-

Economic and Geopolitical Worries Fuel Gold's Rally

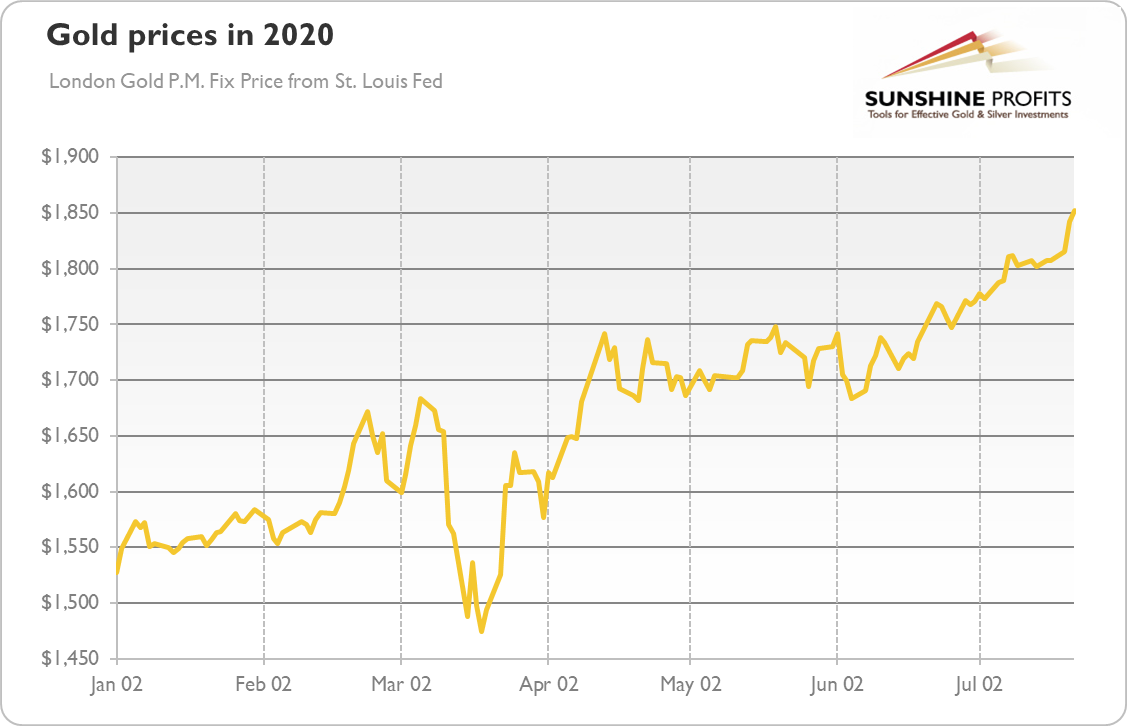

July 28, 2020, 6:25 AMGold has jumped above $1,850 amid expectations of new stimulus, worries about the pace of economic recovery, and concerns about rising tensions between the U.S. and China.

Houston, we have a problem! Please take a look at the chart below that presents the U.S. initial jobless claims. What do you see?

Yes, you are right! The number of people claiming unemployment benefits has recently risen. To be precise, in the week between July 11 and July 18, initial jobless claims increased from 13.1 million to 14.2 million. Yup, instead of falling, they went up! Surely, we should never read too much into a single report. However, the increase in the number of applications for unemployment benefits is not something we should expect during firm, V-shaped recovery. The decline in initial jobless claims was already very sluggish, and the recent reversal in trend will only add to worries that the second wave of coronavirus is slowing down the economy. In other words, the recovery could be more fragile and less vigorous than many people hoped for. As I write in the August edition of the Gold Market Overview, "forget about the V-shaped rebound - the economic recovery could look more like W or like the Nike's swoosh." Indeed, the spread of the Covid-19 makes the V-shaped cycle less likely, while the double-dip recession more probable. Increased worries about the pace of recovery are positive for gold prices. The yellow metal should then gain not only as a safe haven but also thanks to the expectations that sluggish rebound would force the Fed and Treasury to another rounds of monetary and fiscal stimulus.

Increased Tensions between U.S. and China also Support Gold

Geopolitical concerns are another factor that supports gold prices right now. The already heightened tensions between the United States and China have recently escalated to a new level recently. Both superpowers are at odds on almost every front, from still unresolved trade wars to Taiwan, the Covid-19 pandemic, China's human rights abuses in Hong Kong and Xinjiang, and South China Sea. The latter issue has become an flashpoint amid increasing number of naval drills and encounters. On July 13, the U.S. Secretary of State Mike Pompeo signaled a tougher stance, rejecting in a statement most of China's claims to the South China Sea. He said:

We are making clear: Beijing's claims to offshore resources across most of the South China Sea are completely unlawful, as is its campaign of bullying to control them (...) The world will not allow Beijing to treat the South China Sea as its maritime empire."

And, last week, the U.S. ordered China to close its consulate in Houston, Texas, following accusations of spying. It was called by the Chinese Foreign Ministry an "unprecedented escalation" in recent actions taken by Washington. According to some analysts, the risk of an unplanned confrontation is growing as relations worsen very quickly, which could push both countries closer towards war. Such fears increase the safe-haven demand for gold.

Implications for Gold

What does it all mean for the gold market? Well, both the increase in the initial jobless claims (against the markets' expectations) and the rising tensions between China and the U.S. are positive for the yellow metal. They fueled the recent surge of momentum that pushed gold prices above $1,850, as the chart below shows.

Last week I wrote that low real interest rates, ample liquidity from the Fed and expected new round of fiscal stimulus are driving gold prices further north. The concerns about the spread of the coronavirus and the pace of the economic recovery, as well as worries about the U.S.-China relations can only add to the gold's rally.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

New Wave of Economic Stimulus Lifts Gold

July 22, 2020, 9:59 AMEuropean leaders stroke a historic deal that could be a game-changer and provide a support for the euro and gold against the U.S. dollar.

Historic deal. Pivotal moment for Europe. On Monday, the EU leaders agreed on a massive economic stimulus plan, after a long and crotchety summit. If passed through the European Parliament and ratified by all EU states, the European Commission could borrow 750 billion euros to finance the recovery fund and distribute 390 billion in grants and 360 billion in loans across the countries most impacted by the Covid-19 pandemic.

That's breaking news and potentially a game-changer. The stimulus could, of course, help somewhat the European economies, supporting the recovery, but the key issue is that the summit's outcome is an unprecedented act of European solidarity. Some analysts even see the agreement as the first step towards a true fiscal union. It's still far from it, but the recovery fund marks a precedent for common debt financing at the EU level.

Hence, such a strong signal of internal cohesion and solidarity pushed the European equities higher and strengthened the euro against the U.S. dollar. The weaker greenback helped gold to continue its rally, as the chart below shows.

New U.S. Stimulus and Gold

Now, we are waiting for the U.S. to move. The Republicans are expected to deliver the next stimulus package in a response to the coronavirus crisis in the upcoming days. The bill is expected to cost around $1 trillion. The package will likely include second stimulus checks or some form of direct payment, state and local aid, unemployment benefits, and liability protection. However, many details are still unknown, but the bill should be finalized before the Congress' summer recess on August 7, or even until the end of July, when the current federal unemployment benefit program expires.

The bill would provide another round of economic stimulus, supporting the recovery and pleasing the Wall Street. As the package would maintain optimism, it should be theoretically negative for the gold prices. However, the first and larger stimulus did not prevent the gold's rally. Or, it could actually support it.

Implications for Gold

Indeed, gold rallied amid the coronavirus crisis partially because of the authorities' response to the economic collapse. The current level of fiscal and monetary stimulus is unprecedented. The central banks and governments flooded the economies with mammoth liquidity, boosting both the money supply and fiscal deficits. Together with the negative real interest rates, rising public debts and elevated uncertainty, it creates favorable environment for gold prices.

Indeed, in June, the monthly U.S. federal deficit soared to record $864 billion, as the chart below shows. It implies that with the new stimulus just around the corner, the deficit can skyrocket. According to the Congressional Budget Office's projections from April, the economic crisis would raise the FY 2020 deficit to $3.7 trillion, and the FY 2021 deficit to $2.1 trillion. The numbers may be even worse, given the new stimulus and downside economic risks. Such a fiscal extravagance, although partially understandable in face of the pandemic and the Great Lockdown (but now it's clear that the government should tighten its belt in good times), should weaken the U.S. dollar and strengthen gold.

The recent European agreement on the recovery fund and the expected another round of the U.S. economic stimulus make the continuation of gold's bullish trend very probable. Additionally, the EU's unprecedented move to issue common debt on behalf of all 27 members - something that Germany always opposed - could increase the faith in euro, weakening the position of the U.S. dollar as the only game in town, which should also support gold.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

China Recovered in Q2. Will the Red Dragon Sink Gold?

July 21, 2020, 4:55 AMChina's economy grew 3.2 percent in Q2 2020. The expansion was above expectations, but it does not have to sink gold.

Last week, China reported that its economy grew 3.2 percent year-on-year in the second quarter of this year, following a 6.8 percent contraction in the previous quarter, as the chart below shows. Importantly, the actual growth rate beat the market expectations of a 2.5 percent expansion. The number is of great importance also because China is the first major economy to report positive growth after the coronavirus pandemic and the Great Lockdown. So, the Chinese data bode well for the U.S. and other countries, where the epidemic started later.

Does it really? After all, there are doubts about the accuracy of China's official reports. Moreover, although the economy partially rebounded, it still contracted 1.6 percent in the first half of 2020. And consumption remains weak in China. Retail sales were down 1.8 percent in June on an annual basis, which is below forecasts. It clearly shows that there are still significant headwinds ahead of the second largest economy in the world and that there is still a way to go for a full and sustainable recovery. So far, the economic revival in China is a story of government stimulus and debt-led rebound. According to the Institute of International Finance, China's total debt rose from 300 percent in late 2019 to 317 percent of GDP in the first quarter of 2020.

What is important is that China's official data - even if we take it at face value - does not translate so simply into the American reality. The obvious reason is that while China has contained the epidemic (abstracting the second wave in Hong Kong, where a new outbreak forced the authorities to implement the strictest-ever social distancing measures), the U.S. still struggles with the coronavirus, as the chart below shows.

What is crucial here is that not only the number of new cases have been rising in the United States, but also the number of deaths because of Covid-19. As the chart below shows, it has been increasing for several days to reach almost 3 deaths a day per million inhabitants. It is still less than in April, but more than in the previous weeks and significantly higher than in other countries, including Italy.

Implications for Gold

What does it all mean for the gold market? Well, on the surface, it seems that everything is fine. China's economy has rebounded in the second quarter, and America is also on track to recovery. After all, industrial production rose 5.4 percent in June, following 1.4 percent in May, while the Empire State Index, which measures business activity in New York state, increased 17.2 percent in July from negative 0.2 percent in June, crossing back into positive territory.

However, the sad truth is that economic activity remains well below the pre-pandemic level. As we acknowledged earlier, the upcoming data will be very positive because of the very low base. But later data may be less impressive, especially if the new outbreak in the U.S. spreads wider and further reduces consumer spending.

It is, of course, very possible (and we hope for) that the second wave of infections will be eventually contained, just as the first wave was, but until then it may have a negative effect on the pace of economic recovery - and positive on the yellow metal.

So, although positive economic news from China could boost risk appetite, hitting the safe-haven demand for gold, the fundamental outlook for gold prices remains intact. After all, the economic recovery in America will we weaker than in China, partially because of worse epidemiological situation. But even if the pandemic is contained soon, the easy monetary policy will remain in America for years. The U.S. central bankers will remain dovish and more tolerant of inflation. Indeed, just last week, Patrick Harker, Philadelphia Fed President, said "I'm supportive of the idea of letting inflation get above 2% before we take any action with respect to the federal funds rate." It goes without saying that such ideas are supportive for gold prices.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Inflation Is Up - And So Is Gold

July 16, 2020, 3:56 AMInflation has finally risen, but the Fed will remain dovish. Gold can continue its upward march.

The U.S. CPI inflation rate rose 0.6 percent in June, following a 0.1 percent drop in May. It was the first increase in four months and the biggest jump since 2012. The move was mainly driven by higher energy prices (the energy index increased 5.1 percent in June as the gasoline index rose 12.3 percent). The core CPI rose 0.2 percent, following a 0.1 percent drop in May. It was also the first increase since February, as the prices of apparel and transportation services have finally risen.

On an annual basis, the overall CPI increased 0.7 percent (seasonally adjusted), following a mere 0.2 percent increase in May. However, the core CPI rose 1.2 percent, the same as in the previous month (or actually a bit less if we abstract from rounding). So, as the chart below shows, inflation remains very low, but the period of disinflation has possibly ended. We mean that although we do not expect the outbreak of high inflation in the near future, inflation rate could have reached the bottom, at least for some time.

Implications for Gold

What does it mean for the gold market? Well, on one hand, higher inflation could increase the demand for gold as an inflation hedge. On the other hand, the rebound in inflation could theoretically push the Fed to adopt a more hawkish stance, which would be negative for the gold prices. However, inflation remains very low, so the U.S. central bank is not likely to change its ultra dovish stance for months, if not years. The Fed will not hike the federal funds rate, ending its Zero Interest-Rate Policy, anytime soon, so the real interest rates will stay at their very low, negative level, supporting gold prices (see the chart below).

Given the resurgence in the Covid-19 cases and the slowdown in the pace of the consumer spending and economic recovery, inflation may decline again in July. However, what is really important, is that the rising number of cases and reopening rollback have not yet impacted long-term inflation expectations, as the chart below shows. This is good news for the gold market, as the higher inflation expectations, the lower real interest rates.

Of course, there is a risk that real interest rates would rebound one day, putting downward pressure on gold prices. However, with expectations that the Fed will implement the yield-curve control, capping interest rates, this risk is limited. As Fed Governor Lael Brainard said this week: "There may come a time when it is helpful to reinforce the credibility of forward guidance and lessen the burden on the balance sheet with the addition of targets on the short-to-medium end of the yield curve".

So, it's not surprising that gold has been rising in such a macroeconomic and geopolitical environment (there are renewed tension between the United States and China), jumping even above $1,800. After all, even if the pandemic is ultimately contained, the economy is likely to face important headwinds, which limits risk-appetite among investors. For example, three of the largest U.S. banks said this week that they had set aside $28 billion for loan losses. Indeed, the economic pain from the coronavirus, including corporate bankruptcies and banks' problem, is still to come. Importantly, gold showed ability to return above $1,800 after some normal profit-taking, which suggests that price declines are now viewed as buying opportunities and that the yellow metal can go further north in the long-run.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Rallies Together With U.S. Covid-19 Cases

July 14, 2020, 6:19 AMThe number of cases of Covid-19 in the U.S. have been rallying very quickly in last weeks, giving way only to the gold prices, which have surpassed $1,800.

It's not easy to terminate the viruses, especially that they are not quite alive. Indeed, the pandemic of the coronavirus is still not over, as the chart below shows. The global number of daily confirmed Covid-19 cases has surpassed 220,000 last week - and the trend is still upward.

The rising number of infections in the world is mainly driven by outbreaks in Latin America, but epidemic continues to spread in the United States as well. Actually, the country reported on Friday another record single-day spike of more than 63,000 new cases, as the chart below shows. In total, more than 3 million of Americans got infected and more than 133,000 died because of coronavirus. Importantly, a majority of American states have reported an increase in Covid-19 cases over the last several days.

The spike in in the U.S. infections triggered worries about fresh lockdowns in America and the breakdown of the already fragile economic recovery. Justified worries - data shows that U.S. consumers reduced their visits into shops in the most infected regions of the country. Several other indicators also suggest that economic recovery slowed down or even stopped at the turn of June and July, partially because of the new outbreaks of the coronavirus. If the resurgence is not contained quickly (for example thanks due to wearing masks), the economic recovery will slow down or even collapse. And although the initial claims fell down further to 1.31 million last week, beating market's expectations, they have been falling very, very slowly, as the chart below shows.

The concerns about the epidemiological situation and economic consequences weakened the risk appetite among investors while boosted safe-haven assets such as gold.

Implications for Gold

Indeed, the price of the yellow metal has jumped above the $1,800, as the chart below shows.

This fact is of great importance, as $1,800 was another important level surpassed by the gold since it escaped its sideways trend in 2019. When gold jumped above $1,400, after a few years of being trapped in a narrow trading range of $1,150-$1,350, we knew that something important was happening. Now, gold gained almost 20 percent in 2020 and it needs less than $100 to break its all-time record!

What does it all mean for the gold market? Well, after reaching $1,800, we could see a period of consolidation, or even a correction. After all, speculative positions in Comex are substantial. But, given macroeconomic backdrop, there is further room for gold to go higher in the long-run. The fragile recovery with a lot of uncertainty about the future path of pandemic and economic growth (as well as the outcome of the U.S. November presidential elections), loose fiscal policy and lax monetary policy should support gold prices. The real interest rates are negative. They can go up, but the upside is potential, as investors expect that the Fed will control the yield curve. Actually, the dovish Fed and easy money are among the reasons while gold has been rising simultaneously with the U.S. stock market.

And if gold sets a new record, new investors will join the bulls' party, strengthening the positive momentum. What is, however, important, is that - for now - the current rally in gold has been steady, and we see neither bubble nor speculative fever in the gold market right now. On the contrary, the current rally has been very gradual - especially given the depth of the Great Lockdown and economic crisis. Hence, it was driven by long-term investors rather than by speculators, which bodes well for the long-term outlook for gold.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

Gold Reports

Free Limited Version

Sign up to our daily gold mailing list and get bonus

7 days of premium Gold Alerts!

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM