-

Go S&P 500, Go!

November 4, 2020, 9:48 AMI told you that stocks would rally on election news. I was clear that they aren't rolling over for a fall. Just look at the current S&P 500 futures quote (a bit over 3380) and the still unfolding White House drama. If stocks are refusing to move lower when the mainstream polling predictions got it all wrong again, what do you think they would do once the winner is clear?

Yes, I called for a springboard, for new highs and for finishing 2020 above the early September top. And in today's analysis, I'll dive into the elections aftermath – the market reactions are particularly telling not only as to what were the expectations in the first place, but where market participants' patience with the resultant fits lay.

Before first results were announced, the table was set the following way:

- The elections would determine the stimulus price tag and structure

- Trump's odds were improving throughout the day, but he was still an underdog

- The market wasn't (again) prepared to see him win

- Knowing the winner right after the election night was preferable to waiting and dealing with legal challenges to the voting process

- The bookies got it more right again, and so did stocks (FCX or KOL, the coal ETF especially)

- Lockdowns were not the driving narrative du jour

As the results came trickling in:

- No blue wave, which means no large stimulus bill

- S&P 500 sold off well below 3350

- Gold and oil were hit on the realization that Trump isn't down and out (I expect him to put up a fight – he can still win)

- Yes, there won't be a sugar high from a large stimulus, but his business and tax policies are much more supportive of the real economy than Biden's plans

- Sooner or later the market would come to realize that instead of the short-term disappointment in no quick fix

- Still on the night, Trump already claimed he won, sending markets into a tailspin

- This is where the above mentioned market realization comes – stocks, gold and oil all reversed higher, going right into the "uncertainties" undaunted and not blinking (that's my favorite way of dealing with stuff too)

- While the bookies hiked Trump's odds of winning, it won't be a smooth sailing ahead – I look for namely the Pennsylvania, Michigan and Wisconsin voting to be challenged, for obvious reasons (perhaps Nevada too)

- Should stocks continue on their sharp, ultra-sharp upswing today, they might give up part of their gains even before it comes to recounts (I wouldn't be surprised about the Rust Belt experiencing them really)

Let's not forget that the country is bitterly divided, and this election certainly won't unite it when this many mail-in ballots erase the solid voting day lead in battleground states. True, Democrats are more likely to vote by mail, but still, that leaves a bad taste in one's mouth.

But what about the stock prospects? My yesterday's words naturally still apply:

(…) The bar … is set tremendously low – be it in economic output or earnings expectations. Couple that with activist Fed and stimulus on the horizon – this mix can power stocks higher. I know perfectly well that the bears are often sounding smarter than the bulls but lasting pessimism isn't a hallmark of anything. Track the calls, follow the money generated this way – that's the true metric of success (thus far, I captured 931 points of S&P 500 closed profits since Feb 2020).

No, this is not a double top in S&P 500 – the governments have become way more inventive since the Great Depression (and unshackled from the gold standard or its attenuated forms), and thus I call that we won't experience as harsh (stock) crashes as we would otherwise have had if we weren't under a fiat currency regime where new money creation and its transmission mechanisms have become this easy and smooth).

Look, the most important question that investors and traders need to ask, is whether we're in a bull or a bear market. And looking at the position of various (50-day, 200-day) EMAs on different (monthly, weekly and daily) timeframes (or EMAs slope, perhaps even their ribbon), I say that this is a bull market – and such a 10% correction is to be bought, not sold and declared as a start of a new bear market.

I would even go as far as to tell that it's been historically right after corrections of similar magnitudes that we have seen solid gains next – of course, within the bull market context only. And I have not been proven wrong that we are in a bear market – and unless I am (hint – I don't expect that market character transition in 2020 at all), the gains from the upcoming $SPX move are more likely than not to be worth it.

Just look at the tech sector and semiconductors – they're turning higher with the latter leading the way. That bodes well for the 500-strong index.

Check, check, check. The upswings of yesterday and today have proven clearly that we're in a bull market. Even the tech has turned around yesterday finally, in what was otherwise a value-driven upswing.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Rising solidly on the day, is the briefest description really. Now, we have a completed analogy to the June double bottom, where the second one didn't really reach as low as the first one. I see stocks rising to new highs with some consolidation thrown in here or there for good measure.

Credit Markets and the Dollar

High yield corporate bonds (HYG ETF) were again strong on a daily basis – tellingly strong. The credit markets are clearly supporting the stock upswing to go on.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – keep trading in a risk-on mode.

Overlaying the $SPX and HYG:SHY ratio shows just how discounted stocks have become lately – and it also proved that getting shaken out of long positions would have been a very bad call indeed.

Long-term Treasuries (TLT ETF) declined in confirmation – again, there is no rush to safety or to raise cash.

The dollar completes the risk-on picture – not even the greenback caught a bid yesterday. While the move was sharp, and I am not looking for the world reserve currency to give up this easily, it still tells you about the prevailing direction of the markets, including this one.

Summary

Summing up, stocks are marching higher also a day after the elections that ended thus far without a winner. But it was the credit markets, precious metals, oil and copper that have paved the way for the S&P 500, and stocks indeed followed.

The elections-related volatility has thus been resolved with an upswing, and markets are happy with the amount of certainty they've been provided so far. Let the stock bull market run on – it's a question of time when the early September highs would be overcome.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

I Hope You Didn't Believe Any S&P 500 Double Top Callers

November 3, 2020, 10:24 AMDawn aka rise in stocks – right on cue. Will it turn out false, with stocks turning south and below the September lows? I don't think so – just as I wrote on Oct 26 in my article Stocks Are Like a Freight Train Gaining Speed, the parallel to 2016 is still intact today.

In yesterday's article S&P 500 Enters Turnaround Mode, I've recapped the facts:

- There won't be a stimulus deal before elections

- Fed stepped in and lowered the Main Street lending facilities' loan threshold from $250K to $100K, helping with the late-Friday stock rebound

- Trump isn't broadly expected to win

- The winner might not be known on Nov 03

- Stocks (FCX vs. ICLN lately – FRAK or KOL ETFs alone don't tell the full story) lean more favorably to Trump than the mainstream polls or even the bookies

- Lockdowns overseas are largely priced in

I've also argued earlier for the positive effect of removal of (some) election uncertainty. Yes, its effects have been harsh last week, exacerbated by the lockdown fears, which however ignore an important fact.

While Europe has effectively flattened the curve in spring, slowing down new cases (let's leave aside the non-reliability of PCR or antigen testing for a moment) to a trickle, back in the U.S. the flattened base was established at a much higher level – the plateau was and is beyond comparison for multiple reasons (some fast reopenings, Sunbelt surge, rioting across the large cities etc).

This makes Europe's casedemic explosion much easier to explain, and stands in stark comparison to no new "corona waves" in Sweden that just let it run its course earlier. Or take the similarly hands-off approach in Belarus with all the mass protests running for weeks since their presidential elections and see they're not dropping like flies. Apparently even the WHO is up to something by declaring that lockdowns just buy you time, delaying the inevitable – at tremendous economic and other costs.

Coronavirus is not the unknown unknown that it was back in February or March – the world is better equipped to deal with it now. It doesn't generate that amount of inordinate fear it did back then, as the below Google Trends chart shows. It's only when the economy voluntarily or involuntarily shuts down, that brings widespread suffering.

No, the fear lies elsewhere, and you for sure remember me talking about that the lockdown cure can't be worse than the disease (again, chart courtesy of Google Trends – please note the heavy regional focus: it's South Africa, India, UK, Australia and New Zealand that are more responsible for the current spike than Europe or U.S. in general).

Then, central banks around the world stand ready to support the national economies – and Australia just acted too. What will the Fed do on Thursday?

As regards fiscal policy, the markets are betting that the stimulus hurdles would be one way or another removed (this isn't about my Oct 26 call for Trump landslide or that he can pull another rabbit out of his hat like 4 years ago) – and thus stimulus would come. By the way, FCX rallied nicely yesterday while ICLN relatively lagged – the markets are leaning towards Trump some more in the final days (just as African Americans or Latinos did).

The bar for stocks is set tremendously low – be it in economic output or earnings expectations. Couple that with activist Fed and stimulus on the horizon – this mix can power stocks higher. I know perfectly well that the bears are often sounding smarter than the bulls but lasting pessimism isn't a hallmark of anything. Track the calls, follow the money generated this way – that's the true metric of success (thus far, I captured 931 points of S&P 500 closed profits since Feb 2020).

No, this is not a double top in S&P 500 – the governments have become way more inventive since the Great Depression (and unshackled from the gold standard or its attenuated forms), and thus I call that we won't experience as harsh (stock) crashes as we would otherwise have had if we weren't under a fiat currency regime where new money creation and its transmission mechanisms have become this easy and smooth).

Look, the most important question that investors and traders need to ask, is whether we're in a bull or a bear market. And looking at the position of various (50-day, 200-day) EMAs on different (monthly, weekly and daily) timeframes (or EMAs slope, perhaps even their ribbon), I say that this is a bull market – and such a 10% correction is to be bought, not sold and declared as a start of a new bear market.

I would even go as far as to tell that it's been historically right after corrections of similar magnitudes that we have seen solid gains next – of course, within the bull market context only. And I have not been proven wrong that we are in a bear market – and unless I am (hint – I don't expect that market character transition in 2020 at all), the gains from the upcoming $SPX move are more likely than not to be worth it.

Just look at the tech sector and semiconductors – they're turning higher with the latter leading the way. That bodes well for the 500-strong index.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The daily chart shows the rebound in progress. Turning around on Friday quite a bit above the September bottom, the stock bulls are on the move now.

Credit Markets and the Dollar

High yield corporate bonds (HYG ETF) were again strong on a daily basis – and even made a sizable spike, which is in my view indicative of where the markets truly want to go next – as in a path of least resistance.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – give appearance of risk-on moves to go on.

Long-term Treasuries (TLT ETF) are tellingly unable to spike – no rush to safety, no frantic panic to raise cash either. And inflation isn't sinking Treasuries either.

Let's take on the dollar now in the context of risk-on vs. risk-off assessment. If Treasuries didn't rise, the greenback could have stepped in – yet it didn't. Is it because the markets aren't taking risk-off trades seriously? Couple that with rising put/call ratio and increasingly vocal bears, and you get the point which way the boat is tilting more prominently these days. Time for a wildcard, for a surprise? I think so.

Key PMs and Commodity Ratios

If we were on the verge of a serious risk-off move, gold could be expected to spike relatively to silver. Or at least to be in a rising trend. No, there is nothing like that going on that would stop the ratio's gradual decline. That's quite a feat for the white metal, given the money printing support (and anticipated inflation tailwind) the king of metals is getting.

Even the gold miners to gold ratio isn't serious about any kind of breakdown here – and thus doesn't point at a bloodbath in metals ahead. That's another point against a heavy decline in stocks.

Copper to gold also shows that the red metal isn't under heavy selling pressure. That's a vote of confidence in the economic recovery to go on.

The oil to gold ratio is down, but hasn't taken a real beating. I take it as the markets not currently believing that we're on the cusp of another deflationary crash that would depress the oil prices as badly as in April.

Oil can be and really is volatile – and I am not taking lightly the weakening of Russian rouble that has been going on since June. For now though, I see a daily reversal candle pointing higher in the ratio yesterday, and $WTIC going up by a few percent today.

Regardless of all the green economy talk, the world still runs on oil largely – solar and wind can't fill in the void totally yet (California rolling blackouts, anyone?)

This chart presents the commodities' verdict on the S&P 500 future. With both copper to gold and oil to gold ratios holding as steady as they are, they both point to the overdone nature of the $SPX downswing in October, and favor the economic recovery – and by extension the stock bull market – to go on.

Summary

Summing up, stocks are marching higher on the election day, extending yesterday's gains. Both the credit market and commodities action points to the stock bull market continuation, and regardless of the uncertainties of the day, to higher prices ahead. I look for the elections-related volatility to be resolved with an upswing, and I've presented the case in the opening part of today's special analysis. Will the election results deal the markets as much certainty (and not a drawn-out battle) as they would and do anticipate?

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

S&P 500 Enters Turnaround Mode

November 2, 2020, 9:39 AMDespite the intraday back-and-forth trading, Friday wasn't shaping up to be the best S&P 500 day ever. The daily parallel to 2016 remains still intact though. Let's recap some facts:

- There won't be a stimulus deal before elections

- Fed stepped in and lowered the Main Street lending facilities' loan threshold from $250K to $100K, helping with the late-Friday stock rebound

- Trump isn't broadly expected to win

- The winner might not be known on Nov 03

- Stocks (FCX vs. ICLN lately – FRAK or KOL ETFs alone don't tell the full story) lean more favorably to Trump than the mainstream polls or even the bookies

- Lockdowns overseas are largely priced in

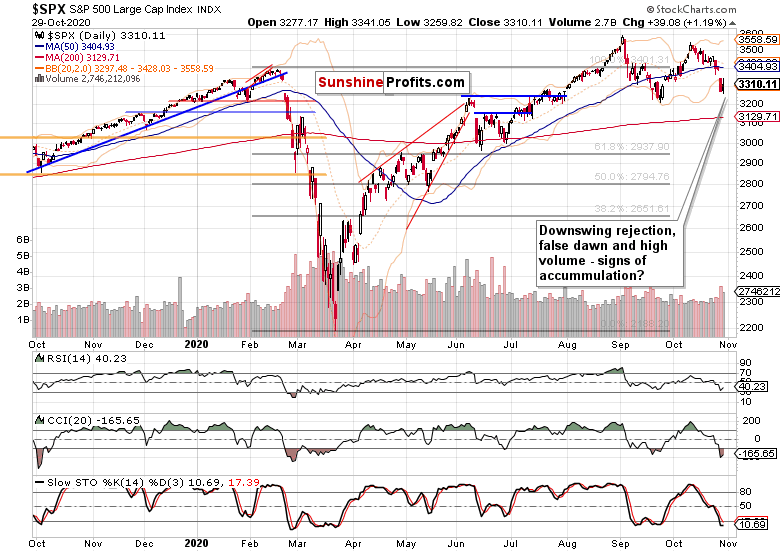

S&P 500 in the Long-, Medium- and Short-Run

I’ll start with the monthly chart perspective (charts courtesy of http://stockcharts.com ):

Tough, reversalish month, but the volume wasn't totally there, behind the move. The long-term picture isn't clear, and prices could either slide in November again, or gradually reverse higher.

Bad week, really bad week – on par with March. While the S&P 500 stopped at the lower border of the rising black trend channel, that's no guarantee it's the end station as there are two more trading days to the election results. But I don't view the revisit of Friday's lows as likely to happen tomorrow.

The daily chart shows the rebound off the 3220s lows, and the question remains how much of the turnaround spills over into Monday's session, or better yet how much of it sticks till the closing bell. I'm leaning towards a sizable upswing today.

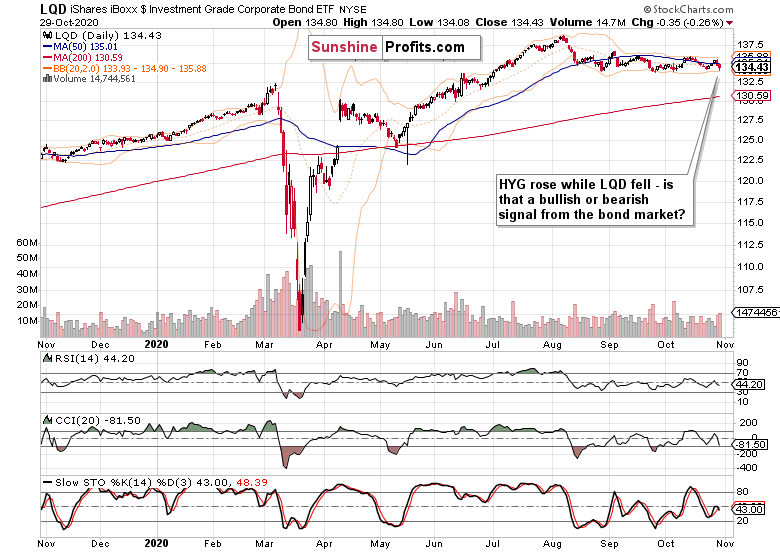

Do the credit markets bring in more clarity?

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) again showed daily strength – that's a very encouraging sign. Obviously, the rally needs to go on over the coming days to provide a more conclusive evidence, but the ball is in the bulls' court now.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – paint a picture of Friday being a risk-on day. Yes, risk-on regardless of the S&P 500 decline.

This mood was reflected in long-term Treasuries (TLT ETF) – they had a strong down day.

Also, the ratio of junk corporate bonds to all corporate bonds (PHB:$DJCB) doesn't agree with the stock market downturn, and actually points to the turn of fortunes.

Market Breath and Volatility

The advance-decline line could have taken a bigger hit, but didn't – rotation into value has been kicking into gear.

$VIX reversed also on Friday, but didn't actually decline. While that's inconclusive, it bears a certain promise to the coming days. Would it be clear enough to drive market volatility lower who won after Tuesday already?

Summary

Summing up, stocks again declined, and again provided signs of a turnaround that fits the 2016 analogy. Fleeting turnaround, or a springboard that would take on last week's index losses? That's a tough call but given how (unintentionally or intentionally – have your pick) wrong the media has been since 2016, and what I term as the rise of the shy Trump voter, I am leaning towards a post-election rally rather than slump continuation.

The medium-term bullish trend thus far hasn't changed, and it's bullish. The Fed is supportive, stimulus will come, and inflation isn't on the front burner. All bull markets are climbing a wall of worry, and this one is no exception.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Yes, the SPX Chart Doesn't Frighten Me

October 30, 2020, 10:49 AMAfter a spooky Wednesday, the awaited daily candle rejecting both the downswing and upswing, came – and with a noticeably longer upper knot. A sign of the mid-October downswing approaching its selling climax, or a daily pause along Tuesday's lines?

I'm leaning towards the former as I think that regardless of Pennsylvania, Wisconsin or North Virginia mail-in ballots late counting deadlines, the Rasmussen poll's pro-Trump 31% share of African American vote, would indeed give him a landslide – or a result sufficient enough to spark fireworks in the asset classes sold as hard as stocks.

Even the clean energy ETFs such as e.g. ICLN, have stopped their parabolic rise as the Biden family issues (if that's an appropriate and fitting word) rose to the fore. The Wisconsin early vote interim results shows clearly the momentum in my view.

It's my opinion that we're carving out a volatile local bottom, and that the post-election fireworks would show that betting on a decline extension, would have been a wrong choice.

But let's move to the charts next – do they hint at my interpretation of the narratives and 2016 lessons as correct?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Stocks didn't really want to decline much more yesterday as both daily candle knots show. That's why I am not all that much worried about the premarket downswing to almost 3225 – it's the rebound back to 3275 in the futures as we speak, that gives me increasing confidence that the bottom in this volatile week, is at hand.

And similarly to the March 23 bottom (which was when I closed the open short position) that was also accompanied by daily ups and downs, I see the current price action as reversing higher similarly sharply across the board – and that means both stocks and precious metals (suppressed GDX:$GOLD is a strong hint of confirmation to me).

But what about the credit markets?

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) showed daily strength – more so than they did on Tuesday as compared to the preceding day. Also the relative volume comparison says that yesterday's move is to be trusted more.

Investment grade corporate bonds (LQD ETF) weren't though as resilient yesterday, which would hint at still prevailing risk-off wind blowing.

But such a mood isn't reflected in long-term Treasuries (TLT ETF) – they had a strong down day.

Let's feature the dollar untraditionally within the credit market sections already, as this is where the risk-off move is visible the most. It took the dollar quite some time to move higher, and the bulls seem to be getting starting there.

The stocks to all Treasuries ($SPX:$UST) ratio is far from making a lower low, which means that the uptrend (rotations into stocks from government bonds) is alive and well, regardless of this week's moves.

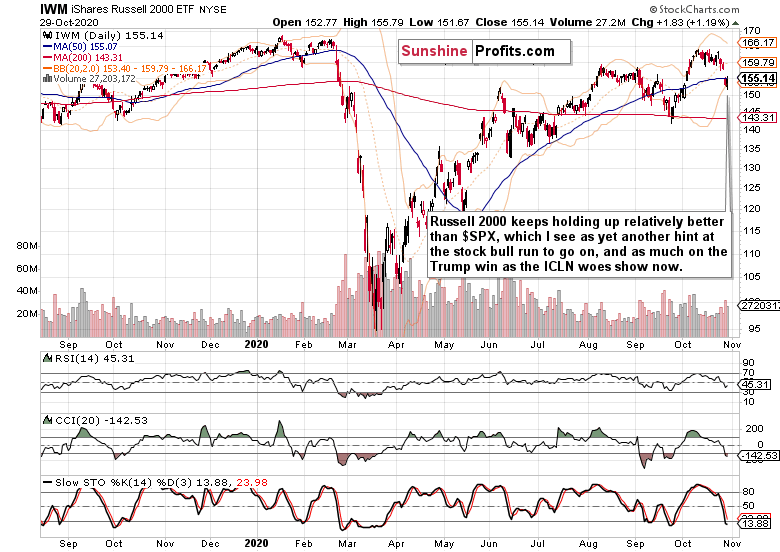

Market Breath, Volatility and Smallcaps

The advance-decline line has sharply recovered even though the price advance wasn't outrageous. That points to the upswing being led by sectors other than tech.

$VIX finally reversed, and the upside rejection is encouraging for the short run. It appears the stock downswing is getting long in the tooth.

The Russell 2000 (IWM ETF) is doing better than the 500-strong index, and just did so on a daily basis too. How long before the buying pressure can't be overwhelmed any longer?

Summary

Summing up, stock bulls have neither outshined, nor disappointed yesterday. The parallel to 2016 thus far remains intact, and I view the upper knot(s) as encouraging for the moment the election results come trickling in next week. Tech earnings didn't come in the strongest, but other S&P 500 sectors have stepped in.

Credit markets are still offering signs of an impending turnaround, and copper isn't willing to decline much more – I'm looking for similar turnarounds in other commodities too. The pre-election volatility could easily turn on a dime, leaving the impression of us going through a springboard in the making. The medium-term bullish trend simply hasn't changed one bit.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM