-

The SPX Chart Isn't as Spooky As It Looks Like

October 29, 2020, 10:42 AMTuesday's missed opportunity brought about a strong down day yesterday. S&P 500, oil, and even copper weren't unscathed. Let's check the pre-elections 2016 analogy, and more clues so as to see how this week's jitters compare to the past.

Doom and gloom? Yesterday, I answered that on a daily basis, maybe. So, is some dawn, false or real, on the horizon for stocks?

S&P 500 in the Short-Run

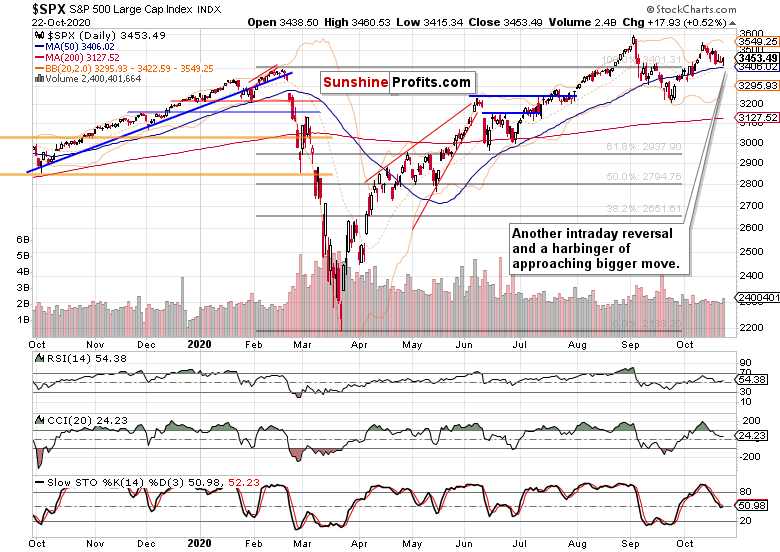

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

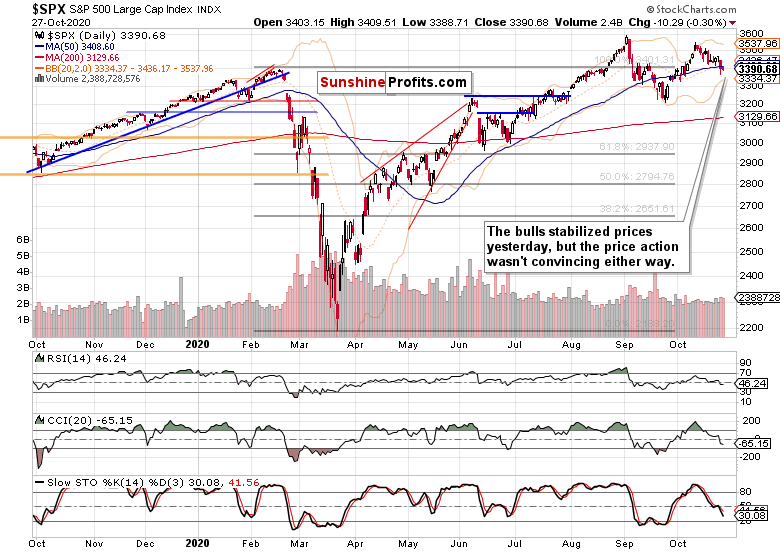

Tuesday's daily consolidation gave way to a renewed downswing yesterday – such is the conclusion the above chart gives. A new downtrend or volume spike at the bottom – let's head to other charts to check the odds.

Credit Markets’ Point of View

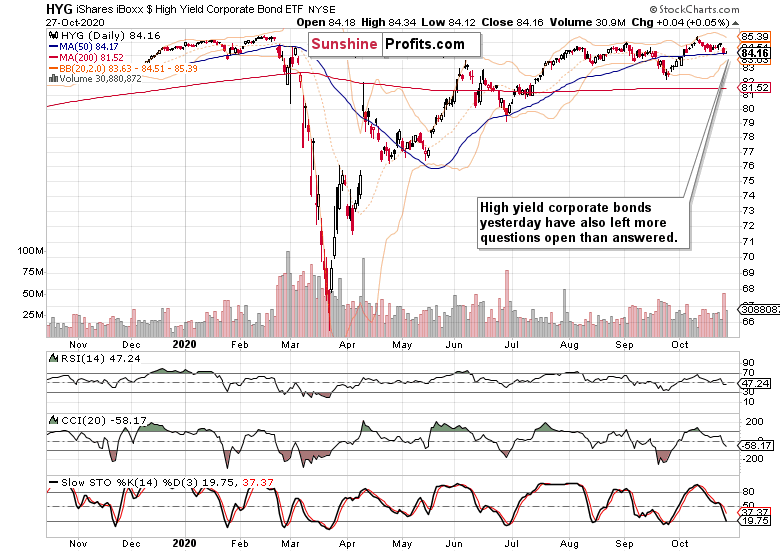

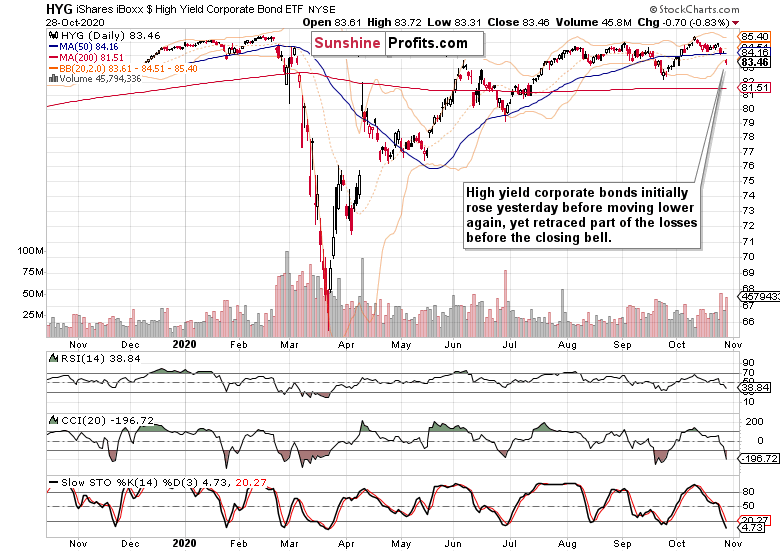

High yield corporate bonds (HYG ETF) plunged yesterday, but the intraday price action offers a glimmer of hope as the bulls didn't give up as easily as over in stocks.

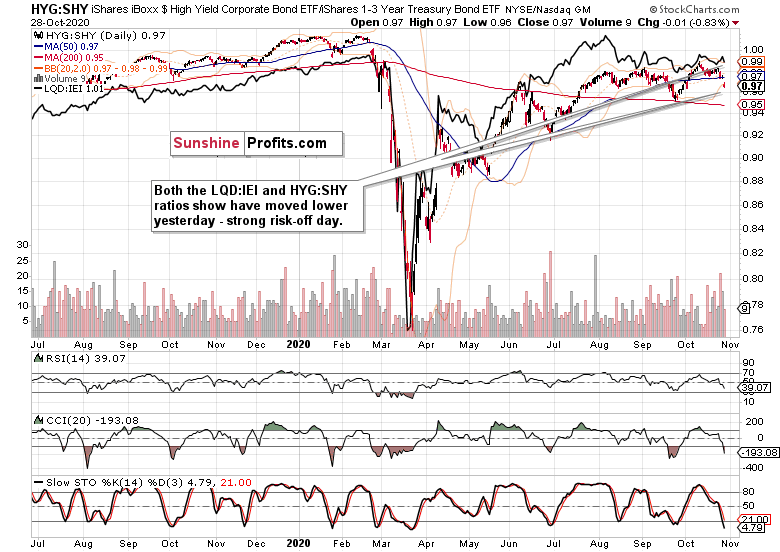

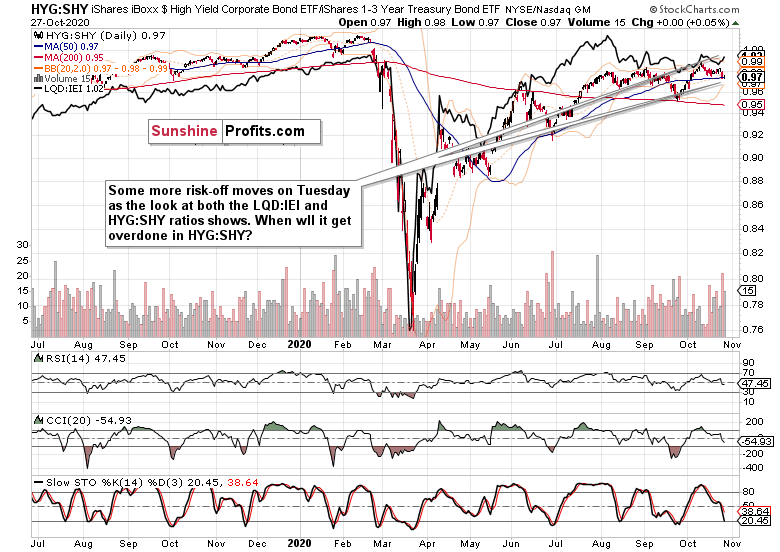

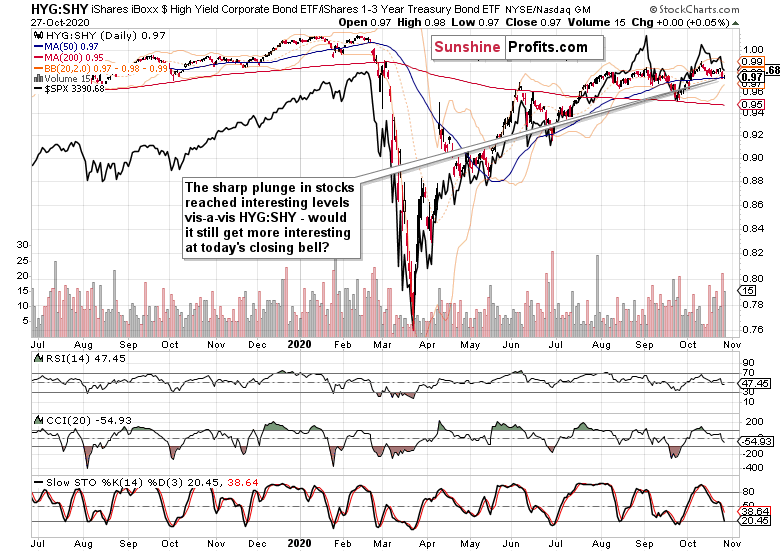

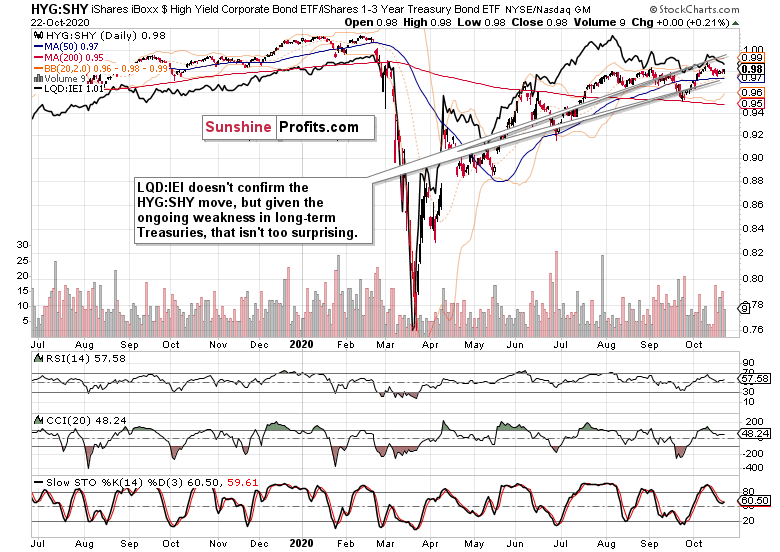

High yield corporate bonds (HYG ETF) plunged yesterday, but the intraday price action offers a glimmer of hope as the bulls didn't give up as easily as over in stocks.Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – reflect the down day across the board yesterday. Yet, it isn't as bleak if coupled with the below look at long-term Treasuries (TLT ETF).

Almost an intraday reversal in TLT, and a down day in TIPS (TIP ETF). Is there a turn to risk-on on the horizon? However fledgling one – I look for the next week to be better than this one, for all the fundamental reasons.

Market Breath, Volatility and Technology

The advance-decline line has sure taken a plunge, and the bullish percent index shows that the bulls are likely to step in close to the 50 level – just as in June, July or September. Unless the market character has changed – and I see nothing to justify calling for that right now.

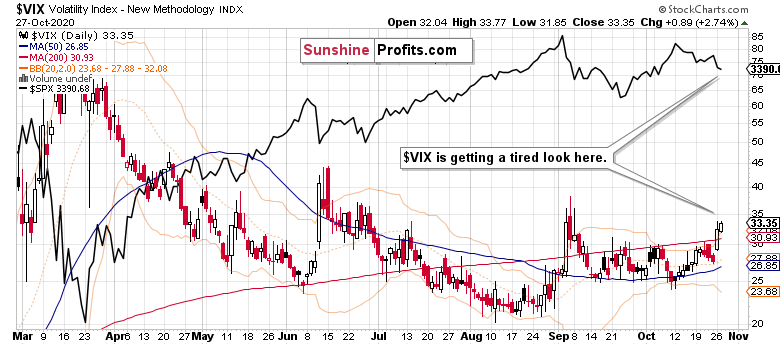

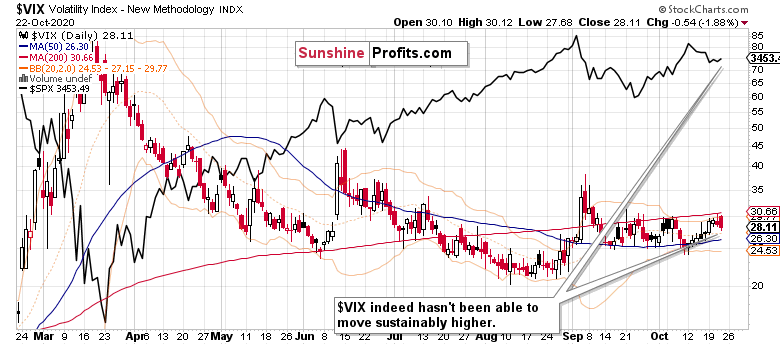

Instead of reversing, $VIX overcame the early September highs. How much of that action relates to elections, and how much to corona repercussions? It's easy to get scared if you look at what's happening over at Europe. A cynical view would be though that the seasonal flu is done this year, now that the deaths are classified / incentivized to be classified as corona. But the point is what the state response would do to the economy, and that isn't a good prospect.

Technology (XLK ETF) plunged, and so did semiconductors (XSD ETF) – but the latter are trading well above their September lows. That's a bullish divergence – one of the many reasons why I think that tech would move higher instead of much lower next.

Currencies Weigh In

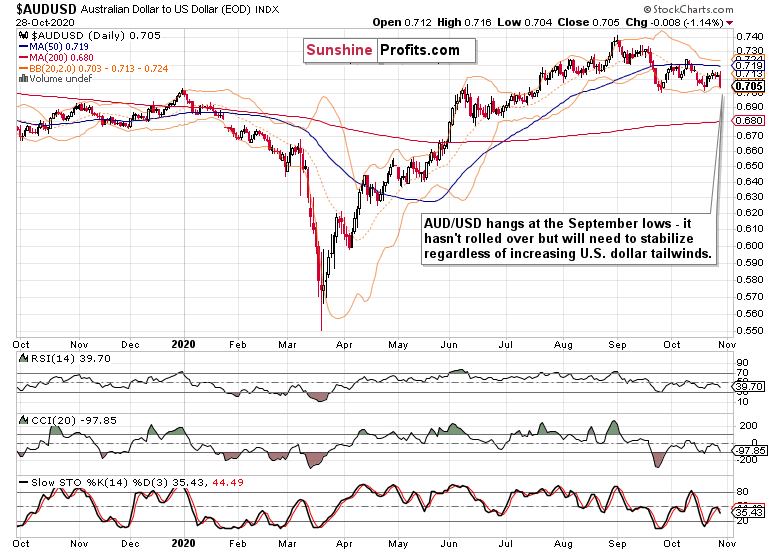

The Australian dollar isn't acting too weak – take away yesterday's session, and it's been quite resilient. Unless it clearly breaks below 0.7000, its medium-term outlook would remain sideways to higher. The present days' dollar resilience though favors headwinds here too – headwinds, not a trend reversal.

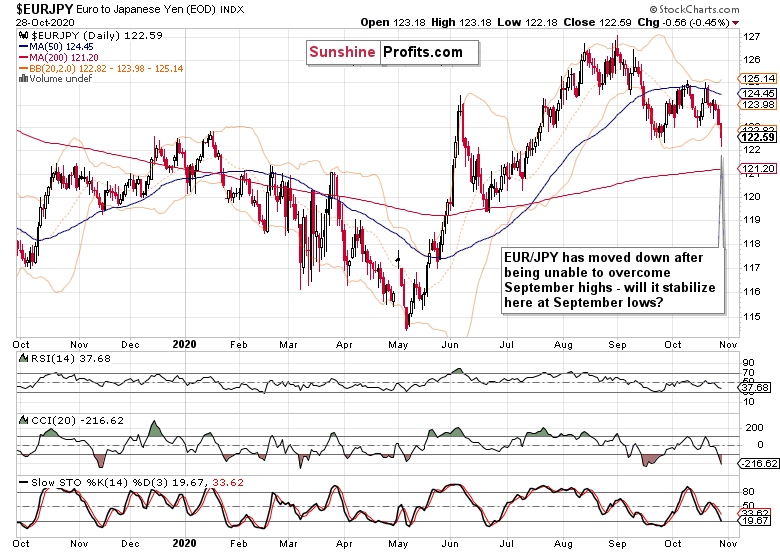

Given the European situation, the $EURJPY could have been doubting the economic recovery a lot more. While the pair's short-term dynamic is nothing to call home about, I view it as a regular consolidation, as no disaster.

Summary

Summing up, stock bulls have an opportunity to repair some of yesterday's damage, and create at least upper knots as was the case back in 2016. First, slowing down the decline, and then probing to go higher. Credit markets are offering signs of an impending turnaround, and technology shows that the bulls can prove themselves. Today's Big Tech earnings could easily be the story of sectoral turnaround. As for the dollar, there is no denying that it's most of the time a headwind for stocks, yet both the presented pairs paint no catastrophic picture. The pre-election volatility could easily turn on a dime, leaving the impression of us going through a springboard in the making. The medium-term bullish trend simply hasn't changed.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading StrategistSunshine Profits: Analysis. Care. Profits. -

Where Is the Pre-elections SPX Bottom?

October 28, 2020, 9:57 AMStocks could have rebounded yesterday, but didn't – the daily action didn't bring too many telling news. And in today's premarket, stocks are under pressure again – well below the 3400 level. Indeed they are not out of the woods in the short run as I telegraphed yesterday – and in today's analysis, I'll lay out what I consider an inspirational scenario for the days ahead.

What about the narratives? Corona is back in the spotlight, especially in Europe where lockdowns are back on the table in France and Germany – not to mention protests in Rome or London – putting pressure on cyclicals. Big Tech is on the defensive over its role in Biden corruption news suppression. And stimulus talks are (predictably?) nowhere near their close.

Doom and gloom? On a daily basis, maybe.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The sellers didn't get far yesterday, but neither did the buyers. The daily volume remained elevated, and no clear conclusion as to the coming days trading, can be made based on this chart alone.

The Feb highs are being challenged – but what could the elections dynamics of the coming days bring next?

The pointer on the above chart marks the last few days before the 2016 elections. Notice the steady but slow deterioration before, the large red candle with a long lower knot, decreasing momentum with quite a few false intraday dawns, and finally an upswing that would have largely left you in the dust weren't you onboard already.

We're facing a similar situation – the message of Biden's likely win is being hammered on regardless of the mounting scandals. The country is polarized, with core supporters of both candidates expecting their camp's win. Until the votes are counted (and the accompanying matters such as mail-in ballots sorted out), it's still Trump vs. the Establishment.

And given the corona resurgence and still no stimulus, stocks are doing rather well in my view. Over the pond, they're suffering larger declines as the $SPX:$DAX ratio shows. Let's check whether some flight to the (perceived U.S.) safety is going on.

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) didn't recover much lost ground really, and still remain in a perilous position. Relatively speaking though, they are trading much higher above their September lows that the S&P 500 does.

TIPS though have recovered just as smartly as investment grade corporate bonds (LQD ETF) did. The impression still remains one of an orderly risk-off episode, and not of a start of another major or minor crash.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved in line with the regular risk-off hypothesis.

Stocks have given up most of the high ground gained vs. the HYG:SHY ratio, and their relative valuation stemming from this chart, appears appealing enough already. The question remains whether we have seen the HYG bottom already, which doesn't appear to be the case yet.

Volatility and the Force Index

How far is an intraday reversal in $VIX? Monday's upper knot hasn't been overcome yesterday, and I am not betting on a continuous resurgence in volatility here. Much depends upon how fast the elections dust settles.

The Force index is showing the dicey position the $SPX is in. It's already negative (not higher after yesterday's lackluster trading), while the Bollinger Bands still remain quite tight – that's quite a potential for some more downside in the short run. Will it all happen over this week?

Summary

Summing up, stocks missed to opportunity to recover some lost ground yesterday, and the key 3400 line is history now, but the Russell 2000 is holding up quite well. The selloff in oil, gold and silver illustrates the headwinds stocks are (and will be) facing today. Is the risk-off turning into an elections-enhanced panic? Both Treasuries and the dollar could have been rising some more if that were the case (wasn't the dollar sold a bit too indiscriminately before the elections?) – I look for the post-election period to be kinder to equities. Will they indeed look past the turmoil that some on the Left have been promising should Biden lose?

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

No Point to Jump the Gun in Stocks and Sell

October 27, 2020, 7:38 AMPrevious Monday, stocks declined as well – yesterday is thus no precedent. Yet both cases have important differences – a week ago, the volume wasn't as high and there was no lower knot. Yesterday, the bulls stepped in and erased almost half of intraday losses.

Does it mean they're out of the woods already? I am not so sure about the short run – after all, the solidly above 3400 levels in the S&P 500 futures were given up, and the 3400 which I see as key, is being probed from below. Thus far successfully as stock futures trade at over 3405 as we speak.

But a lot more has to happen, and ideally today or shortly in order to prove my yesterday's observations as correct in the mid-term:

(…) Elections are here in two weeks, and the S&P 500 keeps being resilient – above 3400. It doesn't matter right now that I looked (and look) for it to be so (though should the 3400 area get broken, the resultant selloff would be likely sharp), but it's nothing short of a demonstration of the markets' collective wisdom given that more than half of Americans are preparing for a civil war.

This is indeed a stark choice the nation faces, and against the many polls, I'm making it clear today that I expect a Donald Trump landslide. Yes, this has serious and positive implications for the stock market. Can you imagine how the capitalistic system would take to Biden's increased social spending, Obamacare expansion, more progressive tax code, $15 an hour federal minimum wage or the Green New Deal?

I think that stocks anticipate the incumbent's win.

So, how dicey is actually the short-term outlook?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The stabilization as seen on the daily chart, gave way to heavy selling. Is that a disaster? I don't think so. In the second half of September, there was a similar day with a long lower knot too.

And what happened then? A retest combined with a slight undershoot of the preceding lows – and then a rebound that hasn't looked back since. Such a scenario would fit the post-election rally from the timing point of view as well – approximately.

Credit Markets’ Point of View

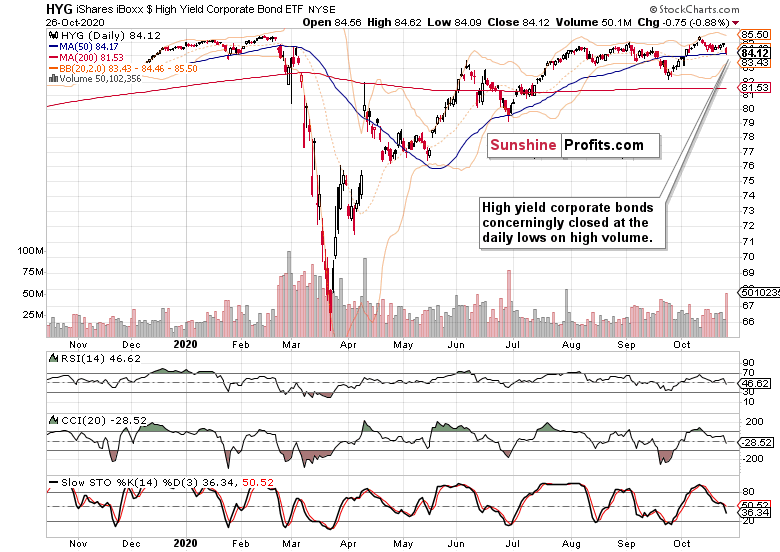

High yield corporate bonds (HYG ETF) declined, and on extraordinary volume. Closing near the daily lows – but isn't that a puke point similar to end of June instead? This could very well be true, so let's see further whether a daily risk-off period hypothesis holds water or not.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved as if it was indeed a strong risk-off day only. I am not jumping to conclusions whether it's a daily occurrence or a turnaround – I'm strongly leaning towards the former and discounting the latter.

High yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio have weakened, but it's still in the context of a daily decline only. This is not a rollover, it doesn't look like one yet. Far from it, and I look for the ratio to support the stock upswing as we go.

The Dollar

While long-term Treasuries (TLT ETF) have risen sharply, the dollar can't seem to shake off its blues while the precious metals are holding up fine, and copper is readying another move higher. These factors point to a kneejerk reaction yesterday, and favor a modest S&P 500 recovery today.

Summary

Summing up, stocks declined sharply yesterday, but I still see the move as temporary – the 3400 line that I see as critical in the short-run, has practically held. The Russell 2000 erased even more of its intraday losses than the 500-strong index, making me think that the time for the bulls to respond, is approaching.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stocks Are Like a Freight Train Gaining Speed

October 26, 2020, 10:28 AMA week ago, the stock bulls stumbled – and could have been forced on the defensive quite some more, yet the benefit of the (medium-term) doubt stayed with them. The short-term caution that still warranted staying long, proved to be the right decision as the medium-term outlook hasn't changed one bit.

That reminds me of my favorite resilience maxim: "Lose not faith; but when you become down, or get frustrated on something you can't change, work on something you CAN change. Start small, and you will work forward to larger things. Keep your faith, your family, and your hope!"

Beautiful inspiration along the lines of Franklin Covey's "Focus your energy and attention where it counts, on the things over which you have influence. As you focus on things within your Circle of Influence, it will expand."

I agree wholeheartedly with both empowering expressions. It makes no sense to remain mired when you see that such is the faithful expression of the status quo. So, have the stock bulls expanded their circle of influence on Friday just as successfully as they did throughout the week?

I think so they did – regardless of the today's premarket visit of the 3420s area. Elections are here in two weeks, and the S&P 500 keeps being resilient – above 3400. It doesn't matter right now that I looked (and look) for it to be so (though should the 3400 area get broken, the resultant selloff would be likely sharp), but it's nothing short of a demonstration of the markets' collective wisdom given that more than half of Americans are preparing for a civil war.

This is indeed a stark choice the nation faces, and against the many polls, I'm making it clear today that I expect a Donald Trump landslide. Yes, this has serious and positive implications for the stock market. Can you imagine how the capitalistic system would take to Biden's increased social spending, Obamacare expansion, more progressive tax code, $15 an hour federal minimum wage or the Green New Deal?

I think that stocks anticipate the incumbent's win. Of course, volatility can and likely will increase as we approach those key days, but a lot depends upon the instrument that you're using to trade the S&P 500 moves.

The full S&P 500 futures contract might be too strong a proposition for some of you, but with e-mini S&P 500 contracts, a 1-point S&P 500 move translates into merely $50, which is manageable for most accounts. And if you're willing to merely dip your toe and no more, there is micro e-mini S&P 500, where a 1-point S&P 500 move only means $5.

This way, you can easily see what my (very flexible in that I am not too shy to close the position way earlier as you know) trade parameters (namely the stop-loss) would do to your trading account if hit, and risk only those few percent of your equity that you're comfortable with – per each trade taken.

That's the right way to go about it, the way I do it before each move – planning every single trade from the full trading account's perspective. Conscientious money management comes first.

All right, that's the game plan for this trade – and for the trading marathon in full.

S&P 500 in the Medium- and Short-Run

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

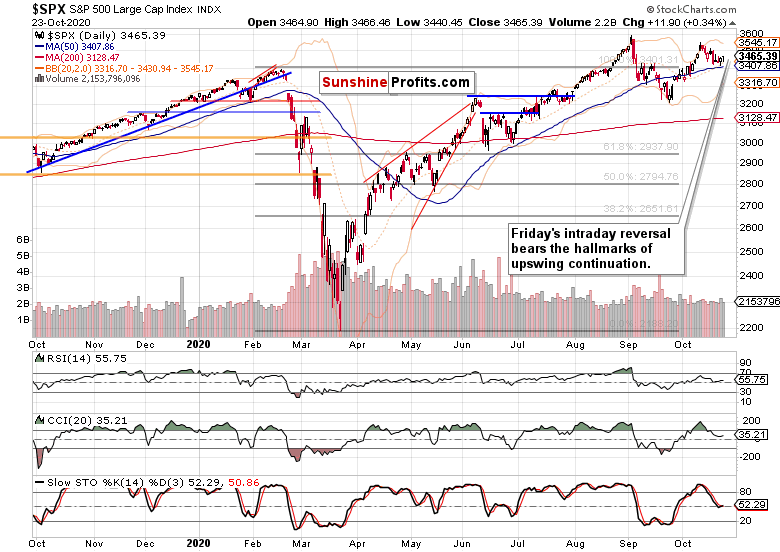

On Oct 19, I disputed the notion of having seen a reversal. And stocks are back at the upper border of the rising black trend channel. I continue to think their consolidation goes on – the weekly indicators don't look problematic here at all.

The daily chart refines the picture of a very slow, very measured stabilization with an upward bias. On Friday, the bulls staged yet another successful intraday reversal, and I see the upswing as more likely to continue than not.

Credit Markets’ Point of View

My Friday's observations still keep holding true after the closing bell:

(..) High yield corporate bonds (HYG ETF) went up, just as could be expected during a stock market upswing. Not stealing the spotlight on its own, but a solid performance nonetheless. Yes, the very short-term sign of willingness to go higher and take stocks along was indeed there.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – were in tune on Friday. On one hand, long-term Treasuries (TLT ETF) rose, and on the other hand, the USD Index fell. Overall, my interpretation is still risk-on.

International Risk Appetite

Comparing the S&P 500 to German DAX is a very helpful tool, revealing that U.S. stocks are in high demand, relatively speaking. That's little surprising given the economically self-defeating European corona measures (have you noticed how well the Red states, the South such as Georgia etc rebounded when they left the lockdown mentality behind?) and weakening eurozone indicators.

Take a look also at the beginning of September, which goes to show how overdone the U.S. selloffs were. While the S&P 500 isn't dirty cheap right now, it'll likely become more pricey than overseas markets as we go.

Sectoral View of the S&P 500

Technology (XLK ETF) is likely to move higher next – looks primed to do so. I like those lower knots and declining volume.

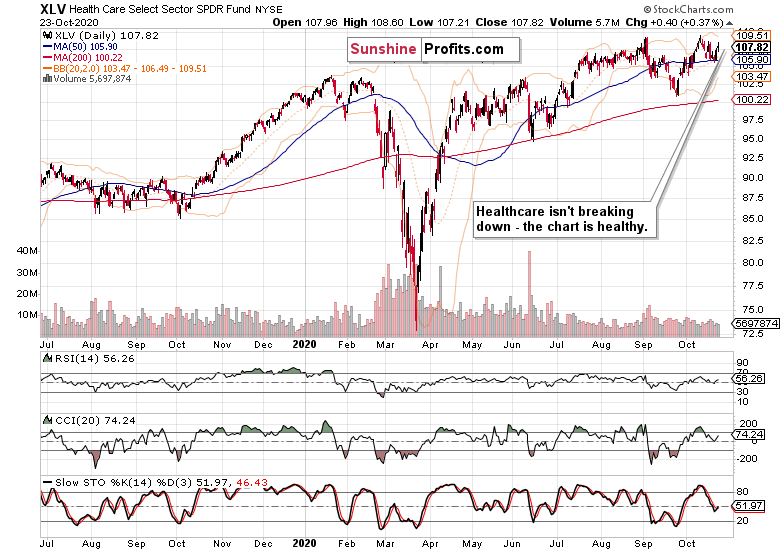

I'm keeping a close eye on healthcare (XLV ETF) too – and the sector is consolidating with a bullish bias, not too far from its highs.

Financials (XLF ETF) are coming back to life, and the price action just illustrates cyclicals are likely to do better than they have done so thus far.

Summary

Summing up, the $SPX tug of war in the short run keeps favoring the medium-term probabilities that see the bulls emerging victorious. The stimulus saga is closer to its end than its beginning, making the bearish case for a short-term move down in stocks less and less probable. The markets are looking past, anyway. Credit markets, precious metals, copper and technology are gearing up for an upswing, while I see signs of budding rotation into many other sectors – the stock bull run remains amply supported.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Bulls Are On the Move – the Waiting Was Worth It

October 23, 2020, 9:26 AMThe bulls pushed higher already yesterday in the end, nicely illustrating that standing aside in this market is more dangerous than withstanding its intraday fluctuations. That's the key message of my today's analysis – in similar times, keep your eyes on the big picture.

There are times to focus on the big momentum moves, and other periods when being nimble is the call of the day. Bull or bear, I've applied a good chunk of such repertoire of mine in your favor since February 2020, grabbing a grand total profit of 931 points in S&P 500 futures. That's almost 27% of the full 500-strong index value in a little over 8 months!

Zooming out, the great scheme of things unequivocally speaks in favor of more fiscal and monetary support for the economy, and given the autumn dynamics I discussed yesterday:

(…) Bottom line, the markets are justifiably expecting a deal around the corner. I don't see them throwing a hissy fit as they did in 2016 – that notion was invalidated for me with the arrival of early September storms. Throughout October (…), I've been calling for a mildly positive month – and here we are, that's the status currently.

Coiled spring once the uncertainties are removed, anyone?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Finally, yesterday's price progress hasn't been lost, and the bulls staged a successful intraday reversal. The upper knots whose tipping hand I mentioned yesterday, have indeed indicated the upcoming move. What I particularly like about yesterday's session, is that the volume went up, which bodes well for the coming day(s).

Credit Markets’ Point of View

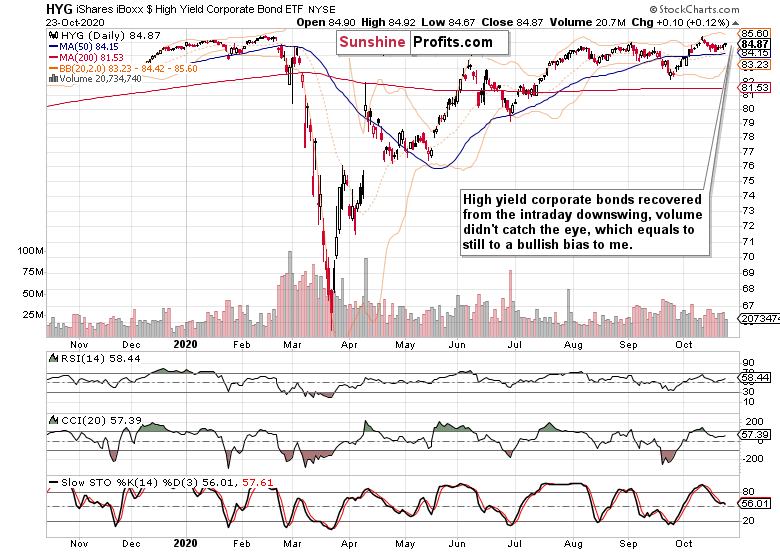

High yield corporate bonds (HYG ETF) went up, just as could be expected during a stock market upswing. Not stealing the spotlight on its own, but a solid performance nonetheless. Yes, the very short-term sign of willingness to go higher and take stocks along was indeed there.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved again in different directions. But I still ascribe the LQD:IEI move to weakening Treasuries (long-term ones, TLT ETF).

The high yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio reveals that we're in a risk-on environment, regardless of where stocks trade at this moment – they have the power to catch up vigorously once uncertainties get removed.

Volatility and Some Key Metals Ratios

Volatility that I doubted to rise much and sustainably, is heading lower again. The put/call ratio moved higher as the bears became more vocal. Unrightfully vocal, in my view – unjustifiably, because I see prices as moving higher next.

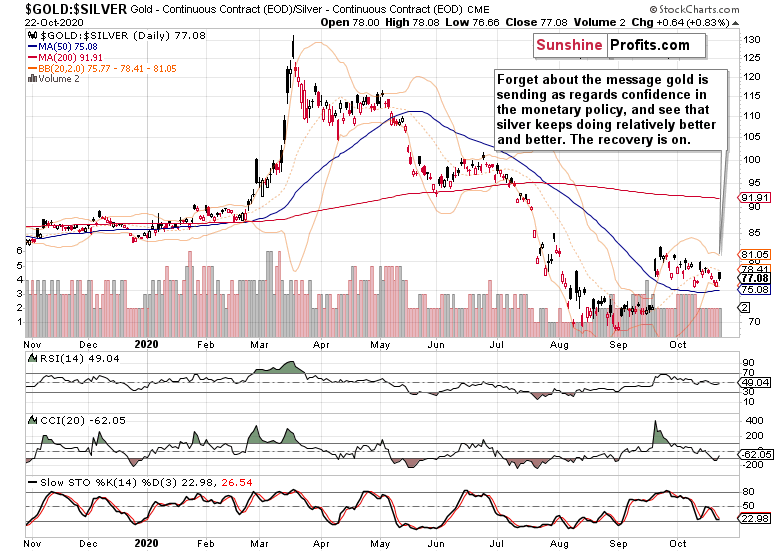

The copper-to-gold ratio speaks in favor of the economic recovery. The sensitive red metal is going higher, outperforming the stalwart king of metals. No small feat, no small feat.

The gold-to-silver ratio also confirms that we're in a recovery (I am not looking at the temporary weakness in Baltic Dry Index right now) – the white metal's posture is improving, both relatively and absolutely. More power to the stock bull run!

Summary

Summing up, the $SPX tug of war in the short run has taken a turn in favor of the medium-term probabilities that see the bulls emerging victorious. The stimulus saga is definitely closer to its end than its beginning, making the bearish case for a short-term move down in stocks less and less probable. The credit markets, precious metals, copper and technology gearing up for an upswing, continue supporting the bulls.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM