-

Does Gold Still Have Plenty of Potential?

September 3, 2020, 6:27 AMAccording to the WGC, the latest leg of gold's 2020 bull run has come too fast, but gold has still potential for further upside.

The World Gold Council has recently published a few interesting reports. Let's analyze them and draw important conclusions for the precious metals investors!

I'll start with the July Investment Update: "Gold hits record high: sprint or marathon?" about the summer's rally in gold that elevated the price of the yellow metal to the new record high. According to the WGC, the combination of high uncertainty, easy monetary policy, very low interest rates, positive price momentum, the depreciation of the U.S. dollar, and fears of higher inflation fueled record flows of 734 tons into gold-backed ETFs in the first half of the year and the gold's price appreciation:

Central banks have aggressively cut interest rates, often in combination with quantitative easing and other non-traditional policy measures. Governments have also approved massive rescue packages to support their local economies. And much more may be needed. These initiatives have increased concerns that easy money, rather than fundamentals, is fuelling the stock market rally and that all the extra money being pumped into the system may result in very high inflation or, at the very least, currency debasements.Although the WGC correctly predicted price correction, given that the latest leg of gold's 2020 bull run has come very fast, the gold's industry organization believes that there is still room for further upside. It offers two arguments in support of this claim.

The first is that the price of gold more than doubled amid the Great Recession, while it has increased by just under 30 percent since the Covid-19 pandemic. For me, as history never repeats itself, but only rhymes, it would be naïve to expect similar price movement. After all, the quantitative easing is less scary today than a decade ago and we have not experienced so far the financial crisis. However, I agree that gold could go further north, especially that the current macroeconomic environment seems to be more inflationary than after the collapse of the Lehman Brothers.

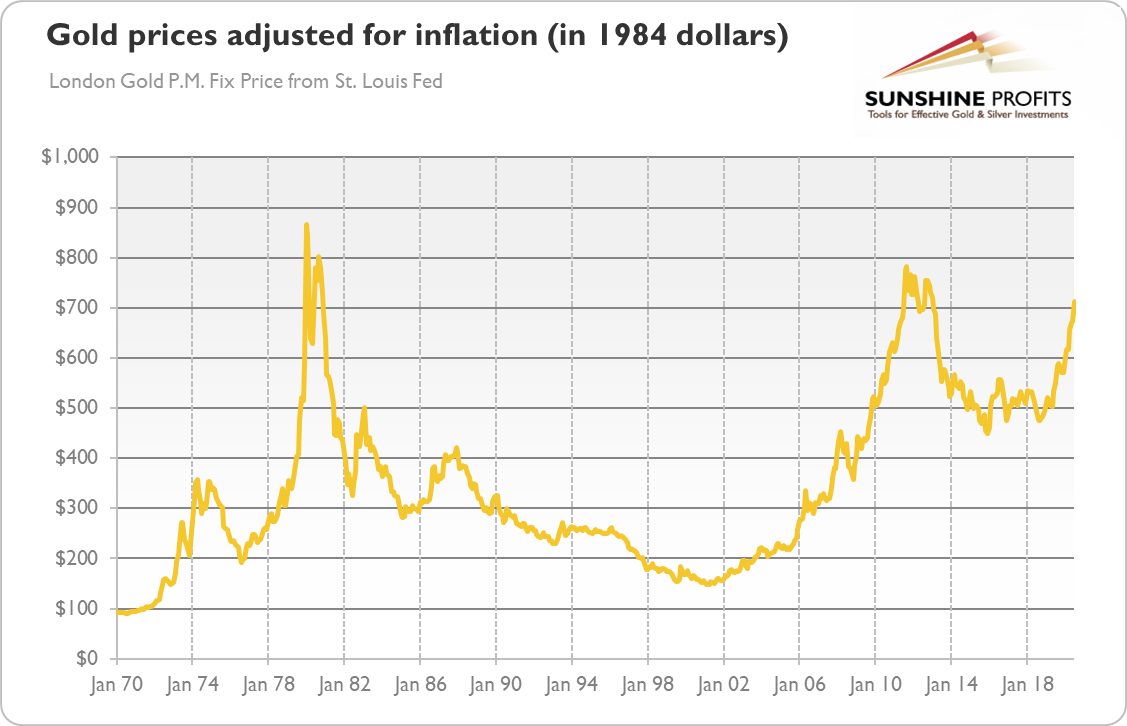

The second argument is also very interesting, as it says that the price of gold, when adjusted for inflation, is still significantly below the levels seen in 2011 or 1980. Indeed, as the chart below shows, gold prices are about 9 and 18 percent shy of the previous peaks, respectively, when expressed in 1984 U.S. dollars.

This is why many analysts believe that gold still has plenty of potential. For example, Nicholas Johnson, a PIMCO portfolio manager focusing on commodities, also noted that the real price of gold is currently below the levels during the 2008 financial crisis.

Currently, gold trades at the lower end of the post-2004 band. We think it's likely, however, that its real-yield-adjusted price could move higher within that band, as gold's recent strong performance attracts more interest in the market, similar to what occurred following the 2008 financial crisis.Although I'm not fully convinced that we should look at real, not nominal prices, one can reasonably wonder whether gold shouldn't rally stronger that during the global financial crisis given more aggressive character and larger scale of monetary stimulus and fiscal packages today.

The Role of Gold In a Volatile World

Another interesting piece from the WGC is an interview with Charles Crowson, Portfolio Manager at RWC Partners, entitled The role of gold in a volatile world.

He seems to agree with my observation that the current economic crisis could result in higher inflation than the Great Recession, which should be positive for the gold prices:

A combination of increased monetary supply, increased velocity of money and extremely low interest rates creates the perfect backdrop for inflation. It is also, incidentally, the perfect combination for gold to outperform. This occurred in the late 1970s, for instance, and gold went up fourfold. We are not at that stage yet but we are moving in that direction.However, purchasing gold today is not only a great way of maintaining purchasing power over time, but "there is the potential both to preserve wealth and deliver outperformance by investing in gold."

Another important issue raised in the interview is the potential for fundamental changes in asset allocation among investors. Gold is still under-owned in the investment community, as it accounts on average for merely about 0.5 percent of the portfolio, but in the current macroeconomic environment of very low real interest rates, weak U.S. dollar, expansionary monetary policies and ballooning fiscal deficits, the demand for gold as a portfolio diversifier could increase:

In recent decades, gold has been regarded as a peripheral asset within the institutional investment community. But we believe that markets are embarking on a period of change, which could provoke a fundamental shift in asset allocation.If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Fed Embraces Higher Inflation. Will It Embrace Gold, Too?

September 1, 2020, 5:08 AMFed adopts a new strategy that opens the door for higher inflation. The change is fundamentally positive for gold prices.

So, it happened! In line with market expectations, the Fed has changed its monetary policy framework into a more dovish one! This is something we warned our Readers in our last Fundamental Gold Report:

the Fed could change how it defines and achieves its inflation goal, trying, for example, to achieve its inflation target as an average over a longer time period rather than on an annual basis.And it turned out that our worries were justified. On Thursday, the FOMC announced the approval of updates to its Statement on Longer-Run Goals and Monetary Policy Strategy. The change was timed for Fed Chairman Jerome Powell's speech to the Jackson Hole economic symposium.

Generally speaking, the Fed declared that it will focus more on the job market and won't worry about higher inflation. This is because "a robust job market can be sustained without causing an unwelcome increase in inflation", as Powell explained in his remarks discussing the policy shift.

Being more specific, the most significant changes to the framework document are:

The Fed explicitly acknowledges the decline in the neutral interest rates and challenges for monetary policy in an environment of persistently low interest rates, in particular the effective lower bound. And, of course, these challenges will create excellent excuse to adopt even more dovish policies than currently implemented. After all, to overcome these challenges, the Fed is prepared to "use its full range of tools to achieve its maximum employment and price stability goals",On maximum employment, the FOMC announced that its policy decision will be informed by the shortfalls rather than deviations of employment from its the maximum level. Oh boy, this is such a radical change! It means that the Fed will cease to worry about the overheating of the economy. In other words, the U.S. central bank drops the Philips curve. You see, in the past, the strong labor market meant that higher inflation could be just around the corner, which would be a reason to hike the federal funds rate. Now, the Fed could print money and ease its monetary stance like there's no tomorrow! A great triumph of doves!And finally, on price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2 percent by noting that it "seeks to achieve inflation that averages 2 percent over time." It means that after periods of inflation rates below the target, the Fed would accept inflation rates above the target! As the revised statement states "following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time." It's a great change (at least in rhetoric, as we doubt whether the Fed ever worried about inflation since Volcker left the U.S. central bank), as it means de facto adopting price-level targeting. Undershoots of inflation are not forgotten, but they are made up for later. Of course, we are yet to see whether the Fed will manage to trigger higher official inflation rates (as successfully as asset price inflation), but shift allows the Fed to ease its monetary policy even further and to implement its dovish bias even stronger!Implications for Gold

What does it all mean for the gold market? Well, the updated Fed's strategy opens the door for easier monetary policy, ultra low interest rates for longer, and higher inflation. So, the shift is fundamentally positive for the gold prices. Actually, it could be the trigger that gold needed to continue its rally further north. However, the initial gold's reaction has been negative (i.e., after a spike, there was a sharp reversal), as the chart below shows.

Of course, investors should remember that the updated strategy does not mean that we will see double-digit inflation tomorrow. The inflation has been under the Fed's target for years, so it does not have to rise just because the Fed changed its monetary framework. And the FOMC wrote about inflation "moderately" above the target - yeah, we know that they couldn't write otherwise, but we really doubt whether the Fed officials really want to see double-digit inflation rates.

However, as we have repeated many times, the current economic crisis is more inflationary that the Great Recession. The recent fast increase in the broad money supply increases the risk of higher inflation in the future. Now, the Fed's announcement that it will welcome and embrace the rise in inflation, should increase inflation expectations, increasing the demand for gold as an inflation-hedge. Higher inflation expectations would also lower the real interest rates, also supporting the gold prices. Thank you, Mr. Powell!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will You Say Something Golden, Mr. Powell?

August 27, 2020, 6:15 AMThe epidemiological outlook improves, while the U.S. stock market reaches one record high after another. But the key question today for the gold investors is: what will Powell say?

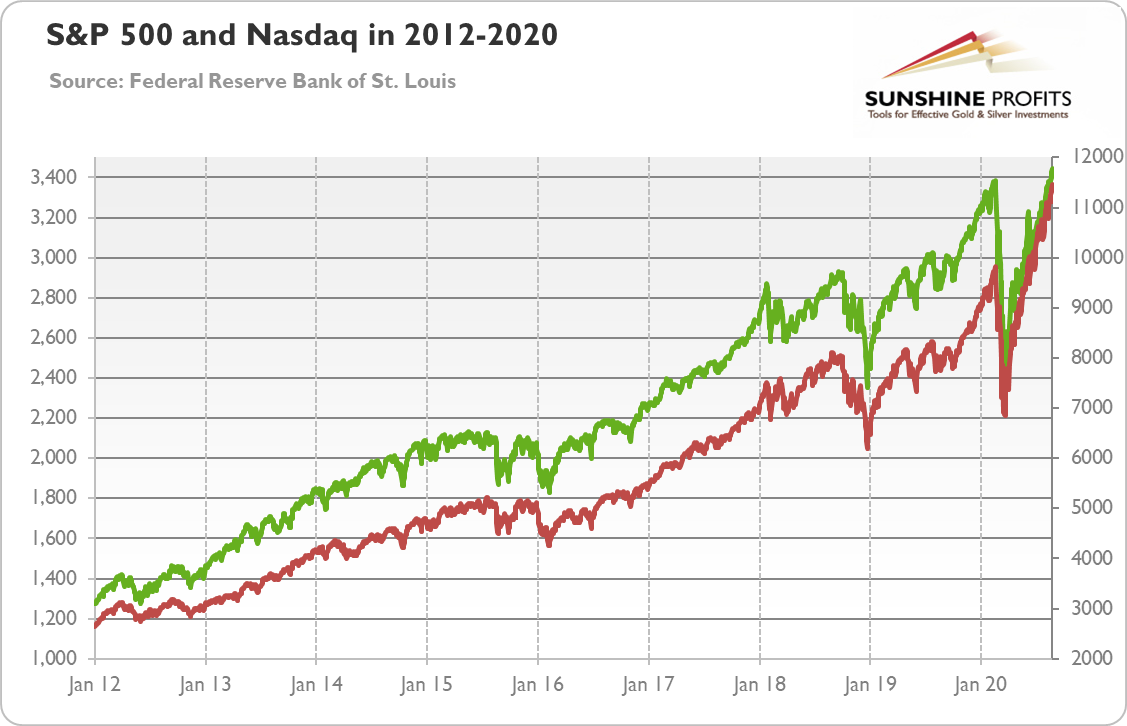

The U.S. stock market is in the bullish mood. Although Dow Jones is still a few percent below its February peak, the S&P 500 has recovered completely from the coronavirus-driven plunge, surpassing even 3,400 this week, as one can see in the chart below. But the real euphoria is on the Nasdaq exchange. As the chart below shows, the Nasdaq Composite has not only recouped all its losses caused by the Covid-19 pandemic, but it actually soared to above 11,450.

What is happening? Well, the progress in a Phase-1 trade deal between the U.S. and China has been cited as a reason behind the positive market sentiment. Another important issue is optimism over progress in developing treatments and vaccines for Covid-19, as the U.S. Food and Drug Administration approved the emergency use of blood plasma from recovered patients.

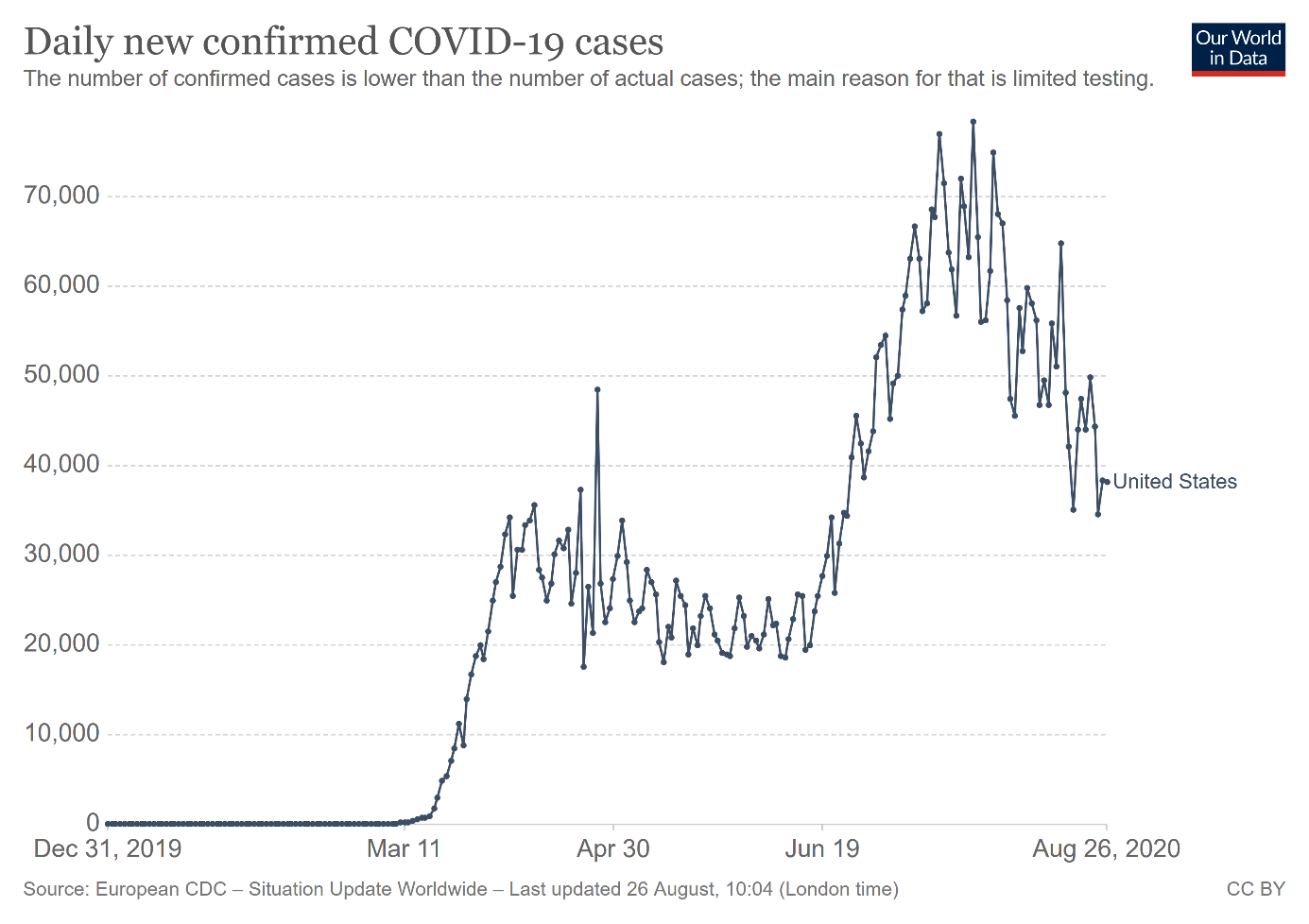

Moreover, the epidemiological situation has improved recently. As the chart below shows, the number of daily new cases of infections peaked at the end of July and has been declining since then. Although the numbers are still above the levels seen in March and April, it seems that the second wave (or the second leg of the first wave) of cases has been brought under control.

The improved epidemiological situation creates hopes for a more vigorous and sustainable economic recovery. So, the recent rally in the stock market prices could be reasonable, after all. Of course, bears could rightly point out that the S&P 500 rise is driven by just five tech stocks and the Fed's massive liquidity injections, but for now the party goes on and the bulls celebrate.

Implications for Gold

What does it all mean for the gold market? Well, the risk-on sentiment is negative for the safe-haven assets such as gold. However, with stock prices so elevated and still rising, gold could be sought more often as a sensible hedge and portfolio diversifier. Moreover, the yellow metal often goes in tandem with equities - as both asset class benefit from the easy monetary policy and low interest rates.

The improving epidemiological situation and upcoming economic recovery are also headwinds for the gold market. However - and luckily for the gold bulls - gold does not need a global epidemic to shine. And it can also rally during recoveries - after all, in the previous bull market, gold peaked in 2011, two years after the official end of the Great Recession.

What is key for gold's outlook, is the macroeconomic environment, and that is greatly shaped by the Fed's actions. The ultra dovish stance adopted by the Fed in a response to the coronavirus crisis has been very supportive for gold prices, as the U.S. central bank signaled that real interest rates will remain low for long.

However, it might be the case that the Fed has turned so dovish and rates so low, that investors now believe that they could go only higher (although it seems to me that we are not yet there). So, it is possible that gold needs another dovish declaration from the Fed to continue its bullish rally.

Luckily, it may happen as soon as today. The Federal Reserve Chair Jerome Powell will talk at the Kansas City Fed Jackson Hole symposium on the monetary policy framework review that has been recently conducted by the U.S. central bank. His speech is highly anticipated as investors expect that he will accept more inflation in the future. Indeed, the current inflation-targeting regime has been criticized by many Fed officials who would prefer either higher inflation target or a monetary regime looking more as price-level targeting that allows for higher inflation after periods of low inflation. In other words, the Fed could change how it defines and achieves its inflation goal, trying, for example, to achieve its inflation target as an average over a longer time period rather than on an annual basis.

It goes without saying that allowing for higher inflation would be positive for gold prices. However, if Powell disappoints market expectations and deliver more hawkish speech than expected, gold price could enter a deeper correction. Stay tuned!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

FOMC Minutes Push Gold Down

August 25, 2020, 5:49 AMJuly FOMC minutes hit the gold prices. But what's next for the yellow metal?

The key event last week was the publication of the minutes from the FOMC meeting in July. After their release, the U.S. dollar jumped, while the price of gold dropped, as the chart below shows. Why? Well, the Fed officials disappointed investors who expected some clues about upgrading the U.S. central bank's forward guidance in September. In other words, the Fed failed to provide any new guidance as to the interest rate expectations.

And, perhaps even more importantly, the discussion among the FOMC members shows that they do not want to introduce the yield curve control, at least not now, as costs outweigh benefits:

Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee's forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low. Many of these participants also pointed to potential costs associated with yield caps and targets. Among these costs, participants noted the possibility of an excessively rapid expansion of the balance sheet and difficulties in the design and communication of the conditions under which such a policy would be terminated, especially in conjunction with forward guidance regarding the policy rate. In light of these concerns, many participants judged that yield caps and targets were not warranted in the current environment but should remain an option that the Committee could reassess in the future if circumstances changed markedly.Hence, the minutes were interpreted as less dovish than expected, so investors sold gold and bought the greenback. The hawkish FOMC minutes coincided with some positive economic reports from the U.S. that also supported the dollar. In particular, the flash U.S. Composite PMI Index jumped from 50.3 in July to 54.7 in August, the highest level since February 2019. Importantly, the service sector recorded the first rise since the start of the year. Meanwhile, the comparable indices for the eurozone came in worse than expected, which helped the U.S. dollar against the euro.

Moreover, housing market has improved. In July, the housing starts rose 22.6 percent compared to June, while the existing home sales soared 24.7 percent, marking two consecutive months of significant sales gains.

Implications for Gold

What does it all mean for the gold market? Well, the expressed aversion to the yield curve control is indeed negative for gold prices. Without fresh dovish declarations from the Fed, the market interest rates may increase, creating downward pressure on the gold prices.

However, with or without the yield curve measures, the Fed is even not thinking about thinking about hiking the federal funds rate. So, the fundamentals remain bullish for gold. What we are observing right now, is a much needed consolidation phase. After all, the real interest rates will remain in the low to negative territory for years. The public debt is soaring. The pandemic continues to wreak havoc within the economy. And the FOMC is aware of this. The minutes acknowledges that

the projected rate of recovery in real GDP, and the pace of declines in the unemployment rate, over the second half of this year were expected to be somewhat less robust than in the previous forecast.and that

through June, only about one-third of the roughly 22 million loss in jobs that occurred over March and April had been offset by subsequent gainsYup, only about one-third! So, the economy is still far from being normal, and the uncertainty surrounding the economic outlook is elevated. The upcoming presidential election and tensions between the U.S. and China contribute as well.

So, don't believe that the Fed has become hawkish suddenly and that gold's bull market has ended. On the contrary, we could see new dovish moves by the U.S. central bank in the future:

Noting the increase in uncertainty about the economic outlook over the intermeeting period, several participants suggested that additional accommodation could be required to promote economic recovery and return inflation to the Committee's 2 percent objective.This week is crucial, as the annual Jackson Hole symposium is taking place and Fed Chair Jerome Powell is scheduled to speak on Thursday. If we see a hawkish turn, then, of course, gold may suffer. However, the Fed is likely to remain dovish, and it may even strengthen its dovish stance, which would support gold prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

CPI Goes Up in July. Will Inflation Dragon Take to the Air with Gold?

August 20, 2020, 6:39 AMCPI rises again in July. But will the inflation dragon take to the air, taking gold with it?

The U.S. CPI inflation rate rose 0.6 percent in July, for the second month in a row. The move was driven to a large extent by higher energy prices (the energy index increased 5.1 percent in June as the gasoline index rose 12.3 percent). The core CPI rose also 0.6 percent, following a 0.1 percent drop in May. It was the biggest monthly increase in the core rate since 1991.

On an annual basis, the overall CPI increased 1 percent (seasonally adjusted), following 0.7 percent increase in June. Meanwhile, the core CPI rose 1.6 percent, which implies the acceleration from 1.2 percent recorded in the previous month. So, as the chart below shows, inflation remains low, but it is no longer very low.

In other words, inflation rebounded from the pandemic lows, ending the period of disinflation, as we correctly predicted last month. After the release of the June report, we wrote "inflation remains very low, but the period of disinflation have possibly ended. We mean here that although we do not expect the outbreak of high inflation in the near future, inflation rate could reach the bottom, at least for some time."

But will inflation finally rear its ugly head? Where is the inflation we predicted? Nowhere. But we never predicted that the pandemic of Covid-19 would trigger massive inflation. What we wrote was that the coronavirus crisis could be simply more inflationary than the Great Recession, as the former was also a supply shock. And we were right, as the chart below shows.

But we were fully aware of deflationary forces operating during economic crises, so we wrote that "in the short term disinflation pressure should prevail" and that "while in the short term the disinflation scenario seems more likely, in the longer run the risk of stagflation increases".

And indeed, the disinflation occurred, but inflation has rebounded somewhat recently, which raises the odds of stagflationary scenario. There are a few reasons while inflation could increase later on the way. First, the economy will recover one day, which means that the demand will be back. Second, high and rising public debts increases the possibility that the central banks will monetize the government's obligations. After all, inflation is often the best way to lower the real burden of sovereign debt. Third, both the Fed and the commercial banks have expanded the money supply as crazy, as one can see in the chart below. To be clear, I do not mean the monetary base which does not necessarily enters the circulation, but the broad measure of the money supply called the M2.

Last but not least, the American central bank is now even more dovish that during the global financial crisis. I mean here two facts. The first is that the quantitative easing is now a new normal and it has an indefinite character compared to amount-limited or time-limited rounds several years ago. The second is that the FOMC members are now much more eager to accept zero interest rates for very long period and inflation rate above the Fed's target. As Fed Chair Jerome Powell said during his July press conference, the American central bankers are not even thinking about ending the very easy monetary policy:

So as I--as I said earlier, or a while back, we're not even thinking about--thinking about raising rates. We're--we're totally focused on providing the economy the support that it will need. We think that the economy will need highly accommodative monetary policy and the use of our tools for an extended period.Implications for Gold

What does it all mean for the gold market? Well, it's true that low inflation does not have to be detrimental for gold, as the yellow metal can shine during both inflation and deflations. And that although inflation rebounded somewhat, it is far from being elevated. Actually, it remains below the Fed's target and pre-recession level.

However, the two last CPI reports suggest that the inflationary bottom could be already behind us and that inflation could rise in the future. Even if it does not happen, what really counts is what Mr. Market expects. As the chart below shows, inflationary expectations have practically rebounded after the coronavirus crisis.

This indicates that investors - rightly or not - worry that mammoth injections of liquidity will translate into higher inflation one day. This is something that creates additional demand for gold as an inflation hedge, supporting its prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM