-

Friday’s Decline May Be Retraced, but Will S&P 500 Get Back Above 4,500?

September 13, 2021, 8:40 AMOn Friday stocks were the lowest since the end of August. We may see a rebound today, but is the market poised to go even lower then?

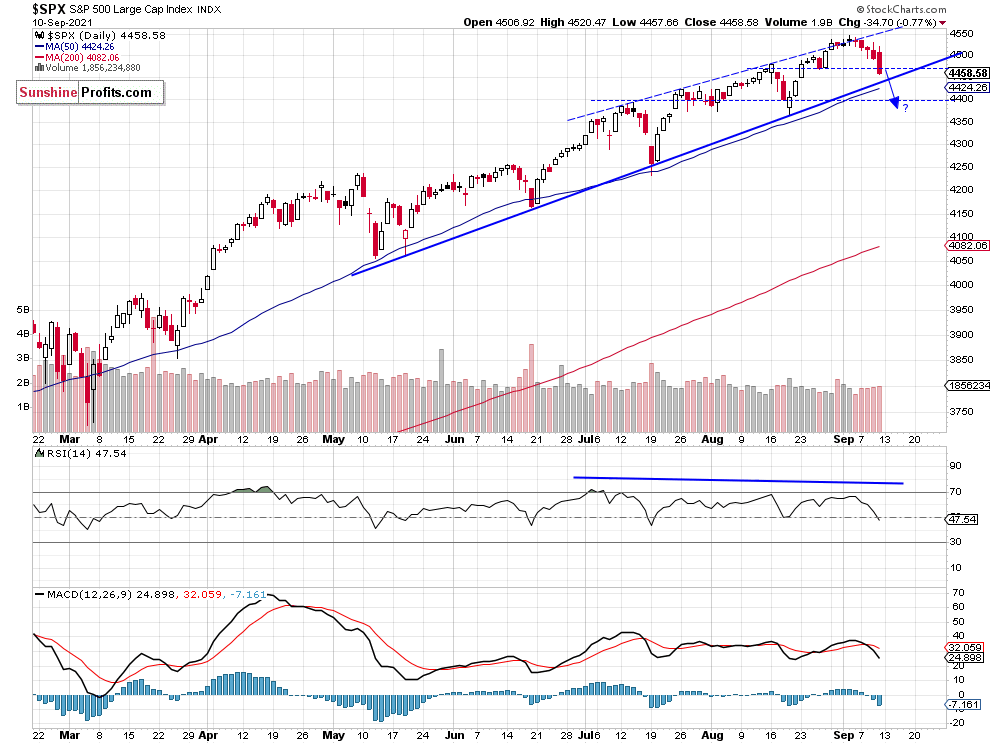

The broad stock market index lost 0.77% on Friday after falling almost 0.5% on Thursday. It went much below the 4,500 level. On September 2 the index reached a new record high of 4,545.85. Since then it has lost almost 90 points (around 2%). This morning stocks are expected to open higher and retrace some of the recent decline.

The index remains elevated after the recent run-up, so we may see some more profound profit-taking action at some point.

The nearest important support level of the broad stock market index is at 4,465-4,470, marked by the previous local low. The next support level is at 4,445-4,450. On the other hand, the nearest important resistance level is at 4,490-4,500, marked by the previous support level. The S&P 500 got back close to its over four-month-long upward trend line on Friday, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Remains Below Medium-Term Trend Line

The S&P 500 index broke below its medium-term upward trend line. However, it is still relatively close to that trend line. The nearest important support level is at 4,300, as we can see on the weekly chart:

Dow Jones Went Lower – As Expected

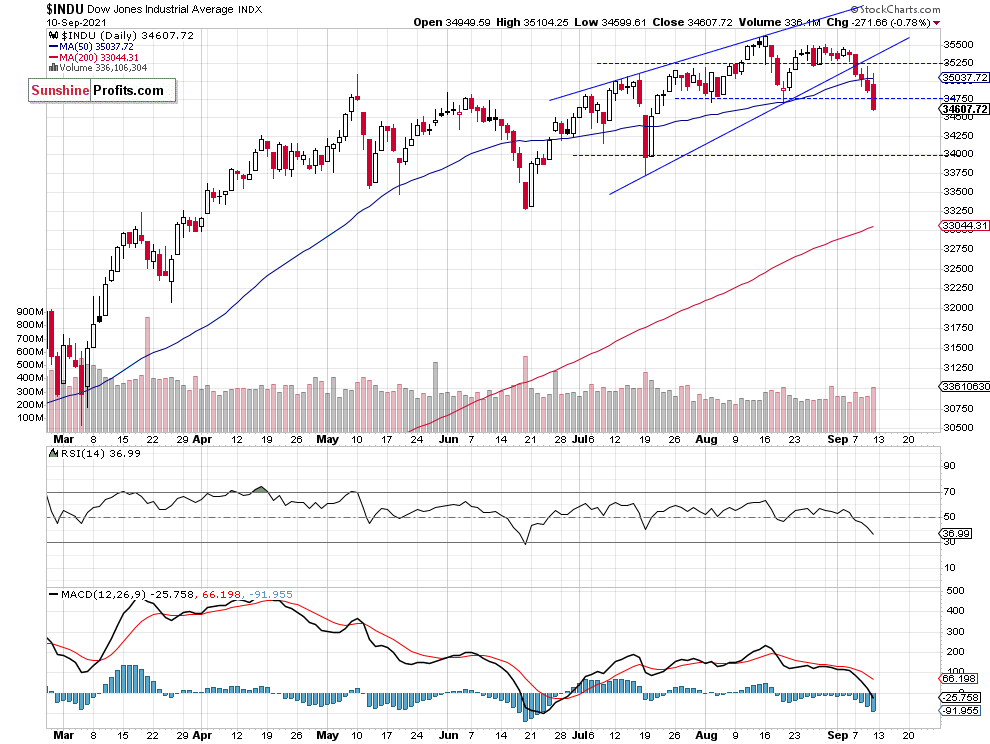

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index broke below a potential two-month-long rising wedge downward reversal pattern last week. It remained relatively weaker, as it didn’t reach a new record high like the S&P 500 and the Nasdaq. The support level is now at around 34,500 and the near resistance level is at 34,750, marked by the recent support level, as we can see on the daily chart:

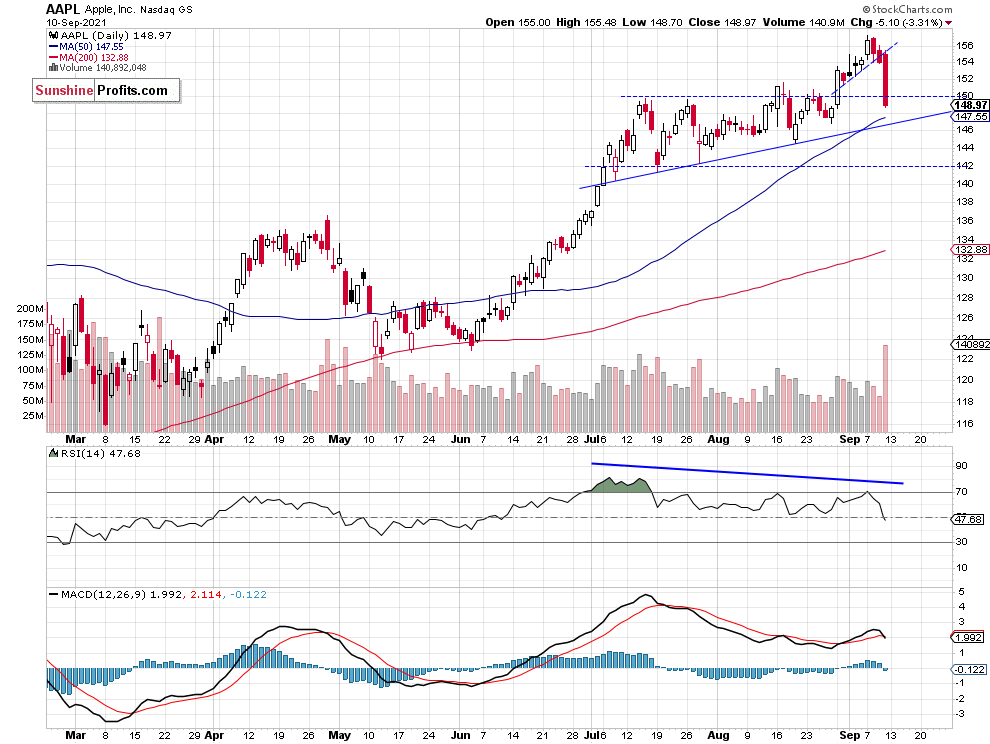

Apple’s Bull Trap

Apple stock weighs around 6.3% in the S&P 500 index, so it is important for the whole broad stock market picture. Almost a week ago on Tuesday it reached a new record high of $157.26. Since then it has been declining. So it looks like a bull trap trading action. On Friday the stock accelerated its downtrend following an unfavorable federal judge's ruling. We can still see negative technical divergences between the price and indicators and a potential topping pattern. The two-month-long upward trend line remains at around $145.0-147.5.

Our Short Position – Closer to Break-Even Point

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. The position was profitable before the recent run-up. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

On Friday, the S&P 500 index accelerated its short-term downtrend after breaking below 4,500 level again. For now, it still looks like a correction within an uptrend. Today we will most likely see a higher opening of the trading session – we may see another profit-taking action later in the day though.

The market seems short-term overbought, and we may see some downward correction soon. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market retraced more of its recent advances on Friday, as the S&P 500 index extended its decline below 4,500 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting a 5% or bigger correction from the record high.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500: Does It Have the Strength to Run Higher?

September 10, 2021, 9:38 AMStocks closed at a local low yesterday, but today the market will likely be trying to retrace the decline. So, is the S&P 500 heading lower soon?

The broad stock market index lost 0.46% yesterday as it got back to Wednesday’s local low. It even went below the 4,500 level! Last Thursday (Sept. 2) the index reached a new record high of 4,545.85. This morning it is expected to open higher. The index remains elevated after the recent run-up, so we may see some more profound profit-taking action at some point.

The nearest important support level of the broad stock market index remains at 4,490-4,500, and the next support level is at 4,465-4,470, marked by the previous Thursday’s low. On the other hand, the nearest important resistance level is at 4,550. The S&P 500 bounced from its four-month-long upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Dow Jones Extended Its Short-term Downtrend

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index broke below a potential two-month-long rising wedge downward reversal pattern this week. It remains relatively weaker, as it didn’t reach a new record high like the S&P 500 and the Nasdaq. The support level is now at around 34,750 and the near resistance level is at 35,000, as we can see on the daily chart:

Apple Retraced the Recent Advance

Apple stock weighs around 6.3% in the S&P 500 index, so it is important for the whole broad stock market picture. On Tuesday it reached a new record high of $157.26. Since then it has been declining. We can still see negative technical divergences between the price and indicators and a potential topping pattern. The two-month-long upward trend line remains at around $145, and the nearest important support level is now at $150-152.

AAII’s Sentiment Is Less Bearish

On Wednesday we’ve got the latest reading of the American Association of Individual Investors Sentiment Survey. There was a relatively big decline in bearish sentiment last week and an accompanying drop of neutral votes. So, individual investors are clearly less bearish right now, and that may be another sign of a topping action of the stock market. (chart by courtesy of http://www.aaii.com)

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500: Be Sure to Look Closely at the 4,500 Support Level

September 9, 2021, 9:12 AMAvailable to premium subscribers only.

-

S&P 500: More Short-Term Weakness Despite Tech Rally?

September 8, 2021, 9:31 AMStocks backed off from last week’s high yesterday, as investor sentiment worsened following Friday’s jobs data. But more downside may be coming.

The broad stock market index lost 0.34% on Tuesday (Sep. 7), as it bounced from the resistance level of around 4,550. Last Thursday (Sept. 2) saw the index reach a new record high of 4,545.85. This morning the market is expected to open virtually flat. However, it retraced the overnight decline.

The index remains elevated after the recent run-up, so we may see some more profound profit-taking action at some point.

The nearest important support level of the broad stock market index remains at 4,500, and the next support level is at 4,465-4,470, marked by the previous Thursday’s low. On the other hand, the nearest important resistance level is at 4,550. The S&P 500 bounced from its four-month-long upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Continues to Climb Along the Trend Line

The S&P 500 index remains close to its almost year-long upward trend line. The nearest important medium-term support level remains at 4,300, as we can see on the weekly chart:

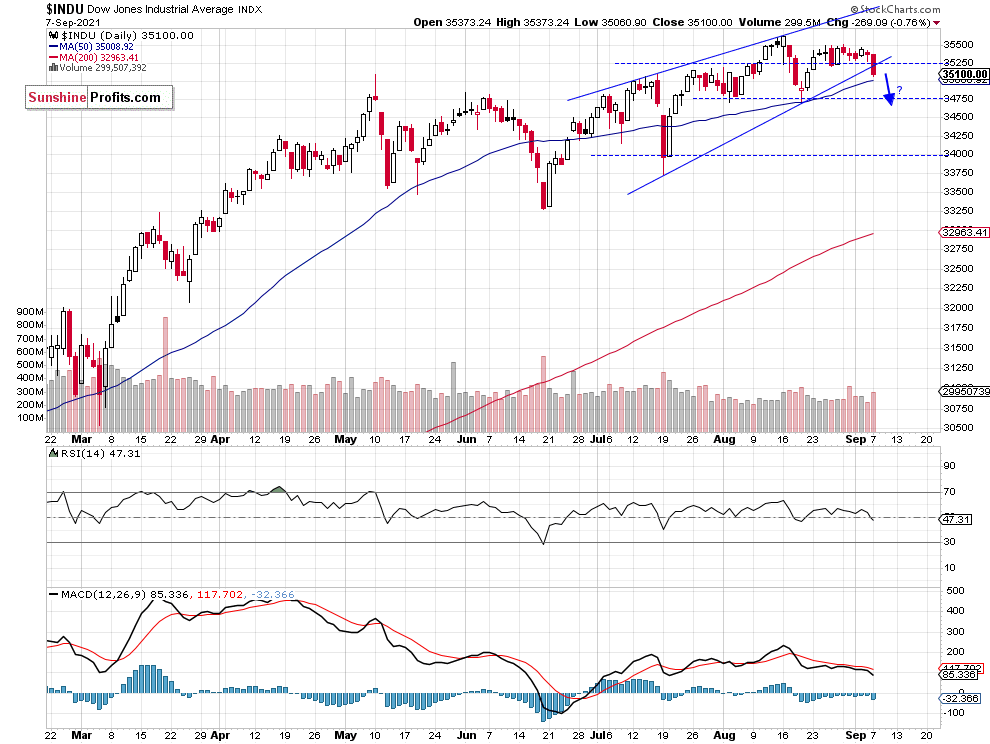

Dow Jones Broke Down

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index broke below a potential two-month-long rising wedge downward reversal pattern yesterday. It remains relatively weaker, as it didn’t reach a new record high like the S&P 500 and the Nasdaq. The support level remains at around 35,000, as we can see on the daily chart:

Apple Reached Yet Another Record High

Apple stock weighs around 6.3% in the S&P 500 index, so it is important for the whole broad stock market picture. Yesterday it reached a new record high of $157.26. We can still see negative technical divergences between the price and indicators and a potential topping pattern. The two-month-long upward trend line remains at around $145, and the nearest important support level is now at $150-152.

Is Short Position Still Justified?

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. The position was profitable before the recent run-up. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index remains relatively close to its last week’s record high of 4,545.85. However, we can see some short-term profit-taking action, although yesterday’s decline has been stopped by the relatively strong tech sector. Today we will most likely see a neutral opening of the trading session followed by another profit-taking action.

The market seems short-term overbought, and we may see some profit-taking action soon. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market extended its advance last week, as the S&P 500 index broke above the 4,500 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting a 5% or bigger correction from the new record high.

As always, we’ll keep you, our subscribers, well-informed.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500: It’s a Week-Long Consolidation Already!

September 7, 2021, 8:11 AMAvailable to premium subscribers only.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM