-

Correction for Nasdaq- More Indices to Follow?

March 5, 2021, 9:11 AMI called Jay Powell's bluff a week ago. Remember when he said last week that we're still far from The Fed's inflation targets?

Well, I was right to doubt him. The market didn't like his change in tone Thursday (Mar. 5).

You see, when bond yields are rising as fast as they have, and Powell is maintaining that Fed policy won't change while admitting that inflation may "return temporarily," how are investors supposed to react? On the surface, this may not sound like a big deal. But there are six things to consider here:

- It's a significant backtrack from saying that inflation isn't a concern. By admitting that inflation "could" return temporarily, that's giving credence to the fact that it's inevitable.

- The Fed can't expect to let the GDP scorch without hiking rates. If inflation "temporarily returns," who is to say that rates won't hike sooner than anyone imagines?

- Fool me once, shame on me, fool me twice...you know the rest. If Powell changed his tune now about inflation, what will he do a few weeks or months from now when it really becomes an issue?

- Does Jay Powell know what he's doing, and does he have control of the bond market?

- A reopening economy is a blessing and a curse. It's a blessing for value plays and cyclicals that were crushed during COVID and a curse for high-flying tech names who benefitted from "stay-at-home" and low-interest rates.

- The Senate will be debating President Biden’s $1.9 trillion stimulus plan. If this passes, as I assume it will, could it actually be worse for the economy than better? Could markets sell-off rather than surge? Once this passes, inflation is all but a formality.

Look, it's not the fact that bond yields are rising that are freaking out investors. Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%. But it's the speed at which they've risen that are terrifying people.

According to Bloomberg, the price of gas and food already appear to be getting a head start on inflation. For January, Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in all goods included in the CPI.

The month of January. Can you imagine what this was like for February? Can you imagine what it will be like for March?

I'm not trying to sound the alarm- but be very aware. These are just the early warning signs.

So, where do we go from here? Time will tell. While I still do not foresee a crash like we saw last March and feel that the wheels remain in motion for a healthy 2021, that correction that I've been calling for has already started for the Nasdaq. Other indices could potentially follow.

Finally.

Corrections are healthy and normal market behavior, and we have been long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

Most importantly, this correction could be an excellent buying opportunity.

It can be a very tricky time for investors right now. But never, ever, trade with emotion. Buy low, sell high, and be a little bit contrarian. There could be some more short-term pain, yes. But if you sat out last March when others bought, you are probably very disappointed in yourself. Be careful, but be a little bold right now too.

There's always a bull market somewhere, and valuations, while still somewhat frothy, are at much more buyable levels now.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. A further downturn by the end of the month is very possible, but I don't think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- From Overbought to Oversold in 3 Weeks?

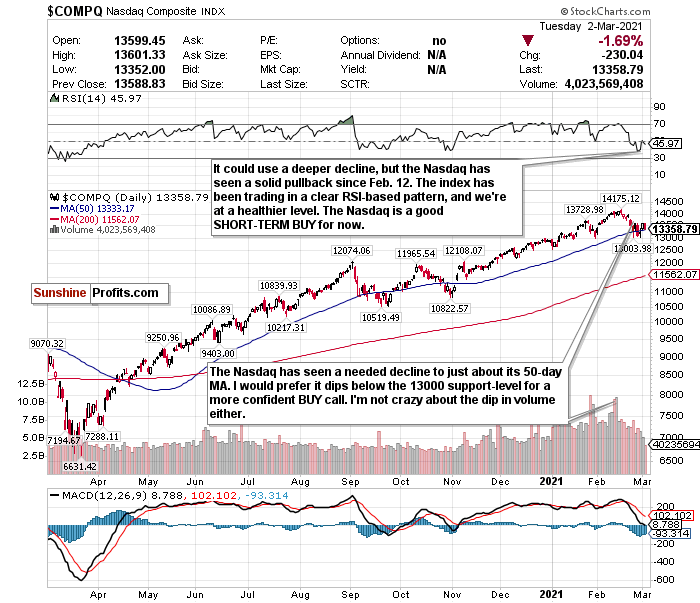

Figure 1- Nasdaq Composite Index $COMP

The Nasdaq is finally in correction territory! I have been waiting for this. It’s been long overdue and valuations, while still frothy, are much more buyable. While more pain could be on the horizon until we get some clarity on this bond market and inflation, its drop below 13000 is certainly buyable.

The Nasdaq has also given up its gains for 2021, its RSI is nearly oversold at about 35, and we’re almost at a 2-month low.

It can’t hurt to start nibbling now. There could be some more short-term pain, but if you waited for that perfect moment to start buying a year ago when it looked like the world was ending, you wouldn’t have gained as much as you could have.

Plus, it’s safe to say that Cathie Wood, the guru of the ARK ETFs, is the best growth stock picker of our generation. Bloomberg News’ editor-in-chief emeritus Matthew A. Winkler seems to think so too. Her ETFs, which have continuously outperformed, focus on the most innovative and disruptive tech companies out there. Not to put a lot of stock in one person. But it’s safe to say she knows a thing or two about tech stocks and when to initiate positions- and she did a lot of buying the last few weeks.

I think the key here is to “selectively buy.” I remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

I also think it’s an outstanding buying opportunity for big tech companies with proven businesses and solid balance sheets. Take Apple (AAPL), for example. It’s about 30% off its all-time highs. That is what I call discount shopping.

What’s also crazy is the Nasdaq went from overbought 3 weeks ago to nearly oversold this week. The Nasdaq has been trading in a clear RSI-based pattern, and we’re at a very buyable level right now.

I like the levels we’re at, and despite the possibility of more losses in the short-run, it’s a good time to start to BUY. But just be mindful of the RSI, and don’t buy risky assets. Find emerging tech sectors or high-quality companies trading at a discount.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Mixed Start for Stocks in March

March 3, 2021, 8:45 AMAfter March kicked off with a session that indicated the worst for stocks may be over (for now), Tuesday saw the indices sell-off towards the close.

At least Rocket Mortgage (RKT) had a good day, though! And, at least the 10-year yield didn’t spike either. But that could change. Yields ticked up overnight to 1.433%, after President Biden pledged enough vaccine supply to inoculate every American adult by the end of May.

So, where do we go from here? This positive economic and health news is excellent for reopening. But rising bond yields are a blessing and a curse. On the one hand, bond investors see the economy reopening and heating up. On the other hand, with the Fed expected to let the GDP scorch without hiking rates, inflation may return.

I don’t care what Chairman Powell says about inflation targets this and that. The price of gas and food is increasing already. In fact, according to Bloomberg, food prices are soaring faster than inflation and incomes.

For January, Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in the prices of all goods included in the CPI.

Can you imagine what this was like for February? Can you imagine what it will be like for March? I’m not trying to sound the alarm - but be very aware. These are just the early warning signs.

So about March. Will it be more like Monday or Tuesday? Was the second half of February the start of the correction that I’ve been calling for? Or is the “downturn” already over? Only time will tell. While I still do not foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of this month could happen.

Rising bond yields are concerning. Inflation signs are there. But structurally, I don’t think it will crash the market (yet).

Corrections are also healthy and normal market behavior, and we are long overdue for one. It’s been almost a year now. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. A further downturn by the end of the month is very possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- a Buyable Slowdown?

Figure 1- Nasdaq Composite Index $COMP

The Nasdaq’s slowdown has been long overdue. Even though more pain could be on the horizon, I like the Nasdaq at this level for some buying opportunities.

But I’d prefer it drop below support at 13000 for real buying opportunities.

But it can’t hurt to start nibbling now. If you waited for that perfect moment to start buying a year ago when it looked like the world was ending, you wouldn’t have gained as much as you could have.

Plus, it’s safe to say that Cathie Wood, the guru of the ARK ETFs, is the best growth stock picker of our generation. Bloomberg News’ editor-in-chief emeritus Matthew A. Winkler seems to think so too. Her ETFs, which have continuously outperformed, focus on the most innovative and disruptive tech companies out there. Not to put a lot of stock in one person. But it’s safe to say she knows a thing or two about tech stocks and when to initiate positions- and she did a lot of buying the last few weeks.

I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

Before February 12, I would always discuss the Nasdaq’s RSI and recommend watching out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF, the Nasdaq has plummeted almost 5.5% since February 12 and is closer to oversold than overbought!

But it’s still not enough.

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after its recent slowdown, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

The RSI is king for the Nasdaq. Its RSI is now around 45.

I follow the RSI for the Nasdaq religiously because the index is merely trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded an overbought 70 RSI, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

Again- if the index drops below 13000, and the RSI hits undeniably overbought levels, get on the train.

But because we haven’t declined just enough, I am making this a SHORT-TERM BUY. But follow the RSI literally and take profits once you have the chance to.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Worst for Stocks Over?

March 1, 2021, 8:50 AMIs the worst of what the last few weeks brought over? February started off with so much promise, only to be ruined by surging bond yields.

The way that bond yields have popped has weighed heavily on growth stocks. Outside of seeing a minor comeback on Friday (Feb. 26), the Nasdaq dropped almost 7% between February 12 and Friday’s (Feb. 26) close.

Other indices didn’t fare much better either.

The spike bond yields, however, in my view, are nothing more than a catalyst for stocks to cool off and an indicator of some medium to long-term concerns. But calling them a structural threat is a bit of an overstatement.

Rising bond yields are a blessing and a curse. On the one hand, bond investors see the economy reopening and heating up. On the other hand, with the Fed expected to let the GDP heat up without hiking rates, inflation may return.

I don’t care what Chairman Powell says about inflation targets this and that. He can’t expect to keep rates this low, buy bonds, permit money to be printed without a care, and have the economy not overheat.

He may not have a choice but to hike rates sooner than expected. If not this year, then in 2022. I no longer buy all that talk about keeping rates at 0% through 2023. It just can’t happen if bond yields keep popping like this.

So was the second half of February the start of the correction that I’ve been calling for? Or is this “downturn” already over?

Time will tell. While I still do not foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of this month could happen.

Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in almost a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

Pay attention to several things this week. The PMI composite, jobs data, and consumer credit levels will be announced this week.

We have more earnings on tap this week too. Monday (March 1), we have Nio (NIO) and Zoom (ZM), Tuesday (March 2) we have Target (TGT) and Sea Limited (SE), Wednesday (March 3), we have Okta (OKTA) and Snowflake (SNOW), and Thursday (March 3) we have

Broadcom (AVGO).

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

The downturn we experienced to close out February could be the start of a short-term correction- or it may be a brief slowdown. A further downturn by the end of the month is very possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- a Buyable Slowdown?

Figure 1- Nasdaq Composite Index $COMP

The Nasdaq’s downturn was so overdue. Even though more pain could be on the horizon, I like the Nasdaq at this level for some buying opportunities.

If more losses come and the tech-heavy index dips below support at 13000, then it could be an even better buying opportunity. It can’t hurt to start nibbling now, though. If you waited for that perfect moment to start buying a year ago when it looked like the world was ending, you wouldn’t have gained as much as you could have.

Plus, if Cathie Wood, the guru of the ARK ETFs that have continuously outperformed, did a lot of buying the last two weeks, it’s safe to say she knows a thing or two about tech stocks and when to initiate positions. Bloomberg News’ editor-in-chief emeritus Matthew A. Winkler wouldn’t have just named anyone the best stock picker of 2020.

Before February 12, I would always discuss the Nasdaq’s RSI and recommend watching out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF, the Nasdaq has plummeted almost 7% since February 12 and is closer to oversold than overbought. !

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Chairman Powell’s testimony last week (even if I don’t totally buy into it). Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after its recent slowdown, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

The RSI is king for the Nasdaq. Its RSI is now around 40.

I follow the RSI for the Nasdaq religiously because the index is merely trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded an overbought 70 RSI, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is almost at its support level of 13000, and especially that it’s below its 50-day moving average now.

I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a SHORT-TERM BUY. But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Finally, the Stock Market Tanks

February 26, 2021, 9:15 AMSurging bond yields continue to weigh on tech stocks. When the 10-year yield pops by 20 basis points to reach a 1-year high, that will happen.

Tuesday (Feb. 23) saw the Dow down 360 points at one point, and the Nasdaq down 3% before a sharp reversal that carried to Wednesday (Feb. 24).

Thursday (Feb. 25) was a different story and long overdue.

Overall, the market saw a broad sell-off with the Dow down over 550 points, the S&P falling 2.45%, the Nasdaq tanking over 3.50%, and seeing its worst day since October, and the small-cap Russell 2000 shedding 3.70%.

Rising bond yields are a blessing and a curse. On the one hand, bond investors see the economy reopening and heating up. On the other hand, with the Fed expected to let the GDP heat up without hiking rates, say welcome back to inflation.

I don’t care what Chairman Powell says about inflation targets this and that. He can’t expect to keep rates this low, buy bonds, permit money to be printed without a care, and have the economy not overheat.

He may not have a choice but to hike rates sooner than expected. If not this year, then in 2022. I no longer buy all that talk about keeping rates at 0% through 2023. It just can’t happen if bond yields keep popping like this.

This slowdown, namely with the Nasdaq, poses some desirable buying opportunities. The QQQ ETF, which tracks the Nasdaq is down a reasonably attractive 7% since February 12. But there still could be some short-term pressure on stocks.

That correction I’ve been calling for weeks? It may have potentially started, especially for tech. While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of March could happen.

I mean, we’re already about 3% away from an actual correction in the Nasdaq...

Bank of America also echoed this statement and said, “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

Look. This has been a rough week. But don’t panic... look for opportunities. We have a very market-friendly monetary policy, and corrections are more common than most realize.

Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq - To Buy or Not to Buy?

Figure 1- Nasdaq Composite Index $COMP

This downturn is long overdue. More pain could be on the horizon, but this road towards a correction was needed for the Nasdaq.

Before February 12, I would always discuss the Nasdaq’s RSI and recommend watching out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF, the Nasdaq has plummeted by nearly 7% since February 12 and is trending towards oversold levels! I hate to say I’m excited about this recent decline, but I am.

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Chairman Powell’s testimony the other day (even if I don’t totally buy into it). Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after its recent slowdown, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

The RSI is king for the Nasdaq. Its RSI is now under 40, which makes it borderline oversold.

I follow the RSI for the Nasdaq religiously because the index is simply trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded an overbought 70 RSI, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is almost the 13100-level, and especially that it’s below its 50-day moving average now.

I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a SHORT-TERM BUY. But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist -

Shortest Stock Correction Ever

February 24, 2021, 9:05 AMWhat a day that was. What started off looking like a sea of red not seen in months ended with the Dow and S&P in the green.

It was an overdue plummet- at least that’s what I thought at the start of the day. The Dow was down 360 points at one point, and the Nasdaq was down 3%.

But by the end of the day, Jay Powell played the role of Fed Chair and investor therapist and eased the fears of the masses.

The Dow closed up, the S&P snapped a 5-day losing streak, and the Nasdaq only closed down a half of a percent!

You really can’t make this up.

The day started gloomily with more fears from rising bond yields.

Sure, the rising bonds signal a return to normal. But they also signal inflation and rate hikes from the Fed.

But Powell said “not so fast” and eased market fears.

“Once we get this pandemic under control, we could be getting through this much more quickly than we had feared, and that would be terrific, but the job is not done,” Powell said.

He also alluded to the Fed maintaining its commitment to buy at least $120 billion a month in U.S. Treasuries and agency mortgage-backed securities until “substantial further progress is made with the recovery.

While the slowdown (I’d stop short of calling it a “downturn”) we’ve seen lately, namely with the Nasdaq, poses some desirable buying opportunities, there still could be some short-term pressure on stocks. That correction I’ve been calling for weeks may have potentially started, despite the sharp reversal we saw today.

Yes, we may see more green this week. But while I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said, “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

With more earnings on tap for this week with Nvidia (NVDA) on Wednesday (Feb. 24) and Virgin Galactic (SPCE) and Moderna (MRNA) on Thursday (Feb. 25), buckle up.

The rest of this week could get very interesting.

Look. Don’t panic. We have a very market-friendly monetary policy, and corrections are more common than most realize. Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- To Buy or Not to Buy?

Figure 1- Nasdaq Composite Index $COMP

What a difference a few weeks can make!

Before, I was talking about the Nasdaq’s RSI and to watch out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF, the Nasdaq has plummeted by 4.5% since February 12 and is trending towards oversold levels! I hate to say I’m excited about this recent decline, but I am. This has been long overdue, and I’m sort of disappointed it didn’t end the day lower.

Now THAT would’ve been a legit buying opportunity.

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Chairman Powell’s testimony. Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after today, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

But remember. The RSI is king for the Nasdaq. If it pops over 70 again, that makes it a SELL in my book.

Why?

Because the Nasdaq is trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded 70, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is below the 13500-level, and especially that it’s below its 50-day moving average now. I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

But the pullback hasn’t been enough.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a SHORT-TERM BUY. But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM