-

Making Sense of the Mixed Signals the S&P 500 Sends

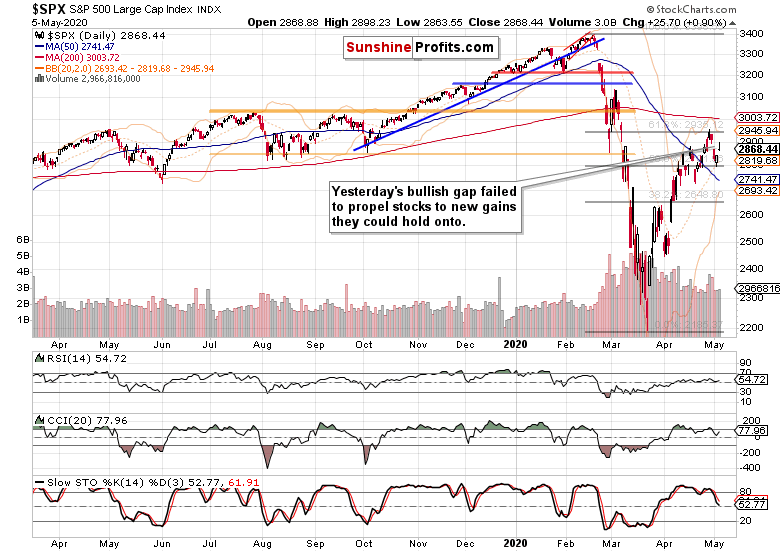

May 6, 2020, 9:27 AMStocks made it clear they were not ready to decline back to the 50% Fibonacci retracement yesterday, and instead opened higher. The bulls have been patiently and slowly adding to their modest intraday gains, before losing them all in the final 45 minutes of trading. How did that change the balance of forces in the market?

S&P 500 in the Short-Run

We'll start with the daily chart analysis (charts courtesy of http://stockcharts.com ):

The rebound from the 50% Fibonacci retracement continued yesterday, yet not without its fair share of obstacles - the sizable upper knot shows that clearly. Regardless, the daily indicators' posture has taken a modest turn for the better, but just as the volume level, it leans in favor of more downside.

Would the credit markets favor a downside move?

The Credit Markets' Point of View

High yield corporate debt opened higher, and has seen issues keeping additional intraday gains. It only managed to do so in the final 15 minutes of trading, which doesn't bode well for a sustained move higher in the short run. We'll see that later in this analysis when we discuss financials (XLF ETF).

But it must be said that corporate junk bonds closed higher behind respectable volume, which is a sign of non-confirmation to the wavering stocks. On the other hand, investment grade corporate bonds didn't make any headway yesterday.

As both the HYG ETF and its ratio to short-dated Treasuries (HYG:SHY) keep trading both above its recent lows and below its recent highs, only a breakout either way will bring about more clarity. In our opinion, a break to the downside is more likely - and that would point to an upcoming downswing in stocks.

Right now, all we're seeing is back-and-forth credit market action that provides no overly clear direction for stocks in the very short run.

However, the same can't be said about sectoral analysis. Let's dive into what the many sectors (including the message from financials) are telling us.

Key S&P 500 Sectors in Focus

The tech sector added to its opening gains, but these evaporated before the closing bell. The daily indicators are extended, but yesterday's volume doesn't represent a reversal. But it's likely that we'll see one in the nearest sessions, because one could be pardoned for expecting stronger leadership from the tech sector. And this means that the stock bulls are skating on increasingly thin ice.

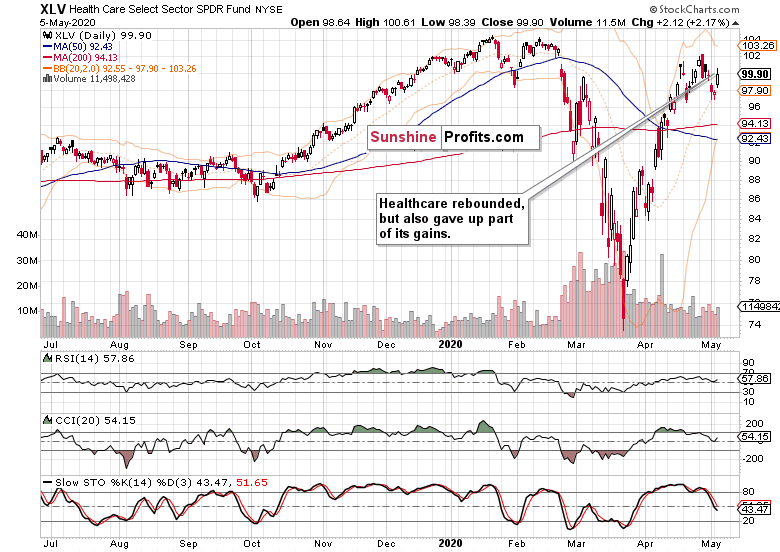

Healthcare at least managed to hold on to much of its intraday gains, but the sector is also vulnerable to a takedown. It's true that the daily indicators are improving but they did not yet improve sufficiently to herald sectoral uptrend return.

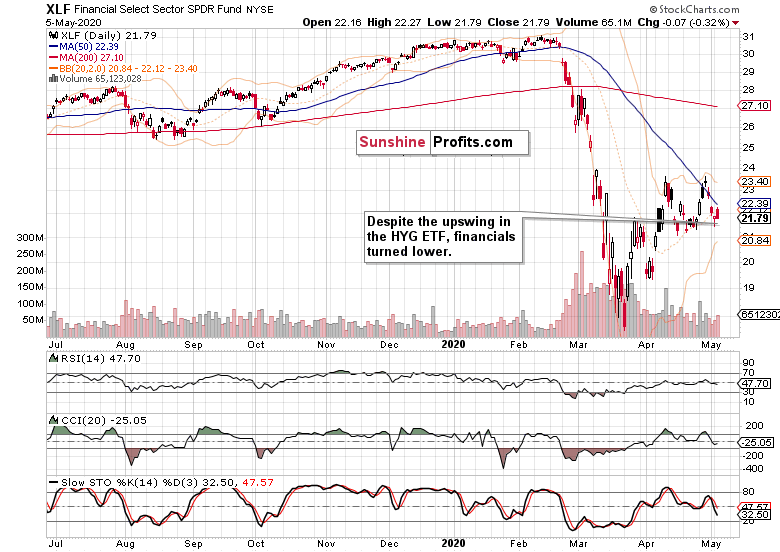

It's high time for the story financials tell - and it's not a bullish one.

Despite the corporate debt performance, financials entirely erased the bullish opening gap. They did so on slightly higher volume and during bearish daily indicators' posture, raising the odds of more downside to come.

Coupled with the previous two S&P 500 heavyweights examination, the odds for a downswing in the entire index are alive and well.

Next, let's discuss the stealth bull market trio of sectors (energy, materials and industrials) that are supposed to lead the index higher, if we are in a bull market, that is.

Considering yesterday's upswing in oil, energy (XLE ETF) could have performed better. Instead, the sector moved down from its bullish opening gap to close where it did a day ago. Not exactly a show of strength.

Materials (XLB ETF) also reversed lower yesterday. Despite keeping very modest gains from the bullish opening gap, the overall implications are near-term bearish. The very same conclusion goes for industrials (XLI ETF) or consumer discretionaries (XLY), which mirrorer the action in materials.

Interestingly, consumer staples (XLP ETF) or utilities (XLU ETF) also ran into similar issues. It certainly doesn't bode well for stocks overall that not even the defensive sectors perform.

Our yesterday's observations proved correct:

(...) Overall, the sectoral analysis speaks in favor of a short-term pause in the S&P 500 downswing, and the $64,000 question is when will the move lower continue in earnest.

Today, we would add that the bulls will face a harder time keeping or extending gains. The 61.8% Fibonacci retracement is relatively near (around 2935), if they can make it there at all. If we take a close look at the daily S&P 500 chart again, we see rising volume around the local tops, with the volume on the upswings quite far from matching it. This speaks subtly in favor of being in the latter stages of a sharp bear market rally, which is confirmed by the wobbling stealth bull market trio of sectors.

Summary

Summing up, stocks extended gains from the 50% Fibonacci retracement rebound, and the credit markets improved yesterday. That would speak for the S&P 500 upswing to continue, but the sectoral performance doesn't confirm that at the moment. While the bulls' standing improved since the start of Monday's trading, the risks continue being skewed to the downside. This is confirmed by the daily volume examination - regardless of the back-and-forth trading of the day, it appears we're in the early stages of the S&P 500 downswing and our short position remains justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

The Bulls Respond to the S&P 500 Selloff

May 5, 2020, 8:47 AMStocks opened yesterday with a bearish gap, yet the 50% Fibonacci retracement withstood the test, and the bulls staged a comeback. Let's dig deeper into the health of the comeback - does it mark a reversal?

S&P 500 in the Short-Run

We'll start with the daily chart analysis (charts courtesy of http://stockcharts.com ):

Friday's bearish momentum continued into yesterday's premarket session, but the bulls gradually repaired the damage, and closed the opening gap in the final two hourly candles of yesterday's trading. So, the 50% Fibonacci retracement withstood yesterday's test.

However, the rebound didn't happen on volume levels that would be consistent with turnarounds, and instead gives an impression of a short-term pause in the downswing. The daily indicators' sell signals have also been unaffected by yesterday's price action.

Our yesterday's observations on volume hold true also today:

(...) In all likelihood, the lower volume just shows that a larger move is underway, and that the bulls don't find the setup interesting enough to step in and buy with conviction. Similarly the bears don't find it a good time or place to get out of their positions just yet.

As credit leads stocks, how did the debt markets do yesterday?

The Credit Markets' Point of View

Just as its ratio to short-term Treasuries (HYG:SHY), high yield corporate debt also opened lower, yet refused to decline further. As it were rising, we closed our profitable Friday's short position, while stocks were still consolidating. Let's quote from our yesterday's intraday Stock Trading Alert:

(...) The S&P 500 bulls didn't take advantage of the price recovery from overnight lows just above 2770 to well over 2815, and the credit markets (HYG ETF and LQD ETF) are losing steam. This increases the likelihood that we're not to see their immediate rebound in the session, but rather bobbing above and around their last week's lows - and that doesn't bode well for any S&P 500 upswing in the short-term.

Since then, the HYG ETF declined a bit more only to revert to trading close to unchanged on the day, while stocks lagged. This prompted us to reenter the short position at a better risk-reward ratio thanks to the preceding credit markets action. Stocks rose strongly only in the final 75 minutes of trading, while corporate junk bonds saw their upswing attempt rejected during the same time window. Unless credit markets (yes, we mean the LQD ETF as well) perform strongly later today, stocks are getting ahead of themselves in a way.

Investment grade corporate bonds didn't experience a selling wave after the open, yet they also refused to move up during the day. The same is true about its ratio to the longer-dated Treasuries (LQD:IEI).

Importantly, just as with the HYG ETF, the LQD ETF session was characterized by lower volume, and thus lacks implications of any kind of reversal. Unless both ETFs' moves lower are reversed, the credit markets aren't really on the bulls' side right now.

Key S&P 500 Sectors in Focus

The tech sector erased its opening losses, and cut deep into Friday's bearish gap. But the volume of the upswing didn't outshine that of the preceding downswing. Given that the S&P 500 futures trade at around 2850 as we speak, technology will surely open higher later today and attempt to resume leadership.

Healthcare merely managed to slow its pace of decline yesterday, but the lower knots of two preceding sessions reveal where the bears are meeting buying interest. With that in mind, a short-term upswing isn't out of the question. That's fine, because no market goes up or down in a straight line.

As the credit markets stood relatively unchanged, how did that reflect upon the financials?

The financials also largely refused to decline during the day, and their move happened on larger volume than Friday's downswing. It means that a short-term rebound can't be ruled out, regardless of the daily indicators of all these three S&P 500 heavyweights favoring a move lower.

Next, let's discuss the stealth bull market trio of sectors (energy, materials and industrials) that are supposed to lead the index higher, if we are in a bull market, that is.

Energy (XLE ETF) moved up, closing just below its Friday's open, on not too bad a volume - but still trades well below its local peak. So did the materials (XLB ETF), but given their larger Friday's gap, the implications aren't as bullish as in the case of energy. Industrials (XLI ETF) performed along the lines of financials, which means that they just refused to decline on the day, and couldn't bring themselves up to closing even their Monday's gap, let alone the Friday's one.

Overall, the sectoral analysis speaks in favor of a short-term pause in the S&P 500 downswing, and the $64,000 question is when will the move lower continue in earnest.

Later today, we're getting the ISM non-manufacturing PMI. While it's likely the reading will come in at above expectations, stocks might meet a buy-the-rumor-sell-the-news reaction.

The Fundamental S&P 500 Outlook

Stating the obvious, the reopening euphoria keeps being a major theme. As it's a long process, its veracity will be continually reassessed, and we're of the opinion that the market is assigning too high a probability to a V-shaped outcome, which should drive disappointment.

The rally we've seen from the Mar 23 bottom, has been a sharp one, and a multi-week affair on top. But it's within the bear markets where the strongest rallies happen - and they might take a time to reverse. First meekly, then more profoundly. Even if the stealth bull market sectors regain the pool position and overcome their local highs down the road, the current consolidation with a bearish bias still hasn't run its course in our opinion.

The credit markets are the places to watch right now. Once they break below their local lows (and it's more likely than not that they will), stocks will catch up with vengeance.

Summary

Summing up, stocks rebounded from the 50% Fibonacci retracement, but the credit markets and sectoral performance are giving mixed signals. Stocks are getting ahead of themselves, unless the corporate debt markets reverse higher. On balance, it appears we're in the early stages of the S&P 500 downswing and our short position remains justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM