-

Economic Data Suggests Reopening, not Recovery. Will Gold Re-Rally Now?

August 18, 2020, 5:30 AMRetail sales growth has slowed down. What does it mean for the U.S. economy and the gold market?

Retail sales increased 1.2 percent in July. The growth was worse than expected, which hit the U.S. stock market. As the chart below shows, the number was also much weaker than in the two previous months (8.4 percent gain in June and 18.3 percent jump in May), when it seemed that the economy started to rebound.

Now, the weak July reading indicates that we have seen a false recovery. Or that it was brutally interrupted by the second wave of the coronavirus infections. Given that epidemic is still widespread (it seems that, as John Cochrane put it, "America has essentially given upon containing the corona virus, and will just let it spread while we await a vaccine"), the mediocre July data might be a sign of what is ahead.

In other words, August could be also not the best month for the U.S. economy, as the resurgence of the Covid-19 cases delayed the return of people to their jobs and the overall economy's return to normal. Importantly, the second wave coincided with the expiration of the $600 federal unemployment benefit, which also hit the real incomes of Americans and their spending power. All this is, of course, great news for the gold market.

And what about other data? Industrial production rose 3 percent in July, more than forecasted. It was the third monthly gain in a row, which is a superb achievement in the current manic-depressive economy, but industrial production remains below the pre-crisis level, as the chart below shows.

Importantly, senior executives say that not all the jobs lost during the economic crisis are coming back soon. What a surprise! We warned since the very beginning that there will be no V-shaped recovery, especially in the labor market.

Oh, by the way, how is the labor market doing? Well, so-so. There are good signs, that's for sure. For example, last week, initial jobless claims fell below 1 million for the first time since the coronavirus crisis began, as the chart below shows. However, the drop reflects only partially economic reopening, as it also suggests the expiration of federal supplemental unemployment benefit last month.

And although the unemployment rate declined in July to 10.2 percent, the pace of the U.S. employment growth has seriously slowed down, as one can see in the chart below. The economy regained 1.76 million jobs, not so many when compared with the revised 4.79 gain in June. And so far, the American economy restored less than half of the lost jobs during the pandemic.

As the health crisis goes on, many of the initially temporary job losses will become permanent, making it harder for the economy to recover. And making gold shine even brighter. What is important is that the U.S. labor market is weaker than the official data suggest, which was admitted recently by Cleveland Fed President Loretta Mester on Wednesday. She said that more than half of the companies in her district is laying off workers and cutting pay in response to the coronavirus crisis.

Implications for Gold

What does it all mean for the gold market? Well, it's true that July data is not as bad as it could be, given the resurgence of the Covid-19 cases. It seems that people, although still worried about their health, stopped to panic and instead they get used to the new epidemiological situation (the fact that people learned to wear masks definitely helped here).

However, the recent data indicates that there will be W-shaped rather than V-shaped recovery. Or that the economy will be in the "reopening" phase, rather than the "recovery" phase, as Loretta Mester put it. The labor market and industrial production are well below the pre-pandemic level. The retail sales managed to recover, but its growth has recently slowed down. It suggests that the recovery has been fragile and based to the large extent on the massive liquidity injections and stimulus packages. Now, without any fresh economic aid, we are observing the true condition of the U.S. economy. So, although the standoff among Democrats and Republicans over the size and scope of the next financial aid package could be the "unfortunate development" for the economy, as Chicago Fed President Charles Evans put it, it might be quite fortunate for the gold prices. However, it might be also the case that both the US equities and gold need the next round of liquidity (and fear of inflation and sovereign debt crisis) to rally again.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Plunges More Than $100 In One Day. How Do You Like It?

August 13, 2020, 10:20 AMGold prices plunged on Tuesday. Does it mean the end of the bull market?

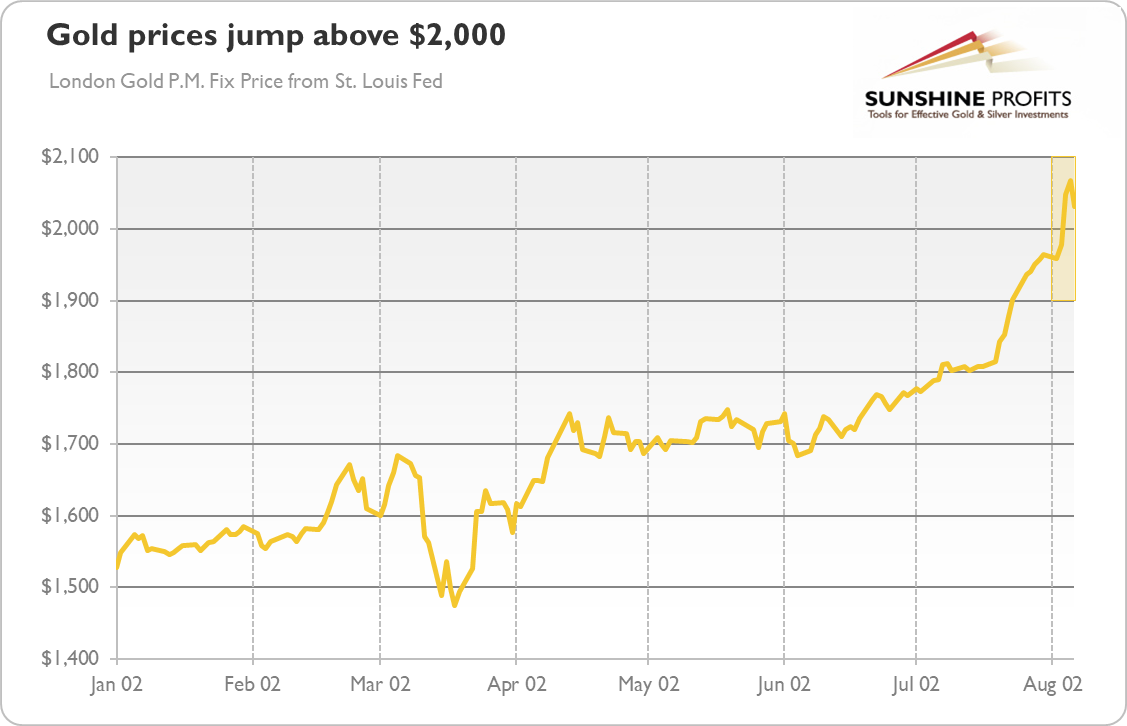

Tuesday was hot! And I don't mean the weather. I mean that it was a remarkable day for the precious metals. The price of gold plunged more than $100 two days ago and it even dove below the key $1,900 level at one point on Wednesday. As the chart below shows, the London Gold Fix dropped from $2,044.50 to $1,939.65, or more than 5 percent, the worst fall in one session during the past several years. The price of silver plunged even more, from $29 to $24.40, which is more than 15 percent.

Are you disappointed? Why should you be? Are you disappointed when the sun goes down after sunrise? Are you disappointed when there is a cold and rainy day during the summer? You see, one day neither confirms nor falsifies the longer-term bull or bear market. The bull market does mean that gold has to rise constantly, day after day, in a straight line. There are always corrections on the way. Nothing goes straight up forever. Ups and down, as in our daily lives.

Actually, you have been warned about the correction in the gold market in the last edition of the Fundamental Gold Report (and both in the Gold & Silver Trading Alerts and Stock Trading Alerts as well). I wrote that "correction in the short-run would be totally normal, or even desirable" and that "until July, the rally in gold has been very gradual and steady. So, after the recent amazing acceleration, correction would not be something strange." And voila, it happened! So I hope that you were not surprised - the pace of the recent rally was simply too fast to be not followed by the correction. Gold was like Icarus - it flew too close to sun, and it had to fall.

What's Next for Gold?

Some people believe that the recent plunge means the end of the bull market and that gold should go lower now. One of the major arguments behind this opinion is the improving epidemiological situation in America. Indeed, as the chart below shows, the U.S. daily infection rate is dropping slightly, which creates also better economic prospects.

Well, the improving epidemiological situation and followed better economic prospects are definitely the headwinds for gold. It might be the case that most of the worst news related to the coronavirus pandemic is already priced in. And that the American economy will now only strengthen.

However, the yellow metal is not strictly linked to the number of new cases of Covid-19. Actually, its recent rally occurred at the turn of July and August, when the epidemiological situation already started improving. And gold did not enter the bear market when the U.S. seemed to strengthen after the first wave of infections.

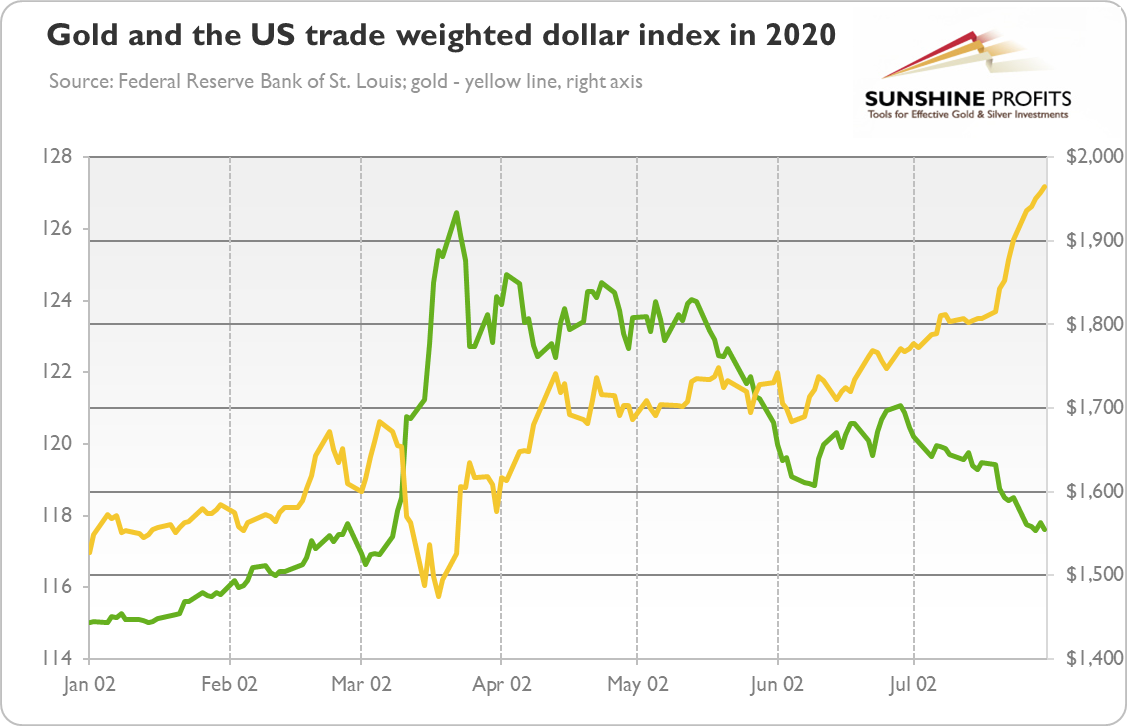

There are also other risks present. The dollar may rebound, while the real interest rates can go up. But these risks are always with us and we monitor them closely. However, the truth is that - from the long-term point of view - nothing changed this week in the fundamental outlook for gold. The Fed will remain dovish for an extended period of time, which means that the interest rates will remain at ultra low levels for years (as Powell has admitted recently: hikes are not likely to happen for a very long time). So, we still have lax monetary policy, unsound fiscal policy with rising fiscal deficits and public debts, geopolitical concerns and risk that all the injected stimulus will translate one day into inflation - and that the central banks will allow it to rise above the target.

In other words, the marketplace became simply overcrowded and the correction could, thus, occur without any fundamental shifts. If true, when the correction - and consolidation - is over, gold could continue its march north (maybe in a calmer way), especially if the greenback remains soft. But, of course, investors should be - as always - cautious (and they should read our Gold & Silver Trading Alerts for more technical analyses); the upcoming days will be critical for the gold market.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

With Gold Above $2,000, Bulls Triumph! What's Next?

August 11, 2020, 5:17 AMThe triumph of the gold bulls has finally come, as gold jumped above $2,000. But what's next for the shiny metal?

Well, that escalated quickly! At the end of July, when gold was still below $1,900, I went on a short vacation, and when I'm back, the yellow metal is above $2,000. Whoa, it was a real blitzkrieg! Just please take a look at the chart below - as you can see, gold soared in early August, surpassing the psychologically important level of $2,000 per ounce.

Am I surprised? Should I be? Is anyone surprised that the sun rises in the morning and sets in the evening? Yes, the pace at which gold has broken above $2,000 is astounding, but I've been bullish on gold since 2019, when the yellow metal escaped the sideways trend and jumped above $1,400 per ounce. When the Fed started to cut interest rates, even before the pandemic, I've become convinced that the bull market in gold had really set in. And when the epidemic of the coronavirus and the following economic crisis occurred, I've become even more bullish.

As a proof, this is what I wrote in the last two editions of the Fundamental Gold Report, just before my vacation:

the repercussions of the coronavirus recession could be more inflationary than the Great Recession, and (...) gold is in the bull market that could last for a while. The coronavirus crisis and the following economic crisis and the response of the central banks and governments significantly shifted the already bullish fundamental outlook for gold prices into even more bullish, also potentially strengthening the role of gold as a strategic asset.And this is what I wrote in the last edition of the Gold Market Overview: even without the next crisis, the yellow metal should thrive in the current macroeconomic environment of dovish central banks, low real interest rates, high public debts, and uncertain economic outlook.And indeed, we can say many things about gold, but one thing is certain: it is thriving right now. Thriving as hell!

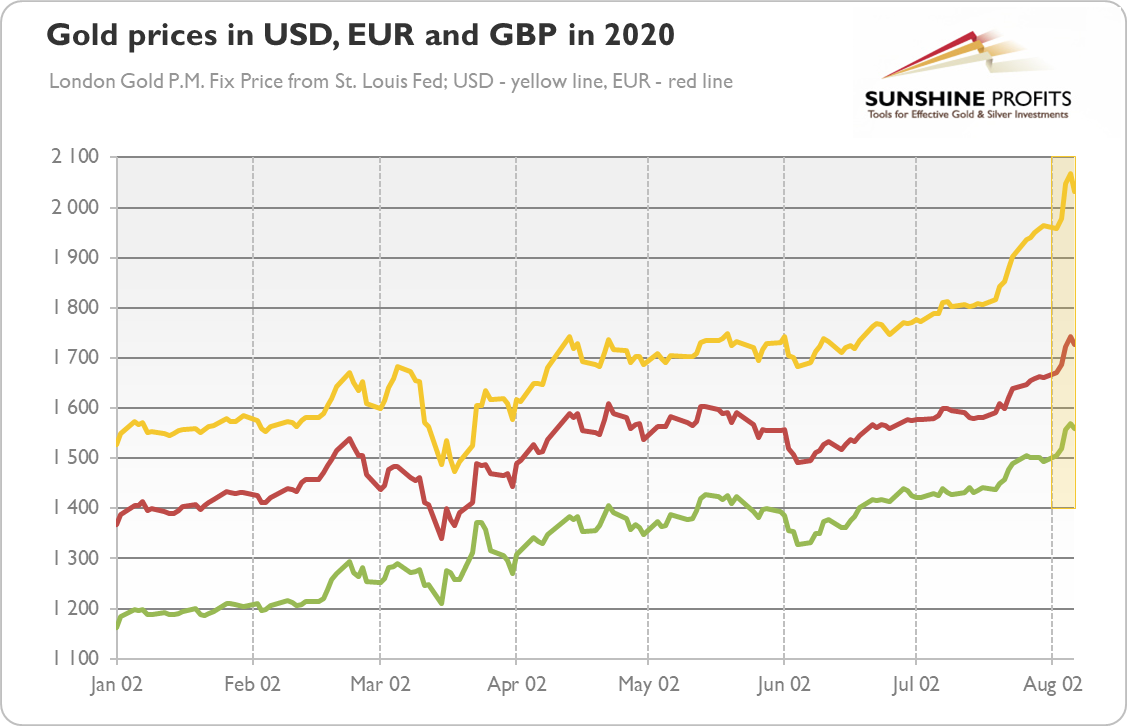

Please pardon my French, but these are the facts: gold has risen more than $500 this year, and about $200 in the last two weeks alone! In percentage terms, the shiny metal has gained more than 34 percent in 2020, or more than one third! It means that gold is one of the best performing mainstream assets, if not the best, this year.

What's Next for Gold?

Now, the key question is what happens next for gold. Some analysts fear the correction - and they might be right. Until July, the rally in gold has been very gradual and steady. So, after recent amazing acceleration, correction would not be something strange.

However, I will repeat what I said in July: from the fundamental point of view, there is further room for gold to go higher in the long-run. The obvious reason for this is the macroeconomic backdrop with fragile recovery and a lot of uncertainty about the future path of pandemic and economic growth, extravagant fiscal policy, dovish Fed that will maintain lax monetary policy and negative real interest rates.

The second argument for the bull run in gold not ending soon is the situation in the forex market. As you can see in the chart below, the U.S. dollar has softened recently against the euro, which fueled the rally in gold.

To be clear, I'm not saying that the bull market in gold will end as soon as the greenback rebounds. After all, as you can see in the chart below, gold has been rallying recently in both U.S. dollar and euro, and in pound sterling as well. Having said that, the weakness of the U.S. dollar has definitely helped gold to reach $2,000 so quickly.

Last but not least, investors shouldn't forget about the positive momentum. After all, what has happened is not that gold has merely crossed another important level. No, gold has surged to a record high, surpassing the previous peak from September 2011, as the chart below shows.

That's a big achievement. A triumphant moment for all gold bulls. Something that will confirm the gold bugs' belief that gold prices can only go up. Breaking the previous all-time record is definitely something that could affect imagination of many people who will join the bulls' party, strengthening the positive momentum. Fear of missing out is strong and can attract many people, who normally don't invest in precious metals, to gold. Hence, although correction in the short-run would be totally normal, or even desirable, the underlying bull market should continue, at least for a while, i.e., until the dominant economic narrative changes, which is not yet happening.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Could Gold Reach $7,000 by 2030?

August 4, 2020, 4:35 AMThis bull market can be more positive than the previous one both for gold and the mining stocks.

In the last edition of the Fundamental Gold Report, I analyzed various WGC's reports on the gold market. Today, I will focus on the issues of Alchemist - the flagship publication of the London Bullion Market Associations - I was unable to discuss during the most acute phase of the pandemic and the following economic crisis.

I'll start with the article "Is there a place of Gold Equities in a Gold Allocation?" by James Luke from issue no. 96. The Author poses title question because gold equities performed poorly relative to the gold prices over the last 10 or even 20 years, and "investors would have been better served staying well away." Indeed, while the gold price is up more than 250 percent since 2005, the HUI Gold Index is just about 20 percent higher.

Wow, it was a harsh criticism! But justified given the fact that although in theory mining stocks provide a leveraged way to own exposure to movements in commodity prices, in reality many miners lag behind the physical market. This is why I always warn investors that investing in gold shares is very demanding, as mining stocks are not a perfect play on gold or other metals. In other words, investing in miner's equity is a whole different kettle of fish, as "the stocks are not a safe haven against market turmoil, but a bet on company's operating earnings and the management team which controls it". Indeed, the problem of gold equities over the last decades was - according to Luke - that "yes, you had higher prices, but no, the industry did not capture margin, and no, the industry did not generate returns".

However, that may change now. The Author believes that producers are facing now a friendlier environment in which they could be able to capture profit margins far greater than in the past. You see, in the 2000s, gold was rallying together with other commodities and with its own input cost base, which cannibalized the margins. But the current gold's rally is more monetary-based than commodity-based, which supports gold prices but remains cost inflation limited.

Gold Resilient in Adversity

Another interesting article from the Alchemist, this time from issue no. 97, is "Gold Resilient in Adversity" by Rhona O'Connel. She compares gold with other commodities, pointing out gold has been the outperformer within the sector. While other metals suffered massive demand destruction and price falls of several percent amid the coronavirus crisis, gold has been a "sanctuary from the vicissitudes of the economic environment". The conclusion is simple: the impressive gold's performance compared with its commodity peers underlines the safe-haven status of the yellow metal and the fact, emphasized by me for a long time, that gold is more of a monetary asset than a mere commodity.

The Rational Case for $7,000 Gold by 2030

I left the most controversial article from Alchemist issue no. 97 - The Rational Case for $7,000 Gold by 2030 written by Charlie Morris - for last. The Author starts with the observation that gold has been the leading major asset class in the 21st century, which is an extraordinary achievement given that gold doesn't pay a yield.

Some people believe that because gold doesn't pay a yield, gold can't be valued. But Morris disagrees - and he models gold, very interestingly, as a bond with the following characteristics: it is zero-coupon because it pays no interest; it has a long duration because it lasts forever; it is inflation linked, as historic purchasing power has demonstrated; it has zero credit risk, assuming it is held in physical form; it was issued by God.

Wow, what an original bond! The model makes clear why the main driver behind the gold's gains in this century was the fall in the U.S. real interest rates, as the chart below shows. According to the Author's model, gold is traded now with premium over its fair value, but investors should not worry, as "it is more likely to rise from here than reverse. That's because gold is in a bull market and the forces driving it higher far outweigh the forces holding it back."

In particular, Morris believes that gold simply sees inflation coming in 2021. After all, contrary to the quantitative easing that occurred in the aftermath of the Great Recession, this time the surge in money supply flows into the real economy. Hence, according to the Author, if the long-term inflation expectations rise, together with the gold's premium, while the bond yields remain ultra low, the price of gold could rationally achieve the level of $7,000. After all, "the huge gains in the 21st century have occurred in an environment with falling rates, while long-term inflation expectations have barely moved. With higher inflation on the horizon, things start to get interesting."

Although $7,000 sounds to me like an exaggeration, I agree with the article's main premises: the repercussions of the coronavirus recession could be more inflationary than the Great Recession, and that gold is in the bull market that could last for a while.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhDSunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Corona Crisis Will Have Lasting Impact on Gold Market

July 30, 2020, 5:52 AMNo matter what shape the recovery is, the epidemic will likely have lasting, positive effects on the gold market.

During the most acute phase of the pandemic and the following economic crisis, there was no time to analyze various WGC's reports on the gold market. Let's make up for it!

I'll start with the report "Recovery paths and impact on performance" about the gold mid-year outlook 2020. The World Gold Council notes that gold had a really excellent performance in the first half of 2020, rising almost by 17 percent (see the chart below), much higher than other major asset classes.

Given gold's impressive gains, adding between 2 and 10 percent in gold to an average investor's portfolio would have resulted in higher risk-adjusted returns over the pandemic and economic crisis (as well as over the past decade). Similarly, according to a separate WGC's research, higher allocations to gold would have improved the performance of a typical central bank's total reserve portfolio during the coronavirus crisis.

When it comes to the future, the WGC points out that expectations for a V-shaped recovery are shifting towards U-shaped or even W-shaped (a double-dip recession). Such transformation keep uncertainty high, supporting save-haven assets such as gold.

However, the key takeaway from the report is that no matter what shape the recovery is, the epidemic will likely have a long-term, positive effects on the gold market, strengthening the role of gold as a portfolio diversifier. According to the former WGC's analysis of potential impact of coronavirus crisis on the gold market, the deep recession would be, of course the best for the gold prices, but even in the scenario of swift recovery, gold would shine this year and maintain positive returns until 2022, as the Fed would keep its monetary policy loose, while the real interest rates would remain close to zero.

Supply Disruptions Made Gold Prices Disconnected

In a former report entitled "Gold supply chain shows resilience amid disruption," the WGC notes that the pandemic has caused unprecedented disruption to various parts of the gold supply chain, but the gold market has remained resilient after all.

However, the epidemic and the resulting supply crisis has hit the retail segment, which is more fragmented, has more complex supply chain, and holds less stocks of small gold bars and bullion coins. This is why "the supply and logistical issues caused depletion of some dealer inventories and left many investors facing long wait times and high premiums". So, not necessarily manipulation, but supply disruptions explain the high premium for coins over spot price.

Interestingly, and somewhat similarly, the logistical disruptions - and not necessarily malicious conspiracy - triggered by the coronavirus and the Great Lockdown caused the widening of the differential between the London spot price and the futures price on Comex, which jumped from $2 to $75 at one point.

Implications for Gold

Not surprisingly, the WGC is, as always, bullish on gold. The organization believes that "the combination of high risk, low opportunity cost and positive price momentum looks set to support gold investment and offset weakness in consumption from an economic contraction". This time we agree with the WGC. The coronavirus crisis and the following economic crisis and the response of the central banks and governments significantly shifted the already bullish fundamental outlook for gold prices into an even more bullish one, also potentially strengthening the role of gold as a strategic asset.

The thing is that the Fed and other central banks have cut interest rates to zero and reintroduced or expanded the quantitative easing. In consequence, equity and bond prices are elevated, which increases the risk of pullbacks. Moreover, the soaring fiscal deficits and public debts raise concerns about the sovereign-debt crisis, or a long-term run up of inflation. All these risks and uncertainties related to the ongoing pandemic and fragile economic recovery could increase the role of gold as a strategic hedge in investor portfolios.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM