-

Stock Bulls Can Still Retake Initiative. Today?

October 22, 2020, 9:27 AMIt was the bulls' turn yesterday to waste the good opportunity that they had. But is the case lost, and they won't push the S&P 500 higher one of these days? I still think they will – regardless of being unable to accomplish that yesterday. Today though? I am not so sure.

You know, some things are almost a surefire bet regardless of their appearance in the interim. This is one of those cases when it pays to ignore the white noise of the day, and focus on the big picture. There are countless examples of very similar situations such as the rise and fall of nations, empires, or campaigns such as in advertising, healthcare or even military.

Talking confrontations and cultures, it's a bit like watching the rightful and sympathetic struggle to set oneself free against the backdrop of travelling in time or in cultural values. Take the 9 and a Half Weeks movie where the heroine in the end breaks free after a long struggle and shattered illusions – courage to say enough is enough, is celebrated. I say bravo!

Compare that to three decades later and 50 Shades of Gray – its celebration of submission and dissolution. No boundaries, no standing for oneself, just sinking deeper and deeper. The markets are smarter, and assessing their footprint helps uncover hope being born (April 2020), despondency reigning supreme (March 2020), hubris before the fall (February 2020), or complacency (autumn stretching into winter 2019).

Now, markets are about to call the (stimulus negotiations) bluff. Deal will be signed – it's a question of time and mechanics. And face saving for good measure. I have a feeling that the absence of a deal is actually having a worse effect on the Democrats, if the early voting data are anything to go by (and I personally think they are).

Bottom line, the markets are justifiably expecting a deal around the corner. I don't see them throwing a hissy fit as they did in 2016 – that notion was invalidated for me with the arrival of early September storms. Throughout October after my return since the "Administrative Announcement", I've been calling for a mildly positive month – and here we are, that's the status currently.

Coiled spring once the uncertainties are removed, anyone?

S&P 500 in the Short-Run

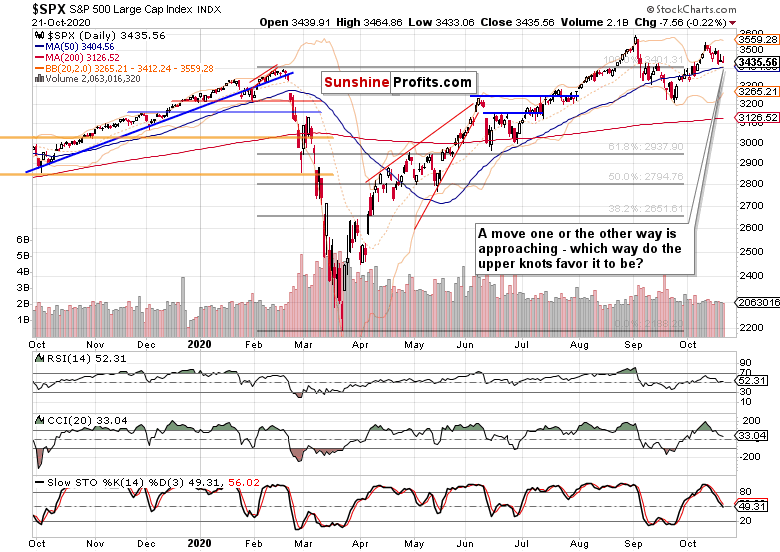

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yes, yesterday's price progress has been again lost in the day, but the bulls keep on fighting their individual fights. The match is pretty even still but the upper knots tip the hand. The current price congestion will give in, and it's my opinion that to an upside move.

Credit Markets’ Point of View

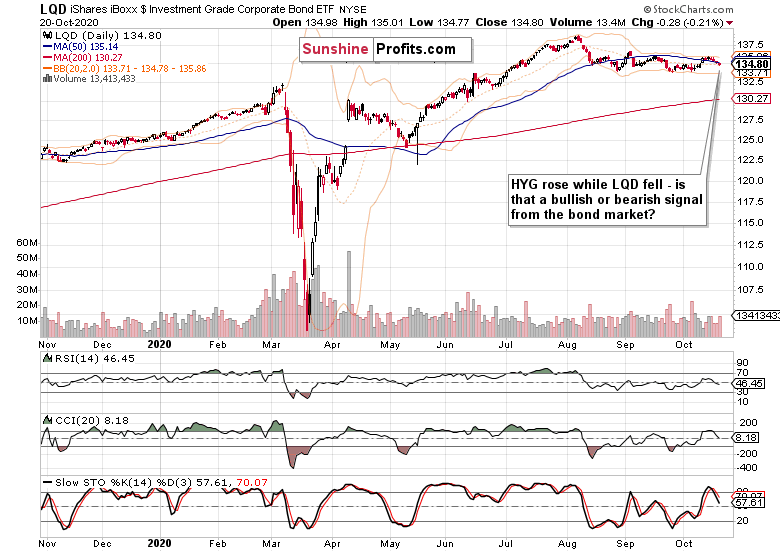

High yield corporate bonds (HYG ETF) still give the best reason for why the stimulus is a storm in a tea cup – a foregone conclusion. The intraday gains weren't given up, far from it, and that forms a very short-term sign of willingness to go higher and take stocks along. It's hard not to walk off with this impression if you look at the other debt markets – investment grade corporate bonds (LQD ETF) weakening. And Treasuries…

Declining as the other high quality debt – long-term Treasuries (TLT ETF) are twisting the Fed's hand. And they are not the only ones.

TIPS, these inflation-protected government bonds, are joining in the pressure applied.

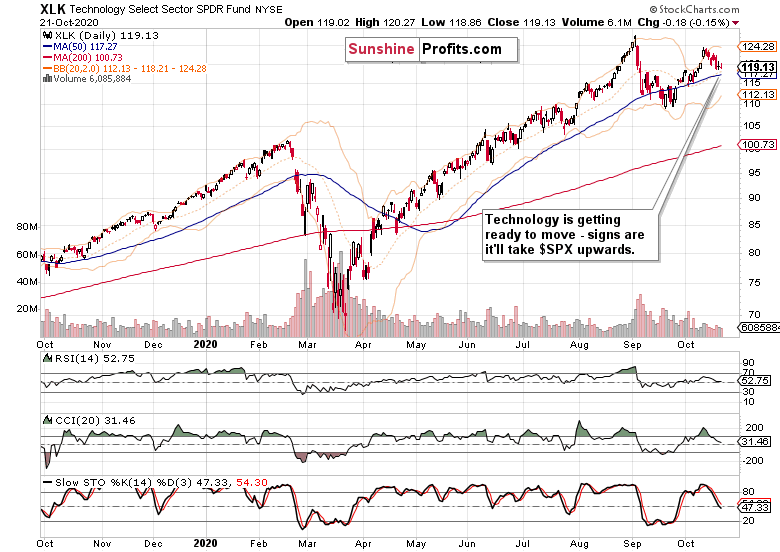

USD and Technology Speak

It's the dollar though that has the loudest voice here. It's in hot water, acting actually weaker than I looked for it to act this month. But given that I called off the October storms arrival as soon as I could (first days of this month), the dollar woes aren't that surprising.

Instead of a daily spike here and there amongst largely sideways trading (which could have been the go-to scenario), the greenback is weakening and its bullish divergencies in the making are being lost. That tells a lot about the short run.

Technology (XLK ETF) is getting ready to rise again, volume is contracting, and the downswing is conspicuously absent. These are the hallmarks of an upside move in the making, one that is hard to time to the day exactly. And that goes for the S&P 500 index as well, where I see the risk of missing out on the "surprising" move as a bigger risk that suffering several dozen points of directionless volatility on a daily basis.

Summary

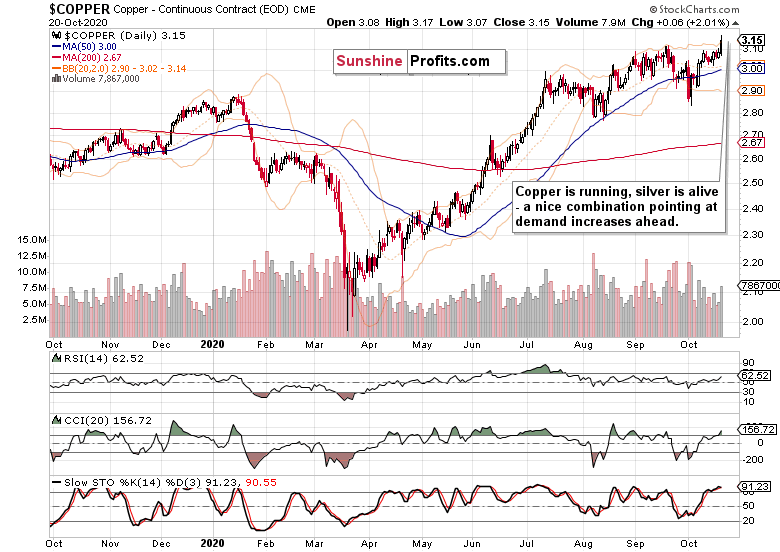

Summing up, the $SPX tug of war in the short run doesn't take away from the medium-term probabilities of seeing the bulls emerging victorious. As time is running out before both the stimulus "deadlines" and the elections themselves are history, the bearish case for a short-term stock move down, is shrinking in prominence – and the credit markets, dollar and copper still favor the bulls.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Bulls Can Retake the Initiative Today

October 21, 2020, 9:37 AMYesterday's S&P 500 price action gave the bulls a few intraday reasons for optimism, but they went away before the closing bell. Not that we would have seen a bearish turn though – the push higher will have to come (and will come, I would add) another day. The cup and handle approximation hasn't been invalidated, but it's the fiscal policy trepidations that are driving the prices in the short run.

Does it look to you that the stimulus negotiations are getting a pretty high share of the media coverage? The self-imposed Pelosi deadline has come and gone, getting extended. I smell that she is interested in reaching a deal, a deal not forgetting about the Blue states and cities. With Trump willing to accept a larger price tag than originally, this uncertainty might be indeed removed before the elections.

Not that it would matter in the larger scheme of things, but for stocks in the short-run, it does. And they are more pessimistic here than warranted in my view. Let's check out why I think so.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yes, yesterday's price progress has been lost late in the day, and stocks are under pressure in today's premarket, but that doesn't worry me way too much. I view that rather as the stock market forcing the hand to get the deal it expects and wants. Yesterday's volume certainly hasn't been reversalish one bit – just a daily consolidation in the stimulus horse trading that it is.

I repeat, there is no need to reconsider the medium-term outlook here. It's a matter of time before the differences get bridged one way or the other.

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) provide the best reason for why this is a storm in a tea cup – mere posturing. The intraday gains weren't given up, far from it, and that forms a very short-term sign of willingness to go higher and take stocks along. It's hard not to walk off with this impression if you look at the other debt markets.

Investment grade corporate bonds (LQD ETF) have declined yesterday, which would be by itself worrying to a degree – unless you look at Treasuries, and realize that the rising yields among quality debt instruments (LQD and TLT) reflect market conviction that a deal indeed approaching.

Yeah, the stimulus deal fight is as fake as wrestling. Makes for a nice show, though. Guess who has the kind of shorter end of the stick here…

USD and Copper Speak

It's the dollar in the end, and I see its yesterday's decline as a vote of confidence in a (more costly than the Republicans wanted, but way too short of the Democratic expectations) deal at hand.

Stocks will like it, and if you look at the market breath $SPX indicators, you'll notice smart bets being already placed indication it's time to take out the S&P 500 shopping list, and make some choices.

That's certainly and still the direction I am leaning towards, disregarding the Big Tech suppression of Joe / Hunter Biden legally obtained emails on Ukraine, or the hardly unexpected mail-in ballot woes in Pennsylvania (and where else, I ask)…

The red metal has cast its vote, and it is in favor of more demand, of the economic recovery. Economically sensitive metals are doing fine (yes, that includes iron too), bond yields are rising, and junk bonds aren't really going down.

The stock bull run goes on, and will comfortably survive the elections – and thrive.

Summary

Summing up, the $SPX bears could have stepped in yesterday, but didn't – they didn't win yesterday's tug of war. Very telling, and totally fitting my yesterday's message here in the summary about one stimulus "deadline" passing after another. The case for stocks getting under pressure quite fast, has turned much less probable.

The bullish medium-term outlook remains intact, and the stimulus negotiations look today more likely to positively surprise than they did a day ago – and this has been telegraphed by commodities or smallcaps already. With the dollar failing to take the cue, the stock bulls' position has relatively improved in the short run.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Serious Short-term Question Mark(s) Raised

October 20, 2020, 9:58 AMA bull flag, still a bull flag? Monday's price action is making me doubt that. It's starting to take a bit too long for a bull flag – unless you would want to measure it from the September lows. In which case, the formation would start to resemble cup and handle instead.

With much talk hitting the airwaves about the double top lately, some degree of anxiousness is understandable. But that's the short-term, and I ask whether it has the power to flip the medium-term outlook bearish. Yes, it's short-term concerning when momentum stemming from Thursday's intraday reversal is lost this easily, and prices move back to square one.

The ball is back in the bulls' court, and it's their turn to show they can stabilize the index solidly above 3440, and take it back to the spitting distance of 3500 where it reached yesterday.

While the charts show that's far from unthinkable (and actually highly likely if you step back and look at the dynamics at play), it could take more than a few days before that happens – unless stimulus fireworks arrive. Judging by my yesterday's article, I am not betting on that – and certainly not the farm.

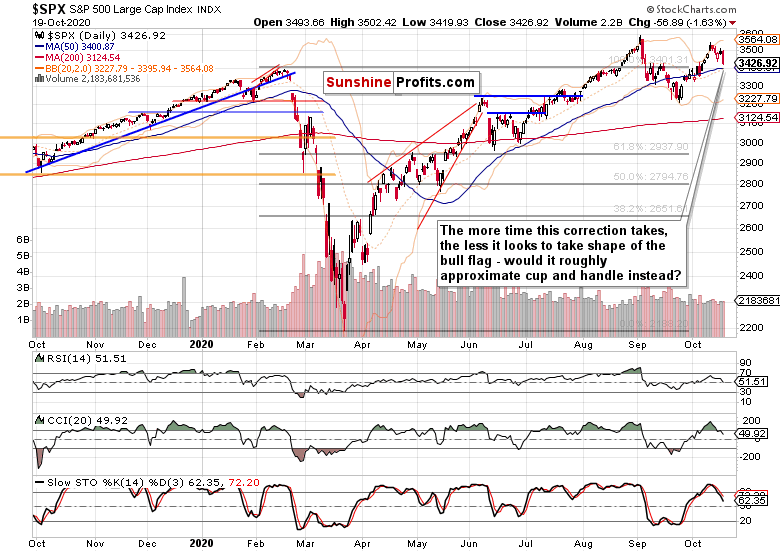

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Taking one look at the daily chart shows that the current correction might actually feel worse than it really is. No technically important level has been broken – but the Feb highs are in peril again.

The volume says no decisive battle has been fought yet. Will it, or will we see a similarly fast liftoff as on Thursday? I still see that as more probable than for yesterday's decline to continue long enough to force mid-term outlook reconsideration.

Credit Markets’ Point of View

Starting with the high yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio, we're not in a breakdown situation. I rather see second half of September as a false breakdown – an attempt that has been rebuffed. Stocks are just getting a bit nervous here in my view.

Long-term Treasuries (TLT ETF) on the other hand can turn up here again. While that wouldn't be a flight to safety in a risk-off rush, it could still put some short-term pressure on stocks. That's especially the case when the dollar is examined.

I talked recently quite a lot about the greenback woes and that the world reserve currency is likely to finish 2020 at lower values than it is currently trading at. At the same time, I said that it's ready to put up a fight here – and yesterday' lower knot coupled with the daily indicators, points at this possibility clearly, regardless of the USD index trading at around 93.25 currently.

The point is that the short-term move higher, which I see as approaching, will likely put some pressure on stocks. The way S&P 500 sectoral analysis looks at the moment, would make it likely.

Technology took a hit yesterday, healthcare and finance too – it was materials, industrials, consumer discretionaries and utilities that did the best lately. Beaten down energy might also surprise. Such a mix simply isn't conducive to a sharp stock upswing right now.

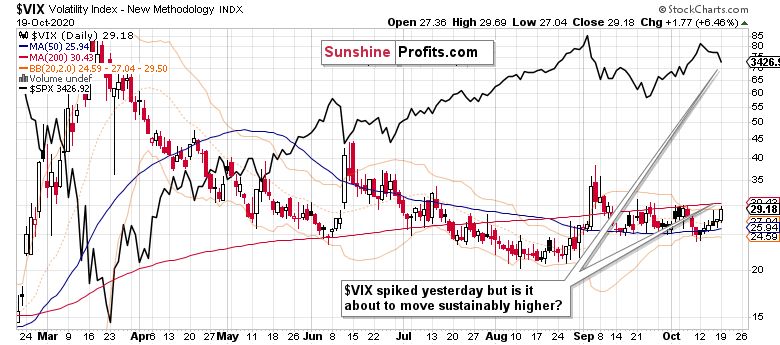

Peeking Under the $SPX Hood

The Force index has finally moved below the zero line. It took time, and the boundary wasn't defended successfully yesterday. Does it portend a sharp drop? No, not necessarily, no. Trying one's patience though? Yes, that's the camp I lean towards. Probably this sharp a daily move, is what could turn out to be the one and done by the bears – when it come to sharpness of a given move.

The daily advance-decline line paints a more cautious picture, especially if the sellers retake initiative, and erase today's premarket upswing. The above chart certainly shows that stock prices are under short-term pressure – pressure whose length and depth is being decided currently.

Volatility is highlighting that point nicely. The third larger wave of its decline after the early September spike, didn't get too far – the values haven't really profoundly declined. On the other hand, it can easily spike over 30-35 before calming down again.

Summary

Summing up, Monday's session presents a formidable short-term setback, and took away from the short-term outlook's clarity. Stock prices can go on hanging by the fingernails as one stimulus "deadline" after another passes, or can get under pressure fast. It's unclear how that would turn out right now, but (as I have been rarely saying over the last many months, now it's that right time to say so because the danger of a renewed downswing is here now) stocks can get under pressure quite fast.

Would that change the medium-term picture though? Despite the look of the week in progress, it's not my go-to scenario. Instead of greed, we're slowly approaching fear readings, all the time while the options markets keep being quite complacent. That tells me we're likely facing some kind of a renewed downturn next, but wouldn't the rebound be similarly hard to time because of how fast it would happen?

And what if the stimulus negotiations surprise on the upside? Neither commodities not smallcaps are selling off, and the dollar has to refute my cautious tone first. Stock bulls, prove yourselves.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stocks Power On Regardless, Not Because of Pelosi Rekindling (False?) Hopes

October 19, 2020, 10:43 AMA bull flag, still a bull flag… That's what the S&P 500 price action is telling, validating the points I've been making throughout the prior week. But how does Friday's weaker high yield corporate bonds performance fit into the picture?

Are they serious or only bluffing? I have an answer, and will take your through my strong opinions on the matter. I'll lay out the case, in no uncertain terms, objectively and faithfully, the way you're used to from myself – because you, the people, deserve the daily best of me and nothing less.

A new week is here, and no signs of stimulus deal gaps being bridged. But stocks don't appear to care – they look to me banking on the deal being reached within weeks. The real economy is not on the ropes, not down and out – the stock market is sending its own verdict that the differences will be overcome one way or another.

What might not always be the best strategy in life (and I personally think it isn't for I am a big believer in tackling matters head on, in taking the bull by the horns), however appears to be the sensible plan for trading the stock market right now.

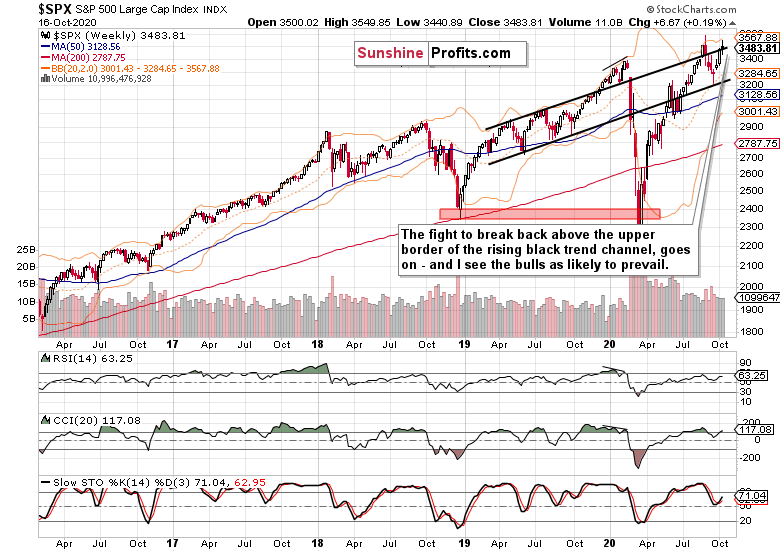

S&P 500 in the Medium- and Short-Run

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

After the large white candle characterizing the week ending Oct 11, I called for the next week to be rather lean. And it indeed was, becase stocks didn't sustain their breakout above the upper border of the rising black trend channel last week. Did they reverse down though?

No, I think they've merely consolidated after sharply recovering from the similarly sharp September selloff. The volume doesn't hint at a reversal really – the weekly indicators remain fairly neutral to positive.

The daily chart concurs with the mildly bullish but still bullish assessment. The price upswing from the depths of the bull flag (bull flag in progress, remember – the hypothesis can still get invalidated down the road even though that doesn't seem as likely currently) hasn't been overwhelmigly rejected by the S&P 500 selloff in the last 75 minutes of Friday's regular session.

While the bulls may bid their time a little longer here (the daily indicators don't exactly favor a sharp upswing immediately), they're made of steel just as I told in my Sep 11 article Rocky S&P 500 Recovery From the Sharp Correction Goes On – they'll overcome the challenges and close above the early September highs well before 2020 is over.

Credit Markets’ Point of View

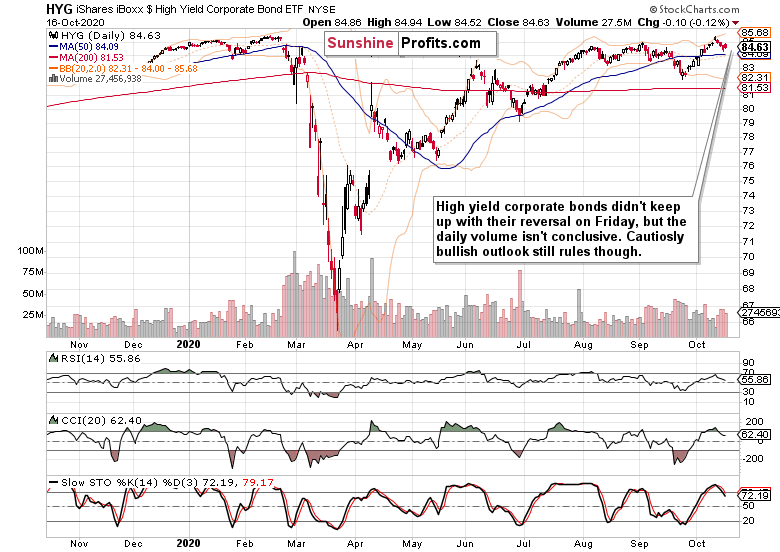

High yield corporate bonds (HYG ETF), that's the fly in the (short-term) ointment. Not exactly stumbling, but hesitating – noticeably hesitating on a daily basis.

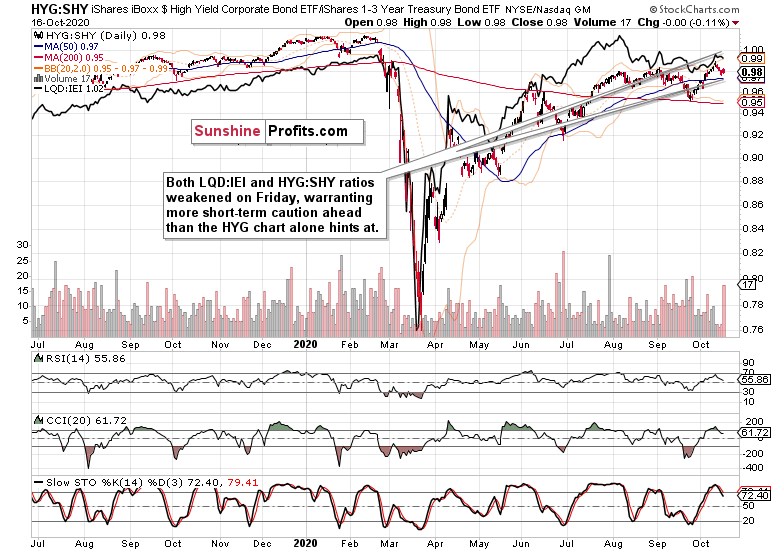

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have ticked lower on Friday. That's a short-term non-confirmation even though both individual ETFs' chart posture remains largely constructive.

Time to trust it, or to call its bluff as meaningless daily white noise?

Long-term Treasuries (TLT ETF) are again declining. This fact, plus the action in precious metals, oil and commodities regardless of the daily decline in copper, that's why I am not taking the daily headwinds in credit markets as a harbinger of stocks rolling over. I told you, the bulls are stronger – and will prevail.

The Dollar Weighs In

Such were my Friday's take on the dollar:

(…) Talking fundamentals, they're clearly reflected in the dollar's struggles. I don't think the budding divergences would take the greenback far and lastingly – stocks certainly don't seem to get under too much pressure due to spiking dollar.

The greenback doesn't reflect rising fever in the world economy or national stock markets. It's actually moving lower today already, which is in tune with the prevailing tone of my today's analysis.

Summary

Summing up, I am not reading too much into the late Friday's setback in stocks or the weaker corporate debt markets. This is not a risk-off environment we're in – prices are muddling through with a general bullish bias. The charts are not hinting at a game changer right here, right now. Copper has weakened, but will run again – precious metals and oil are acting really constructive. Then, Treasury yields are far from spiking.

In spite of the sentiment in stocks inching closer to extreme greed again, in spite of the put/call ratio dipping a tad dangerously lower again, it's the bulls who are on the move. Technology is in the pool position again, Russell 2000 is doing great and emerging markets are on fire. In short, S&P 500 is a little underperforming these weeks in what is a brief patch of risk-on-risk-off hesitancy.

The bullish $SPX outlook in the medium-term remains justified, and the short-term price action will confirm that in my view before too long. After September storms, I do look for the month of October to close in black.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Bull Flag, Told You So...

October 16, 2020, 9:21 AMDays ago, I called for this consolidation to take shape of a bull flag. I also laid out what would be the developments to make me worry and reconsider the short-term outlook. But the intraday reversal I saw as likely to happen either yesterday or today, arrived – and the bull flag hypothesis has been confirmed in the short-run.

Thinking in scenarios, considering alternatives, that's the trader's job. If things work out according to plan, you stay the course. If they don't, you better turn on a dime. It's the same in life – if you do your best but are treated poorly and there is no light at the end of the tunnel, you just turn around and leave as fast as you can. Traders do the same – if the open position isn't profitable, and its rationale isn't there anymore, you just cut your losses and get ready for the next opportunity.

There is no looking back and trying to rationalize the sunk costs. Or reframing that as headwinds that only the bravest of the brave can overcome because (the favorite reason why the trade was taken in the first place goes here). No, trading is not a perverse test of courage that has to hurt like hell to be worth it in the end. You deserve better and life is a great inspiration for finding and appreciating real value anywhere you look.

Works 100% like that with me, and in today's analysis, I'll present the case for why the stock bull run is unchallenged both in the medium- and short-term.

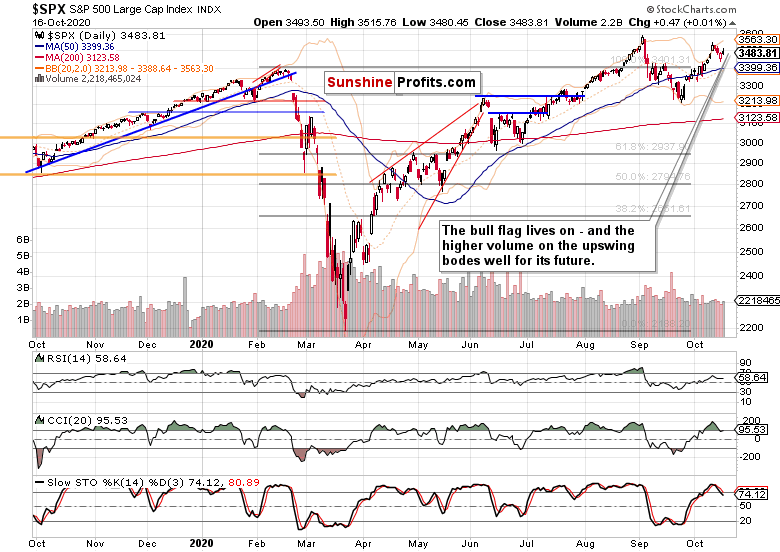

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

So far, so good. Prices have rebounded and the bull flag shape is still intact. Yesterday's spike in volatility that was visible only on the daily chart to start with, was reversed. As I have written above about self-respect and saying enough is enough, the bulls have done so yesterday.

And judging by the premarket action thus far (stock futures are trading at around 3485 as we speak), the bulls are (you may remember the theme of my Sep 11 article Rocky S&P 500 Recovery From the Sharp Correction Goes On) made of steel and rising up to the challenges.

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) reversed from the opening lows, and the volume was there. That's promising and exactly what I wanted to see accompanying a stock upswing to make it credible. Credible, that's the key word here because there is no shortage of poseurs or false signals all around us.

The brief and shallow buying in long-term Treasuries (TLT ETF) has hit the wall yesterday – and Wednesday's candle was indeed a telling one. Yes, that still means the bond markets are tentatively supporting the economic recovery story.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved up, with the more risk-on one travelling a farther distance. That's good for the stock upswing's prospects.

Metals and Currencies

Copper tirelessly keeps pushing higher, recovering from every setback. It's not alone doing so, both precious metals are keeping steady. The long sideways consolidation before another leg higher keeps unfolding – and the stronger the base, the stronger the subsequent advance, fundamentals and technical are aligned.

Talking fundamentals, they're clearly reflected in the dollar's struggles. I don't think the budding divergences would take the greenback far and lastingly – stocks certainly don't seem to get under too much pressure due to spiking dollar.

Is EUR/CHF breaking down, or has its breakdown just been rejected? It's the latter in my view – the risk-on euro will be favored at the expense of Swiss franc as the recovery progresses.

On Oct 08, I talked why I follow currencies, on Oct 14 I discussed the above pair, noting that it doesn't represent a reversal of fortunes in the risk-on-risk-off trade. And today, I'll add another key pair to follow.

AUD/USD is giving an impression of breaking down – if you ignore the lower knot, that is. In my view though, we're in for another leg higher in here that would be accompanied by bullish divergences. That's another supportive factor for the stock bull run to reassert itself.

Summary

Summing up, the sellers were stopped yesterday – enough is enough, and time to run higher is approaching. The bull flag remains intact thus far, and the 500-strong index looks set to be led higher by smallcaps and technology. As I noted yesterday, if commodities are anything to go by, then the stock downswing is likely to run into headwinds soon – it indeed did, and commodities keep supporting $SPX recovery.

Thank you for reading today’s free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM