmed Covid-19 cases in the US is rising again. The worries about the second wave could support the safe-haven demand for gold, but it could also ignite a selloff and rush towards cash if pushed to the extreme.

On the other hand, Trump’s recovery and downplaying of the coronavirus threat in public could also make people less fearful of the pandemic. He has tweeted recently: “Don’t be afraid of Covid. Don’t let it dominate your life.” And the fact that the President got the best and newest drugs to fight the infection could also revive the optimism in the medical COVID-19 treatment, which could be rather negative for the gold prices.

The political gridlock over the fresh stimulus package seems bad for gold, but it is more bearish for the stock market, as equities require fiscal (and monetary) support to a far greater than the yellow metal.

The effect of the presidential race on gold depends on whether the Democrats take full control over Congress. But given that fundamental drivers remain favorable for gold in the medium-term, I would bet neither on blue nor on red, but on gold.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Q2 Was Disastrous. But What's Next for the US Economy - and Gold?

October 6, 2020, 3:02 PMThe real US GDP plunged with a 31.4 percent annual rate in Q2 of 2020. In that regard, what's next for the American economy and the gold market?

We all know that the second quarter was disastrous for the US economy. And now, it's official. Last week, the Bureau of Economic Analysis published the third real GDP estimate in the Q2. According to the report, the real GDP decreased at an annual rate of 31.4 percent (slightly better than the second estimate of 31.7-percent plunge), or 9 percent more from the previous quarter and the second quarter of 2019, as the chart below shows. In other words, the US economy has suffered the sharpest contraction since the government started keeping records in 1947.

Although the report sounds devastating, since it is also terribly old news, nobody really cares, while market players are always future-oriented and focused on a fast recovery. And indeed, the data is encouraging. For example, the consumer Confidence Index has jumped from 86.3 in August to 101.8 in September, which is the highest level since the pandemic started.

Cleveland Fed President Loretta Mester says that the economic recovery is split into the tale of two cities: You have a lot of the economy now where the activity is picking up, but you also have a significant part of the economy - travel, leisure, and hospitality - where a pickup is not visible at all.

Indeed, some data is somewhat discouraging. For example, the September nonfarm payrolls came below expectations (we will elaborate on this in the future), while the Chicago Fed's national activity index, which measures the overall U.S. economic activity, dropped from 2.54 in July to 0.79 in August. It means that the economy is stagnating or slowing down rather than accelerating. Another important index is New York Recovery Index, which is the combination of five sub-indices that aim to measure the pace of the recovery of the New York. As the chart below points out, the index remains around 50, which means that the city is only halfway back to pre-pandemic levels.

The sad truth is that the American recovery pace depends significantly on further stimulus packages. For that reason, Fed officials call the Congress to make a deal on the next aid bill quickly. Without a doubt, there will be a big rebound in the third quarter, but the economy will likely still decline in the whole year. According to the Economist Intelligence Unit, this year, the US economy will drop 5.3 percent, probably not returning to the pre-pandemic level until 2020.

In other words, a V-shaped recovery will occur. But it will take place in China, not in the US. China's COVID-19 suppression turned out to be draconian in the short-term, but really effective in the long-run, as it allowed consumers to revert to their pre-epidemic behavior.

In contrast, the US never had any serious strategy to combat the coronavirus. So, not surprisingly, the end of the pandemic is still far away in America. Recently, the number of new cases has been rising again, as the chart below shows. Even President Trump tested positive for the new virus (we will elaborate on this in the next edition of the Fundamental Gold Report). And let's not forget that the fall has just begun - with winter still ahead of us!

And no, waiting for a vaccine is not a strategy. Even if the vaccine gets invented by the end of the year, the economy may not rebound quickly enough. You see, the vaccine must also be distributed and injected, which takes time. The authorities may try to speed up the whole process, but its rapid implementation may result in ineffectiveness or, even worse, in some serious side-effects. Besides, a big part of society may refuse to be vaccinated, given the high uncertainty related to the Covid-19 and the eventual vaccine against it.

Implications for Gold

What does it all mean for the gold market? Well, just as the second quarter was disastrous for the American economy, it was similarly excellent for the gold market. And just as the third quarter was better for the economy that partially rebounded, it was worse for the yellow metal, which retreated from above $2,000 to below $1,900, as the chart below indicates.

However, given that the pandemic is not yet over and that the road towards full recovery will be long and bumpy, with further stimulus packages on the way, it seems that the recent correction was just, well, a short-term correction in a long-term bull market rather than a major reversal.

Investors should not forget about the dovish change in the Fed's monetary regime. Even though gold didn't rise or decline, it does not matter in an immediate reaction to the Fed's strategy shift. You see, contrary to the widespread practice of market analysts, strategic movements should not be judged based on the current response financial markets response. Strategic political decisions, such as the Fed's significant change in its monetary framework, are slow to act and bear fruit only over time. Given that the discussed shift implies lower real interest rates for longer and stronger tolerance to higher inflation, gold should benefit from it in the longer run.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will You Go Up, Gold?

October 1, 2020, 10:14 AMBiden asked Trump to shut up during the first presidential debate. But for us, the most important question is whether gold will finally go up.

Thankfully, the first U.S Elections debate between Donald Trump and Joe Biden is behind us. Arguably, it was awful to watch and one of the worst presidential debates in history, as both candidates talked over each other and threw insults. Consequently, the debate did nothing to alter the Presidential race dynamic nor educate the public about the candidates. As the chart below shows, currently, Joe Biden has an average polling lead of 7.3 points over Donald Trump. Of course, the polls, especially nationwide, are not considered as very credible. But, according to the polls, if Trump changes nothing, Biden remains in the lead, and it is projected that the Democratic nominee will win.

The election could spur short-term volatility in the precious metals market, especially if the results are contested. However, they should not materially impact gold in the long run. Of course, a lot depends on who will win and how the markets will interpret the election results. At this point, it's important to bear in mind that Biden could be more favorable for the stock market than many people think (as his views on tax hikes should soften over time, especially in the fragile post-epidemic recovery).

The best-case scenario for gold would be a full Democratic sweep of the White House and the Senate. A complete takeover by the Democrats could unsettle the marketplace (think about worries about new regulations and tax hikes), pushing investors again towards safe-havens such as gold.

On the other hand, if Biden wins the presidency but Republicans maintain the control over the Senate, it could indulge Wall Street by abandoning the harmful foreign and trade policies while keeping Trump's tax reform in place. But still, in such a scenario, gold might somewhat struggle.

Implications for Gold

Throughout the debate, Trump made many interruptions. Biden quickly got irritated and said told him: "Will you shut up, man?" But the real question is: "Will you go up, gold".

It remains to be seen. Most probably, the stage for the gold's rebound is set, as the prices started to go up last week, approaching $1,900, as indicated in the chart below. The catalyst was the new hope of the U.S. fiscal stimulus package possibly being passed this year or even before the elections. After all, Congress members are under immense pressure to deliver aid to their voters. The new hope emerged as the Democrats have presented a brand new proposal of aid package with some Republicans concessions.

Most importantly, if the stimulus package is approved, the U.S. public debt will continue to climb at its historic pace, which should support the gold price as a result. The Fed would also have more Treasuries available to expand its balance sheet again.

To sum up, the debate between Trump and Biden was quite awful for watching and did not alter the presidential race at all. The elections and related uncertainty could cause short-term volatility in the gold market. Too much depends on the results, but they shouldn't resume the underlying upward trend.

In any case, the U.S. fiscal stimulus will eventually be passed, which should encourage gold to continue with its bullish trajectory. This should remain in place given the environment of accommodative fiscal and monetary policies and negative real interest rates. Indeed, the persistent inflows of funds into the gold ETFs signal that the bull market is not over. The retreat from the August heights still looks like correction or consolidation, not a major reversal. To be clear, I do not claim that ETF flows drive the gold prices, but that the investors do not turn their backs on gold. And that gold's fundamental drivers remain supportive, maybe still apart from the US dollar.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Fed Isn't Thinking about Rate Hikes. So Does It Maybe Think about Gold?

September 29, 2020, 10:17 AMThe Fed Vice Chair says that the Fed will not even think about hiking interest rates until the inflation reaches 2 percent. Meanwhile, the price of gold decreases further. What is exactly happening in the gold market?

Over the last week, several Fed officials spoke publicly with the purpose of convincing investors that their new policy strategy would be positive for the economy. Powell himself testified three times before Congress. However, the most interesting remarks were delivered by Richard Clarida, Fed Vice-Chair.

On Wednesday, he told Bloomberg Television that the FOMC would not even think about hiking the federal funds rate until the inflation reaches 2 percent:

Rates will be at the current level, which is basically zero, until actual observed PCE inflation has reached 2%. That's 'at least.' We could actually keep rates at this level beyond that. But we are not even going to begin thinking about lifting off, we expect, until we actually get observed inflation ... equal to 2%.That's excellent news for the gold market! Clarida's words imply lower interest rates for a more extended period. The Fed will not raise the rates until the labor market recovers completely, and the inflation at least hits the Fed's target, or until it somehow surpasses it for some time. According to the US central bankers, these conditions will not be met until the end of 2023, if not later. The dovish monetary policy of lower for longer means that the real interest rates will likely stay in negative territory, supporting gold, but does not bear any yield. And if the inflation rises, the real interest rates will decline even further.

But still, if this is so positive for the gold market, why the yellow metal price has declined further below $1,900, as the chart below shows?

Well, the interest rate policy is only one aspect of the Fed's standpoint. Another is the asset-buying program - and this is the one area where the US central bank disappointed investors. You see, market participants were upset because the Fed did not announce the bond purchases expansion.

It is an event that saddened precious metals investors. After all, gold benefited substantially from the mammoth growth of the Fed's balance sheet. But, as indicated in the chart below, already in May, this growth lost its momentum and stagnated further later on. Additionally, since summer, the central bank's assets have been stabilized at around $7 trillion.

Implications for Gold

So, to conclude, what does the above mean for the gold market? Well, amid the recession, negative interest rates, rising public debt (last week, the Congressional Budget Office projected that the U.S. federal debt held by the public would balloon to about 195 percent of the US GDP in 2050), easy monetary and fiscal policies and the risk of inflation acceleration, the fundamental outlook for gold remains positive in the long-run.

However, despite that, this fall, we can see more weakness in the gold price. The downside risks include the renewed recession with a rush toward cash, a smooth presidential election, the introduction of a COVID-19 vaccine and related market euphoria, and the lack of additional fiscal and monetary stimuli. Indeed, the current stalemate in Congress over additional aid programs, although negative for the GDP outlook, does not help gold. The lack of freshly issued Treasury bonds also lowers the Fed's potential to monetize the public debt.

In other words, it seems that the second leg of the bull market in gold will not come into effect unless the Fed expands its assets again or the inflation accelerates, which at the end of the day, it is quite possible, given the broad money supply expansion, the rising federal debt, and the Fed's new monetary framework.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe, but you are not on our free gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Declines Below $1,900 amid Stronger Corona and Dollar

September 24, 2020, 9:50 AMThe gold price dropped below $1,900 amidst Covid-19 cases increases in the West and the US dollar appreciation. So, what happens next with the yellow metal?

For the time being, things are not looking good, my bull friends. The bearish trend in the gold market continues. As the chart below shows, we saw a significant selloff on Monday with gold prices decreasing from above $1,950 to $1,909. To make matters worse, the decline continued on Tuesday and Wednesday, with the price of gold dropping below the critical level of $1,900, for the first time since the end of July.

So, what exactly happened here? Well, as we wrote in Tuesday's Fundamental Gold Report, the coronavirus just came back with another wave. As pointed out in the chart below, the daily new confirmed Covid-19 cases are increasing again in several European countries, and the United States.

Yes, even the U.K. Prime Minister Boris Johnson has already introduced some new restrictions, including 10 p.m. curfews for pubs and restaurants in England. Can you imagine pubs in England opened only until 10 p.m. - that's not just a crisis, it's a disaster!

As a result, the recent Covid-19 cases resurgence renewed the global concerns about the reinstatement of lockdowns or other constraining measurements that can hamper the pace of the economic recovery (I warned you that there is no point in expecting a V-shaped rebound). This anxiety caused was the main reason behind the recent stock market declines, pushing down the S&P 500 and Dow Jones from 3319 and 27657 to 3281 and 27148, respectively (see the chart below).

Moreover, the negative market sentiment intensified U.S. dollar's safe-haven demand, which rose to the two-months high. Consequently, the EUR/USD exchange rate dropped to a two-months low of $1.1671 on Wednesday morning.

Although the new cases are increasing in America, infections are spreading incredibly rapidly in Europe, strengthening the greenback's position against the euro. The recent cases resurgence across Europe have coincided with the weak economic Eurozone indicators: for example, the business growth ground to a halt in September.

Implications for Gold

So, what does the above mean for the gold market? Well, the renewed global concerns about the second Covid-19 wave of infections, primarily in Europe, along with its economic implications, pushed investors toward the US dollar. It is all normal - in every crisis, cash is always the king. But in a global or European crisis such as the current one, the greenback is the tsar.

Several other risks have accumulated recently. Let's not forget that the U.S. presidential elections are quickly approaching. It is likely that the elections' results will be disputed, as Trump already suggested that mail-in voting could be rigged. Moreover, the fight over Supreme Court Justice Ruth Bader Ginsburg's successor adds up another volatile element, as it decreases the chances of a quick deal on the new stimulus measurements. You see, if Trump manages to install a conservative replacement in time, the new judge could help resolve any dispute in his favor. These risks supported the US dollar, which put downward pressure on the gold prices as a result.

Therefore, the market sentiment is clearly bearish right now, and it appears that the yellow metal needs a real spark to reenter a bullish trend. Indeed, it seems that both the stock and gold market await patiently for the upcoming fiscal and monetary stimuli. Unfortunately for the gold bulls, the market expectations for a new Congress or the Fed support have declined in recent days. That is why the fears about the second wave of infections and the renewed sanitary restrictions are so acute - there is no government or central bank's help on the horizon that can protect and solidify the economy.

But still, gold bulls shouldn't give up. Remember the first wave of the pandemic? Gold also plunged, only to soar afterward, resulting in a record high. The fundamental outlook for gold is still bullish: the real interest rates are negative, the public debt is ballooning, while the Fed's monetary policy is very dovish. Although right now, both the Congress and the central bank could potentially disappoint investors, they will have no choice but to provide additional support as they always do indulge the Wall Street - and, although somewhat unintentionally, gold bulls.

If you enjoyed today's free gold report, we invite you to check out our premium services for richer information. We provide much more comprehensive fundamental gold market analyses in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet, but you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM