-

The Credit Markets Gave Their Nod to the S&P 500 Upswing

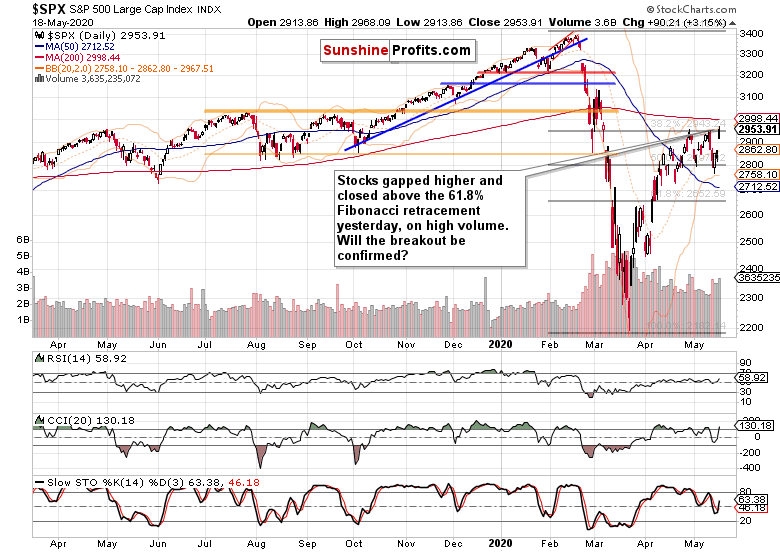

May 19, 2020, 7:38 AMYesterday's session did away with the non-confirmation of last week's reversal from the 50% Fibonacci retracement. Junk corporate bonds lent their support to the stock upswing, and the S&P 500 closed above the 61.8% Fibonacci retracement. Will the bulls be strong enough to confirm the breakout, or is a correction next?

S&P 500 in the Short-Run

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Steadily rising in the runup to the start of the US session, stocks opened with a sizable bullish gap. And they haven't looked back since, closing on high volume above the key resistance, the 61.8% Fibonacci retracement. Reflecting the upswing, the daily indicators turned largely supportive.

What has happened as far as headlines go? We got another Powell statement, but it didn't bring materially bullish surprises. Be the judge - he said that the US economy can decline 20-30% amid the pandemic, with the downturn possibly being with us till late 2021. His next remark that the Fed hasn't exhausted its toolbox isn't totally new either - it's only that during his Wednesday's Peterson Institute webinar, the call for more fiscal measures was the prominent one.

The willingness to reverse and expand the shrank versions of active lending programs, or introduce new ones, appears to be really there. And it didn't require a more sizable downswing - the breakdown attempt below the 50% Fibonacci retracement was all it took. Fed Chair's testimony before the Senate Banking Committee is coming later today, with stocks moving down to the low 2940s.

The second piece to the puzzle has been the Moderna (MRNA) early trial vaccine announcement. Despite the study's focus being safety, and that the composition was actually tested in two low doses on merely 8 patients, the stock market reacted broadly and positively on these interim results. It should be said however, that both the stock itself and the healthcare sector (XLV ETF) as such, have formed sizable black candles, i.e. they gapped higher but gave up large amounts of the opening gains.

These were our yesterday's intraday observations:

(...) we're dealing with a sizable bullish gap that makes a move higher later today likely. On the other hand, our expectation as to tomorrow's Powell testimony remain the same - i.e. a downswing in its wake remains likely.

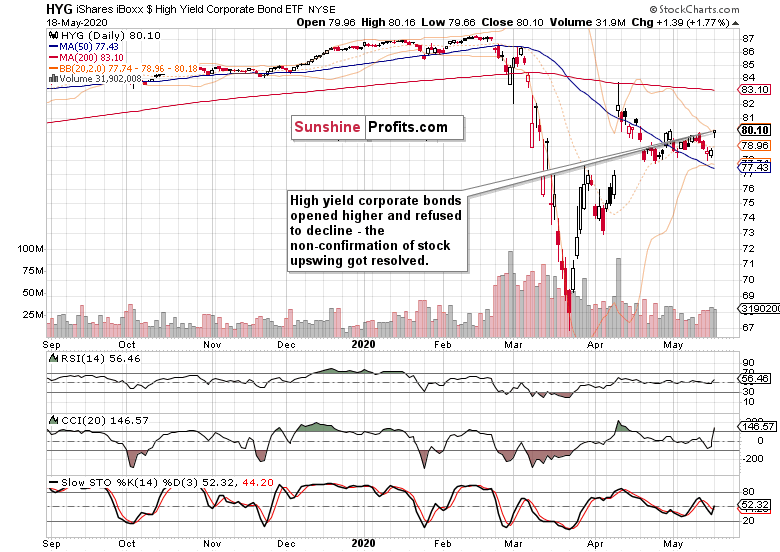

Chances are, the HYG ETF won't decline in a bearish attempt to close the gap.

As credit has been underperforming stocks recently, stocks don't have to spring higher immediately after the HYG ETF overcomes its highs. At the same time, a large part of the rationale for the short position has been taken away with the HYG ETF action so far.

At the same time, buying a breakout attempt doesn't come without its own set of risks. It's unconfirmed yet.

In closing, today's market action so far has given more weight to the bullish case, and our scenario of a slow grind higher still seems most probable.

The bullish gap remains open, supporting the buyers. High yield corporate bonds indeed haven't declined yesterday, and have caught up with the stock upswing seen on Thursday and Friday. As stocks refused to decline, the slow gring higher over the coming weeks and months got more likely.

The below comments on the S&P 500 prospects expressed in our yesterday's flagship Stock Trading Alert remain valid also today:

(...) As the coronavirus infection charts appear to have relatively stabilized, and the Fed offered ample support at a critical juncture, the stock market hasn't sold off in a dramatic way since. Moving from the March 23 lows to the 50% Fibonacci retracement, it has overcome this resistance and taken twice on the 61.8% one. Last week, the 50% retracement held as support.

The above paragraph would speak in favor of a near-term trading range between the two retracements. But would that mean that no selloff below the lower one can happen? Absolutely not, the 2720 or even the low 2600s can get tested. And that needn't to happen on very adverse corona-related developments. Faced with incoming data, the market can start to doubt whether we're within sight / we've reached the bottom and the real economy is on the mend now. Continuing unemployment claims, retail data, manufacturing figures and similar would show. Or escalation in US-China trade tensions can drive the stock selloff similarly to the way it did early on Friday. Or the Fed playing the monetary interventions on-off game, can work to similar effect.

Still, having gone as high from the low 2200s, the risk of retest or breakdown below these lows, isn't there at the moment. Not with all the implicit and explicit Fed support, the many fiscal stimulus measures, and crucially, not unless corona goes from we-have-flattened-the-curve to oh-it's-exponential-again. Despite the relative complacency and the dangers it brings, we're still far from the market pressing the panic button.

Reaching 2800, 2720 or the low 2600s wouldn't count as panic. Considering this year's swings, a move to these levels (especially the first two, but there's potential for an overshoot to the 2600s) would constitute a relatively shallow correction, after which a slow grind higher could go on (barring catastrophic corona developments). After all, we're in an election year.

Let's check yesterday's key move that happened in the credit markets.

The Credit Markets' Point of View

High yield corporate debt (HYG ETF) gapped higher, rejected the intraday attempt to move lower, and finished with more gains. The volume on the upswing has been respectable, and the daily indicators paint a bullish picture for the sessions to come.

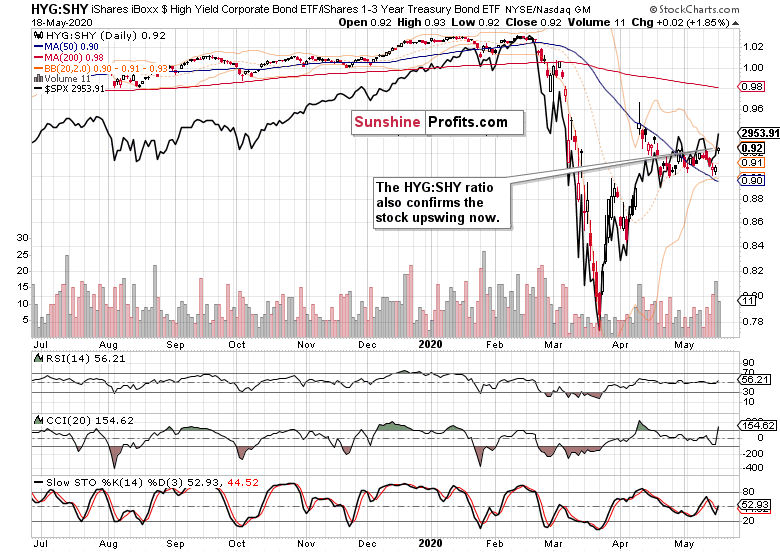

The high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) now also confirms the overlaid S&P 500 chart's upswing (the black line). Relatively speaking though, stocks are getting a bit pricey as they're the asset class leading higher.

Key S&P 500 Sectors in Focus

Technology (XLK ETF) kept its bullish gap open, hesitantly rising during the day on low volume. Healthcare (XLV ETF) erased around two thirds of its bullish gap, while financials (XLF ETF) rose to the midpoint of their April range. It's been only the consumer discretionaries (XLY ETF) that overcame their recent highs.

Among the stealth bull market trio, both energy (XLE ETF) and materials (XLB ETF) are challenging their local tops, with industrials (XLI ETF) not lagging too far behind. The volumes behind there upswings attest to the unfolding resumption of a push higher, supporting our hypothesis of slow grind higher over the coming months.

Summary

Summing up, yesterday's upturn in the credit markets dealt with the key remaining obstacle in the prospect of generally higher stock prices. The breakout above the 61.8% Fibonacci retracement stands a chance of being confirmed perhaps as early as this week. The effects of today's Powell testimony should prove temporary in keeping a lid on stock prices. As outlined, while we don't expect a sizable selloff, we don't see dramatic gains as overly likely either. The best known measure of volatility, VIX, appears to support this view. The perceived likelihood of the real economy bottom being at hand, also speaks in favor of the above.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care -

It's the Credit Markets Vs. the S&P 500 Upswing Now

May 18, 2020, 6:52 AMNeither on Thursday, nor on Friday did the bears manage to break below the 50% Fibonacci retracement. Stocks rebounded, albeit less convincingly than on Thursday. Or was it convincing enough? Let's examine both sides of the story to assess whether it's the bulls or bears that are holding the upper hand now.

S&P 500 in the Medium- and Short-Run

We'll start this week's flagship Stock Trading Alert with the weekly chart (charts courtesy of http://stockcharts.com ):

The bulls opened the week, making another run at the 61.8% Fibonacci retracement. Late on Tuesday, the Fed made several pronouncement that were not really surprising, but they still served to take the wind off the bulls' sails. Namely, it was stated that more fiscal stimulus might be necessary, and that the virus needs to get under control so as to fix the economy. On Wednesday, Powell echoed these kind-of-obvious positions, and stocks sold off to the 50% Fibonacci retracement. On Thursday, they declined on another 3,000K unemployment claims data, yet reversed later in the day. Friday brought us renewed US-China tensions and terrible retail sales figures, which took stocks lower again - yet they recovered in the latter half of the session.

As a result, the weekly candle bears a red body that marks the decline, and a sizable lower knot denoting last two days' recovery. Neither the weekly volume nor the weekly indicators stand out in any way. Are stocks likely to go on grinding slowly higher, or will the bears try luck again with another downswing attempt?

Let's see the daily charts for more details.

Trading around the 50% Fibonacci retracement attracted relatively more volume than the breakout attempt above the 61.8% one. As the buyers are certainly becoming more active around the 2800 area, is it likely to hold another selling wave should it come? And how likely will it come?

Well, the daily indicators aren't exactly on their buy signals just yet - Stochastics is still on a sell signal, while CCI has ticked higher before reaching the -100 area and RSI is fairly neutral.

Let's dig a bit deeper into Friday's events and paint a picture of what's to come early this week. While the Democrat-proposed $3T bill is dead on arrival, it's fairly obvious there would be a new fiscal stimulus - however, it hasn't materialized yet even as an outline. Then, after backlash against the implied cure-all coronavirus vaccine position, Trump flip-flopped to say that the virus would just go away at some point, all by itself - which seems to have helped with Friday's modest upswing.

On Tuesday, we'll hear Powell's testimony - and after last week's reaction to the cautious tone struck, the risks of another selloff are there. It can't be denied that the authorities have managed to paper over the problem, but is the consumer and small business sector coming back? We're of the opinion that the nearest months will show the veracity of the rebound, and we suspect that a very wide-stretched U-shaped real economy recovery would actually be the optimistic scenario here.

These weeks, the market will likely remain in a wait-and-see mode, reluctant to make a sizable move either way. But what if the risks were skewed rather to the downside in the very near-term? Coming back to the Fed, it's likely - after moving decisively in late March and early April, their Treasury/mortgage-backed securities purchases keep being low. That's one key buyers less. What would be a better excuse to ramp up the printing presses than another slide in the markets?

In other words, it's unlikely that Powell, after putting pressure on the executive branch to act, would bring the punch bowl to the Senate hearing. This makes it likely that the market would need to spook the Fed into action first.

Do we find support for the above theory in the credit markets?

The Credit Markets' Point of View

High yield corporate debt (HYG ETF) didn't really rebound either on Thursday or on Friday. That's a sign of non-confirmation of the stock upswing.

The high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) also keeps underperforming. Just as we wrote on Thursday, this ratio is well positioned to exert downside pressure on the overlaid S&P 500 chart (the black line), even after Friday's modest move higher.

Fundamentally speaking, that's what one can expect when Fed's firepower isn't really there at the moment. This is why another attempt to move lower in stocks, is likely.

Key S&P 500 Sectors and Ratios in Focus

Sure, technology (XLK ETF) rebounded on encouraging volume, but the technical picture isn't fully convincing. The daily indicators still aren't on their buy signals, and while the sector keeps making higher highs and higher lows, last two days' rebound appears extended and consolidation with a downside bias isn't out of the question.

Healthcare's (XLV ETF) price action looks more favorable to the bulls, especially since Friday's volume overcame that of the Wednesday's downswing. Unlike tech, the sector didn't open near its Thursday's starting prices. But can it keep pulling the S&P 500 higher?

Financials (XLF ETF) continue underperforming, and despite erasing Wednesday's plunge, they're not trending higher. They reflect the weak performance of the credit markets, which doesn't bode well for the advancing index as such.

Energy (XLE ETF) is taking a breather, and has issues moving higher regardless of the oil price recovery. As the volume also leaves quite something to be desired, the short-term risks appear skewed to the downside.

However, that's not true to such an extent in materials (XLB ETF). On one hand, they rejected the lower low and sprang higher, but the daily indicators and volume aren't yet on the side of the bulls. While that may change later this week, we're not there yet, and consolidation over the nearest sessions remains the most likely scenario.

The last of the stealth bull market trio, the industrials (XLI ETF) performed as feebly as energy did. It's a safe bet to say that these three sectors haven't exactly assumed leadership in the S&P 500 rebound, making it more likely that the stock bulls will get again tested this week.

The financials to utilities ratio (XLF:XLU) still doesn't act bullish - the sideways action would favor consolidation in this relatively broad sideways trading range (2800 to 2940) in the S&P 500 - still within the lower half of that spectrum for now.

Similarly, the consumer discretionaries to consumer staples ratio (XLY:XLP) is consolidating. It means that it's not giving clear signs of the upcoming directional move in stocks.

The Fundamental S&P 500 Outlook

As the coronavirus infection charts appear to have relatively stabilized, and the Fed offered ample support at a critical juncture, the stock market hasn't sold off in a dramatic way since. Moving from the March 23 lows to the 50% Fibonacci retracement, it has overcome this resistance and taken twice on the 61.8% one. Last week, the 50% retracement held as support.

The above paragraph would speak in favor of a near-term trading range between the two retracements. But would that mean that no selloff below the lower one can happen? Absolutely not, the 2720 or even the low 2600s can get tested. And that needn't to happen on very adverse corona-related developments. Faced with incoming data, the market can start to doubt whether we're within sight / we've reached the bottom and the real economy is on the mend now. Continuing unemployment claims, retail data, manufacturing figures and similar would show. Or escalation in US-China trade tensions can drive the stock selloff similarly to the way it did early on Friday. Or the Fed playing the monetary interventions on-off game, can work to similar effect.

Still, having gone as high from the low 2200s, the risk of retest or breakdown below these lows, isn't there at the moment. Not with all the implicit and explicit Fed support, the many fiscal stimulus measures, and crucially, not unless corona goes from we-have-flattened-the-curve to oh-it's-exponential-again. Despite the relative complacency and the dangers it brings, we're still far from the market pressing the panic button.

Reaching 2800, 2720 or the low 2600s wouldn't count as panic. Considering this year's swings, a move to these levels (especially the first two, but there's potential for an overshoot to the 2600s) would constitute a relatively shallow correction, after which a slow grind higher could go on (barring catastrophic corona developments). After all, we're in an election year.

What to do about the current S&P 500 pricing, what actions to take? For all the above-mentioned reasons (namely the credit-related ones), we're expecting a push lower in stocks to happen most likely over this week, and in all likelihood still within May. With breakouts and breakdowns having failed recently (bringing about no directional move or momentum to trade), the choice of opportune entry and exit points is rising in importance.

Summary

Summing up, despite the bullish finish to Friday's trading, the buyers don't have yet the indicators on their side. Weekly ones including volume are mostly neutral, while the daily ones remain vulnerable to a downside move. As the credit markets portend, the stock upswing appears to have gotten a bit ahead of itself, and Tuesday's Powell testimony coupled with yet another reduction in Fed's purchases starting today, are likely to be the catalyst of renewed selling. Delivered with a sober assessment of the real economy prospects and uncertainties (yes, the Q2 Fed-projected GDP drop is now 35%), it could drive stocks back to the 2800s, and the HYG ETF breaking below the late April lows. This would strengthen the bearish case for stocks in the near term - just as the US-China trade tensions or anchoring the reopening rebound expectations do.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe - the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM