-

S&P 500 Bounced, But It’s Not Out of Woods Yet

August 20, 2021, 9:20 AMAvailable to premium subscribers only.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500 Back Below 4,400. Dip to Buy or a New Downtrend?

August 19, 2021, 9:30 AMStocks sold off yesterday as the fear of Fed tapering grew. Monday’s run-up was definitely a bull trap, and our short position is profitable now.

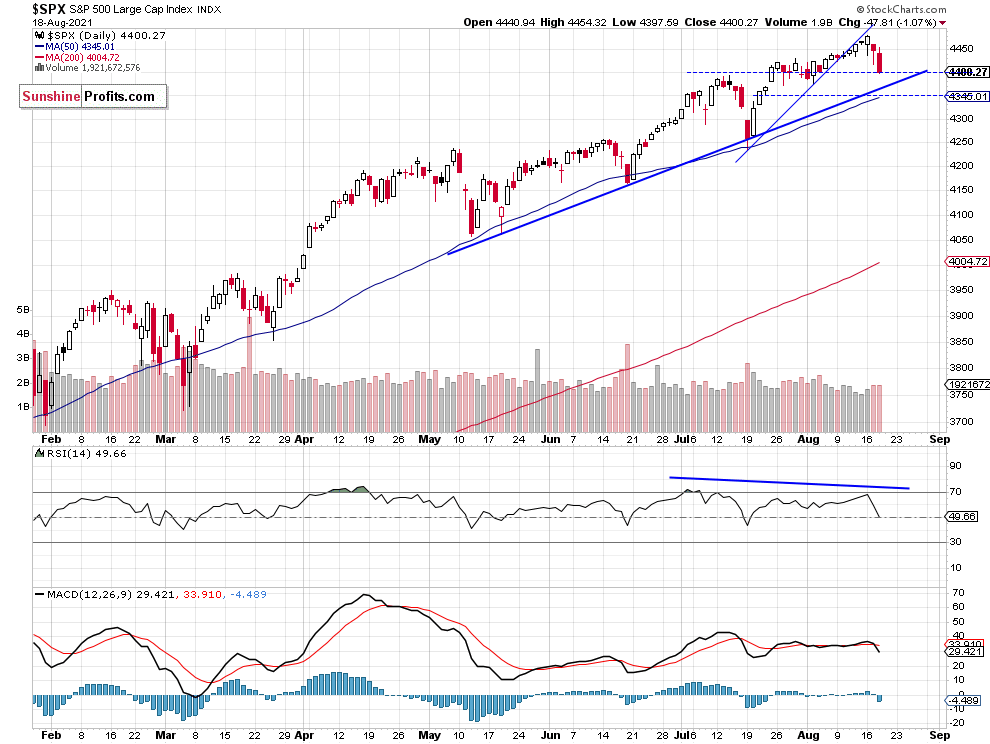

The S&P 500 index lost 1.1% on Wednesday and the futures contract continued selling off overnight. The index will most likely break below its late July consolidation and the support level of 4,370 this morning. However, it may get near a short-term bottom, as it gets closer to the 4,350 level. It’s the nearest important support level, marked by the three-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Profitable short position

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened our short position on Thursday a week ago at the level of 4,435. The position is profitable, but we will wait for more downside movement, as there have been no confirmed short-term positive signals so far. If the market extends the short-term decline, we will move the stop-loss level lower (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index got back to the 4,400 level yesterday following the Fed minutes release, among others factors. The market is expected to extend the decline this morning but it’s also likely that it will reach a short-term bottom. Thus, we may see an intraday upward correction.

Here’s the breakdown:

- The market reversed its short-term uptrend on Tuesday.

- Our last Thursday’s speculative short position is now profitable.

- We are expecting a 5% or bigger correction from the current levels.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500: Is a Dip Coming?

August 18, 2021, 12:15 PMAvailable to premium subscribers only.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

Was Yesterday’s Rally in S&P 500 a Bull Trap?

August 17, 2021, 10:25 AMAvailable to premium subscribers only.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

-

S&P 500: Is Today’s Low Opening Implying a Ride Downward?

August 16, 2021, 10:01 AMAvailable to premium subscribers only.

Today's premium Stock Trading Alert includes details of our trading position. Interested in more exclusive updates? Join our premium Stock Trading Alerts newsletter and read all the details today.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM