-

S&P 500 Recovery? It's Here, Told You So!

October 6, 2020, 9:41 AMUpbeat news, upbeat - anywhere you look! Trump at the White House, stimulus talks progressing, and perhaps Powell will help reassure the markets some more later today. Stocks have risen, commodities doubly so, and bond prices plunged - that's exactly what you would expect to see whenever bullish spirits return in earnest.

That has been the core of my writings - since August, I've been warning against the autumn storms, and they arrived not in October as in the 2016 elections, but right at the beginning of September. Stocks declined over 10% from their highs, but I said this correction was no end of the stock bull market - it has much further to run.

Bull markets climb a wall of worry, and the kneejerk reaction to Trump testing corona-positive, is no exception. Look how fast was Friday's downswing erased, and where we are in Tuesday's premarket (S&P 500 futures are trading above 3385 as we speak).

There will be many more instances such as this hiccup - and stocks will be more than willing to look past. Mark my words, this bull market isn't going to end in 2020 - but perhaps it'll become finally broadly recognized as such still this year to the dismay of still much more numerous bears compared to the bulls. Sorry, no gloom and doom, no calls for a market crash, though I expect turbulences to go on till elections are over and done with.

Right now, we have signs aplenty that the stock upswing is ready to go on.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The bulls filled in the void strongly yesterday, and I look for them to carry on and extend gains also today. Like it or not, the path of least resistance is still higher. Feb highs will be once again left in the dust, and rightfully so - in my September 30 article, I wrote that it's reasonable to expect the remaining S&P 500 downside to be relatively modest.

Credit Markets and the Dollar Weigh In

High yield corporate bonds (HYG ETF) perfectly illustrate the return of the bulls - closing at the daily highs and on respectable volume. Yes, after the false breakdown below the early September lows, the riskiest corporate bonds are rising again, with the August highs not far off. That's bullish for stocks, very bullish actually.

The ratio of high yield corporate bonds to all corporate bonds (PHB:$DJCB) confirms the bullish takeaway. While still trading below its early June high, it has reached the August highs, while stocks are still below their respective peak. That means the credit ratio is ready to help stocks rise further in the very short run - the momentum is there.

What about the beaten greenback? Not only that I called late in spring for it to roll over, but on September 11, I noted that:

(...) Barely recovering from yesterday's downswing attempt, they're wasting precious time to reach up beyond the 50-day moving average. The advantage of bullish divergences in the daily indicators, is slowly but surely being lost.

The bulls overcame that barrier, yet promptly run out of steam, and we are seeing the sideways-to-down trading working to reassert itself again now. My assessment of the dollar not standing in the way of further stock rally is nicely confirmed by both yellow and black gold. The reflationary efforts are working, and they simply come at a cost - to the world reserve currency.

S&P 500 Sectoral Overview

The daily upswing in technology (XLK ETF) isn't really convincing thanks to the very low volume. Is that a one-day occurrence only?

Semiconductors (XSD ETF) think so - their chart posture is stronger, and yesterday's upswing attracted higher relative volume. Intermarket analysis and the art of its interpretation is one of my favorite tools, and if it's worth its weight in salt, then it should show returning strength also in other key S&P 500 sectors.

Healthcare (XLV ETF) is surely doing fine, very fine actually. How long before its early September highs are history?

Financials (XLF ETF) have more work cut out for themselves - their underperformance continues. And I look for them to take more time before they catch up with vengeance. We're nowhere near that point - for now, they're stopping to be a drag on S&P 500 prices, which is encouraging given the corona fallout in bank loans and real estate that still hasn't hit the fan.

Consumer discretionaries (XLY ETF) are one of the best performing sectors, and look ready to overcome their early September highs just about when healthcare does the same.

Summary

Summing up, stock upswing is more likely to go on than not - the many signs come from credit markets, Russell 2000 and emerging market stocks. With commodities rising, dollar on the defensive and Treasury yields up, it's risk on again, and many asset classes stand to benefit. In stocks, I still look for technology to catch up a bit more, relatively speaking, but the even current sectoral overview sends reliable signals of the 500-strong index continuing its climb.

The above perfectly rhymes with my yesterday's parting words: the dollar continues treading water, and I fully expect (as I have been saying for months) that its 2020 top is in, which will facilitate via different avenues the gain in many risk-on trades, including stocks. The credit markets are supporting this notion, and once technology regains its luster, the S&P 500 fireworks would return. As for now though, that appears weeks away still, so a very measured grind higher remains the most likely scenario for the days and immediate weeks ahead.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading StrategistSunshine Profits: Analysis. Care. Profits. -

The Bright Prospects of the S&P 500 Recovery

October 5, 2020, 8:54 AMSo, Trump is corona-positive, and over the weekend had possibly received treatment reserved for the most difficult cases (or is it that he improved and could be discharged today?) - but stocks recovered as I called for them to do at the onset of Friday. I said that this isn't the start of a new downleg but rather that this is an exaggerated reaction.

Friday's non-farm payrolls disappointed to a degree, but the recovery is still going on. And in the meantime, stimulus news are moving back into the headlines - will the price tag and mechanics be settled still before the elections?

The economy needs that, and any talk about overheating would obviously be very premature. The recovery is still too young, needing sufficient monetary and fiscal support.

So, how much of the S&P 500 chart deterioration has been overcome on Friday exactly?

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

The weekly price action points higher, true, but the sizable upper knot is sticking out like a sore thumb. While not all the downside appears to be in looking at this chart alone, I am not calling for a new downswing to start here. The weekly indicators remain fairly neutral, and sideways trading with bullish bias reasserting itself, is the best the bulls can look for.

The daily chart's view of Friday leaves quite something to be desired - but given the dramatic Trump headline, it's positive for the bulls that we saw buying emerging. All in all, sideways to higher trading appears to be the most likely development next.

The Credit Markets' Point of View

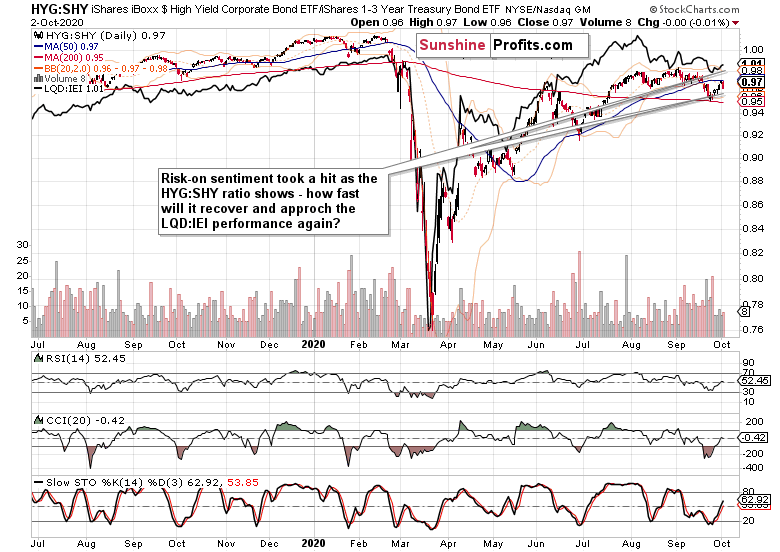

Both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - are not in unison. The more risk-on one (HYG:SHY) has weakened while LQD:IEI didn't, which can be expected to be seen when risk-on assets come under pressure the way they did in Friday's premarket session.

Long-term Treasuries (TLT ETF) haven't risen on Friday, which bodes well for stocks. But as the volume has declined, I wouldn't be surprised to see them turn north shortly. Not dramatically higher, but still. As regards Friday, the session didn't ring up the alarm bell, meaning that whatever bullish spirits there are in stocks, can run on - and that in the current circumstances means a measured uptrend reasserting itself.

The ratio of stocks to all Treasuries ($SPX:$UST) remains in an uptrend that has met its consolidation. The short-term dynamics is actually favorable to the stock bulls' prospects.

Smallcaps, Emerging Markets and Copper

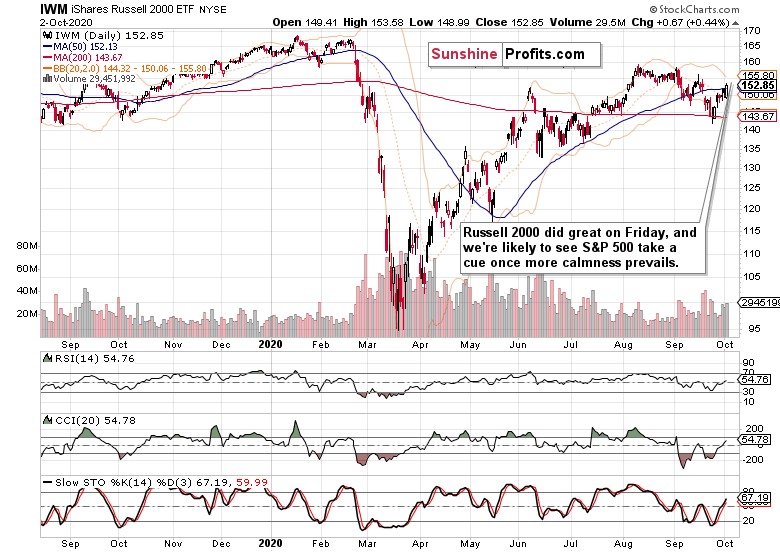

The Russell 2000 (IWM ETF) isn't exactly breaking down - it actually recovered on solid volume. The stock bulls better pay attention that there are no signs of distribution, meaning that the bull market can go on.

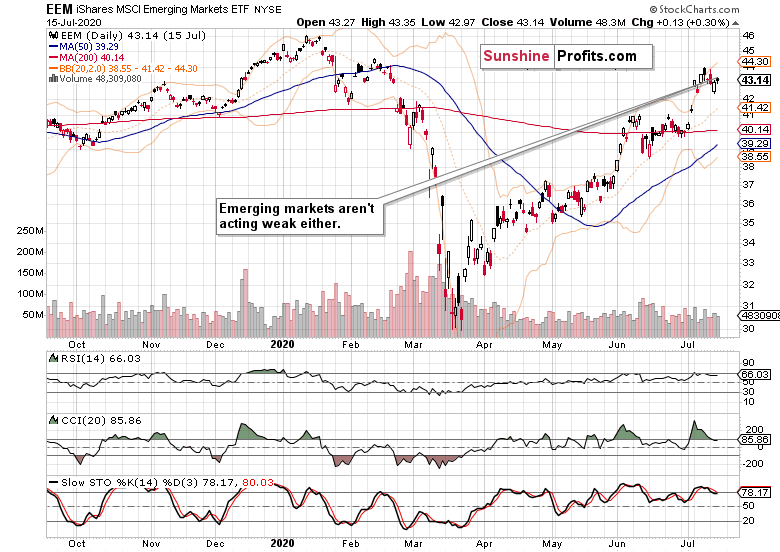

Emerging markets (EEM ETF) aren't meeting a weak patch either, and I look for the positive influence from international stocks and U.S. smallcaps to translate into the 500-strong index perfomance as well.

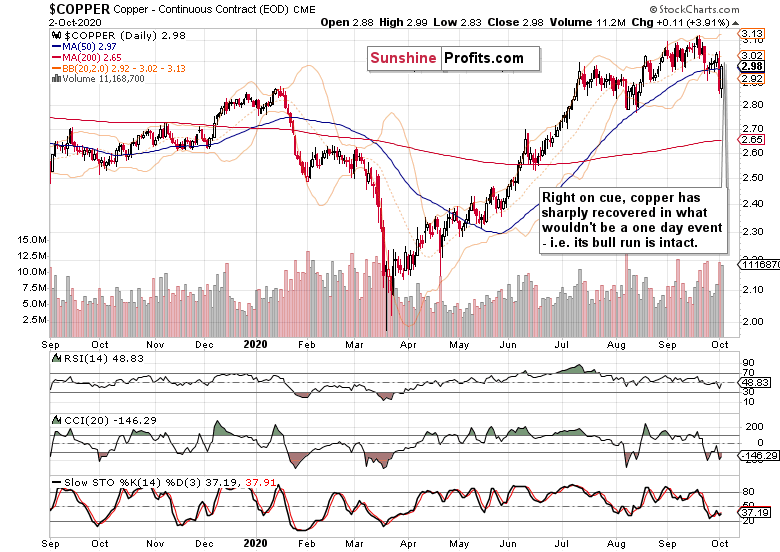

Along with gold and oil, the key barometer of economic health, the red metal, didn't disappoint me. Such were my Friday's observations:

(...) The red metal truly plunged yesterday, and on heavy volume. Sure, it was vulnerable to a takedown following the rebound off its 50-day moving average, but the slide looks a bit overdone. Certainly, it doesn't invalidate the bullish chart posture as copper stands to capitalize on the electric cars fever and the like it or not rush into green economy in general. The setback suffered will thus be reversed relatively shortly in my opinion.

And indeed, the rebound was strong and on heavy volume, meaning that it's more likely than not to proceed. The price is primed to go higher, and all we've seen in my opinion, is a breakdown attempt that will be proven to have failed.

Summary

Summing up, stocks have retraced a good part of Friday's premarket downswing, but are far from out of the woods. The short-term outlook remains muddied and sideways trading almost a surefire bet, while the medium-term bias remains up. The dollar continues treading water, and I fully expect (as I have been saying for months) that its 2020 top is in, which will facilitate via different avenues the gain in many risk-on trades, including stocks. The credit markets are supporting this notion, and once technology regains its lusted, the S&P 500 fireworks would return. As for now though, that appears weeks away still, so a very measured grind higher remains the most likely scenario for the days and immediate weeks ahead.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Renewed S&P 500 Downswing? Not Really

October 2, 2020, 9:37 AMTrump's corona-positive test rattled the markets, bringing about sell-off across many assets, including stocks. After yesterday's trading in a tight range, the S&P 500 has quite moved in today's premarket session. Is this the start of a new downleg?

I this it's an exaggerated reaction - the President is feeling fine, not showing any symptoms, and has likely been taking hydroxychloroquine for quite some time. I look for this storm in a tea cup to blow over sooner rather than later.

Such were my yesterday's take on the stock prospects:

(...) The daily indicators support the upswing to go on, and taking part in the unfolding stock move higher, is a question of risk-reward setup preferences.

What about today's non-farm payrolls, won't they disappoint? I think they'll show the tepid pace of the economic recovery perhaps just as much yesterday's ISM manufacturing. On the bright side, Wednesday's Chicago PMI strongly overcame expectations - that's good, because this is a leading indicator that we'll see reflected in upcoming manufacturing and other data. Tuesday's Conference Board consumer confidence came in similarly strongly, and while well below the pre-pandemic levels, it's supporting the story of the unfolding economic recovery.

Given the no stimulus bill through Congress yet, that's quite encouraging if you ask me. Do the charts agree with the generally bullish interpretation for the short- and medium-term?

S&P 500 in the Short-Run

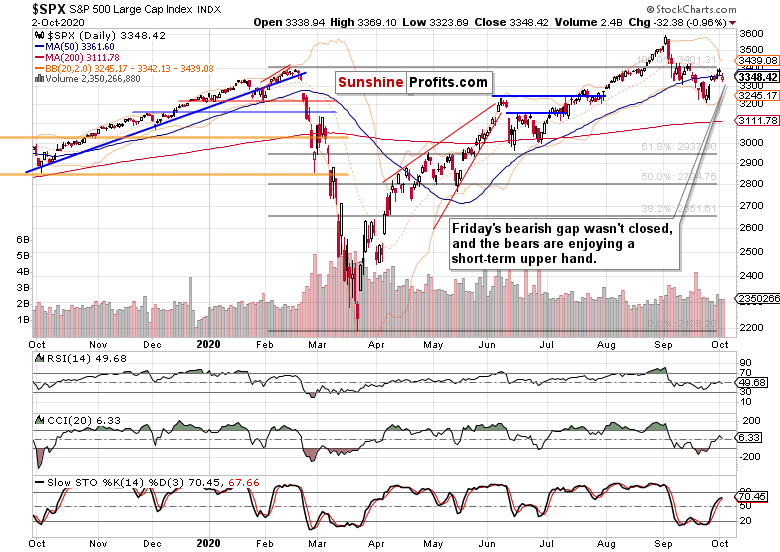

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The S&P 500 consolidated recently gained ground yesterday, and the daily volume didn't send a message either way. But the longer such trading goes on, and the better the bulls are able to recover from setbacks, the stronger the launching pad for the next leg higher.

This is in line with my yesterday's thoughts on what's next:

(...) The bears can make another stand at the Feb highs, which correspond to yesterday's highs too - but I am not counting on that as I see base building at these levels as a more probable scenario.

The Credit Markets' Point of View

Both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - are still acting constructive, and the daily leadership baton went from HYG:SHY to LQD:IEI yesterday.

Looks like a normal event to me, with nothing pointing to the start of a risk-off daily string. And Treasuries concur.

Long-term Treasuries (TLT ETF) haven't caught fire during the September storms, pointing to the temporary nature of lower stock prices. In the latter part of September, yields have risen again, lending credibility to the economic recovery story. That's quite in line with the economic indicators data I discussed in the opening part of today's analysis. As the dollar tellingly hasn't swung higher yesterday, both factors are leaning bullish for stocks.

Copper and S&P 500 Sectoral Heavyweights

The red metal truly plunged yesterday, and on heavy volume. Sure, it was vulnerable to a takedown following the rebound off its 50-day moving average, but the slide looks a bit overdone. Certainly, it doesn't invalidate the bullish chart posture as copper stands to capitalize on the electric cars fever and the like it or not rush into green economy in general. The setback suffered will thus be reversed relatively shortly in my opinion.

Technology (XLK ETF) upswing goes on but some digestion of recent gains appears likely. But as I said yesterday, tech is growing in strength vs. the other S&P 500 sectors again.

Healthcare (XLV ETF) is slowly but surely adding to its gains, and the chart doesn't hint at much more than temporary downside.

Financials (XLF ETF) continue their price recovery, yet have quite a way to go to capture both the 50- and 200-day moving averages again. While they are an underperforming sector that in a way questions the S&P 500 upswing from the March lows, it's my opinion that they'll catch up over the weeks and especially months to come.

From the Readers' Mailbag

Q: What do you think about investing in individual stocks compared to investing in EFTs with equal research performed of course.

A: I've answered a similar question in my September 03 top calling article Wasn't Yesterday's Strong S&P 500 Day a Bit Climactic? Quoting the relevant part:

(...) Stock picking can be extremely profitable but a dud too - far from all the picks are tenbaggers. You're still exposed to company risk (the quality of its management etc). With surefire stuff such as the (...) bet on AI (happening for so many years already by the way), going the sectoral route is more risk-proof to me. I would compare it to going with GDXJ (junior gold miners ETF) as opposed to trying to pick the company that might or might not have the touted ore quality at hand, in a friendly foreign jurisdiction or not, if you know what I mean...

That's still valid, and I would add that sector rotation strategies are a very valid, yet a bit demanding approach. Different sectors experience their heyday during different stages of the bull market. For example, materials, energy and industrials are the first ones to dust themselves off the bear market bottoms. Or, financials tend to perform better during the latter stages of the bull market in general. But given the current bull run and corona repercussions, I expect financials and real estate to underperform for quite a while longer. Coming back to your question, picking a renowned sectoral ETF is better from the diversification point of view that putting all eggs into a single stock basket.

Summary

Summing up, stocks have traded with a bullish bias until the Trump corona test result sunk in. Is that a game changer? Unlikely, and as neither smallcaps nor emerging markets are breaking down, I look for strength to eventually reassert itself in the 500-strong sector as well. Yes, I look for this bear raid to fail in short order.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

S&P 500 Running into a Brick Wall? Not Really

October 1, 2020, 9:51 AMFollowing Tuesday's indecision, stock bulls yesterday took over the reins before running out of steam. Is that an upcoming reversal, or a run of the mill breather? It's the latter, in my opinion. The daily indicators support the upswing to go on, and taking part in the unfolding stock move higher, is a question of risk-reward setup preferences.

Yesterday-presented fundamental realities are valid also today:

(...) Political uncertainties remain, the first presidential debate is over, and there is still no stimulus bill, while corona is getting worse overseas. New lockdowns are hanging in the air, with the U.K. and Israel leading the way. Then, the Fed hasn't done all that much lately, leaving the credit markets relatively unfazed. Continuing claims are trending lower only painfully slowly, and U.S. tensions with China haven't seen a turnaround.

The corona casedemic indeed isn't dying down, but the slow economic recovery goes on as yesterday's ADP non-farm employment change data beating expectations show. It's my opinion that today's ISM manufacturing won't really disappoint, and thus won't present a headwind for stocks.

But is this rough scenario of a measured rise in the S&P 500 prices standing up to scrutiny?

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The S&P 500 rebound goes on, and has finally picked up some volume yesterday. But isn't it negated by the significant upper knot? I think that yesterday's intraday highs will be challenged and overcome before too long. The bears can make another stand at the Feb highs, which correspond to yesterday's highs too - but I am not counting on that as I see base building at these levels as a more probable scenario.

Should it indeed unfold as described, such a sideways consolidation would offer an opportune entry point on the long side. And if we get a daily downswing or two at these levels, then it's even better.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) speak in favor of the unfolding stock rebound, for yesterday's session has been marked by higher volume and also closed nearer the daily highs than the stock market's daily candle. Let's see this relative daily strength reflected in the below chart.

High yield corporate bonds to short-term Treasuries (HYG:SHY) have caught up a little with the stock market upswing. In this light, the $SPX pause is a healthy development. Will it last and power them both higher? I think it's more likely than not, and the examination of Treasuries supports this conclusion.

Market Breadth, Technology and the Dollar

The advance-decline line has recovered a tad from its not so stellar Tuesday performance, which is a tentatively bullish sign. More than this obviously needs to happen, but the ground looks set for stocks to continue trading with a generally bullish bias. Generally bullish, that means a constructive swing structure - i.e. higher highs and higher lows.

Technology (XLK ETF) reflects the turning tide, and I see signs of rotation back into this leading heavyweight sector. Tech certainly looks slated to trade with a bullish outlook over the coming days and weeks - the current rebound doesn't bear the hallmarks of a dead cat bounce.

Finally, the dollar - the risk-off play. After its mid-September rebound, the greenback has pulled back recently. But I don't look for it to roll over just yet - another upswing is more probable than not. But will it fizzle out yet again? I think it will. But before doing so, it could coincide with, catalyze (have your pick) a temporary weakness in stocks that I am looking to take advantage of.

Summary

Summing up, given the risk-reward setup, I am not comfortable chasing stocks at these levels. I look for a more opportune chart setup that could present itself even at higher S&P 500 price levels than currently (futures trade at 3380 as we speak) but with stronger internals. Or more likely, after some sideways trading or a quick dip to offer a discounted entry. Yes, I look for a possible bear raid to fail - the put/call ratio doesn't give it much chance of success really.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM