-

Gold Is Likely to Win This Election

October 27, 2020, 1:47 PMTrump and Biden debated for the second and last time in this campaign. So, who will win, and why gold is likely to be the biggest winner of them all?

President Donald Trump and Democratic challenger Joe Biden met for the second and the last debate before the elections. Thankfully, this time things were less chaotic and with far fewer interruptions and insults. Perhaps Trump has acknowledged that his aggressive behavior was a liability and decided to change his approach – especially since this was his final opportunity to alter the presidential campaign dynamics.

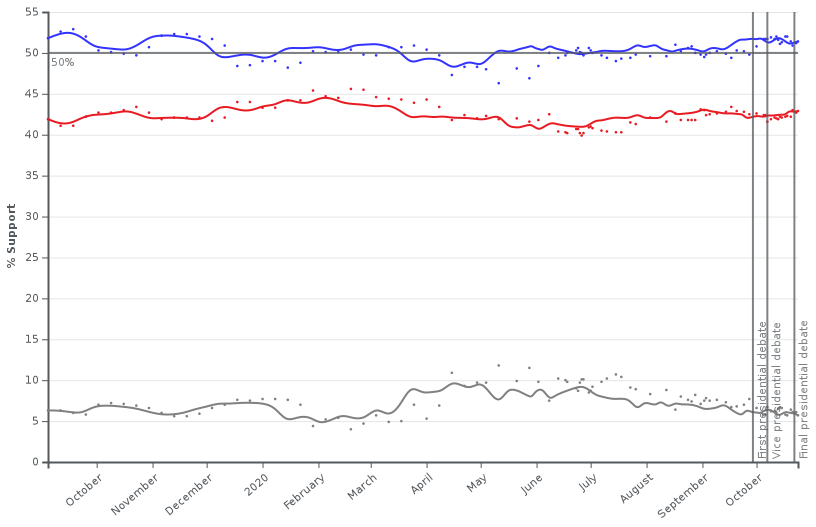

However, it might be too late now. According to both nation-wide and state-by-state polls, and market bets, Biden is still in a significant lead (as the chart below shows). Moreover, because of the postal voting, many votes are already locked in, as a record 47 million Americans have already cast their ballots.

In addition to the above, the epidemiological situation does not help Trump at all. People believe that he dealt poorly with the epidemic, and now we even have the resurgence in the number of Covid-19 cases in the United States (and other countries as well), presented in the chart below. It is not only a resurgence, it is a new black record of the number of cases!

The pandemic is hitting even harder now than in the spring. This means that the economic recovery will remain fragile, which is bad news for Trump, but excellent for gold prices. Indeed, the latest Beige Book showed that most parts of the country's economic activity were "slight to modest". And the leading economic index rose just 0.7 percent in September, following the increases of 1.4 percent in August and 2 percent in July.

However, even though mainstream pollsters have corrected some of the mistakes they made in 2016, it’s safe to assume that Trump has better reelection chances than it is widely believed and reflected in the mainstream polls. As you might’ve noticed by now, Biden spurs less enthusiasm than Trump and even less enthusiasm than Clinton, for that matter. He is mainly an anti-Trump choice, so some of his voters may not show up on a ballot day.

Implications for Gold

So, what does all the above mean for the gold market? Well, it depends on the election results. The best scenario for gold will be a Democratic sweep, as it would imply more chances of higher taxes, increased regulation, and big fiscal stimulus. Trump’s victory should be good for gold, as it would be a continuation of the trade wars, budget deficits and geopolitical uncertainty. After all, as the chart below indicates, gold saw about 50-percent gain during Trump’s presidency.

The worst scenario (but not necessarily significantly bad in absolute terms) could be Biden’s victory but with Republicans retaining Senate. In such a case, we would get more predictability in the White House and in the foreign policy, while Republicans would block the most disastrous ideas of a new president.

Another issue is that the election results will probably be contested. Some analysts claim that it would be bad for the gold prices, as contested outcomes would delay the fiscal stimulus. However, the results' conflicts should also drive political uncertainty and support the save-haven demand for gold.

Last but not least, I will reiterate what I said many times earlier. The presidential election’s relevance for gold prices may be overstated. After all, the gold’s fundamentals are still positive: the real interest rates remain in the negative territory, while the US dollar has recently weakened compared to the spring.

Moreover, the fiscal stimulus will take place, despite who wins the elections. The only difference is that Democrats are willing to spend more. The fresh government spending will increase the fiscal deficit, and public debt should be even more favorable for gold. Furthermore, the COVID-19 cases resurgence increases the chances for higher stimulus or even for additional packages after some time. And of course, the Fed will buy most of these newly issued Treasuries, leading to further quantitative easing and a larger Fed balance sheet, which should also support the gold prices.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Elections Are Coming. Will Gold Win?

October 22, 2020, 12:08 PMThe US presidential elections are quickly approaching. So, what do they have in store for the price of gold?

There are less than two weeks until the US presidential elections. Who will become the next POTUS? Biden or Trump? Well, according to the polls, the Democratic candidate will definitely move into the White House. As the chart below shows, Biden has an average polling lead of 7.9 percentage points over Trump.

Recently, Biden’s advantage has been slightly decreased, but despite that, the man is still in a huge lead. The problem is that it doesn’t matter. Back in 2016, Hillary Clinton was also in a continuous lead according to polls, but she ultimately lost the race. Of course, Biden’s lead appears much higher, but still, the polls cannot be trusted, especially nationwide ones. The recent state-by-state polling date, as well as the predicting markets, also forecast Biden’s victory. But, everything can happen, and Trump can remain in the White House.

What will happen if that’s the case then? Well, Trump’s triumph in 2016 sent gold prices lower – As the chart below shows, they declined from about $1,300 to almost $1,100 in December.

However, the possibility of a 2016 rerun is not very likely now. And why is that? The first reason is that Trump’s victory was a surprise, making markets more cautious not to discount any particular outcome. Second, investors hoped that Trump, as a pro-business-oriented person, would cut red tape and taxes (what he actually did), accelerating economic growth as a result. However, he also began trade wars, put pressure on the Fed, and added uncertainty into the markets with his erratic behavior. His fiscal policy was entirely frivolous as well, resulting in a substantial budget deficits expansion, even before the pandemic occurred. Third, the macroeconomic and epidemiological situation was much different. We are currently in the second wave of coronavirus infections, which makes the economic recovery really fragile. The real interest rates are negative, while both the Fed’s balance sheet and the public debt have ballooned in response to the economic crisis.

In such a macroeconomic environment, gold shouldn’t plunge after Trump’s victory. After all, if he wins, we could expect the current situation to continue (however, given Trump’s unpredictable behavior, I wouldn’t be surprised to see changes during his second presidency). The administration’s coping with the epidemic will remain unsatisfactory, while the public debt will stay on an upwardly-steep trajectory.

Therefore, Biden’s triumph could bring more volatility into the marketplace. The consensus is that Biden will expand government spending even more than Trump did, triggering higher inflation as a result. If Democrats also take over the Senate, tax hikes are highly likely, but not immediate. For all of these reasons, Biden, as the next POTUS, is considered very positive for gold.

But still, precious metals investors should remain cautious. Market narratives can change quickly. Before the 2016 presidential elections, analysts believed that Trump would be negative for the stock market, but it turned out that Wall Street quickly started to like Donald. Thus, Mr. Market could also decide that Biden could be a nice change after all, ending trade wars, etc.

Another reason why we don’t have to see a replay of 2016 is the likelihood that the 2020 election results would be contested due to the massive use of absentee voting amid the coronavirus epidemic. Many times, Trump expressed his skepticism about mail-in ballots and refused to promise in advance that he will accept the results and hand over the power in a peaceful manner.

Ergo, a remarkably close and contested result would cause a legal battle that leaves the outcome uncertain until January, when the new Congress certifies the election results. In other words, a contested election could throw the country into chaos, which should support the gold prices in the short-term.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

IMF Expects Precious Metals Index to Rise

October 20, 2020, 7:52 AMIMF’s economic outlook for 2020 is less grim, but the more distant future is more worrisome. Therefore, the precious metals index is expected to rise.

October’s edition of the IMF’s World Economic Outlook Report is out! The main message that the report conveys is that the IMF now predicts a less severe global contraction than in 2020 but a slower recovery in 2021. The global economy is projected to plunge 4.4 percent this year and rise 5.2 percent in the subsequent year, contrary to the -5.2 and 5.4 percent changes forecasted in June.

Unfortunately, the prospects for emerging countries, excluding China, have worsened, and the economic decline for 2020 is projected to be greater than previously estimated. As a result, the pandemic will reverse the progress made since the 1990s in reducing global poverty.

When it comes to the US economy, it is forecasted to contract by 4.3 percent this year before growing at 3.1 percent in 2021, compared to -8 percent and 4.5 percent seen a few months ago. However, the reasons for the celebration are limited, as these projections could be revised down soon.

You see, the problem is that the second wave of the coronavirus cases (see the chart below) is hurting the employment rate again.

As the chart below points out, the number of Americans who applied for unemployment benefits has recently risen to the highest level over the last few weeks.

Even though the IMF’s near-term projection improved, another issue is that the baseline forecast envisages growth to slow down into the medium term, as the deep downturn this year will harm the supply potential. It means that the US will only modestly progress toward the 2020–25 path of economic activity projected before the epidemic.

Most importantly, the subdued outlook for medium-term growth comes with a significant projected increase in public debt stock. What is worrying is that the reduced potential output also implies a smaller mid-term tax base than previously anticipated, making repaying debts even more difficult.

Indeed, debt is an increasingly pressing problem all over the world, including the US. As a matter of fact, according to the IMF’s Fiscal Monitor, the debt-to-GDP ratio will stabilize next year everywhere but China and the US:

In 2020, government deficits are set to surge by an average of 9 percent of GDP, and global public debt is projected to approach 100 percent of GDP, a record high. Under the baseline assumptions of a healthy rebound in economic activity and low, stable interest rates, the global public debt ratio is expected to stabilize in 2021, on average, except in China and the United States.

However, public debt is not the only big problem in the US. Corporate indebtedness is also a worrying issue. In response to the coronavirus crisis, firms have also taken on more debt to cope with the reduced income and cash shortages, adding to the already high debt levels. Therefore, if the recovery is delayed, “liquidity pressures may morph into insolvencies,” according to the IMF’s Global Financial Stability Report. So far, the policy support limited the scale of bankruptcies. Still, the economists from the Bank of International Settlements predict that bankruptcies in advanced economies could rise from the baseline in 2019 by around 20 percent in 2021.

Implications for Gold

What does all the above mean for the gold market? Well, the improved near-term outlook for the US economy is not good news for the yellow metal. However, the slower expected growth in 2021 and beyond is becoming more positive. Notably, “the global economy’s long ascent back to pre-pandemic levels of activity remains prone to setbacks”. In other words, the uncertainties persist, which should support the safe-haven demand for gold as a result.

It is perhaps why the IMF expects that the precious metals index will increase by 28.4 percent in 2020 and by an additional 10.4 percent in 2021 amid the elevated risks and dovish monetary policy.

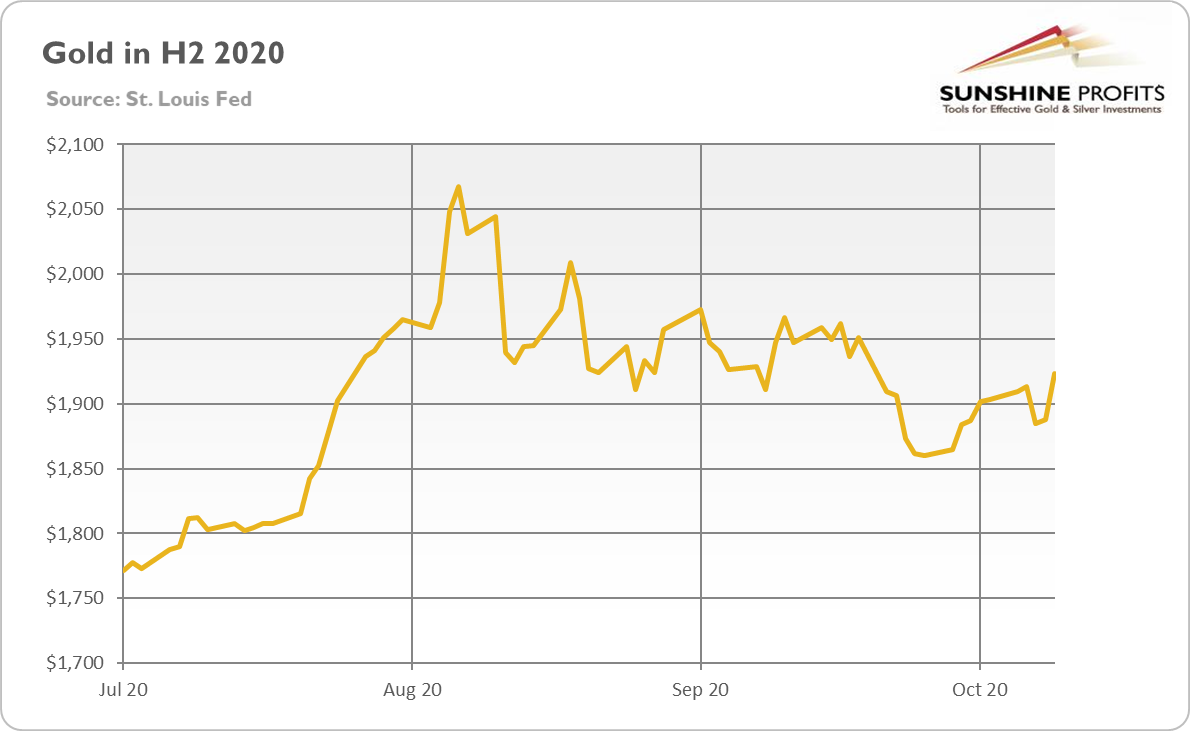

The growing coronavirus cases, subsequent worries about the already fragile recovery, US presidential election uncertainty have recently pushed gold prices above $1,900, as one can see in the chart below.

What is most important here is that the price of gold managed to rise above $1,900 again, despite the declining odds of a new fiscal stimulus before the elections and the resulting S&P 500 Index decrease. Gold’s decoupling from the stock market would increase its role as a safe-haven asset.

However, it might be the case that gold is just hovering around $1,900 right now, and it needs a fresh catalyst to continue its rally. Who knows, maybe the US presidential elections, which are likely to be contested, will provide such a trigger? We will elaborate on this later – stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Asks Where Is The Inflation

October 15, 2020, 12:54 PMThe inflation remains low and below the Fed’s target. So, should gold bulls worry about it?

The U.S. CPI inflation rate rose by 0.2 percent in September, following a 0.4 percent increase in August. It was the smallest jump since May. The move was driven by a 6.7- percent spike in the cost of used cars and trucks, and it’s the most significant upward change over half a century. The core CPI rose 0.2 percent, following a 0.4 percent increase in the preceding month.

On an annual basis, the overall CPI increased 1.4 percent (seasonally adjusted), following a 1.3 percent increase in August. The core CPI rose 1.7 percent, much like in the month prior (or a bit less if we abstract from rounding). Therefore, as the chart below shows, the period of disinflation perhaps ended, but the inflation remains low. It seems that even though the inflation rate has reached the bottom in May or June, the outbreak of high inflation in the near future is unlikely.

Indeed, the expectations from the inflation rebounded after a plunge during the coronavirus crisis. But, they have stabilized around the pre-pandemic level, at which market players don’t see an outbreak of inflation, as shown in the chart below.

So, is Mr. Market right that the inflation will remain low, i.e., below the Fed’s target? Well, he might be. After all, the pandemic caused a profound economic shock, and the demand remains subdued. Now, with the new wave of Covid-19 infections and the slow economic recovery within the fourth quarter, inflation could remain tepid for quite some time.

However, it is also possible that both expectations and the inflation itself will be increased over the medium term. This is due to another boost in government spending monetized by the Fed, the delayed respond of prices to the earlier increase in the broad money supply (see the chart below) – there is always a lag here that can last from 6 to 18 months), and the declining confidence in both the government and the central bank.

At some point it should be clear for everyone that the GDP recovery from the coronavirus crisis is driven by massive increases in debt, government spending and the central bank’s liquidity. Thus, although the few winners of the pandemic are clear, most of the small and medium sized businesses remains significantly away from 2019 levels. At some point people should realize that neither the easy monetary policy or fiscal deficits wouldn’t help the Main Street and small business fabric.

Implications for Gold

What does all of the above mean for the gold market? Well, as gold is by many perceived as an inflation hedge (not always correctly), it should welcome the inflation rate acceleration. However, the subdued inflation is not necessarily awfully bad for the yellow metal. This is because low inflation implies that the Fed will remain dovish and won’t hike the federal funds rate for years to come. Yes, the rising inflation could force the central bank to normalize its monetary policy – but under the new monetary regime (I wrote about it in a detail the last edition of the Gold Market Overview), the Fed will not raise interest rates until the inflation stays above 2 percent for a certain period of time. As long the Fed remains behind the curve, gold should shine.

To put it differently, the lack of higher inflation is not surprising at all. After all, during economic crises and recessions, the uncertainty increase and people decide to spend less of their incomes than previously. So, the demand for money increases, which neutralizes part of the rise in the money supply. However, when the crisis finally ends, people will gradually withdraw their cash balances. Therefore, we could still see a higher inflation. But it will not happen now. Instead, it will occur when the situation normalizes, and the economic recovery sets in for good.

And, who knows, maybe this is a crazy idea, but isn’t is possible that the Fed expects such a scenario, and it is the reason why it changed its monetary regime to allow for higher inflation? In any case, investors should remember that although higher inflation is an upside risk for the gold that would support its prices, gold does not need – as the 2000s and 2020 bull market showed – double-digit inflation to shine.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Jumps above $1,900. Again

October 13, 2020, 3:33 AMBiden widened his lead over Trump, while gold jumped above $1,900 again.

According to the most recent Reuters/Ipsos poll, Biden has increased his presidential race advantage. Now, as the chart below shows, he leads by 7 percent.

I don’t trust in opinion polls. And why is that you might wonder. It is because they measure the popular vote, which doesn’t exactly decide who wins the presidency. We all remember how the polls failed to predict Trump’s victory in 2016, and that is why we must take them with a grain of salt. However, investors have also increased their bets that the Democrat will have a clear-cut victory, as the green technology and trade-linked companies shares that would likely benefit from Democratic policies have climbed recently. The rising possibility of Biden’s triumph and Democrats taking control of the Senate has also increased the Treasury yields in anticipations of higher stimulus packages, as shown in the chart below.

Theoretically, this is bad news for gold, which prefers declining bond yields. But still, gold could also rise amid strengthened expectations of a bigger stimulus package. After all, the federal debt has recently ballooned. Last week, the Congressional Budget Office projected that the U.S. fiscal deficit had hit a record of $3.1 trillion in the 2020 budget year.

Compared to the GDP, the budget deficit amounts to 15.2 percent, the highest one since 1945. Additionally, 2020 was the fifth year in a row in which the deficit increased as a share of the economy’s size. In a ballooning public debt environment, the U.S. dollar could find itself under downward pressure, which should support the gold prices as a result.

The specter of mammoth debt is the reason why Republicans prefer a smaller stimulus package. However, they are now under immense pressure, as almost all mainstream economists claim that the economic recovery pace will slow down without significant financial support. For example, Jerome Powell, the Fed Chair, in a speech to the National Association for Business Economics, last week reiterated that Congress should provide more fiscal help. “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” he said. More specifically, the support is more than necessary due to the ongoing coronavirus threat, which drags the economy down. Indeed, things are devastating. As the chart below indicates, the daily number of new Covid-19 cases has risen again to 50,000!

The economic data is not encouraging, as well. Although the unemployment rate decreased further, last month’s employment increase fell short of Wall Street’s estimate, while the initial jobless claims remain elevated. Even more importantly, the high-frequency indicators show little evidence of quick and smooth recovery. For example, Oxford Economic Recovery Index is around 20 percent below the pre-pandemic level.

Implications for Gold

What does all of the above mean for the gold market? Well, as the chart below shows, gold jumped above $1,900 last week, partially due to the optimistic expectations of a new aid package, as Trump said on Thursday that talks with Congress have restarted over the fresh stimulus. And on Friday, the White House lifted its stimulus offer from $1.6 to $1.8 trillion. Two hundred billion one way or the other, what a difference!

The additional fiscal help would not only further balloon the already mammoth public debt, but it will also force the Fed to at least partially monetize the government’s debt, which would only increase the central bank’s balance sheet. This is good news for the yellow metal.

Of course, there are also some headwinds ahead of gold. For example, the minutes from the ECB’s last monetary policy meeting indicate that the ECB could be more worried about the state of the eurozone’s economy than previously thought and that it is planning additional monetary stimulus, maybe even this year. Even though the gold bugs could welcome additional liquidity from the central banks, the ECB's new measurements could weaken both the euro and the yellow metal against the US dollar.

Another risk is quicker than expected coronavirus vaccine distribution, which would increase the risk appetite among investors and slightly reduce the demand for gold as a safe-haven.

Nevertheless, the fundamental outlook remains positive for gold. An almost $2 trillion worth of stimulus is coming, which will balloon the public debt and weaken the U.S. dollar. The bond yields have recently increased, but the Fed’s purchases should prevent them from rising too much. All in all, gold should shine in such a macroeconomic environment.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM